Whether it pertains to a cozy bed and breakfast or a bustling city restaurant, mastering cash flow management can make the difference between a hospitality business that thrives or one that merely survives—or fails. While generating revenue is crucial, of course, maintaining steady cash flow is what truly sustains a business—especially in an industry with tight margins whose challenges include factors like the need to continually delight customers.

This article discusses the basics of cash flow management and dives into the unique cash flow challenges of the hospitality industry, and lays out practical strategies for overcoming these challenges while optimizing cash flow.

What Is Cash Flow Management?

Managing cash flow involves tracking, analyzing, and controlling the money flowing into and out of a business. It involves monitoring the inflow of cash from sales and services, as well as the outflow of funds for expenses such as supplies, payroll, and overhead. Effective cash flow management ensures that there is always enough cash on hand to meet obligations and invest in growth opportunities.

What Is Cash Flow Management in Hospitality?

Proactively managing cash flow is key to hospitality businesses’ financial resilience, as well as to their ability to seize growth opportunities. But cash flow management in the hospitality industry faces some unique challenges due to the sector’s operational and financial characteristics. Hospitality businesses, such as hotels and restaurants, often encounter significant seasonal fluctuations in demand, leading to uneven cash inflows throughout the year. This can make it difficult to maintain a consistent level of cash reserves to cover ongoing expenses.

At the same time, the high operating costs associated with running hospitality establishments, such as labor, utilities, and maintenance, put constant pressure on cash outflows. In addition, it is common for hospitality businesses to deal with a wide variety of suppliers, many with differing payment terms and credit arrangements, further adding to the complexity of juggling these outflows.

All of this requires hospitality professionals to implement robust cash flow management strategies to handle cash flow forecasting, revenue management, streamlining of operations to control costs, and using technology to gain real-time visibility into financial performance.

Key Takeaways

- Implementing effective cash flow management strategies is essential for hospitality businesses to ensure operational stability, support growth, and anticipate financial needs.

- Managing cash flow can significantly improve a hospitality business’s overall financial health.

- Especially important are cash flow management strategies related to pricing, reducing expenses, improving receivables, and overseeing inventory and payables.

- Overcoming endemic challenges, such as seasonal revenue fluctuations and high fixed costs, requires careful planning, precise cash flow forecasting, and active monitoring.

- Leveraging technology, such as advanced financial software, can enhance cash flow management by providing real-time insights and automating financial processes.

Hospitality Cash Flow Management Explained

Revenue management, accounts receivable, and inventory management each play a significant role in a hospitality business’s ability to generate and maintain a healthy cash flow. Revenue management directly affects cash flow through the application of various pricing strategies, demand forecasting, and allocation of products, such as hotel rooms or restaurant tables. Effective revenue management maximizes cash inflows and helps smooth out cash flow fluctuations by anticipating and responding to changes in demand. For example, during peak seasons, a well-executed revenue management strategy can help a hotel fill its rooms at higher prices, generating a surge in cash flow. Conversely, during low seasons, revenue management techniques such as targeted promotions and discounts can stimulate demand and maintain at least a baseline cash flow level.

Accounts receivable management is particularly important because, in the hospitality industry, services are often provided before payment is received. That can lead to a gap in cash flow. By minimizing the time lag between provision of services and receipt of payment, hospitality businesses improve their cash flow and reduce the risk of bad debt. Tactics to accomplish this include establishing clear payment terms, promptly invoicing customers, and consistently following up on overdue payments.

Inventory management also plays a key part in hospitality businesses’ cash flow, because understocking can lead to missed sales opportunities, while overstocking ties up cash in excess or slow-moving inventory. What’s more, inventory such as food, beverages, linens, and toiletries, is one of the largest expenses—and cash drains—for a hospitality business. Proven inventory management techniques, such as just-in-time (JIT) ordering and regular stock audits, can help hospitality businesses refine their inventory levels and minimize waste, thus improving cash flow.

Common Hospitality Cash Flow Challenges

The hospitality industry encompasses a wide range of business types—hotels, resorts, restaurants, cafes, and event venues, for example. While each segment has its own unique characteristics and operating model, they all share some common cash flow challenges. These challenges can affect businesses of all sizes, from small, family-run operations to large, multinational chains. By understanding and addressing these shared obstacles, hospitality accounting professionals can develop reasonable strategies for managing cash flow.

- Seasonal variations: Significant fluctuations in demand related to the time of year cause major swings in cash inflows, with peak seasons bringing in more cash and off-seasons resulting in far less. This requires businesses to carefully manage their expenses and cash reserves to survive slower periods. For example, since a ski resort is likely to generate the majority of its revenue during the winter months, it must store a sizable cash reserve to help cover its fixed costs during the summer.

- High operating costs: The hospitality industry is characterized by low profit margins and high operating costs because of expenses such as labor, utilities, supplies, and maintenance. These costs can put significant pressure on a business’s cash flow, particularly during slower periods when revenue is low. For instance, a restaurant needs to pay for ingredients, staff wages, and rent even during times when customer traffic is slow, which can lead to a strain on its cash reserves.

- Capital expenditures: Hospitality businesses often require significant investments in property, equipment, and technology to remain competitive and meet guest expectations. These capital expenses can tie up large amounts of cash, making it difficult to manage day-to-day cash flow needs. For example, a hotel may need to invest in renovations, new furniture, or upgraded technology systems, which can put a temporary strain on its cash flow until the benefits of these investments are realized through increased revenue or operational efficiencies.

- Delayed receivables: Many hospitality businesses face delays in receiving payments from customers. Online travel agencies (OTAs) can take up to 45 days after a guest checks out to remit payment; credit card processors can take one to three days after a meal was served to pay; and it takes even longer for checks to clear for rental of event space. These delayed receivables can create cash flow gaps because businesses often must pay their expenses before payments arrive. For instance, a catering company may have to pay for food, labor, and supplies up front for a large event, but it might not receive payment from the client until several weeks after the event has taken place.

- Inventory management: Strong inventory management balances the need for having sufficient supplies on hand to meet customer demand and expectations against the risk of tying up too much cash in inventory. Poor inventory management can lead to cash flow problems. In the case of hospitality businesses, some tend to overspend on supplies to guard against shortages that diminish their ability to generate revenue. For example, a restaurant may struggle with cash flow if it purchases too much perishable food that then goes to waste. On the flip side, if the restaurant errs on the side of spending less on inventory, it could run out of popular menu items and lose sales. For hotels, inventory management also refers to the allocation of hotel rooms to the various booking channels, including OTAs, the hotel’s website, global distribution systems and other channels. This allocation can directly affect cash flow.

- Credit management: Credit facilities, such as business loans, credit cards, or other revolving lines of credit can be a helpful tool for managing cash flow and investing in growth opportunities. However, managing credit wisely is essential to avoid overextending a business’s borrowing and accumulating costly interest charges, which further burden future cash flow. Credit management includes assessing the business’s credit needs, shopping for the best terms, and creating a repayment plan that aligns with cash flow projections. For example, a hotel may take out a line of credit to fund a renovation project, but must carefully manage the debt to ensure that it can make payments on time, thus avoiding damage to its credit score or a default on the loan.

- Unexpected expenses: The unexpected happens—equipment breaks down, property is damaged, sudden changes arise in regulations. Unexpected costs can significantly strain a business’s cash flow, particularly if they occur during slower periods or when cash reserves are already low. For example, a restaurant may face a sudden need to replace a broken refrigerator, which can be a significant, unplanned expense that bites into its available cash.

- Regulatory compliance: Hospitality businesses are subject to a wide range of regulations, from food safety and labor laws to tax and licensing requirements. Complying with these regulations can be costly, both in terms of direct expenses and the time and resources required to stay up to date and compliant. Noncompliance can result in fines, legal fees, and reputational damage, any of which can negatively impact a business’s cash flow. For instance, a hotel may need to invest in new safety equipment or training to comply with updated fire safety regulations, constituting a significant unplanned expense.

Strategies for Optimizing Hospitality Cash Flow

The responsibility for developing and implementing strategies to optimize cash flow falls on various shoulders within a hospitality organization. In smaller hospitality businesses, the owner or general manager may take on the primary responsibility for managing cash flow; in larger organizations, this role may be assigned to a dedicated financial professional, such as the CFO or treasurer. In all cases, the key decision-makers must collaborate with other team members, such as front-line managers and department heads, to identify areas for improvement and to execute practical solutions across the organization, which might include one or all of the eight strategies discussed next.

Enhance Revenue Management

Revenue management focuses on maximizing revenue through strategic pricing, inventory management, and demand forecasting. Prioritizing improvements in revenue management helps hospitality businesses not only adapt better to changing market conditions, customer preferences, and competitive pressures, but also achieve a more consistent cash flow throughout the year. Demand forecasting is an essential component of revenue management that helps businesses anticipate future demand based on historical data, market trends, and other relevant factors. It helps inform proactive decision-making about pricing, staffing and resource allocation, ultimately leading to higher revenue, lower expenses, and improved cash flow.

- Use dynamic pricing: This pricing strategy, which involves adjusting prices in real time based on factors such as demand, competition, and market conditions, is widely used in the hospitality industry. It maximizes revenue during peak periods and stimulates demand during slower times, leading to a more consistent cash flow. For example, a hotel might increase room rates during a popular festival weekend to capitalize on high demand but offer discounts during a slow midweek period to attract more guests and generate additional cash.

- Diversify income streams: Identifying and developing new sources of income beyond a business’s core offerings can reduce its reliance on a single source of sales, making its cash flow more resilient. For instance, a restaurant may choose to offer catering services, cooking classes, or merchandise sales in addition to its regular dining services to provide additional sources of revenue that can help smooth out cash flow fluctuations caused by seasonal or market-related factors.

Control Inventory Efficiently

Inventory control directly affects the amount of money tied up in stock, the business’s overall liquidity, and its ability to free up cash for other essential expenses or investments. Managing inventory levels requires collaboration among departments to identify and reduce the amount of cash invested in slow-moving or excess stock and minimize the risk of waste due to spoilage or obsolescence. It’s equally important to ensure that adequate inventory is always available to capture all sales opportunities. Implementing inventory cost control techniques, such as JIT inventory management and negotiating lower prices with suppliers can help hospitality businesses reduce costs, improve efficiency, and maintain a more stable cash flow.

- Implement just-in-time inventory: JIT inventory management involves ordering and receiving goods as close to the time of need as possible, rather than holding large amounts of stock in advance of orders. By adopting a JIT approach, hospitality businesses reduce the amount of cash tied up in inventory, minimize storage costs and decrease the risk of waste due to spoilage or obsolescence. However, implementing JIT can be challenging, as it requires precise demand forecasting, reliable suppliers, and unshakable logistics to ensure that the right goods are delivered at the right time. A simple example of JIT is when a restaurant orders perishable ingredients on a daily basis, based on anticipated demand for each day’s menu, rather than keeping a large inventory on hand.

- Negotiate with suppliers: Building strong relationships with suppliers and negotiating favorable terms, such as extended payment periods or consignment arrangements, can better align the timing of cash outflows with sales inflows, reducing the strain on cash reserves. It can also help minimize purchasing costs, lowering overall cash needs. For instance, an inn that negotiates a 60-day payment term with its linen supplier can receive and use the linens before having to pay for them. That makes for better alignment of cash outflows and inflows because the inn will get to collect revenue from guests staying in rooms with the new linens before it must pay for them.

Streamline Operations

Streamlining operations means reducing costs, improving efficiency and eliminating waste. This not only helps businesses save money but also frees up valuable cash and resources that can be redirected toward growth initiatives such as expanding services, upgrading facilities, or investing more in marketing promotions. Moreover, a leaner, more efficient organization is better positioned to weather the cash flow challenges of slow seasons, as it requires fewer resources to maintain operations and can more easily adapt to fluctuations in demand.

- Automate processes: Using technology to simplify, standardize and automate repetitive tasks reduces the need for manual labor, minimizes the number of errors, and cuts down on inefficient rework. In turn, this improves cash flow as businesses serve more customers with fewer resources, mitigates the risk of lost revenue due to errors or inefficiencies, and avoids customer frustration. By automating processes such as reservation management, room assignment, and billing, hospitality businesses can trim labor costs, improve accuracy, and increase the speed of their operations. Some hotels, for example, have implemented automated check-in systems that allow guests to bypass the front desk and access their rooms using a mobile app, keeping staff needs minimal and streamlining the check-in process.

- Become energy efficient: Investing in energy-efficient technologies such as LED lighting, smart thermostats, and energy management systems can significantly slash utility expenses, resulting in a positive impact on cash flow. Instituting sustainable practices such as cutting back on water usage and minimizing waste, can help businesses lower their operating costs while appealing to environmentally conscious customers, potentially increasing sales. For instance, a restaurant may install low-flow faucets and toilets, use energy-efficient appliances, and implement a recycling program to reduce its water, energy, and waste disposal costs, ultimately improving both its cash flow and profitability.

Improve Accounts Receivable

Hospitality businesses deal with various types of receivables: Payments come from individual guests, corporate clients, OTAs, and event planners. Collection of these receivables can be delayed or difficult. A cash flow challenge could come, for example, from waiting for a corporate client to process an invoice or, for a restaurant, having to follow up with a travel agency to obtain payment for a group booking. By implementing strategies that streamline invoicing on the front end of the receivable process and encourage prompt payment on the back end, a hospitality business can shorten payment lag times and end up with a healthier cash flow. Good accounts receivable practices also reduce the risk of bad debt, which is the ultimate cash risk.

Three ways to improve the accounts receivable process are:

- Be prompt with invoicing: Sending out invoices immediately after a service is rendered or a product is delivered sets clear expectations for payment, decreases the likelihood of delays, and helps avoid cash flow disruptions. Electronic invoicing can further streamline this process, which entails businesses generating and sending invoices automatically, thereby diminishing the risk of errors or delays associated with manual invoicing. This is particularly important for hospitality companies because customers are more likely to forget or dispute charges if too much time has passed. A hotel should send an electronic invoice for a corporate group stay as soon as the group checks out, rather than waiting until the end of the month to process corporate invoices.

- Set clear payment terms: Invoices and sales contracts should include clear payment deadlines, late payment fees, and other terms to encourage customers to pay on time and to avert potential disputes or cash collection delays. This is especially important when dealing with corporate clients or event planners that may have longer payment cycles or require more detailed invoicing.

- Encourage electronic payments: Going cashless is another strategy for improving receivables and cash inflows. Offering convenient online payment options, such as credit cards, mobile payment apps, or automated bank transfers makes it easier for customers to pay their bills promptly and for hospitality businesses to get cash in-house quicker. These options also minimize the risk of lost or delayed payments due to postal mail or processing issues. For instance, some restaurants use mobile payment systems that allow customers to pay their tab directly from their smartphones, eliminating the need for cash or paper receipts.

Manage Payables Wisely

Payables management is the process of overseeing and controlling the money that a business owes to its various suppliers, vendors and service providers. In the hospitality industry, this can include everything from food and beverage suppliers and linen services to advertising media, utility companies, and landlords. Effective payables management involves carefully tracking and prioritizing these expenses, negotiating favorable payment terms, and scheduling payments in a way that preserves cash flow while ensuring the smooth operation of the business. For hospitality businesses, which often operate on tight margins and face seasonal fluctuations in cash flow, effective payables management is essential for maintaining financial stability.

- Use scheduled payments: Setting up automatic payments for recurring expenses such as rent or utilities is an advisable way to manage payables and control cash outflows. Doing so helps businesses make sure bills are paid on time, which helps them avoid late payment fees or service disruptions. It also allows businesses to better plan their cash outflows and allocate resources effectively.

- Prioritize payments: Categorizing payments on the basis of their importance and due dates is a key aspect of effective payables management. By doing so, the most critical expenses, such as payroll or essential supplier invoices, are paid first, minimizing the risk of cash shortages that could disrupt operations because of missed or delayed payments. A bed and breakfast, for example, may prioritize payments to its linen supplier over less essential expenses such as landscaping so that guest rooms are always properly stocked and maintained.

Monitor Cash Flow Regularly

Hospitality companies must actively manage their cash flow. The key tool for doing so is the business’s statement of cash flows, the financial statement specifically designed to show the company’s sources and uses of cash over a given fiscal period. The statement categorizes cash inflows and outflows by activity, allowing managers to separately view and analyze cash flows from operational, financial, and investment activities. At a minimum, the statement of cash flows should be run and reviewed as part of the monthly accounting close. But hospitality companies with advanced accounting software, or with enterprise resource planning (ERP) systems that seamlessly integrate financial and operational data can automate related processes and view cash flow in real time.

The cash flow statement is also the basis for tracking important cash-related metrics, including the operating cash flow ratio, which measures the business’s ability to generate cash from core operations, and the cash conversion cycle, which represents the time it takes to convert inventory into cash from sales. Regularly monitoring these metrics, along with performing bank reconciliations to verify the accuracy of cash balances, allows businesses to quickly identify and address potential cash issues.

Forecasting future cash needs and using financial dashboards to gain real-time visibility into the company’s financial health are other ways to keep close tabs on cash flow.

- Forecast cash flow: Create and regularly update cash flow forecasts using historical data, seasonal trends, and anticipated changes in the business environment. These forecasts help businesses identify and plan for potential cash gaps. If a business identifies such a gap, it can adjust upcoming spending downward and/or secure short-term or long-term financing options. A hotel whose cash flow forecast predicts a worse-than-normal impact from lower seasonal occupancy rates, for example, could make plans to pare expenses such as labor costs or marketing spend to maintain a minimum cash balance. Alternatively, the hotel may choose to secure a line of credit to bridge any potential cash gaps during slower periods, enabling it to meet its financial obligations and maintain operations until business picks up again.

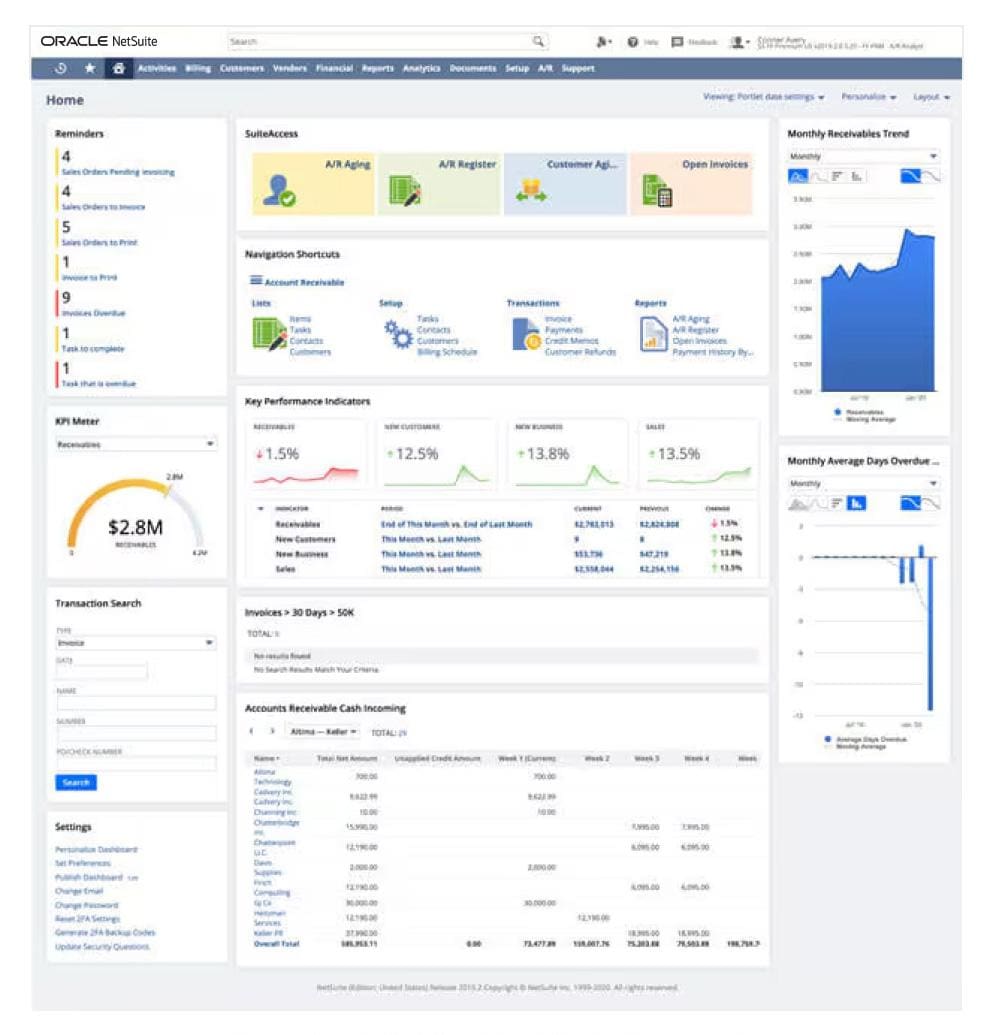

- Create a financial dashboard: By leveraging real-time data and graphic displays, dashboards help hospitality businesses quickly assess their cash flow position, identify trends and anomalies, and make better-informed decisions. A comprehensive financial dashboard should include key metrics such as revenue, expenses, and cash balances, as well as specialized reports for receivables and payables. An accounts receivable dashboard helps businesses monitor customer payment trends and identify potential collection issues that could impact cash flow, while an accounts payable dashboard enables the business to better manage supplier payments and control cash outflows.

Focus on Customer Experience

Delivering exceptional service and creating memorable moments for guests can lead to increased customer loyalty, positive reviews, and word-of-mouth referrals, all of which contribute to higher occupancy rates, increased customer spending—and more consistent cash inflows. Furthermore, by prioritizing customer satisfaction, hospitality businesses can reduce the likelihood of complaints, refunds, and negative reviews, all of which cut into cash inflows. Investing in staff training, facilities upgrades, and personalized touches can pay off in the form of enhanced customer experience, as do loyalty programs and high-quality service.

- Implement loyalty programs: Loyalty programs offer rewards, discounts, or exclusive perks to frequent guests, encouraging repeat business and higher spending during each visit. By fostering long-term relationships with customers, loyalty programs help stabilize revenue streams and decrease the impact of seasonality on cash flow.

- Focus on quality service: Consistently delivering exceptional service can enhance a business’s reputation, attract new customers, and foster loyalty among existing ones. Investing in staff training, empowering employees to go above and beyond, and regularly seeking and acting upon guest feedback are ways to keep quality service as a top priority. For hotels this can translate into increased occupancy rates, higher revenue per guest, and more stable cash flow. For restaurants, this can translate into faster table turnover and/or higher average check amounts, either of which will boost cash flow.

Establish a Contingency Fund

A contingency fund creates a financial safety net to help businesses weather unexpected events such as economic downturns, natural disasters, or sudden changes in demand. A dedicated cash reserve fund puts businesses in a better position to maintain operations during challenging times and avoid business disruptions that would strain their cash flow. Once in place, it’s important to regularly assess and adjust the size of a contingency fund based on the business’s changing risks, goals, and financial situation.

- Set aside reserve funds: Systematically saving a percentage of monthly or quarterly profits can help create a substantial buffer over time without placing undue strain on daily operations or cash flow. Consider setting aside 5% of the company’s monthly profit to place in a reserve fund to cover emergency repairs, temporary closures, or other cash flow disruptions. Placing those funds in a separate bank account is a best practice to avoid dipping into it unintentionally.

- Utilize financing options: Lines of credit, business credit cards, or term loans can be another source of contingency funding. Securing access to additional funds before they’re needed can help businesses navigate cash flow gaps or cover unexpected expenses without depleting their cash reserves. For example, a seaside motel that secures a line of credit can draw upon those funds during slow seasons to cover operating expenses and stabilize cash flow until business picks up again.

- Consider working capital loans: Working capital loans are a financing option specifically designed to help businesses cover short-term operational expenses such as payroll, inventory, and utilities. Careful use of working capital loans can help hospitality businesses bridge cash flow gaps, manage seasonal fluctuations, or cover immediate expenses without committing to long-term debt. For instance, a catering company that secures a working capital loan to purchase ingredients and supplies for a large event can repay the loan quickly once the event is completed and payment is received, minimizing the impact on its long-term cash flow.

Leveraging Technology in Hospitality Cash Flow Management

Technology is revolutionizing cash flow management in the hospitality industry, providing powerful tools to help businesses streamline financial processes, enhance decision-making, and improve overall financial performance. Adopting various technologies gives businesses greater control over their cash flow and eases administrative burdens, allowing staff to focus on delivering exceptional guest experiences.

Already, for example, automated accounting software is simplifying bookkeeping for many hospitality businesses and providing real-time financial insights that help them make better-informed decisions to optimize cash flow. Cloud-based ERP platforms that can integrate data from multiple sources such as property management and point-of-sale systems are facilitating comprehensive financial analysis and forecasting that help businesses anticipate and manage cash flow fluctuations. Mobile payment solutions and online booking systems are accelerating cash inflows, improving liquidity, and limiting cash flow disruptions. Artificial intelligence is also supporting cash flow management by analyzing vast amounts of data to identify patterns and help make predictive decisions that optimize pricing, inventory management, and staffing.

Manage Cash Flow in Your Hotel or Restaurant With NetSuite

NetSuite’s ERP system includes comprehensive financial management functionality that empowers hospitality businesses to take control of their cash flow. With real-time visibility into financial performance, automated processes, and powerful forecasting tools, NetSuite helps hotels and restaurants streamline their financial operations and optimize cash flow management, reducing administrative burdens and freeing up time to focus on delivering exceptional guest experiences.

NetSuite’s key features for hospitality cash flow management include real-time financial reporting and analytics, giving businesses up-to-date information on cash flow, revenue, and expenses. Automated accounts payable and accounts receivable processes help reduce manual errors, enable smarter disbursements, and accelerate cash inflows. NetSuite also includes integrated AI-powered forecasting tools capable of analyzing large data sets to produce more accurate cash flow projections. The centralized data repository integrates operational data and financial information from various systems and multiple properties or locations. And customizable dashboards allow managers to more easily monitor KPIs and optimize cash flow performance.

Mastering cash flow management is strategically imperative for hospitality businesses aiming for long-term success. By better understanding their unique industry challenges and implementing effective strategies such as dynamic pricing, JIT inventory, and smarter receivables and payables management, hospitality businesses can achieve cash flow stability even when faced with seasonal fluctuations and high operating costs. Leveraging technology to automate processes and gain real-time insights enhances efficiency and accuracy in cash flow management, allowing hospitality managers to focus more acutely on their customers’ experiences.

Hospitality Cash Flow Management FAQs

What is cash flow in the hospitality industry?

Cash flow in the hospitality industry refers to the movement of money into and out of a business. This means the inflow of revenue from various sources, such as room bookings, sales of food and beverage, and event hosting, as well as the outflow of expenses like payroll, supplies, utilities, and maintenance. Positive cash flow means that the inflow of cash exceeds the outflow. It provides the business with sufficient liquidity to meet its financial obligations, invest in growth opportunities, and maintain a healthy financial position.

How to manage hotel cash flow?

To effectively manage hotel cash flow, businesses should implement a comprehensive approach that includes cash flow forecasting using historical data and market trend analysis to help anticipate and prepare for projected fluctuations in demand. Revenue management strategies, including dynamic pricing, inventory management, and marketing can help maximize revenue, which minimizes cash flow gaps. Streamlining operations by identifying efficiencies and deploying automation can reduce overall costs and accelerate cash inflows. Additionally, establishing a contingency fund helps maintain cash flow stability in the face of unexpected challenges.

What is hospitality financial management?

Hospitality financial management is a broad process of planning, organizing, and controlling the financial resources of a business to achieve its goals and objectives. It involves managing revenue, expenses, cash flow, and investments to ensure the long-term financial health and profitability of the business. Key aspects of hospitality financial management include budgeting, forecasting, financial reporting, cost control, and decision-making based on financial data and analysis.

What are the four components of cash flow management?

The four components of cash flow management are making projections, preparing a cash flow statement, monitoring cash flow, and implementing corrective strategies. Making projections involves estimating future revenues and expenses, while preparing a cash flow statement categorizes cash flows into operating, investing, and financing activities. Monitoring cash flow requires regularly tracking and updating actual cash flows and comparing them to projections. Finally, implementing corrective strategies involves taking actions to optimize the company’s financial position such as accelerating cash collections, reducing expenses, renegotiating payment terms, and exploring financing options.