In an industry characterized by a broad spectrum of offerings and continuous demands for updates and support, information technology (IT) services firms face distinct challenges regarding how to bill external clients for their work. After all, effective IT billing isn’t just about issuing accurate invoices on time. It’s also about creating a system that is transparent, adaptable and aligned with both service value and client expectations. This article dives into the intricacies of IT services billing, examining various billing models, essential components of the billing process and best practices that facilitate effective financial management and customer satisfaction.

What Is Billing for IT Services?

Billing for IT services refers to the process of charging for a vast array of IT-related work, from access to software, hardware and cloud solutions to consultancy and ongoing tech support. As a result, billing requires a tailored approach that can accommodate the precise characteristics of each service. In addition, IT service providers might adopt different billing approaches to suit their business models and the types of service provided. For example, a cloud storage provider might bill based on the quantity of data stored, while an IT consultancy might charge a flat fee for a specific project or a retainer for ongoing advice.

IT services also tend to be complex, necessitating ongoing updates, support and customization, all of which (and more) can introduce additional layers to the billing process. This complexity is magnified by a rapidly evolving industry, one that demands a billing system that is both precise and flexible enough to adapt to continual advances to technology.

Key Takeaways

- IT services billing is multifaceted. Understanding the different billing models and their suitability for different IT services is important for both providers and clients.

- Clear contracts, accurate tracking and transparent communication are essential for successful IT service billing, not to mention client trust.

- Due to the continually evolving nature of IT, effective billing practices should progress with the business.

- Regular reviews and updates of billing practices are necessary to keep pace with technological advancements and regulatory changes.

- Advanced billing systems can streamline the billing process, reduce manual errors, offer real-time financial insights and help support customer satisfaction.

Billing for IT Services Explained

In response to the nuanced and evolving nature of technology services, billing for IT demands an approach that is both systematic and adaptable to the specific services offered. Since services can vary widely from one client or project to the next, it’s not uncommon to prepare a new, customized invoice every time a bill goes out — quite unlike a manufacturer’s replicable invoice template that simply lists product SKUs and quantities to align with every purchase order.

And because tech and client needs can rapidly evolve even over the course of one project, an IT service provider’s billing system must be adaptable enough to accommodate a variety of billing models, from fixed-price contracts for more clearly defined projects to time-and-materials (T&M) billing for more open-ended engagements. This flexibility keeps billing practices aligned with both the service value and the changing dynamics of IT projects.

For global IT service providers, the complexity of billing escalates. Diverse tax laws and international regulations require a billing approach capable of handling such intricacies. Fortunately, modern billing software is often equipped to deal with these challenges and automate the process to ensure compliance and support efficiency.

Why Is IT Services Billing Unique?

IT services billing is unique relative to traditional service industries due to the complexity and customization inherent in IT services. Consider a more traditional, standardized service, like a car rental company. Whereas the rental agency might simply charge a daily rate plus mileage for use of its vehicles, IT solutions often require intricate configurations and ongoing management, each of which must be meticulously accounted for in billing practices. For example, an IT service provider might offer an array of consultancy, tech support and cloud computing services, for which it employs a variety of pricing models — from subscriptions to usage-based fees — that reflect the ways in which the services are consumed.

Companies that offer multiple pricing models require a dynamic billing system capable of tracking real-time service use and adapting to service changes. The rapid pace of innovation in IT also means that billing systems must be flexible enough to incorporate new services and pricing structures as they emerge. And with IT services often crossing international borders, billing systems should be able to handle multiple currencies and comply with tax regulations and a range of international laws.

Types of IT Services Billing Models

IT firms use different pricing models to accommodate the varied nature of their services and client preferences. These models are designed to align with the IT project’s demands, customer expectations and value delivered. Each billing model has advantages and challenges, and the choice often depends on the specific circumstances of the service provided. Some IT service providers may even choose a combination of models to offer flexibility and cater to individual client needs and IT project types. But key to them all, so as to minimize any chance of disputes: clearly spelling out the way a client will be billed — before services begin.

-

Time and Materials

In the T&M model, clients are billed for the actual hours spent by the service provider and for the materials used in the completion of IT projects. This model is especially flexible, accommodating projects that are likely to change or where the scope is not clearly defined. For example, an IT service provider may use the T&M model for a project in which the client’s needs are expected to evolve, such as developing a new software feature or integrating a complex system where the full requirements are not known at the outset. The provider would then track the number of hours its developers spend on the project, billing for the actual work done along with any materials, such as hardware components and physical media, used during development.

Although the time and materials model can be more cost-effective for short or variable projects, it also presents some challenges. Clients may be concerned about a lack of a cap on spending, leading to potential budget overruns. And without a fixed price, it can be harder for clients to budget for the project. There’s also a risk of disputes over the amount of time billed, as tracking exact hours worked can be subjective — what constitutes billable work from the IT service provider’s viewpoint might vary from the client’s perspective.

-

Fixed Price

Fixed-price contracts represent a straightforward billing approach in which the service provider charges a set amount for an entire project. This model is ideal for IT projects with a clearly defined scope and deliverables. For instance, a company might enter into a fixed-price contract with an IT service provider to set up its corporate network infrastructure or for IT training services. The agreed-on sum would cover all work specified in the contract, regardless of the time and resources the provider ultimately spends on the project.

Of note, fixed-price contracts can be risky for IT service providers if they underestimate project scope, resulting in financial losses due to having to complete more work than anticipated. This could also lead to reduced quality of work if the provider rushes to complete tasks within the set budget. Conversely, if the scope is overestimated, clients may end up paying more than the service’s market value, leading to customer dissatisfaction and potential damage to the provider-client relationship.

-

Retainer or Subscription-Based

Retainer and subscription-based billing services are two similar billing approaches in which a recurring fee is paid to access IT services or products. While a retainer is an up-front fee for future services (with funds held in an account and deducted from as services are rendered), a subscription is a recurring payment for continuous service, such as for software updates and support. A cybersecurity firm, for instance, might opt for a retainer to ensure standby incident response, while a cloud service provider might prefer a subscription contract for data backup services.

Subscription models that offer automated renewals are convenient for clients and businesses alike; this hands-off approach guarantees continuous service to customers and continuous revenue flow to service providers. In addition, automated renewals can be a particularly useful feature in sophisticated billing systems, as they can facilitate uninterrupted service without manual intervention.

While both retainer and subscription-based models offer financial predictability and can simplify budgeting for both the provider and the client, either can lead to situations where clients pay for services they do not fully use. Furthermore, an IT service provider must deliver consistent value in order to justify the ongoing costs to their clients.

NetSuite SuiteBilling can help companies simplify and automate various billing models, including recurring subscriptions. -

Value-Based Pricing

Value-based pricing is predicated on the perceived or actual value delivered to the client, rather than the cost of the service itself. This model is often most effective when IT services contribute directly to a client’s business outcomes — e.g., services that enhance efficiency, drive revenue growth or safeguard regulatory compliance. For example, an IT service provider hired to implement a new enterprise resource planning (ERP) system that streamlines a client’s operations might set its price based on the expected cost savings and productivity gains for the client, rather than on the number of hours or resources used.

Because this billing model aligns the IT service provider’s incentives with the client’s success, it can potentially lead to higher profits for providers. But it also requires a deep understanding of the client’s business model and objectives, as well as access to clear metrics that can be used to measure the actual value delivered. Otherwise, it may be hard to justify the cost to the client. What’s more, the provider will likely need to stay deeply engaged with client outcomes to maintain the perception of continued value over time.

-

Per User/Per Device

The per-user/per-device model is a straightforward IT billing approach whereby clients are charged based on the number of people operating the IT service or the devices that access it. This model can be suitable for managed IT services, such as remote server, desktop, device management and remote cybersecurity services. For example, a managed IT service provider might offer remote monitoring and management of a company’s network infrastructure, charging a monthly fee for each workstation or server it oversees. This approach makes costs directly proportional to the scale of the service provided.

However, the cost of per-user billing may not reflect the varied levels of use among different users. Similarly, per-device billing might not account for the complexity or criticality of various devices. If a server that needs extensive monitoring and management incurs the same charge as a less-critical device, it could lead to a misalignment of costs and services. And, as the number of devices and users grows, costs can increase significantly. Unless the service provider offers a discounted rate above a set threshold of users, the per-user/per-device model may be less attractive to larger enterprises.

-

Project-Based

In project-based billing, clients are charged a specific fee for a specific project. This model can be especially useful to IT services that have a well-defined scope and end goal, such as installing new network infrastructure, migrating databases or implementing a cybersecurity solution. When upgrading a client’s hardware systems, for instance, a service provider could charge a flat fee for the complete project, covering everything from assessment to installation. This allows the client to budget for the project without worrying about fluctuating costs. However, unlike fixed-price billing, project-based billing allows for more flexibility if changes in project scope or requirements occur (though specifics depend on the IT service provider). It’s important to be up front with clients to ensure that they know what they will be billed for, and how, and whether the quoted price is subject to change.

While project billing can grant clarity and simplicity for both client and provider, it does have potential drawbacks. If the project scope is not accurately defined and the service provider doesn’t offer any flexibility for changing requirements, the provider may encounter scope creep, leading to unanticipated work without additional pay. For the client, there’s a risk of overpaying if the project requires less work than anticipated. If the billing model allows for flexibility, clients could surpass their budget should unexpected complexities arise or the scope exceeds expectations.

-

Tiered Pricing

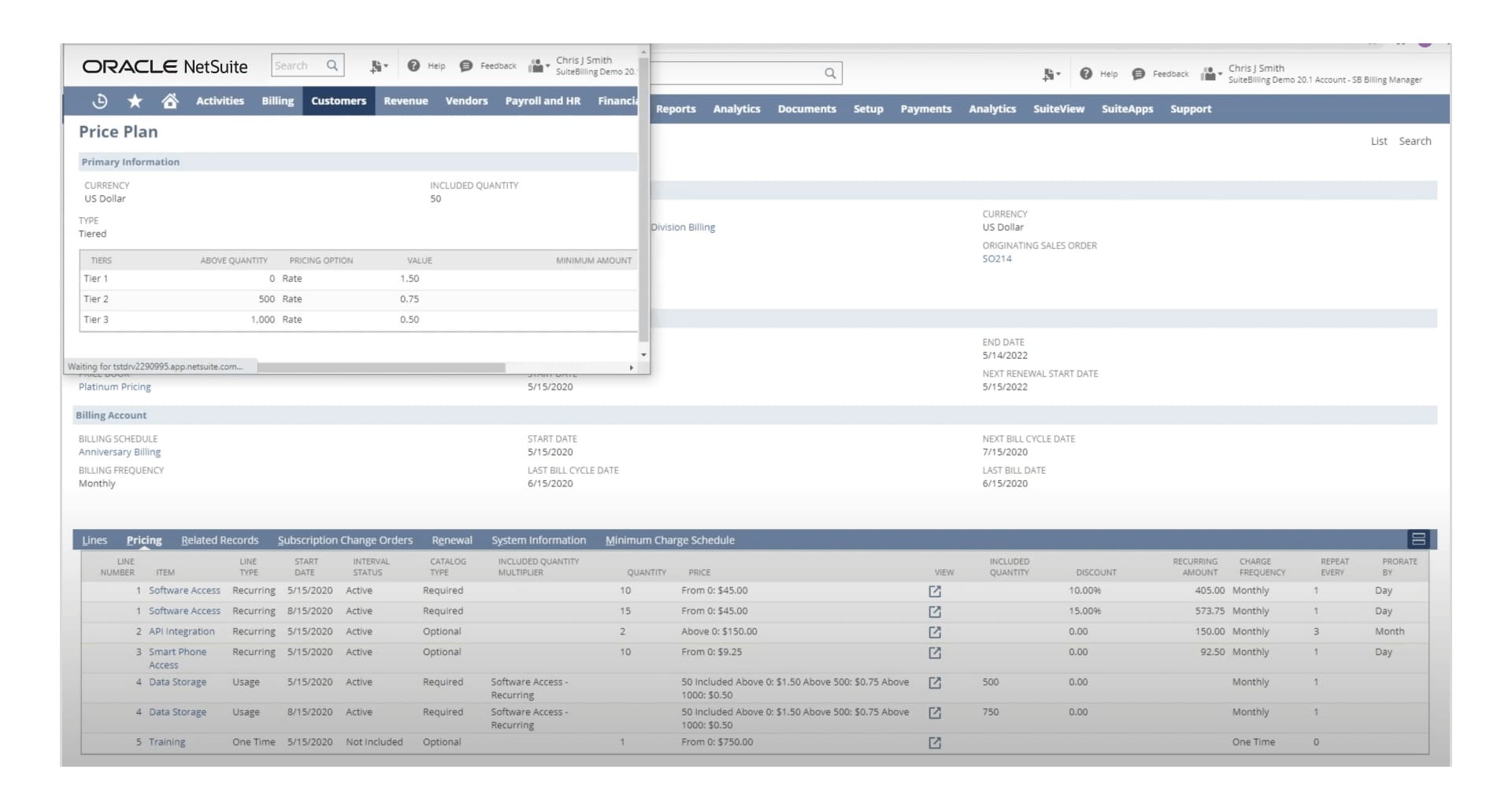

Tiered pricing involves creating different levels of service packages, each with its own price point and set of features or services. This model generally caters to clients with various budgets and needs, allowing them to select a service level that matches their requirements without paying for unnecessary extras. For example, a cloud hosting provider could offer basic, standard and premium packages. The basic tier might cover minimal storage and support, making it suitable for startups. The premium tier could offer extensive storage, advanced security features and dedicated support, appealing to larger enterprises with more complex needs and deeper pockets. The standard package would fall somewhere in between.

Tiered pricing can be a useful way to accommodate a range of customer needs and budgets, but it can also complicate the billing process. IT service providers must clearly communicate the differences among tiers to avoid confusion and allow clients to select the appropriate level of service. Clients may also need to reassess their tier choice as their business needs change. In turn, the provider should make sure to offer a flexible upgrade and downgrade policy, lest they risk customer dissatisfaction.

NetSuite SuiteBilling can help companies simplify and automate various billing models, including recurring subscriptions.

Key Components in IT Services Billing

Effective IT services billing is not just about choosing the right model; it’s also about understanding and managing the key components that make up the billing process. These elements can help make sure that billing is accurate, legally compliant and reflective of the value provided to the client.

-

Project Scope and Deliverables

Project scope and deliverables form the blueprint for an IT engagement, especially when it comes to fixed-price or value-based contracts. A well-defined scope includes the project’s objectives, tasks, deliverables and timelines. For example, the contract for a cloud migration project could outline the number of servers to be migrated, the data volume, security protocols to be implemented and milestone completion dates.

This level of detail can help prevent misunderstandings by making sure both the client and provider are on the same page, setting the stage for a successful partnership and a transparent billing process. However, laying out the project’s scope and deliverables might not always be relevant for all billing models. For instance, retainer-based and time and materials billing tend to work with a more flexible scope that allows for adjustments over time. In these cases, the billing is based on the actual work done or the ongoing relationship, rather than a predefined outcome.

-

Labor and Time-Tracking

Labor and time-tracking involves meticulously recording the time spent by technicians, developers and other IT professionals on specific tasks or projects. It confirms that clients will be billed fairly for the work done and that service providers are compensated for their time. There is one proviso: Service providers must take care not to inadvertently include nonbillable time. Labor and time-tracking is relevant to any IT services billing approach, not only because it can help facilitate accurate billing, but because it allows service providers to analyze labor costs and efficiency.

-

Expenses and Materials

Tracking direct costs for expenses and materials ensures that all IT-related costs are accounted for and accurately reflected in client invoices. This includes tangible items, such as servers and replacement hardware, as well as any third-party services that are essential to project completion. For an IT security service provider, for example, this means maintaining thorough records of all direct costs, from antivirus software licenses and firewall hardware to any specialized equipment and subcontracted services, such as for penetration testing.

Tracking expenses and materials is a must for any service provider that wants to create detailed invoices that itemize each cost. Doing so supports transparency and can help justify final charges to the client. It also ensures that the service provider covers all costs — a key to safeguarding profit margins. Sophisticated expense management systems are useful, as they can track such costs in real time, while offering an integrated view of expenses throughout the project life cycle.

-

Overhead Costs

Overhead costs encompass the indirect expenses not directly attributable to a specific project but necessary for running the business. In IT services, these costs can include rent, utilities, administrative salaries and general office supplies. Accurately allocating a portion of these overhead costs to each project will help ensure that pricing reflects the true cost of service delivery.

IT service providers can benefit from developing a method to apportion overhead costs fairly across their projects and services. This can be done by assigning a percentage of overhead to each project, based on direct costs, or by evenly distributing overhead costs across all services provided during a billing period. Proper management of overhead costs helps providers maintain competitive pricing while covering all of the expenses necessary to keep the lights on and, ideally, turn a profit.

-

Profit Margins

Profit margins represent the difference between the IT service provider’s cost of delivering a service and the price charged to the client. Setting appropriate profit margins is essential for a provider’s sustainability and growth. It involves careful consideration of both direct costs, such as labor and materials, and indirect costs, such as overhead. IT service providers should also consider the value that their services offer to clients, as perceived value can justify higher margins. The right profit margin for a business will depend on the services offered, market conditions and the service provider’s business strategy. Regular review of costs and market trends can help ensure that profit margins remain appropriate over time.

-

Invoicing and Payment Terms

Invoices should be detailed, providing a clear breakdown of services rendered, costs, dates, taxes, discounts and payment instructions. Payment terms, including due dates, late payment penalties and any early payment discounts, should also be explicitly stated to prevent confusion and facilitate timely payment. Clear, consistent invoice formats that avoid industry jargon can make invoices easier for clients to understand — a crucial element in their overall level of satisfaction.

In practice, consider an IT firm that issues invoices on a net-30 basis, requiring payment within 30 days of invoice date, and includes a 2% discount for payments made within 10 days. It also stipulates a late fee for overdue payments to encourage prompt settlement. This information is clearly laid out in the invoice. When listing services rendered, the firm presents simple, nontechnical language to describe each service. For instance, rather than merely listing “Network Infrastructure Optimization,” the firm describes what it did, such as “Enhancing and fine-tuning the company’s network setup for peak performance and reliability.” This approach means clients, especially those unfamiliar with IT terminology, will easily understand what they are being charged for.

-

Customization and Variability

Since IT service providers often offer tailored solutions that can vary in scope and complexity, customization and variability in billing are essential for addressing and adapting to the unique needs of each client and/or project. In turn, billing protocols — and the billing system itself — should be able to handle different pricing structures, as needed. This flexibility can be especially useful for IT service providers that offer a range of standardized offerings and highly customized solutions.

In addition, IT billing systems should be able to support many pricing structures and quickly adapt to project changes, including scaling services up or down, modifying service bundles and updating pricing as client needs evolve.

-

Taxation and Compliance

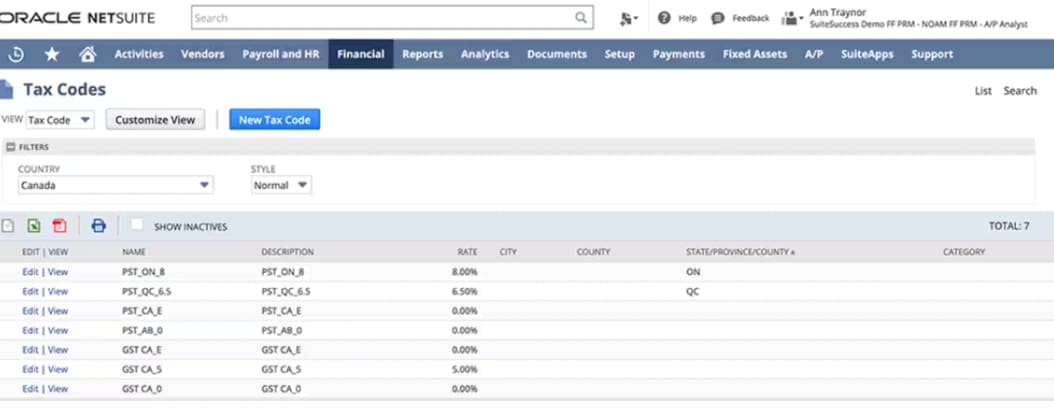

IT service providers often have clients located all over the world, which means having to navigate a complex landscape of local, national and international tax obligations. In turn, sales tax and other levies specific to the regions they operate in could need to be accounted for. What’s more, compliance extends beyond taxation to encompass data protection laws, such as the General Data Protection Regulation in the European Union and the Health Insurance Portability and Accountability Act for health information in the U.S.

Billing systems that accurately calculate and include the appropriate taxes for each client, relative to their locations and the nature of the services provided, are a must for simplifying the already complex IT billing process. In addition, billing systems that automatically maintain up-to-date knowledge of regulatory changes to make sure billing practices are in strict adherence to these requirements can help service providers avoid penalties and maintain client trust.

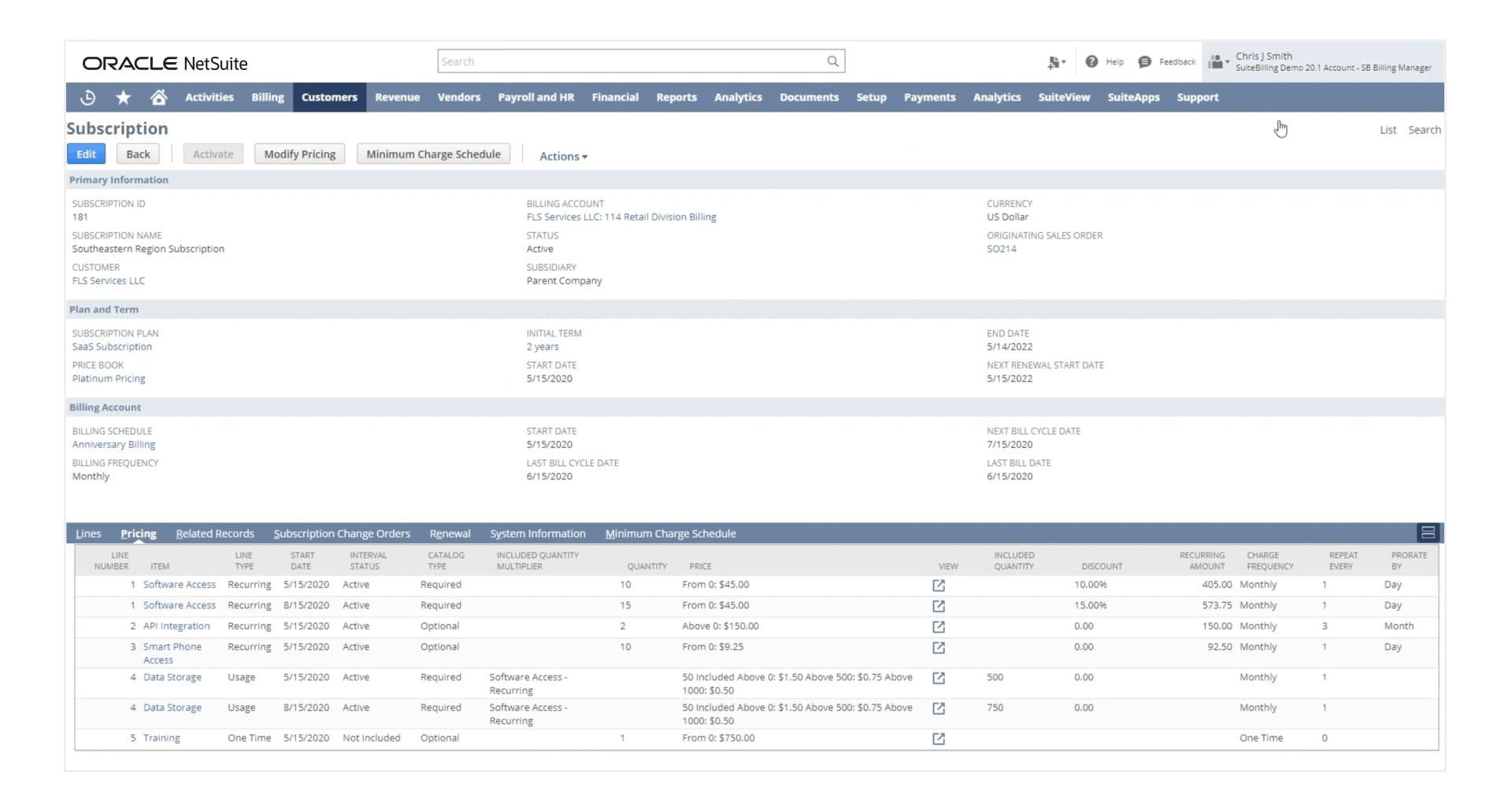

NetSuite SuiteBilling offers a seamless way to manage complex pricing requirements, such as tier-based options that rely on different rates for different service packages.

Best Practices for Effective IT Services Billing

Adopting effective best practices in IT services billing can enhance accuracy, client satisfaction and the financial well-being of the service provider. These practices are specifically designed to streamline the billing process, minimize errors and strengthen client relationships, thereby contributing to the overall success of the business.

-

Clear and Detailed Contracts

Contracts are the bedrock of predictable and understandable billing practices in IT services. They delineate the scope of work, deliverables, payment terms and conditions for changes or additional charges. A contract that articulates these elements in detail minimizes the risk of misunderstandings and sets the stage for a transparent relationship between the provider and the client.

Within these contracts, regular billing cycles — such as monthly, quarterly or annually — are established, providing a predictable framework for the provider’s cash flow management and budgeting. One-time fees, like setup or installation charges, should also be clearly outlined so as not to take a client by surprise. Educating clients on these aspects, particularly when complex pricing structures are involved, is necessary to help them understand exactly what they are being charged for, when and why.

-

Transparent Communication With Client

Transparent communication underscores client trust and customer satisfaction. Beyond providing clear and comprehensible invoices, IT service providers should aim to maintain open lines of communication regarding project progress, service changes and billing queries. Proactive dispute resolution is also important. Whether it’s a dedicated customer service hotline or an online chatbot, having a clear process for handling questions and billing disputes can facilitate quick resolution while maintaining strong client relationships.

Gathering feedback from clients on the overall billing process can also be helpful. Is the breakdown of charges clear? Is the online payment process easy to navigate? Do clients feel they receive adequate notice for changes in billing? Getting — and using — this type of feedback can lead to enhancements in the billing system, perhaps by making it more user-friendly and reducing the likelihood of future disagreements. It also can help customers realize that their opinions matter and that they’re more than merely a source of income.

Billing software featuring customer portals is also useful. For example, it can promote transparency by offering clients the convenience of managing their account information, viewing their billing histories and making payments online. This level of accessibility can boost client satisfaction and benefit the service provider’s administrative processes.

-

Using the Right Tools

Advanced accounting and billing software can handle the complexities of IT service billing, including time-tracking, expense management and invoicing. These software systems should be customizable and capable of adapting to varied service offerings. They should also be scalable to accommodate growth in the number of clients or services, as well as able to manage compliance with tax laws and other regulations.

For instance, automated e-billing systems can generate invoices, process payments, manage customer accounts and track use of services, such as cloud storage or support hours — all while maintaining high levels of security to protect against data breaches. Seamless integration with other business systems, such as customer relationship management, can enhance operational efficiency and provide a single source of truth for all billing-related data.

Furthermore, these advanced tools can offer real-time visibility into billing and financial activities, which is crucial for tracking important metrics, such as monthly recurring revenue, total contract value and customer churn. In turn, IT billing can evolve from its role as a mere administrative task into serving as a strategic business tool. For example, when provided with real-time, detailed data, service providers can make better informed decisions about pricing strategies, service improvements and customer retention tactics.

-

Regular Billing Practice Reviews and Updates

If IT service providers want their billing processes to remain current, efficient and in line with industry standards, it’s important that they regularly review their billing practices and update them accordingly. Taking a proactive approach can involve auditing existing practices, incorporating client and team feedback, and staying abreast of new billing technologies and regulatory changes that could impact billing operations. As a result, businesses will be better positioned to maintain their competitive edge and foster ongoing client satisfaction. For example, a service provider might discover during a quarterly audit that upgrading to a new billing platform would streamline its invoicing and payment processing, leading to faster turnaround times, improved billing accuracy and increased customer happiness.

Streamline IT Billing With NetSuite

NetSuite offers efficient, flexible solutions for managing IT billing, accommodating everything from subscription- to usage-based models. NetSuite SuiteBilling, for example, adapts to various billing schedules and pricing models, essential for diverse customer needs in IT services. With the ability to integrate seamlessly with other enterprise systems, NetSuite facilitates cross-business data accuracy while providing real-time insights into your company’s financial management capabilities. The platform’s e-billing system also fully digitizes the billing process, which facilitates customer convenience and encourages timely payments. And automation within SuiteBilling can help improve billing efficiency while minimizing errors — two factors critical for maintaining competitive pricing and customer satisfaction.

What’s more, NetSuite makes it easy to manage payment collections with its accounts receivable tool, which allows companies to check invoice statuses, receive notifications about late payments and improve cash flow. Meanwhile, its SuiteTax tool offers robust tax management capabilities that help simplify global tax compliance by integrating automated tax calculations into the billing process. This ensures that each invoice precisely reflects relevant taxes and compliance with regional regulations, further enhancing the system’s ability to effortlessly manage complex IT billing requirements.

Billing for IT services is a dynamic and vital aspect of the technology industry. By embracing advanced billing solutions, maintaining clear communication and adhering to IT billing best practices, IT service providers can make sure their billing processes are as efficient and client-friendly as possible. In doing so, these companies will find themselves better positioned to safeguard their revenue streams and reinforce their reputations as reliable and customer-centric businesses.

Billing for IT Services FAQs

What is billing in the IT industry?

Billing in the IT industry refers to the process of invoicing clients for technology services and products provided. This can include software development, cloud services, cybersecurity, IT consultancy and support services, among other offerings.

What is the difference between invoicing and billing?

Billing in the IT industry is a comprehensive process that involves not only creating and sending invoices, but also encompasses the overall management of financial transactions, including setting prices, tracking payments and managing accounts receivable. Invoicing, on the other hand, specifically refers to the creation and sending of a detailed document requesting payment for services or products provided after their delivery.

How do I bill for my services?

To bill for IT services, determine the appropriate billing model (e.g., time and materials, fixed price, subscription-based, etc.), track time and expenses accurately and create detailed invoices. Be sure to clearly communicate payment terms and conditions to clients.

How do you bill for consulting services?

Billing for consulting services typically involves setting a rate (hourly or fixed), tracking the time spent on the project and issuing invoices based on the agreed-on pricing structure. It’s also important to provide detailed invoices that reflect the value and scope of the consulting work.