Convenient, secure and easy to use, digital wallets have become must-haves for people engaged in the growing world of ecommerce and mobile payments. Now they’re beginning to emerge as business-to-business payment tools, as well. Here we’ll explore what digital wallets actually are, how they work and their key technology underpinnings.

What Is a Digital Wallet?

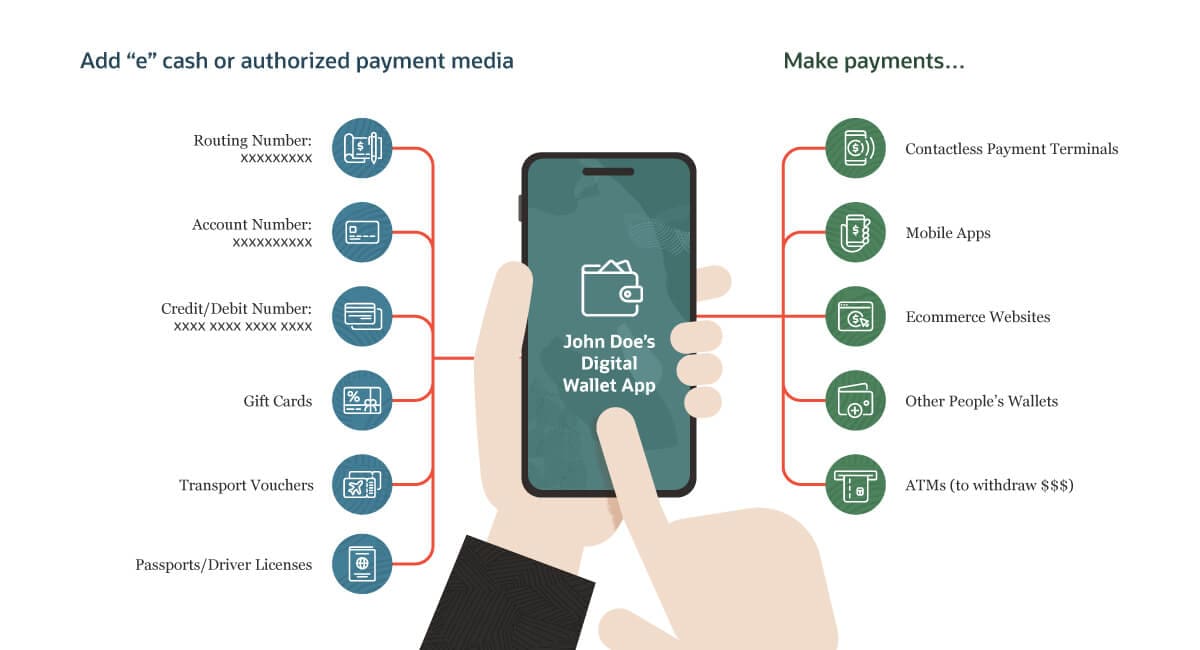

A digital wallet, sometimes called an e-wallet, is a software application and service that allows you to make payments directly from a mobile device, such as a smartphone. Most commonly, they take the form of a downloadable mobile phone app that works in physical retail stores and online. Digital wallets securely store cash balances and other payment media, such as credit and debit cards, but without actually “storing” them (more on that later). Some can also store passports, driver’s licenses, transportation passes, tickets for events and gift cards. There are also digital wallets specifically for cryptocurrencies.

In addition, a new kind of global digital wallet for business-to-business (B2B) transactions began to appear in 2021. Such wallets integrate with the accounting modules of a company’s enterprise resource planning (ERP) system to simplify electronic payments between a company and its supply chain. They include multicurrency capability so a company can pay foreign suppliers in the currency they prefer.

Key Takeaways

- Digital wallets are downloadable apps that securely record e-cash balances, multiple credit/debit cards, other payment media, such as gift vouchers and transportation passes, event tickets and identity documents.

- They are typically used on mobile devices, such as smartphones, tablets and smart watches.

- Digital wallets can be used to make contactless payments, pay for online or in-app purchases, transfer money to friends or withdraw cash from ATMs.

- Digital wallets offer better security than conventional wallets and greater convenience for users.

- Cryptocurrency keys can be kept in “hot wallets” on exchanges for active trading or off-line “cold wallets” for safekeeping.

Digital Wallet Explained

The most widely used digital wallets are downloadable apps for smartphones and tablets, but there are also digital wallets for personal computers and others designed for cryptocurrency, including dedicated hardware wallets that resemble USB sticks. Just like a physical wallet, a digital wallet holds cash, credit cards and bank cards, though, of course, the cash is electronic and the cards are virtual images of real cards.

Consumers can use digital wallets to make contactless payments for goods and services in stores or to make online ecommerce payments. To use e-cash to make a payment, you need to preload the digital wallet with cash, just as you would a physical wallet. Alternatively, users can authorize the digital wallet to pay with a virtual card, in which case the payment will come from their bank or credit card account. Some digital wallets allow you to withdraw physical cash from ATMs.

B2B digital wallets integrate with a business’s payment system. The one announced for NetSuite’s SuiteBanking solution, a software module that embeds fintech functions into the firm’s ERP system to automate key financial processes, ties to a business’s bank account and/or a virtual credit card. NetSuite has partnered with HSBC as the first international banking partner to provide services via the global digital wallet. With it, companies can make or receive payments through their bank accounts or cards in more than 60 countries, greatly simplifying the current process of working through multiple payment providers and holding separate foreign bank accounts for each currency a company must use.

Beyond cash and cards, many consumer digital wallets can securely store identity information, such as passport and driver’s license details, security passes and transportation passes. They can also hold virtual tickets for events and virtual gift cards. In fact, almost anything you can put in a physical wallet can be recorded in a digital wallet.

Cryptocurrency is a special case. Since cryptocurrencies exist only in digital form, they can only be accessed via digital wallets. However, cryptocurrency wallets don’t store actual cryptocurrencies, since these are recorded on public blockchains. Instead, digital wallets for cryptocurrencies hold the keys that give access to an individual’s or an institution’s cryptocurrency holdings.

How Does a Digital Wallet Work?

Digital wallets for individuals are simple to use. First, download the wallet app and set up security. Second, load it with payment media or cash. Then, use the wallet to pay for goods and services, deposit funds into your bank account, split restaurant bills with friends, send money to relatives or obtain cash from ATMs.

To add bank account details, credit cards or debit cards to the wallet, the device hosting the wallet must be connected to the internet. A person enters account or card details, the wallet contacts the bank or card issuer to authorize the account or card and then issues a “token” representing the account or card (so that the actual account details are not stored). In general, a person can authorize as many bank accounts or cards as they wish, from multiple providers, then choose which to use for any given payment.

Many digital wallet providers also allow users to upload e-money into the wallet. For example, with Apple Pay(opens in new tab) you can authorize an e-money card, then transfer into it the electronic equivalent of cash from a bank or credit card. Venmo(opens in new tab) allows users to upload cash from their bank accounts or even have part of their wages automatically deposited into their Venmo balance.

Users can also upload other forms of payment media, such as transportation passes, gift cards and e-vouchers, depending on the wallet and what it supports. Some accept digital identity documents such as passports and driver’s licenses.

Once a digital wallet contains authorized payment media, it can be used to make payments or transfer money in one of four ways:

- Via contactless technology to pay retailers at stores and gas stations.

- Using digital wallet payment buttons on mobile and online apps or websites.

- Sending money directly to another person’s digital wallet.

- By QR code generated by the digital wallet.

For contactless payments, many digital wallets use near-field communication (NFC). When two NFC-enabled devices are close together, they can exchange information. For example, you can make a payment by holding a smartphone or watch close to a shop’s contactless reader; the device doesn’t need to be online for this. If you are using a debit or credit card, the shop’s contactless terminal will obtain your authorized card details from your digital wallet and contact the issuer to approve the payment. Apple Pay and Google Pay both use NFC technology.

Some digital wallets use magnetic secure transmission (MST), which transmits to the contactless reader a secure signal that mimics the signal generated when the magnetic strip on a credit card is swiped. Samsung Pay(opens in new tab) uses both NFC and MST technology.

Advantages of Digital Wallets

Digital wallets make payments faster, simpler and more convenient for both individuals and businesses. Plus, they’re usually more secure than other payment methods.

For buyers: Digital wallets make shopping simple. Instead of having to carry cash and multiple cards, a shopper needs only a smartphone or watch. You can make contactless payments by waving the device at a contactless reader, and online or in-app payments using a clickable button. Users don’t have to remember PIN numbers or sign their names to make a credit card purchase. Moreover, digital wallets make it easier to split restaurant bills with friends, send money to relatives, get cash from an ATM or deposit funds in your bank account, all without having to use cards or visit a bank.

Purchases made from a digital wallet are more secure than those made using credit or debit cards, since the wallet doesn’t expose — or even store — the actual card details and the payments are encrypted. Storing identity information securely in a digital wallet can be useful in situations where you’re asked for identity confirmation when making a purchase — for example, when buying alcohol.

Digital wallets also help track expenditures, since they automatically keep a record of transactions.

Some credit card issuers offer enhanced rewards when their cards are used in a digital wallet.

For businesses: Retail businesses gain a number of advantages from buyers’ growing use of digital wallets. Since paying from a digital wallet is more convenient for customers, accepting digital wallet payments can improve business sales. Because of the strong security on digital wallets, there’s less likelihood of fraudulent payments. And businesses can use digital wallet apps to offer loyalty rewards, coupons, special offers and discounts, thus helping to build repeat business.

Businesses that integrate a global digital wallet with their accounting systems can get more benefits. They can simplify and automate many payment processes that would otherwise take up staff time and be more error-prone. They can help companies get paid faster. And they can handle currency conversions, reducing the complexity and risk inherent in international supplier payments.

Types of Digital Wallets

Not counting the special case of cryptocurrency wallets, there are three types of digital wallets for individuals: closed, semi-closed and open.

- A closed wallet is provided by a retailer such as Walmart or Amazon and can be used for purchases, refunds or cash back only from that retailer.

- A semi-closed wallet is provided by a retailer or internet company and can be used for purchases from multiple businesses approved by the provider.

- An open wallet is typically provided by a device maker such as Apple or Samsung, an internet company such as Google, a bank or a fintech company such as PayPal or Venmo. It can be used for purchases from retailers that accept digital contactless payments using NCR or MST technology; for online and app purchases; and to transfer money to and from other wallets.

Cryptocurrency wallets are a special type of digital wallet that holds cryptocurrency “private keys,” which are like passwords and used to sign blockchain transactions and prove ownership. Both the key and the cryptocurrency wallet can be either online or off-line. If online, the wallet is called “hot”; if off-line, “cold.”

Hot wallets: These are typically hosted by cryptocurrency exchanges and accessed via a mobile device or personal computer. Hot wallets are used to exchange or trade cryptocurrency or transfer it to a cold wallet.

Cold wallets: Also known as “cold storage,” cold wallets are off-line storage media. Personal computers, USB sticks, cryptocurrency hardware wallets such as Nano or Trezor — or even a piece of paper on which cryptocurrency keys are written — can all be cold wallets. At present, it’s not possible to trade or exchange cryptocurrencies directly from cold wallets. Maintaining them off-line makes cold wallets far more secure than their online counterparts. On the flip side, they can be physically lost, misplaced or stolen. The safest place to store a cold wallet containing private keys to a valuable store of cryptocurrency is, literally, a safe or bank’s safe deposit box.

Digital Wallets and Security

Digital wallets have two layers of security — their own and that of the device on which they are hosted.

Digital wallets are typically accessed by a password or PIN number, and they may require two-stage verification. Some digital wallets use biometric identification, such as face or voice recognition. As additional protection against hacking, digital wallets don’t hold the actual details of bank accounts, debit cards or credit cards. Instead, they “tokenize” the account or card using the authorization code provided by the bank or card issuer. They also encrypt payments and transfers, end to end.

However, mobile devices can be lost or stolen. So, although digital wallets on mobile devices have their own security, it’s also wise to make maximum use of the device’s security features. Many wallet providers enforce device security by requiring the hosting device’s screen lock to be activated. It’s also sensible to set passwords on personal computers and laptops that are hosting digital wallets, including cryptocurrency cold wallets, even if they are kept in a physically secure environment.

Hot wallets on cryptocurrency exchanges often have multi-signature (aka Multisig) security, which requires two or more signatures to execute a transaction, or other security arrangements to guard against hacking. However, as these have not always proved secure, cryptocurrency exchanges usually discourage keeping large quantities of cryptocurrency in hot wallets. Cold wallets are intrinsically more secure than hot wallets since they are off-line.

Are Digital Wallets Safe?

Provided you take advantage of all the security features of the wallet and its hosting device, it is safer to keep credit cards, bank cards and personal identity documents in digital wallets than in conventional wallets — the one in your pocket or handbag. If a conventional wallet is stolen, thieves can immediately use any contactless cards and may be able to use non-contactless cards by forging a signature or breaking a PIN. They can also use documents such as a driver’s license to steal someone’s identity and obtain money fraudulently. But if a phone is stolen, thieves must break both the phone’s own security and the security on the digital wallet to gain access to your money and identity documents.

Contactless payments made from digital wallets are also safer than contactless card payments, since the payment is encrypted end to end and there is no risk of the card being cloned or its details copied. They are also safer than swiped card payments, since they don’t reveal security information such as a signature or PIN number.

Examples of Digital Wallets

There are many dozens of digital wallets in the world — perhaps even hundreds — because each bank, fintech company, cryptocurrency exchange and any other type of financial institution provides its own for its customers. But the ones that come most readily to mind are those offered by first-wave fintech companies like PayPal and leading device providers and internet companies like Apple, Samsung and Google. These are open wallets in widespread, international use. Google Pay is the native digital wallet for Android smartphones, replacing Android Pay, and Samsung Pay also works on Android phones. Apple Pay is the native digital wallet for Apple smartphones, tablets and watches. It uses biometric security.

Venmo and Zelle are both widely used for peer-to-peer transactions between individuals. Zelle transfers money between U.S. bank accounts. Venmo transfers e-cash to and from other Venmo accounts and can also be used to make online purchases. E-cash can be loaded into the Venmo account from a bank account or credit/debit card. PayPal’s digital wallet can be used internationally. Since 2012, Venmo has been owned by PayPal.

Digital Wallets and Ecommerce

Whether it’s increased use of voice search, rising numbers of payment options, augmented reality that helps buyers visualize how they’ll use their purchases, or multichannel customer support, the major trends in ecommerce all point to improving the customer experience. Digital wallets are playing an important role in that experience by making ecommerce purchases simpler, faster and more secure.

Use of digital wallets in ecommerce is growing rapidly, as customers discover the convenience and improved security that they offer. For businesses, accepting “one-click” payments with a digital wallet button reduces friction in customer payments and makes it less likely that customers will cancel the purchase. And the greater security of digital wallets makes fraudulent payments less likely.

Digital Wallet Trends

The pandemic of 2020-22 sharply accelerated the trend toward cashless and online purchases, as people remained in their homes and avoided physical contact. That prompted initial use of digital and mobile wallets by people who might have been slower to adopt them. Now the convenience and security of digital wallets for cashless and online purchases is bringing about widespread adoption and rapid growth of transaction volumes.

According to a survey by the credit card company Discover, the value of transactions using digital wallets is set to top $10 trillion globally by 2025, counting both in-store and ecommerce transactions. As of 2020, digital wallets already represented 27% of in-store spending, 41% of ecommerce spending and 46% of mobile commerce spending, with their use growing fastest in China, India and Singapore.

In business supply chains, digital wallets are just beginning to emerge. They promise to bring the same kind of convenience, security and automation advantages that consumers now enjoy to the realm of B2B payments and accounting processes.

As the online and mobile revolution in payments gathers pace, digital wallets seem set to become ubiquitous.

Digital Wallet FAQs

What are examples of digital wallets?

Google Pay, Apple Pay, Samsung Pay, PayPal, Venmo and Zelle are all digital wallets.

What is a digital wallet and how does it work?

A digital wallet is a downloadable app that securely stores your bank account details, credit and debit cards, e-money and identity documents. You can make contactless payments from your digital wallet, make online or in-app purchases, and send and receive money.

How do I get a digital wallet?

You can download a digital wallet from the internet sites of banks, fintech companies, securities and cryptocurrency exchanges, and other financial institutions. Some mobile devices, including Apple and Android smartphones, come with preloaded digital wallets.

What’s the best digital wallet?

The best digital wallet is going to be the one whose features or provider meets your needs. If you just want to send and receive money, then Venmo or CashApp could work. If you want to make contactless payments from your smartphone, then Apple Pay or Google Pay become top considerations. Alternatively, explore the range of wallets provided by banks and fintech companies to find one that suits your needs. Some people have more than one wallet for different purposes.