All businesses need to monitor their performance toward achieving business, team and individual goals, and B2B companies are no exception. That’s where key performance indicators (KPIs) come in. B2B salespeople and sales managers rely on data-driven KPIs to inform strategic and operational decision-making, highlight areas in need of improvement and help their businesses stay ahead of the competition.

What Are B2B Sales KPIs?

B2B sales key performance indicators (KPIs) help sales representatives and their managers track progress toward established targets, identify high-level trends, pinpoint pain points, highlight successes and manage both individual and team performance. KPIs are quantitative measurements that demonstrate how well a company is progressing toward its key business objectives. KPIs can look at the company as a whole, or they can focus on individual departments within the company, such as sales. For example, sales KPIs can reveal that a sales team is effective at converting prospects — also known as leads — to customers; that salespeople are spending inordinate amounts of time on data entry (and could benefit from automation tools); or that a particular salesperson needs additional training or support (if the individual’s monthly sales are lagging behind those of peers).

Of note, the terms “sales metrics” and “sales KPIs” are often used synonymously, but they are not identical in meaning. While all KPIs are metrics, not all metrics are KPIs. Sales metrics measure sales-related activities and performance over time; sales KPIs are metrics that measure performance against strategic goals.

Key Takeaways

- KPIs measure how well a business is progressing toward specific goals.

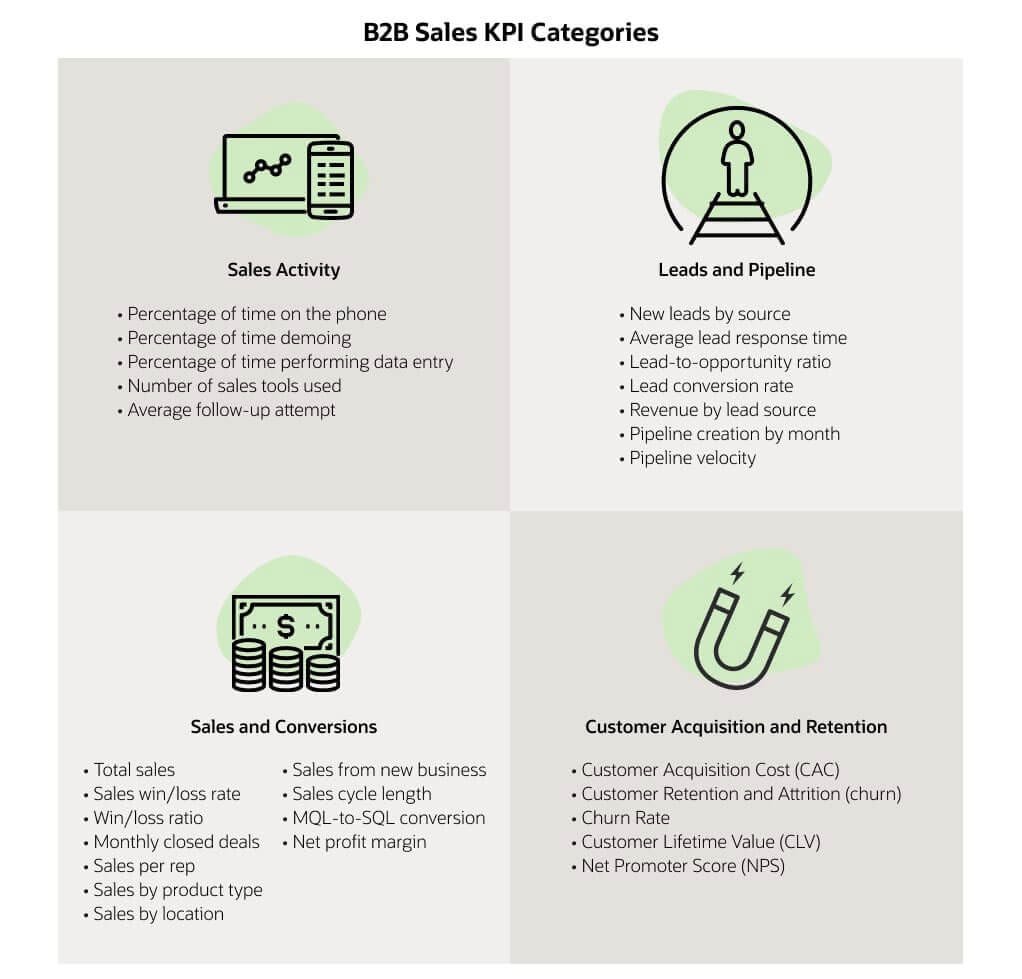

- B2B sales KPIs can be categorized by sales activity, leads and pipeline, sales and conversions, and customer acquisition and retention.

- New leads by source, monthly closed deals, net profit margin and customer retention/attrition are just a few valuable KPIs worth monitoring.

- Software can automatically calculate B2B sales KPIs and display them on dashboards for a real-time, at-a-glance view of critical data.

28 B2B Sales KPIs to Track

When it comes to choosing the right sales KPIs, there’s no one-size-fits-all methodology or list of must-track measurements. B2B businesses should favor quality over quantity when choosing among the scores of possible KPIs to track, with selection based on those that best assess progress toward their specific goals and objectives. That said, companies would do well to mind the SMART acronym when making their selections; that is, KPIs should be specific, measurable, achievable, relevant and timely.

So where should a business begin? Following are 28 common KPIs to consider, organized into four categories: sales activity, leads and pipeline, sales and conversions, and customer acquisition and retention. Keep in mind that following the same KPIs over time tells a bigger story than one isolated number or percentage.

Sales Activity

These five KPIs relate to the tactical activities performed by B2B salespeople when contacting potential business customers, generating leads, performing administrative tasks and responding to inquiries from prospects.

-

Percentage of time on the phone: The phone remains a powerful tool for all aspects of the sales cycle, as well as relationship-building. As such, a KPI focused on the percentage of time salespeople spend on the phone can prove useful for sales managers seeking to monitor staff productivity and for individual sales reps looking to monitor their own. It’s calculated by using the following formula:

Percentage of time on the phone =

(number of hours spent on phone / total number of hours worked) x 100To gather more granular data about phone usage, sales teams can break down their calls by type, whether cold, warm, scheduled or follow-up; assess their “connect” rate, or the number of high-quality calls or connections they have; determine the average time spent on a call; and assess their call-to-lead conversion rate.

-

Percentage of time demoing: Sales demonstrations give salespeople an opportunity to showcase the value of their products or services to potential business customers; they’re a big part of the B2B sales process. Leads in the demo phase often become customers — at this point, they’re interested enough to see the offering in action — so measuring the percentage of time sales reps and teams spend walking potential clients through how their offerings work is critical. It’s also another way sales managers can assess team and individual productivity and correlate the effectiveness of demos to closing deals. Use this formula to calculate the KPI:

Percentage of time demoing =

(number of hours spent demoing / total number of hours worked) x 100 -

Percentage of time performing data entry: This KPI shows how much time a sales team spends on the repetitive and time-consuming tasks associated with data entry. Every minute spent keying in information is a minute not spent on selling a company’s products and services. A high percentage of time spent on this task may signal a need for automation tools that can handle data entry so that salespeople can focus on boosting sales. Here’s the formula needed to calculate this KPI:

Percentage of time performing data entry =

(number of data entry hours / total number of hours worked) x 100 -

Number of sales tools used: Many of the sales tools of yesteryear — pen and paper, address books and conference rooms, for example — have taken a back seat to a slew of digital tools and websites. Think customer relationship management (CRM), email management and sales productivity tools that handle administrative tasks, such as scheduling meetings and collecting signatures. Tracking the number of sales tools used can help sales teams streamline both the number of tools used and the amount of time spent using them. One way to do this is through time-tracking apps that salespeople can use to record how much time they spend employing each sales tool per day or per week.

-

Average follow-up attempt: This KPI tracks the average number of times a sales rep tries to contact a prospect before closing a deal or giving up on it. The fewer the attempts required, the more interested the prospect was at the outset. Studying this number can offer some insight into the persistence of a sales rep pursuing leads. Of course, more follow-up attempts aren’t always better: A high number could indicate a salesperson wasn’t well prepared during a conversation and needed to call back multiple times. Whatever the case, salespeople will want to take care not to badger prospective clients.

Leads and Pipeline

Leads and pipeline KPIs allow B2B sales teams to measure the effectiveness of their sales activities by tracking and analyzing leads — defined as people or businesses expressing interest in a company’s products or services — as they make their way through the sales pipeline.

-

New leads by source: Keeping track of where leads come from is an important KPI. Lead sources — the channels through which potential customers discover a company — include search engines, social media, referrals, events, advertisements and website contact forms. By determining the predominant source of leads for a sales team, a sales manager can better decide where to invest resources.

-

Average lead response time: It stands to reason that the less time it takes a salesperson to follow up with a lead that has expressed interest in a product or service, the higher the odds the prospect will be open to hearing more. To accelerate response time, sales teams could employ live chat at their websites; engage in social listening to stay abreast of, and respond quickly to, social media comments and direct inquiries; and institute email workflows that automate the routing of requests from leads to the appropriate personnel.

-

Lead-to-opportunity ratio: The lead-to-opportunity ratio is the percentage of leads that convert to opportunities, defined as qualified sales leads — meaning leads that have met certain criteria and are now deemed as highly valuable to the business or likely to result in a deal:

Lead-to-opportunity ratio =

(total number of opportunities / total number of leads) x 100 -

Lead conversion rate: A valuable follow-on to the lead-to-opportunity ratio is the lead-to-sale percentage, also known as the lead conversion rate, which is the percentage of leads converted to actual sales. This KPI gauges how effective a sales team is at converting prospects into paying customers. These two KPIs can be determined by the following formulas:

Lead conversion rate =

(total number of sales / total number of leads) x 100 -

Revenue by lead source: In addition to tracking purely where leads come from, most businesses will want to gauge how much of their revenue comes from each lead source. Here’s an example: If in one month Company X’s sales team generated $20,000 in sales, with $5,000 of that revenue coming from leads that engaged via social media, then social media accounted for 25% of Company X’s revenue. Company X may also want to know which particular social channel brought in leads that resulted in the most added revenue. Perhaps $4,000 of that $5,000 in revenue from social media leads came from LinkedIn. It would make sense, then, for the company to focus most of its energy — and budget — on LinkedIn rather than, say, Facebook. Here’s how to calculate the KPI:

Revenue by lead source = total sales / sales from a given lead source

-

Pipeline creation by month: A sales pipeline represents the buyer’s journey — how a prospect progresses through each stage of a company’s sales process by completing specific actions, such as setting up an appointment with a company salesperson or reviewing a company’s proposal. Pipeline creation tracks the number of new leads in a given time frame, often by month. Bigger picture, by looking at where prospects are in the pipeline and predicting how many will close deals, sales managers can forecast revenue for a specific period.

To calculate the total value of a pipeline, sales teams can add up the value of all the possible deals in that pipeline. For more granular insight, they can look at the total pipeline value by sales stage — prospecting, lead qualification, initial contact, proposal, etc. Of note, not every company breaks down its sales pipeline the same way.

-

Pipeline velocity: This KPI gauges how long it takes to move prospects through the entire sales process, from first contact to closed deal. Pipeline velocity can be calculated using this formula:

Pipeline velocity =

(number of opportunities x average deal value) x win rate / length of sales cycle in daysIf a salesperson for Company X has 10 opportunities (i.e., qualified leads) in the pipeline with an average deal size of $1,000, a 20% win rate of converting qualified sales leads into paying customers, and a sales cycle of 45 days — (10 x $1,000) x 20% / 45 — then the pipeline velocity for that rep is about $45 per day and $1,350 for the month ($45 x 30).

Even slight improvements in any of the equation’s elements, such as decreasing sales cycle length or increasing average deal size, can increase pipeline velocity. The longer it takes to move prospects through the sales process, the more likely a company will lose those prospects along the way.

Sales and Conversions

Through sales and conversion KPIs, B2B sales teams can track the outcomes of their efforts. For example, how much revenue are they generating? And how effective are they at turning prospects into paying customers?

-

Total sales: A simple but telling KPI, total sales is the total amount of money that a B2B company has generated from sales in a given period of time. This is often calculated on a monthly basis. The total sales KPI can be especially valuable when used to compare time periods — sales increases or declines from quarter to quarter, for example, or year-over-year changes in the volume of sales generated by a sales team. It’s also important to remember that total sales is a relative value that should not be viewed in isolation. High total sales in any given period could be offset by high expenses, thus lowering the company’s overall profitability.

-

Sales win/loss rate: Another number that B2B businesses and their sales teams might want to examine is their sales win and loss rates, meaning the percentage of deals they close or lose in each time period. To calculate, divide the number of closed or lost deals by the total number of potential deals in the pipeline. At its most basic, this is the formula:

Sales win/loss rate =

(number of won/lost opportunities / total number of opportunities) x 100 -

Win/loss ratio: A related calculation that can prove valuable is the win/loss ratio, which puts wins and losses side by side. Here’s the formula:

Win/loss ratio = (number of won opportunities / number of lost opportunities)

Let’s take the example of Company X, which, out of 50 possible deals in the past quarter, won 20 and lost 30. Its win/loss ratio would be 2 to 3 (20 / 30). Multiple the quotient (0.67) by 100 to determine the percentage of deals lost during that time (67%).

Of course, win/loss ratios don’t tell the whole story. For example, they don’t take into consideration the size of the won and lost deals. A handful of high-value wins can outweigh a bevy of low-value losses. This underscores why sales teams need to dig deeper and not look at any one KPI in isolation. A win/loss analysis — systematically assessing the reasons why sales opportunities are won or lost — offers more granular insights, such as competitive win rate, win rate by sales segment and product, and loss rate by reason.

-

Monthly closed deals: Monthly closed deals is the percentage of sales won, as described above, every month. Keeping tabs on this KPI allows sales managers to gauge the productivity and efficiency of their sales teams and to set realistic goals, such as quotas.

-

Sales per rep: This KPI — the number of qualified sales made by each salesperson on the team during a particular time period — gives sales managers a more detailed look at their staffers. By tracking this number, sales managers can tell, for example, whether Salesperson A is improving over time or Salesperson B is meeting overall sales goals. Using the sales-per-rep KPI, leaders can establish sales baselines and, with closer examination, determine the strengths and weaknesses of each team member. This KPI is calculated using the following formula:

Sales per rep = total team sales / number of sales made by a specific rep

Sales KPIs that drill down to individual rep performance demonstrates how well they are meeting their sales goals. -

Sales by product type: Looking just at sales volume doesn’t tell a complete story. To be successful, companies need to segment B2B sales performance in a variety of ways, one of which is by product type. By monitoring this KPI, businesses can see which products and services are selling well, which ones could benefit, for example, from some extra marketing attention and which may have reached the end of their life cycle. This information also guides production planning and inventory management decisions.

-

Sales by location: Just like analyzing sales by product type, companies that operate in more than one location, region or country will want to know how much is sold wherever they do business. This KPI informs related decision-making, such as where (and where not) to open new factories or warehouses and how to strategically allocate products.

-

Sales from new business: While customer retention and expansion of deals are key to B2B sales success (more on that later), it’s equally important for a business to continually bring new logos into the fold. Some even say that the volume of sales from new business is a barometer of a company’s future health. This KPI can help organizations assess the effectiveness of both their sales and marketing teams and how well they collaborate. A steady influx of new clients can increase total revenue, which can potentially fund business growth and expansion. To calculate how much first-time customers are contributing to total sales, businesses can use this formula:

Sales from new business = (sales from new customers / total sales) x 100

-

Sales cycle length: Unlike B2C sales cycles, which can run mere minutes or hours, B2B sales cycles — defined as the average amount of time between a salesperson first contacting a lead and eventually closing a deal — can extend for days, weeks or months. That’s because B2B sales are typically complex, involving multiple decision-makers and a lot of money. Here’s the formula for average sales cycle length:

Sales cycle length =

total number of days to close all sales / total number of new dealsUltimately, this KPI measures the efficiency of the sales process. There are many ways that sales teams can shorten sales cycles. They include automating repetitive tasks, anticipating prospect objections, setting agreed-upon goals for sales calls, regularly scrubbing CRM systems to get rid of cold leads and focusing on the best-performing sales channels.

-

MQL-to-SQL conversion rate: While the term “lead” is somewhat generic in the sense that it is used to describe a potential customer, there are actually a half-dozen or so specific types of leads. Two of them are a marketing qualified lead (MQL) and a sales qualified lead (SQL). An MQL is defined as a prospective customer that has expressed interest in a company’s product or service, perhaps by downloading content, redeeming an offer or signing up for a webinar. An SQL is a prospective customer that has been vetted by the sales team and is ready to engage in a conversation with a salesperson. By measuring how many MQLs have been converted to SQLs, a B2B business can determine the quality of leads it brings in through its marketing efforts — i.e., the degree of synergy between its sales and marketing teams.

For example, if 100 people download a report from Company X’s website (MQLs), and 20 of them become SQLs, the company’s MQL-to-SQL conversion rate is 20%, according to this formula:

MQL-to-SQL conversion rate = (number of SQLs / number of MQLs) x 100

-

Net profit margin: At or near the top of the most tracked B2B sales KPIs is net profit margin. This KPI measures the percentage of sales revenue left after all business expenses and costs have been deducted; it’s considered a telltale sign of a company’s financial health. To calculate net profit margin, use this formula:

Net profit margin = (net income / net sales) x 100

Net income (synonymous with profit) appears on the bottom line of an income statement. If Company X has a net income of $100,000 and sales of $1 million, its net profit margin is 10%. Clearly, the higher the net profit margin, the better for the company, but what constitutes a “good” percentage varies among industries.

A single sales KPI can be informative, but deeper insight can be gained by comparing it to past performance.

Customer Acquisition and Retention

Running a profitable B2B business isn’t just about closing a few deals. To ensure profitability, companies need to maintain a steady flow of new customers, monitor how much it costs to acquire each one and keep those customers coming back for more. Customer acquisition and retention KPIs allow organizations to measure those aspects of their sales operations.

-

Customer acquisition cost (CAC): It’s well known in B2B sales circles that it can cost up to five times more to recruit a new customer than it does to retain an existing one. The customer acquisition cost KPI refers to how much it costs a business to acquire a single new customer. A comprehensive CAC calculation can be achieved by factoring in all sales and marketing expenses, including overhead and salaries. Reducing the CAC while increasing average revenue per customer and customer lifetime value can help a B2B business maintain or increase its profitability. Here’s the formula for calculating CAC:

Customer acquisition cost =

total sales and marketing cost / number of new customers -

Customer retention rate: Another sales reality is that existing customers are more likely to continue buying products and services from a company they know and trust. KPIs that measure customer retention — customers that stay with, and hopefully buy more from, the company during a given time period — and churn rate.

Retention rate =

(number of customers at the end of a period - number of customers acquired during a time period / starting number of customers) x 100 -

Customer churn (attrition) rate: Customer attrition (the ones who leave) and customer retention rates are two sides of the same coin, both impacting revenue. These KPIs are especially important for subscription-based businesses, which rely on a predictable stream of recurring revenue, to measure. Here are the formulas to calculate each KPI:

Churn rate =

(number of customers lost in a period / starting number of customers) x 100 -

Customer lifetime value (CLV): Customer lifetime value, or CLV, as it’s widely known, refers to the amount of money a company expects to earn from a customer during the course of the relationship. Many businesses consider this an important metric in determining which customers and customer segments generate the most revenue and how much should be spent to acquire new accounts. The formula to calculate CLV is:

Customer lifetime value =

average transaction size x number of transactions x retention period -

Net promoter score (NPS): A widely used customer success KPI created by author, speaker and business strategist Fred Reichheld, the NPS is based on respondents’ answers to a single question: How likely are you to recommend Company X/Brand X/Product X to a friend or colleague? Respondents answer on a scale of 0 to 10, where 0 is “not at all likely” and 10 is “extremely likely.” The score, typically used as a measure of customer or brand loyalty, is calculated by subtracting the percentage of detractors (those who chose a score of 0 to 6 on the scale) from the percentage of promoters (those who chose a 9 or 10). Respondents choosing 7 or 8 are considered “passives” and are not factored into the score. Scores range from -100 to 100, with scores of 20 or above considered good and scores of 50 or above considered excellent. Here is the formula to calculate the NPS:

Net promoter score = percentage of promoters – percentage of detractors

Some have argued that the NPS, when examined for companies within an industry, correlates with revenue growth relative to competitors. Proponents of the NPS, widely adopted by the Fortune 500, say that the score can be used to motivate companies to improve their products and services.

Dashboards for Your Top Sales KPIs

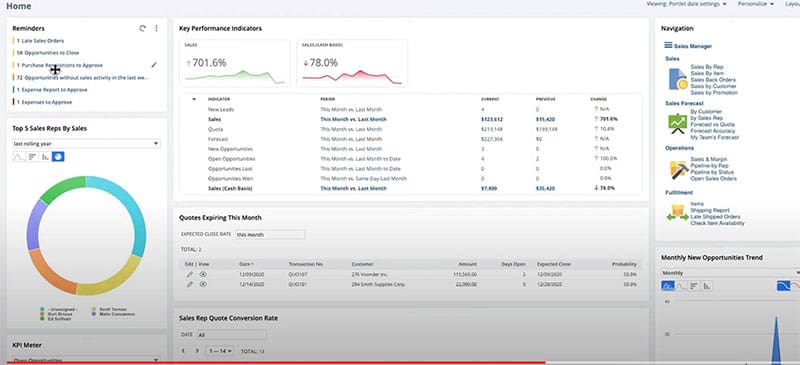

KPI dashboards, which are typically included with best-in-class business software, such as customer CRM and enterprise resource planning (ERP) systems, are invaluable tools for providing a visual snapshot of a company’s sales KPIs. Enabling B2B sales teams to see at a glance how well they’re performing streamlines the process of identifying strengths and weaknesses and allows teams to draft guidelines for improvement quickly and efficiently. Dashboards allow for real-time analysis of data, which can improve decision-making and drive better outcomes for sales teams. They also help sales managers monitor the performance of individual team members.

While it may be tempting for sales organizations to cram as many KPIs as possible into a dashboard, it’s considered a much better idea to narrow down the list to a manageable cluster — five to nine is the general recommendation — that will truly help sales team members drive the business forward. Here’s one way to look at this: In what areas would poor performance jeopardize the business, potentially causing it to close its doors? Surely the number of monthly social media impressions doesn’t fall into that category, whereas an exorbitant customer acquisition cost just might. The chosen KPIs should be related to a company’s sales strategy and include a mix of forward- and backward-looking metrics (also known as leading and lagging indicators, respectively).

It’s also important that dashboards be role-based and customizable, provide ample visualization options and include IT controls that allow for data security, privacy and confidentiality.

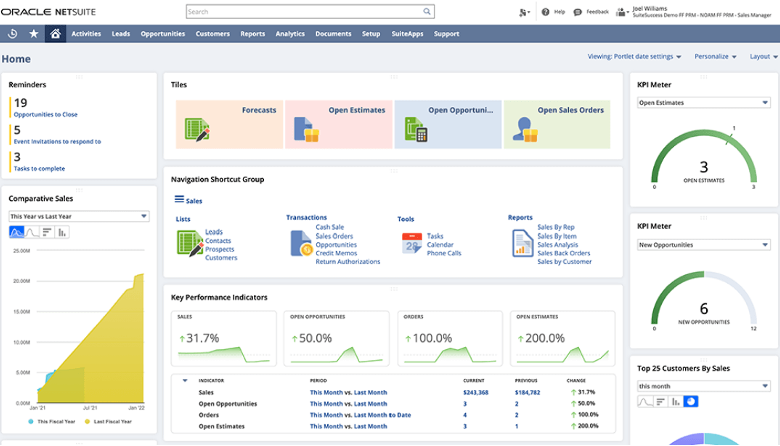

Track Your B2B Sales KPIs in One Place With NetSuite Analytics and BI

NetSuite SuiteAnalytics delivers business-intelligence insights through its analytics and reporting tools to users with a NetSuite platform license. Prebuilt and easily customized, these tools provide real-time visibility into a company’s operational and financial performance. While embedded analytics give users fast, easy access to the data they need, a library of customizable reports streamlines reporting processes and improves communications across an organization.

Real-time dashboards provide users with intelligence from all departments and business units, including accounting, sales, fulfillment and support. By adding sales KPIs to a dashboard and leveraging the array of ways to visualize them, sales teams can see business-critical information at a glance, improving both their agility and efficiency. The SuiteAnalytics Saved Search functionality filters and matches data in response to a variety of business queries. And with the Connect Service, users can analyze, archive and report on NetSuite data using a third-party tool or any custom-built application on any device.

SuiteAnalytics addresses a number of challenges faced by today’s fast-paced businesses. It does away with data silos by centralizing financial and operational data, eliminates the need for manual reporting with prebuilt, industry-standard reports and no-code customization capabilities and makes hard-to-track business performance a thing of the past by allowing teams to incorporate KPIs into dashboards.

Got KPIs? Now Visualize

B2B sales KPIs — sales-related performance measurements that allow sales teams to track their progress toward established, strategic business goals — provide companies with critical insights into their strengths and weaknesses, help them to make informed decisions that could affect the future health and status of their businesses and keep them on a path to long-term growth. It’s important, though, for businesses to focus only on the KPIs most relevant to their objectives and to leverage the actionable insights they gain from those KPIs to achieve success.

B2B Sales KPI FAQs

What are KPIs for B2B sales?

Sales KPIs measure the performance of B2B sales teams over time against established goals and targets. They can be a good indicator of an organization’s overall health and performance.

What are typical sales KPIs?

A company has many KPIs at its disposal. Typically, KPIs can be placed in “buckets” — that is, organized in categories by what’s being measured. One way to do that is by sales activities (e.g., percentage of time on the phone or demoing); lead and pipeline metrics (e.g., new leads by source, pipeline velocity); sales and conversions (e.g., monthly closed deals, MQL-to-SQL conversion rate); and customer acquisition and retention measurements (e.g., customer acquisition cost and churn).

What are the most important KPIs in sales?

KPIs vary greatly among businesses, depending on industry, the role of staffers using them and organizational goals and objectives. But certain KPIs — including monthly sales growth, profit margin, customer retention rate, customer acquisition cost, customer lifetime value, sales win rate and sales cycle length — tend to rise to the top of many companies’ lists.

What are the four main KPIs?

There is no shortage of B2B sales KPIs. However, they tend to fall into four main categories: sales activity, leads and pipeline, sales and conversions, and customer acquisition and retention.

How do you write or prepare a sales KPI?

With so many KPIs already in use today, most sales organizations can select from the existing “menu” and go from there. But for those that want to create KPIs of their own, following a set process could prove helpful.

- Define the objective or goal that the KPI will measure.

- Identify the data and data sources that will be used for the KPI.

- Establish how, and how often, the KPI data will be collected and updated.

- Build a formula — often a mathematical equation where data can be entered to generate a result.

- Determine how to communicate the KPI and visually present it to stakeholders.

How do you measure KPIs for sales?

For many sales KPIs, all that’s needed for computation is to plug the appropriate data into a mathematical formula. This can be achieved manually, of course, but leaving the calculations to an automated software platform, such as NetSuite ERP, that pulls data from multiple business systems and presents KPIs on user-friendly dashboards is a far more efficient option.