Large organizations with operations in many countries need multi-book accounting to help them adhere to all the requirements of the many different places in which they do business. But did you know that $10- or $20-million-a-year, entirely domestic companies can benefit from it, too? That’s because the standards for financial reporting typically differ from those of local tax reporting. And keeping separate books for those purposes alone can be a complex, error-prone process—often requiring duplicate data entry, manual reconciliations, and constant vigilance to maintain compliance. Plus, business leaders usually benefit from a third book—focusing on operational metrics and cash flow—that provides clearer insights for decision-making without compromising regulatory reporting.

This article explains how modern, multi-book accounting software can turn what was once an accounting burden into a strategic asset by simplifying and speeding up the process of keeping multiple books while reducing the risk of noncompliance.

What Is Multi-Book Accounting?

Multi-book accounting is a practice that allows businesses to maintain multiple sets of accounting records (or “books”) from a single set of transactions. But instead of recording the same financial information separately for different purposes, most companies use a multi-book system, which automatically applies various accounting rules, standards, and currencies to a single record of business activity to produce different books.

Each accounting book functions as an independent general ledger (GL) with its own rules for revenue recognition, depreciation methods, expense handling, and currency representation. When a transaction is entered, the system automatically processes it according to the specific requirements of each book, eliminating the need for offline spreadsheets, duplicate data entry, and manual reconciliations.

Organizations typically implement multi-book accounting to address specific business requirements, such as financial reporting that complies with both US Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). They also do so to separate financial and tax accounting treatments and to create specialized management reporting views. For example, a US-based company doing business in Italy must report financials in that country under IFRS or Italian GAAP, prepare US GAAP financials for the consolidated parent company, and file a tax return compliant with the US Internal Revenue Service’s tax code. All the while, senior management may want reports to help analyze the business without all the accounting intricacies obscuring potential insights.

Single-Book Accounting vs. Multi-Book Accounting

Single-book accounting uses one central GL where all transactions post under a single set of standards. When reporting requires different rules (like tax versus GAAP), accountants must create manual adjustments in separate systems or spreadsheets, extending close times and creating reconciliation challenges as transaction volumes grow.

Multi-book accounting establishes parallel ledgers that automatically replicate and convert transactions according to different standards. Each GL maintains its own balances, generating real-time statements and analyses for any required basis without manual intervention. This approach becomes essentially nonnegotiable once a company operates across multiple jurisdictions or standards.

Key Takeaways

- Multi-book accounting systems make it easier for businesses to comply with multiple accounting standards simultaneously.

- By maintaining separate ledgers, businesses can generate real-time financial statements for different regulatory requirements from a single source of transaction data.

- At period-end close time, multi-book systems automate currency conversions, account mapping, and book-specific treatments.

- Multi-book systems can help business leaders gain deeper financial insights by viewing business performance through multiple accounting lenses.

- They support global growth with built-in capabilities for handling multiple currencies, jurisdictions, and reporting standards.

Multi-Book Accounting Explained

Think of multi-book accounting as a crystal prism: A single beam of white light—your unified ledger—passes through and instantly refracts into distinct colors, each representing a different accounting lens (GAAP, IFRS, tax, cash, and so on). The practice has evolved so business leaders can study the full spectrum of their organization’s financial reality while still giving every stakeholder the precise shade of information their regulations or decisions require.

In the US, businesses began doing manual multi-book accounting sometime between 1913, when the country’s progressive income tax was introduced, and the 1950s, when US tax rules began to differ from GAAP more significantly. But the necessary accounting processes were, and remain, extremely burdensome and expensive. The arrival in the 1990s of modern accounting software, in general, and enterprise resource planning (ERP) systems, in particular, automated those processes, enabling more widespread use of multi-book accounting. In practice, ERP systems, or the equivalent, are a virtual necessity for multi-book accounting because they integrate data from all or most business functions into a central data store and can automate most of the required accounting processes.

Automated multi-book accounting can be a godsend for companies with international operations, multiple domestic subsidiaries, or simply different financial, tax, and internal reporting requirements. It maintains data integrity, lets each book use its own base currency, and helps enforce data security via role-based security that grants users, such as auditors and regulators, access to only “their” books. Senior financial teams, meanwhile, can have visibility across all perspectives.

Important use cases for small-to-medium-sized businesses (SMBs) include setting up a separate book for analyzing operating performance without muddying that analysis with noncash items, such as depreciation, amortization, and nonoperating gains and losses. Another involves the common occurrence of a US SMB launching a website that lets it start selling into multiple states for the first time, thus requiring it to report income taxes and sales taxes. It would find itself buried in manual spreadsheets unless it establishes separate books to comply with each state’s different rules and filing schedules and automates the processes for doing so.

Perhaps most importantly, especially for the multistate use case just mentioned, multi-book accounting lets businesses close accounting periods independently for each book. This means a company can finalize one set of books (such as tax reporting) while continuing to make adjustments in another (such as GAAP financial statements). The result is greater flexibility and efficiency in managing different reporting cycles and requirements without compromising data consistency.

Multi-Book Accounting vs. Adjustment-Only Books

As mentioned, multi-book accounting creates complete parallel ledgers in which every transaction is replicated according to different accounting standards. Adjustment-only books store only the incremental changes—as journal entries that overlay the primary book—needed to convert primary book figures to an alternate basis. This approach is easier to implement than manually maintaining multiple books and suits situations with limited differences between reporting requirements. But adjustment-only books generally use the same functional currency and accounting periods as the primary book, making them less flexible for complex and international reporting.

In practice, adjustment-only books are built after the primary ledger is closed, making them less timely than full multi-book accounting secondary books because they’re always at least one accounting cycle behind. Finance teams lock the primary book first because any late postings that slip into an unlocked primary ledger would require matching “catch-up” entries in the adjustment-only book, turning a tidy overlay into a messy, error-prone chase.

Companies sometimes use both approaches to maximize the efficiency of their accounting processes and software installation. A multinational business, for example, might use full multi-book accounting between a primary GAAP book and its IFRS book but use adjustment-only books for mergers and acquisitions analysis or tax reporting. Modern ERP systems support both, but full multi-book setup is costlier and more complex, usually requiring assistance from professional services or a multi-book-qualified reseller.

How Does Multi-Book Accounting Work?

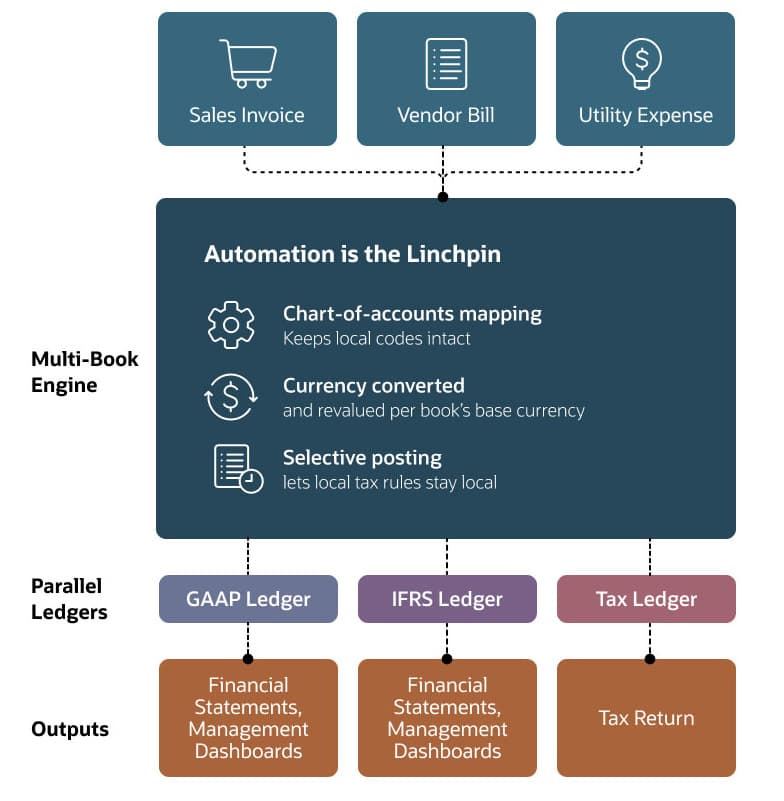

Automation is the linchpin that makes multi-book accounting able to maintain the integrity of an organization’s financial data even as it produces disparate reports for different jurisdictions. It works through a transaction-processing engine that automatically distributes information to each book. When a user enters an item—a sales invoice, vendor bill, or depreciation expense—a multi-book system automatically posts it to all relevant accounting books simultaneously, applying preset book-specific treatments to each version.

Behind the scenes, chart-of-accounts (COA) mapping helps ensure that transactions flow to the appropriate accounts in each book. This allows companies to maintain different account structures in each book, which is crucial when local requirements mandate specific account codes or categorizations. It’s also meaningful to the business when one division needs a detailed COA for various revenue streams and another division has far simpler requirements. For instance, a transaction might post to account #1000 in the primary GAAP book but automatically map to account #10001 in a secondary book that follows local reporting standards.

Likewise, currency differences can be managed automatically. When a transaction occurs in a foreign currency, the multi-book engine converts amounts using exchange rates for each book’s base currency. Because foreign currency exchange (FX) rates fluctuate, period-end revaluation can be performed separately for each book according to its specific requirements.

Not surprisingly, there are also book-specific entries resulting, for example, from local tax rules that apply to only one reporting standard. So multi-booking accounting systems let users create transactions that post to only designated books. Such selective posting allows finance teams to maintain book-specific treatments without affecting other ledgers.

Benefits of Multi-Book Accounting

Multi-book accounting’s benefits begin with the fact that it operates as a trusted interpreter, providing side-by-side views of operational and standards-compliant reporting to help business leaders sharpen their decision-making. Multi-book software strips much risk out of the reporting process by feeding GAAP, IFRS, tax, and local ledgers from one transaction stream. Plus, its automation enables companies to redeploy finance talent from spreadsheet drudgery to forward-looking analysis; stay agile by spinning up or retiring books in step with acquisitions and divestitures, market entries, or rule changes; and reinforce stakeholder confidence with audit-ready ledgers and tailored reports that keep boards, regulators, and investors fully aligned.

- Regulatory compliance: Multi-book accounting lets companies comply with different accounting standards simultaneously—without compromise. By maintaining separate books for GAAP, IFRS, and tax reporting, organizations can be sure that each set of financial statements strictly adheres to its governing principles. This eliminates compliance gaps that occur when trying to force different standards into a single ledger, reducing audit adjustments and potential penalties from regulatory bodies.

- Accurate financial reporting: Each accounting book can produce financial statements that reflect the appropriate accounting treatment for its intended audience without error-prone manual conversions. When corrections are needed, they can be applied to the primary book and automatically reflected in secondary books according to defined rules, so that all stakeholders receive precise information tailored to their needs.

- Global operations support: Multi-book accounting automation lets every subsidiary transact in its own currency and comply with its home-country reporting standards, while the parent company’s ERP system converts, maps, and rolls those transactions into a real-time global view. An intercompany sale, for example, can be posted once, auto-eliminated in every book, and become immediately visible in consolidated reports. This gives business leaders borderless analysis without manual currency workarounds or late-night reconciliation marathons.

- Improved decision-making: Business leaders and analysts can instantly toggle between management, GAAP, IFRS, and tax lenses—seeing the business’s real economic engine and the statutory picture side by side. This enables leadership to more clearly spot performance drivers, anticipate compliance impacts, and communicate a single, unambiguous story to every stakeholder. Just as easily, they can switch between accrual-basis and cash-basis views, giving finance teams an immediate read on actual cash movement versus paper profits—crucial for tight day-to-day liquidity and cash-flow planning.

- Efficiency: Record once, reconcile never. What once required days of period-end adjustments can be automated through a multi-book accounting software engine, which sends every transaction to all ledgers in real time. This eliminates copy-paste errors and frees accounting staff from tedious reconciliation work so they can focus on value-add analysis.

- Audit readiness: Verification becomes very straightforward for auditors because each accounting book in a multi-book system maintains a complete audit trail with transactions tied to their originating source. So-called “black-box” adjustments between books disappear, so nobody has to explain them. Therefore, audits wrap up faster with fewer surprises, resulting in greater trust and possibly lower fees.

- Flexibility: Multi-book accounting systems help businesses adapt quickly to changing business structures and regulatory requirements. Organizations can spin up, tweak—or retire—entire ledgers in weeks, so they have greater agility for considering acquisitions, entering new foreign markets, or simply test-driving IFRS alongside GAAP. Expansion plans, rule changes, and one-off reporting demands need never disrupt existing operations.

How to Adopt Multi-Book Accounting

When it’s time for a business to switch from single- to multi-book accounting, a hard cutover is out of the question. For a smooth transition, it’s best to develop and run a phased implementation that aligns the old and new rules, data, people, and controls. Following the six-step framework below can help businesses migrate with minimal disruption and a clear audit trail.

- Scope the differences that matter: Start by cataloging every place your current ledger diverges—or will diverge—from alternate standards: GAAP vs. IFRS timing rules, foreign subsidiary statutory GAAP, local-tax depreciation, cash-basis management views, functional-currency requirements, and so on. List affected entities, currencies, subledger processes, and reporting deadlines. Use that information to build a “difference matrix” that will drive every subsequent design decision, from how many books you need to which account mappings are mandatory.

- Choose (or upgrade to) software that supports true multi-book: Most standalone accounting packages offer only one live GL. Real-time parallel books require an ERP-class platform with a multi-ledger engine. Confirm the system can post a single transaction to multiple books simultaneously and support book-specific charts of accounts, currencies, and independent close periods. If you already use an ERP, verify that its multi-book feature is provisioned; some vendors require an advanced module or otherwise “gate” multi-book functionality.

- Configure books, mappings, and rules: With true multi-book accounting software, you can create the primary and secondary accounting books scoped in Step 1. Start by assigning each secondary book’s base currency, subsidiaries, and reporting basis, then decide whether it will be a full or adjustment-only book. Next, map every primary-book account to the appropriate account in each secondary book (or leave it mapped to itself if no difference exists). Finally, set book-specific policies for revenue recognition, asset depreciation, expense amortization, foreign-currency revaluation, and intercompany eliminations. Good practice is to start in a sandbox, import a handful of recent transactions, and validate postings in every book before touching production data.

- Load opening balances or backfill history: If you’re going live in the middle of a reporting period, decide whether to bring secondary books up to the same opening date as the primary ledger or to back-post historical periods. To keep things as simple as possible, many firms load opening balances (trial-balance level) and maintain detailed transaction histories only going forward. Others do a one-time migration that copies prior transactions into each new book so that more detailed comparative reports work on day one. Either way, it’s important to reconcile each book to expected balances before proceeding.

- Train the team and embed book-aware close tasks: Training requirements for the transition to multi-book vary by role, from very light to medium-heavy. Accounts payable and receivable clerks, for example, will still key in invoices and vendor bills only once, just as they did before, and the multi-book software engine will automatically enter the data in all the appropriate books. What’s new for them are a handful of pick lists (subsidiary, currency, maybe a revenue template or amortization schedule) that tell the engine which books to hit and how. Controllers, however, will need a revised close checklist that includes running period-end FX revaluations per book, reviewing book-specific journals, and locking each ledger in the order that best fits their reporting calendar. Internal auditors should also learn how to pull book-filtered reports and drill to source entries.

- Test, reconcile, and go live: Run at least one parallel close, in which you process a full month in both the legacy method and the new multi-book flow, then compare outputs for every ledger. Resolve mapping gaps, tweak rules, and repeat until variances are fully explained. Once satisfied, push the configuration to production, monitor the first period close closely, and schedule regular cross-book reconciliations to ensure the ledgers stay in sync.

Challenges & Solutions in Multi-Book Accounting

Multi-book accounting software dramatically simplifies workflows for financial reporting across different standards, but, naturally, it brings its own complexities. Often, the difference between a business struggling or succeeding lies in recognizing the challenges early and implementing targeted solutions before they compound into larger issues.

Multi-Book Accounting Challenges

Even with automation, maintaining parallel financial universes introduces specific hurdles that organizations must navigate:

- Data consistency: What’s challenging from the data consistency perspective is ensuring identical transaction data flows correctly to all books and that book-specific entries don’t create hard-to-explain differences between ledgers.

- Complex compliance: Keeping pace with evolving regulations in a single jurisdiction is hard enough, though ERP systems customarily ease this burden through automatic updates to maintain compliance with changes. But doing so across multiple jurisdictions simultaneously multiplies the scope of the challenge because changes to one standard may create new disconnects with others.

- System integration: Connecting disparate financial systems is a thornier problem in a multi-book accounting context. For example, when acquisitions bring legacy platforms into the organization, they must feed the multi-book engine without data loss or corruption.

- Error propagation: This challenge is unique to multi-book accounting: Finance teams must prevent mistakes from multiplying across all books. A single misconfigured account mapping or transposed number can distort every affected report.

- Resource intensive: Multi-book systems eliminate much of the drudgery involved in maintaining multiple accounting books, but they bring complex requirements. Initial setup demands a high level of expertise to properly map accounts, define book-specific rules, and so on; finance staff must understand multiple accounting and tax standards and how they are implemented in the system; period-end close processes are multiplied, as each book requires its own review and adjustments; and additional oversight controls are necessary to help ensure each book stays compliant with its respective standard. Managing this increased complexity without proportionally increasing headcount, especially during implementation and early reporting cycles, is a big hurdle.

Multi-Book Accounting Solutions

Forward-thinking organizations overcome these challenges through a combination of technology, process design, and governance:

- Centralized data management: Multi-book accounting solutions address data consistency and system integration challenges by establishing a unified transaction repository from which all books draw their data. This can eliminate the discrepancies that arise from disparate systems.

- Automation tools: An ERP system with robust multi-book capabilities can help address the resource and error-propagation issues by automating the application of complex rules in each book. This can reduce manual workloads while upholding the consistent treatment of transactions.

- Validation rules: These counter the problem of error propagation by automatically detecting when transactions would create unexpected differences between books. This way, the finance team can make immediate corrections before errors reach financial statements.

- Standardized processes: Developing clear, documented procedures for handling book-specific treatments, especially for complex areas like revenue recognition and intercompany transactions, can help companies manage their compliance complexity and staff resource demands. It also helps when staff turns over because when processes are standardized, the knowledge of how to do them doesn’t leave, too.

- Regular reconciliation: Scheduling frequent cross-book reviews that compare actual variances against expected differences helps tackle the data consistency issue. The regular book-to-book variance reviews become a kind of early warning system for potential integration issues or mapping errors, helping to ensure data integrity across all accounting bases.

Optimize Multi-Book Accounting With Technology & Automation

Modern cloud-based ERP systems like NetSuite’s can turn multi-book accounting from a complex burden into a strategic advantage. The multi-book architecture of NetSuite’s cloud accounting software addresses core multi-book accounting challenges by integrating transaction processing, revenue recognition, foreign currency management, and consolidation in one platform. When transactions are entered, the system automatically applies book-specific treatments across up to five active ledgers, avoiding data consistency issues while enforcing proper account mappings. For global enterprises, NetSuite handles currency conversions for each book’s base currency in real time and automates period-end revaluations, reducing the resource burden of maintaining parallel books.

NetSuite’s flexible solution supports both full multi-book books and unlimited adjustment-only books. NetSuite’s SuiteScript enforces book-specific logic and validation rules, catching potential errors before they propagate. And custom dashboards let users toggle reports by accounting book, providing instant pictures of how finances look for each different standard. NetSuite’s embedded artificial intelligence capabilities can detect book-to-book anomalies, generate book-specific narratives and variance analyses, and perform multi-book analyses, such as “Chart revenue recognition differences between GAAP and tax books last quarter.”

With its comprehensive approach, NetSuite can help businesses transform multi-book accounting from an error-prone manual process into a streamlined, automated system that delivers compliant financial statements for multiple standards without proportionally increasing finance headcount.

Multi-book accounting turns what was once an accounting burden into a strategic asset by simplifying compliance for multiple standards while providing deep financial insights. Organizations that take this approach gain the ability to satisfy diverse stakeholders with accurate, standard-specific reporting without proportional growth in their workload. Multi-book accounting delivers clarity through consistent data, speed through reduced manual reconciliations, and readiness for global operations—all while strengthening audit controls and decision-making capabilities. Leading ERP solutions make this sophisticated accounting practice accessible and manageable for organizations of all sizes.

Multi-Book Accounting FAQs

Why do companies keep two sets of accounting books?

Companies maintain multiple sets of books to comply with different standards and requirements simultaneously. Financial reporting standards, such as US Generally Accepted Accounting Principles, and tax accounting follow different rules for aspects like depreciation, revenue recognition, and expense treatment. Keeping separate books allows businesses to produce accurate statements for each purpose. This practice is legal and necessary, unlike separate books that are kept to intentionally hide or falsify information.

What are the three books of accounting?

This can refer to the three traditional accounting records: journals (chronological transaction records), ledgers (records grouped by account), and cash books (tracking cash movements). In modern multi-book accounting, it typically means three parallel ledgers maintained for different purposes—commonly a financial reporting book, a tax book, and a management reporting book that provide operational analysis with different treatments than regulatory reports.

How do I enable multi-book accounting in NetSuite?

NetSuite OneWorld is required for multi-book accounting. First, ensure the feature is

provisioned to your account. Then navigate to Setup > Company > Enable Features >

Accounting tab and check the appropriate multi-book options. For full multi-book

functionality, NetSuite Professional Services assistance is typically required for

implementation. Create and configure each accounting book, map charts of accounts as needed,

and load opening balances or historical data. Adjustment-only books can be implemented by

administrators without professional services involvement.