A business’s success hinges on its ability to efficiently and effectively procure the goods and services needed to keep operations running smoothly. Enter procure-to-pay, a critical process that lies at the heart of an organization’s procurement function. Far more than an administrative task, procure-to-pay can make or break a company’s bottom line. This article examines the procure-to-pay process, how it works and which best practices and technologies can be used to streamline purchasing and drive success.

What Is Procure-to-Pay?

Procure-to-pay, also known as P2P or purchase-to-pay, is the process of requisitioning, purchasing, receiving, paying for and accounting for goods and services. While primarily an operational process, P2P has significant financial applications, as it directly impacts an organization’s profitability, cash flow and budgeting.

As a subset of the larger procurement management process, P2P focuses on managing spend and maintaining financial control. It provides a structured framework for requesting, approving and tracking purchases, ensuring that all expenditures align with budgets and business objectives. This centralized and standardized purchasing process helps organizations prevent maverick spending, reduce fraud risk and improve compliance with internal policies and external regulations.

Additionally, P2P plays a key role in strategic sourcing and vendor management by providing end-to-end visibility into procurement activities. Through the P2P cycle, organizations can consolidate and analyze spending data to identify potential cost-saving opportunities, negotiate better terms with suppliers and uphold compliance with contracts. And by enhancing communication and automating workflows, P2P can foster stronger, more collaborative and mutually beneficial relationships with suppliers.

-

Procure-to-Pay vs. Order-to-Cash

While P2P and order-to-cash are distinct processes, they are closely related. In fact, they represent two sides of the same transaction. Order-to-cash, also known as O2C or OTC, refers to the supplier’s perspective of receiving and fulfilling customer orders, invoicing and collecting payment. It encompasses all of the steps from the moment a customer places an order to when the payment is received and reconciled in the seller’s financial records.

In other words, the output of the P2P process serves as the input for the supplier’s O2C process and vice versa. For example, the purchase order in the P2P process serves as the trigger for the supplier’s O2C process. Similarly, the output of the O2C (an invoice) becomes a key document in the P2P process. Tight coordination between P2P and O2C is crucial for ensuring a smooth flow of goods, services and payments between buyers and sellers.

-

Procure-to-Pay vs. Source-to-Pay

P2P, which focuses on the transactional aspects of purchasing, is a subset of the source-to-pay (S2P) process. S2P is a comprehensive term that includes all of the activities involved in identifying, evaluating and engaging suppliers, managing ongoing supplier relationships and performance, as well as every step in P2P.

The S2P process generally includes the following key stages:

- Supplier identification and qualification

- Supplier evaluation and selection

- Contract negotiation and management

- Spend analysis and demand planning

- Purchase requisitioning and ordering

- Invoice processing and payment

- Supplier performance monitoring and management

As this list illustrates, S2P extends beyond P2P both upstream and downstream. On the front end, S2P includes strategic sourcing activities like spend analysis, supplier identification and contract negotiation. These activities lay the foundation for the transactional P2P process by establishing the right suppliers, prices and terms.

On the back end, S2P also includes ongoing supplier performance management and relationship management to ensure that organizations are getting the best value from their suppliers and to identify opportunities for continuous improvement. By effectively integrating S2P and P2P, organizations can drive greater value in their procurement functions.

Key Takeaways

- Procure-to-pay (P2P) covers specific steps involved in purchasing goods and services, from identifying a need to making the final payment.

- An effective P2P process can cut costs, improve supplier relationships and strengthen financial controls.

- Each step of the P2P process involves various stakeholders and activities.

- Organizations can optimize P2P through process standardization, technology adoption, supplier management and continuous improvement.

- Advanced technology is transforming the future of P2P by enabling greater automation, efficiency and innovation.

Procure-to-Pay Explained

The P2P process is a multistep workflow. The process begins with requisitioning, where employees in operating departments identify a need for a good or service and submit a purchase request (PR). This request then moves to the approval stage, where designated approvers review and authorize the transaction based on factors such as budget, policy and business need. Once the purchase is approved, a formal purchase order (PO) is created and sent to the supplier. After receipt, inspection and approval of the ordered goods or services, the supplier’s invoice is matched to the PO and delivery receipt — a process called three-way matching. After the invoice is validated, payment is issued to the supplier according to terms of the agreement.

Throughout the P2P cycle, various stakeholders play critical roles in ensuring purchases are made in compliance with organizational policies and that the process runs smoothly. These stakeholders include the requesting employee or department, budget owners, procurement professionals, accounts payable (AP) staff and suppliers. Each contributes to the overall efficiency and effectiveness of the P2P process.

Digital tools, including e-procurement platforms, electronic invoicing and automated workflows, can streamline the P2P process. These tools make the process smoother by reducing manual effort, minimizing errors and accelerating cycle times. In turn, organizations can get more value from their workforces and more value from their spending, ultimately improving their bottom lines.

What Are the Advantages of Effective Procure-to-Pay?

An effective P2P process offers organizations a range of compelling benefits that extend beyond transactional efficiency. By optimizing the end-to-end P2P workflow, businesses can drive significant cost savings, boost operational performance and strengthen their strategic relationships with suppliers. It also enables better spend management, risk mitigation and data-driven decision-making.

- Cost savings: By applying spend analysis, strategic sourcing and supplier negotiation to the P2P process, companies can secure better prices, terms and discounts from their suppliers. For example, a manufacturing firm with a robust P2P process may be able to consolidate its spend by contracting with fewer, more strategic suppliers to earn volume discounts.

- Improved supplier relationships: Automating routine tasks, enhancing communication and providing self-service portals can make it easier for suppliers to do business with organizations. For instance, a retail company that implements a supplier portal as part of its P2P process may be able to onboard new suppliers more quickly and share real-time information to resolve issues more efficiently.

- Enhanced efficiency and accuracy: Optimized P2P workflows, especially via technologies like robotic processing automation (RPA) and e-invoicing, can reduce manual effort, minimize errors, speed up cycle times and support scalability. One leading financial institution that automated over 80% of its P2P process was able to increase compliance to procedures by 80%, capitalizing on the combined benefits of increased efficiency and standardization.

- Better financial control: Effective P2P processes include internal financial controls, such as standardized workflows, approval hierarchies and spending policies. These controls help manage spending, enhance visibility and detect errors and unusual transactions. For instance, a healthcare agency that implements a standardized P2P system with robust spend controls may be able to reduce unauthorized or fraudulent spending, improve budget adherence and enhance audit readiness.

- Data-driven decision making: The P2P process is multifaceted, with lots of valuable data that can be leveraged to inform businesswide decision-making. Procurement teams can use spend analytics, supplier performance metrics and market intelligence to identify trends, optimize sourcing strategies and drive continuous improvement. For example, an electronics company that analyzes its P2P data may be able to identify opportunities to standardize product specs, rationalize its supplier base and sharpen demand forecasting accuracy.

- Increased transparency: Well-defined P2P processes build trust and accountability by providing visibility into requisitions, POs and invoices. This can then improve communication among procurement teams, suppliers and internal customers. For instance, a furniture manufacturer could better monitor its international supply chain to not only identify potential disruptions, but also communicate them to suppliers to help minimize production downtime. Such transparency can also help demonstrate compliance with regulations, enhancing the company’s reputation for ethical business practices.

How Does the Procure-to-Pay Process Work?

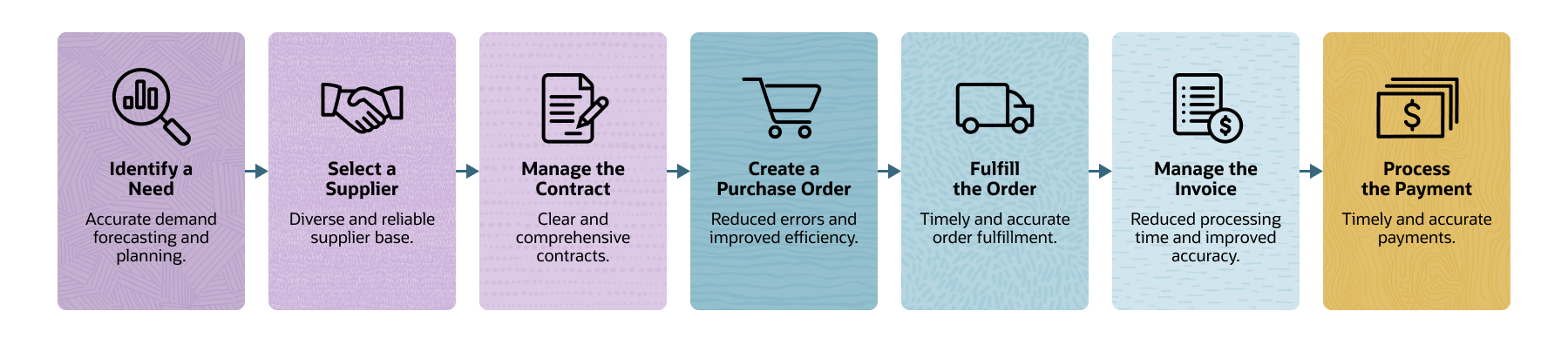

The P2P process is a structured, step-by-step approach. Each step in the process plays a critical role in making sure that purchases are cost-effective and in compliance with organizational policies and procedures. By understanding the key activities and stakeholders involved at each stage (illustrated, then detailed, below) organizations can identify opportunities to rationalize processes, automate manual tasks and improve collaboration both internally and with suppliers. The entire seven step P2P process is illustrated here. An exploration of each step follows.

The 7-Step Procure-to-Pay Process

Step 1. Identify a Need

The P2P process begins when a business identifies a need to acquire goods or services. This need may arise from various departments or functions within the organization, such as manufacturing, marketing or IT, and can range from the need for paper goods and raw materials to promotional materials for an upcoming product launch. Once identified, the requester submits a PR documenting the specifications, quantities and timeline for the needed items or services. It’s important that the need is clearly defined, justified and aligns with organizational goals and budgets.

Step 2. Select a Supplier

With a properly authorized PR in hand, the procurement team searches for potential suppliers that can fulfill the requirement. This process may involve issuing requests for proposals (RFPs), conducting market research or reaching out to existing supplier relationships. The team selects the right supplier based on criteria such as price, quality, delivery time and reputation. For instance, a procurement manager may compare proposals from multiple IT vendors to find the best fit for a software development project. The challenge lies in balancing multiple criteria and making an objective, data-driven decision that delivers the best value for the organization

Step 3. Manage the Contract

After selecting the supplier, the procurement team negotiates the terms and conditions of the contract — such as pricing, payment terms, delivery schedules, quality standards and service-level agreements — in accordance with its own organization’s policies and objectives. If applicable, the legal department reviews and approves the contract for legal and regulatory compliance since it will serve as a legally binding agreement between the parties.

Contract management also involves ongoing monitoring and performance management to verify suppliers meet agreed-upon terms and conditions. This helps minimize risks and maximize value by allowing quick identification and resolution of issues. For example, a construction company may negotiate a contract with a supplier for raw materials, specifying quantities, quality and delivery requirements. The company would then monitor the supplier’s performance to maintain a smooth and reliable supply of materials for its projects. This way, the company can quickly address concerns and prevent project delays or quality issues.

Step 4. Create a Purchase Order

With the contract in place, the procurement team creates a PO that formalizes the details of each order, including the items or services purchased, quantities, prices and delivery requirements. The PO is then sent to the supplier, activating its order management process. A standard PO is used for a single purchase, while a blanket PO is set up for recurring purchases within established contracted terms. For instance, a bakery would create a standard PO for a new oven, specifying the model, accessories, installation requirements and payment terms, but use a blanket PO with its food-service vendor for recurring deliveries of flour in specific quantities over a set period of time.

Since a PO is a legally binding document, accuracy and completeness are critical, as errors can lead to delays, misunderstandings or additional costs.

Step 5. Fulfill the Order

After submitting the PO, the procurement team expects the supplier to fulfill the order accurately and on time. During this step, the supplier typically sends out an order confirmation and provides a way for the procurement team to track order status. Depending on the goods and nature of the business, the procurement team may also prepare for the incoming goods by allocating warehouse space and arranging for the necessary equipment and personnel to handle the delivery.

Upon delivery, the receiving team will inspect the goods to verify quality and compliance with the PO, documenting any discrepancies or issues. If the delivered goods meet expectations, the items are logged into inventory and queued for future use. The receiving documents (packing slips, goods receipts, etc.) are then matched with the PO and sent to the AP team to verify the goods have been received as ordered. The payment will then be processed once the invoice is submitted.

Step 6. Manage the Invoice

The supplier usually submits its invoice to the buyer soon after fulfilling the order. The invoice details the items delivered, quantities, prices and payment terms. The buyer’s AP team reviews the invoice, matches it against the corresponding PO and receiving documents, and resolves any discrepancies. If there are no discrepancies in this three-way match, the invoice typically moves to the next step — payment processing.

Say a hospital receives an invoice for medical supplies. It would first verify that the prices and quantities on the invoice align with those listed in the PO. Then it would confirm that the supplies received were in the correct quantities and condition. This invoice management step in the P2P process helps ensure accuracy and detect errors or fraud prior to disbursing funds. Additional safeguards may include requiring additional approval if issues arise in the three-way matching or if purchases exceed certain threshold amounts.

Step 7. Process the Payment

Once the invoice is approved, the AP team initiates payment to the supplier based on the established payment terms. The disbursement may be made via check, electronic funds transfer or other agreed-upon methods. Careful payment timing can prevent late penalties and take advantage of prepayment discounts, both of which impact cash flow and profitability. For example, say a consulting firm receives an invoice from a subcontractor for services rendered on a client project. By paying the invoice within 10 days instead of the usual 30-day term outlined in the contract, the firm is able to secure a 2% prepayment discount, improving profitability and potentially strengthens its relationship with the subcontractor through prompt payment.

It’s worth noting that how well an organization handles payment processing can significantly impact relationships with suppliers, for good or bad.

Best Practices for Optimizing P2P

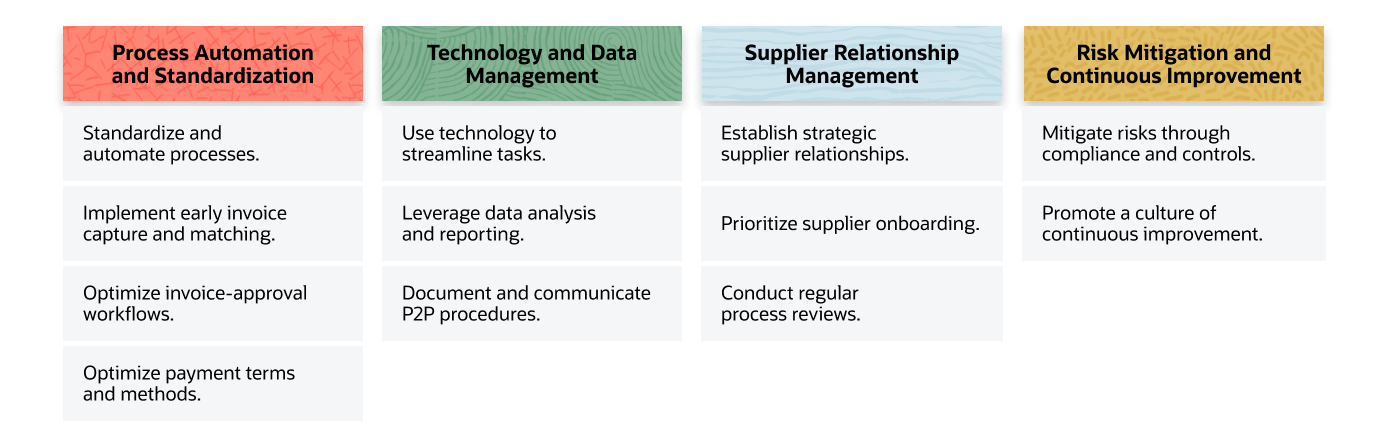

Adopting best practices can help companies unlock the full potential of their P2P process, driving better business outcomes and enhancing their competitive advantage. While there are countless smart approaches to P2P, here are 12 best practices split into four categories, each representing critical areas where companies should focus their efforts to achieve a robust, successful procurement process.

12 Best Practices for P2P Success

1. Process optimization and standardization: This best practice focuses on improving the efficiency and effectiveness of the P2P process by streamlining and standardizing various activities. The goal here is to reduce complexity, minimize errors and increase productivity, ultimately saving an organization time and money. Best practices include:

- Standardizing and automating processes: Implement consistent, automated workflows to reduce manual effort and errors.

- Implementing early invoice-capture and matching: Accelerate invoice processing by capturing invoices early and automating matching with POs and receipts.

- Optimizing invoice-approval workflows: Design efficient approval workflows that minimize bottlenecks and support timely processing.

- Agreeing on payment terms and methods: Negotiate favorable payment terms and use electronic payment methods to strengthen cash flow and reduce processing costs.

2. Technology and data management: Manual P2P methods are a bottleneck waiting to happen. By using the right tools and systems, organizations can automate tasks, improve accuracy, scale with growth and uncover opportunities for cost savings and process improvements. Effective data management and clear communication provide all stakeholders with the information they need to make more informed decisions. Best practices include:

- Using technology to streamline tasks: Choose P2P software and tools to automate manual tasks, boost efficiency and redeploy employee time for higher value activities.

- Leveraging data analysis and reporting: Use data analytics to gain insights into spending patterns, supplier performance and process inefficiencies.

- Documenting and communicating P2P procedures: Maintain clear, up-to-date documentation of P2P policies and procedures, and effectively communicate them to all stakeholders.

3. Supplier relationship management: The importance of building and maintaining strong relationships with suppliers, particularly for essential supplies and services, cannot be overemphasized. By fostering collaboration, communication and trust throughout the P2P process, organizations can cultivate supplier relationships that not only meet expectations but also transform suppliers into partners that contribute to the overall success of the business. Best practices include:

- Establishing strategic supplier relationships: Nurture long-term, mutually beneficial partnerships with key suppliers to drive innovation, quality and cost savings.

- Prioritizing supplier onboarding: Make the supplier onboarding process easy to ensure smooth integration and compliance with company standards.

- Conducting regular process reviews: Regularly assess supplier performance and conduct joint process reviews to identify areas for improvement and strengthen collaboration.

4. Risk mitigation and continuous improvement: Organizations should avoid a “set and forget” mentality for even the best P2P processes. Business and market conditions are constantly evolving, so it’s essential to proactively identify and address potential risks that may impact the P2P process. Equally, cultivating a culture of continuous improvement helps keep practices up to snuff. Best practices include:

- Mitigating risks through compliance and controls: Implement robust internal controls to uphold compliance with regulations and company policies to reduce the likelihood of financial and reputational harm.

- Promoting a culture of continuous improvement: Encourage employee feedback, monitor key performance indicators (KPIs) and regularly review and update P2P processes.

How Can Automation Improve the Procure-to-Pay Process?

Automation is a game-changer for the P2P process. Advanced technologies and digital tools transform manual, paper-based processes into efficient, automated workflows that drive cost savings while increasing accuracy, visibility and control. From automating PRs and supplier selection to simplifying invoice processing and payments, P2P automation can help organizations unlock a wide range of benefits across the entire procurement life cycle. Here are eight key areas where automation can significantly improve the P2P process and deliver value to the business.

1. Streamlining Procurement Activities

- Automated purchase requests: Automated requests reduce the time and effort required to create, submit and approve PRs. Employees can easily fill out electronic forms with prepopulated data, which promotes accuracy and completeness. Meanwhile, automated workflows route the requests to the appropriate approvers based on predefined rules and thresholds.

- Supplier selection: Automation can speed up supplier selection by quickly and easily comparing quotes from multiple suppliers based on predefined criteria, such as price, quality and delivery time. This helps procurement teams make informed decisions and select the best suppliers for their needs.

2. Enhanced Order Management

- Automated purchase orders: Once a PR is approved, automation can generate POs automatically, reducing time spent on manual data entry and increasing accuracy. These digital POs can then be sent electronically to suppliers, eliminating the need for paper-based documents and manual transmission.

- Order tracking: Real-time visibility into the status of orders allows the procurement team to automatically track deliveries, monitor supplier performance and proactively address any issues or delays. This enhanced transparency also allows organizations to be more agile, especially as part of an enterprise resource planning (ERP) system that integrates demand forecasting and inventory management.

3. Efficient Invoice Management

- Invoice matching: Invoices can be automatically matched to corresponding POs and delivery receipts. This reduces manual effort and improves document storage. Consistent, faster three-way matching verifies that the organization pays for only the goods and services that were ordered and received, reducing the risk of errors and overpayments.

- Automatic invoice approval: Automation can route verified invoices through predefined, customizable approval workflows based on factors such as invoice value, variances from POs, department and vendor. This eliminates all manual routing and can provide incremental controls for certain invoices. All told, automation makes invoice processing faster and more efficient, in turn, supporting good supplier relationships.

4. Payment Processing

- Automated payments: Automation can streamline the payment process by enabling organizations to make electronic payments to suppliers based on approved invoices. This eliminates the need for manual check processing and facilitates accurate, on-time payments to suppliers. Cash flow and supplier relationships improve as a result.

- Compliance and reporting: Automated payment systems increase compliance with financial regulations and internal policies by consistently enforcing approval thresholds, segregating duties more effectively and providing comprehensive audit trails. Additionally, automation can generate real-time reports on payment status, which is useful for cash flow management and financial planning.

5. Data Management and Analytics

- Centralized data: P2P automation centralizes all procurement-related data in a single, digital platform, eliminating silos and providing everyone with access to the same accurate, up-to-date information. This centralized data repository serves as a single source of truth for procurement activities, supporting collaboration and decision-making.

- Real-time insights: Automation provides real-time insights into procurement performance through powerful analytics and reporting capabilities. Procurement teams can track key metrics, such as spend by category, supplier performance and process cycle times, to identify opportunities for improvement and address issues before they become big problems.

6. Improved Supplier Relationships

- Consistent communication: Access to centralized information hubs and standardized communication channels pave the way for consistent, up-to-date and transparent interactions between businesses and their suppliers. Self-service portals, for instance, allow suppliers to view the status of their orders, invoices and payments. This reduces the need for manual inquiries and improves supplier satisfaction.

- Performance monitoring: Supplier performance metrics, such as on-time delivery, defect rates and issue resolution time, are easier to track with automated systems that consolidate real-time data and generate performance reports. This information can help organizations identify top-performing suppliers and those not living up to expectations. A data-driven approach to supplier management can lead to stronger, more strategic relationships with suppliers.

7. Risk Management

- Reduced human error: Automating manual P2P tasks and enforcing standardized procedures significantly reduces the risk of human error. This includes mistakes in data entry, calculations and approvals, which can lead to costly mistakes and compliance issues.

- Fraud detection: Although no system is fail-proof, automated P2P software is better at detecting and preventing fraudulent activities than using manual processes. By enforcing strict access controls, approval thresholds and audit trails, automated systems can flag suspicious transactions and prevent unauthorized purchases or payments.

8. Cost Reduction

- Lower administrative costs: P2P automation significantly reduces processing costs by eliminating manual tasks, minimizing errors, accelerating approval workflows and increasing staff productivity. Organizations can save on labor costs, paper and printing expenses, and the time spent on low-value activities, freeing up resources for more strategic initiatives.

- Better vendor prices: Armed with informed insights into spending patterns and supplier performance, organizations can negotiate more favorable terms with suppliers, including pricing, early payment or bulk discounts, and payment schedules. This can lead to cost savings and greater profitability.

The Future of Procure-to-Pay

The future of P2P is becoming more automated, data-driven and digitally integrated. To adapt to the evolving business landscape and gain a competitive edge, leading companies will embrace P2P solutions that harness the power of advanced technologies, such as artificial intelligence (AI), the Internet of Things (IoT), blockchain and cloud solutions.

- AI-powered chatbots and virtual assistants will increasingly handle routine supplier inquiries and support tasks, providing 24/7 service and freeing up procurement professionals to focus on more strategic initiatives. AI will also likely play a role in predictive analytics to inform demand forecasting and quickly conduct thorough supplier risk assessments.

- IoT-enabled sensors and devices will provide real-time data on supplier performance, inventory levels and shipment tracking. This will help reduce the risk of material shortages and fuel more proactive decision-making. However, the adoption of IoT may vary by industry, with manufacturing and logistics likely to see earlier and more extensive implementation than, say, small retail businesses or companies in the professional services industry.

- Blockchain technology has the potential to reshape supplier relationships by facilitating secure, transparent and tamper-proof transactions and contracts to foster trust. Increased trust can create a foundation for better collaboration, as parties may be more willing to share information and work closely together when they have confidence in the integrity of their shared records and transactions. That said, technical complexities and the need for standardization are slowing the widespread adoption of blockchain in P2P.

- Cloud-based P2P solutions will become the norm as organizations increasingly prioritize flexibility and accessibility. These solutions offer the scalability and mobility needed to support modern operational models, such as remote work and global operations that require procurement teams to manage processes across various locations and time zones. On-premises solutions will struggle to keep pace with these demands, making cloud adoption a critical factor in the success of future P2P strategies.

In addition, P2P is becoming more focused on sustainability, with more industries and organizations prioritizing environmental, social and governance (ESG) policies. With an eye toward increasing local sourcing, recycling, upcycling and reducing carbon footprints, P2P systems will need to foster even more collaboration and transparency with suppliers. This trend will also drive the adoption of specialized, standardized metrics to evaluate the sustainability practices, such as water usage and waste management. Blockchain (for traceability) and AI (for data analysis) will be important tools to facilitate this shift toward sustainable procurement.

Optimize Procure-to-Pay Efficiency With NetSuite

NetSuite Procurement is a comprehensive solution that streamlines and automates the entire P2P process. The centralized, cloud-based platform manages all aspects of procurement, from vendor selection and purchase requisitions to invoice processing and payments. By eliminating manual tasks and paperwork, NetSuite Procurement helps organizations increase efficiency, reduce costs and gain better control over their spending.

NetSuite Procurement offers advanced features, including automated three-way matching of invoices, POs and delivery receipts, as well as configurable approval workflows and spend controls. These capabilities support compliance with company policies and regulatory requirements, reducing the risk of noncompliance and helping to prevent fraud. NetSuite Procurement also offers a self-service vendor portal and collaborative tools that can be used to make life easier for both procurement teams and suppliers, in turn, fostering stronger supplier relationships.

What’s more, NetSuite Procurement seamlessly integrates with other NetSuite ERP modules, such as financials, inventory and supply chain management, to enable a smooth flow of information and processes across the organization. With access to real-time, businesswide data and powerful analytics, NetSuite not only provides actionable insights into spending patterns, supplier performance and procurement process bottlenecks, but it also empowers companies to identify ways to optimize sourcing, improve vendor negotiations and enhance overall procurement efficiency — ultimately contributing to a healthier bottom line.

Every company has some sort of a procure-to-pay process, but those that manage it well are better positioned for long-term success. By understanding the key steps, best practices and technologies involved in P2P, companies can streamline their purchasing activities, reduce costs, improve supplier relationships and enhance overall financial performance. As the procurement landscape continues to evolve, organizations that embrace digital transformation and adopt innovative solutions will be well-positioned to navigate challenges, seize opportunities and achieve their strategic objectives.

P2P FAQs

What is the difference between procure-to-pay and procurement?

Procurement is the overarching process of acquiring goods and services that an organization needs to operate; activities include identifying requirements, selecting suppliers, negotiating contracts and managing supplier relationships. Procure-to-pay, or P2P, is a subset of procurement that focuses specifically on the transactional steps involved in purchasing goods and services, from creating a purchase requisition to receiving the goods and paying the supplier invoice. In essence, procurement is a broader strategic function that encompasses the entire life cycle of acquiring and managing goods and services, while P2P is the tactical execution of the purchasing process within that life cycle.

What is the difference between accounts payable and procure-to-pay?

Accounts payable (AP) is a financial function that deals with the processing, management and payment of invoices received from suppliers for goods and services purchased by the organization. Procure-to-pay (P2P) includes all tasks involved in purchasing goods and services, such as identifying a need, creating a purchase requisition, receiving goods and paying for them. In a way, AP can be thought of as a subset of P2P because it focuses solely on managing and paying supplier invoices.

What services use procure-to-pay?

Procure-to-pay (P2P) services are used by a wide range of organizations across various industries, including manufacturing, healthcare, financial services, retail and government. Any organization that purchases goods or services from external suppliers can benefit from using P2P services to streamline and automate their purchasing processes. Some common examples of goods and services that are typically purchased through P2P include:

- Raw materials and components for manufacturing

- Office supplies and equipment

- IT hardware and software

- Professional services such as consulting and marketing

- Maintenance and repair services

What is an example of a P2P process?

Here’s a typical example of what a P2P process might involve: An employee at a manufacturing company identifies a need for a new raw material. The employee creates a purchase requisition in the company’s P2P system, which routes the request to a manager for approval. Once approved, a purchase order is generated and sent to the selected supplier. When the raw material is delivered, the warehouse records the receipt in inventory. The supplier submits an invoice, which is matched against the purchase order and receiving documents. If everything matches, the invoice is routed for approval and then to accounts payable for payment processing.

What is procure-to-pay for dummies?

Procure-to-pay, or P2P for short, is the formal term that describes the way companies buy the goods and services they need. It refers to the whole process from start to finish. First, someone in the company realizes they need something, like paper for the printer or parts to make a product. Then they fill out a form detailing what they need and why. When a manager approves the request form, the company places an order from a chosen seller. When the items arrive, the company checks to make sure it’s exactly what they wanted. The seller sends a bill, and the company makes sure the bill matches the order before paying. P2P is all about making this whole process as smooth and easy as possible.

What does P2P mean in business?

In business, P2P typically stands for procure-to-pay or purchase-to-pay. It refers to the end-to-end process of purchasing goods and services, from the initial identification of a need to the final payment to the supplier.