“You have to spend money to make money.” That classic business adage is embodied in a company’s operating cycle. The moment a company agrees to spend money to buy raw materials, for example, the operating cycle starts. Then the business produces goods, collects money for them and spends at least a part of that money on more raw materials for more goods it will sell for more money — and so on and so on, as the operating cycle’s wheel turns. This is the nature of a successful business operation.

The speed with which the operating cycle wheel turns is a key indicator of the efficiency and health of a business.

What Is An Operating Cycle?

The operating cycle measures the length of time that passes between when a business orders materials or goods and when it collects cash from the sale of the resulting goods it produces or resells. The operating cycle (OC) starts with the buying of materials or goods; it includes the time it takes to produce goods, in the case of a manufacturer, or to place them on the shelf, in the case of a retailer; it accounts for the time it takes to sell the goods; and it ends with the collecting of cash from those sales The length of an operating cycle can be very different from one industry to the next. A supermarket, for example, has a far shorter average operating cycle than a furniture retailer might experience.

Key Takeaways

- A shorter operating cycle means a company can generate cash at a quicker rate and meet its financial responsibilities in a more timely way.

- Managerial decisions can effect changes in the length of an operating cycle.

- Adjusting credit and payment terms with customers and suppliers can be beneficial to cash flow and, in turn, the operating cycle.

Operating Cycle Explained

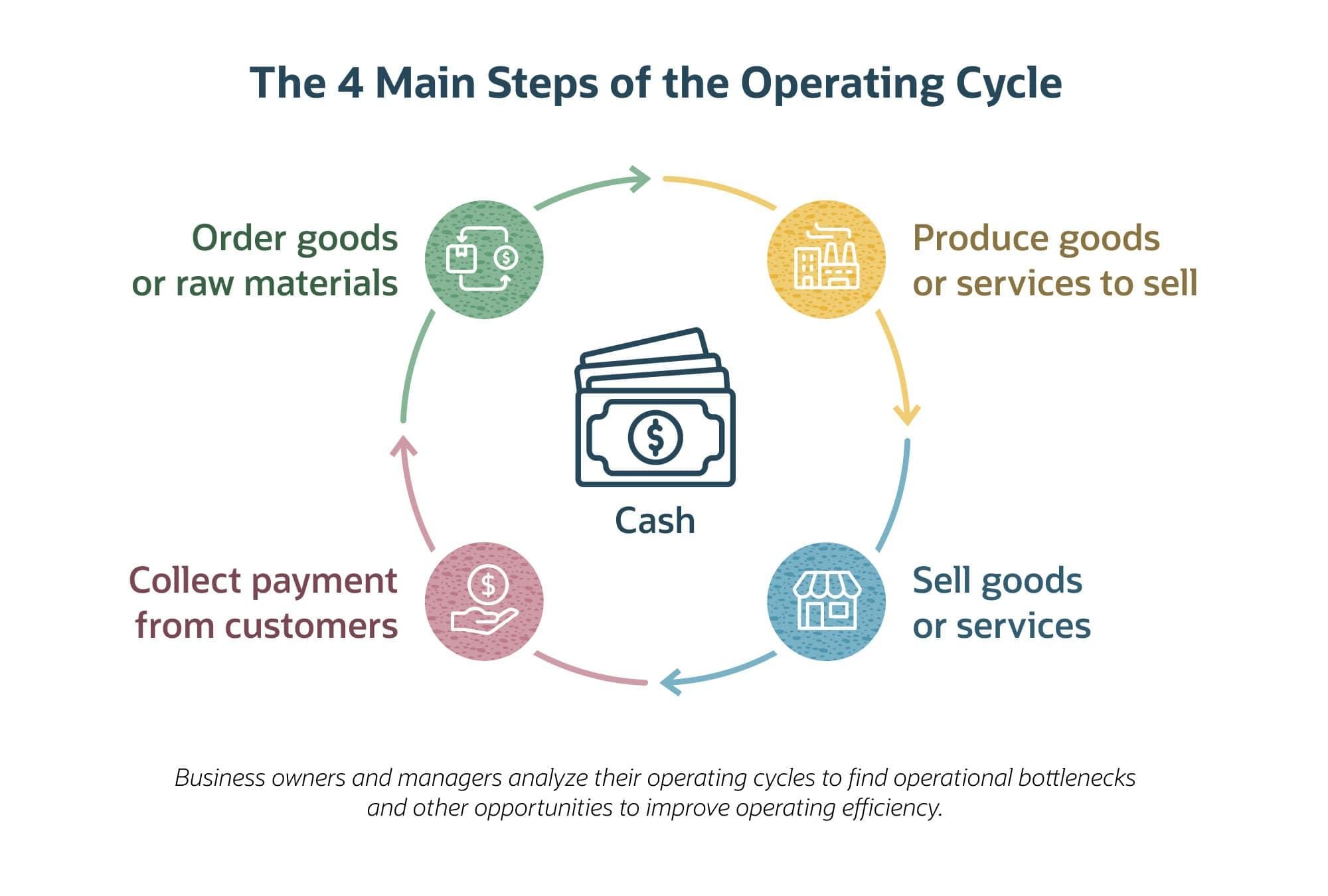

The four basic steps in the flow of an OC are:

- Order the raw materials or goods.

- Produce goods or services for sale.

- Sell the goods or services.

- Collect payment from customers.

The more a business’s owners and managers understand their OC, the better sense they will have about the business’s cash flow — in other words, they’ll be clearer about when they’ll be able to pay expenses and liabilities. The quicker a business can generate cash — indicating a shorter OC – the faster it can reduce or pay off its debts, pocket profits and/or reinvest in the business.

The OC is sometimes confused with a similar-sounding and related term: the net operating cycle (NOC), which is also known as the cash conversion cycle or cash cycle. The OC marks the time that elapses between the ordering of inventory or its components and the collection of cash for subsequent sales, whereas the NOC looks at the time that passes between payment for the ordered inventory and the cash collected from its sale. The key differentiator is the time between purchasing inventory and paying for it (often referred to as the accounts payable cycle). The formulas to calculate OC and NOC are different. And, at the end of the day, the operating cycle provides insights into how efficiently the business’s processes run, while the cash cycle provides information that helps manage cash flow.

Why Is the Operating Cycle Important?

How efficient is your business at turning its inventory into cash? The answer to that question can be determined by establishing, understanding and monitoring the two major parts of the OC: how quickly the business produces and sells products or services, and how quickly it collects cash for those sales.

The longer it takes a company to procure inventory, produce goods and sell them, the more time required to get a return on its invested cash. That means the company must tie up more cash to maintain operations and cover the business’s financial responsibilities. It also means that the risk of additional inventory costs, such as damage, shrinkage and obsolescence, becomes greater. By contrast, a shorter OC allows a quicker turnaround of products, which results in more cash on hand to meet obligations, reduces the need for short-term financing and helps the business grow.

Operating Cycle Formula

The equation to calculate the operation cycle is straightforward:

Operating cycle = Inventory period + Accounts receivable period

But using it gets a little complicated because it takes several steps. First, you must determine the inventory period, which is the average number of days that inventory goes unsold. Accountants do this by taking the average inventory value for a fiscal period and dividing it by that period’s cost of goods sold (COGS), then multiplying the result by 365. Average inventory for a period is simply beginning inventory plus ending inventory divided by two.

Let’s work through an example. Consider the fictional MLM Widgets Inc., a U.S. widget importer. For its 2024 calendar first quarter, it had:

- Beginning inventory on January 1 of $8,000

- Ending inventory on March 31 of $12,000

- COGs for the quarter of $44,000

The average of the quarter’s beginning and ending inventory is $10,000. Dividing $10,000 by the COGS of $44,000 results in a quotient of 0.227. And multiplying 0.227 times 365 yields an inventory period of 82.86 days — let’s call it 83.

Next, to determine the accounts receivable (AR) period — i.e., the average number of days a credit sale remains uncollected — calculate the average AR for the period in a similar manner as the average inventory value we just did, then divide the result by net credit sales and multiply by 365. Net credit sales can sometimes be found on a company’s income statement but often requires a deeper dive into the company’s adjusted trial balance.

Returning to the MLM Widgets example, it had:

- Opening AR of $7,000 for the first quarter

- Closing AR of $11,000

- Net credit sales for the period of $92,000

MLM Widgets’ average AR for the period is $9,000. Dividing $9,000 by the net credit sales of $92,000 results in a quotient of 0.098 (rounded up). And multiplying 0.098 times 365 yields an AR period of 35.77 days — call it 36.

Since OC equals inventory period (83 days) plus AR period (36 days), MLM Widget’s OC during the first quarter of 2024 was 119 days.

How to Interpret the Operating Cycle

The nature of a business determines the broad parameters of its OC and how short or long it “should” be. For example, a pizzeria would have a much shorter OC than a furniture manufacturer. A pizza’s flour, olive oil, tomatoes, etc., are all likely to be ordered and stay in inventory for a total of only a few days. And, once produced, the pizza is likely to be sold today (or tomorrow, at the latest), and the customers are likely to pay on the spot, often in cash. All of that makes for very short inventory and AR periods that add up to a short OC. But the furniture maker’s hardwood materials take longer to be delivered, longer to fashion into furniture, longer to be transported to retail furniture galleries and longer to sell. Then some customers will pay with credit cards while others buy on credit and pay over time.

By comparing its OC to the norms or average for its industry, a business can tell how efficiently it’s operating.

- Shorter operating cycle: If a business has a shorter OC than its peers, that means it is recovering its investment in inventory more quickly and, therefore, tying up less of its cash in working capital.

- Longer operating cycle: A longer OC than that of industry peers is a warning sign. The slower movement of inventory could indicate that products aren’t performing as expected. A longer OC can lead to cash flow problems, as goods that the business has already paid for sit on shelves or warehouses instead of bringing in revenue.

8 Factors Impacting Operating Cycle

An OC has many moving parts, any one of which can affect its duration. They range from decisions made by company employees to external elements that affect the economy as a whole. Here’s a snapshot of eight such factors.

-

Inventory Management

The goal of inventory management is to understand and properly maintain the right amount of goods on hand. Many inventory management issues can affect the OC. For example, over-ordering raw materials for products that aren’t selling as aren’t selling as fast as expected can lengthen the OC.

-

Sales and Marketing Strategies

If sales slow, inventory piles up and the OC gets longer. As sales accelerate, a product’s turnover rate improves, shortening the OC. So the more effective a business’s sales and marketing strategies, the shorter its OCs.

-

Credit Policies

A longer credit period granted to a customer means a slower OC. In turn, prolonged collection periods can increase the chance of a business not being able to meet its own cash commitments.

-

Supplier Relationships

The stronger the relationship between a supplier and a business, the better the opportunity to negotiate more favorable delivery terms. Faster delivery from a supplier shortens a business’s OC.

-

Product Type and Industry

As discussed, OC varies across industries, as well as from product to product. For example, an operating cycle for a medical equipment manufacturer would be far different from that of a shoemaker. But within that medical equipment OC, the comparative time spans for syringes versus EKG machines also likely would differ. In any industry, understanding the OC of competitors can be a useful mode of comparison for your business.

-

Technological Advancements

Consider where in the workflow you can implement better technologies to shorten the OC and/or streamline other parts of the business. That could be in supply chain management, manufacturing (reducing the length of the production process), inventory management (better alignment with demand forecasting, such as using the just-in-time, or JIT, inventory method) and accounting software (which automates the AR collection process and offers customers more ways to pay).

-

Economic Conditions

Whether the economy as a whole or within certain sectors is in a recession or growth period can greatly affect an OC. For example, when a period of high inflation hits, demand for many products and services falls, which then slows inventory turnover and can also cause customers to pay more slowly or default altogether. History shows that there are many kinds of economic downturns, and their impact can be hard to predict. It’s important to make your business as recession-proof as possible.

-

Company Policies and Management Decisions

Many company policies and business decisions directly impact the OC. Ideally, policies and decisions should keep the OC as short as possible. For example, choosing to invest in the JIT inventory model mentioned above would shorten an OC, as would stricter credit policies and improving the efficiency of AR collections.

7 Tips to Shorten the Operating Cycle

As this article has shown in a number of ways, a shorter OC means a more efficient business. Here are seven tips to help business managers think about how to shorten their own organizations’ OCs.

-

Optimize Inventory Management

Optimizing how much inventory is available, where it is located, how much more the business needs to satisfy demand — and when — is the crux of inventory management. Optimized inventory management — normally achieved through sophisticated software that includes real-time analytics — is one of several keys to shorter OCs.

-

Enhance Sales and Marketing Efforts

Speeding up the sale of goods and services brings cash in quicker and boosts inventory turnover, all of which shortens the OC. Of course, that’s often easier said than done. It may require new ways to position the product in the marketplace or inspire promotional incentives to boost sales and increase cash flow.

-

Accelerate Receivables Collection

Cutting down on the time it takes to collect on credit sales will decrease the OC. There are several ways to speed up accounts receivable collections, including offering early pay discounts, sending digital invoices, automating payment reminder notifications and creating self-pay portals.

-

Streamline Production Processes

Creating a more efficient production process cuts down on the time it takes to create inventory, which, in turn, makes goods ready for sale quicker. Consider an audit of operations management to identify opportunities to reduce or eliminate steps and pain points to speed things up.

-

Negotiate Better Terms With Suppliers

If your focus in supplier negotiations is all about price and payment terms, you may be missing a more subtle opportunity to add to the business’s cash flow. Obtaining faster delivery times will shorten the OC, freeing up more cash for the business.

-

Review and Adjust Credit Terms Offered to Customers

A well-run business’s accounting department should regularly review customers’ credit terms for many reasons, as a matter of sound fiscal policy — and not just to benefit the OC. But tightening up the amount of time customers are given to pay invoices will get cash in the company coffers quicker, shortening the OC.

-

Leverage Technology for Overall Efficiency

There are many ways business managers can deploy technology to improve operations, but the first step always is to analyze the business’s operations to identify any existing pain points in the workflow, as well as opportunities to improve, even in areas that are not causing pain. Strategically deploying new technology, whether that means new factory machines or software to automate accounting processes, should improve operational efficiency. Superior warehouse management software, for example, can accelerate delivery of goods through more efficient order processing, picking, packing and shipping.

Manage Your Operating Cycle With NetSuite

Shortening the operating cycle is tied to increasing a business’s operational efficiency. As this article has explained, the first half of the OC equation is all about the efficiency of procurement, supply chains and inventory management, and the second half is about finance and accounting, particularly accounts receivable. NetSuite’s Enterprise Resource Management (ERP) system comprises a suite of cloud-based software modules that cover all those bases, such as NetSuite Inventory Management and NetSuite Cloud Accounting. NetSuite’s seamlessly integrated ERP modules can automate a business’s entire workflow. With configurable dashboards, reports and metrics, NetSuite can provide the necessary information, in real time, to monitor and manage inventory and AR, creating opportunities to reduce any OC to that company’s best-optimized duration.

The operating cycle influences a company’s liquidity and its working capital requirements. Keeping the OC as short as possible increases the pace of cash flow and the company’s ability to turn over products and grow its business. Understanding all the ways in which it’s possible to cut the time it takes to turn inventory into cash can help business managers improve the overall financial health of their business.

Operating Cycle FAQs

What are normal operating cycles?

An operating cycle represents the amount of time it takes to turn cash into materials, then into finished goods, and then into sales that generate cash. The length of time for a “normal” operating cycle differs from one industry to the next. In general, a shorter operating cycle is preferred, because it indicates a healthier financial picture for the business. It means the company generates cash quicker and is able to invest more cash, more often, than businesses with longer operating cycles.

What is the accounting cycle operating cycle?

The accounting cycle focuses on the financial transactions of a business, whereas the operating cycle tracks how long it takes to go from the purchase of inventory to the collection of cash from sales. The accounting cycle records transactions from start to finish in the company’s ledger. The whole accounting cycle consists of eight steps: identifying transactions, recording them in a journal, posting to the ledger, calculating the trial balance, developing a worksheet, adjusting entries, preparing financial statements and closing the books.

What is the operating cycle or circular flow concept?

The operating cycle begins with the purchase of goods or services and runs through production, sales and the collection of cash from those sales. That cash then gets reinvested in the next wave of goods, production and sales. Essentially, the circular flow concept follows the money from creation to collection and back to creation, beginning the process again.

What is the cash-to-cash operating cycle?

This question combines two separate but related concepts. The cash-to-cash cycle is also referred to as the cash conversion cycle, and it provides insight into a company’s operational efficiency, as well as its overall liquidity. The cash-to-cash cycle measures how long it takes a company to proceed from the time it pays cash for its inventory until the time it receives cash payments in from sales. That time period goes from the point of cash payment between business and supplier to the time of cash collection from customers. This cycle helps companies understand how effective they are at managing their working capital. To calculate the cash-to-cash cycle, add the days inventory outstanding (DIO) and days sales outstanding (DSO), then subtract days payables outstanding, or DPO. By comparison, the operating cycle measures the amount of time that elapses between ordering inventory and collecting cash from sales, so you do not subtract DPO when calculating operating cycles.