Payment terms are often a source of extensive negotiation between suppliers and buyers because they have a major impact on the financials of both companies. Longer payment terms work in the buyer's favor but can make cash flow management more challenging for the supplier. The reverse is true with shorter terms.

Supply chain finance can resolve this challenge by using a financial intermediary to increase cash on-hand for both those selling a product or service and those purchasing them. This can make it an appealing option for companies that often have many suppliers to manage and pay across the globe.

What Is Supply Chain Finance (SCF)?

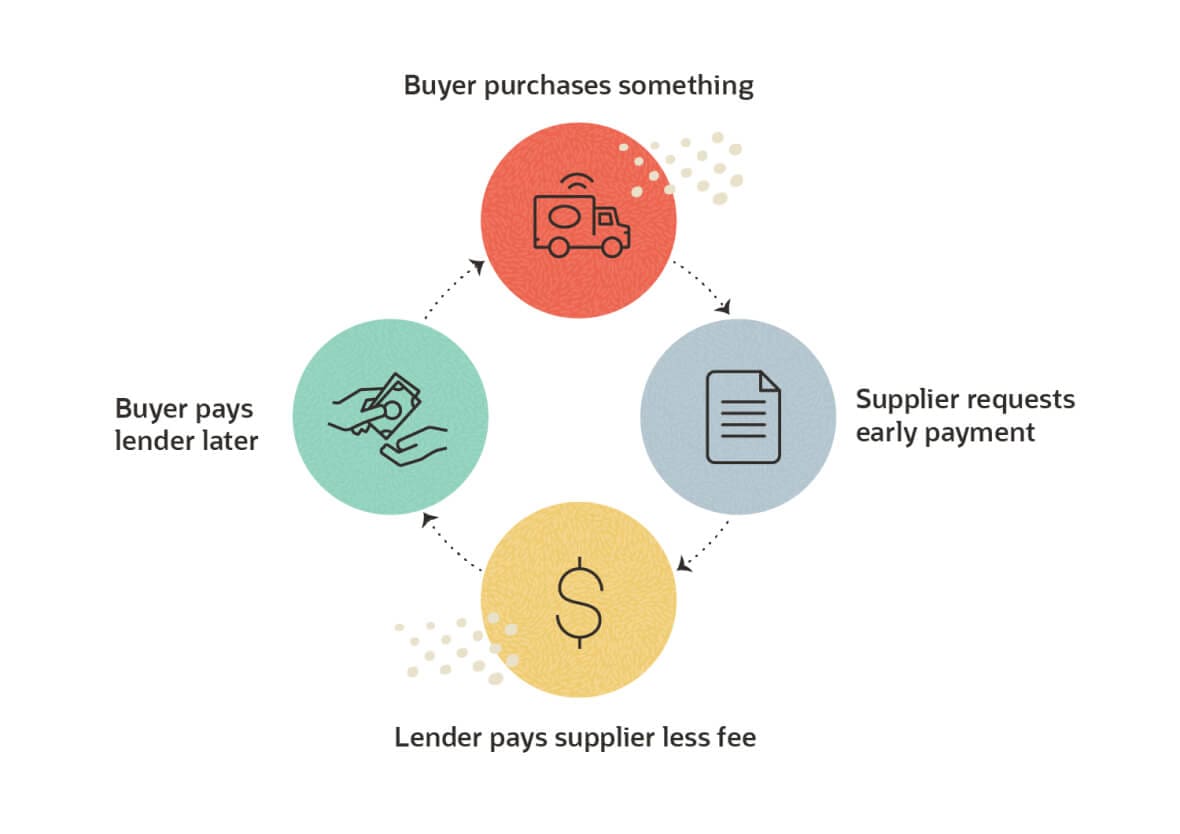

Supply chain finance is an agreement in which the buyer partners with a financial institution that will then pay suppliers on the buyer's behalf. These suppliers may have to sign up for the program, but the onus of setting it up is on the purchasing company. After the business buys something from the supplier, the seller can request an early payment and the financier — often a bank — will quickly pay them less a small fee. The purchasing company then pays the funder at a certain agreed-upon date in the future.

The central benefit of supply chain finance, also called reverse factoring, is that suppliers can be paid in a matter of days and buyers may get longer terms than those provided by the supplier. This can strengthen the financial position of both parties by increasing cash flow and working capital. Companies may use this option only as necessary, like during the slow season if they experience seasonal spikes and dips in demand.

Key Takeaways

- Supply chain finance is a buyer-led type of financing where the buyer works with a third-party financial institution that will pay suppliers quickly while providing the purchaser extended terms.

- Under this agreement, suppliers can often be paid in a few days while their customers don't have to pay their invoices for several months.

- This technique can boost working capital for both parties while also supporting the long-term viability of suppliers. That means it can strengthen the customer's supply chain.

- While this financing method lost popularity for some time, it's having a resurgence as businesses seek cheaper sources of capital due to inflation and climbing interest rates.

Supply Chain Finance Explained

Supply chain finance differs from other types of financing like AR factoring and lines of credit in that it's initiated and handled by the buyer. This makes it more convenient for suppliers and also beneficial for them if the purchaser has better credit and therefore can receive better rates than the supplier would. Although the financier takes a small cut of the payment in exchange for expedited delivery, supply chain finance can be up to 10 times cheaper than other types of financing like receivables factoring. Many financiers offer dynamic discounting, meaning the size of the fee changes based on how early the supplier requests payment. There is no direct cost to purchasers for the extra time they receive to pay.

This practice lost popularity in the past due to widespread access to cheap financing and increased regulatory scrutiny in how businesses account for these transactions. However, it is starting to have a resurgence — the global supply chain finance market rose nearly 40% to $1.8 trillion from 2020 to 2021, according to BCR Publishing.How Does Supply Chain Finance Work?

Today, most companies handle reverse factoring through software designed to assist with this process. Software can automate this multi-step process to the point where it's mostly self-serve and requires minimal work from the buyer and lender. It's also important to note that a single lender is not the only option — companies can use a combination of banks and other entities to fund the initiative.

Supply Chain Finance Process

Here's an overview of each step involved in a transaction using supply chain finance:

-

The buyer finds a bank or other financial institution — and sometimes multiple lenders — that agree to fund their supply chain finance initiative.

-

The purchaser then looks through outstanding invoices for various suppliers to pick out the ones to “approve” for early payment. The buyer then posts these approved invoices to a system for supply chain finance, either through an integration with its procurement solution or manually.

-

The supplier registers for the program and can then log in to view these approved invoices. It choose the ones for which it would like to receive payment as soon as possible.

-

The supplier pays a financing or transaction fee and the money is then transferred to its account.

-

The purchaser pays back the lender at later date, usually one after the initial due date for that order, depending on the terms the financier gave them. The buyer pays the supplier directly by the due date for any invoices that were not paid early.

Benefits of Supply Chain Finance

We've already touched on some of the biggest benefits of supply chain finance, but let's outline how this practice helps parties on both sides of the transaction. This will help you understand how this arrangement can give suppliers and buyers an advantage.

Suppliers

-

More working capital:

Many suppliers are in capital-intensive industries that put a strain on cash flow. Supply chain finance helps by providing cash — and therefore adding to current assets — when they need it. This adds to the working capital businesses need to cover expenses and stay afloat.

-

Lower-cost funding:

Some suppliers have better credit than others, but reverse factoring gives many organizations money at a lower cost than they could find elsewhere. This is especially valuable when interest rates on loans are higher than usual or rising quickly.

-

Predictable cash flow:

Many customers simply don't pay their bills on time, which makes it difficult to know when money owed will start to come in. But when suppliers can essentially get paid on demand, days sales outstanding (DSO) drops and cash forecasting becomes much more predictable.

Buyers

-

Optimize working capital:

Just as supply chain finance gives suppliers more working capital, it also allows buyers to hold onto their money longer. More available cash means more working capital to invest in the business, like to capitalize on short-term opportunities.

-

Supply chain resilience:

In some sectors and parts of the world, it's not uncommon for a supplier to go under with little warning. That can throw a wrench into the operations of customers who are counting on them for upcoming deliveries of products or services that keep their own operations running smoothly. Finding a replacement supplier is much easier said than done, especially in the era of constant supply chain issues. But reverse factoring gives these partners money when they need it to help keep them afloat during difficult times. This can reduce the risk inherent in these global networks.

-

Stronger supplier relationships:

Supply chain finance can be something of a competitive differentiator because the customer is offering the supplier something few others can: cheap capital. This could make you a more important and well-regarded customer. That recognition can bring a number of advantages, like early notice of any problems and first priority if the supplier has limited capacity.

-

Greater negotiating power:

Another benefit of being a preferred customer is that you may be able to negotiate better prices or bigger discounts on large orders. That means bigger margins, particularly helpful in a time when profitability is of supreme importance. Negotiations could cover more than price — you may be able to get faster shipping times for the same price, for example.

-

Centralization of payments:

One of the complexities of supplier management is remitting payment to a laundry list of companies. But if most or all of your suppliers join the supply chain finance program, all payments can be routed to the financer rather than this long list of vendors. This simplifies AP and could reduce the related work and costs.

Supply Chain Finance Example

To get a better sense of how supply chain finance works, let's walk through an example. Imagine a health and beauty brand that sells through its own ecommerce website and distributes to a handful of large beauty store chains. The business relies on a number of suppliers for makeup, hair care products, skincare solutions and related items, some of which carry the retailer's private label.

The health and beauty company has 45- or 60-day payment terms with all of these suppliers. Recently, however, more have requested early payment as the suppliers' cost of materials increases. But the company doesn't want to hurt its own financial position by paying earlier than planned, so it decides to leverage supply chain finance.

It explores options with a few lenders, including the bank through which it does most of its business, and selects the one with the best combination of low fees and a proven track record of great service for both buyers and suppliers. After that, the majority of suppliers sign up for the program. The health and beauty retailer starts uploading invoices approved for early payment to a system that the bank and suppliers can also access.

When vendors are stretched for cash, they log into the system to review what invoices are eligible for immediate payment and the applicable fees, then select the ones they want. This alerts the bank, which starts processing the payment and the supplier receives it within a few days. The purchaser doesn't need to do anything to facilitate this.

As part of the agreement, the business gets net-90 terms instead of net-45 or net-60 to ease cash flow management and boost its working capital. So three months after receiving the bill, the company pays the bank the amount due for any payments it fronted.

Challenges of Supply Chain Finance

Supply chain finance can be useful arrangement for both suppliers and their customers, especially when cash is in short supply or a company is putting a lot of its available money toward a short-term strategic project. However, leaning on supply chain finance too heavily can put buyers in a precarious financial position, as evidenced by businesses and lenders that have closed their doors after pushing out too many payments for too long.

While this approach may have waned in recent years, it is gaining popularity again as cash management becomes a focal point for companies and payment cycles lengthen. Supply chain finance could also be a component in a broader supply chain resilience strategy because it can make you a preferred customer, a badge many are looking to earn in a time of widespread shortages and delays. The key is for both parties to understand the nature of the agreement before turning to this type of financing and using it only when it makes sense for the business.

There's also the issue of how the money buyers owe to lenders is reflected on the balance sheet and cash flow statement. Even though purchasers often receive extended terms from the financial institution, under current IFRS and GAAP rules they can still classify this money as accounts payable rather than another type of liability like debt. However, this can make it appear as though a company has more cash available than it really does given their substantial upcoming payments due to the lender.

For that reason, supply chain finance has been a topic of regulatory scrutiny in the past few years. The Financial Accounting Standards Board (FASB), which sets GAAP guidelines, is considering a proposal and the SEC has offered guidance on the issue. This means businesses may soon need a way to track all supply chain finance activity during a certain period and include that information on financial statements.

How NetSuite Helps With Supply Chain Finance

Supply chain finance can add complexity to management of your finances and properly accounting for transactions. First of all, it's another source of money in and out of the business depending on whether you're the supplier or customer. It also requires buyers to track and view all invoices so they can tell the financer which are approved for early payment.

NetSuite's cloud accounting solution can help by tracking all invoices and automatically recording supply chain finance transactions in the appropriate ledgers for clear audit trails. This makes it easy to see and disclose these agreements and the status of money owed in financial statements or other communication with investors. The software can then quickly generate the three financial statements every business needs to show money owed to financial institutions in the near future if that becomes a requirement at some point.

A separate system for supply chain finance could also be integrated with NetSuite to automatically and accurately record transactions and payment terms. This would also make it easy to upload invoices for the buyer and for the supplier to track those for which it requested early payment.

Supply Chain Finance FAQs

What is the difference between trade finance and supply chain finance?

Trade finance refers to a broad set of payment solutions for commerce. A popular form of this is a letter of credit from the importer's bank to the exporter guaranteeing payment upon proof of a certain event, like shipment of an order. Supply chain finance is another type of trade finance that can also reduce risk for the exporter (seller) but must be set up and managed by the importer (buyer). Supply chain finance offers faster payment to the supplier and longer payment terms for the buyer.

Is finance part of the supply chain?

Finance is involved in many aspects of the supply chain because it involves the creation and transfer of goods from one company to another. Suppliers must send invoices to those that buy their products and customers must remit payment to them by a certain date. Although supply chain finance sounds broad, it refers to a specific agreement where a buyer works with a financial institution that pays suppliers early for a small fee and often extends payment terms for the purchaser.

What are the benefits of supply chain finance?

Supply chain finance has numerous benefits for both suppliers and buyers. Suppliers get paid faster to boost cash flow, more accurately predict future income and avoid more expensive financing methods like AP factoring. Buyers also gain access to more working capital since they receive extended payment terms from the financier and reduce risk in their supply chain by helping to keep these key partners financially stable. They can also strengthen relationships with suppliers and earn greater negotiating power by giving them this option for faster payments.

Why is supply chain finance becoming more popular?

This type of financing tends to spike in popularity when interest rates are higher and cash flow is tighter. The Federal Reserve has been rapidly raising base interest rates since early 2021, making other sources of capital more expensive and therefore less appealing. Many companies also have less cash available due to inflation, which has driven up the costs of goods and services. At the same time, products businesses have much more inventory on hand than usual after they stocked up to protect themselves from supply chain problems and a lack of predictability, increasing expenses.