Professional services businesses want to get paid for their work, just like any other company. But the process of billing for services at one business isn’t always as simple as that for another. As a project runs its course, many factors can complicate both billing and accounting, including accounting standards for revenue recognition. So, how a professional services firm — a law firm, say, or a marketing agency — bills its clients can sometimes play a major role in that company’s financial outlook. And the longer a project takes to complete, the more important the role of project billing becomes in producing steady cash flow and a consistent profitability outlook. Project billing can also help or hurt a firm’s relationship with the client, another vital part of navigating the ups and downs of a project.

What Is Project Billing?

Many businesses work with clients on planned projects that take time to complete. For these dealings, companies may choose to use project billing to accelerate payment for their work and maintain a steady cash flow, rather than billing at completion of the project. Project billing begins by setting the rates and payment structure, then preparing the invoices and collecting revenue over the course of a project that might last months or even years.

What Is Project Billing for Professional Services?

Ever hear a lawyer talk about “billable hours”? Or a consultant mention “being on retainer”? Those are two methods of project billing for professional services. It’s how those firms earn money. While retail stores sell products and collect revenue at the time of a sale, professional services providers’ products are their knowledge and expertise, which they typically dispense over time. The financial transactions involved in project billing reflect the service providers’ time spent and the value of the services delivered to the client. Invoicing for such projects differs from one service to the next, based on the nature of the industry and the type of billing plan they have chosen.

Key Takeaways

- The right strategy for project billing can vary, depending on the professional services being provided and may even change from project to project.

- Maintaining a sustainable cash flow is an integral part of successful project billing.

- Invoicing mistakes create delays in receivables, which can put a strain on cash flow, as well as on client relationships.

- Using accounting software to automate many invoicing tasks helps prevent improper billing and increase efficiency.

Project Billing for Professional Services Explained

The term “professional services” casts a wide net with regard to the types of businesses it encompasses: legal, accounting, architectural, consulting, marketing, event management, creative services — to name a few. Each has its own characteristics, so, for example, much of what makes sense for a law firm may not suit an architecture company. But this much is certain: Making the right decisions about project-billing methods, time-and-expense tracking, payment structure and supporting technology can boost a service business’s financial outlook. It can streamline certain processes, improve forecasting and help professional services companies increase their profitability.

The challenge for professional services billing is that there are three intertwined tracks within their client relationships. First, there are the timing and amounts of the invoices — the project billing itself — and their collection. That must be aligned and reconciled with the second track, which is the pace of the work being done in terms of project deliverables; and the third, which are the revenue recognition rules to which the servicing company must comply under accrual-basis accounting standards. There are multiple ways to approach project billing, but a key goal they all share is to enable a professional services firm to collect payments from clients before a project is completed. This helps pay the salaries of the people performing the services and cover any expenses the project incurs.

Importance of Accurate Professional Services Project Billing

No one wants to pay more than they are supposed to for a service, no matter how satisfied they are with that service. So, it follows that billing your customers accurately keeps them happy, keeps the cash flowing and keeps your company operating at optimal efficiency.

- Building trust with clients: Keeping a client happy rides on a strong relationship. Sending correct invoices from the start helps establish a business’s credibility and, equally important, prevents the client from developing an impression that the firm might be careless or unreliable.

- Ensuring smooth cash flow for the business: Incoming cash is the lifeline of a company, and getting accurate invoices out to clients in a timely fashion helps bring that cash in the door quickly. It also decreases the likelihood of payment delays or nonpayment. Remember the last time you were billed incorrectly by a doctor’s office, for example? Odds are you called to fix it, and they sent a new bill. That new bill took time to generate and deliver, and probably came with a reset due date. That’s how inaccuracies lead to delays that hinder cash flow.

- Compliance with financial regulations and standards: When reporting financial results, it is critical that a business understand and adhere to Generally Accepted Accounting Principles (GAAP), if based in the U.S., and to International Financial Reporting Standards (IFRS), if based elsewhere. To meet terms for revenue recognition, standards-compliant services firms must adhere to Accounting Standards Codification (ASC) 606, a measure jointly issued by the governing bodies that publish GAAP and IFRS regulations. ASC 606 gives businesses a standard framework within which to account for revenue acquired over a certain period of time. Remaining up to date with these regulations, as well as with local financial regulations and laws in all the places where the services firm conducts business, ensures a smoother billing and payment process, eliminates potential fines and avoids weakened credibility with clients.

- Enhancing profitability and understanding costs: With accurate project billing comes a sharper understanding of the length of time various tasks require. This leads to improved knowledge of the costs inherent in your professional services, which can, in turn, improve future project forecasts.

Common Billing Methods in Professional Services

Professional services firms can choose from among several commonly used billing methods, depending on which works best for them. The main factors to consider when making this selection are how the business provides value and the way costs are incurred to deliver that value.

Time and Materials (T&M) Billing

With a time and materials contract, customers are billed for the actual cost of materials and hours of labor needed to complete the project. Some clients prefer T&M billing because it helps them limit the risk of overruns on the project, but providers may find it difficult to accurately forecast revenue under this method. Contracts often include a “not to exceed” clause to protect a client against overruns. The provider and client also need to agree on billing frequency, such as weekly, monthly or quarterly. T&M billing works best when the entire job’s scope and duration can’t be fully determined beforehand. For example, a construction company may start a renovation project, but, as a team removes walls and flooring, it discovers corrosion in the building frame, which must then be replaced, extending the estimated timeline.

Fixed-Price Billing

This method essentially says, “Here are the services we’ll provide, and this is what it will cost.” A fixed-price billing plan works best for companies whose work is not subject to the fluctuating (usually rising) prices of materials and labor; for example, a marketing agency may charge a flat fee of $100 per social media post created for a client. To use this approach, examine your company’s overall cash and billing flow to determine when in the process of the project to bill the client, and get agreement up front. Regardless of whether the client pays the bill at the beginning, middle or end, any professional services firm that uses accrual-basis accounting must recognize revenue only when they perform the activities necessary to earn it, under the guidelines of ASC 606.

Retainer-Based Billing

A retainer is a designated amount of money paid up front by a client to reserve or “retain” a company’s services for a certain period. It also can be designed as an ongoing fee for services provided on a continual basis. Lawyers generally charge a retainer to take on a case. But retainers are also used in other professional services industries. For example, a client may want to work with one digital content creator or agency over time to establish a trusting relationship and build expert knowledge of the brand. Retainer-based billing provides a steadier cash flow to the service provider and allows companies to more easily forecast revenue. It also removes a few financial concerns and lets service practitioners focus more on client concerns, since it diminishes uncertainty over a firm’s financial stability. On the flip side, services firms must guard against under- or over-servicing the client.

Milestone-Based Billing

Under this form of project billing, payments kick in after certain predetermined milestones are reached. With milestone-based billing, the total fee is distributed across the life cycle of the project, rather than received at the end or at designated time periods. By tying payments to performance, as defined by the milestones to be achieved, a company can show alignment with its client’s goals and needs. Imagine a new advertising project, for example. Its milestone-billing moments could occur when:

- The creative concept is agreed.

- Media channels are chosen for ad placements.

- Ad creative is finalized.

- Ad performance is reported (with incremental money tied to above-goal results).

Depending on how well or poorly the project moves along, this method has the potential to create cash flow issues. A benefit, though, is that milestone-based project billing usually aligns closely with the accounting rules for revenue recognition.

Value-Based Billing

This relatively new and growing billing model groups services into a bundle and charges a set amount based on the perceived value provided. The price is set and fixed at the start, so the client knows what it’s paying for and the business knows what revenue it’s getting. Think of how most smartphone service plans now come with unlimited talk and data. It wasn’t that long ago that customers had no choice but to pay according to minutes used talking, texts sent and data uploaded or downloaded. Customers may not make as many calls or stream as much data from one month to the next, but the convenience of knowing they can, increases the service’s value.

Value-based billing helps separate the price of a service from the time it requires, creating an incentive for service providers to work smarter and more efficiently. If you can find a way to do something in two hours that normally took three, and get paid the same amount, that’s a win for your company.

Stages of the Project Billing Process

The end goal of project billing for a professional service, of course, is to get cash in house. But there’s a process for that. The more precise and timely the billing process, the more likely the cash will be collected and the smoother the customer relationship will be. The following seven steps are a good overview of the project billing process and can be customized to the needs of an individual service provider.

1. Project Initiation and Agreement

The roots of the billing process start at the very beginning of the relationship between the service business and its customer.

- Contract negotiation: In addition to the standard contract elements, such as deliverables, confidentiality, liability and dispute resolution, this is where all billing and payment terms are discussed and agreed to by the firm and its client. That includes how much the project will cost in total, the billing method to be used, the schedule of payments, currency and any penalties, such as late fees.

- Project scope definition: In many instances, service providers create a statement of work or a service-level agreement — or both — that clearly defines what services will be delivered to the client and how they will be billed. These documents often include a guaranteed level of service, deadlines for deliverables and response times for dealing with any breakdowns in service.

- Setting rates: Most professional services establish billable hourly rates for each level of employee. For example, a partner in a law firm has one rate, while a second-year associate has a different rate. Scoping a project should include estimating the billable hours needed at each rate level, then multiplying accordingly and summing the results to get a total price. Add in any expected expenses and fees for distinct tasks, then factor in the firm’s overhead percentage.

2. Time and Expense Tracking

Generally speaking, you can’t bill what you don’t track. Clients and customers often want their invoices to include detailed breakdowns of the following categories.

- Resource allocation: How many people will be needed to complete the project requirements? What physical resources are needed? Sometimes, it’s as simple as a small group with existing laptops. Sometimes, it means buying new software or equipment to take on the task.

- Timekeeping: Time-tracking consists of logging the number of work hours submitted for various project tasks and painting a clear picture showing how those resources were used. There are many ways to track time, from weekly paper timesheets to software that tracks individuals’ working hours. Using professional services automation (PSA) software can help people more efficiently keep track of their billable and nonbillable hours, show project managers how the project is progressing and identify any potential issues.

- Expense recording: As with time spent, accurate and timely expense reporting is important in the billing process. It ensures that the right expenses are paid for at the right time and reduces cash flow concerns as the project moves along. Again, automated software can boost expense recording efficiency.

3. Invoice Creation

Now it’s time to get paid for work produced so far, as the project moves along. Invoice structure will be different depending on which of the five project billing methods described above is being used, but consider the following key elements when writing any invoice. Here, good project accounting software can help produce timely, accurate invoices.

- Itemization: An itemized invoice offers clarity and transparency to the client. It spells out each specific item a customer is responsible for paying for, based on the type of project billing selected. That might include all goods and services, the quantity used and/or the cost per piece or per hour.

- Taxation: Any taxes and fees should be included as a separate line entry on an itemized invoice. Each type of tax — sales, state and federal, for example — should be listed individually and include the percentage rate and subtotal.

- Discounts and adjustments: Any types of coupons, promo codes, credits, etc., should be listed separately and subtracted from the subtotal to generate the final total of the invoice.

4. Invoice Review and Approval

Nothing slows down collecting on an invoice more than inaccuracies. Take the time necessary to double-check the invoice.

- Internal review: With so many small but vital details on an invoice — client name, invoice number, date, itemizations and so on — it’s wise to have someone proofread it carefully, even if it was produced by reliable automated financial software.

- Management approval: Before an invoice is sent to the customer, it should be reviewed by the project manager and/or their supervisor for accuracy, clarity and possible agreed-upon inclusions not known by the invoice creator or not yet entered into the account via software.

5. Invoice Delivery

Because time is so crucial in billing — the sooner invoices are delivered, the sooner they can be paid — internal processing time is key to this step. To accelerate invoice delivery, automate whatever parts of the workflow you can and set up an alert reminder system for invoices in waiting.

- Mode of delivery: Invoices can be delivered via mail/other physical delivery service or electronically. To reduce company costs, offer clients the digital option first, as it can speed up the time until the client’s payment arrives.

- Confirmation: Your financial software should use a form of “read receipt” functionality that confirms the client received, and perhaps opened, the email. But regardless of delivery mode, establish a process to confirm customer receipt of each invoice.

6. Payment Collection

You may dribble up the court and soar through the air, but you don’t score until the ball goes through the hoop. Several elements can help businesses achieve the “swish” they’re looking for, such as payment reminders, payment tracking and offering as many payment modes as possible.

- Payment modes: It’s best to provide multiple payment modes. There’s no shortage of such options, from bank transfers to credit cards to peer-to-peer payment services to, of course, cash or check. The easier it is for customers to pay, the easier and faster it is for you to collect.

- Payment tracking: A record of each payment should be generated by accounting software, showing completion of the transaction as well as any outstanding balances on the account. Keeping customer accounts current and accurate reduces the potential for embarrassing errors, such as collection efforts on an invoice that the customer already paid.

- Reminders and follow-ups: Just as you set payment due dates, you also should send reminder emails or texts at set times before the date arrives to those who have yet to pay. It’s considered a best practice to put in place an automated process that generates “payment received” and “payment past due” notifications for customers, as well as internal alerts that flag large or long-past-due invoices.

7. Reporting and Analysis

Accounting software should have dashboards that track key metrics, such as accounts receivable aging, days sales outstanding and more. These and other KPIs can help with various types of billing analyses.

- Cash flow analysis: Doing a cash flow analysis as a project moves along helps identify outstanding payments, as well as forecast the timeframe of the project. A company may decide not to put more resources into a project if it notices delays in payment.

- Profitability analysis: Will this project deliver a financial gain for the firm? That’s a question asked at the project launch. And, with proper analysis during and at the end of the project process, it can be answered by comparing collected revenue against the cost of delivering those services. Depending on the nature of the company, that might include time spent, materials or other expenses. It can also help alert managers to situations where adjustments need to be made.

- Client history: Think of a client’s payment history as akin to a credit score. Do they always pay on time? Are they always late or short on payments? Knowing these details will help with forecasting and shaping contract discussions for future projects.

Common Professional Services Project Billing Mistakes

Mistakes happen. When it comes to managing professional services revenue, it helps to be aware of some of the more common project billing mistakes to watch for.

- Underestimating project scope and costs: This common mistake can be costly, in terms of both money and relationships. For example, a law firm estimates that a project will require 100 billable hours to complete, but, by week two, it realizes they’re only halfway done and already approaching that number. Correcting this oversight requires rewriting the contract and communicating as early as possible with the client about the changes.

- Delayed invoicing: The longer it takes to send an invoice, the longer it takes to get paid on it. This can lead to problems with cash flow, as well as reduce the efficiency of the accounting department. Professional services firms that experience frequent delays should consider automating the process via electronic invoicing.

- Not having clear terms in contracts regarding payment delays and penalties: When there are billing misunderstandings or disputes, the first step is to check contract language to determine where the resolution lies. Make sure contracts clearly spell out payment terms, such as due dates and late-payment fees/penalties.

- Inaccurate time-tracking leading to billing discrepancies: Beyond the obvious error of undercharging or overcharging the client and delaying payment, there are credibility and trustworthiness factors that come into play here. One mistake here or there shouldn’t be too big a deal, but repeated errors make a client think twice about the relationship.

- Not regularly reviewing and adjusting billing rates: Billing rates can change for various reasons, and if a firm doesn’t maintain up-to-date rates in its accounting system, it runs the risk of bringing in less revenue than it actually earned.

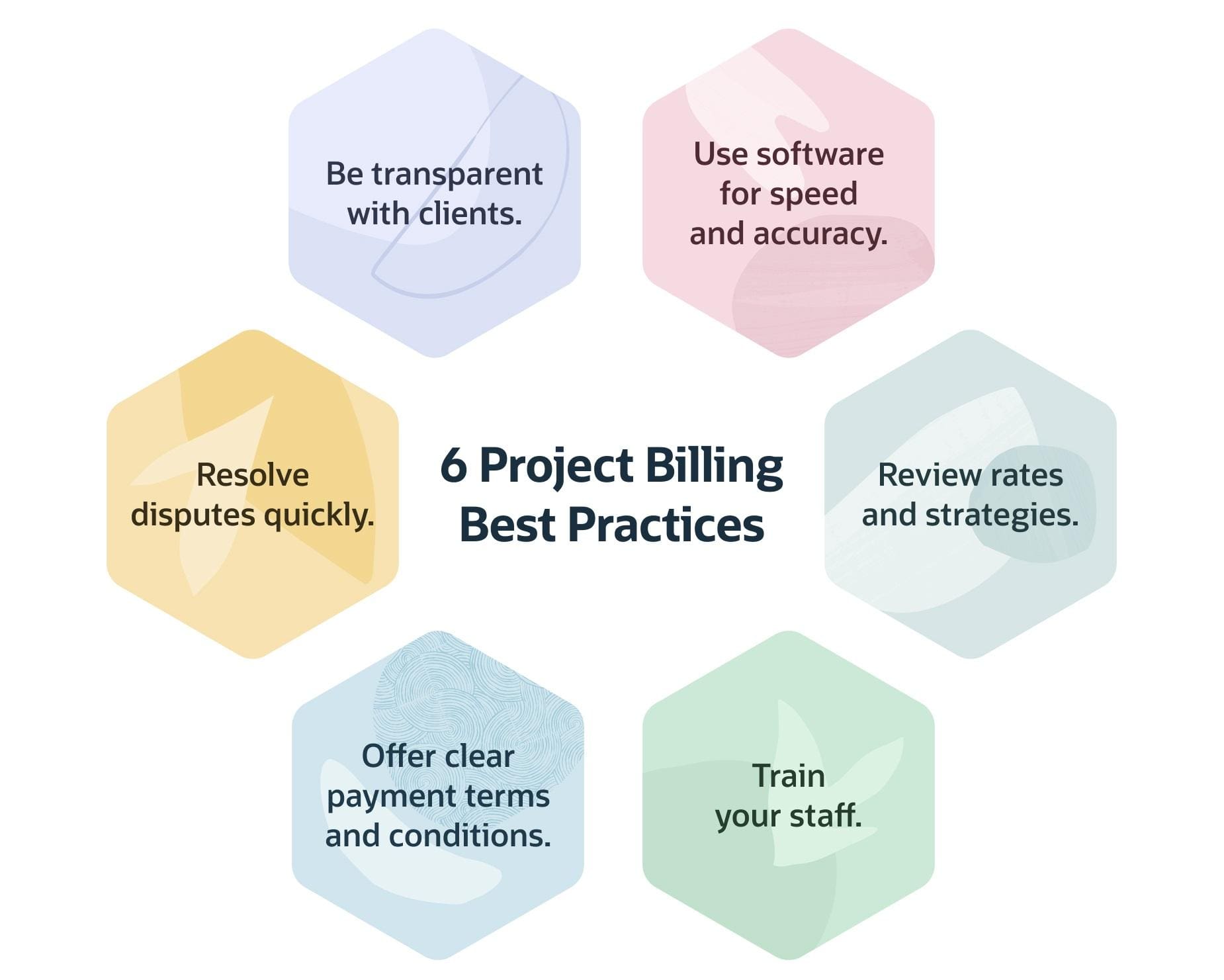

Best Practices for Project Billing in Professional Services

These six tips to keep in mind from the outset of any professional services project all aim at a single goal: to get customer payments into the bank quickly by making project billing as clear, fast and accurate as possible.

- Ensuring transparent communication with clients about billing methods and rates: Part of the relationship and trust-building with a client involves making sure they understand how — and how much — they’ll be billed. No one likes surprises when it comes to paying bills.

- Using advanced billing software and tools for accuracy and efficiency: Automating as much of the project billing process as possible via electronic billing software makes the company and its employees more efficient. It eliminates considerable manual effort and minimizes the chances of mistakes.

- Regularly reviewing and updating billing rates and strategies: Stay current with industry trends, as well as what makes sense for your company’s bottom line when it comes to how you bill clients. Should certain tasks now be considered billable hours when previously they weren’t? Is there a business reason to increase or decrease billing rates to meet demand or acquiesce to external factors?

- Training and workshops for staff to stay updated on best billing practices: As the business grows and evolves, and government rules and regulations change, make sure everyone involved in the billing process is properly informed and trained on what to do. If new software is being rolled out, give staff plenty of lead time to train and get hands-on experience.

- Establishing clear contract terms and conditions related to billing: Whichever form of project billing is used, service agreements should spell it out clearly and precisely, leaving no doubt. Terms of payment, due dates, late fees and acceptable payment methods should be specified on each invoice to avoid any misunderstandings.

- Promptly addressing any disputes or queries related to invoices: The sooner questions that arise from the client are handled, the more this practice establishes and reinforces the company’s credibility and reliability. It helps assuage the business-client relationship, and it cuts down the time it takes to get paid. Having stakeholders familiar with the client run a quality check before invoices are sent usually reduces the potential for disputes.

6 Project Billing Best Practices

Improve Your Project Billing With NetSuite

Time is money, as the adage goes. The less time a firm spends manually generating invoices, the less time it takes to collect that money. Project billing for professional services can become complex and challenging, depending on the service type and the project, and so is an ideal candidate for automation. NetSuite’s cloud accounting software and professional services automation solution allows companies to manage and track revenue, cost and profitability over the course of even the most complex projects. Digestible visuals, in the form of dashboard charts and reports, enable professional services accountants and business managers to check in on project accounts and understand profitability metrics from one project to another. NetSuite offers a billing environment that can be customized for each project and customer. Drill-down capabilities and automated dashboards allow for easy analyses and comparisons. Thinking long-term, the information provided on each project makes forecasting simpler and more accurate, which, in turn, can make future project bids smarter and more profitable.

Billing is often more challenging for professional services firms than for other types of businesses because the “sale” usually takes the form of a project that is delivered over time. A firm has several options for how it sets rates and bills clients, with the nature of the work being done serving as the main determining factor. Perhaps a fixed rate is easiest for one project, while incremental billing based on time or stage of the project works best elsewhere. Being clear and up front with clients on billing plans makes the process more efficient, aids in collecting payments and helps both parties maintain a strong relationship.

Project Billing for Professional Services FAQs

Who is involved in project billing?

Project billing is a multifaceted process that goes beyond just the accounting department. The actual work of generating, delivering and tracking invoices may begin and end there, but the billing journey actually begins with the initial contract negotiation. It also includes project managers who work with clients and review invoices for accuracy, and all members of the project team, who are typically responsible for tracking their own time.

What are the different types of project billing?

There are five commonly used methods used by professional services firms for project billing. They include time and materials, fixed price, retainer-, milestone- and value-based billing. Each has unique characteristics, and a company must choose which one is right for its business and the project at hand.

What are billable hours in professional services?

Billable hours are exactly as they sound — hours of work completed that a client can be charged for by the service provider. That may be any type of work necessary to complete the project. Depending on the type of professional service, it can include creative work, legal negotiating and consulting, research, administrative work and more. These hours can be tracked using time-tracking software.

How do I create an invoice for professional services?

Financial and accounting software will typically provide invoice templates that services firms can use right out of the box or customize to their needs. The invoice should include the company’s info, client’s info, invoice number, itemized list of services provided and clear payment terms.

Why is choosing the right billing process model important?

There are five project billing models for professional services firms to choose among: time and materials, fixed price, retainer-, milestone- and value-based. The right billing process model is the one that makes the most financial sense for your company on a particular project. Some businesses will use multiple methods to bill their clients. The key element in selecting the right one lies in how effectively the business can manage its revenue flow while providing a superb experience for the client.

How are professional services billed?

Each professional services firm can bill its clients as it sees fit, with the variations potentially differing by industry, as well as from project to project. For example, some marketing firms may bill based on billable hours while others prefer to work on retainer. A contractor may have some jobs billed by time and materials as the project goes on, and others where bills are based on the completion of certain milestones. In each case, the billing method should be determined at the outset so that all stakeholders understand what’s expected.