International businesses are sharpening their multicurrency accounting skills and tools to ward off the impacts of heightened volatility in the value of the dollar and other global currencies. The stakes are high. Fluctuating foreign currency exchange (FX) rates can increase a company’s costs, lower the value of sales, and disrupt cash flow.

Well-planned financial strategies and specialized software can help minimize the risks from FX fluctuations while providing a more accurate view of the business for decision-making and investing. This article offers a guide to multicurrency accounting for companies doing business abroad.

What Is Multicurrency Accounting?

Multicurrency accounting is a financial management system used by companies that record, report on, summarize, and analyze transactions that occur in more than one currency. It allows for translating foreign cash flows into a primary currency to maintain accurate financial records and for reporting and making comparisons over time. It also helps account for exchange rate fluctuations.

Companies whose business transactions occur in more than one currency use multicurrency accounting to support financial transactions in two ways:

- In the foreign currencies in which the company conducts business.

- In the company’s primary currency, which is often the denomination used in a parent company’s home market.

For example, the Paris subsidiary of a New York-based company might record a sale in euros. Then, the accounting department at headquarters would convert this amount using the appropriate exchange rate and report the sale in US dollars in its consolidated financial statements.

Not surprisingly, multicurrency accounting is more complicated than single-currency accounting.

Key Takeaways

- Currency exchange rates often experience high volatility, posing both operational and accounting challenges to companies conducting international trade.

- Multicurrency accounting can take the edge off currency volatility.

- It bolsters financial management with standards-compliant recording, processing, reporting, and analysis of international transactions.

- International businesses rely on specialized multicurrency accounting software that uses real-time, worldwide data on transactions and applicable exchange rates.

Multicurrency Accounting Explained

Timing is one of the most challenging aspects of multicurrency accounting, introducing two main types of FX risk: transaction and translation.

- Transaction risk: Exchange rates can shift between the moment a transaction is initiated and the time it’s paid, potentially changing the actual amount received or paid in a company’s primary currency.

- Translation risk: This second type of exposure to exchange rate volatility arises when rolling the financial statements of foreign subsidiaries into the parent company’s consolidated report, a process that includes converting the currency. The timing of this translation is key, since it typically happens on specific reporting dates at the end of a month, quarter, or year. Using current exchange rates at these points in time can result in foreign exchange gains or losses on paper, even if the subsidiary’s actual performance hasn’t changed.

To prevent translation-related gains or losses from directly affecting net income and, in turn, causing distortions in reported earnings, they are recorded as “currency translation adjustments” in the “other comprehensive income” equity account on a company’s balance sheet. Companies customarily present “FX-neutral” results in such cases, separating the impact of currency fluctuations to give better insight into the company’s operational performance.

To illustrate the potential impact of FX fluctuations, consider that in the first four months of 2025 the US dollar depreciated by nearly 10% against the euro. For a company with thin profit margins, a swing like this could mean the difference between a profit and a loss, either in higher operational costs or in distorted financials—or both.

Operationally, a weaker home currency can increase expenses by making imported raw materials, components, and finished goods more expensive. Conversely, a stronger home currency makes imports less expensive, potentially reducing production costs, but a company’s exports become more expensive in foreign markets, which may reduce demand and international sales.

On paper, when the home currency weakens, the value of foreign revenues, assets, liabilities, and equity increases when translated into the home currency, creating unrealized FX gains. When the home currency strengthens, the opposite occurs: Foreign assets and revenues may appear less valuable in home-currency terms, and foreign liabilities may look smaller. Though a stronger home currency can reduce debt burdens on paper, it might also reduce reported earnings from international operations—affecting consolidated financial results.

How Does Multicurrency Accounting Work?

Multicurrency accounting works by tracking financial transactions in their original currencies and then converting them into a company’s home currency for accurate recording in the general ledger and consistent translation into financial statements. This process involves applying appropriate exchange rates at key points in time—at the moment of the transaction, upon settlement, or at month-, quarter-, or year-end. Companies may rely on spot rates, that is, the market rate at a specific moment in time, or contractually agreed-on fixed rates, depending on which of these they believe will better withstand currency fluctuations that could cause losses.

Translation, which is performed on financial reporting dates, involves reassessing the value of foreign-currency-denominated items using up-to-date exchange rates. This ensures that financial statements reflect the most current values. Different translation methods may be used, depending on the nature of the accounts:

- Current rate method: This is typically used for assets and liabilities on the balance sheet. Because the balance sheet shows a snapshot of a company’s finances on a specific date, the rate used for translation is the current rate on the date of the balance sheet.

- Historical rate method: Used for equity accounts and nonmonetary assets, this translation uses the rate that was in effect when the transaction occurred, thus preserving the original investment value.

- Average rate method: This is commonly used for income statement items, such as revenue and expenses. Because income statements cover periods—a month, quarter, or year—the rate used is the average exchange rate during that period.

These and other multicurrency accounting processes are guided by accounting standards like US Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Why Do Companies Need Multicurrency Accounting?

Multicurrency accounting is necessary for companies to accurately manage and report financial transactions that occur in different currencies. These might involve purchases from international suppliers, sales to overseas customers, the operations of foreign subsidiaries, or intercompany transactions, such as asset transfers between the parent company and a subsidiary. Effective multicurrency accounting helps ensure that these transactions are recorded correctly, converted consistently into the company’s home currency, and reported in compliance with accounting standards and national regulations.

Beyond those basics, multicurrency accounting is pivotal for managing the risk of fluctuating exchange rates, which can affect financial statements, cash flow, and profits. The practice also provides clear data for decision-making on pricing, sourcing, and other important business considerations. And it delivers transparency for investors and other stakeholders.

Importantly, multicurrency accounting helps evaluate the true performance of foreign subsidiaries or international divisions. It allows companies to distinguish between operational performance and the effects of currency fluctuations, providing a clearer picture of each unit’s contribution to the overall business.

Key Concepts in Multicurrency Accounting

Multicurrency accounting has its own vocabulary of terms that applies to currencies used in different places of business and for different accounting purposes, such as functional, base, transaction, and reporting currencies. Other key concepts address the timing and nature of foreign currency transactions and conversions, such as spot and fixed rates. This section provides a primer on key multicurrency concepts.

- Functional currency: This is the primary currency a company uses in day-to-day operations. An international business may have one functional, or home, currency at headquarters, while its foreign subsidiaries each use their own functional currency.

- Base currency: This term is sometimes used interchangeably with “functional currency,” but it more commonly refers to the currency into which a parent company translates foreign subsidiaries’ accounts when consolidating financial results. This means that the base currency is often the same as the functional or reporting currency.

- Reporting currency: Sometimes called presentation currency, reporting currency is the currency in which a company prepares and presents its financial statements, such as the balance sheet, income statement, and cash flow statement. As indicated above, international businesses tend to use their base currency as their reporting currency.

- Transaction currency: The transaction currency is the original currency used in an overseas purchase or sale.

- Foreign currency transaction: This is a business transaction in a currency other than a company’s functional currency.

- Foreign currency exchange rate: The exchange rate specifies how much of one currency is needed to buy another, typically expressed as a currency pair, such as USD/EUR. Since exchange rates fluctuate constantly, companies must establish policies for when to apply different types of rates. For example, a spot rate reflects the current market rate at the time of a transaction. A fixed or forward rate, often established through a forward FX contract, locks in an exchange rate for a future date—usually as part of a hedging strategy to manage exposure to currency volatility. Companies might use spot rates for day-to-day transactions when immediate settlement is needed, yet turn to fixed or forward rates for large purchases, long-term contracts, or financial planning where predictability of costs and revenues is crucial.

- Translation vs. revaluation (remeasurement): The term “translation” usually applies to converting entire financial statements from one currency to another; the process known as revaluation or remeasurement addresses individual transactions or balances.

Multicurrency Accounting Challenges

Distorted financial statements. Cash flow issues. Compliance woes. When it comes to multicurrency, multi-entity accounting, there’s a lot on the line. And getting it right can be difficult, as illustrated by these obstacles:

- Exchange rate fluctuations: Currency values change constantly, affecting the value of assets, liabilities, revenues, and expenses denominated in foreign currencies. If exchange rates aren’t well managed, a company’s income statement, balance sheet, and other financial statements could mislead shareholders, showing unexpected losses or swings in earnings, even if the business itself is doing fine operationally. Company executives could find it difficult to budget, forecast, or make solid decisions on pricing and investing because of the skewed numbers.

- Complex financial reporting: Multicurrency accounting requires consistent conversion of transactions into the company’s reporting currency, uniformly applied across all business units. Inconsistent use of exchange rates, such as applying an outdated rate to some transactions and a current rate to others, can distort financial statements. The same goes for translation errors, such as simple miscalculations.

- Regulatory compliance: As if complying with widely adopted standards like GAAP or IFRS weren’t challenging enough, companies still need to navigate each country’s national accounting rules. In some emerging markets, these can be much more detailed or restrictive than in developed economies. For instance, some governments may require companies to report foreign exchange transactions to regulatory authorities.

- Transaction fees and costs: Currency conversions often come with banking fees, brokerage charges, or hidden costs from unfavorable exchange rates. Especially for companies operating on thin margins or engaging in frequent cross-border transactions, these expenses can erode profit margins if not closely monitored and managed.

- Data entry errors: Many small companies and business units still rely heavily on spreadsheets, while others use accounting software that isn’t fully automated for multicurrency processing. Mistakes, such as misapplied exchange rates or errors in conversion formulas, can quickly compound across large volumes of transactions. These errors often create time-consuming reconciliation challenges when matching foreign currency transactions to general ledger balances, identifying discrepancies across subsidiaries, or consolidating financial results.

- Multi-taxation issues: Different countries impose different tax treatments on foreign currency transactions, making tax compliance complex. For example, some governments might treat foreign exchange gains or losses as taxable income or deductible expenses, while others might exempt business-related FX fluctuations from taxation. These differences can complicate the calculation of taxable income across subsidiaries and parent companies, potentially leading to double taxation or missed deductions.

- Foreign currency gains/losses: As noted above, unexpected gains or losses from exchange rate movements can create unpredictable swings in financial statements, particularly on the income statement and in equity accounts. In a typical example, if the home currency strengthens significantly during a reporting period, a company may record a foreign exchange loss on its foreign-denominated revenues or assets, even if its core business performance was strong. Similarly, on the balance sheet, fluctuations in exchange rates can lead to changes in the value of foreign subsidiary equity, affecting consolidated equity accounts.

- Bank reconciliation complexity: Another reconciliation challenge occurs between companies and their banks. International businesses often maintain bank accounts in multiple currencies, and reconciliation requires that the balances in the company’s general ledger match those reported in each bank account. This reconciliation can be time-consuming and error-prone. Differences in transaction timing, bank fees, and exchange rates can complicate the matching of deposits, withdrawals, and transfers, especially as fluctuating exchange rates change the home-currency value of these transactions.

- Accounting system limitations: Some financial systems lack strong multicurrency functionality, forcing companies to rely on workarounds or manual calculations. For example, some systems may not support automatic real-time exchange rate updates or may be unable to handle revaluation of foreign currency balances at the end of a reporting period. Gaps like these can increase the risk of error and reduce efficiency.

- Operational inefficiencies: Extra steps required for currency conversions can delay invoicing, payments, and financial close processes. These delays can, in turn, negatively affect cash flow by slowing down the receipt of customer payments. And, if payments to suppliers are delayed or mismanaged due to currency issues, it could lead to penalties, strained vendor relationships, or missed early-payment discounts, any of which can indirectly hurt cash flow. Delays can also impinge on the accuracy and timeliness of internal financial reporting.

Multicurrency Accounting Best Practices

To tame the complexity of multicurrency accounting, successful companies lean heavily on modern technologies. They automate procedures and integrate across enterprise resource planning (ERP), accounting, cash management, banking, FX management, and other systems, as well as across domestic and international operations. The following best practices help improve accuracy, efficiency, and financial control:

-

Use reliable software: Organizations should invest in accounting systems with strong

multicurrency capabilities, including real-time exchange rate updates. Accurate, up-to-date currency data, drawn

from integrated ERP, accounting, and other financial and operational systems, minimizes manual intervention and

improves financial reporting reliability and thus reports’ usefulness in decision-making.

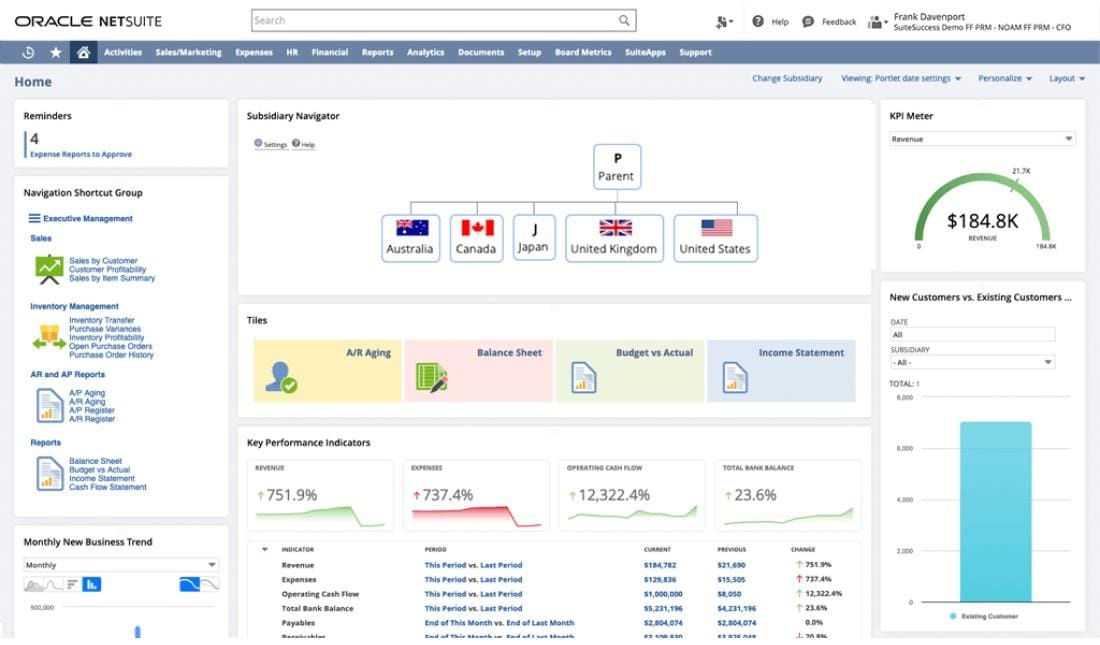

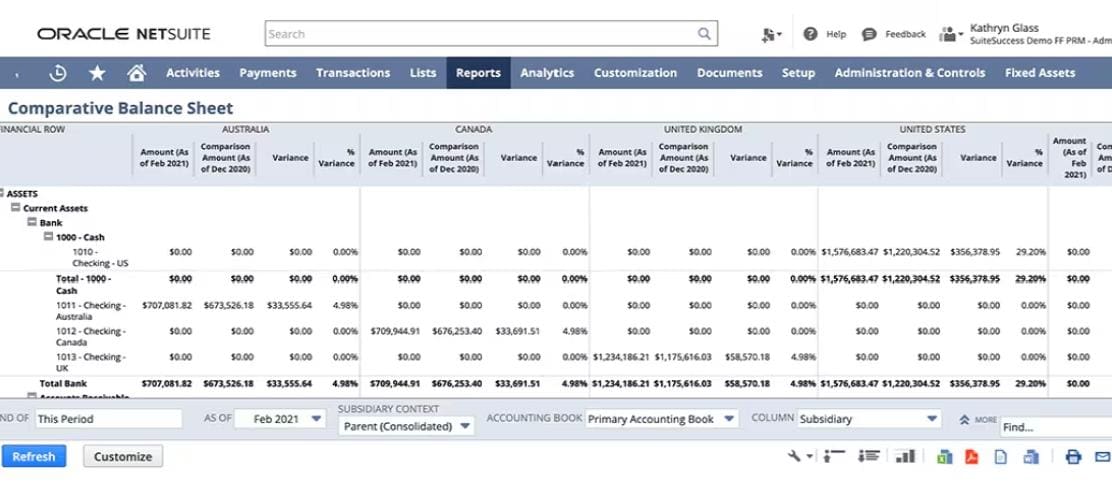

This graphic demonstrates NetSuite's capabilities, showcasing its cloud accounting software's currency management support for over 190 currencies. It features real-time exchange rate updates, automating rate application to reduce errors and improve accounting workflows for global operations. - Set a functional currency: The parent company and each foreign subsidiary should designate a functional currency derived from the primary market in which it operates. Establishing a clear functional currency simplifies financial reporting and helps ensure consistency across subsidiaries.

- Automate currency conversions: Automating the application of exchange rates during transactions and while closing the books helps reduce errors and rationalize accounting workflows. Automated systems see to it that conversions are timely, consistent, and traceable.

- Monitor exchange rate fluctuations: Successful companies continuously monitor the impact of currency movements on their financial results using reporting tools and dashboards. Regular analysis of currency trends and periodic scenario planning can improve decision-making and risk management.

- Ensure regulatory compliance: Accounting systems and processes should be designed to align with international standards, such as GAAP and IFRS, and also meet country-specific regulations. Built-in controls can reduce the risk of noncompliance and fines and improve audit performance. Clear procedures should be set for disclosing currency-related information in financial statements, including details of foreign currency risks, hedging activities, and the impact of exchange rate changes on financial results.

- Standardize reporting: Financial statements should be prepared using consistent methods and assumptions for all business units and currencies. Standardized reporting frameworks support clearer financial consolidation and facilitate the comparison of results across markets.

- Reconcile regularly: Financial accuracy requires frequent reconciliation of bank accounts, subsidiary ledgers, and intercompany transactions. Automated reconciliation tools help speed up the process and reduce the likelihood of discrepancies.

- Improve intercompany transactions: Special attention should be paid to tracking, reconciling, and eliminating intercompany transactions across different currencies. Methods include using intercompany netting systems to reduce the number of cross-border payments and associated currency conversions.

- Manage foreign transaction fees: Companies can minimize costs by selecting banking solutions that offer favorable exchange rates and low transaction fees. For instance, multiple-currency bank accounts can reduce transaction fees and provide greater FX flexibility because they allow companies to manage funds in several different currencies within a single account. Integrated cash management systems that centralize and optimize a company’s cash flows for multiple accounts and currencies also provide greater visibility and control over currency-related expenses.

- Use hedging strategies: Hedging techniques, such as forward contracts and currency swaps, can be employed to reduce exposure to currency fluctuations. For example, a US company expecting to receive a large payment in euros in three months might enter into a forward contract to sell those euros at a predetermined exchange rate, thus protecting itself against potential depreciation of the euro against the dollar. When integrated with accounting systems, strategies like this help protect profitability and stabilize financial forecasts. However, hedging can introduce its own accounting challenges. Companies must adhere to complex rules for hedge accounting, including proper documentation, effectiveness testing, and fair value measurements.

- Train accounting teams: Ongoing training helps keep accounting personnel familiar with current multicurrency processes, technologies, and regulatory requirements. Well-trained teams are better equipped to manage complex currency environments and to maximize the value of technology investments.

- Maintain comprehensive documentation: Keeping detailed documentation of all currency-related transactions, hedging decisions, and exchange rate applications creates a clear audit trail and supports compliance efforts.

What to Look for in Multicurrency Accounting Software

Companies operating multinationally or otherwise dealing with more than one currency rely on multicurrency accounting software platforms to streamline financial processes, deliver accurate reports, and comply with different national reporting standards. When evaluating such software, finance managers should consider essential features, including:

- Automatic currency conversion: The ability to automatically convert transactions into the primary currency while simultaneously tracking and updating exchange rates in real time.

- Integration capabilities: Easy integration with other business systems, such as ERP and banking platforms.

- Compliance updates: Up-to-date, country-specific feeds related to tax rules, reporting requirements, and other compliance standards.

- Consolidated management: Support for managing multiple subsidiaries within a single system. This should include intercompany transaction-handling features to manage and reconcile transactions between different business units.

- Customizable reporting: The ability to generate reports in multiple currencies and formats to meet various stakeholder needs.

More advanced accounting systems use artificial intelligence to level up many of the features listed above. For example, the predictive capabilities of AI can help companies improve cash flow forecasts by accounting for exchange rate variations when analyzing multicurrency data.

Benefits of Multicurrency Accounting Software

Multicurrency accounting software can simplify the complex task of managing finances across many currencies and country borders. By automating currency conversions, improving reporting processes, and providing real-time insights into global financial operations, this specialized software can enhance a company’s efficiency and accuracy in handling overseas transactions, managing the financial risk of currency fluctuations, and complying with complex international regulations. Benefits include:

- Global transactions: Advanced accounting tools facilitate international business operations by allowing companies to process transactions in multiple currencies. This helps businesses more easily expand into new markets, work with international suppliers, and serve customers worldwide without currency barriers.

- Real-time exchange rates: Software automatically updates currency values for accuracy, affirming that all financial data reflects current market rates. This feature eliminates the need for manual updates and reduces the risk of using outdated exchange rates, which could lead to financial misstatements.

- Compliance and reporting: Automation improves adherence to international accounting standards, such as GAAP and IFRS. The software can automatically apply the correct accounting treatments for foreign currency transactions and translations, simplifying the process of preparing compliant financial statements for multiple countries. Leading systems can produce reports that comply with either standard from the same underlying accounting data.

- Reduced currency risks: Automated processes also minimize errors and inconsistencies in currency conversions. Any reduction in manual handling not only improves accuracy but also saves time and helps identify and manage foreign exchange risks more effectively.

- Financial transparency: The built-in ability to present financial data in both foreign and home currencies provides clear insights into global revenues and expenses. This transparency allows management to better understand the true performance of international operations and the impact of currency fluctuations on the business.

- Improved decision-making: Decision-making becomes more informed and analytical, with dashboards and other tools that provide both country-specific and consolidated views of financial data. For instance, a consolidated view of global operations in a common currency allows for easier comparison of performance across different regions and business units.

- Efficiency and automation: Accounting software streamlines multicurrency transactions and their translations, reducing the time and effort required for financial processes. Automated currency conversions and revaluations can significantly speed up month-end close procedures and improve overall accounting efficiency.

- Cost savings: Automated currency conversions save money by slashing the need for manual conversion and can also help minimize the costs of administrative time and resources.

- Customer and vendor convenience: The ability to conduct transactions in their preferred national currencies can ease relationships with international customers and suppliers.

- Scalability: Multicurrency accounting supports business expansion into new markets by simplifying the incorporation of additional currencies and foreign entities.

Manage Currency Easily With NetSuite

NetSuite’s ERP system and cloud accounting software provide comprehensive multicurrency accounting capabilities to help international businesses improve financial operations across borders. With support for more than 190 currencies and automated exchange rate updates, NetSuite eliminates the manual effort otherwise associated with currency management. Its real-time currency conversion features help affirm that financial data accurately reflects current market conditions, while maintaining transaction records in both foreign and home currencies simultaneously.

NetSuite also enables businesses to manage multiple subsidiaries within a single system, supporting country-specific reporting requirements and providing a unified view of global operations. The software’s customizable financial reports can be generated in multiple currencies, giving stakeholders insights into performance across different markets. And its integrated approach to multicurrency management also facilitates smoother intercompany transactions, simplifies tax compliance across regions, and provides the scalability needed to support business expansion into new international markets.

For companies doing business internationally, the challenges are significant—from FX volatility to regulatory compliance. Yet the right financial strategies coupled with multicurrency accounting software can help companies streamline the management of their finances, mitigate currency risks, and make more-informed decisions about growing their global operations.

Multicurrency Accounting FAQs

What is a multiple currency account?

A multiple currency account is a type of bank account that a company can use to manage funds in several different currencies. For businesses conducting international trade, this type of account facilitates holding balances in multiple currencies and making or receiving payments without forcing untimely conversions that may result in foreign exchange losses. Benefits of these accounts also include lower currency conversion costs and greater flexibility in managing international cash flows.

Why is accounting so difficult when multiple currencies are involved?

Several factors make multicurrency accounting more complex and challenging than accounting in a single currency. For one thing, exchange rates fluctuate constantly. This can impact the value of assets, liabilities, revenues, and expenses, making accurate reporting difficult.

At the same time, compliance obligations mount, due to the different accounting standards and regulatory requirements in various countries. Additionally, the need for currency conversion at different points in time—such as transaction date, settlement date, or reporting date—can lead to foreign exchange gains or losses that must be properly accounted for. Without adequate software tools, the high probability of errors in manual conversions only compounds these and other risks surrounding multicurrency accounting.