Organizations have plenty to consider in their quest for profitability, including how much to charge for their products and services. Contributing factors include covering their total production costs, determining markup, and understanding how much customers are willing to pay. Complicating matters is figuring out how to allocate expenses that can’t be easily traced to specific output.

Activity-based costing (ABC) aims to address this challenge, providing businesses with a granular understanding of the indirect costs involved in sourcing, manufacturing, and delivering products and services to customers. Read on to learn how ABC works, its benefits and limitations, and when to use it instead of the standard costing accounting approach.

What Is Activity-Based Costing (ABC)?

ABC is a form of managerial accounting that identifies and allocates costs to activities involved in the production of a company’s goods and services. These activities refer to events, tasks, and units of work that have specific goals, such as assembling a car, creating a purchase order, or setting up equipment.

For instance, a company that delivers cloud IT services might use ABC to dispense utility and data center overhead costs across its product portfolio. By identifying the highest cost drivers—the activities that consume the biggest portions of resources—ABC can help businesses focus their efforts when looking for places to cut costs and streamline processes. The method is also helpful for budgeting and pricing purposes.

Key Takeaways

- Activity-based costing provides companies with an accurate understanding of their indirect costs.

- Activities, cost pools, cost objects, and cost drivers all play a role in ABC.

- Increased visibility into processes and profit margins are among the benefits of this accounting approach.

- ABC also helps companies better price their products and adjust their product mix to focus on the best performers.

- ABC is more complex than other methods, so it might not be right for every business.

Activity-Based Costing Explained

ABC combines two types of cost accounting techniques, product costing and process costing, to link a company’s indirect activities directly to its primary activities, thus identifying every resource involved in developing and selling its products and services. ABC is particularly useful for manufacturing accounting, whose indirect activities account for a large portion of their overall costs. The method also makes cost data more reliable for the accounting teams tasked with classifying and analyzing production costs.

ABC also works well in other sectors, including hospitals that use it to break down the unit costs of their medical supplies and management consultancies that want to improve how they allocate costs for their internal IT services. Still other businesses use ABC to optimize their technology deployments, especially in the case of emerging technologies, such as artificial intelligence, which benefit from careful testing and strategic implementation.

In practice, ABC can lead to greater efficiency and help business leaders determine whether their production forecasts are realistic. That’s especially good news for manufacturers facing fluctuating costs for raw materials, labor, equipment, and overhead.

Key Components of Activity-Based Costing

ABC is popular among businesses with multiple product lines that involve different manufacturing processes and inputs. It has four primary components: activities, cost pools, cost drivers, and cost objects.

Activities

Activities consume a business’s resources. They can be a single task or groups of tasks related to a specific operational process. Activities can be broken down into five levels:

- Unit-level activities occur on a per-unit basis, such as welding the frame of a car or installing the engine in each vehicle.

- Batch-level activities are performed each time a group of products is manufactured and processed, such as a shipment sent to a manufacturer’s retail customers.

- Product-level activities are tasks related to developing a specific product line, such as a design or engineering process.

- Customer-level activities include tasks that specifically serve customers, such as technical services or product support.

- Organizational activities, such as office administration and janitorial services, keep a business running.

Cost Pools

Cost pools gather individual costs into related buckets, such as manufacturing costs or business overhead, so decision-makers can more easily track and allocate expenses back to their exact activities. For example, a manufacturer might create separate cost pools for machinery setup and quality-control inspections that each contain multiple tasks that contribute to the overall cost of production. The manufacturer might also create a cost pool for business overhead to group expenses, such as rent, utilities, and office supplies.

Cost Objects

Cost objects are any items for which a cost is traced or allocated, be they activities, products or services, customers, distribution channels, projects, or internal departments. Cost objects represent a key reporting target for a company’s accounting team.

Cost Drivers

Cost drivers are factors that influence the amount of time or resources needed to complete an activity. Examples include the number of machine and labor hours necessary to manufacture a product, or the number of units produced. A single activity can have multiple cost drivers. Accounting teams use these drivers to assign costs to different cost objects.

How Does Activity-Based Costing Work?

ABC assigns costs to a company’s products or services based on the specific activities that drive those expenses. It’s a four-step process that involves identifying business activities, allocating resources, calculating costs, and determining cost drivers.

-

Identify Activities

The first and arguably most critical step in ABC is to identify and record all activities in an organization that incur costs and consume resources. This comprehensive assessment spans virtually every business function—manufacturing, distribution, marketing, sales, customer service, and support. Activities are then grouped into primary and secondary cost pools. Primary cost pools group expenses directly related to production, such as materials and labor. Secondary cost pools group costs that are indirectly related to production, such as overhead and warehouse maintenance.

Companies should be mindful of which activities they deem relevant to their cost assessments to avoid compromising the accuracy of their calculations. For instance, a business that wants to calculate the cost of its delivery and logistics would likely leave advertising activities out of the equation.

-

Allocate Resources

Next, companies must evaluate the consumption rate of each activity identified in step one, as well as any related expenses, and assign a cost to each, based on the appropriate rate. To make this process easier, some businesses use data visualization techniques to help them understand accumulation patterns for their various activities. Some adapt the concept of a separate inventory management technique called ABC analysis to rank their activities by tiers—A, B, and C—so they can focus on high-priority items first.

-

Calculate Costs

To determine costs, a business first divides the total cost of each cost pool by the total amount of activity assigned to that pool. This determines cost per unit of activity, which is then multiplied by the number of units consumed by that activity to arrive at a total cost. For instance, if product assembly at a high-end bicycle manufacturer has a $10,000 per month cost pool, 5 full-time workers working a combined 800 hours per month (the cost driver), with each bike taking 3 hours to assemble, each bike would be allocated $37.50 [($10,000 / 800) × 3]. This figure would be added to the company’s other direct and indirect costs to determine the total cost per bicycle.

-

Determine Cost Drivers

Cost drivers are variables that represent the cause-and-effect relationship between a business’s activities and its expenses. Consider the activities involved in setting up manufacturing machines. Cost drivers might include, for example, the number of machine setups, setup time, or the complexity of setups; the choice would depend on which one most accurately reflects the consumption of resources for that activity. Once selected, the manufacturer determines its cost driver rate by dividing the total value of a given activity or cost pool by the number of cost driver units. For example, if the total cost of machine setups is $100,000 and there are 1,000 setups, the cost driver rate per setup would be $100 ($100,000 / 1,000).

Example of Activity-Based Costing

Let’s take the hypothetical example of a baby food manufacturer that uses the ABC method to allocate costs of its puffed rice snack, called Puffies. To begin, the manufacturer identifies two activities involved in the production and delivery of its snack that are relevant for ABC: inspecting rice and other raw ingredients from suppliers, and processing, cooking, and packaging Puffies snacks using the machines in its plant.

Next, it determines the cost drivers for these activities. The cost driver for the first activity is the labor hours required for this task. The cost drivers for the second activity include machine setup and maintenance costs.

The manufacturer can now allocate its resources to each activity. For simplicity, let’s say that ingredient inspection requires 400 labor hours per month and costs the business $10,000, while machine setup and maintenance involve 100 machine hours per month at a cost of $8,000.

The next step is to calculate the unit costs for each activity. The unit cost for ingredient inspection is determined by dividing $10,000 by 400 hours, or $25 per hour. The unit cost for machine setups and maintenance is determined by dividing $8,000 by 100 hours, or $80 per hour.

Using this information, the company can calculate the total cost of manufacturing a single package of Puffies. Aware that each package requires 1 minute of material inspection and 30 seconds of machine setup and maintenance, its production cost per package would be $1.08 per package:

- Inspection cost: $25 per hour × (1 minute / 60 minutes) = $0.4167

- Machine setup and maintenance: $80 per hour × (0.5 minute / 60 minutes) = $0.6667

- Total cost per package: $0.4167 + $0.6667 = $1.08

Benefits of Activity-Based Costing

Companies use ABC to gain a detailed understanding of how specific activities contribute to their overall production costs. In turn, this insight highlights which activities they might want to modify to operate in a lean fashion. It also informs price adjustments to maintain a healthy profit margin. Here is a closer look at these benefits:

- More precise analysis of production costs: With ABC, businesses pool their indirect costs into specific activity-based categories, rather than into a single companywide pool, which makes costing more accurate. Costs are then allocated to products or services according to their consumption of these activities, which directly contribute to their production or delivery. This method is more precise than allocating costs based on volume measures of activity, such as labor or machine hours, and is most helpful for companies with multiple products on a shared production line.

- Improved traceability: Thanks to its use of cost pools, ABC makes it easier for accounting teams to quantify and trace indirect costs. Even those that would otherwise be difficult to follow, such as costs for depreciation and utilities, can be linked back to specific business activities, such as equipment maintenance, supply chain operations, and warehouse management.

-

Better visibility into profit margins: ABC offers businesses a more complete and accurate view of how much their products cost, helping decision-makers identify which ones aren’t generating enough profit. Using this information, companies can either rework their processes to lower costs or stop producing these items altogether and redirect resources elsewhere.

ABC is well suited to costing low-volume products, which tend to have higher overhead costs per unit than mass-produced goods. For example, a fashion retailer selling a line of personalized T-shirts will have higher overhead costs for each of these items than for its mass-produced plain T-shirts; it can use ABC costing to allocate its overhead costs to each product line accordingly. - Better troubleshooting of production inefficiencies: Inefficiency is the enemy of profit, especially amid rising costs of labor, materials, and equipment. Using the ABC method, businesses can quantify the true impact of overhead and other indirect costs on their overall costs. This helps them pinpoint issues that eat into their profits, such as process inefficiencies, and iron them out at the source.

Limitations of Activity-Based Costing

ABC is a more accurate and precise way to allocate business costs for accounting teams, but it is also more complex than other methods. Here are three limitations of ABC worth considering before proceeding with this costing method:

- May not be the right fit for your specific business: ABC requires companies to invest in new technologies and staff training, making it potentially cost-prohibitive for resource-constrained small businesses. It may also be unnecessarily complicated for businesses with simple operations or a narrow range of products.

- Method requires a lot of data: The ABC method requires businesses to collect, track, process, and analyze large volumes of data in numerous formats from across the organization. In most cases, these tasks require a team of employees with data analysis expertise. ABC is also not a one-time effort. As manufacturing processes evolve, new data must be constantly gathered and analyzed to ensure that cost pools and drivers remain accurate.

- More resource-intensive than other methods: Accounting teams must go through a long, detailed process of breaking down product lines into distinct activities, grouping these activities into cost pools, and determining the cause-and-effect relationship between these cost pools and their overall costs. What’s more, ABC requires specific accounting expertise, which is why some businesses have to spend additional funds to outsource the process to external accountants.

Activity-Based Costing vs. Standard Costing

Standard costing is another, often complementary, approach to managing and allocating costs. It establishes predetermined rates for how much activities should ideally cost under efficient operating conditions.

The biggest distinction between ABC and standard costing lies in the way indirect costs are allocated. Standard costing combines expenses into a single cost pool and allocates them equally across every product produced or service delivered. Though straightforward and simpler to analyze, this approach does not account for the different rates at which each product consumes overhead costs. As a result, standard costing calculations are less precise than the ABC method, which ascribes indirect costs to specific activities using cost drivers that reflects the cause-and-effect relationship between them. This approach is more accurate and helps decision-makers calculate their true profit margins across various product lines—an invaluable insight for companies looking to optimize their manufacturing and pricing strategies.

To illustrate the difference between standard costing and ABC, consider a carmaker that produces two types of vehicles: an entry-level automobile, manufactured using entirely automated processes, and a luxury vehicle with hand-stitched leather seats and other custom options that require human involvement. The standard costing method would allocate production costs equally to both product lines, while the ABC method would identify different activities (automated assembly, hand stitching, quality control) and their associated cost drivers, likely allocating a higher proportion of certain overhead costs to the luxury vehicles. The latter method provides the manufacturer with a more accurate picture of its overall production costs, so it can price the two vehicle types accordingly.

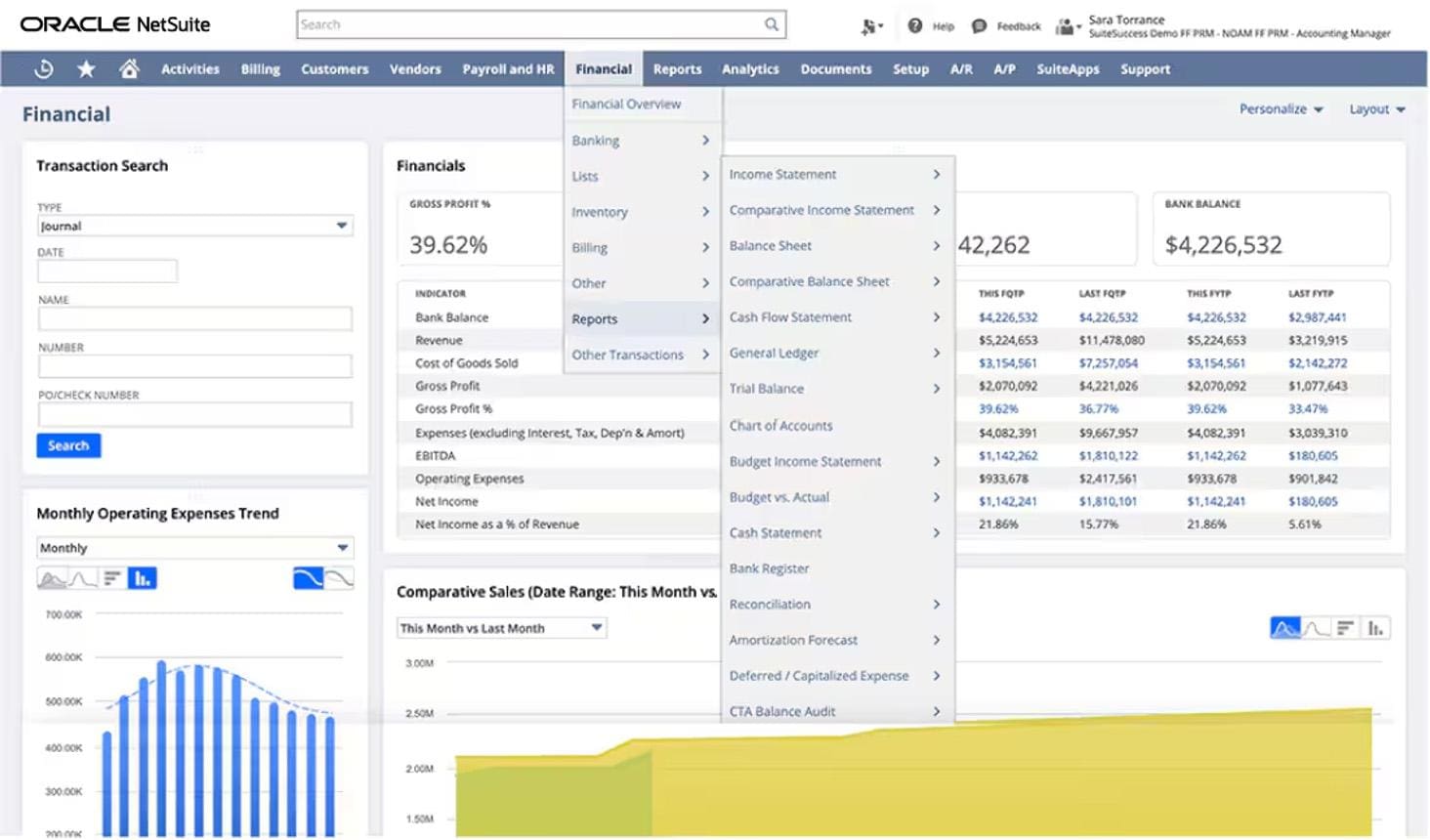

Accurate and Easy Costing With NetSuite Cloud Accounting

Activity-based costing provides valuable insights into production costs, but its data-intensive nature can make implementation challenging without the right tools. NetSuite Cloud Accounting provides finance teams with complete visibility into their cash flows and positions, so they can make sound business decisions based on accurate, real-time data and drive efficiencies in their production workflows. Purpose-built reporting tools simplify and streamline manual accounting processes with automation and artificial intelligence, saving companies time while boosting the accuracy of their cost analyses by eliminating duplicated data entry and supporting granular costing methods, like ABC.

A single view of transactional, financial, and operational data allows decision-makers to track both direct and indirect costs across multiple cost pools, while real-time metrics and role-based dashboards ensure that they always have the latest information on hand when analyzing costs and developing future plans. NetSuite Cloud Accounting was developed with compliance top of mind, allowing finance teams to apply specific rules when calculating complex costs, such as depreciation. This means their processes are not only optimized but also comply with financial regulation.

Faced with economic uncertainty, companies cannot afford to absorb unnecessary costs that eat into their profit margins. Activity-based costing is an accounting method that provides detailed insights into their production costs by organizing activities into cost pools and using cost drivers to allocate indirect expenses. For companies such as manufacturers, with complex operations or diverse product lines, ABC can pinpoint areas in need of efficiencies that might otherwise remain hidden under the standard costing approach. It can also help them make more informed decisions about pricing strategies and resource allocation to maintain healthy profit margins.

Activity-Based Costing FAQs

Why is cost allocation important?

Cost allocation helps businesses understand how resources are consumed by different activities, products, and services. With an accurate understanding of their direct and indirect costs, businesses can make data-informed decisions about their operations, pricing strategies, and product lines, focusing on activities that drive profitability and correcting those that lead to inefficiency.

What type of companies use activity-based costing?

Activity-based costing is used by businesses across multiple industries, but it has gained the most traction among manufacturing companies that produce multiple items and require a more accurate way to allocate their indirect costs.

When would you use activity-based costing over standard costing?

Compared with standard costing, activity-based costing (ABC) provides businesses with better visibility into their indirect costs. ABC is typically used by businesses that produce a variety of products using different manufacturing processes, as well as by companies with high overhead costs looking to allocate these costs more accurately across their various products and services.