Payment reconciliation is an accounting process that ensures a company's internal records of payments owed and due match the transactions that appear on statements from its bank, credit cards and other financial institutions. Payment reconciliation leads to an accurate view of how much cash the company has on hand, in turn leading to informed decision-making that results in business growth. Payment reconciliation may also uncover issues — mistakes made due to manual entry, unpaid invoices or fraudulent activity, to name a few — that require investigation and underscore the need for automation.

What Is Payment Reconciliation?

Payment reconciliation is part of the accounting process where account balances are verified, comparing a company's financial records to its bank statements. Every business transaction is typically backed by at least two forms of documentation. The first is the company's internal record of a purchase or amount due from a customer, typically in the form of a journal entry in its general ledger. The second is an external statement from, for example, a bank or credit card company that shows the expense was paid.

Payment reconciliation compares each internal and external record to verify the amounts are equal. If they aren't, an accountant or bookkeeper will need to investigate the reason for the discrepancy. While the concept of payment reconciliation is straightforward, the more accounts payable and accounts receivable a growing business accumulates and the more sources of payment channels, the more complicated and labor-intensive reconciliation becomes.

Key Takeaways

- Payment reconciliation ensures a company's internal records of payments owed and due match the transactions that appear in its bank statements and other payments methods.

- This accounting process can uncover errors, root out fraud and catch unpaid invoices and bills.

- Automation can handle the lion's share of the payment reconciliation process.

- The surge of online payment services and the potential rise of cryptocurrency have added to the complexity of payment reconciliation.

Payment Reconciliation Explained

A financially responsible business is unlikely to take on new expenses without first confirming it has or will have the cash to cover these costs when payment is due. That determination hinges on the meticulous internal recording of expenses and payments due and the subsequent matching to bank statements and other financial accounts that show an equal value of payments were accepted. This process is called payment reconciliation, which helps a company manage its cash flow and provides an accurate picture of its true cash balance and overall financial health.

Equally important, the payment reconciliation process discovers when records don't match, which can lead a company to think it has more or less money than it actually does. Reconciliation is also critical for regulatory compliance purposes.

Video: Payment Reconciliation Explained

Why Is Payment Reconciliation Important?

Have you ever neglected to record a check in your bank book so you thought you had more money in your account than you really did, which caused you to overdraw? On the flip side, perhaps you actually had more money than you realized — extra cash you would have invested elsewhere rather than leave it in the bank. These are two basic reasons why payment reconciliation is critical — for businesses, too. Reconciliation is also ripe for automation.

There are many reasons why a company's internal and external records may not match. Perhaps a payment made to a supplier wasn't recorded in the general ledger, or the company overlooked and failed to pay an invoice. It's also possible an accountant transposed two numbers when manually entering transaction information in the company's accounting software. Or maybe the payment processor inadvertently sent out the same payment twice or tacked on service charges that the business didn't account for in its books.

A more sinister reason records might not match is due to fraudulent activity. Fraud is a costly problem — and losses amount to 5% of a company's annual revenue on average, according to the Association of Certified Fraud Examiners. Accounts payable fraud comes in many forms and is committed by a variety of sources, including a company's employees, vendors or suppliers and cybercriminals hoping to sneak in under the radar.

Why Do Businesses Need Payment Reconciliation?

Payment reconciliation enables businesses to root out potential payment errors flowing in and out of the business and allows companies to determine where discrepancies lie. The more frequent the reconciliation, the faster the company can recognize and correct the underlying problem. Generally speaking, experts advise businesses to reconcile their payments at least once a month or, ideally, each time a statement is received. In the event of a discrepancy, the closer the reconciliation is performed to when the initial transaction took place, the easier it may be to recall details about the transaction.

It's critical for smaller organizations to establish an efficient payment reconciliation process early on that scales as the business grows and the number of digital payment methods it uses increases. These payment methods may include mobile payment services, digital wallets and cryptocurrencies, some of which tack on extra fees for processing.

How Does Payment Reconciliation Work?

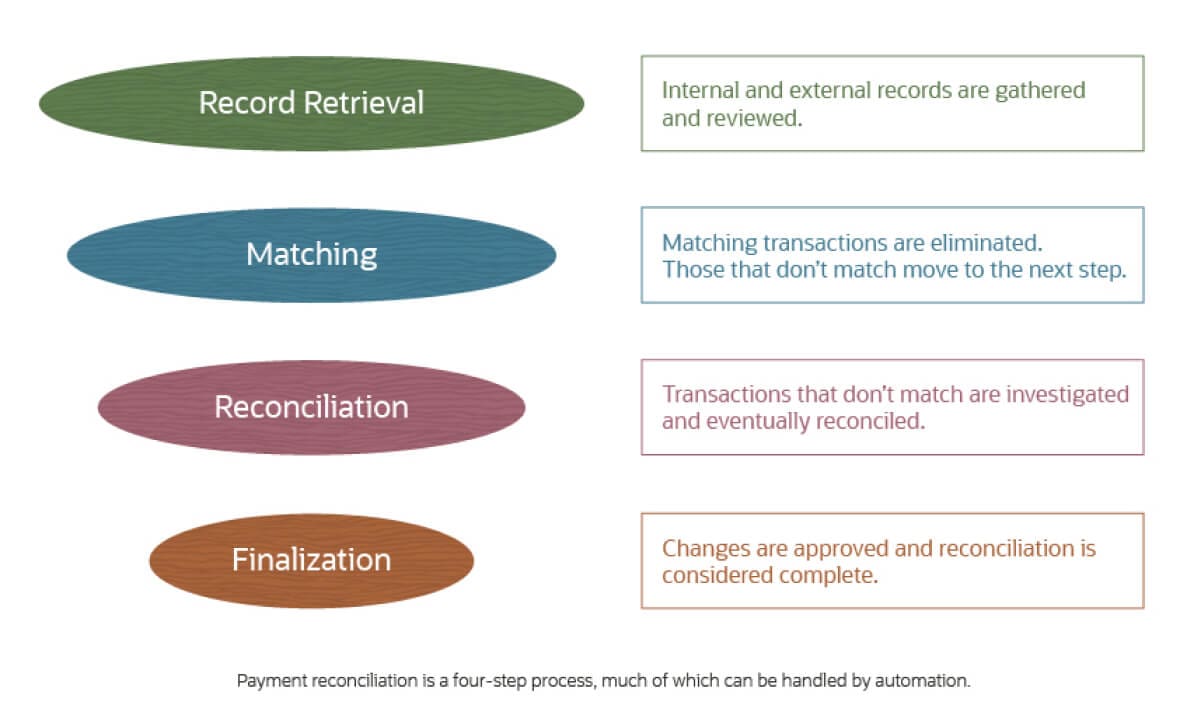

Payment reconciliation is best conducted regularly and frequently to make sure internal and external records of transactions are aligned. Payment reconciliation is generally a four-step process, with each step building on the previous one, so businesses will want to carve out the time to complete each step thoroughly. Better yet, let software handle the heavy lifting through AR and AP automation.

-

Record retrieval:

As the name suggests, this step involves gathering all relevant records needed to reconcile a payment — namely, internal records of transactions and external statements from banks, credit and debit cards, mobile payment services and more — and extracting the specific information needed to compare dollar amounts against internal records. For companies that have not yet automated, this step can be quite labor-intensive and involves normalizing the data into a single format.

-

Matching:

During the matching phase, each recorded transaction is compared with bank statements. Those that match are eliminated from further review. Those that don't move on to the next phase. An automated system can easily take over the matching phase.

-

Reconciliation:

Transactions that failed to match are investigated to determine the cause or source of the discrepancy and eventually rectified. Corrections may require a review and approval process. This stage can be tedious and labor-intensive, which is why it makes sense to use automation to handle the previous step.

-

Finalization:

Once every transaction has been reconciled, journal entries can be made to fix errors and adjust general ledger accounts. At this point, payment reconciliation is complete.

Operational Reconciliation vs. Financial Conciliation

Operational reconciliation strives to marry inventory amounts recorded in a company's books to its physical inventory levels. As with payment reconciliation, anomalies may be attributed to human or bank error, or they could point to some intentional malfeasance within an organization, such as employee theft. Financial conciliation comes into play when two organizations disagree on where an error lies in an unmatched financial transaction. An external and impartial arbiter reviews the transactions in question and renders a judgment as to the source of the error.

Types of Payment Reconciliation

There are as many types of payment reconciliation as there are ways to make and receive payments. The growing popularity of online payment services, like Venmo and PayPal, and the potential rise of cryptocurrency add to the complexity of tracking down statements for payment reconciliation. Zelle, another online payment service, adds a new wrinkle because it does not store money but instead passes it straight through to a bank account, creating new challenges for payment reconciliation.

Here are four common types of payment reconciliation.

-

Bank reconciliation.

The bulk of reconciliations occur against bank records, though the variety of ways money can flow in and out of bank accounts — from checks and PayPal to digital wallets — has made the process more complex. Disbursements and deposits must be matched against the company's books and its bank statements. Unrecorded bank service fees, transaction fees and penalties for a missed payment could also throw off the records. Take, for example, a real-estate holding company that receives 400 rent checks per month, a few of which undoubtedly will bounce and generate a bank fee that must be accounted for.

-

Credit card reconciliation.

Customers and businesses alike use credit cards to pay for their purchases. Credit card reconciliation matches the transactions that appear on a monthly credit card statement to their corresponding internal records, as well as the bank statement that shows money was deposited or withdrawn to cover the credit card bills.

-

Cash reconciliation.

This occurs at the physical location level, where the amount of money collected in a register, whether cash, checks or credit cards, needs to be matched against the register's sales receipts at the end of the business day or before a shift change. If the totals aren't the same, it may be an indication of employee theft or an accounting inaccuracy.

-

Digital wallet reconciliation.

Spending via digital wallets is predicted to surpass $10 billion worldwide, according to Juniper Research. But for now, whether cash or crypto is involved, it's rare that a digital wallet provider will send an actual statement that can be used for reconciliation. The security levels of different digital wallets add to the difficulty of obtaining financial data. Companies will need to devise a policy to document digital-wallet transactions.

Benefits of Automated Payment Reconciliation

Each step of the way, payment reconciliation screams for automation, which can improve a company's performance by every meaningful measure. The key benefits of automated payment reconciliation include:

-

Less administration.

Today, most financial platforms offer payment data in a digital format that software can recognize and use for matching records. Most transactions do, in fact, match, eliminating the majority of the work that would need to be performed manually. Employees can then focus on the smaller fraction of problematic transactions, freeing up precious staff resources to tackle other jobs.

-

Increased accuracy.

During payment reconciliation, the dizzying array of digits can easily lead to making mistakes in manual reconciliations and interpretations. After all, humans often become tired and bleary-eyed. Automation, on the other hand, can meticulously process all of the numbers, make comparisons and accept matches.

-

Faster error and fraud detection.

Records that don't match during the payment reconciliation process are often flagged more quickly when automated than when handled manually. Payment reconciliation automation can also flag suspicious activity that occurs over a particular period of time, such as a duplicate payment issued to a supplier for the exact same amount month after month.

-

Up-to-date invoice payment/collection.

Automated payment reconciliation can quickly highlight outstanding invoices so a company can take action, whether that means chasing down a customer or paying its own bill, thereby avoiding late fees.

-

Faster financial closing.

The sooner payments can be reconciled, the sooner a company can close out its books for a particular time period. With automation, payment reconciliation doesn't have to be relegated to, say, the end of the month. It can be ongoing.

-

Scalability.

Companies that plan to grow are best served with a financial system that grows with them. Automation makes it easy to reconcile an increasing volume of payments.

-

Compliance.

Automation can help ensure the accuracy of transactions and reconciliations, which helps a company stay in compliance with industry regulations. And it comes with additional benefits: It prevents the company from having to pay penalties due to noncompliance and also provides an audit trail.

-

Cash-flow clarity:

By automating payment reconciliation and resolving issues that prevent records from matching, companies will have a more accurate, timely picture of how much cash they have on hand at any point in time.

Become An Expert In Payment Reconciliation

Risks of Payment Reconciliation

Manual payment reconciliation has many inherent risks — all of which can be overcome by automation. Among the risks businesses face when reconciliation is handled manually:

-

An inability to standardize internal data.

Different operating systems, software incompatibility, spreadsheet version-control chaos and even lack of field-name standardization are all real challenges companies face when manually conducting payment reconciliation.

-

No single source of truth.

In a distributed organization, data is often distributed, too. This makes record retrieval a time-intensive task, not only for payment reconciliation but for virtually every accounting function.

-

Errors and miscalculations.

To err is human, compounded by the labor-intensive task of pinpointing what occurred and then rectifying it. Plus, as the number of transactions grows, so does the likelihood of errors.

-

Delayed financial visibility.

The longer it takes a company to reconcile its payments, the longer it takes the company to close its books and generate financial statements. Prior to reconciliation, an accurate view of cash flow can also be impeded.

Payment Reconciliation Examples

Cheese Please is a hypothetical artisanal cheese company based in upstate New York. It makes its own cheeses — which means daily ordering of fresh ingredients and constant equipment maintenance — as well as sourcing from others to round out its selection. Cheese Please runs a single brick-and-mortar store, which involves a slew of operational costs, and relies on third-party logistics partners to ship its products to in-state customers who order through its website. Suffice it to say, the company's bookkeeper is busy.

At the beginning of the month, Cheese Please places an order for a $5,000 cheese press on credit. The bookkeeper records the transaction in the company's accounting software. The invoice arrives soon afterward and is paid electronically, two weeks before it's due. When Cheese Please's bank statement arrives, the software automatically checks that the amount withdrawn matches its internal records. If it does, the payment reconciliation process is complete. But in this case, it doesn't. The bookkeeper does a little digging to determine that the equipment company neglected to apply a promised 15% discount for paying the invoice earlier than its due date. The supplier refunds what is owed, the bookkeeper notes the discounted amount in the general ledger and payment reconciliation is complete.

History of Payment Reconciliation

Before digital technologies came to the office, payment reconciliation was a manual process. Records of transactions were handwritten as journey entries in a company's general ledger and later matched against bank and credit card statements to ensure the right amounts were deducted or deposited — or “ticked and tried,” as accountants like to say.

Over time, new technologies and software emerged to help companies store their data and, among other features, better manage the reconciliation process. On-premises accounting software and enterprise resource planning (ERP) systems debuted in the early 1980s to help growing businesses manage their finances. The internet's public emergence in the mid-1990s put those platforms to the test by enabling small businesses to reach more customers.

As the volume of transactions increased, the payment reconciliation process became increasingly complex. For companies buying and selling internationally, for example, money might be kept in overseas banks using different currency types, thereby requiring additional steps in the payment reconciliation process. In more recent years, new ways to make and accept payments have come onto the scene, such as Google Pay and Apple Pay, diversifying the number of accounts against which internal transaction records had to be matched during the payment reconciliation process.

The accounting trend for many growing businesses are realizing the benefits of automating the payment reconciliation process. With automation, accounting staff has to tend only to the anomalies, leading to faster resolution of issues and catching fraudulent activity before it can go too far. This also hastens the financial close process and helps companies manage their cash flow.

Payment Reconciliation Best Practices

As with any accounting process, best practices apply when reconciling payments. They include:

-

Establish and follow policies.

Standardize the payment reconciliation process. Define in a formal and transparent way how it will be conducted and then stick to it. This lends authority to the entire process.

-

Automate.

The lion's share of payment reconciliation results in confirmation that internal and external records match. Automation can relieve staff of that time-intensive responsibility so they can focus on what doesn't match and on other higher-level tasks.

-

Set thresholds for unreconciled differences.

Why spend time reconciling to the penny if there are bigger fish to fry? By establishing a threshold, a company ensures that valuable time is spent on resolving larger dollar discrepancies.

-

Reconcile regularly and frequently.

It stands to reason that reconciling payments on an ongoing basis can help a company more quickly catch errors or possible fraudulent activity that may worsen the longer problems go unchecked. Doing so also increases the likelihood that a company can close its financial books on time.

-

Improve processes.

Just because a company establishes and follows policies doesn't mean it can rest on its laurels. The key: Analyze financial and performance metrics. This will provide the hard data needed to determine whether changes need to be made, such as introducing automation to the process.

The Future of Payment Reconciliation: Automation & Technology

Automation hands companies a win they can't ignore. According to Ventana Research, automation correlates with a faster quarterly close — within six days — for 85% of businesses that automated their entire close process and for 43% that partially automated it. Additional technologies that can bolster the payment reconciliation process include:

Cloud computing:

The advent of cloud computing created a platform that makes payment reconciliation more efficient. Not only does the cloud provide infrastructure for running technologies that can separate the entries that match from those that don't, the collaborative, anytime-anywhere nature of the platform can spread the payment reconciliation responsibilities across an organization.

ERP:

ERP automates business processes across a company's various departments, so it's a natural fit for payment reconciliation. Indeed, ERP systems can track all transactions (payables and receivables) via a financial module that handles payment reconciliation and generates financial reports.

Accounting software:

Accounting software can also automate the payment reconciliation process, taking over the time-consuming record-matching step.

Improve Efficiency and Cash Flow With Automation

From creating journal entries to reconciling account statements, automation is among the hallmarks of NetSuite Cloud Accounting Software. Not only does the software provide companies with a complete, transparent and from-anywhere view of cash flow and financial performance, it helps them close their books faster and in compliance with regulatory financial requirements.

NetSuite Cash Management also automates the payment reconciliation process. Bank and credit card data can be automatically imported into the software, which compares the information to internal records of transactions, reconciles matching entries and highlights the ones that don't match and require investigation. Automation also provides companies with real-time visibility into cash flow and expedites the financial close process.

Payment reconciliation is an important accounting process that compares internal financial records to bank and other payment records to ensure the amounts are the same. This helps a company understand how much cash it has on hand and identifies errors and potential fraud. Automating the payment reconciliation process cuts down on the staff's work by flagging only anomalies for human investigation. It also leads to a faster close process.

Payment Reconciliation FAQs

What are the 3 types of reconciliation?

Three traditional types of payment reconciliation are bank reconciliation, credit card reconciliation and cash reconciliation. Bank reconciliation compares a company's internal financial records to its bank statements. Similarly, credit card reconciliation compares a company's internal financial records to its credit card statements, which also may be matched against its bank statements. Cash reconciliation matches the amount of money collected in a cash register to the register's sales receipts at the end of a business day or before a shift change. Additionally, companies will need to devise a policy to document digital-wallet transactions as a fourth type, as digital-wallet transactions increase in popularity.

How do you do perform a payment reconciliation?

Payment reconciliation is an accounting process that ensures a company's internal records of payments owed and due match the transactions that appear in its bank statements and other payment methods. Payment reconciliation involves four steps:

-

Record retrieval: This step involves gathering internal records of transactions and external statements from banks, credit and debit cards, mobile payment services and more, and then extracting the specific information needed to compare dollar amounts against internal records.

-

Matching: Each recorded transaction is compared to bank statements. Those that match are eliminated from further review.

-

Reconciliation: Transactions that fail to match are investigated and eventually rectified. Corrections may require a review and approval process.

-

Finalization: Once every transaction has been reconciled, journal entries can be made to fix errors and adjust general ledger accounts. At this point, payment reconciliation is complete.