In real estate, some small businesses may choose cash-basis accounting because it is easy to understand and feels intuitive, but larger and/or public real estate firms—and any that wish to comply with U.S. or international accounting standards—must use accrual-basis accounting. This can be challenging for real estate companies, whose transactions often involve complex scenarios that require accountants to make nuanced judgments about when, exactly, revenues are earned and how the business should recognize and record them.

What Is Revenue Recognition?

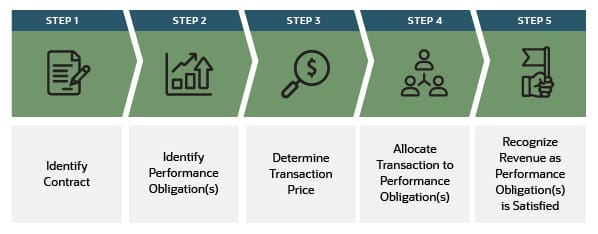

Revenue recognition is an accounting principle that asserts businesses must recognize revenue when it is earned, not when payment is received. In practice, businesses typically earn revenue when a critical event occurs, such as a product being delivered to a customer. Revenue recognition often involves identifying contracts and their specific performance obligations, determining and allocating transaction prices, and recording revenue as earned when performance obligations are fulfilled.

What Is Revenue Recognition for Real Estate?

Real estate companies must apply the same revenue recognition principles and processes, as established in U.S. and international accounting standards, as any other company. But because of the specialized nature of many real-estate transactions, the number of different possible revenue recognition methods, and the depth of detail in the accounting standards, recognizing revenue is not always straightforward for real estate firms. Nonetheless, the rules apply to all real estate transactions, including off-plan sales (when property is sold before construction is completed). For simple property sales, revenue is recognized when control is transferred to the buyer, which usually occurs upon completion of the sale.

For development projects, the picture is more complex. Depending on the terms of the contract, revenue can be recognized over time if the seller creates a “work-in-progress” asset controlled by the customer. Contracts of this kind typically have interim deliverables or measurable targets—the “performance obligations.” When a developer satisfies a performance obligation, it must recognize the revenue associated with that obligation whether or not the customer has paid. Revenue recognition also applies to management fees in real estate service contracts. If a deal bundles such fees with other elements in a transaction, they must be unbundled for revenue recognition purposes. For example, if a sales contract combines transfer of ownership of a property with a long-term service contract, the real estate company that sold the deal must split that revenue into its component parts and recognize each part separately in its financial reports.

When real estate is leased, rather than purchased, lease income is generally recognized on a straight-line basis over the term of the lease.

Key Takeaways

- Revenue recognition is an accounting principle that says revenue must be recognized when it is earned and costs when they are incurred, not when cash changes hands.

- There are many methods of revenue recognition for real estate, but they broadly fall into two types: recognition at a point in time and recognition over a period of time.

- Revenue recognition in accrual-basis accounting gives a clearer picture of a real estate business’s financial health than cash-basis accounting.

- Revenue recognition is separate from cash flow. So, if a real estate business has significant gaps between earning revenue and receiving payments, it must manage cash flow independently to avoid cash flow strain.

Revenue Recognition for Real Estate Explained

Revenue recognition in real estate follows accrual accounting, ensuring revenues and related expenses are recorded in the same period, regardless of cash flow. This method provides a clearer financial picture than cash accounting but requires more complex procedures, especially for intricate transactions.

Real estate firms recognize revenue when services are provided (e.g., property management fees) and expenses when incurred, even if payments are deferred. Earned but unpaid revenue is recorded as an asset, while unpaid expenses are liabilities. Prepayments add complexity—advance payments are initially recorded as both an asset and offsetting liability, with revenue recognized gradually as services are delivered.

Real estate transactions often reflect complex scenarios that require nuanced application of these revenue recognition principles, involving professional judgment and careful analysis of contract terms. Consider the following three common types of real estate transactions:

- Multielement arrangements: When a single transaction includes multiple components, such as selling a luxury condo with concierge and spa services, the business must allocate and recognize revenue separately for each element.

- Variable consideration: In cases where part of the transaction price is uncertain, such as performance-based fees in commercial property sales, companies must estimate the variable portion of revenue. The standards advise accountants to estimate conservatively to avoid recognizing revenue that might need to be substantially reduced (or “reversed”) in the future, if estimates prove overly optimistic. This careful approach is known as “constraining” the variable consideration.

- Long-term development contracts: For extended projects, such as office complex developments, revenue is often recognized over time as the project progresses, based on the percentage-of-completion method (discussed in detail below).

Revenue recognition can sometimes span accounting periods, including a company’s year-end tally. In such cases, accountants must make careful adjustments to ensure that financial statements accurately reflect the portion of revenue or expense recognized in each period.

Why Is Revenue Recognition Important in Real Estate?

Because accrual accounting, including revenue recognition, matches revenues with the costs that generated them and recognizes contractual obligations rather than cash flows, it typically gives a more accurate picture of a business’s financial health than cash accounting. This is particularly important in real estate, where it’s common for there to be significant timing differences between delivery of goods and services and the cash flows they generate. Real estate projects often have extended timescales, and the sums of money involved can be large, so it’s important that customers and investors have the information they need to feel confident about a real estate business’s financial health. A business that is showing sustained profits on an accrual basis is likely to be more attractive to investors and obtain credit at low interest rates.

Revenue Recognition Standards

Revenue recognition standards are set in U.S. Generally Accepted Accounting Principles (GAAP) and international financial reporting standards (IFRS). In GAAP, Accounting Standards Codification (ASC) 606 establishes the rules for revenue recognition; IFRS 15 is the international standard. Generally, firms headquartered in the U.S. use ASC 606 and international firms use IFRS 15. However, the two standards are broadly equivalent.

- ASC 606: This standard establishes four principles for revenue recognition. First, revenue must be recognized on the income statement in the period when it is earned, which may or may not be when payment is received. Second, revenue can be recognized only when the activity that generates it is fully or essentially complete. Third, there must be a reasonable level of certainty that payment will be received. Last, the revenue and its associated costs must be reported in the same accounting period. In addition, ASC 606 specifies five key steps in the revenue recognition process; they are described in depth in the next section.

- IFRS 15: Also called “Revenue from Contracts with Customers,” IFRS 15 aims to ensure that revenue is recognized when the buyer takes control of goods or services. The amount recognized is the consideration agreed upon by the parties for the goods and services supplied. Central to IFRS 15, therefore, is the existence of a contract between the buyer and the seller.

5 Steps of Revenue Recognition

ASC 606 and IFRS 15 specify the same five steps for recognizing revenue. All businesses that apply revenue recognition must follow these five steps.

Step 1: Identify the Contract

Revenue recognition depends on there being a contract between the buyer and seller. So, the first step in the revenue recognition process is to identify the contract.

The contract describes the goods or services to be transferred and the consideration to be paid in exchange. The contract must have “commercial substance,” which means that the deal must have a genuine business purpose, that it makes sense for both parties, and that it will carry real financial consequences for them. There must also be a reasonable likelihood that payment will be made. So, for example, a seller might perform credit checks on a prospective customer before entering into the contract.

All parties must agree to the contract and be committed to fulfilling their obligations.

Step 2: Identify the Performance Obligations

The next step is to identify the seller’s performance obligations under the contract. A performance obligation is a promise from the seller to transfer to the buyer distinct goods or services. “Distinct” means that the good or service transferred is clearly distinguishable from other goods and services in the contract and that the buyer can benefit from it either by itself or with other resources available to the buyer. There can be several performance obligations in a contract, and they can be deliverable at different times.

Step 3: Determine the Transaction Price

The transaction price is the amount of money that the seller will earn from providing the promised goods and services to the buyer. It is normally specified in the contract. However, sometimes the price in the contract is uncertain or variable—for example, there could be a bonus for early delivery or a penalty for late delivery. In this case, the seller must estimate how much it reasonably expects to earn from the contract.

Step 4: Allocate the Transaction Price

When a single agreement includes multiple distinct commitments or deliverables, the real estate company must divide the total contract value among the various elements. This allocation should be based on what each component would cost if it were sold on its own. In essence, the price of the entire package needs to be fairly distributed across all individual promises made in the contract.

Step 5: Recognize Revenue

Revenue must be recognized every time a performance obligation is satisfied, whether or not payment has been received. The amount of money recognized should be the amount the seller expects to receive in exchange for the goods and services provided.

A performance obligation is satisfied when the promised goods or services are transferred to the customer in such a way that the customer gains control of them. This may occur at a particular point in time (which is typical for residential property sales, for example) or over a period of time (typical for commercial leases). When a performance obligation is satisfied over a period of time, there are typically interim measures or checkpoints to determine how much revenue should be recognized as the performance obligation progresses.

The contract is not complete until all performance obligations have been satisfied.

Revenue Recognition Methods

Despite the sometimes complex nature of real estate contracts and their performance obligations, companies must recognize all revenue when control is transferred to the buyer, either at a single point in time or over a period of time. The contract should specify whether control transfers all at once or over time, in alignment with performance obligations outlined in ASC 606 and IFRS 15.

Once the choice between point-in-time and period-of-time recognition is determined, a real estate firm can choose among the following revenue recognition approaches. Though some of them are tailored to very specific or rare types of transactions or contractual arrangements, they all adhere to the overarching principles of accrual accounting and align with one or the other of the control-transfer choices. The sales-basis and completed contract methods, for example, align with point-in-time transfer of control; percentage of completion, cost recovery, installment, and proportional performance are examples of alignment with transfer over time.

Sales-Basis Method

This is the simplest method of revenue recognition. In real estate, the sales-basis method is commonly used for straightforward property transactions. Revenue is recognized when the sale closes and control of the property transfers to the buyer, typically at the time of deed transfer. This method is often applied to sales of existing properties, such as residential homes or commercial buildings. When payment is received simultaneously, this can look like cash accounting. However, it is the delivery of the product or service and the transfer of control to the customer that triggers the revenue recognition, not the receipt of payment

Percentage of Completion Method

The percentage of completion method (PoC) recognizes revenue earned gradually over the course of a contract by measuring progress toward the final transfer of control, based on the percentage of the work that is completed. PoC is commonly used for extended real estate development projects—except for residential home construction—because it is the approach preferred by GAAP, IFRS, and the U.S. Internal Revenue Service (IRS) for most long-term contracts. PoC is preferred because recognizing revenue gradually over the course of a project, as the actual work is completed, provides a better sense of the economic reality of the project in a developer’s financial statements.

The most common approach to determining the percentage of completion is the cost-to-cost method. Here's how it works:

- Determine the total costs incurred to date

- Estimate the final cost of the project

- Divide the costs incurred by the estimated total cost

- Multiply by 100 to get the percentage

For example, suppose a developer wants to recognize revenue earned thus far on a major project that is currently in progress but is not expected to be completed for another year. Costs incurred so far total $240,000, and the developer estimates the total final cost will be $600,000. Using the cost-to-cost method, the percentage completed is 240/600 x 100, or 40%.

The percentage of completion method is widely used for large-scale, multiyear projects, such as office complexes, shopping centers, or industrial parks. It enables developers to recognize revenues as they are earned, rather than waiting for contract completion, and provides a more accurate representation of a developer’s financial performance over time, aligning revenue recognition with the progress of the project. However, PoC requires reliable estimates of project costs and careful tracking of expenses. Inaccurate estimates can lead to the need for significant adjustments in later periods, potentially distorting financial statements.

Completed Contract Method

The completed contract method (CCM) is an alternative that recognizes revenue when the entire project is completed. CCM is allowed only in very limited circumstances, and primarily for tax purposes. Under IRS rules, CCM can be selected for any home construction contract, regardless of duration or company size. It’s also permissible for other construction contracts if they meet two specific criteria: that the project is expected to be completed within two years of commencement, and that the real estate business electing CCM has had average annual gross revenue for the preceding three tax years equal to or less than a threshold amount (which was $30 million in 2024 and is adjusted annually for inflation). It may not be suitable for contracts with a warranty period extending beyond the end of the contract.

CCM recognizes all revenue and profit at the point when the project is completed and control is transferred to the client. This can lead to rather volatile financial statements, with periods of no revenue followed by large spikes when projects are completed. For example, consider a small construction company building a custom home with a contract value of $2 million over 18 months, incurring costs of $1.5 million. Under CCM, the company would not recognize any revenue or profit until the home is completed and handed over to the client. At that point, they would recognize the full $2 million in revenue and $500,000 in profit.

It’s important to note that while CCM may be used for tax purposes, companies may still need to use PoC or other methods for financial reporting to comply with GAAP or IFRS standards. GAAP’s limitations on CCM are stricter than the IRS’s, and IFRS does not allow it at all.

Cost Recovery Method

The cost recovery method (CRM) is a highly conservative approach to revenue recognition—even more so than CCM, which recognizes revenue only after a project is completed. Typically used only when there is significant doubt that the revenue owed will be collected, such as sales to customers with poor credit histories or in unstable real estate markets, CRM recognizes only revenues that are equal to costs incurred, until all costs associated with a project have been recouped. The net effect of this method is that it delays recognizing profit until all costs have been recovered through cash payments.

Here’s a simplified view of real estate accounting for CRM. The full amount of a contracted sale is not recorded on the income statement but, rather, on the balance sheet, as an accounts receivable asset. The costs estimated in the contract are removed from inventory, lowering the value of that balance sheet asset. The difference is the contract’s potential profit, which is recorded as a liability (deferred gross profit). As the customer makes payments, the accounts receivable asset is lowered by the amount paid, which is recognized as revenue on the income statement, along with the exact same dollar amount of expenses, which are transferred from the inventory asset. Thus, even though revenue is recognized over time, no profit is recognized prematurely because the revenue and costs net to zero on the income statement until all the costs have been recouped.

Although this method safeguards against recognizing profits that may never materialize, it does not align with current GAAP or IFRS standards for most situations.

Installment Method

The installment method is a less conservative alternative to CRM, also used for projects where revenue collection is uncertain. Typically, the customer provides a down payment at the start of the project, then makes interim payments at intervals throughout the project. Any remaining balance is paid upon completion. Revenue is recognized for each interim payment and the final payment, but only a proportional amount of expenses are recognized. The net effect is that both revenue and profit are recognized over time.

To illustrate, consider a $1 million property sale that costs the real estate company $700,000, giving it a 30% gross margin. The customer pays in five annual installments of $200,000. For each payment, the real estate company recognizes the revenue and ascribes $140,000 as cost of goods sold and $60,000 (30%) as gross profit.

The installment method aligns well with GAAP and IFRS.

Proportional Performance Method

The proportional performance method is similar to the percentage of completion method, but revenue is recognized based on the performance obligations completed, rather than on costs incurred. Under this method, the contract identifies a set of distinct performance obligations, and the “proportional performance” is the percentage of performance obligations that have been satisfied. For example, if a contract identifies 20 distinct performance obligations of which eight have been completed, the proportional performance is 40%. In practice, many contracts that employ this method will value performance obligations differently, due to varying kinds of complexity, for example. Such cases add complexity to the math described in the example.

The proportional performance method is typically used for situations in which the seller can transfer ownership and control to the customer on delivery of each distinct performance obligation. For example, a developer building a complex that includes a hotel, a casino, and multiple retail wings, could transfer control of each of those independently. It is less practical for a developer building a residential home to transfer control of, say the framed-out structure, even if its completion is listed as a contractual milestone. The proportional performance method aligns well with GAAP and IFRS.

Deposit Method

The deposit method is used when contract terms require the customer’s deposit or down payment on a project to be refunded in the event of cancellation by either side. When the deposit is paid, no revenue is recognized; instead, the cash is recorded with an offsetting current liability on the balance sheet until it is certain that it will not have to be refunded—for example, if the cancellation period has expired or performance obligations have been satisfied. A common example is when a buyer pays an up-front down payment on a home purchase but contract terms stipulate that the sale is contingent on the buyer obtaining funding for the full purchase price. The down payment represents a liability on the seller’s balance sheet until it is either refunded—with no revenue ever having been recognized—or the deal closes and the seller recognizes the full sale amount. The deposit method complies with GAAP and IFRS.

Brokerage Agreement Method

A broker arranges a transaction between two parties, earning a fee or commission for doing so. Using the brokerage method, the broker’s revenue is recognized when the transaction is finalized and the broker’s contractual obligation is fulfilled. If a broker provides multiple services—such as deep cleaning, staging, and photography and videography—the broker distinguishes performance obligations for each one and, therefore, may need to allocate and recognize revenue separately. In addition to GAAP or IFRS, brokerage agreements are subject to IRS and Securities Exchange Commission regulations in the U.S. and similar regulations in other countries.

Lease Agreement Method

Lease accounting under ASC 842 under GAAP and internationally under IFRS 16 primarily affects lessees but also impact how lessors (property owners) recognize revenue. Lessors classify leases as operating, sales-type, or finance leases, each with distinct revenue recognition rules. Most real estate leases fall under operating leases, but if ownership transfers, the lease is long-term, the property is specialized, or lease payments cover most of the property’s fair value, it may be classified as a sales-type or finance lease.

Operating leases (like rentals) recognize revenue straight-line over the lease term, including adjustments for rent escalations or free periods. Sales-type leases (akin to property sales) recognize upfront revenue and profit at lease inception, with interest income recorded over time. Finance leases (similar to sales-type but without ownership transfer) recognize interest revenue over the lease term but defer selling profit. If a selling loss occurs, it’s recorded at lease inception. Under IFRS 16, lessor accounting aligns closely with ASC 842.

Bill-and-Hold Transactions

This method is rarely used in real estate transactions and then only under specific circumstances. In a bill-and-hold transaction, the customer is invoiced in advance of the goods being physically delivered and revenue can be recognized at that point, while the goods are still being held by the seller. But to recognize the revenue in that way, the arrangement must meet several criteria specified in the GAAP and IFRS standards. For example, the customer must be unable to accept the goods when they become available—for example, if they lack storage space or are experiencing production delays. There must be a “substantive” reason for using the bill-and-hold method, such as the customer requesting it. The goods must be clearly identified as the customer’s property and ready for delivery, and the seller must be unable to use the goods or transfer them to another customer.

An example of the bill-and-hold method might be illustrated by an artisanal joiner supplying bespoke wood work to the developer of a prestige retail project. The joiner produces the goods to the developer’s specification, so cannot offer them to another customer. The contract includes a clause allowing the bill-and-hold method to be used by the joiner if the developer is unable to accept the goods when they are available, due to adverse weather conditions, for example.

Appreciation Method

There is no such thing as the appreciation method of revenue recognition. But it remains on this list because multiple articles on the web have mistakenly included it in their lists of revenue recognition approaches, with potentially adverse consequences for readers. To set the record straight: Revenue is never recognized based on the appreciation of an asset’s value—in other words, while the appreciation remains an unrealized gain. That would be a violation of GAAP and IFRS accounting standards. Appreciation can be recognized as revenue only when the asset is sold, in which case one of the methods described above—such as the sales-basis method—would be used to recognize the revenue. Thus, the appreciation would be reflected in the gain on sale, rather than as a separate revenue item.

Revenue Recognition Tax Considerations

Revenue recognition can simplify tax calculations, since matching expenditures and revenues helps to ensure that profit for an accounting period is correctly calculated. However, because tax accounting methods sometimes differ from financial accounting methods, a real estate firm can end up with temporary differences that lead to deferred tax assets or liabilities. Furthermore, where there are significant timing differences between revenue recognition and receipt of payment, businesses can be liable to pay taxes on earned revenue before they have received the cash. For smaller businesses, this can cause cash flow strain. In some cases, the installment method of recognizing revenue for tax purposes may be allowed, which can help alleviate this cash flow issue for certain transactions.

There are specific tax considerations for certain types of real estate transactions. For example, property management services agreements with regular fee payments need to be carefully matched with the associated costs to ensure that tax calculations are accurate. Developer fees, where revenue is earned from services provided during construction, similarly need to be carefully matched with costs. In shared-savings arrangements, where cost savings achieved during construction may be shared with the customer, the revenue recognized must exclude the customer’s share of any savings. For long-term construction contracts, special tax rules may apply, as would be the case with PoC or CCM, depending on the contract’s duration and the company’s size.

Fairly common in real estate are 1031 “like-kind” exchanges, which allow a firm to defer capital gains taxes when exchanging one investment property for another. A 1031 exchange requires different reporting for financial statements and tax returns. On the financial statements, revenue is typically recognized immediately on the income statement for the property sale, while the deferred taxes appear on the balance sheet as a tax liability.

Best Practices for Recognizing Revenue in Real Estate

These best practices help real estate businesses recognize revenue effectively and avoid common problems, such as premature recognition, which can lead to a distorted picture of financial health.

- Establish clear policies: Clear and consistent policies are essential for effective use of revenue recognition to benefit the business and its customers. They enable the business to standardize and streamline revenue recognition processes for individual contracts and maintain full compliance with accounting standards.

- Regularly review and update policies: As the business evolves, the policies underpinning revenue recognition processes must adapt to meet changing business objectives and customer needs. Regulatory and legal changes also need to be accommodated in a timely fashion. So, it’s important to have a regular review-and-update process for revenue recognition policies.

- Identify performance obligations: Real estate contracts are often complex and of long duration. Breaking them down into a series of performance obligations with distinct deliverables helps real estate firms recognize revenue at the right time and verify that it is correctly matched to the associated costs. This means that taxable profits will be accurately reported and will prevent large swings on the bottom line.

- Use accurate estimation techniques: In real estate, revenue recognition often depends on estimated figures—for example, the widely used PoC method relies on estimating the project’s total cost. Using accurate estimation techniques helps establish that revenue recognition is as realistic as possible, thus helping to avert auditor challenges and profit restatements.

- Maintain detailed documentation: It’s essential to keep accurate and detailed records of all transactions involved in revenue recognition. Incomplete or inadequate recordkeeping makes it difficult to match costs and revenues or accurately measure progress against performance obligations. Recordkeeping for revenue recognition needs to include supporting documentation, such as contracts, invoices, and work orders, since this provides the audit trail needed to demonstrate compliance with accounting standards.

- Implement internal controls: Timely and accurate revenue recognition requires effective internal controls so that contracts, performance obligations, and transaction prices will be fully identified, transaction details recorded, progress and completion estimates properly calculated, and earned revenues recognized at the right time and matched with costs. Internal controls need to be enforced across all teams involved with contract delivery.

- Involve cross-functional teams: Revenue recognition isn’t just a matter for the finance department. All teams involved with identifying, measuring, and delivering performance obligations must apply the principles and processes of revenue recognition. Where there are cross-functional teams, business managers need to make sure everyone understands and buys into the business’s revenue recognition policies. It’s also wise to involve specialists in revenue recognition to advise management and help iron out any problems.

- Conduct regular training: Holding regular training sessions in the business’s revenue recognition policies and procedures for staff and contractors strengthens acceptance that the policies are meant to be embedded throughout the organization. When everyone understands the need for revenue recognition, as well as their role in making it work for the business, revenue recognition is much more likely to deliver real business benefits.

- Leverage technology: For effective revenue recognition, automate accounting processes wherever possible to reduce the need for manual intervention and the likelihood of errors. Take advantage of technological advances that enable managers to supervise the revenue recognition process on a real-time basis.

- Communicate with stakeholders: It’s not just management, staff, and contractors who need to understand and buy into revenue recognition principles and processes. Customers and suppliers do, too, because revenue recognition affects the way contracts are defined and progress measured. And add current and potential investors to that list as well. Effective revenue recognition processes that generate reliable bottom-line profit figures are more likely to attract investors and enable the business to obtain credit at favorable rates. So, it’s important to communicate the business’s revenue recognition policies to all stakeholders.

Real Estate Industry-Specific Challenges

Real estate transactions are complex, requiring careful revenue recognition while adhering to evolving regulations. Lease agreements, long-term projects, and multi-component deals present particular challenges. Leases often have characteristics of both operating and finance leases, making classification under GAAP difficult, especially when variable or contingent payments affect revenue timing. Long-term development projects require choosing between point-in-time or over-time revenue recognition. Point-in-time recognition simplifies accounting but can cause profit fluctuations with tax implications, while over-time recognition smooths profits but relies on potentially inaccurate cost and revenue estimates. The appropriate method depends on contract terms, performance obligations, and the buyer-seller relationship.

It’s not possible to recognize revenue for a single contract involving multiple components. Such a contract must be broken down into its component parts, with revenue recognized for each part separately.

The five-step model for revenue recognition found in ASC 606 and IFRS 15 helps businesses address the challenges in real estate transactions. Clearly identifying the performance obligations in the contract and allocating the transaction price correctly to the performance obligations simplifies revenue recognition for complex and uncertain contracts.

Future Trends in Revenue Recognition for Real Estate

Six key technology trends are set to transform the landscape for revenue recognition in the real estate industry: automation, real-time reporting, customer metrics, customizable business models, blockchain, and increasing emphasis on regulatory compliance. As these trends evolve, real estate companies will need to adapt their revenue recognition practices if they hope to remain compliant, competitive, and responsive to market demands.

- Automation: Automated tools and artificial intelligence (AI) will enable real estate businesses to streamline processes for revenue recognition and cost matching, eliminate manual errors, and increase speed and accuracy of reporting. For example, AI-powered accounting systems could automatically classify different types of lease income or accurately allocate costs in mixed-use developments.

- Real-time reporting: Technology increasingly operates in real time, giving real estate businesses instant access to data and providing advanced analytics tools for data mining, reporting, and interpretation. This could allow for real-time adjustments to revenue forecasts, for example, based on occupancy rates or immediate recognition of sales in large-scale property developments.

- Customer metrics: Advanced technologies are opening the door to improved integration of customer data with revenue recognition processes, supporting more granular tracking of performance obligations, contract modifications, and variable compensation. Customer-centric data integration could enhance a real estate firm’s ability to accurately allocate transaction prices in complex, customer-specific contracts and support more precise revenue forecasting. This kind of data-driven approach also facilitates better alignment between financial reporting and customer relationship management, providing valuable insights for both accounting and strategic decision-making. For instance, customer data could help inform decisions on lease renewal offers or guide the development of value-added services in commercial properties.

- Customizable business models: Technological advances make some processes, such as revenue recognition, more flexible and responsive to business needs, thus enabling real estate companies to customize their business models. This could facilitate the adoption of new models, such as fractional ownership or short-term rentals, each of which comes with its own unique revenue-recognition challenges.

- Blockchain: The implementation of blockchain and smart contracts in real estate transactions could significantly impact revenue recognition. Technologies like these could help automate and provide irrefutable records of property sales, leases, and service contracts, potentially changing the timing and verification of revenue recognition. For example, rental income could be automatically recognized and distributed among multiple owners of a property in real time as payments are received.

- Regulatory compliance: Another important trend is the increasing regulatory emphasis on compliance with accounting standards. Keeping up with technological innovations in revenue recognition will be essential for real estate business success in a tougher regulatory environment.

Enhance Your Revenue Recognition Process With NetSuite

NetSuite cloud accounting software can automate and simplify the revenue recognition process for real estate firms, helping them satisfy compliance requirements mandated by U.S. and international accounting standards. Whether a real estate company handles simple house sales, complex projects with embedded service agreements, or long developments studded with multiple milestones, NetSuite’s revenue recognition framework lets firms establish their own recognition rules, and then it meticulously schedules, calculates, and recognizes revenue based on those rules. Using NetSuite to handle revenue recognition processes improves the accuracy of financial statements, as well as revenue forecasts and allocation of resources to performance obligations. It can also simplify audits. With NetSuite’s accounting software, revenue recognition can be embedded in business processes and supervised in real time from the center, ensuring consistency and timeliness across all contracts.

Revenue recognition embraces much more than accounting standards. It provides an opportunity for businesses to understand and control their earnings and generate a strong, stable bottom line. Effectively deploying revenue recognition to report profits accurately and avoid wild swings on the bottom line helps build trust among investors, while customers, staff, and suppliers benefit from streamlined and standardized management of contracts, milestones, and progress.

#1 Cloud

Accounting

Software

Revenue Recognition for Real Estate FAQs

How do real estate developers recognize revenue?

Real estate developers recognize revenue in different ways, depending on whether they are selling a product or a service, and whether they are recognizing revenue at a specific point in time or over a period of time. Typically, if they are selling a product, such as a house, they will recognize revenue at a point in time; but if they are selling a service, such as construction, they will recognize revenue over the duration of the project, often on a percentage of completion basis.

What is considered revenue in real estate?

Revenue in real estate is any money generated from property, such as from property sales, property leases, service fees, rentals, car parking charges—even conference and event bookings.

How does an agent recognize revenue?

A real estate agent earns revenue by arranging property sales. The revenue is typically recognized when the sale closes, and is the net amount earned from a property transaction after the seller and any other interested parties have been remunerated.

What are the 5 criteria for revenue recognition?

There are 5 steps in the revenue recognition process:

- Identify the contract

- Identify the performance obligations in the contract

- Establish the transaction price

- Allocate the transaction price

- Recognize and record revenue