The U.S. healthcare industry is big business: $4.5 trillion during 2022. To put that in perspective, it’s about 17% of the country’s gross domestic product and a little more than $13,000 per person. The problem is it’s not very profitable. Hospitals and health systems, which represent roughly half of the total, have operating profit margins in the low single digits — or worse. A recent study of 1,300 hospitals showed operating margins of 2% for 2023 through the end of November, while other estimates show that 30% of all hospitals and healthcare systems operate at a loss.

Cost accounting — or, rather, the lack of good cost accounting in healthcare — is a major contributing factor to these bleak numbers. Unlike other industries that have highly evolved cost accounting systems and can precisely analyze their gross profit on products and services, healthcare organizations are challenged when it comes to measuring their costs to provide services. Going forward, providers that can put a successful cost accounting system in place will be in the best position to better understand and manage their costs of care and remain viable. This article can help healthcare financial professionals do so by explaining what cost accounting is, methods for how it works as well as the benefits and challenges, all in the context of the healthcare industry.

What Is Cost Accounting in Healthcare?

Cost accounting is a specific type of accounting that focuses on accumulating, analyzing and controlling the costs incurred to develop a product or deliver a service. It’s a form of managerial accounting, meaning it is intended to help an organization’s internal managers make better-informed business decisions. It can be customized to meet that objective, unlike financial accounting, which must conform to regulatory standards.

The key tasks involved in cost accounting are to organize and track all direct and indirect costs by product or service. The aim is to create visibility that enables business leaders to manage those costs and make price-setting decisions that maximize profitability.

For healthcare businesses, cost accounting starts by organizing direct costs, such as medical supplies used and labor costs for physicians and nurses, to create standard unit costs for each delivered service — from casting a broken limb to delivering a baby. It also requires identifying and applying the indirect costs that support patient care services, such as equipment costs and operating room time. And finally, a full cost-accounting process must allocate to each service a share of the organization’s overhead costs, such as administrative salaries, facility costs and insurance, using a systematic and rational approach. Ideally, cost accounting enables a hospital to say that it costs a specific amount to do an X-ray or surgery, a dental practice to understand its cost to fill a cavity or a nursing home to know the average daily cost of supporting a resident.

Key Takeaways

- Using various costing methods, cost accounting can show a healthcare operator how much it costs to provide a specific procedure or treatment.

- Analyzing service costs and cost drivers can uncover potential savings and opportunities to improve productivity, efficiency and profitability.

- Cost accounting benefits extend to improvements in patient care, workflow and forecasting.

- The massive number of care steps and variations are a primary challenge to cost accounting in healthcare, in addition to resource constraints, resistance to change and regulatory compliance burdens.

- Integrated technology can help make healthcare cost accounting feasible.

Cost Accounting in Healthcare Explained

A healthcare organization must be financially stable to deliver quality care. Cost accounting helps healthcare leaders manage costs and set fees that achieve their desired level of profitability. Armed with data about how much it costs to provide a service, healthcare providers can better negotiate payment levels with insurance companies and other payment providers. Without that information, a disconnect between the price charged for a treatment and the expenses the provider incurs to fulfill it will exist. Cost accounting also gives business leaders visibility into costs and the underlying cost drivers, which helps them better manage resources. Typically, cost-accounting processes also identify areas for cost reduction and increased efficiency, both of which improve profitability.

How Does Healthcare Cost Accounting Work?

To determine the cost per episode of care, healthcare accountants must first establish the true cost of every step involved in that care. This is no small undertaking considering how many steps are involved in each of the many, varied services that healthcare organizations provide. Furthermore, unlike a mass-market manufacturer, healthcare services are customized to fit the needs of each patient’s circumstances, so there are likely to be material variations in cost.

Nonetheless, with an assist from the right accounting software, cost accounting for healthcare can be accomplished. The first step is to identify every possible individual care step, from small services, like administering a bandage, to large services, like complex surgeries. The more complicated services may have dozens of steps. Next, accountants must figure out the cost drivers of each care step and put a process in place to measure and categorize them. This means collecting the direct costs, such as medications and physician visits, as well as tracking and allocating indirect resources. Then they aggregate the costs and volume of similar services to calculate an average, or standard, cost per episode of care.

Beyond these initial calculations, cost accounting also includes regularly comparing these “standard” costs to actual costs and analyzing the cause of any variance, usually via automated reports and dashboards. Depending on the circumstances, the standard costs can be updated as a result of the findings and/or healthcare managers can take action to bring the actual costs back in line with the standards.

Cost Accounting Methods Applied to Healthcare

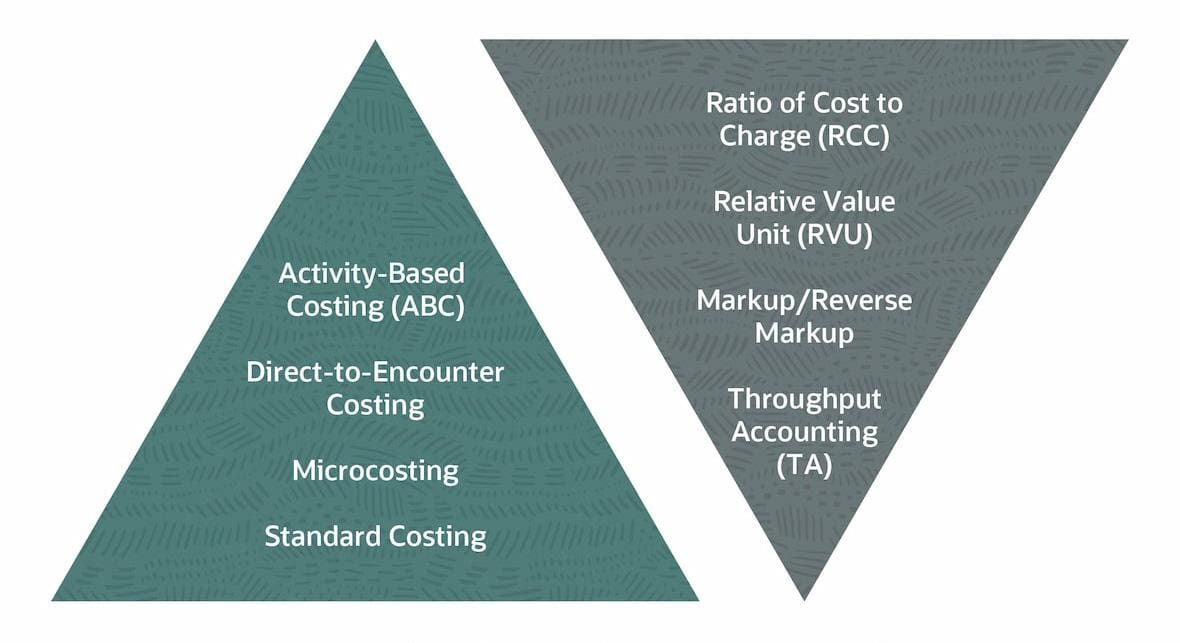

Four standard cost accounting methods that are commonly used in many other industries can also be applied in healthcare. Each method aims to provide a rational and systematic way to determine the true costs of products and services. Selecting the appropriate method for your organization depends on practical concerns, such as availability of data and resources. Additionally, the organization’s overall goals and objectives will suggest the necessary level of granularity. The application of the four methods in healthcare is discussed in this section and then followed by a discussion of more healthcare-focused cost accounting methods.

-

Standard Cost Accounting

As its name implies, the standard cost method uses an average value for each element in the direct cost of a product or service to develop a total standard cost. This means that an average amount of labor, materials and overhead are used to determine the cost of an item, regardless of the actual costs of those components. Standard costing uses historical data and industry benchmarks to calculate the averages. It’s a simple method that is commonly used by organizations that have limited resources available to devote to cost accounting and/or that offer products and services where the actual costs tend to stay fairly consistent.

The advantages of standard costing are its simplicity and ease of use for building healthcare budgets and forecasts. The primary disadvantage is that the standards may not perfectly reflect actual costs. For this reason, organizations that use standard costing regularly analyze variances between standards and actual costs and update the standards accordingly. This analysis can be a particular challenge for healthcare companies because individual patient needs can drive significant cost variances. In addition, consider that frequent updates to standard costs may be necessary to keep up with changing care protocols and new technologies that are common in the healthcare industry.

-

Activity-Based Cost Accounting

Activity-based costing (ABC) is more precise — and more complex — than standard costing. Costs are developed in two parts under this method: Direct costs are specifically matched to products or services and indirect costs are allocated after grouping costs by activity. This could mean, for example, that direct costs, such as labor hours for physicians and nurses, are included in the service costs using actual time and labor-rate information. Indirect costs, however, are collected into “cost pools” based on cross-departmental activities defined by the organization, such as patient registration or diagnostic testing, and then allocated to the service cost. The allocation is made using a predetermined metric, or cost driver, which correlates with how much of the activity is used to provide that service. The appropriate portion of each activity’s indirect costs are added to the direct materials and labor costs to calculate the product’s or service’s total cost.

The main advantages of ABC are that it is more accurate and aligns the costing with how the organization actually works. Both of these advantages can help leaders better understand and manage costs. However, the significant disadvantage lies in the workload of collecting data, analyzing cost drivers and administering this approach across the many products and services offered by healthcare providers.

With the assistance of technology, two versions of ABC have become common for healthcare providers:

- Time-driven activity based costing (TDABC) is a simplified version of ABC that assumes all costs are driven by time. TDABC calculates the total cost for each stage of patient care and then derives a standard per-minute cost for each stage. The total cost for an episode of care is calculated by adding the cost of each stage based on the minutes consumed in that stage. For example, costs for a typical X-ray might be accumulated by applying a per-minute rate for each stage in the process, such as patient time in the waiting room and exam room, the administrative check-in and checkout processes and the time it takes the technician to perform the X-ray and the radiologist to read it. The reliance on time is both the main advantage and disadvantage for TDABC, as it greatly simplifies the calculations but also introduces the need to maintain precise time data.

- Performance-focused activity based costing (PFABC) adds extra steps to traditional ABC. Because those extra steps link performance and cost, PFABC is useful for not only costing products and services, but also for measuring alignment with an organization’s strategic goals. To do this, PFABC starts with the fundamentals of ABC — identifying all the activities involved in patient care, assigning costs to each activity and then deriving a standard cost, such as the cost per patient of each activity. Then PFABC introduces several factors to determine activity usage, rather than the preset drivers in traditional ABC. In healthcare, these factors include consumption data, such as quantity and price of resources consumed and performance measures, such as customer satisfaction, patient outcomes and efficiency metrics. Healthcare providers can use the data from PFABC to make strategic decisions about service offerings, resource allocation and process improvements.

-

Throughput Accounting (TA)

Throughput accounting puts a different spin on cost accounting. Whereas other cost accounting methods aim to identify the full costs per unit produced (or served) so that those costs can be managed or reduced to increase profitability, throughput accounting focuses on raising profit by maximizing volume. Specifically, TA includes in product/service costs only direct material costs that fluctuate based on volume, leaving out most labor costs and all indirect costs to be evaluated separately as either operating costs or investments. In healthcare, throughput is the number of patient services provided over a period of time. The aim of TA is to maximize that throughput. Investments costs, such as spending on diagnostic equipment or inventories of supplies, are evaluated separately based on how they improve the quantity and quality of patient care or reduce bottlenecks in the stream of care to increase throughput. Operating costs is a catch-all that includes all other costs, from salaried staff to facility costs. In TA, operating costs should be minimized unless they increase the quality of patient care or throughput. TA’s advantage is its focus on maximizing revenue by eliminating or reducing bottlenecks that slow down throughput, rather than getting caught up in cost accounting calculations. However, it’s a different mindset for maximizing profitability. If not thoughtfully administered, it could negatively affect patient care as a side effect of the race to increase quantity served.

-

Cost-Volume-Profit (CVP)

Cost-volume-profit is an analytical technique that aims to show the potential impact that changes in one variable of an organization’s operations might have on its revenue and profit. It does this by combining multiple formulas to perform different “what-if” analyses. For example, a CVP analysis can show how changes in patient service volume affect an organization’s total revenue, costs and income. It can also be used to calculate break-even points. CVP analyses rely on the relationship among variable costs, fixed costs and profitability, all of which are calculated using one of the various costing methods. While CVP is not a true, standalone costing method, it is used in conjunction with cost accounting to help manage profitability by guiding pricing of services and evaluating profit thresholds for investments. Its main disadvantage is that it relies on estimates and assumptions, which may or may not be valid in the dynamic world of healthcare.

Healthcare-First Costing Methods

Several costing methods have been developed primarily for healthcare providers to help them more accurately determine the cost of a patient service, though they have since been adapted for use in other industries. These techniques are broadly categorized as either “top down” or “bottom up” approaches. Top-down approaches are quick and easy because they use ratios and relationships to estimate costs, but they lack precision. Bottom-up approaches involve creating estimates or researching actual costs for every part of a service and aggregating them to create a total service cost. Bottom-up costing tends to be more accurate but demands significantly more effort. Six costing methods commonly used in the healthcare industry are explained below.

-

Ratio of Cost to Charge (RCC)

One of the most popular top-down costing approaches in the healthcare industry is the ratio of cost to charge. The RCC creates a ratio of overall departmental costs to the aggregate revenue charged to patients. This ratio is then used to “back into” estimated procedure-level costs. For example, if the obstetrics department has a total annual cost of $40 million and bills $100 million in charges to patients each year, the ratio is $40/$100, or 40%. Using this ratio, the cost of a specific obstetric procedure with a $15,000 charge would be estimated at $6,000 ($15,000 x 40%). This is a quick way to estimate costs and can be used by management to directionally monitor the profitability of the department. However, individual procedure costs may not be accurate because RCC relies on homogenous averages. Additionally, using charges as the independent variable may be distortive, since the rates charged for a procedure are complicated by many external factors, such as insurance company contracts.

-

Relative Value Unit (RVU)

Relative value unit is another top-down costing approach. RVUs are standardized measures meant to objectively represent the amount of resources, including physician time, staff time, equipment and liability insurance, used for a particular procedure. They’re set by the Specialty Society Relative Value Scale Update Committee of the American Medical Association (AMA). More RVUs associated with a procedure indicate greater amounts of resources and work involved in performing the procedure. RVUs can be used for cost accounting as a way to estimate the cost involved for a procedure by translating each RVU into a dollar value. A simplified example of how to develop a cost per RVU would be to divide total organizational expenses for a period by the total number of RVUs for all the procedures performed during that period. The cost per RVU could be multiplied by the number of RVUs for a particular procedure to estimate that procedure’s total cost.

One advantage of this technique is that RVUs are likely to be familiar metrics to industry insiders since they are often part of government and insurance payer contracts. Another advantage is the ease of use and relative objectivity that creates higher costs for more complex and intense procedures. However, it is important to remember that RVUs are only estimates and may not reflect the actual efforts that drive a given provider’s costs due to local variations in methods, patient populations and organizational characteristics.

-

Microcosting

Microcosting is a bottom-up technique for developing cost estimates. Microcosting uses actual cost information from an organization’s general ledger to determine a cost per unit for every resource used in every step of a patient’s care. It requires collecting data on the quantity of resources actually used for each procedure. The cost for each patient is calculated as the product of these two factors. Microcosting is one of the most accurate costing techniques, but it is extremely tedious and resource-intensive. It requires significant integration of financial data with clinical data.

-

Markup

Markup is a top-down approach that is a familiar term in many industries, representing the difference between the selling price of a product and its cost. In the healthcare industry, markup is the amount charged to patients or insurers over the cost to perform the procedure. Markup is typically referenced as a percentage of cost, so the difference between the amount charged and the cost is then divided by the cost. For example, a knee replacement surgery that costs $30,000 and is charged to the patient at $80,000 has a 167% markup [($80,000 - $30,000)/$30,000]. Markup is commonly used to set pricing, or billing, levels. The cost is the known value (or estimated) and the billing value is calculated using the markup.

-

Reverse Markup

Related to markup, reverse markup is a top-down approach for determining the cost of a procedure. It is useful for converting a selling price, or the amount charged to patients and other payers, into an estimated cost of the procedure. In reverse markup, the known (or estimated) value is the amount charged to the patient and the cost is reverse-engineered using the markup percentage. While reverse markup only calculates an estimated cost, it is useful for setting target costs based on a desired markup. If actual costs exceed the target cost, the markup, or profit margin, will be lower than anticipated. This is a simple, helpful way to monitor costs and identify potential problems. However, it requires the markup percentages to be known or estimated.

-

Direct-to-Encounter Costing

Direct-to-encounter costing is the most detailed method of costing in the healthcare industry because it is performed on a patient-by-patient basis. This bottom-up approach accumulates all the individual direct resources used for a specific patient’s particular encounter, such as a visit to the emergency room, an annual checkup with a dentist or a telehealth counseling session. Its goal is to identify and attribute as many direct costs to the specific encounter as possible, such as physician or specialist time and any medications, services and supplies consumed. This costing approach is similar to standard costing, except that standard costing aggregates average costs while direct-to-encounter costing tracks specific costs. Direct-to-encounter costing is the most accurate but also demands the most effort. Additionally, in order to calculate the total true cost of an encounter, any indirect costs must be allocated separately using another method.

Bottom-Up vs. Top-Down Costing Methods

What Are the Benefits of Cost Accounting in Healthcare?

The healthcare industry strives to provide quality care for its patients, and cost accounting provides significant benefits that help to achieve that goal. Better and more granular understanding of provider finances helps the organization maximize its duty to patients, employees and owners. Eight of the most common benefits of cost accounting in healthcare are explored here.

-

Make better-informed decisions about resource allocation and pricing.

Leaders in healthcare organizations are challenged by regulatory changes, price pressure and increased competition. Cost accounting gives visibility into how resources are being used, which can help to identify the areas that are working well — and those that aren’t. Whether by controlling costs or adjusting prices, maximizing profitability helps an organization stay viable and competitive.

-

Forecast costs and revenues, leading to better financial planning and control.

Cost accounting is especially important for developing financial forecasts. Using the more accurate and complete expense estimates that cost accounting provides makes the forecasts more realistic, which is essential for managing expected cash flow and profitability. More realistic forecasts put the organization in a better position to make investments, hire resources, set up credit facilities or downsize, depending on what circumstances require.

-

Analyze performance by comparing actual costs with budgeted costs.

It’s vital for a healthcare system to get the most productivity from its resources while still providing high-quality patient care. Cost accounting is an objective approach for setting cost targets and capturing actual results. Establishing a cost accounting process provides a basis to analyze performance across time periods, departments and providers and against industry benchmarks.

-

Set prices that accurately reflect the cost of services provided.

Understanding the true cost of services is central to setting prices or negotiating contracts with payers. Without full knowledge of actual costs — direct and indirect — the organization is at risk of setting prices too low and even possibly losing money on services.

-

Increase transparency with patients, insurers and stakeholders.

Cost accounting helps a healthcare organization substantiate its costs to provide services. Such documentation helps payers, whether an individual patient or large insurer, better understand the value they are receiving and put the charges into context. It can also assist with regulatory compliance and auditability.

-

Understand the financial risks associated with different services and treatments.

At a macro level, the cost data from cost accounting helps health system leaders be more sensitive to external factors that might create financial risks to their organizations. For example, significant changes to reimbursement rates of a particular procedure from government or private insurers might cause that procedure to become a financial drain. Arming physicians with cost data acquired via robust cost accounting systems can influence their decisions on the cost/benefit of one care path versus another, driving up patient value.

-

Understand the cost-effectiveness of different treatments.

Analyzing cost accounting information can provide insights into clinical treatment variations that increase costs without enhancing patient outcomes. For example, cost variances for the same procedures performed in different locations or by different providers might represent an opportunity for clinicians to collaborate and improve processes for everyone.

-

Identify areas where costs can be reduced without compromising patient care.

Cost accounting shows the amount of resources spent on a particular service, as well as the drivers of those costs. This level of granularity helps identify opportunities for raising efficiency, reducing waste and adjusting workflows, all of which can increase profitability without lowering care quality.

What Are the Challenges of Healthcare Cost Accounting?

The healthcare industry has made progress in adopting cost accounting, but it is still far from ubiquitous due to the challenges involved, starting with the large accounting workload, complexity of cost data and difficulties of tracking that data accurately and keeping it up to date. Also, the range of healthcare organizations is particularly diverse, including hospitals, physician practices, laboratories, urgent care facilities and physical therapists of varying sizes and with different levels of resources and sophistication. For many of these providers, cost accounting has been out of reach due to the resources required. But improving technology, especially integrated financial and clinical software, can help providers catch up, upgrade and overcome the following nine common challenges.

-

Data Complexity

For 2024, there are 11,163 Current Procedural Terminology (CPT) codes used to identify medical procedures in the U.S. What’s more, according to the American Medical Association, the CPT “keeps evolving to match the rapid pace of innovation in medical science and health technology.” For example, the 2024 CPT set includes 230 additions, 49 deletions and 70 revisions. Within each CPT may be multiple care steps, or bundled services, like X-raying and casting a broken bone. Each care step must be costed individually to properly estimate a patient’s encounter costs and to account for individualized patient care. Developing a cost for every step of care involves significant volume and complexity of data.

-

Indirect Costs

To calculate the true cost of a product or service, it’s necessary to include both direct and indirect costs. Unlike direct costs, which are more straightforward to attribute, indirect costs — such as medical equipment maintenance and overhead costs (administrative staff, utilities, maintenance and many others) — present two main challenges. First, these costs need to be tracked and collected in a meaningful way. Second, they need to be allocated to every care step in a reasonable and consistent way. Both of these challenges are difficult to administer and would be extremely labor-intensive if done manually. Even good, automated accounting software tailored to a healthcare organization’s needs would require meticulous setup, configuration and continual updating to be effective at collecting indirect cost data and allocating the costs appropriately.

-

Lack of Standardization

While understanding the costs of products and services helps inform decision-making at the administrative level, it often doesn’t translate to the patient level. Clinicians must make decisions based on the individual needs of their patients, who may have a variety of complicating factors. This lack of standardization at the patient level can cause distortions in the standard costs per episode of care. Collectively, these variations can undermine the accuracy of standard costs, as well as forecasts and the budgets that rely on them.

-

Updating Cost Data

Because healthcare is always changing and advancing, it’s essential that cost data be continually updated. New methods, medications and research create a constant need to revise cost data in conjunction with clinical expertise. In addition, routine changes in vendor pricing from a wide array of suppliers need to be captured from disparate systems, such as supply chain management and inventory systems. Add to that mix changing payroll data, all of which compound the challenge of maintaining accurate, up-to-date cost data.

-

Resistance to Change

Realizing the benefits of a robust cost accounting approach may require a shift in organizational culture to increase collaboration between financial and healthcare professionals. Overcoming resistance to change can be a significant, thorny challenge, especially as clinical processes are questioned for potential reform and cost information may be distrusted, requiring buy-in from key stakeholders. A disciplined change management program would likely be necessary to complement a healthcare system’s adoption of cost accounting.

-

Lack of Transparency

U.S. healthcare providers currently have little or no incentive to invest in the people, processes and technology required for cost accounting because the majority of their payments come from insurers. That includes federal and state governments, which set their prices through contract negotiations that are largely disconnected from the cost of delivering services. Because this process does not reward cost transparency, healthcare providers have hesitated to dedicate significant resources toward developing and maintaining cost accounting systems. Consequently, providers lack visibility into their own costs, which makes it challenging to monitor, control or reduce those costs.

-

Regulatory Compliance

The plethora of regulatory guidelines, policies and reporting requirements from multiple agencies is a daunting burden for healthcare organizations, in general — and it multiplies the complexity of cost accounting in healthcare. For example, an organization needs to make sure that its method of allocating indirect costs makes sense and is useful for business analysis, but that it also adheres to various regulatory provisions, such as Medicare’s cost reporting rules. Cost accounting systems must also have robust controls for data privacy, security and encryption in order to meet regulatory obligations for patient health information and electronic data records.

-

Resource Constraints

Because healthcare providers are under ever-increasing pressure to deliver higher quality for lower cost, they often deal with significant resource constraints for nonpatient-facing activities, such as cost accounting. These constraints apply to both human resources and technology. Overcoming inadequate or obsolete financial software, overstretched accounting teams and underskilled staff requires investments in modern technology, including financial software, enterprise resource planning (ERP) systems, business intelligence and analytics tools; recruiting better talent; and training/educating that talent. The resources to make these investments are, sometimes, simply unavailable.

-

Patient Complexity

Cost accounting works especially well in industries that create standardized, inventoriable products, such as manufacturing. But healthcare patients aren’t widgets — they have individual medical histories and distinct treatment needs. This broad diversity causes virtually every patient encounter to be unique, creating inherent variances between the actual cost and any standard cost developed through cost accounting. The more sophisticated cost accounting methods do a better job at overcoming this challenge, but that comes at the expense of being more complex and requiring more robust processes. In other words, the challenge can be addressed, but it costs a lot to do so.

8 Ways to Improve Hospital Cost Accounting Approaches

Cost accounting requires commitment to rigorous processes, but there are ways to make the initial implementation smoother and ongoing maintenance easier. Key among them is selecting the right technology that reflects the circumstances of the organization, without overcomplicating the process. In addition, consider the following eight ways to improve your organization’s cost accounting process.

- Service-line planning: Service lines — think of cardiology,

neurology,

oncology, maternity and many others — are a way to look at a hospital’s operations

through the lens of a patient’s care journey, rather than by unrelated departments.

Attributing revenue and costs to each multidisciplinary service line can help

leaders

understand how each service line impacts profitability, opportunities to increase

efficiency and which lines should be expanded or reduced.

- Provider modeling: In healthcare, provider modeling uses analytical

methods and tools to understand, predict and optimize the deployment of providers,

such

as physicians, nurses and specialists. Modeling provider behavior can help make cost

accounting more accurate. Predicting treatment approaches and the supplies,

diagnostic

tests and specialists that are involved helps ensure that all the costs of a

treatment

are captured and properly attributed.

- Revenue analytics: Examining and analyzing revenue can improve cost

accounting in several ways. First, analyzing reimbursement amounts can show whether

payers rejected any billed charges so that the costs related to those unpaid charges

can

be reevaluated. Conversely, comparing accumulated costs to revenue billed can

uncover

missed or incorrectly billed charges. Second, revenue analytics are necessary for

various costing approaches, such as RCC and reverse markup. Third, revenue analytics

highlight trends in payer behavior and patient services and volume, which can be

correlated with changes in costs.

- Payer negotiations and rate setting: The rates established during

payer

negotiations serve as a benchmark for costs. Ideally, the rates more than cover the

costs and yield profit. However, understanding the reimbursement parameters can help

leaders manage the cost of care within those limits. Cost accounting shows whether

that

has been achieved successfully, alerts leaders to take action if it hasn’t and can

inform future negotiations.

- Strategic pricing: As the healthcare industry becomes more

competitive,

organizations will be tasked with setting strategic pricing for their services.

Certain

service lines may be seen as high-value rainmakers, while others are necessary loss

makers. Strategic pricing helps ensure that revenue is maximized and helps leaders

prioritize resource allocation. Cost accounting helps monitor that everything is

going

according to plan.

- Variation analysis: Cost accounting can uncover variations in the

costs

for providing the same service. The underlying variations in clinical procedures and

resource utilization that drive the cost variations can highlight areas for

continuing

process improvement and potential cost savings.

- Performance management: Cost accounting sets standards for the cost

of

care that can be used to measure performance. When compared to actual costs,

physicians

can be held accountable for the financial performance of their service line,

department

or practice.

- Internal and external comparative analytics: Implementing a cost accounting process establishes cost benchmarks that can be used for internal and external comparative analysis. For example, one physician’s patients may consistently have longer rehab stays than another’s. Bringing the comparison to light and examining the cause can often lead to cost savings and/or better patient outcomes.

Impact of Cost Accounting on Healthcare Pricing

Cost accounting has not traditionally been a must-have for healthcare providers, but that may be changing. Historically, healthcare prices have been set at agreed-upon reimbursements during contract negotiations with payers — the government and private insurers. Costs to provide the services were not typically considered, so providers weren’t motivated to develop effective cost accounting systems. However, two dynamics are in the process of changing that, both of which increase the need for better cost accounting.

First, healthcare prices have continued to a rapid ascent even as patients are having to pay higher health insurance premiums and coinsurance, intensifying patients’ price sensitivity. This pushes healthcare organizations to think of their pricing in the context of competitors; they may need to decide whether to be the low- or high-priced provider, taking into account the impact that decision may have on volume. Such decisions require accurate, timely cost information.

The second dynamic is a shift by payers, such as Medicare, toward value-based pricing for healthcare services. That means including factors such as quality of service, patient satisfaction, performance and outcomes when calculating the price they are willing to pay for services. Healthcare organizations must be able to support the quality of care delivered together with the costs in order to justify their value to payers. This requires comprehensive costing methods that can be connected to other performance metrics, as well as the ability to measure, monitor and act on all the data. Customarily, requirements like these point to an integrated ERP solution.

NetSuite: Your Modern Healthcare Accounting Solution

Cost accounting can be an especially complex and detailed process for the healthcare industry. Historically, the costs of these processes outweighed their benefits, so many healthcare providers opted out of pursuing them. However, the benefits of modern accounting software that can easily integrate with electronic medical records, such as NetSuite’s cloud-based business management suite, make cost accounting a possibility for many healthcare providers. The financial management software in the suite provides a flexible framework to set up cost categories in a way that makes sense for organizations of all sizes and specialties.

When combined with the capabilities of a full ERP system, clinical and financial data collection and cost calculations can be done automatically, eliminating the time and effort demanded by manual cost accounting and supporting the massive scale needed to accurately cost thousands of potential care steps. Essential reporting tools, including customized dashboards and reporting, provide the information needed to inform business decisions with real-time information. NetSuite’s solution helps healthcare providers identify potential cost savings and opportunities, so they remain viable and competitive as the industry pushes for lower costs and value-driven pricing.

Though they deal with matters of life and death, healthcare providers aren’t immune from the natural laws of business. They must keep close tabs on the financial health of their operations by understanding their revenue and expenses and maximizing their resources. Cost accounting is the way providers can measure and control the costs of delivering patient care so that they can best serve their patients, employees and owners, while making investments for the future. There are several costing methods to select from, but even the most straightforward requires robust, tailored software to be manageable. With the right cost accounting technology and the eight best practices discussed above, healthcare providers can address the challenge of ever-escalating healthcare costs and be in the best position to meet the rising demand for value-based pricing.

Healthcare Cost Accounting FAQs

What are examples of cost accounting?

Cost accounting is a type of managerial accounting that aims to capture the total costs to produce a product or deliver a service. In the manufacturing industry, cost accountants collect the costs of the raw materials and labor directly used to produce an item, as well as an allocation of indirect costs and overhead for the company. In the healthcare industry, cost accounting calculates the cost of providing a service, like taking an X-ray, by accumulating the cost of the X-ray technician, the radiologist’s time, the cost of supplies and an estimated share of the cost of facilities and equipment.

What is an example of cost allocation in healthcare?

While direct costs, such as raw materials and labor, are specifically matched to products or services, indirect costs tend to be aggregated and allocated. Examples of indirect costs in healthcare include patient registration or pharmacy services. The accumulated costs of the department are allocated using a reasonable and systematic metric or driver — perhaps the number of patients registered in a specific time period. The allocation is then added to the direct costs to calculate a product’s or service’s total cost.

How can healthcare cost accounting support value-based care models?

Value is defined as quality at a given price. Cost accounting supports the price part of the value equation. When linked to quality metrics, healthcare providers can better justify a service’s value to the payers.

How does cost accounting impact pricing in healthcare?

Historically, there was a disconnect between cost accounting and price-setting in the healthcare industry. Instead, prices were set in contract negotiations with payers. However, this type of pricing model is already beginning to move toward competitive, value-based pricing, which will require healthcare organizations to provide complete cost data.

What is considered cost accounting?

Cost accounting is a form of managerial accounting, meaning that it is used for internal purposes only. Cost accounting is the calculation of the fixed and variable costs that go into producing a product or delivering a service. The costs include raw materials, direct labor and allocated shares of indirect and overhead costs. Cost accounting helps businesses control costs, set customer pricing and manage the profitability of their product or service offering mix.