It isn’t unusual for companies to have irregular cash flows. But irregular cash flows combined with limited cash reserves can create problems for both businesses and those who manage them. Growing businesses often face this simultaneous challenge, especially those in B2B sectors that rely on credit terms, where customers may have 45, 60, or even 90 days to pay. In situations where stretched-out payment terms create a cash crunch, companies sometimes look to invoice financing to turn their accounts receivable into cash. Invoice financing can offer a good alternative to bank loans or credit lines for companies that can’t readily access those more traditional forms of capital.

What Is Invoice Financing?

Invoice financing is a funding method where businesses borrow against their outstanding accounts receivable. Companies use their unpaid invoices as collateral to secure immediate cash from a financial provider, repaying the advance—with interest—once customers settle their accounts.

This approach helps B2B companies that offer credit terms bridge the gap between delivering goods or services and receiving payment, especially when customer payment terms exceed their own obligations. Businesses finance their invoices to access a percentage of the invoice value—typically 70% to 90%—within days while still maintaining competitive payment terms for their customers.

Key Takeaways

- Invoice financing allows businesses to borrow money against their pending accounts receivable.

- Businesses typically opt for invoice financing when they’re facing a cash shortage or temporary cash-flow problem.

- Invoice financing is more expensive than traditional bank financing, but it requires significantly less paperwork and can usually be secured much quicker.

- Invoice financing makes most sense for businesses that have well-known customers that pay their bills on time.

- It’s not an option for B2C businesses; it’s only applicable in B2B sectors.

Invoice Financing Explained

Every company needs cash to fund its operations; materials, distribution, rent, and payroll are just a few of the necessities requiring payment. Companies with bank loans or lines of credit can take advantage of them during periods of slow cash flow. But companies that need cash quickly or can’t secure a traditional bank loan sometimes turn to receivables financing. In receivables financing, a financial company extends a loan to a business based on revenue earned but not yet collected. For some companies, the cash they receive—often within a day or two of entering into a financing arrangement with a financial company—can provide essential liquidity until they have a more comfortable cash cushion.

Invoice financing works best for B2B sellers that have well-known customers with a reliable payment history. Retail, manufacturing, and agriculture companies are among the types of businesses that often turn to invoice financing as a financing mechanism. Invoice financing isn’t an option for companies that primarily sell to consumers or whose payment model is cash and carry.

How Does Invoice Financing Work?

An invoice financing arrangement involves three parties: the business that issues an invoice, the customer that receives the invoice, and the financial services company. To get the maximum benefit from this type of receivables financing, a business must negotiate terms with the financing company and hope that its customer pays by the due date on the invoice—or earlier.

The following chart captures the main steps in invoice financing:

How Is Invoice Financing Structured?

Invoice financing arrangements have some similarities to short-term loans. In its simplest form, invoice financing is based on a single invoice, or account receivable. With that invoice serving as collateral, a financial company acts as the lender to advance cash to the business that owns the invoice. When the business gets paid, the business sends the original loan amount back to the financial company, along with interest based on the length of time the loan has been outstanding.

How Much Does Invoice Financing Cost?

Invoice financing can be a costly way to raise capital. A financial company providing cash to a business under this arrangement will typically charge both a single-digit percentage processing fee and a weekly factor fee, also in the single digits. Because of the weekly assessment of the factor fee—so-called because such lenders are themselves known as “factors”—even a low factor fee can result in an annual percentage rate (APR) of 25%, 35%, 50%, or even more.

To understand the economics, consider a hypothetical urban design firm looking to raise cash against a $50,000 invoice. A financial company agrees to advance the design firm 80% of the invoice value, or $40,000. In return, the design firm will pay a 0.5% processing fee and a 1.5% weekly factor fee on the cash outstanding. The design firm’s customer pays in four weeks, allowing the design firm to send the financial company the original $40,000 it borrowed, plus the $200 processing fee and $2,400 it owes as a factor fee—or $2,600 altogether. The design firm nets $47,400 of its $50,000 invoice.

Types of Receivables Financing

If a business has well-known customers with good credit, its accounts receivable can generate capital during periods of slow cash flow. There are three main types of receivables financing:

- Receivables-based line of credit: This is a credit line that businesses can get using their accounts receivable as collateral. The financial terms are often more favorable than the terms available through invoice financing or factoring. In many cases, though, the dollar volume of invoices needed to obtain the credit line is too high for smaller businesses.

- Invoice financing: In this arrangement, a business goes to a financial company to get a cash advance against one or more outstanding invoices. The cash advance can be for the full value of the invoice, though it’s usually somewhat lower.

- Invoice factoring: This is similar to invoice financing as method for collecting on an invoice prior to its payment. In invoice factoring, however, a factoring company buys the invoice and takes responsibility for collecting payment from the customer.

Accounts Receivable Line of Credit

This is a type of receivables financing that functions like a bank line of credit, but with a business’s unpaid invoices serving as collateral. It can be set up so that the business pays interest only on the money it borrows. Accounts receivable lines of credit, however, can be difficult to qualify for. Lenders usually require a relatively long-term commitment and a substantial dollar volume of invoices, neither of which are typically options for early-stage businesses.

Invoice Factoring

Invoice factoring is similar to invoice financing in that they’re both mechanisms for getting cash quickly, and often the same financial companies will offer both kinds of financing. However, in invoice factoring, the financial company actually buys the invoice from a business and takes responsibility for collection. This has the advantage of relieving businesses from time consuming collections efforts. That said, it also involves the risk of ceding control of an important customer interaction to a third party.

Invoice Financing vs. Invoice Factoring: What’s the Difference?

Invoice financing and invoice factoring provide two ways for businesses to generate cash from unpaid invoices.

Invoice financing is similar to a traditional secured loan in that it has set payment terms and interest charges accumulate on outstanding balances, but it uses one or more invoices as collateral for the loan. In invoice factoring, the cash the business receives isn’t in the form of a loan. Rather, a factoring company, AKA a factor, actually buys the invoice and assumes responsibility for its collection.

Key differences: While the benefits of invoice financing and invoice factoring are equivalent—namely, the receipt of cash on receivables that are still outstanding—the two methods are structured very differently. The differences include how the financing company charges for its service and which party pursues the customer for payment.

| Invoice Financing | Invoice Factoring | |

|---|---|---|

| Invoice ownership | Business that creates the invoice continues to own it. | Factoring company that buys the invoice becomes its owner. |

| Invoice collection | Usually handled by the business that created it. | Usually handled by the factoring company. |

| Financial company’s fee | Financing company charges a percentage each week on the amount of cash advanced, which is considered a loan. There’s also often a processing fee. | Factoring company purchases the invoices for less than their actual dollar value. |

Benefits of Invoice Financing

Invoice financing can be immensely valuable to companies by enabling both continued operations during periods of constrained cash flow and pursuit potentially fortune-changing opportunities. But it also has some drawbacks. Management teams should understand both sides before deciding whether to use invoice financing.

Invoice financing offers three main benefits that are especially helpful for growing businesses, which may face certain challenges due to their early stage of development and limited resources:

- Fast cash: In certain businesses, it’s not unusual for companies to enjoy significant sales and profit but struggle with cash flow. Invoice financing allows advance cash for B2B companies, sometimes within 24 hours, on earned-but-uncollected revenues. In these circumstances, invoice financing can reduce an owner’s cash flow and allow management teams to proceed with important initiatives that they would otherwise have to forgo.

- Highly valuable in an emergency: Natural disasters often result in damaged inventory, a disruption involving a key supplier, or the bankruptcy of a key customer; developments like these can quickly put companies in survival mode. If a business finds itself facing one of these existential threats and doesn’t have significant reserves, the rapid cash provided by invoice financing can be company-saving.

- Relatively light-touch approval processes: Many young and growing companies don’t have the necessary credit ratings to secure bank loans and lines of credit. This doesn’t matter as much to companies that provide invoice financing because they’re more concerned about the credit rating of a company’s customers than about the business itself. A business applying for a cash advance on its invoices will typically face less paperwork and fewer questions.

Drawbacks of Invoice Financing

Against these advantages, companies should consider the three main disadvantages of invoice financing:

- High cost: Invoice financing is a relatively expensive way to raise capital. The processing fees and weekly interest, or factor, rates can result in APRs that are multiples of what a business would ordinarily pay for a bank loan.

- Unpredictability of ultimate cost: When a business enters into an invoice financing arrangement, it generally doesn’t know what its final cost will be. The ultimate cost often depends on how quickly a customer pays the invoice. A longer-than-contracted delay in payment can wipe out any profit from a sale.

- Limited applicability: Not all businesses are able to use invoice financing. For its use to make sense, a business must be in a B2B sector. It must also have customers with excellent credit ratings and a history of paying on time.

Invoice Financing Example

It’s the first day of the month, and Nippity-Doo-Dah, a hypothetical maker of winter apparel, has just fulfilled a $200,000 contract for finished clothes with a retail chain. It’s aware that the delay in payment—the retailer’s payment terms are 30 days—is going to leave Nippity-Doo-Dah short of cash for other operating needs. So, after sending the invoice to the retail chain, Nippity-Doo-Dah’s next step is to approach a company that occasionally finances its invoices.

The financing company says it can wire Nippity-Doo-Dah 80% of the invoice value, or $160,000. The processing fee for the loan is 2%, and the factor fee—similar to an interest rate—will be 1% a week until the invoice is paid. The retailer actually pays 21 days after receiving the invoice, meaning Nippity-Doo-Dah will pay 3% interest on the $160,000. Altogether, Nippity-Doo-Dah’s owner owes the financing company $8,000. This breaks down into $3,200 for processing plus $4,800 in interest. With the payment in hand, the apparel maker wires $168,000 to the financing company. After deducting financing charges from the invoice amount, Nippity-Doo-Dah brings in $192,000 from the retailer.

| Day 2 | Day 21 | Day 28 | ||

|---|---|---|---|---|

| What happens | Nippity-Doo-Dah receives 80% of the $200,000 invoice value from its financing company. This is basically the principal on the short-term loan. | Nippity-Doo-Dah receives retailer’s payment. | Nippity-Doo-Dah returns loan values to finance company, along with the processing fee and 3% total factor fee. | Nippity-Doo-Dah nets $192,000 from the original $200,000 order. |

| Cash flow | +$160,000 | +$200,000 | -$168,000 | N/A |

Which Businesses Benefit the Most From Invoice Financing?

While invoice financing is common across B2B industries, it works particularly well for companies with predictable payment cycles and established customer relationships. Staffing agencies, logistics companies, and business services firms often rely on invoice financing to cover significant upfront or seasonal costs—payroll, fuel, or raw materials—while waiting weeks or months for clients to settle their accounts. For example, an education services company contracted by a school district that pays on net-30 terms for monthly invoices may struggle to pay its employees when the school year begins. The company can finance the first two months of invoices to pay staff while they await payment from the district.

Startups without extensive credit histories also find invoice financing valuable, as they may not qualify for traditional bank loans or credit lines, even with reliable income from creditworthy customers. Additionally, rapidly expanding companies use invoice financing to sustain operations without diluting their equity or incurring long-term debt. This approach helps them accept larger orders and extend competitive payment terms without straining working capital or compromising long-term sustainability.

How to Qualify for Invoice Financing

To qualify for invoice financing, a business should have accounts receivable from creditworthy customers showing a history of paying invoices promptly. A business should also understand that its own credit score and business fundamentals will likely be examined, even if they aren’t the financing company’s main concern. An owner with a poor credit score might have trouble getting approval from certain financial companies. In other cases, a low credit score will result in higher payments and fees.

How to Apply for Invoice Financing

The process begins with a business filling out an application, often online, and sharing details about the invoices it wants to finance. The businessperson handling the application will have to show some form of identification, which could be a driver’s license. Other documentation may also be required, such as a voided business check, bank statement, or financial statements.

Make Informed Invoice Financing Decision With NetSuite

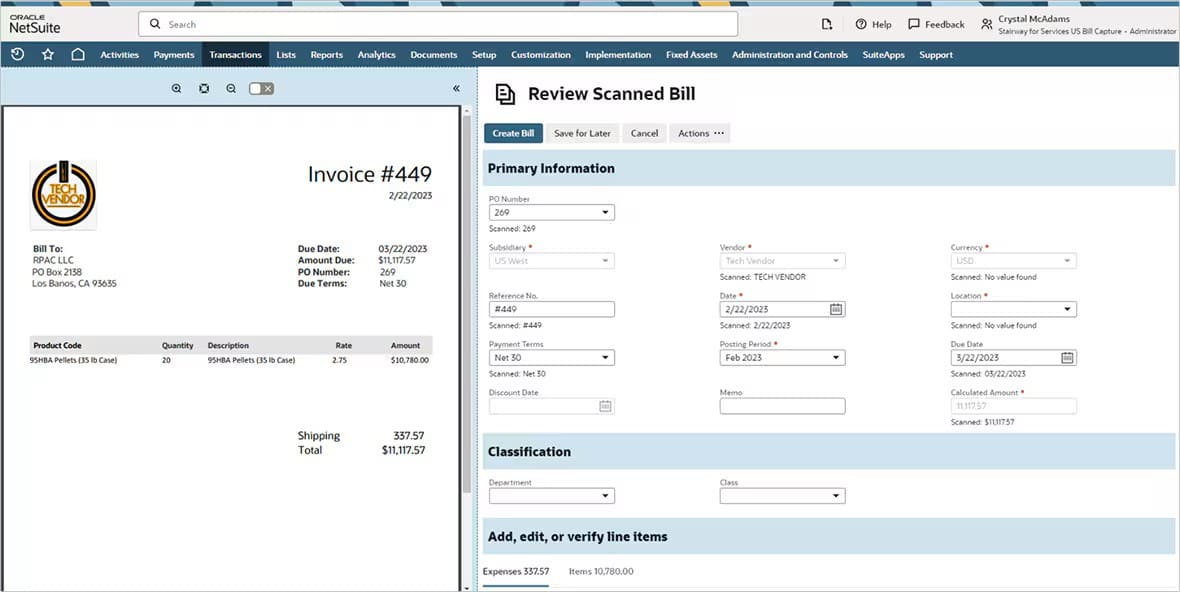

NetSuite Bill Capture software simplifies invoice processing by allowing users to drag-and-drop or email invoices to automatically update customer billing information, link invoices to all relevant purchase orders, and verify data accuracy. These features work together to create clear visibility into invoice status and eligibility for financing. NetSuite’s integrated financial reporting tools help companies calculate the actual cost of invoice financing against other funding options to decide when financing invoices will improve cash flow across revenue streams. The platform’s automated workflows also reduce manual data entry errors and provide accounts receivable teams with real-time insights into outstanding balances and due dates.

NetSuite Bill Capture Software

Many B2B businesses go through periods of irregular cash flow, especially if they have slow-paying customers or offer extended payment terms. Companies that face this situation without a flush bank account can face cash constraints. If they don’t have access to traditional bank loans or lines of credit, invoice financing can be a good solution. With invoice financing, a company that needs cash fast uses some of its invoices as collateral to secure additional capital from a company that provides short-term financing. Although invoice financing is a relatively expensive way of raising cash, it’s often used by growing businesses to cover near-term operating expenses or pursue growth opportunities.

Invoice Financing FAQs

Is invoice financing a good idea?

Invoice financing can make sense for companies experiencing a temporary cash flow shortfall. It’s more expensive than traditional bank financing and is thus most often used by businesses that don’t have access to bank financing in the amounts they need.

What is sales invoice financing?

Sales invoice financing is a form of accounts receivable financing. It describes an arrangement in which B2B companies use their unpaid invoices as collateral to borrow money from financial companies.

What is the difference between invoice financing and factoring?

Both are ways to raise cash quickly using unpaid invoices. With invoice financing, the financial company basically acts as a lender, advancing money to a business while treating the unpaid invoice as collateral. In invoice factoring, the financial company actually buys the invoice and assumes responsibility for collecting payment.