Businesses that make international payments have historically had to resort to expensive wire transfers or develop and vet a potentially complex series of international banking relationships and accounts. International ACH offers another option—managing global payments through familiar networks at a fraction of the cost of those other approaches. By understanding how international ACH works and the benefits it bestows over traditional international payment methods, finance teams can craft practical steps for decreasing international transaction costs without sacrificing the security and reliability their global operations demand.

What Is International ACH?

International ACH is a network of systems and agreements that make cross-border electronic payments possible using each country’s local ACH infrastructure. Unlike more costly bank wire transfers, ACH—which stands for automated clearing house—converts payments into the new currency and completes the transfer through region- or nation-specific systems that are comparable to the ACH network in the US, such as Europe’s Single Euro Payments Area or Canada’s Electronic Funds Transfers.

The US ACH system is managed by the National Automated Clearinghouse Association, which reported processing 33.6 billion payments, valued at $86.2 trillion, in 2024. Businesses typically use ACH to make direct payments, such as direct deposits for employees or vendors. While domestic ACH transfers move money directly between US banks, international ACH connects the US banking system with payment systems in other countries to transfer funds from and to customers and businesses. This connection allows businesses to send payments abroad, yet achieve the same benefits local ACH processes provide—namely, lower costs and predictable settlement times.

Key Takeaways

- International ACH connects US payment networks with networks in other regions or countries to process fund transfers without the need for a foreign bank account.

- ACH processes funds in batches, leading to lower costs and longer wait times than wire transfers entail.

- International ACH transactions must adhere to additional documentation standards beyond those commonly called for by domestic standards.

- Accounting software that integrates with both domestic and international ACH networks can help businesses automate currency conversion, compliance documentation, and payment tracking.

International ACH Explained

For global businesses, implementing ACH processes can simplify cross-border business transactions and improve margins. With ACH payments, finance teams use a single platform to make domestic and international payments, reducing complexity and inconsistencies during financial reconciliation processes.

Businesses that integrate international ACH into their accounting systems can automate some multicurrency accounting processes, such as converting one currency to another using real-time exchange rate calculations. Automating this step eliminates the need for manually tabulated currency calculations and pares payment errors, especially for accounts payable and receivable departments. The lower cost per transaction can add up to big savings for AP teams that make large volumes of international vendor payments each month. AR teams benefit by using international ACH to efficiently collect payments from global customers, accelerating cash flow and diminishing the administrative burden of managing multiple incoming payment channels.

How Does International ACH Work?

Every international ACH payment follows a three-step process to coordinate the flow of funds between a US bank and a foreign payment network:

- Initiation: First, the payment originator submits instructions through its bank or accounting software. According to Federal Reserve guidelines, valid international ACH transactions (IATs) should include such details as the originator’s name, address, and bank account number, as well as the receiving party’s bank name, identification number, and branch code.

- Batch processing: ACH networks group payments in batches to send at predetermined intervals or when certain value thresholds are reached. Each batch is sent to a gateway service, such as the Federal Reserve’s FedGlobal ACH, which transmits the payments in the batch to the various foreign payment systems indicated. This usually occurs at set times throughout the business day; funds arrive within one to five days, depending on the destination country.

- Fund settlement: The domestic ACH network must connect with the receiving country’s payment system—generally facilitated by the gateway—to settle the transaction. During settlement, the system applies current currency exchange rates to the transaction and deposits funds into the recipient’s local bank account through their country’s clearing system. As many as three currencies may be involved: the originator’s home currency, the recipient’s home currency, and an intermediary “transaction currency”.

International ACH vs. International ACH Transfer vs. International ACH Transaction (IAT)

International ACH, transfers, and IATs are distinct but related terms that represent different aspects of global payments. International ACH refers to the overall collection of local and regional payment systems, and the contractual agreements among them, that businesses use to send money across borders. International ACH transfers—the actual movement of funds through the networks—are cross-border payments made using the ACH infrastructure.

Unlike the first two, IAT has a precise regulatory meaning: IAT is the classification banks must use when making international ACH payments and that the local ACH system must use to identify cross-border payments. Contrary to domestic payments, IAT transactions set off additional reporting requirements and compliance checks to meet US banking regulations—mandated by the Bank Secrecy Act of 1970—that are designed to help prevent money laundering and terrorist financing. The IAT classification applies to both incoming and outgoing payments.

Benefits of International ACH

International ACH simplifies the often complicated—and expensive—process of sending money overseas. The following four benefits demonstrate how ACH makes international business more accessible, helping even small businesses expand their reach and market:

- Saves money: International ACH transfers typically cost between $0 and $10 per transaction, depending on a bank’s fee policies and the size of its customer relationship with the business that originates the transfer. That compares to up to $75 for international wire transfers, depending on the currencies involved, destination country, amount, and similar details. Savings from these lower fees can drop to, and increase, the bottom line, especially for businesses processing a high volume of international payments.

- Payment simplicity: Businesses send international ACH transfers through the same interfaces as domestic ACH transfers. This creates consistent workflows that simplify training and eliminate the need for separate systems or procedures.

- Increased security: International ACH transactions incorporate multiple security layers. For example, IATs require detailed transaction information that enhances traceability and aids fraud detection. All banks involved in cross-border transfers apply their individual verification processes. Regulatory compliance, including screening by the Office of Foreign Assets Control in the US, helps block illicit activities. Gateway operators implement additional security measures for specific international transactions. These layered security checks create a strong security framework for international ACH transfers.

- Helps expand global reach: With ACH, companies can accept payments from global customers and make cross-border payments to overseas vendors without having to establish foreign bank accounts. This accessibility to foreign markets lets companies of all sizes expand globally without making any significant investments in international financial infrastructure.

What’s the Difference Between International ACH and a Wire Transfer?

International ACH and wire transfers differ in cost, speed, and processing method.

Wire transfers process transactions individually and generally deliver funds within one to two business days, though they sometimes settle on the same day, depending on the specific currencies and banking relationships involved. Wires can reach more countries than ACH payments because of the direct bank-to-bank nature of the transaction. They normally also have higher transaction value limits than ACH transactions—but they tend to be irreversible once completed. These characteristics make them well suited for urgent, high-value transactions. However, their speed comes at a higher cost—international wires usually cost $45 to $65 to send, plus potential “lifting fees” charged by intermediary banks that are subtracted from the payment amount the recipient receives.

By contrast, international ACH processes multiple payments in batches that take one to five business days to complete and at a lower cost than wire transfers—ordinarily less than $10, with no lifting fees. Under certain circumstances, IATs can be reversed. But they are limited to countries with established agreements and, for security purposes, require more detailed information about the parties to the transaction. For businesses engaging in predictable routine transactions like vendor payments or international payroll, international ACH trims costs without sacrificing reliability.

How to Make an International ACH With AP Software

Some recent accounting software automates currency conversion, compliance checks, and payment tracking, making international ACH an efficient way to send and receive international payments. These six steps help companies avoid common errors and processing delays:

- Verify that your accounting software supports international ACH: Confirm that your AP software can process international ACH payments and that the countries and currencies your business needs to reach are part of the ACH system. Some software programs require special modules or bank permission before you send cross-border payments.

- Assemble your bank information and vendor data: Collect necessary information about your vendor recipient and their banking details. Beyond the vendor’s name, address, and other contact information, this should include the recipient’s bank account number—often an “IBAN,” or International Bank Account Number, which is derived from a standardized numbering system developed to identify bank accounts from around the world—and a SWIFT-BIC code to identify the recipient’s bank. Since you may see it either as SWIFT (Society for Worldwide Interbank Financial Telecommunication) or BIC (Bank Identifier Code), it’s important to know that the two are identical—simply distinct labels for the same thing, preferred by different international organizations.

- Enter the data into your accounting software: Input payment details carefully, as errors can prompt rejections or delays. Many AP systems have built-in validation tools that automatically format data to address accepted banking code standards.

- Double-check the data and exchange rate: Review all payment information and confirm that the system’s exchange rate matches current market rates. Some systems allow businesses to lock in rates during initial payment setup to avoid settlement surprises that could cut into expected margins.

- Confirm your payment method and approve the payment: Select international ACH and obtain any necessary internal approvals before releasing funds. The system then documents the payment, including its purpose, for compliance records.

- Monitor and reconcile payment: Software automatically tracks payment status and matches cleared transfers against account statements. Automated reconciliations and system-generated transaction references can help speed up subsequent accounting processes, such as periodic accounting closes or ongoing financial analyses.

Improve Cash Flow and Reduce Processing Costs With NetSuite Payment Management

Manually managing international payments across multiple currencies, vendors, and compliance requirements can slow payment cycles and increase costs, hurting cash flow. NetSuite payment management software simplifies these processes by integrating international payment capabilities directly into the ERP system, automating currency conversions according to real-time exchange rates and generating appropriate compliance documentation for every transaction. NetSuite helps accounting teams manage both domestic and international ACH payments using one unified platform, so staff can send and receive global payments with the same efficiency as local transactions. Real-time payment tracking, approval routing, audit trails, and automated multicurrency account reconciliation further shrink manual accounting requirements, allowing businesses to accelerate their month-end close cycles and strengthen their cash flow.

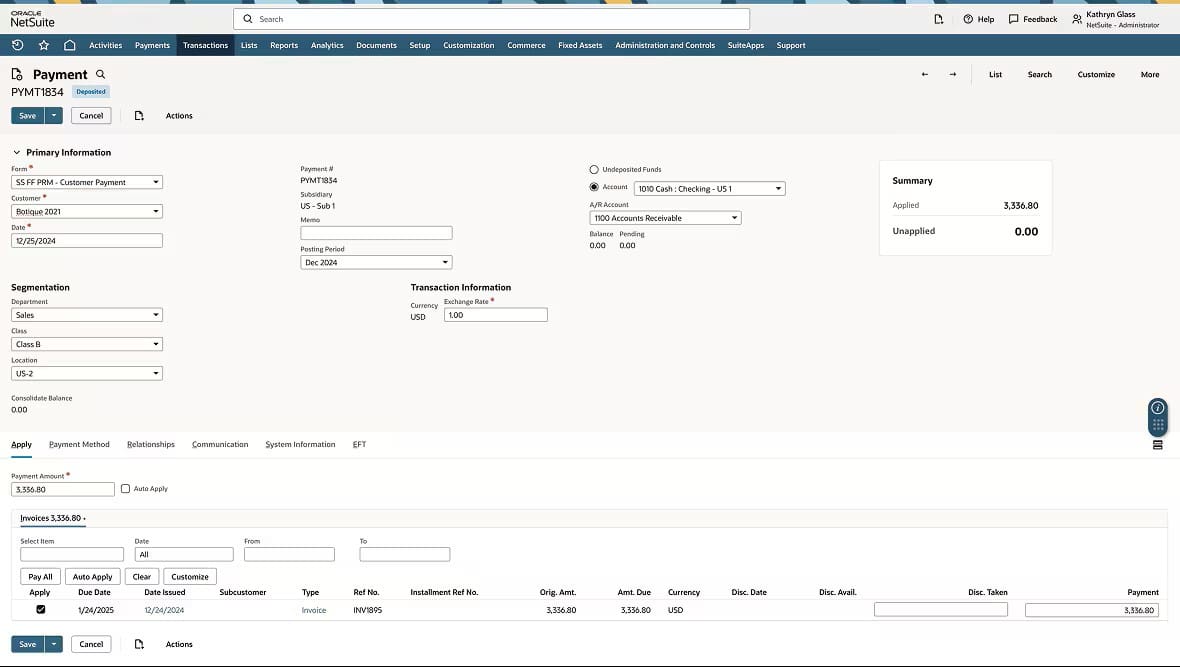

NetSuite’s Payment Processing Dashboard

International ACH replaces expensive, complex wire transfers with efficient electronic transactions that employ processes similar to those used for domestic payments. With its lower transaction costs and predictable settlement times, international ACH makes global commerce accessible to businesses of all sizes. Companies that integrate ACH processes with accounting software can automate currency conversion, simplify compliance requirements, and provide the real-time visibility that helps finance teams optimize cash flow. And, as businesses expand, international ACH remains a scalable, cost-effective way to send and receive payments to and from global business partners.

International ACH FAQs

How does international ACH differ from domestic ACH?

The domestic ACH network transfers funds between accounts in US banks, while international ACH connects the US network to payment systems in other countries. International transfers require additional documentation and transmitted payments generally take longer to process.

How long does it take an international ACH transfer to process?

International ACH payments usually take one to five business days to complete, depending on the banking systems used by the originator and at the destination. Transfers between parties in major markets, such as the US, Europe, and Canada, are often faster, typically taking two to three days.

Is there a fee for international ACH?

Yes, international ACH payments usually cost up to $10 per transaction, varying by bank and country. ACH is often more cost-effective than international wire transfers, which typically cost $45 to $65.

Can ACH be cross-border?

Yes, ACH can process cross-border payments through international ACH transactions, or IATs. These payments connect the US ACH network to similar systems in other countries to allow businesses to send and receive electronic payments internationally.