Customers expect competitive pricing, high-quality goods, and reliable delivery—pressures that manufacturers must balance despite rising material costs, labor shortages, and increasing overhead expenses. Meeting these demands while maintaining profitability requires careful planning of production schedules, resource allocation, and pricing strategies. However, none of this is possible without a clear understanding of manufacturing expenses and their impact on financial performance.

Total manufacturing cost (TMC) provides a comprehensive view of all manufacturing expenses, helping business leaders see exactly where their money is going to make informed decisions about making each dollar go further.

What Is Total Manufacturing Cost (TMC)?

Total manufacturing cost (TMC) represents the all-inclusive expenses involved in manufacturing goods during a given period, including finished products, works in progress, and scrapped items. TMC is calculated by adding up three cost components: direct materials, direct labor, and manufacturing overhead. Direct materials are the supplies and raw materials that make up the finished product, while direct labor includes wages, benefits, and taxes relevant to the workers involved in production. Manufacturing overhead covers costs that aren’t directly connected to specific products, such as equipment maintenance and utilities.

For example, a furniture manufacturer calculating its TMC would include an assembly team’s wood, screws, and wages as direct costs, and equipment maintenance, utilities, and factory rent as indirect expenses.

Key Takeaways

- Total manufacturing cost comprises three major components: direct materials, direct labor, and manufacturing overhead.

- Ongoing TMC analysis can highlight opportunities for reducing waste, improving processes, informing pricing, allocating resources, and aiding capital investment decisions.

- Analyzing TMC alongside related metrics, such as cost of goods sold (COGS), can help manufacturers better understand different aspects of their operations.

- However, the usefulness of TMC hinges on obtaining comprehensive data and calculation accuracy.

- Accounting software can help companies track, calculate, and analyze TMC to facilitate strategic decision-making.

Total Manufacturing Cost (TMC) Explained

TMC is a core manufacturing accounting metric that can help manufacturers not only pinpoint where costs accumulate but also determine how to reduce expenses without unintentionally increasing costs elsewhere. That said, the three cost components within TMC—direct materials, direct labor, and manufacturing overhead—do not operate in isolation. Though each exists independently, they also influence one another in ways that affect overall manufacturing expenses.

For example, a reduction in direct labor hours may lower wages, but it could also slow production, potentially leading to missed sales opportunities. Similarly, investing in higher quality materials may increase direct material costs but simultaneously reduce waste, decrease the number of defects, and minimize the need for rework—ultimately lowering overhead and labor costs related to quality control and scrap disposal.

Why Is Calculating TMC Important?

TMC provides a comprehensive view of manufacturing costs. This holistic perspective bridges the gap between financial reporting and operational management, creating a common language that finance teams, operations managers, and executives can all work from. When financial and operational strategies are in sync, manufacturers can make day-to-day decisions that support profitability. Accurate TMC calculations are the foundation for decisions ranging from pricing strategies and production planning to resource allocation and capital investments.

Tracking cost trends can help manufacturers become aware of operational weaknesses, such as rising direct material costs (potentially linked to unreliable vendors) or unusually high overhead costs (possibly caused by inefficient equipment). When confirmed, these insights can justify targeted refinements, such as supplier renegotiations or equipment upgrades.

TMC can also be useful for staying agile in spite of operational uncertainties, such as supply chain disruptions, material cost fluctuations, and rapidly evolving consumer demands. For example, manufacturers can use TMC analyses to quickly evaluate alternative materials that will maintain product integrity and quality to keep production moving, even if it means temporarily absorbing higher costs to protect market share and customer relationships.

Total Manufacturing Cost Formula

Total manufacturing cost is calculated through this straightforward formula, which combines direct materials, direct labor, and manufacturing overhead:

Total manufacturing cost = Direct materials + Direct labor + Manufacturing overhead

Manufacturers must capture all relevant costs without including nonmanufacturing expenses, such as sales commissions. It’s also important not to count the same expenses across multiple categories. For example, if a factory manager spends one day on the assembly line out of every four days spent overseeing operations, 20% of the manager’s wages should be classified as direct labor, while the remaining 80% would fall under manufacturing overhead (because supervisory work supports production, rather than directly contributing to individual units).

How to Calculate Total Manufacturing Cost

Although the basic TMC calculation is straightforward, even this seemingly simple computation can be error-prone if calculations are not carefully derived. Accurate measurement of each cost component requires detailed data collection from multiple departments, which is why companies often use accounting software for consistency and precision.

Below, we’ll examine each cost category—direct materials, direct labor, and manufacturing overhead—in detail, including calculation methods and cost reduction strategies.

Direct Material Costs

Direct material costs include the purchase price of every component that’s directly traceable to producing specific units. For example, in bicycle manufacturing, direct materials include frames, chains, gears, tires, seats, and any add-ons, such as literal bells and whistles. Depending on company policy and the magnitude of the costs involved, some traditionally indirect materials (e.g., lubricants or small tools) may instead be classified as direct materials, if they can be meaningfully attributed to specific products. The cost of direct materials can include related procurement expenses, such as shipping and handling, import duties, transit insurance, and storage costs, if they are significant and can be directly attributed to acquiring the materials for a specific product.

Tracking these costs gives manufacturers a deeper understanding of exactly how much is spent to produce every unit, since these costs generally correlate with production volume. However, the way analysts track these costs can vary, with some businesses tracking costs per job or batch and others focusing on total process costs.

How to Calculate Direct Material Costs

The standard formula for calculating direct material costs for a given financial period is:

Direct materials costs = Opening raw materials inventory + Procurement costs for new materials – Closing raw materials inventory

Suppose a clothing manufacturer starts the month with $100,000 in raw material inventory (fabrics, threads, buttons, zippers, and so on). The company purchases an additional $250,000 in raw materials throughout the period and ends the month with $80,000 in remaining inventory. Its direct materials calculation would be:

Direct materials costs = $100,000 + $250,000 – $80,000 = $270,000

This $270,000 represents the cost of all direct materials used in production during the month, accounting for all the various components that go into manufacturing clothing items.

By factoring in the opening and closing inventory values, this formula calculates the actual cost of materials used in production—not just what was purchased. This distinction is important because procurement activity doesn’t always align with production output. Manufacturers might stock up on materials ahead of seasonal demand, use up some resources for unfinished or discarded goods, or deplete reserves during supply shortages, for instance. Adjusting for inventory changes provides a clearer, more accurate picture of manufacturing costs.

How to Reduce Direct Material Costs

According to the National Association of Manufacturers’ outlook survey for the fourth quarter of 2024, manufacturers expected raw material and other input costs to rise 2.9% by the end of 2025. To help offset direct material expenses, companies can:

- Source more cost-effective supplies that maintain product quality but reduce expenses.

- Renegotiate supplier terms to get lower rates on consolidated orders and bulk purchases or to secure early payment discounts.

- Create more efficient product designs that use fewer components.

- Audit workflows to identify and eliminate wasteful or inefficient manufacturing processes.

- Regularly assess and update sourcing, procurement, and production strategies as market conditions evolve.

Direct Labor Costs

Direct labor costs include:

- Full-time and part-time wages, including overtime pay, for workers directly involved in production.

- Benefits for those employees, including health insurance, retirement contributions, and paid time off.

- Payroll taxes for those employees, including the employer’s share of Social Security, Medicare, and state and federal unemployment taxes.

Direct labor costs typically vary with production volume and seasonal demand shifts, though not always in direct proportion, as businesses may maintain core staffing levels during slower periods to retain skilled workers.

How to Calculate Direct Labor Costs

The basic formula for calculating direct labor costs is:

Direct labor costs = (Total hours worked × Hourly rate) + Benefits + Payroll taxes

For example, if a semiconductor manufacturer employs 50 workers earning an average of $25 per hour and working 160 hours per month, with benefits and taxes adding 30% to base wages, direct labor can be calculated using this multistep process:

Total hours for all employees =

160 hours × 50 workers

= 8,000 hours

Base wage for all employees =

8,000 hours × $25 per hour

= $200,000 per month

Benefits and taxes for all employees =

$200,000 × 30%

= $60,000

Direct labor costs =

$200,000 + $60,000

= $260,000

Depending on company size and preference, “hours worked” and “hourly rates” can be calculated for each employee or averaged across the workforce. Many manufacturers use payroll software to track wages, overtime, contractor pay, and holiday wages. Businesses can also analyze labor costs by production line or product type to better understand labor allocation, which would allow them to adjust staffing levels to balance costs with production demands.

How to Reduce Direct Labor Costs

Manufacturers can reduce their direct labor costs by prioritizing staff allocation and improving workforce productivity. Potential strategies include:

- Cross-training programs to increase worker flexibility, resulting in reduced downtime and dependency on specialized staff.

- Automating repetitive manual processes.

- Redesigning workflows and factory floor plans to reduce unnecessary movement and material handling.

However, cost reduction efforts should balance short-term savings with product quality and worker satisfaction. This is reflected in Fictiv’s 2023 State of Manufacturing report, in which “analyzing and improving productivity” (53%) and “improving employee retention or preventing churn” (49%) were cited as the top two workforce concerns.

Manufacturing Overhead

Manufacturing overhead encompasses all production costs that cannot be directly linked to specific products but are necessary to maintain operations, such as:

- Building costs (rent, utilities, or property taxes for production facilities)

- Indirect labor (production supervisors and equipment maintenance teams)

- Equipment-related expenses (depreciation and repairs)

- Factory supplies not directly traceable to a product (cleaning supplies, small tools, safety equipment)

- Insurance on production equipment and facilities

Unlike direct materials and direct labor, many overhead expenses (e.g. rent or insurance) remain fixed, regardless of production volume. However, some costs can vary with output, including utility bills and equipment maintenance.

How to Calculate Manufacturing Overhead Costs

To calculate total manufacturing overhead, use this formula:

Manufacturing overhead = Indirect materials + Indirect labor + Any additional indirect expenses

For example, a pharmaceutical plant may have the following monthly costs: $20,000 in indirect materials (cleaning supplies and maintenance parts), $80,000 in indirect labor (supervisors and maintenance staff), and $150,000 in factory costs (rent, utilities, and insurance). Its total monthly manufacturing overhead would be calculated like this:

Manufacturing overhead = $20,000 + $80,000 + $150,000 = $250,000

Manufacturing overhead costs are typically distributed across different allocation bases, such as per unit of production, per machine hour, or per direct labor dollar spent. This allows for more accurate product costing and pricing decisions. The overhead rate for each allocation base is calculated as follows:

Overhead allocation rate = Total manufacturing overhead / Allocation base

If the pharmaceutical plant produces 500,000 units per month, its overhead cost per unit would be:

Overhead allocation rate = $250,000 / 500,000 units = $0.50 per unit

This means that for every unit produced, the plant spends $0.50 on overhead costs.

How to Reduce Manufacturing Overhead Costs

Manufacturers can reduce overhead costs by improving their facilities and resource management. This can mean:

- Investing in more energy-efficient equipment to reduce utility costs.

- Implementing proactive and regular equipment maintenance to minimize unexpected breakdowns and costly emergency repairs.

- Tracking and regulating usage of cleaning supplies, small tools, and safety equipment to minimize waste.

Some overhead costs may not be possible to reduce, however, such as locked-rate rent or insurance policies. Businesses should plan their financial strategies accordingly.

Total Manufacturing Cost Example Calculation

A hypothetical medical device manufacturer produces 10,000 heart rate monitors in a month. Its monthly financial breakdown looks like this:

| Direct material inputs | Beginning raw materials inventory | $200,000 |

| Procurement purchases | $450,000 | |

| Ending raw materials inventory | $150,000 | |

| Direct labor inputs | Total direct staff | 40 workers |

| Average wage | $30/hour | |

| Average working time | 160 hours | |

| Benefits and payroll taxes | 35% of wages | |

| Manufacturing overhead costs | Indirect supplies and materials | $25,000 |

| Indirect labor | $90,000 | |

| Rent, utilities, insurance, and depreciation | $175,000 |

Step 1: Calculate direct materials cost using the direct material inputs.

Direct materials costs = Opening raw materials inventory + Procurement costs for new materials – Closing raw materials inventory

Direct materials costs = $200,000 + $450,000 – $150,000 = $500,000

Step 2: Calculate direct labor costs using the direct labor inputs.

Direct labor costs = (Total hours worked × Hourly rate) + Benefits + Payroll taxes

Total hours for all employees = 160 hours × 40 workers = 6,400 hours

Base wage for all employees = (6,400 hours × $30 per hour) = $192,000 per month

Benefits and taxes for all employees = $192,000 × 35% = $67,200

Direct labor costs = $192,000 + $67,200 = $259,200

Step 3: Calculate manufacturing overhead using the manufacturing overhead costs.

Manufacturing overhead = Indirect materials + Indirect labor + Any additional indirect expenses

Manufacturing overhead = $25,000 + $90,000 + $175,000 = $290,000

Step 4: Calculate TMC using the three cost components.

Total manufacturing cost = Direct materials + Direct labor + Manufacturing overhead

Total manufacturing cost = $500,000 + $259,200 + $290,000 = $1,049,200

TMC Benefits

By tracking and analyzing total manufacturing costs over time, manufacturers can gain several competitive advantages applicable to managing operations and increasing profitability. Note that many businesses implement software with built-in automated data collection and real-time reporting features to maximize these benefits.

- Controls costs: TMC analysis can help businesses break down manufacturing costs into discrete components, such as by production line or process. This allows decision-makers to find areas for improvement and implement targeted, cost-saving solutions.

- Identifies waste: Regularly calculating TMC can reveal areas of rising spending, such as in excess material waste or poorly allocated labor resources.

- Uncovers manufacturing insights: Analyzing changes in TMC over time helps leaders recognize patterns among different cost components that affect profitability, such as seasonal changes in material costs or shifts in production output. These insights can inform decisions regarding batch sizes, scheduling, or resource allocation, as well as lead to more accurate budgets and forecasts.

- Increases financial visibility: Comprehensive TMC tracking provides transparency into the costs of every aspect of manufacturing, information that can support decisions around setting appropriate prices, determining order restrictions, and justifying capital investments.

Total Manufacturing Cost (TMC) vs. Cost of Goods Sold (COGS)

Though related, TMC and COGS serve different purposes in manufacturing accounting. TMC represents all costs involved in manufacturing during a specific period, including works in progress or defective/discarded stock—regardless of whether the goods are completed or sold. COGS, on the other hand, only covers the cost of products actually sold to customers during a defined period.

For example, if a construction equipment manufacturer’s TMC for one month is $1,000,000, but it sells only 80% of its output, its COGS would be $800,000, with the remaining $200,000 allocated to inventory. The difference between TMC and COGS may fluctuate during seasonal shifts, especially if a company uses slower seasons to stockpile inventory. In such cases, the company might see an increase in TMC without a corresponding rise in COGS, widening the gap between the two figures. Conversely, during peak selling seasons, COGS might more closely align with or even exceed the current period’s TMC, as the company sells off its accumulated inventory.

Both measurements are used in financial planning and reporting, but COGS directly appears on income statements, while TMC does not. Additionally, COGS often includes post-production costs, such as storage costs for finished goods, which aren’t part of TMC calculations.

Businesses can compare TMC and COGS over time to assess what percentage of manufactured goods are actually being purchased by customers, an especially important metric for goods with short shelf lives or for companies with volatile demand.

Total Manufacturing Cost vs. Cost of Goods Manufactured (COGM)

Cost of goods manufactured (COGM) accounts for goods completed over a given period, excluding all the work-in-progress (WIP) goods that are considered when calculating TMC. Unlike COGS, which represents the cost of products actually sold, COGM includes the cost of all completed goods, regardless of whether they were sold or remain in finished goods inventory.

To find COGM, manufacturers can use this formula:

Cost of goods manufactured = TMC + Beginning WIP inventory – Ending WIP inventory

Say a manufacturer has a monthly TMC of $1,000,000, beginning WIP inventory of $300,000, and ending WIP inventory of $250,000. Its COGM would be $1,050,000 (or $1,000,000 + $300,000 – $250,000).

When COGM is higher than TMC, it indicates that some goods completed were partially manufactured in the previous financial period. If COGM is lower than TMC, it indicates that the company has a larger work-in-progress reserve than when the period started. Comparing these different values over time can help businesses manage inventory levels and production speeds by monitoring how quickly goods are produced compared with when they are finished.

Improve Financial Controls With NetSuite Cloud Accounting

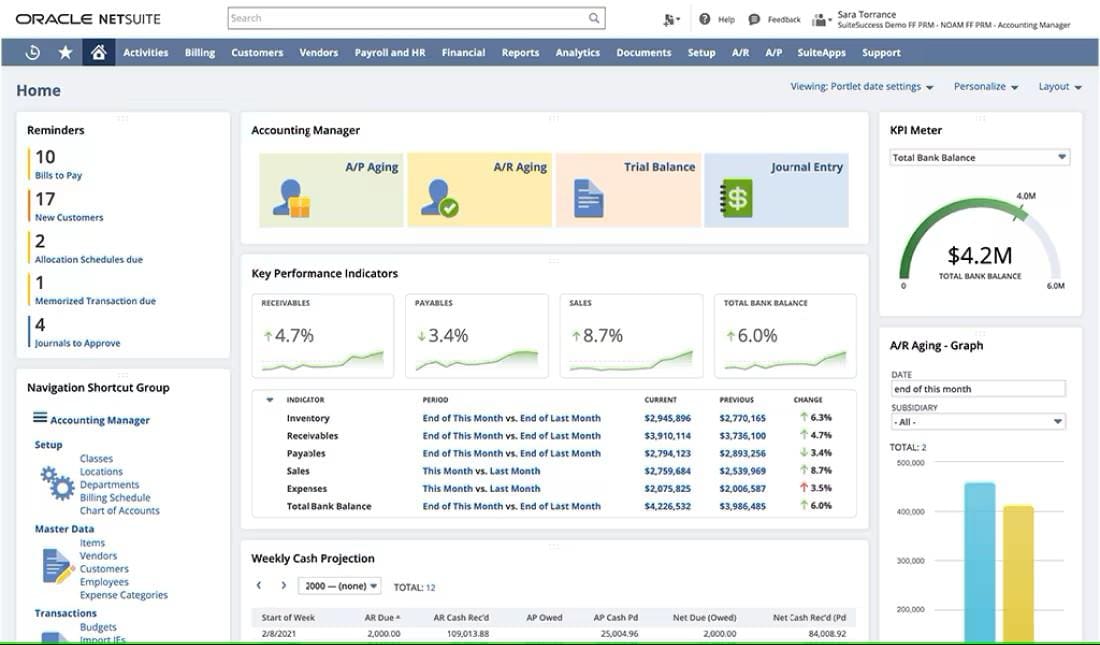

Accurate and timely TMC calculations require comprehensive data collection and analysis across the manufacturing process—but manual tracking can be time-consuming and prone to errors. NetSuite Cloud Accounting Software automates the collection and analysis of manufacturing costs in real time by integrating data from procurement to production across the organization. This cloud-based system provides up-to-the-minute financial visibility through automated alerts and built-in reporting tools that can spot cost-saving opportunities for direct materials, direct labor, and overhead costs.

Beyond performance monitoring, NetSuite Cloud Accounting Software includes advanced forecasting and planning tools that can analyze historical cost patterns for actionable suggestions related to batch sizes, labor needs, budget planning, and more. And, at each step, NetSuite maintains secure and detailed records for future analyses, as well as for compliance and audit purposes.

Manage Your Finances With NetSuite Financial Management

Total manufacturing cost can shed light on where a manufacturer’s money is going during its usual operations. By carefully tracking and analyzing TMC’s primary components—direct materials, direct labor, and manufacturing overhead—businesses can identify waste, inefficient processes, and impractical pricing strategies. Monitoring this important metric over time can help companies make better informed decisions about everything from daily production tasks to long-term capital investments, ultimately creating a more sustainable and competitive operation.

Total Manufacturing Cost FAQs

What is the difference between total manufacturing cost and total variable manufacturing cost?

Total manufacturing cost includes all production costs, while total variable manufacturing cost includes only expenses that change with production volume. For example, total variable manufacturing costs do not include fixed costs, such as rent and insurance, but would include variable costs such as direct materials and production labor.

What is the difference between direct and indirect manufacturing costs?

Direct costs are associated with specific products or production runs, including raw materials or assembly line wages. Indirect costs support overall manufacturing operations but cannot be linked to specific products, such as supervisor salaries and facility maintenance fees. This distinction helps manufacturers accurately allocate costs and budget for different output levels.

Does total manufacturing cost include works in progress?

Yes, total manufacturing cost (TMC) includes all manufacturing costs incurred during a given period, including the materials, labor, and overhead expenses that went into work-in-progress (WIP) goods. TMC differs from other metrics, such as cost of goods manufactured (COGM), which only includes completed goods, and cost of goods sold (COGS), which only includes sold goods. By including WIP in TMC calculations, manufacturers gain a more complete picture of production costs, regardless of completion status or sales.