In short:

- In the increasingly competitive subscription marketplace, price can play a huge role in the success — or failure — of a subscription offering.

- General pricing strategies can help support growth goals by cultivating brand recognition, gaining market share and more.

- Companies should ensure that their chosen strategy works with their subscription model and revisit pricing on a regular cadence to make sure it is effective.

You’re reading part II of a series.

Part I: 5 Subscription-Based Pricing Models, and How to Choose the Right One

We’ve explored various models for pricing a subscription offering. Now, with a model in hand, it’s time to dig into the details of how to attract and retain customers.

We’ll walk through strategic actions around pricing that can support your business’s growth goal — whether it be cultivating brand recognition, gaining market share or simply selling more of a subscription. Bonus: These strategies work for non-subscription offerings, too.

After all, in the immortal lyrics of “Milkshake” by Kelis, “My [pricing

strategies] bring all

the [customers] to the yard.”*

*Lyrics may have been altered slightly.

What Is Pricing?

Pricing is the process of determining how much to charge for goods and services. It takes into account how much it costs a business to produce, develop or acquire its offerings, how much competitors are charging, supply and demand, overhead costs, desired profit margins and more.

What Are Pricing Strategies?

A pricing strategy is the approach a business takes to set prices for its products and services. The strategy is influenced by many factors, including the cost of production, desired sales volume and profit margin, market conditions, competition and target market. But in all cases, the pricing strategy must align with the business’s goals to be successful. For example, a pricing strategy that allows for a free, limited trial period may be the right choice if the business’s goal is to acquire new customers or build market share. A pricing strategy can also tap into consumer behavior and motivations. Affluent shoppers, for instance, may be more willing to pay more for a product because of the perceived higher status that comes with ownership.

Why Are Pricing Strategies Important?

For many businesses large and small, profitability is key to survival and success. The right pricing strategy ensures a business can not only cover its costs but maximize its profit — which in turns enables it to invest in growth initiatives, such as expanding into new geographical markets or rolling out a new product line. The appropriate pricing strategy also helps a business adapt to changing market conditions, such as economic fluctuations that impact the cost of goods or what consumers are willing to buy; target specific customer segments, such as with pricing tiers or promotions; and manage product life cycles, with pricing matched to product introduction, growth, maturity and decline.

8 Pricing Strategies and Their Benefits

1. Captive Product Pricing

Definition: Captive pricing involves a company developing a core product that requires accessories and add-ons in order to function.

Best for: products with natural, complementary add-on options. SaaS companies have used the captive pricing strategy successfully. For instance, a web analytics software company charges $50 a month for its basic version. However, throughout their time using the product, customers will find that they absolutely need the add-ons — like more saved reports per seat, more data modelling capabilities and more monthly tracked users — to enable the core product. So, they buy the add-ons.

Example: A color printer costs $225. However, in order for the printer to work, it needs ink cartridges from the same company. Four-packs of cartridges cost $115, and you’ll need to purchase them on a recurring basis throughout the printer’s life.

Requirements: Products must require regularly replenished supplies.

Advantages

- Customers tend to love the core product’s low price.

- Recurring revenue from add-on products provides steady cash flow.

- The recurring nature of purchases fosters customer relationships.

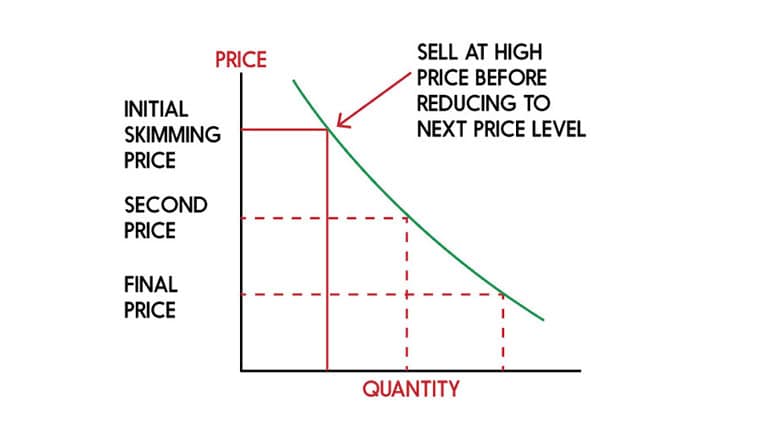

2. Price Skimming

Definition: This strategy entails pricing new products at the highest initial price that customers will pay, then gradually lowering it over time.

Best for: products that are innovative or trendy, have very little competition and appeal to early adopters. To use this strategy, a company and its products usually have to be well-known — and known for quality — in order to justify the hefty price tag. Price skimming is typically effective in sectors like technology and fashion.

Example: A highly-anticipated gaming console is released to the public for $800. However, after two months, the company decreases the price by 25%, to $600.

Requirements: Strong brand recognition; a premium, “must-have” product; and a loyal brand following.

Advantages

- High initial ROI can help companies quickly recoup development costs

- Decreasing prices over time allows for ramping-up production as adoption broadens

- Can boost perception of the product as a “must-have”

Image Credit: Feedough(opens in a new tab)

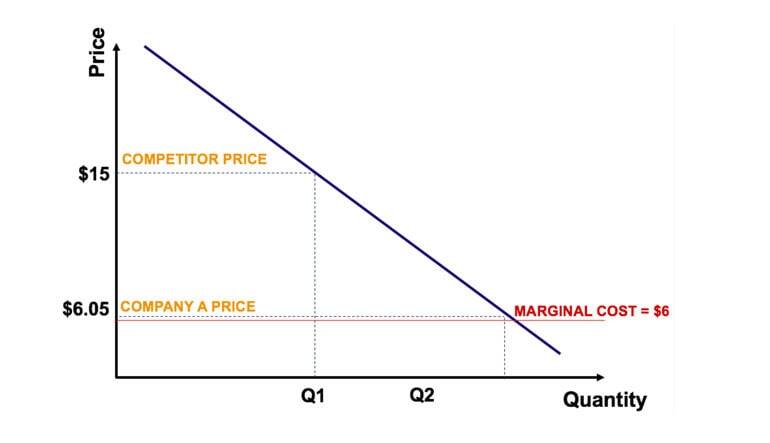

3. Penetration Pricing

Definition: Penetration pricing, also referred to as loss leader pricing, is the opposite of the skimming pricing strategy. A low price allows companies to gain market share by attracting new customers who spread the word about the offering and enticing customers away from competitors. The goal is to rapidly penetrate the market — then eventually raise prices without losing those early adopters.

Best for: a price-sensitive market, unlike the one appropriate for price skimming. Products should have broad appeal with clear economies of scale, since this strategy relies on customers volume to help cover costs prior to the planned price hike.

Example: A streaming platform cuts through the noise of an intensely competitive market by offering its service for $6.99 a month, significantly lower than competitors’ $8.99 and $11.99. After a year at that rate, it increases price by 15% to $8 a month.

Requirements: Products tend to need broad appeal in competitive markets. Additionally, companies will need to be able to withstand any losses that low prices incur.

Advantages

- Quick way to gain recognition and market share

- Capitalizes on economies of scale

- High adoption rates due to low prices — and the ability to steal customers from more expensive products or services

- Cheaper prices create goodwill among customers, who will likely spread the word

Image Credit: Corporate Finance Institute(opens in a new tab)

4. Premium Pricing

Definition: Premium pricing, also known as image or prestige pricing, involves setting a higher price to give the impression of superior quality. The price communicates luxury and performance and encourages favorable perceptions among buyers. Unlike skimming, there isn’t a plan around premium prices to lower them.

Best for: companies with brand loyalty and reputation. The product or service, meanwhile, must have unique features to justify the premium.

Example: A car-rental subscription service offers a “standard” membership for $699 a month and a “deluxe” membership for $899 a month. While the programs are largely the same, “deluxe” offers access to more luxurious cars. The latter is the company’s “premium” pricing option. Depending on its products, a company might have multiple premium pricing options (e.g., Apple).

Requirements: The offering must have a premium, unique perception, which will likely require more marketing spend.

Advantages

- More exposure of business, brand and offering

- Higher profit margins

- Can increase perceived value of the offering and differentiate the product in the market

5. Freemium Pricing

Definition: Companies that use the freemium pricing strategy offer a basic product for free and an enhanced version with more features, services and/or content for a fee. The enhanced version can also be considered premium due to a lack of features — like ads.

Fast-Growing Software Firms and Product-Led Growth: Freemium and free trials (more on those next) are prime examples of product-led growth (PLG), which is immensely popular among young SaaS companies. With this strategy, startups engage directly with end users, allowing them to survive stretches of slow growth.

Best for: products that appeal to a large audience with a natural progression from “free” to “premium.” Freemium conversion rates(opens in a new tab) generally fall between 2–5%, which means that a company needs a large user base and an effective conversion strategy.

Example: An IT management software offers a completely free IT help desk. Included are unlimited tickets, users, devices, agents and technicians. However, the free version is ad- supported. If a customer wants to get rid of the ads, it can pay $50 a month. The paid version also allows customer companies to display their logos in the ad space and in report PDFs.

Requirements: Companies need to have an obvious method for converting non-paying users to paying ones. People like free things — what makes the paid version worth the investment?

Advantages

- No usage barrier, which tends to result in a large user base

- Lower marketing and customer acquisition costs

- Free products tend to be more widely known and have a loyal following

6. Free Trial

Definition: Free trials let customers try an offering at no cost for a limited time. A user can continue using the free version of the offering indefinitely, versus, say, 30 days with a trial subscription.

Free trials are classified as either opt-in or opt-out. An opt-in free trial allows a user to access the trial without providing any information up front. An opt-out free trial requires users to provide a payment method and explicitly leave the program prior to the end of their free trial to avoid being charged.

Best for: companies that want to provide prospects with their full service, not the stripped-down version common in the freemium strategy. With a free trial, users receive every feature they would get with the paid version of the offering — but only for a short amount of time.

Example: A digital media publication gives customers two weeks of free, unlimited content. After those two weeks, the customer must pay $5.99 a month to retain the same access.

Requirements: Companies must have the resources to convert free trial users to paid customers. For instance, does the business have the employee capacity to nurture and follow up with leads? Additionally, it will need to ensure the free trial is not abused. (For instance, can an individual use multiple emails to get multiple free trials of your product?)

Advantages

- Provide more opportunities for collecting user data and feedback on the offering

- Gives the product the chance to “sell itself” to customers, resulting in potentially lower customer acquisition costs

- Eases consumers’ commitment fears

7. Product Bundling

Definition: Product bundling combines several products or services into a package deal. The bundled price is usually lower than the sum of the individual prices of the products when sold separately — and the perceived value of the bundle is greater than those of the individual products.

Best for: companies with multiple products or services that are synergistic or complementary enough to appeal to users when bundled together.

Example: A software company has several apps that allow for digital content creation. A graphic designer can buy either one vector graphics editor app for $19.99 a month or a bundle of eight graphic design apps for $49.99 a month. The bundle’s apps have capabilities that complement the vector graphics app, including page layout and design, 3D rendering and word processing.

Requirements: Bundles should rarely be your only pricing option, as Nintendo discovered when it tried a pure bundling scenario(opens in a new tab). Customers tend to prefer a mixed bundling strategy that allows them to purchase just one product on its own.

Advantages

- Provides a way to increase uptake of lower-volume items

- Gives customers the functionality to get the most value out of a service or product

- Simplified, discipline-specific purchasing

- Custom offerings perceived as having higher value / less time-to-value for the customer

8. Volume Pricing

Definition: With the volume pricing strategy, the prices of items are lowered when customers buy more of them.

Best for: companies looking to price based on individual items (licenses, users, transactions) rather than features. Volume pricing works well for businesses that typically receive — and want to encourage — large orders.

Example: A design platform charges $99 per license when customers buy fewer than 20 licenses. However, the price of each license is lower if customers buy more of them:

| Quantity | Price per license |

|---|---|

| 1 – 19 | $99 |

| 20 – 49 | $89 |

| 50+ | $79 |

If a user buys 51 licenses, then the cost would be $79 each, totalling $4,029.00.

Requirements: Businesses will need to have enough of a profit margin to allow for discounting and possible other perks.

Advantages

- Easy for customers to understand when they’ll benefit from the program

- Competitive differentiation

- Incentivizes use of and reliance on the offering

9. Tiered Pricing

Definition: Like the volume pricing strategy, the tiered pricing strategy entails volume discounting. However, it differs in its pricing structure: The price per unit applies to all units sold within a particular pricing tier. After a customer “buys up” one tier, it moves to the next.

Best for: companies looking to price based on individual items (e.g., users or transactions) rather than features.

Example: A remote team workspace platform charges $20 per user for the first 100 users. Once a customer exceeds 100 users, the price will decline per user.

Quantity Tier 1: For 0–100 users, the price is $20 per

Quantity Tier 2: For

101–1,000 users, the price is $15 per

Quantity Tier 3: For 1,001–10,000

users, the

price is $10 per

Quantity Tier 4: For 10,001+ users, the price is $5 per

If a company wants seats for 10,500 users, the charge is (100 x $20) + (900 x $15) + (9,000 x $10) + (500 x $5) = $108,000

Requirements: More customer use means less value per unit, which means you’ll need to upsell your customers.

Advantages

- Allows for incorporation of initial free units or discounts in higher quantity tiers

- Competitive differentiation

- Incentivizes larger orders

The Tiered Pricing Model vs. Tiered Pricing

Strategy

If you read part I of this series, then you

might notice that both a subscription pricing model and a pricing

strategy are referred to as “tiered.” The terms

“tiered subscription

model” and “tiered pricing strategy” are often, and

erroneously, used

interchangeably. But they’re different concepts and should be

treated as

such.

For our purposes, the “tiered subscription” is a commonly-used pricing model in which an offering comes at several different price points, or tiers, for customers to choose from. The “tiered strategy” refers to the volume discounting tactic that means prices vary based on the number of units purchased, with specific unit volumes constituting the boundaries of each tier.

Implementing Pricing Strategies

As you look to implement pricing strategies to help attract and retain customers, you will need to consider how a given strategy may or may not fit with your chosen subscription pricing model. The effectiveness of some strategies (e.g., skimming, penetration and premium) depends on factors like your product itself, brand recognition and competitors — and not on your chosen pricing model. And, other pricing strategies just won’t pair well with a given subscription pricing model. For instance, a flat- or fixed-rate pricing model doesn’t work with pricing strategies that make use of multiple pricing options (e.g., freemium, tiered, volume). Ensure the realities of your chosen pricing model match the requirements of your selected strategies.

Subscription Pricing Models and Pricing Strategies

| Subscription Pricing Model | Complementary Pricing Strategies |

|---|---|

|

Flat-Rate |

Skimming, Penetration, Premium, Free Trial, Product Bundling |

|

Tiered |

Skimming, Penetration, Premium, Freemium, Product Bundling |

|

Usage-Based |

Skimming, Penetration, Premium, Free Trial, Freemium, Volume, Tiered |

|

Per-Added-Module |

Skimming, Penetration, Premium, Captive, Product Bundling |

|

Per-User |

Skimming, Penetration, Premium, Free Trial, Freemium, Volume, Tiered |

Choosing pricing strategies isn’t a static or single-occurrence activity. As the Harvard Business Review famously claimed in 1992, a 1% improvement in price can increase operating profit by 11%(opens in a new tab), making price tweaks some of the most effective for boosting business performance.

Patrick Campbell, CEO of Price Intelligently, recommends reevaluating pricing performance every three months. Price changes could occur every 6–9 months — or more often for a smaller, nimbler company. Specific signs that pricing strategies need a change include declining subscriber rates, missed profit goals and low retention rates.

Mind Your Business With NetSuite Financial Management

Revenue growth, positive cash flow, higher profits and an increase in customer lifetime value are all signs, in part, of a business having the right pricing strategy in place. NetSuite Financial Management captures and monitors these key performance indicators, and many others, in real time so that business owners and executives can optimize or adjust their pricing strategies as quickly as possible. Powered by automation, the cloud-based solution streamlines key financial and accounting processes, such as subscription billing, planning and budgeting and financial reporting. NetSuite Financial Management seamlessly integrates with NetSuite ERP, as does NetSuite Order Management, which includes pricing management capabilities across multiple strategies. Customers subscribe to NetSuite for an annual fee, based on which solutions best suit their needs.

The Bottom Line

Pricing strategies are a useful tool to use throughout a subscription offering’s lifecycle — not just in the beginning. Tweaking and testing new pricing strategies at a regular cadence can help ensure your company is maximizing profits and attracting customers in the most effective way.

Check back for our next piece in this subscription pricing series, on psychological pricing tactics you can use to grow a subscription offering in a competitive marketplace.

For more helpful information from the Brainyard and our friends at Grow Wire(opens in a new tab) and the NetSuite Blog(opens in a new tab), visit the Business Now Resource Guide.