Focus on the global supply chain has intensified recently as the frustration — and economic peril — of its disruption has become dinner-table conversation around the world. But remember, “supply chain” is a fancy term for a simple concept: a network of interconnected buyers and sellers that depend on each other for success because one company's end product is another's raw material. Cash flow is important to keep this interconnected web running smoothly, since all the participants rely on each other's healthy cash flow. Reverse factoring emerged out of this cash-flow interdependency.

Reverse factoring has been around for years, but it has recently become more popular due to increased uncertainty arising from pandemic and post-pandemic economic effects. For those unfamiliar with reverse factoring, and for others for whom “factoring” rings a bell but the “reverse” is unclear, this article explains how reverse factoring works and how it can lead to tighter, more advantageous supply chain connections.

What Is Reverse Factoring — aka Supply Chain Financing

Reverse factoring is a financing method that improves the cash flows of both buyers and sellers by using a bank or similar financial institution. The buyer contracts with a third-party financial institution, or financial partner, that steps into the middle of certain buyer/seller transactions. The financial partner pays the seller, giving the buyer additional time to pay for its purchase. That means the buyer gets to hold on to its cash longer, which improves its working capital. The seller receives payment directly from the financing partner much sooner than its original invoice terms would otherwise allow, which improves the seller's cash flow. In return for financing a relatively low-risk scenario, the financing partner receives a fee from the seller and interest charges from the buyer.

While the terms sound similar, it's important to note that reverse factoring and factoring are two different things. Reverse factoring, also known as “supply chain finance” or “approved payable financing,” is a financing arrangement that is initiated by the buyer for commercial transactions.

Reverse Factoring vs. Traditional Factoring.

While the terms may sound similar, reverse factoring and traditional factoring are different alternative financing approaches. In traditional factoring, a company sells its product to a buyer on credit and, rather than wait for the buyer to pay, the seller then sells its account receivable for that buyer to the financing partner, at a discount. The factor takes over responsibility for collecting from the buyer and keeps the proceeds when the buyer pays. The factor makes most of its money on the difference between the face value of the receivable to be collected from the customer and the lower amount that the factor paid to the seller.

The chart below compares key characteristics of reverse and traditional factoring.

Traditional Factoring Vs. Reverse Factoring

| Traditional Factoring | Reverse Factoring | |

|---|---|---|

| Initiating Party | Seller | Buyer |

| What Gets Sold | Account Receivable | Account Payable |

| Ownership of Receivable/Payable | Transfers to Factor | Transfers to Factor* |

| Collection | Factor collects from Buyer | Buyer pays Factor |

| Timing | Sellers sells AR to Factor after sale and delivery | Buyer contracts with Factor prior to purchase transaction |

| How the Factor makes money | Factor buys the A/R at a discount and collects full amount plus earns a transaction fee | Factors collects small convenience fee from seller and may also earn an early payment discount. Plus, Buyer pays an interest charge. |

| Whose creditworthiness matters to the Factor | The Buyer's | The Buyer's |

| *But if the factor company fails to pay the seller, the Buyer is still responsible for payment | ||

Key Takeaways

- Reverse factoring is a type of supply chain financing.

- The three parties in a reverse factoring transaction are the buyer, the seller and the banking intermediary.

- Benefits for buyers and sellers include improved cash flow and stronger connection.

- Integrated financial systems can help a business get in on this growing source of alternative financing.

Reverse Factoring Explained

While the concept of a supply chain may seem linear, it's really more like a circle because the relationships among the chain's “links” are symbiotic. Buyers rely on goods from suppliers to make their end products, which, of course, drive the buyers' revenue. Unreliable or financially unhealthy suppliers can cause revenue problems for buyers. At the same time, sellers rely on buyers to pay for their purchases so they can continue funding their operations. In a reverse factoring arrangement, a third-party helps grease the wheels, keeping the circle turning. Financial partners are banks or other financiers that pay a buyer’s accounts payable on the buyer’s behalf. In doing so, the supplier gets paid more quickly, the buyer gets more time to repay the partner and the partner collects fees and interest. The circle is complete, and all parties benefit.

How Does Reverse Factoring Work?

Reverse factoring helps the cash flow of both a buyer and its supplier by using a third-party financier. From the buyer's standpoint, it gets a short-term loan from the financing partner, since they pay the supplier early and the buyer pays the later. The financing partner views the transaction much as a financial institution would, earning income from fees and interest. These partners evaluate the creditworthiness of a buyer when entering into reverse factoring agreements, since the buyer is responsible for paying back the invoice to the partner. Reverse factoring speeds up the supplier's ability to collect on its sales.

Steps in the Reverse Factoring Process

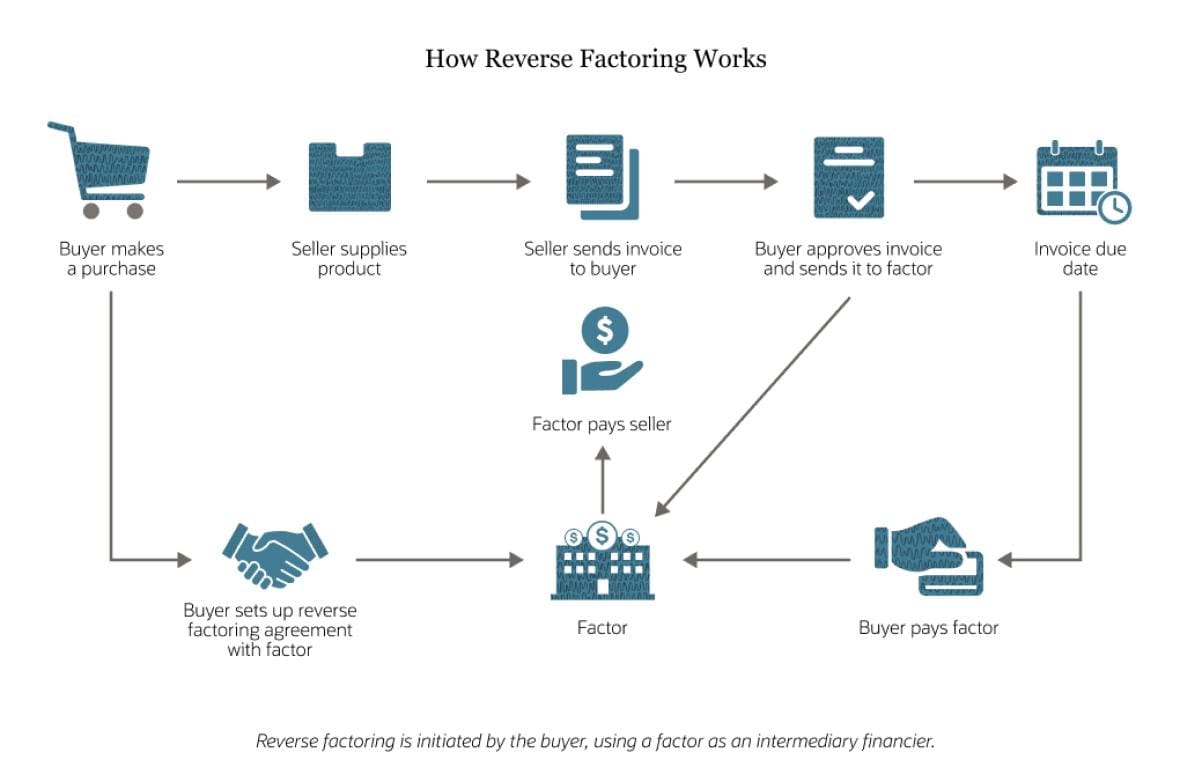

In most reverse factoring scenarios there are five steps to the process. The sequence is:

- A buyer places an order with a supplier/seller.

- The seller fulfills the order and bills the buyer by creating an invoice, using its normal payment terms. The invoice sometimes includes a discount for paying early, but not always.

- The buyer approves the invoice, acknowledges its validity and obligation to pay, and sends it to the financing partner, authorizing payment in accordance with the buyer/contract. This is most often done electronically.

- The financing partner then pays the supplier, taking advantage of any early payment discounts, typically by depositing funds into the supplier's bank account.

- On the due date of the original invoice or an agreed-upon future date, the buyer pays the factor.

Some may bundle the buyer's obligations into a form of debt security and sell them to outside investors. The financing partner then uses the proceeds from the sale of the securities to pay the suppliers (step 4 above). The investors' return comes from capturing the payment discounts, minus a fee to the factor.

Why Is Reverse Factoring Important?

Reverse factoring is especially well suited for situations where the seller is a small or medium-sized business (SMB), and the buyer is a large, established company. The seller can accelerate its cash flow, piggybacking on the reverse factoring agreement, which is based on the creditworthiness of the buyer, rather than on the SMB's own creditworthiness. Without reverse factoring, a large buyer could delay payment to the seller up to the limit of the invoice terms or even longer, potentially creating a cash crunch for the seller. That can be a tricky situation, especially if the buyer has significant leverage in the relationship. By using reverse factoring, the seller can receive payment from the factor within days and use that cash to reinvest in operations. Alternatively, the seller could find itself in a cash-flow crunch and be forced to use its own credit line — if available — often paying a higher interest rate.

Benefits of Reverse Factoring

Reverse factoring has several benefits for both buyers and sellers/suppliers. At a strategic level, entering into a reverse factoring arrangement reinforces the working relationship between a buyer and seller and strengthens the supply chain. It's rarely used for one-time transactions.

For buyers, these are among the benefits of reverse factoring:

-

Enhances the buyer's profile as a reliable customer, which can lead to favorable purchase terms.

-

Potentially extends payment timeframe without incurring late fees or straining supplier relationships.

-

Keeps cash in-house longer.

-

Helps keep favored vendors financially healthy, improving availability of needed supplies.

-

Improves financial metrics used for other debt agreements and covenants because reverse factoring is considered off-balance sheet financing, so it is not listed on the buyer's financial statements.

For suppliers, some benefits of reverse factoring include:

-

Supplier receives payment on sales much quicker than stipulated by typical invoice payment terms.

-

Reduces the volume of collection efforts and bad debts.

-

Fees are reduced because they are based on the buyer's better credit rating.

-

Provides faster, cheaper funding for continued operations.

-

Increases the accuracy of cash-flow forecasting.

Types of Receivables Factoring

There are two primary types of receivables factoring, recourse and nonrecourse. The difference depends on which party to the agreement can be held responsible for payment on the item being factored. In traditional AR factoring, the factor can buy a seller's AR either with or without recourse. If the contract is with recourse, the factor can come back to the seller for payment if the buyer becomes insolvent and doesn't pay. In practice, the seller will give back the amount previously received from the factor or will substitute another AR for the factor to collect. Recourse factoring typically carries lower fees and discounts for the sellers, since the factor is taking less collection risk but keeps the seller “on the hook.”

If a factoring contract is nonrecourse, the factor bears all the risk for collecting the AR from the buyer. If the factor is unable to do so, the seller has no responsibility back to the factor. In nonrecourse factoring, the factor relies more heavily on the creditworthiness of the buyer than on the seller.

Because reverse factoring arrangements are different from traditional factoring arrangements, the concept of recourse is less applicable. The buyer initiates the reverse factoring agreement and commits to pay the financing partner. The financial partner relies on the buyer’s credit rating when entering into these arrangements, thereby accepting collection risk from the buyer. In this way, reverse factoring agreements are considered nonrecourse, since the seller has no responsibility to the financing partner. This characteristic of reverse factoring is one of the reasons for initiating such an agreement in the first place, especially when the buyer is more creditworthy than the seller.

Who Uses Reverse Factoring?

Research indicates that reverse factoring currently accounts for a small portion of global trade finance. However, it has the potential to constitute up to 25% of some industries' accounts payable. The industries most actively using reverse factoring include:

- Aerospace.

- Automotive.

- Chemicals.

- Consumer packaged goods.

- Pharmaceuticals.

- Retail.

- Telecommunications.

Because reverse factoring is not disclosed on the purchasing company's financial statements, it's not easy to highlight specific examples of companies using this alternate financing solution. However, this may change. The U.S. Securities and Exchange Commission (SEC), together with the Financial Accounting Standards Board and the Big Four accounting firms, have all been considering changes to disclosure requirements to address reverse factoring as it becomes more popular. According to The Wall Street Journal, the SEC had contacted several companies, including Coca-Cola and Boeing, about their use of supply chain financing programs, such as reverse factoring. Coca-Cola had promised to include supply chain financing in future financial statements, and Boeing had already begun doing so. Both companies told the SEC that the programs were not material to their liquidity, WSJ noted.

Reverse Factoring vs. Dynamic Discounting

Unlike reverse factoring, which involves three parties, dynamic discounting occurs directly between a buyer and seller. In dynamic discounting, a buyer offers to pay a supplier sooner than requested by the normal payment terms in return for an early-pay discount. Transactions involving dynamic discounting generally take place between the buyer and seller and do not include a factoring or financing company.

History of Reverse Factoring

Reverse factoring has been around for decades. Most sources credit the automotive industry as the pioneer, specifically Fiat, the Italian automaker. In the 1980s, Fiat helped its equipment suppliers by using its credit standing in reverse factoring agreements. Overall, these agreements also reduced Fiat's costs, helping to increase its profit margins.

Through the years, advances in technology have made the administration of reverse factoring less cumbersome, as did the rise of technology-forward financial institutions, aka FinTechs. The use of online platforms made the process of onboarding new suppliers easier and increased the transparency of transactions for all parties.

For several years, reverse factoring grew by about 20% per year. That pace is currently expected to accelerate, due to improvements from blockchain technology. According to a recent study, the estimated global market for reverse factoring ranges between $255 billion and $280 billion.

Support Reverse Factoring Decisions With NetSuite

Because all financing scenarios come at a cost, understanding whether reverse factoring is right for a business requires a healthy amount of data analysis. For buyers, the purchasing decisions should be aligned with demand planning, then linked to working capital requirements. By doing so, better informed reverse factoring determinations can be made. For sellers, cash forecasting is paramount to ensuring that inventory levels are appropriate to meet sales obligations. For both parties, software such as the NetSuite Enterprise Resource Planning (ERP) System is ideal for reverse factoring decision support. ERP systems incorporate integrated modules for accounting, operations, supply chain management, inventory, forecasting and data and analysis, plus robust reporting capabilities that can quickly and easily generate the necessary information required by a financier.

By using a third-party, buyers and sellers can increase their working capital and keep operations moving forward through reverse factoring, a growing, alternative supply chain financing solution. Reverse factoring leverages the (usually) better credit profile of a large established buyer to benefit the supplier. In this way, the underlying cash flows of every company in a given supply chain stay healthy, making the entire supply chain more efficient — and resilient.

Built to Run

Your Business

Reverse Factoring FAQs

Who pays the fee in reverse factoring?

The supplier pays a small fee to the financial partner in return for receiving payment on the invoice much sooner than normal. The buyer pays an interest charge to the financing partner in exchange for extended time to pay for the purchase. Any early-pay discounts may be retained by the partner, if earned.

Is reverse factoring considered debt?

Reverse factoring is considered off-balance sheet financing, which reduces the amount of debt listed on the buyer's financial statements. Several regulatory agencies are reviewing current disclosure rules, since long repayment terms may resemble debt.