Optimizing a company’s accounts receivable (AR) process makes good business sense — after all, uncollected sales mean lost revenue and profit. AR automation software is a game-changer when it comes to getting paid more quickly, and it also makes the AR process more accurate and more customer friendly. But not every software solution is right for every business, so it’s important to choose wisely. Once the business has chosen its AR software, the following 14 best practices for accounts receivable automation can help it get the most out of the implementation.

What Is AR Automation?

There are many variations of AR automation, all aimed at replacing the manual elements of the AR process. Some AR software solutions can automate only certain steps in the AR process, such as digitizing invoices or automating payment acknowledgements. Other AR solutions automate the entire end-to-end process, from order entry through cash application, complete with robust management reporting. Industry research shows that more comprehensive AR automation yields bigger increases in efficiency and accuracy, improved customer service, faster cash conversion and more insightful data for management analysis — all while saving money.

Key Takeaways

- AR automation reduces the time it takes to convert sales made on credit into cash collected from the customer.

- Not all automated AR solutions can deliver the same level of efficiency and cost savings.

- Consider these 14 best practices when automating accounts receivable to get the most out of the solution selected.

14 Key AR Automation Best Practices

The goal of any AR automation project is to enhance the process so that cash comes in faster, customers feel better about doing business with the company, and more work is accomplished by fewer people. But how to accomplish those objectives usually looks different in different companies. That’s why it’s important to have the right people from your company involved in the conversion to AR automation, or in the extension of an AR automation system. The following 14 best practices can help any company shape the way it goes about automating AR.

-

Envision the future state.

This involves identifying the company’s specific AR automation goals and, just as importantly, the way those goals will be measured. It’s helpful to agree on a set of metrics that will quantitatively evaluate progress and measure performance, along with a way to capture the necessary information. Envisioning the future state can help prioritize the features that are most important to the business, which, in turn, helps the team stay focused and avoid being distracted by nice-to-have features that might not have the biggest payoff.

-

Document the current state.

One of the first steps in adopting AR automation is to get the AR team together to thoroughly document the current process, showing all the relevant workflows as they currently exist and describing any pain points and bottlenecks. Doing so helps identify the gaps between the current and future envisioned states. Additionally, this may be a good time to review standard operating policies and procedures, highlighting potential improvements that will become possible once AR automation is implemented.

-

Get your accounting department involved.

Assembling the right team of people to evaluate AR automation is critical, and the earlier AR system users are included the smoother the implementation is likely to go. The accounting staff who are currently responsible for the AR process have invaluable, detailed knowledge that is important to heed. In addition, it’s important to get buy-in before deployment, since they will eventually be the primary users.

-

Establish a key stakeholder for migration.

It’s a best practice to get high level executive buy-in for an AR automation project, especially since the changes are likely to be apparent to the company’s customers. For the same reason, consider adding cross-functional members to the team, such as sales or customer service personnel. Besides an executive sponsor, every project needs an internal accounting department sponsor or champion with responsibility for the project’s success.

-

Ensure new AR tools integrate with existing technology.

More benefits can be achieved with an end-to-end AR automation solution that integrates with other systems, such as order management, general ledger, cash management and inventory management. Including representatives from IT on the team helps identify integration opportunities and challenges.

-

Move to full automation incrementally.

Migrating processes over time rather than all at once is best for both the AR staff and the company’s customers. Wholesale changes can be overwhelming for the internal staff and create chaos with customers, all of which can quickly become problematic for a company’s cash flow. Paced automation helps staff learn and become comfortable with changes before layering on additional change. At the same time, it’s important to keep the invoice review and payment process easy and uncomplicated for customers. Some companies have success making changes incrementally, by software module, or by starting with digitizing invoices (for instance) before introducing consolidated billing, or by using a small number of customers as pilots.

-

Establish Key Performance Indicators (KPIs).

KPIs are useful tools for monitoring performance and can serve as guideposts to measure progress when automating AR. Determine which measures will be used, set benchmarks for each KPI and establish how often they will be reviewed, based on the company’s priorities. For example, if a goal is to reduce the time it takes to collect cash on credit sales, then Days Sales Outstanding (DSO) and the related AR turnover and Cash Conversion Cycle might be important KPIs to track. If reducing the amount of AR write-offs is a priority, then KPIs like Current AR Ratio or Average Days Delinquent can help. And if increasing efficiency in the AR department is important, then Collections Effectiveness Index or customer invoice volume per AR employee might be helpful. There are many other AR-related KPIs and metrics that can be used, based on a company’s goals.

-

Communicate with customers and clients about the switch.

AR automation may change a company’s customer experience, so it’s a best practice to communicate any customer-facing changes in advance. Examples include switching from paper invoices to digital invoices, redesigning digital invoices so that they look different, or changing the data in each field. Let customers know that AR automation may bring additional payment options, and alert customers that they’ll receive more (or different) automated communications for things like payment reminders or payment receipts.

-

Outline and set up your workflows.

After documenting current-state workflows (see no. 2 above), take the time to outline necessary and desired changes based on the chosen AR automation solution. Since AR automation takes over mundane, repetitive tasks, labor should be freed up. Thoughtfully setting up new workflows may provide an opportunity to redeploy efforts to different or new tasks, beyond simply capturing potential cost savings. For example, automated dunning notes might allow collections personnel to focus on improvement to the credit application process, such as the kind of analyses required for determining if/how much credit to extend to a customer before sales are made.

-

Set up dashboards.

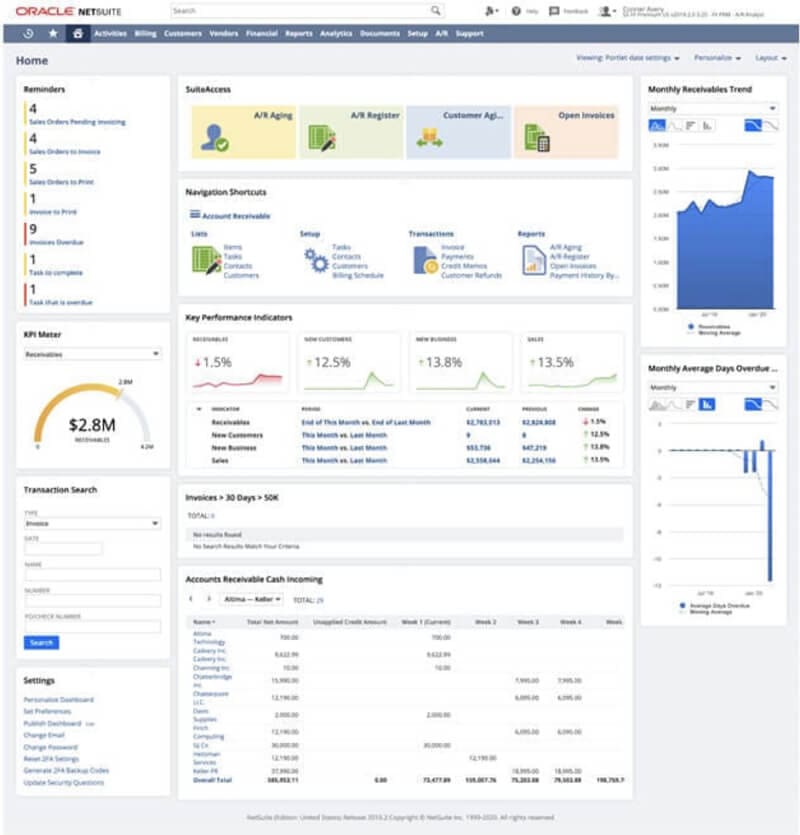

AR dashboards are automated, graphical displays of summary information used to keep tabs on a company’s customer balances and receivable activity. A typical AR dashboard might include KPIs, summary customer aging reports, top customer balances and department productivity measures. Role based AR dashboards can be customized to provide continuous information that is pertinent to an individual’s job responsibilities. Since these dashboards are most useful when they contain real-time data and the ability to drill down for more details, they should be incorporated into the AR automation plan from the beginning.

This image of the NetSuite AR dashboard shows important information, such as your organization’s KPIs and AR cash incoming. -

Track those first invoices to catch glitches early.

Issues or errors with invoices often cause payment delays and uncomfortable discussions with customers. It’s a best practice to put quality control measures in place to ensure those first invoices go out correctly when putting an AR automation solution in place. Beyond that, consider employing KPIs that monitor the level of rework, such as tracking the number of revised invoices or customer disputes.

-

Encourage early payments.

Collecting cash as quickly as possible benefits the company’s cash flow and reduces bad debt. Offering early pay discounts is one way to encourage customers to pay even before the invoice due date, and AR automation can ensure those offers are made consistently and at the right time. Another way to get payments faster is to offer customers electronic payment options, like ACH and credit cards, or embed links to a payment portal in the invoice, all of which is faster than old fashioned paper checks. AR automation can help facilitate all these early payment transactions and track adoption.

-

Seek client/customer feedback.

An automated AR system should enhance relationships with customers. Done well, it can also reduce their processing time and costs, since one company’s AR is another’s accounts payable. To ensure that the working relationship is improving, it’s a good practice to check in with customers on how their experience is changing. For example, automated emails should provide customers with a fast and easy way to ask questions, but the only way to know for sure is by seeking feedback.

-

Review AR regularly for inconsistencies.

It’s a best practice to review AR to ensure the automation plan is working as intended. This may mean redeploying some AR resources to do more frequent AR reconciliations, including of customer contact data as well as any unapplied cash. AR dashboards can assist with alerts that identify irregularities within preset tolerances.

See how accounts receivable automation is just the beginning.

Accounts Receivable Automation From NetSuite

These 14 best practices can help make the conversion from a manual AR process to an automated AR system easier, and the resulting AR processes more productive and efficient. So, too, can choosing the right AR automation solution. NetSuite Accounts Receivable, part of the company’s cloud-based suite of enterprise resource planning (ERP) software for business management, supports end-to-end automation of the entire AR process. From invoice generation through collections, NetSuite provides features that shorten the time it takes to convert sales into cash. In addition, automated, role-based dashboards provide real-time visibility at all stages. Importantly, it also integrates with other ERP modules, such as order management, inventory management and financial management.

Accounts receivable automation often is a game-changer for getting credit sales invoiced and collected better and faster. Add the gains in efficiency and analysis to that faster cash collection and it’s easy to understand why many companies are deploying AR automation. The 14 AR automation best practices described above can help business get the best outcomes when leaving manual processes behind.

AR Automation Best Practices FAQ

How do you automate accounts receivable?

Accounts receivable automation software connects customer contact data with digital invoices for online delivery to customers. It can also generate automated payment reminders and receipts, as well as enable online payment capabilities, multiple payment options, and automated cash-application features. With AR automation, the entire AR process can be monitored and measured using reporting tools, such as customizable dashboards.

What steps can be taken to improve accounts receivable management?

Accounts receivable management focuses on making the sale-to-cash cycle as short as possible so that businesses collect cash faster. There are many stages of the accounts receivable process, and improvements in any of them can help an organization accelerate cash collection. Examples include: get invoices into customer hands more quickly, automate payment reminders to be sent at regular intervals, offer more and faster payment options, and reconcile and apply cash payments to open receivables using machine matching. Overall, role-based dashboards for AR team members with key metrics and KPIs can help management monitor trends and activity.

How do you streamline accounts receivable?

Automated AR software is the best way to streamline accounts receivable. It replaces time-consuming, repetitive manual tasks with automation. This improves accuracy and reduces processing costs. Consider aspects like digitizing invoices, online invoice delivery, automated reminders, web-based payment options, and automated cash-application matching.