Finance departments in well-run companies have for years developed best practices around financial planning and analysis (FP&A), which provides useful insights and analytics that help guide a business’s future direction. But even the best FP&A team can sometimes include a potentially fatal flaw: Its focus on financial planning disconnects it from the operational planning of departments and business units throughout the company.

Creating a financial plan in isolation from the strategic decision-making taking place in other corners of the business is no longer enough. Enter extended planning and analysis (xP&A) — the literal extension of FP&A practices and tools beyond finance to the larger organization.

What Is Extended Planning & Analysis (xP&A)?

One of the simplest definitions of xP&A comes from research firm Gartner, which describes it as the extension of FP&A projects beyond the finance department. When an organization adopts xP&A, any function within the business that produces an operational business plan — human resources, sales, marketing, operations, supply chain, IT, research and development — does so using a shared FP&A platform that unifies data models and analytical methodologies.

This approach offers multiple benefits. Traditionally, FP&A processes have provided a structured approach to budgeting, planning, forecasting and reporting so that the finance team can deliver analysis that helps senior executives understand the financial impact of their decisions. However, other functions in the business are making plans and taking actions that can also affect an organization’s financial posture and future direction.

An xP&A approach embeds FP&A best practices and tools throughout the organization to create a more unified picture of the financial impact of departments’ and business units’ operational plans, strategies and activities. It does so through a central platform that supports customized operational planning applications that use the same FP&A platform, architecture and data model, thus improving alignment of planning practices across the enterprise.

xP&A adoption is accelerating in response to the challenges faced by organizations seeking to exploit new digital business models while navigating economic uncertainty.

Key Takeaways

- Extended planning and analysis (xP&A) extends the use of FP&A principles, tools, data models and processes to non-finance departments throughout an enterprise.

- The adoption of xP&A is rapidly increasing; experts predict it will soon become the dominant approach to FP&A.

- xP&A increases alignment between finance and other departments and business units throughout the organization.

- It also enables finance departments to become more forward-looking, strategic partners to the business.

FP&A Explained

Financial planning and analysis (FP&A) encompasses all the financial planning, budgeting, forecasting and reporting processes a business performs in order to arm its executive leadership and board with accurate, data-derived intelligence for decision-making. FP&A teams gather, prepare and analyze financial data to create reports that provide data-driven answers to key business questions, such as:

- Which products/services/product lines generate the largest portion of the company's net profit?

- Which products/services have the highest or lowest profit margin?

- What percentage of the company's financial resources does each department consume?

- What opportunities should the company consider to expand and grow?

While FP&A was once a more tactical function providing historical information on financial performance or a snapshot of a business’s current financial state, it is increasingly a more forward-looking, strategic process. Advanced technology and new best practices (including xP&A) are enabling FP&A teams to understand why things have happened and more accurately predict what is likely to occur in the future.

Origins of xP&A

While Gartner coined the xP&A term in 2020, the concept itself is not quite that new. Also referred to as collaborative or connected planning or integrated FP&A, xP&A represents the codification of a variety of multidiscipline, cross-functional approaches to business planning, as opposed to the more typical siloed exercises of the past. This more collaborative approach enables the business to integrate financial planning across functions — from sales and marketing to operations, human resources, supply chain and IT — so that everyone is working from the same financial data and insight when creating business plans and strategies, measuring performance and making changes in direction.

While the lack of alignment between traditional FP&A processes and the rest of the business has long been a challenge, the issue is now paramount. In a changing economic environment, more holistic planning and analytics is critical. At the same time, advances in technology are now making extended planning possible.

Businesses that have embraced xP&A tend to see improvements in financial performance over those with more insular FP&A processes. xP&A creates a foundation for more collaborative and inclusive strategic planning, operational planning and forecasting. As a result, this model is rapidly increasing in popularity. According to Gartner, 70% of all new FP&A projects will be xP&A projects by 2024, extending their scope beyond the finance domain into other areas of enterprise planning and analysis.

FP&A vs. xP&A

The FP&A process offers a structured approach to financial budgeting, planning, forecasting and reporting that has long enabled finance teams to deliver critical analysis that informs decision-making by senior management and boards of directors. The problem with the traditional application of FP&A, however, is that it takes place solely in the finance function — walled off from the rest of the business. It often fails to incorporate the activities and plans of other business functions. Rather, each function does its own planning with little insight into or consideration of their combined effect on the business.

xP&A, on the other hand, takes the structured processes and principles of FP&A and applies them to all functions in the business. When the standard principles of FP&A are adopted within other departments, it paves the way for greater integration, more accurate financial planning and analysis and improved performance. With more traditional FP&A, sales, marketing, manufacturing and other teams have their own campaigns, plans, forecasts and targets — and even HR develops its own plans for staffing and compensation levels. With xP&A, you work toward integrating all these functions. For example, it may become obvious to senior executives how the growth planned by the sales team will require increased manufacturing capacity, which means additional staff and equipment.

With xP&A, planning becomes a more cross-functional process that can evolve continuously, yielding a more integrated — and agile — business.

| Traditional FP&A | xP&A |

|---|---|

| Happens only in the finance function | Extends to all functions in the business |

| Includes only data from the central finance function | Integrates data/activities from across the business |

| Updated monthly and quarterly | Delivers real-time analytics and scenario planning |

| Creates siloed or disjointed planning and processes | Enables collaborative planning and a single source of data and analysis |

| Forward-looking, focused on current data | Forward-looking and predictive |

Why Is xP&A Important for Businesses?

A standalone FP&A approach is incapable of meeting the varied planning requirements of non-finance departments. In contrast, xP&A can be used to create a process of continuous organizational financial and operational planning. It coordinates data, people, processes and business plans within a single platform, providing a comprehensive view of the business. That integration of financial and operational planning within a single platform is transformational for modern organizations.

Thanks to advances in digital technology, businesses can now take advantage of xP&A tools that accommodate the differing needs of various functions in the business, preserve data accuracy and control and embed automation and intelligence into FP&A tasks. As a result, finance organizations can create a holistic business plan and enable full visibility into organizational performance. Organizations that adopt xP&A often achieve improved business performance and greater agility.

In 2020, many businesses looked to their FP&A teams for ready insights and analysis in navigating extreme disruption and uncertainty. As finance functions anticipate a future of continuing volatility, xP&A offers capabilities that enable broader and more timely insight for corporate decision-making. As noted in FP&A predictions for 2021, agility will be a priority for finance, and strong but flexible financial planning will be vital.

How to Use xP&A

The main difference between traditional FP&A and xP&A is the variety and volume of data that goes into the processes and xP&A’s connection to departmental business goals. As a result, xP&A is only as good as the data that feeds it and the integration of the resulting analysis into strategy, management and decision-making.

The xP&A process starts with finance coordinating with other functional and operational leaders to understand their key metrics and how they impact business results. For example, if HR values retention and hiring costs or sales focuses on its pipeline numbers and revenues, their thinking goes into the xP&A process. By connecting every part of the business with an integrated plan, business leaders can steer their organizations more effectively, particularly during times of disruption. They can immediately analyze the impact on business performance of actual changes, anticipated shifts or even several different possible decisions.

If the business is facing problems in the supply chain, leaders can more quickly identify sourcing solutions. They can look at sales forecasts and projected marketing campaign ROI in correlation with macroeconomic trends to identify new growth opportunities. Integrating workforce plans with budget, revenue forecasts and corporate financial plans help the company determine when and where to expand next and how to staff the new locations or what practice areas to grow. Indeed, xP&A creates better visibility for all leaders to see what’s happening in all corners of the business. xP&A can also create a foundation for scenario-planning so that businesses can analyze the impact of various strategies to make the best data-driven decisions for the future.

xP&A and the Changing Role of the CFO

Much more than financial stewards, the role of the CFOs is continuing to evolve. A recent NetSuite CFO survey found that the purview of CFOs — even in small and midsize businesses — is expanding beyond traditional responsibilities. Indeed, the biggest concern for CFOs is managing their multiple and growing responsibilities. An xP&A approach is particularly beneficial as CFOs advance their roles in the business; xP&A’s more holistic, data-driven analyses can empower CFOs to lead company-wide strategic initiatives and help optimize business outcomes.

CFOs in small and midsize businesses are now taking on the kinds of roles that once existed only in the finance offices of much larger enterprises. Their companies also want accurate, all-encompassing, real-time data and insight for decision-making. As a result, these CFOs will find value in xP&A processes and tools for delivering more complete and accurate financial intelligence and risk analysis across the business for competitive advantage.

9 Key Benefits of xP&A

The enterprise-wide integration, standardization and alignment that an xP&A approach confers a wide range of advantages not only for finance teams, but also for their entire organizations. Key benefits include the following.

-

A holistic view of financial performance: xP&A breaks down organizational and data silos to create a single view of financial and operational activity. This gives finance leaders visibility into all assets, resources and changes across the company. In the past, such reconciliation would require significant manual labor. This holistic view enables finance to build a plan for the entire organization.

-

Data harmonization: xP&A brings together different types of financial and operation data from across the business (finance, sales, marketing, HR, operations, IT) into a single platform with a unified data model, thus delivering consistent information.

-

Shorter cycle times: Thanks to the automation and integration delivered by an xP&A approach and tools, companies can substantially reduce the cycle times for key planning processes. Budgeting and forecasting can evolve from quarterly exercises into continuous processes.

-

Improved business alignment: Because xP&A connects information from all corners of the business to create an integrated plan, the enterprise becomes more aligned. Strategic goals can be connected to activities that drive the desired outcomes. In addition, leaders can quickly visualize and analyze the impact of changes or disruptions.

-

Greater agility: Organizations that adopt xP&A can make processes like target setting and scenario planning more efficient. This is particularly important as organizations explore new digital business models and navigate economic uncertainties or volatility.

-

Increased collaboration and accountability: When the entire organization is using the same data and assumptions, they can work together on business planning more effectively. The transparency conferred by shared data illustrates how one function’s activities impact another’s, promising greater accountability.

-

More accurate forecasting: Integrated xP&A processes and tools can deliver higher-quality forecasts that incorporate key data from all business stakeholders. When the forecasts are more accurate, leaders can respond to variances more effectively.

-

Scalability: The clarity and insight provided by xP&A’s unified data model can enable an enterprise to grow with its data. Consider the enormous volumes of data generated by digital marketing about customers and prospects, or by internet of things technologies about industrial machines on factory floors (just one example of potential IoT use).

-

Easier identification of opportunities and risks: Thanks to increased visibility, leaders can more quickly identify cost or efficiency improvements, growth opportunities and emerging risks. Scenario modeling can be used to simulate the outcomes of proposed or anticipated changes.

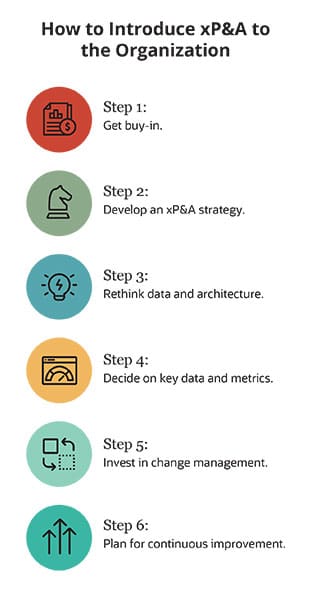

6 Steps to Transition to xP&A

Extended planning and analysis may be the logical evolution of FP&A, but expanding the use of these processes, data and tools beyond the finance function takes careful forethought and planning. Organizations that want to introduce xP&A can take a number of steps to increase the likelihood of successful adoption across the business:

-

Get buy-in. Evolving from FP&A to xP&A requires support from the executive team and departmental leadership. Finance must make sure that everyone understands not only their roles in these new processes, but also the benefits xP&A can provide them.

-

Develop an xP&A strategy. Finance must create a plan for how it will lead the extension of FP&A across the business. It should also develop a strategy for the ongoing coordination of continuous planning and performance management, integrating input from key stakeholders.

-

Rethink data and architecture. A “lift and shift” of existing systems may not be enough to realize the full benefits of xP&A. Determine what digital tools and capabilities will enable the organization’s xP&A goals. There will likely need to be changes in architecture in order to integrate all relevant business data in one platform. It will also be important to factor in increased data management requirements.

-

Decide on key data and metrics. Finance can work with other departments and business units to understand what data is most important to both their operational performance and financial results, what changes might be made and, ultimately, which metrics to incorporate into xP&A.

-

Invest in change management. Implementing xP&A demands changes from everyone involved — from executives and board members to managers and users — not to mention the IT department. Don’t skimp on change management and communication throughout the xP&A deployment process.

-

Plan for continuous improvement. xP&A processes can be expanded and improved over time. Adopting a test-and-learn approach can enable greater success as organizations scale their use of xP&A to different functions, business units or geographic locations.

Integrating xP&A With ERP

Companies moving to xP&A will require certain technology capabilities to support their new company-wide approach to planning.

-

Integrated planning and data: They will need a planning and budgeting solution that automatically pulls accurate and up-to-date data from their enterprise resource planning (ERP) system. This ensures the data is in one place and visible to everyone, boosting collaboration and accountability.

-

Support for multiple planning types: Because xP&A extends to all business functions, financial systems must support the varying needs of different operational areas as well as both company-wide and departmental budgeting within one collaborative, scalable solution. They will need to support workforce planning for HR, sales planning and demand planning. An enterprise performance management solution can offer purpose-built solutions to improve and manage planning processes in sales, marketing, human resources, IT and supply chain functions.

-

Unified data discovery: xP&A requires the kind of unified data model that ERP provides, making data discovery easier and more intuitive.

-

Automated reporting, visualization and predictive planning tools: The most effective FP&A teams are more likely to have automated reporting, data visualization and predictive capabilities. When these are built into systems and processes, finance departments can offer faster planning cycles, more sophisticated modeling and more accurate forecasts for the business.

Conclusion

Finance is in a unique and valuable position to drive extended and continuous planning and analysis for the entire business, helping to drive better decisions and outcomes. There are certainly challenges in evolving from traditional financial planning processes and disparate data sources to create the more integrated data, systems and processes demanded by xP&A. But those organizations that address these issues and integrate xP&A across their businesses may elevate the role of finance as they enable business performance improvement — across the entire enterprise.