Great chefs make magic in the kitchen, but successful restaurant owners make a different kind of magic on the bottom line. To manage a profitable business, they must create and closely review key financial statements that reveal whether they’re on the right track or need to make course corrections. Take heart: Most of the successful ones aren’t accountants or MBAs.

What Are Restaurant Financial Statements?

Restaurant financial statements are summaries of a restaurant’s current financial performance. There are three main types of statements to use, regardless of restaurant size and business volume: Profit and loss (P&L) statements (also known as income statements), balance sheets, and cash flow statements. Together, these reports give a full view of a restaurant’s financial health.

Key Takeaways

- Common financial statements are essential to managing restaurants and making plans to expand.

- Cloud-based software with prebuilt reports makes it easier to create financial statements and understand performance.

- Restaurant operators should look for financial software that’s easy to use, simplifying tasks such as recording transactions and closing the books.

Restaurant Financial Statements Explained

Publicly held restaurants in the United States, those owned by shareholders, are required to file quarterly and annual financial statements with the Securities and Exchange Commission. For internal purposes, some produce statements monthly or even weekly, to keep a close eye on the numbers and, if needed, make operational changes to achieve financial objectives. Privately held restaurants use these statements too, when preparing income taxes, communicating with shareholders, or simply tracking business performance.

Why Are Restaurant Financial Statements Important?

Together, the P&L statement, balance sheet, and cash flow statement help owners and investors understand a restaurant’s performance. They also contain clues on how to manage the business, flagging potential financial problems and guiding corrective actions.

For example, a restaurant might use its P&L statement to understand seasonal sales, comparing June sales to those of the previous year. Did sales drop as the weather warmed? If so, the restaurant may expand its menu to include more salads, sandwiches, and other cold items. If sales are higher thanks to a surge in patio dining, the restaurant may add wait staff.

No one type of statement has all the answers a restaurant needs. All three types are needed to gain a full understanding of its financial condition.

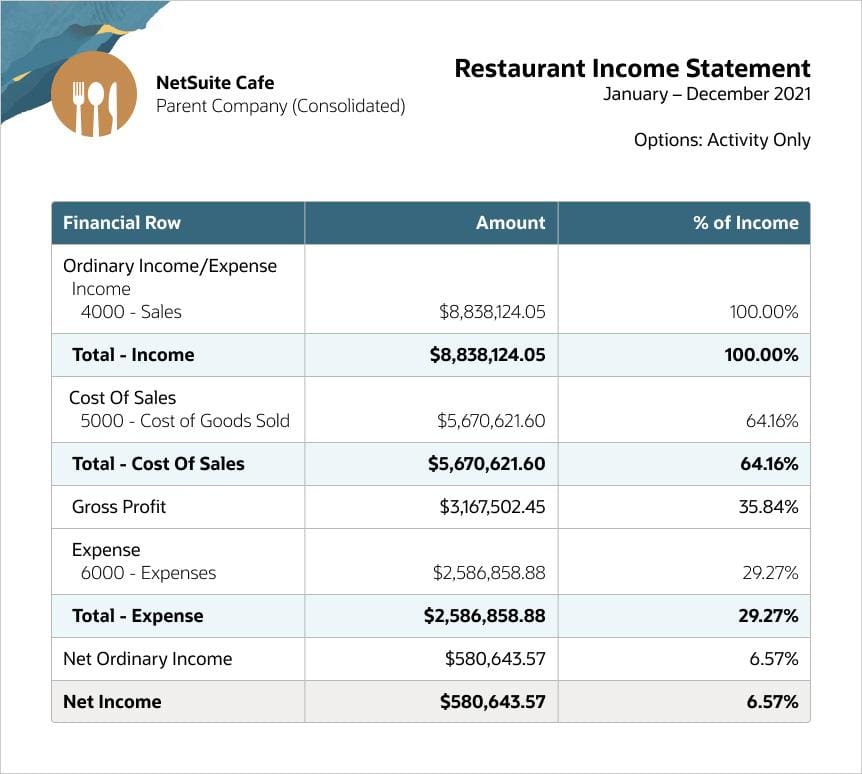

Restaurant Profit and Loss (P&L) Statement (or Income Statement)

A P&L statement, formally known as an income statement, is the most widely used financial statement in the restaurant business. Owners, operations managers, and corporate financial teams rely on the P&L to track sales and costs, stay on budget, and achieve profits.

What is a P&L?

A P&L statement reveals the bottom line, which equals sales minus the cost of goods sold (food and beverages) and operating expenses. It covers a single fiscal period, whether weekly, monthly, quarterly, or annually. Profit, or net income, appears at the end of a P&L statement, on the bottom line.

For example, if a restaurant budgeted for labor at 30% of sales but the P&L statement reveals labor at 32%, management may decide to trim labor costs to help protect profit margins. It’s important to realize that many costs relate to sales and thus will fluctuate. Most restaurants will budget labor as a percentage of sales, not a fixed dollar amount. This way, as sales increase, the operator knows it can also increase its spending to optimize sales.

On average, costs amount to more than 90% of total restaurant revenue, according to a ProjectionHub analysis of nearly 500,000 US establishments in 2019. That comes to an average profit margin of 3% to 5%.

How to Set Up a Restaurant P&L

In creating a P&L and other financial statements, restaurants use accounting software, avoiding the tedious task of grinding through spreadsheets. In adopting financial applications, some restaurants are moving from manual processes; others are switching software brands. Regardless, they all create P&L statements by taking the following steps:

1. Record sales/revenues.

Enter sales of food and beverages during a given period, reflecting various payment methods, whether cash receipts or those from credit cards and gift cards. Sales information is found in a restaurant’s point-of-sale system, the modern version of cash registers. Many P&L statements show in-house dining, catering, and delivery as separate sources of revenue.

2. Record prime costs.

Prime costs are the cost of goods sold (again, food and beverages) plus the cost of labor (wages for cooks, wait staff, bartenders, and others). On average, food and labor costs account for about 60% of sales.

3. Record fixed costs.

In a restaurant, fixed costs typically include rent, insurance, electricity, gas, pest control, operating permits, ongoing maintenance, and more. These costs are more consistent than labor and inventory costs but still need to be contained.

4. Calculate profit or loss.

The P&L’s bottom line reveals how much a restaurant cleared in profit, or how much it lost, after costs are subtracted from sales. Because most restaurants operate on very thin profit margins—clearing a 10% margin means they’re doing well—watching sales versus costs is crucial. It’s common for managers to review these numbers several times a day.

Say a restaurant generated $1 million in annual revenue and paid $950,000 in various expenses. The simple P&L formula would look like this:

Revenue = $1 million – expenses: $950,000

Profit or net income = $50,000

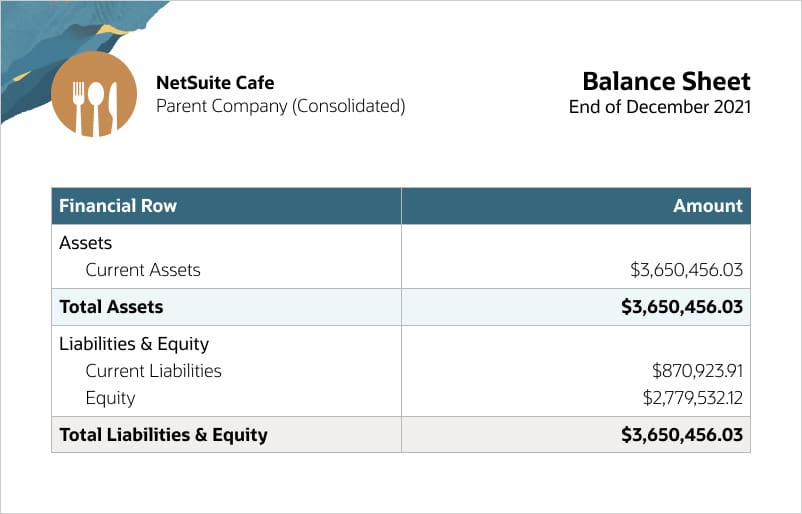

Restaurant Balance Sheet

Unlike the P&L, which covers day-to-day sales, costs, and budgeting, the balance sheet focuses more on a restaurant’s long-term health. It’s used almost exclusively by a restaurant’s finance team, not its managers or operations executives.

What is a Balance Sheet?

A balance sheet shows everything a restaurant owns (assets), everything it owes (liabilities), and what’s left when you subtract the latter from the former (owner’s equity).

Assets – liabilities = owner’s equity

Unlike a P&L statement, the balance sheet doesn’t cover a period of time—it’s a snapshot taken the day it’s published. It’s also a kind of x-ray, revealing the business’s health as measured in liquidity, operating efficiency, and potential return on investment. Because it doesn’t include revenue or cash flow, the balance sheet should be analyzed together with the P&L and cash flow statements.

How to Create a Restaurant Balance Sheet

The balance sheet includes assets (such as kitchen equipment, bar, tables, and chairs) and inventory (food and beverages); liabilities (accounts payable, lines of credit, and leased property or equipment); and equity (what’s left when liabilities are subtracted from assets, sometimes called net assets.

Here’s how to set up a balance sheet:

1. Record assets.

List all current assets, such as cash and accounts receivables, and inventory; all fixed or long-term assets such as property, equipment, and long-term investments; and any other assets such as deferred tax income. Added together, these equal a restaurant’s total assets.

2. Record liabilities.

Account for all current liabilities, for example, accounts payable, short-term loans, and income taxes owed; and all long-term liabilities, such as long-term debt and deferred income tax.

3. Record owner’s equity.

List the ownership’s investment and any retained earnings, that is, what’s left after balancing sales and liabilities. This amount is known as shareholder’s equity if the business is an LLC or corporation, not a sole proprietorship.

Calculate financial ratios

A balance sheet also lets restaurants see common financial ratios, for example, debt ratio (total assets versus total liabilities), working capital (current assets versus current liabilities), and debt-to-equity ratio (total liabilities versus owner’s equity). These ratios give additional insight into business performance.

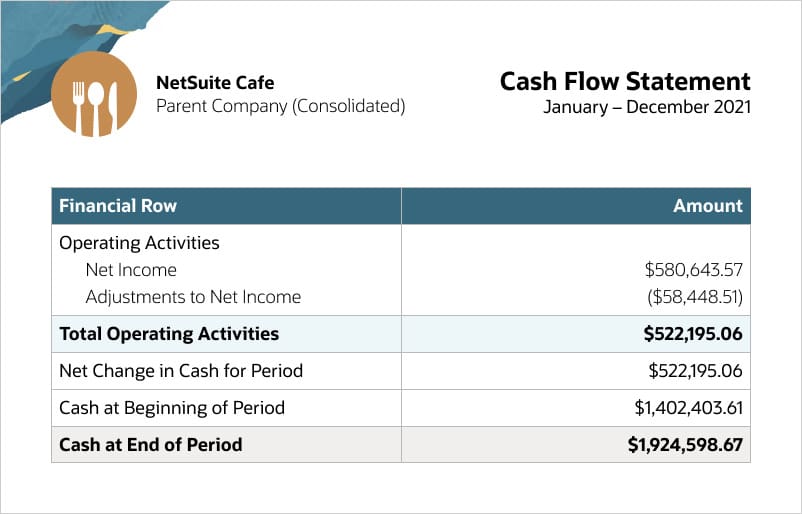

Restaurant Cash Flow Statement

Cash flow is the lifeblood of the restaurant business. Cash flow statements show whether a restaurant has enough cash to fund current operations and planned growth.

What is a Cash Flow Statement?

A cash flow statement records all cash and cash equivalents earned and spent in each period. It reveals liquidity, changes in assets, liabilities, and equity, and it helps restaurants understand operating performance.

In other words, it shows money flowing into and out of a restaurant. This includes cash (both physical money and credit and gift card charges) as well as payments to keep things running, such as those for food and beverages, labor, and dining room maintenance. It also includes any financing or debt that adds or subtracts cash. For instance, taking on more debt will increase cash flow in the short term, while paying down debt too fast could leave a restaurant cash poor.

If receipts exceed payments, the result is positive cash flow. If payments are greater than the money coming in, the cash flow is negative—a red flag.

How to Create a Cash Flow Statement

There are two ways to calculate cash flow: the direct method, showing revenue and expenses as cash is received and disbursed; and the indirect method, showing the same things as they accrue.

To keep things simple, let’s focus on the direct method, described in the steps below:

1. Record operating activities.

Enter expected cash from point of sale, plus payments for inventory, wages, interest on items purchased, and administration and upkeep. Most of this information will come from the P&L statement.

2. Record investing activities.

Note receipts from incoming capital, typically coming from investors, and outgoing capital to pay for new equipment or build new locations.

3. Record financing activities.

Account for debt and equity transactions (found on the balance sheet): receipts from the issuance of stock or shareholder distributions, money borrowed, and cash paid for repurchase of stock (treasury stock), repayment of loans, and dividends.

4. Calculate cash flow.

To determine cash flow, subtract payments from receipts. Here’s the basic formula:

Opening balance + or – cash from all activities, including restaurant operations, financing, and investing

7 Steps to Choose the Right Restaurant Accounting Software

Price is certainly a factor, but it’s certainly not the only one. Restaurant accounting software should be friendly enough for people outside the financial team to use. It should be easy to access, including via mobile devices. The software must be secure, granting access according to employees’ roles and fortified with strong data encryption and password policies. It’s also smart to choose software that integrates with the point-of-sale system, giving managers quicker views of restaurant performance.

Here are seven quick steps to choosing the right accounting software for your restaurant’s specific needs:

- Determine your establishment’s specific software needs: Ask yourself what accounting software features you’d like, including inventory management, payroll, and invoicing. Figure out if the software will integrate with your current systems like POS systems, marketing technology, reservation tools, online ordering software, and more.

- Set your software budget: Consider both setup and ongoing costs in your restaurant accounting software budget. Employees will also need time to be trained, which can cut into time actually performing their jobs.

- Assess all the options available: Read reviews, follow advice of industry experts, and ask your network for their thoughts. You’ll want to make sure the basics are covered in any software you choose like tax compliance, financial reporting, and inventory management. Consider how the accounting software can scale as your business grows and if you’ll need specific customizations.

- Give your top options a test drive: Request product demos and bring your staff along. Since they’ll be the everyday users, have them get involved to ask questions and assess the functionality.

- Don’t forget support and training: A great restaurant accounting system means nothing if you don’t have the support and training to make it work for your business. Consider the availability of the support and training teams in your choice to ensure that your team can use the software to the fullest.

- Make security a top priority: Any tool housing your business’ financial data should have exceptional security and compliance standards in place. Inquire as to how the software protects your financial information and adheres to industry regulations.

- Choose and Implement the Software: Make a pros and cons sheet and include your team in the decision-making process. Consider your restaurant’s future needs along with what you require right now. Once you’ve selected a software, create an implementation plan that includes staff training and progress monitoring.

Take Your Restaurant to the Cloud

Choosing the right accounting software for your restaurant is not a decision to make on a whim. Once implemented, it can cost both time and money to switch solutions and migrate all your data. Done right, the decision involves a comprehensive assessment of an individual business’ needs and a comparative analysis of all the competitors on the market. By following these steps, restaurant owners can choose the software that best aligns with their operational needs, scales as their business grows, and contributes to the overall operational efficiency of their establishment.

Manage Financial Statements and Business Growth with NetSuite

NetSuite Accounting Software makes it easy for restaurants to manage their finances. It’s user-friendly, simplifying activities such as recording transactions, managing payables and receivables, collecting taxes, and closing the books. It also expedites the creation of key financial statements, allowing restaurant owners, executives, managers, and shareholders to delve deeply into profits and losses, assets and liabilities, and cash flow. With these and other capabilities, NetSuite helps restaurants make better financial decisions and grow their businesses.

Restaurant Financial Statements FAQs

Which financial statements should a restaurant use?

A restaurant should use a profit and loss (P&L) statement, a balance sheet, and a cash flow statement. All three are important in gaining a complete view of business performance.

Which financial statement is most important to a restaurant?

Restaurants use the P&L statement more frequently than the balance sheet and cash flow statement. The P&L gives updates—preferably in real time—on sales, costs, and profits and losses. It lets a restaurant know if it’s on budget, hitting financial targets, and on track to grow.

What’s the difference between profit and cash flow?

Profit is the amount of income remaining after a restaurant pays all of its expenses. Cash flow is the flow of money in and out of a restaurant. Sales and accounts receivable pull money in; operating, overhead, and other expenses pull it out.