In short:

- Late payments and long cash-conversion cycles can decimate your ability to pursue ambitious growth opportunities — yet many business owners hesitate to speak up for fear of alienating customers

- A strategic approach to invoicing can improve the customer experience and reduce your days sales outstanding ratio

- Here’s how to optimize your billing processes using technology, thoughtful invoice composition, incentives and tactical timing

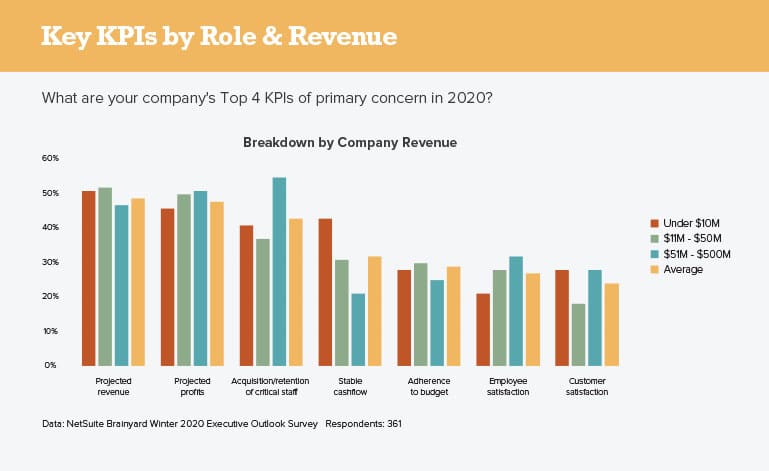

Late payments are not simply an annoyance. In fact, UK-based lender MarketFinance says poor cash flow is behind some 90% of business failures. Even if things aren’t that dire, slow payments directly affect profitability and your ability to grow. And getting paid on time is particularly worrisome for small-to-midsize businesses, our new Brainyard Winter 2020 survey shows. Among companies with under $10 million in revenue, a stable cash flow is a KPI that CFOs are watching closely, along with projected profits and revenue.

Bottom line, you can’t pay employees or suppliers with IOUs. But invoicing clients can feel like walking a tightrope: How can we pursue payment while still putting the customer first?

A hesitation to aggressively pursue payment is understandable — reminding customers is time-consuming, and there is a business relationship at stake. However, effective invoicing is possible and should be part of your growth strategy.

Here are four keys to shortening your cash-conversion cycle.

Embrace Technology – But Don’t Lose the Human Touch

Did you know that 70% of online shoppers abandon their carts at checkout? Reasons include too few available payment methods, a clunky or glitchy system and extra fees being added on. Big ecommerce sites spend a lot of money making their checkout processes as frictionless as possible to ensure shoppers convert to buyers.

Why are we talking about online shopping? Because the importance of payment convenience isn’t limited to the Etsys and Ebays of the world. Technology has officially reached accounts receivable; whether or not businesses are taking advantage is the question.

“Making the payment process as accessible and user-friendly as possible can help shorten your payment cycle,” says Ollie Smith, CEO of Card Accounts, an online guide to the payment processing industry. “By accepting credit card payments, creating a payment portal on your website and encouraging direct debit payments, you can create a shorter and more efficient payment cycle. These methods can also potentially eliminate late payments.”

Failure to automate your billing processes is a missed efficiency for both your company and your clients.

For customers, an automated system allows invoices and reminders to be sent on time and with a regular, predictable frequency. An efficient billing process will also decrease the likelihood of errors, which can extend the payment cycle as well as breed client mistrust. And you can easily generate reports to help customers with their record-keeping.

Internally, automation decreases overhead because your team can stop doing tedious and time-consuming invoicing activities manually. This is especially helpful in cases of complex monetization models, where simplification and standardization are key. For example, many SaaS companies utilize a flexible consumption model(opens in new tab) to bill by usage instead of a flat ownership rate. That requires a great deal of agility in the invoicing process.

Financials also become more transparent overall. Automated systems automatically create thorough records, which can provide valuable documentation for customer insights, tax purposes and, if necessary, legal reasons. Days sales outstanding ratios will improve.

However, Peter Greco, CPA, founder & chief tax strategist at CSI Group, advises against a complete reliance on technology.

“You still need the human touch,” says Greco. “Late or delinquent, we do call the client to see if there is any issue.”

While an intuitive billing process reflects well on your business, relationships are still integral. A phone call, perhaps from the relevant salesperson, conveys both empathy and urgency and can sort out miscommunications. It’s possible the client decision-maker didn’t realize bills weren’t being paid.

Pay Attention to Invoice Composition

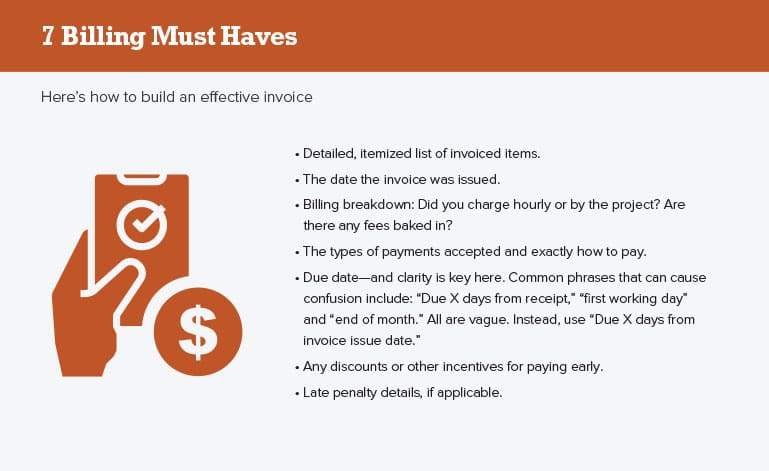

At a bare minimum, an invoice needs the itemized transaction amount. However, failing to include more does your cash cycle a disservice.

The benefits of effective invoice composition are two-fold. First, an informative and organized bill increases your chances of getting paid promptly. Secondly, any communication from your business is marketing collateral. A well-designed invoice can emphasize your company’s professionalism and brand while setting you apart from competitors.

To take full advantage of these benefits, invoices should include the must-haves below as well as a logo and other components of your brand, such as your address and contact information, signature font and colors and slogans or taglines.

And don’t forget your manners! For big purchases or new customers, a handwritten “thank you” from the account executive takes only a few moments but really stands out. At minimum, a simple “please” and “thank you for your business” go a long way.

As you ponder whom to send your beautifully crafted invoices to, keep in mind that listing several people on the bill greatly decreases your chance of getting paid. Everyone figures someone else will handle it. Best practice is to identify a contact person within the organization and direct all communications to that individual.

Use the Carrot and the Stick

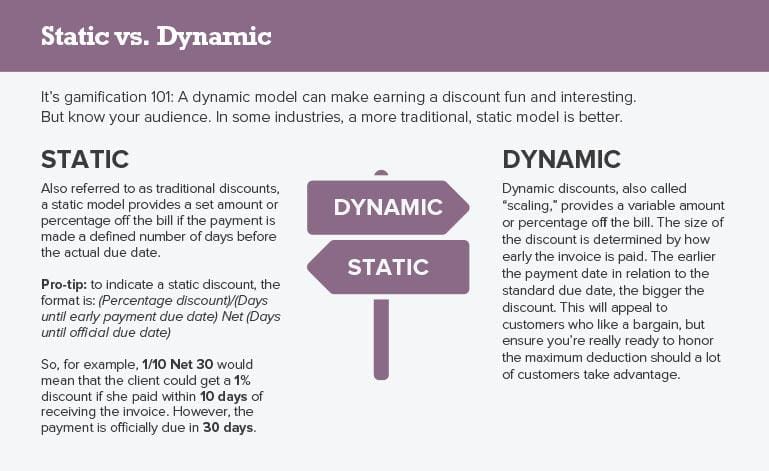

Don’t underestimate the value of incentives — perks make the world go ’round and get you paid. Creative positive reinforcement allows your company to be more proactive than reactive in your invoicing approach, thereby increasing efficiency. Additionally, positive reinforcement with rewards will, ideally, solidify a positive pattern in your client’s paying habits.

There’s a reason gamification is a growing trend for all-size businesses.

Rewards for positive payment behavior could be a discount on the current invoice or for future services, a free extra service or product or a trigger to send a gift or coupon.

Keep in mind, though, that while fast payments free up cash, they come with a cost for your company. Prior to implementing, consider these questions:

- Can you absorb the cost of the perk? If you are offering a discount, gift or free service, that will be deducted straight from your profits. What if most customers take advantage? For those with tighter margins, it may not be a plausible option.

- Are they necessary? If clients are already paying the full price on time, offering incentives can be an unneeded expense.

- Can we handle the cash flow unpredictability? Early payment incentives introduce variability into the payment processing cycle. You’re no longer relying on a set date or amount.

Sometimes, incentives aren’t viable or simply aren’t working for your company. When that’s the case, don’t shy away from late fees. Yes, it’s a sensitive point, for smaller firms especially. No one wants to dampen a good working relationship. However, fees are an effective, and sometimes necessary, strategy to enforce timely payments. They can also serve as a bargaining chip: “Pay us this amount today and we will cancel the late fee.”

You may feel apprehensive about turning to negative reinforcement – and for good reason. Just like positive incentives, late fees have a caveat. Prior to enforcing them, ask three questions:

- Is the client aware of the late fee? Ensure that your late fee policy is clearly listed on the invoice and any other contracts. A late fee without warning will not go over well.

- Has the client been delinquent before? If this is the first time, a gentle reminder will go further than negative reinforcement.

- Is there a reason why the payment is late? Oftentimes, there is more to a late payment that meets the eye. Greco stresses the importance of communication. There could be a situation on the client side, like your contact leaving or a major business disruption. Working with them will strengthen the relationship. Conversely, there are instances where a client is holding back payment because she felt she hasn’t received the expected level of product or service. In those cases, the last thing you want to do is slap on a late fee.

Remember, it can take years to build a strong client relationship — and seconds to tear it down.

Timing is Everything – But Still Subjective

There are plenty of studies examining the timing behind effective invoicing. One says that the best time to bill is over the weekend. Another found that Tuesday is ideal. And still another determined that Monday is the best. That is just when it comes to analyzing the day of the week. The question of how many days to allow for payment brings an equally convoluted set of opinions.

The right answer? There isn’t one.

In business, we love a good best practice that’s supported by data. However, the question of successful invoice timing is shrouded in ambiguity, for good reason: Every company and industry has its own unique processes. One point of consensus though? Payment expectations are getting shorter due to technologies that allow for speedy transactions. Whereas a required payment under 30 days would’ve been unheard of several years ago, 21-, 14- and even 7-day timeframes are now commonplace.

“We never agree to Net 30 or longer,” said Rob Black, CISSP, founder and managing principal of Fractional CISO, “We are not a financial institution.”

That stringency may or may not be possible for your business — or acceptable to all your clients. For instance, very-large companies often have “take-them-or-leave-them” payable terms set up to accommodate many layers of approval. In those cases, you need to determine whether the revenue is such that you can afford to take on that business.

It’s a fine line. Work with your clients to set agreeable payment terms that accommodate their billing schedules and your need for expeditious processing. In cases where the client has a good track record, it may be possible to set “better” credit terms that still work for both parties. However, keep in mind that longer payment cycles make it more difficult to maintain adequate cash flow. Customer happiness, while paramount most of the time, does not outrank the need for access to capital to fund business operations.

Cash really is king. Without it, companies cannot meet their day-to-day operational expenses, let alone pursue opportunities to grow. Optimizing your billing processes to shorten the cash conversion cycle allows for more capital, a better customer experience and a more efficient operation overall.

Remember, being shy about customer payment doesn’t just lengthen the payment processing cycle — it puts your business at risk.

Megan O’Brien is Brainyard’s finance & business editor, covering the latest trends in strategy for CFOs. She has written extensively on executive topics as a former content creator for Deloitte’s C-suite programs. Reach Megan here.