Supplier risk management has become a strategic priority for businesses facing an unprecedented range of threats—from geopolitical tensions and inflation to cyberattacks and financial instability. When disruptions escalate, companies face steep costs. To stay competitive and resilient, companies are embracing smarter risk management practices, including supplier diversification, more stringent contracts, predictive analytics, and real-time monitoring, to proactively reduce downtime, protect revenue, and strengthen long-term performance.

What Is Supplier Risk Management?

Supplier risk management refers to the process of identifying, assessing, and mitigating potential threats within a company’s supply base that could disrupt its operations, damage its reputation, or increase its costs. Managing an abundance of risks requires taking a proactive, structured approach to choosing appropriate partners and regularly monitoring supplier relationships to secure swift corrective reactions when unexpected challenges arise.

Supplier risk management has become increasingly important in recent years as businesses have grappled with more complex and fragile global supply networks. A supplier’s failure to deliver goods and services when they’re needed—whether due to bankruptcy, a natural disaster, a cyberattack, or a regulatory issue—can throw off production schedules and sour customer relationships. To manage this growing exposure, companies are building more resilient supply chains by creating stronger supplier partnerships and leveraging real-time data to anticipate problems early and minimize disruptions before they have a chance to escalate.

Key Takeaways

- When a supplier encounters a problem that causes delivery delays, customers often blame the procuring company rather than the supplier.

- To manage supplier risks, businesses should identify likely threats, assess the impacts of risks, develop a mitigation plan, and monitor suppliers closely for newly emerging hazards.

- Popular supply risk mitigation strategies include carrying excess inventory, diversifying suppliers, building redundancies into the supply chain, and strengthening contracts with vendors.

- Effective supplier risk management controls costs by detecting underperforming suppliers and addressing potential risks early.

Supplier Risk Management Explained

Natural disasters. Geopolitical tensions. Price increases. Cyberattacks. These are just a few of the many perils that constantly threaten supply chains. Supplier risk management is the strategic practice of spotting and addressing these and other risks within a company’s supplier network—basically, any problem that could disrupt the healthy flow of needed supplies and lead to operational delays, reputational harm, or increased costs.

Keeping close tabs on everything that could go wrong isn’t easy, as evidenced by all the companies struggling to get their arms around every possible issue that could prevent raw materials from arriving on time. Case in point: A 2025 WTW survey showed that less than 8% of businesses say they have full control over their supply chain risks.

What’s more, in a 2025 RapidRatings survey of supply chain professionals, 81% say they’ve seen their businesses slammed by supplier disruptions in the past two years, with nearly one-third of these disruptions costing more than $5 million each. And 68% of those surveyed expect disruptions to escalate significantly in 2025. Clearly, businesses need to build effective supplier management practices—not just to respond to disruptions, but to anticipate and prevent threats before they become costly crises.

Why Is Supplier Risk Management Important?

Given the repeated disruptions many procurement and compliance officials have encountered in recent years, developing strong supplier risk management processes is perhaps more essential than ever to make sure companies remain competitive. An effective supplier risk management strategy provides the following benefits:

- Reduces disruptions and waste: Managing risks helps businesses proactively identify and address vulnerabilities in their supply pipeline—a natural disaster, labor strike, or a key supplier’s financial problems, for example. By anticipating supply chain disruptions, companies can create contingency plans that propose ways to locate alternative suppliers or increase safety stock. This lessens the likelihood of facing material shortages and avoids the need for emergency procurement or expedited shipping, which can contribute to excess inventory, higher costs, and other waste.

- Improves reliability: A well-executed supplier risk management program enhances reliability by rigorously vetting suppliers, lining up backup sources, and continuously monitoring the performance of all partners. An effective risk management program might call for diversifying sources to reduce dependence on a single supplier or region, which, in turn, protects operations from unexpected disruptions and keeps a reliable stream of supplies flowing to meet customer demand.

- Protects reputation: If a supplier is accused of a safety violation or labor scandal, businesses that contract with that supplier may also be judged equally harshly by consumers. Or, if a supplier has an issue that interrupts production and causes delivery delays, customers may blame the procuring company rather than the supplier. Risk management propels companies to screen suppliers carefully, enforce compliance with industry standards and government regulations, and closely oversee suppliers to prevent reputational harm.

- Lowers costs: By detecting underperforming suppliers and impending risks early, companies can avoid the high costs associated with emergency sourcing, rush shipping, or holding excessive buffer inventories. Managing risks also involves negotiating better terms with credible suppliers from the get-go, allowing procurement teams to secure supplies in a predictable and economical manner.

- Increases efficiency: Supplier risk management improves operational efficiency by foreseeing the need to identify and mitigate potential disruptions in the supply chain. By keeping an eye on the risks associated with each supplier, businesses can anticipate and respond to issues before they intensify into major manufacturing delays or even shutdowns. This shortens lead times, keeps production lines humming, and allows companies to deliver products to customers as quickly as possible.

Categories of Supplier Risks

The supplier-related risks companies face can stem from both internal and external sources, and each risk category poses distinct challenges. The most common supplier risks that companies should anticipate are:

- Economic risks: Major market shifts arise from economic factors, such as inflation, currency fluctuations, trade barriers, and general financial downturns that impact suppliers’ ability to provide goods or services. For example, in recent years inflationary pressures forced many businesses to renegotiate contracts with their existing suppliers, seek out new partners, and, in some cases, pass costs on to consumers.

- Performance risks: When a supplier has a problem, such as experiencing a production delay or a quality issue with its materials, its ability to deliver high-quality goods or services on time to meet demand is compromised. For instance, quality problems at a semiconductor supplier could shut down an automotive assembly line for days.

- Financial risks: If a key supplier faces liquidity issues, insolvency, or other financial challenges, it might abruptly halt its delivery of materials, impacting a company’s production timeline and potentially increasing costs. A mid-tier supplier that files for bankruptcy due to a sudden spike in fuel prices and insurance costs, for example, might force buyers to scramble for emergency sourcing elsewhere, which often comes at a higher cost. In the past five years, suppliers have been plagued with an unprecedented array of finance-related disruptions because of raw material price volatility, increased labor expenses, and interest rate swings, among other issues, according to Proxima’s “2025 Global Sourcing Risk Index.”

- Event-based risks: Events, such as natural disasters, pandemics, and geopolitical conflicts, can cause sudden disruptions. Experts surveyed for the World Economic Forum’s “2025 Global Risks Report” identified state-based armed conflict as an immediate risk, with nearly a quarter of respondents citing it as the most severe challenge. Extreme weather, such as hurricanes, earthquakes, tsunamis, and flooding, ranked second. These events can disrupt trade routes and destabilize global and regional supply networks, prompting widespread production breakdowns for businesses awaiting supplies.

- Regulatory risks: Buyers need to stay on top of suppliers that aren’t complying with legal standards, including environmental, labor, or data protection requirements. US regulators are increasing their scrutiny of vendor management practices this year, with examiners paying close attention to how companies identify, assess, and monitor risks tied to their suppliers, especially in the financial services, healthcare, and critical infrastructure industries. Failing to comply can result in fines or the loss of operating licenses.

- Category risks: Each industry battles its own kinds of risk, but certain industries with highly specialized products—such as rare earth metals in electronics—may face greater exposure to disruptions and price hikes, since it might be tough for a company to find replacement suppliers if its main supplier can’t provide materials. Meanwhile, those in the agriculture industry worry about droughts, floods, and wildfires that can suddenly wipe out crops and infrastructure, halting shipments and raising costs for buyers.

- Ethical risks: In addition to labor and environmental violations, ethical risks among suppliers may include supply chain fraud and corruption, including bribery; unethical trading practices, such as price gouging; unfair contract stipulations; and harassment of and discrimination against employees and customers. These obstacles can have serious consequences for businesses, including reputational damage, legal liabilities, and loss of customer trust.

- Cybersecurity risks: Supplier systems may be vulnerable to data breaches, ransomware, or supply chain attacks—and sub-tier suppliers are often targeted by attackers that try to exploit weaker security measures to gain access to larger organizations. In 2025, WTW identified supply chain cybersecurity risk as the fastest-growing area of concern, rising from 5% to 16% since 2023.

Managing Supplier Risks

To manage supplier risks, companies should first identify vulnerabilities, assess their potential impact, and design mitigation strategies before risks have an opportunity to materialize into full-blown disruptions. Following the steps outlined below will help businesses prepare for a variety of possible threats:

-

Identify the Risks

The first step in managing supplier risks involves pinpointing all potential threats that could affect the supply chain, including financial, regulatory, ethical, and environmental issues. Each industry has its own specific concerns: Pharmaceutical companies may focus on clinical trial integrity and compliance with global health regulations, for instance, while a food distributor might scrutinize a vendor’s hygiene standards.

Companies may want to use a “SWOT analysis” to identify strengths, weaknesses, opportunities, and threats in their supply base. Regular audits are another good means of reviewing suppliers’ operational processes, quality control systems, compliance protocols, safety standards, and environmental, social, and governance practices. Plus, regularly reviewing supplier data, including previous delivery performance and incident records, can allow companies to identify suppliers demonstrating recurring problems—as well as those doing a stellar job.

-

Assess the Risk Impacts

After identifying potential risks, businesses should assess the chances of threats occurring, as well as the potential ripple effect these problems could have on buyers. If a supplier experiences delays in shipping key materials, for example, what impact will that have on a company’s production schedules, costs, and customer delivery obligations?

Companies might use risk scoring matrices to plot threats based on their probability and impact. High-likelihood and high-impact risks would appear in the most critical quadrant, indicating the supplier issues that could threaten business continuity most severely. For example, a supplier in a politically unstable country might be rated as higher risk, due to possible export restrictions.

-

Plan Your Mitigation Strategy

Once they’ve zeroed in on the most likely risks and their potential impacts, companies should develop clear, actionable strategies for mitigating those risks. Typical mitigation plans include diversifying the supplier base to reduce dependence on a single source, creating inventory buffers, setting up alternative sourcing options, and negotiating flexible contract terms with suppliers that allow companies to make rapid adjustments, as necessary.

At this stage, businesses must balance reducing their risks against keeping operations running smoothly and costs under control. For example, it might not be practical to arrange for multiple suppliers for every material, so a company might want to prioritize developing contingency plans for its most critical or hardest-to-find components.

-

Perform Due Diligence

Businesses can’t just rely on suppliers’ promises that they’ll follow through on providing needed materials. It’s important that companies conduct thorough examinations of suppliers prior to bringing them on board to confirm that they have the resources, capacity, and expertise to deliver the quality supplies a company needs, at the right time.

Vetting suppliers might mean conducting site visits, reviewing operational processes, analyzing financial statements, and verifying industry certifications to make sure they comply with quality and regulatory standards. All these measures offer some peace of mind that suppliers will have the ability to meet their contract obligations.

-

Monitor for Emerging Risks

Once companies contract with suppliers, they should exercise close oversight by regularly reviewing audit reports and other performance data. Spot checks help flag potential issues early to prevent unwelcome surprises—such as a supplier plagued with a host of regulatory penalties that might cause reputational damage. Furthermore, many sectors with strict regulations, such as the pharmaceutical and food industries, require documented evidence of ongoing supplier monitoring.

Vendor technology that integrates audit reports, compliance checks, and performance data into a centralized platform plays an important role in watching out for emerging risks by generating real-time insights, automated alerts, and data analytics that help companies detect early warning signs of impediments so they can respond quickly.

Supplier Risk Mitigation Strategies

To prepare for ongoing disruptions, companies must have the foresight to develop strategies tailored to the vulnerabilities in their specific supply chains. Here are some of the most popular strategies.

Inventory Strategies

Companies should consider maintaining safety stock to absorb sudden supply shocks and surges in demand. By preserving a certain amount of just-in-case inventory, businesses can avoid costly stockouts and continue to meet customer demand, even if an unexpected disruption delays supplies. To determine how much buffer stock to have on hand, start by analyzing lead times, demand fluctuations, and historical consumption data. Keep in mind that determining how much safety stock to maintain without storing too much is a common challenge for businesses. In fact, McKinsey & Co.’s “2024 Global Supply Chain Leader Survey” reveals that the percentage of respondents relying on bigger inventory buffers to manage disruptions fell to 34% from 59% the year before.

In addition to holding some level of safety stock, consider a flexible capacity approach to rapidly scale logistics and fulfillment up or down in response to changing demand and supply interruptions. Unlike fixed capacity, which relies solely on permanent, in-house staff and equipment, flexible capacity takes advantage of temporary or outside resources, such as contract workers or third-party logistics providers, to maintain production continuity without over-investing in assets that may sit idle during slower times.

Supplier Diversification

Relying on a single supplier could put a business in a vulnerable position should a disruption strike that one partner. As a result, supplier diversity has surged in popularity, with many companies connecting with multiple suppliers for critical components to reduce dependence on a single source. In a 2024 Maersk survey, decision-makers ranked supply chain diversification among the top three industry trends.

Many companies now also source from different regions, often blending global and local sourcing to limit vulnerabilities to political tensions, tariffs, or other potential disruptions in any one locale. In fact, nearly half of US businesses said they plan to increase nearshoring in 2025 in response to shifting global conditions, according to a QIMA report.

Build Redundancies

Businesses are increasingly relying on supply chains that are widely dispersed, with materials coming from different parts of the world. Although broad, global access offers many benefits, including lower prices and access to specialized parts, fragmented supply chains are also risky. For example, what happens if political tensions escalate in a certain country and a supplier in that region doesn’t have the staff or resources to fulfill orders? Build redundancies by lining up backup suppliers, secondary transportation routes, and alternative production processes to protect your supply chain in case a main supplier has trouble coming through for any reason.

For example, let’s suppose a US-based pharmaceutical company depends on a specialized manufacturer in Germany to provide a specific ingredient for a life-saving medication. To build redundancy, the company might contract with a second supplier in Canada, perhaps forming an agreement to ramp up supply orders quickly, if needed. In addition, the pharma company could contract with multiple freight carriers, both air and sea, to transport this critical ingredient, so it’s not hamstrung by using a single logistics route.

Contract Strengthening

A strong, protective contract is necessary to alleviate supplier risks. A solid contract sets key expectations for suppliers to meet, including quality requirements, delivery timelines, and the secure protection of sensitive data. Plus, to ensure accountability, the contract should outline what would happen if a supplier deviates from the rules—for instance, can the buyer request service credits, issue financial penalties, or even terminate the agreement after repeated infractions?

A contract should also include a well-defined dispute resolution process, such as arbitration methods, to help de-escalate issues without jeopardizing the relationship long term. In highly regulated sectors, such as banking and healthcare, companies are increasingly tightening their contracts, often mandating that suppliers verify their compliance with legal requirements and industry standards.

Example of Supplier Risk Management

Kroger, one of the largest grocery retailers in the United States, operates a complex supply chain that includes thousands of suppliers of fresh foods, packaged goods, pharmaceuticals, and private-label products. To manage the uncertainties inherent in such a broad supplier network, the retailer has developed an intricate supplier risk management program that includes its supplier hub, a centralized platform that all vendors must use to maintain compliance. This helps Kroger track all suppliers to make sure they adhere to food safety standards and insurance requirements. Vendors are also required to complete risk assessments, provide documentation for certifications, and accommodate periodic audits.

In addition, Kroger uses a dual-sourcing and diversification strategy to avoid overreliance on any single supplier or region, especially for private-label and perishable goods. Kroger also maintains supplier scorecards, tracking on-time delivery, fulfillment rates, compliance with packaging and labeling standards, and how suppliers respond to disruptions. And it uses advanced risk forecasting models to anticipate weather-related crop failures, ingredient shortages, transportation bottlenecks, and more, so it can intervene at the earliest possible moment with alternative plans.

All-in-One Supplier Tracking With NetSuite

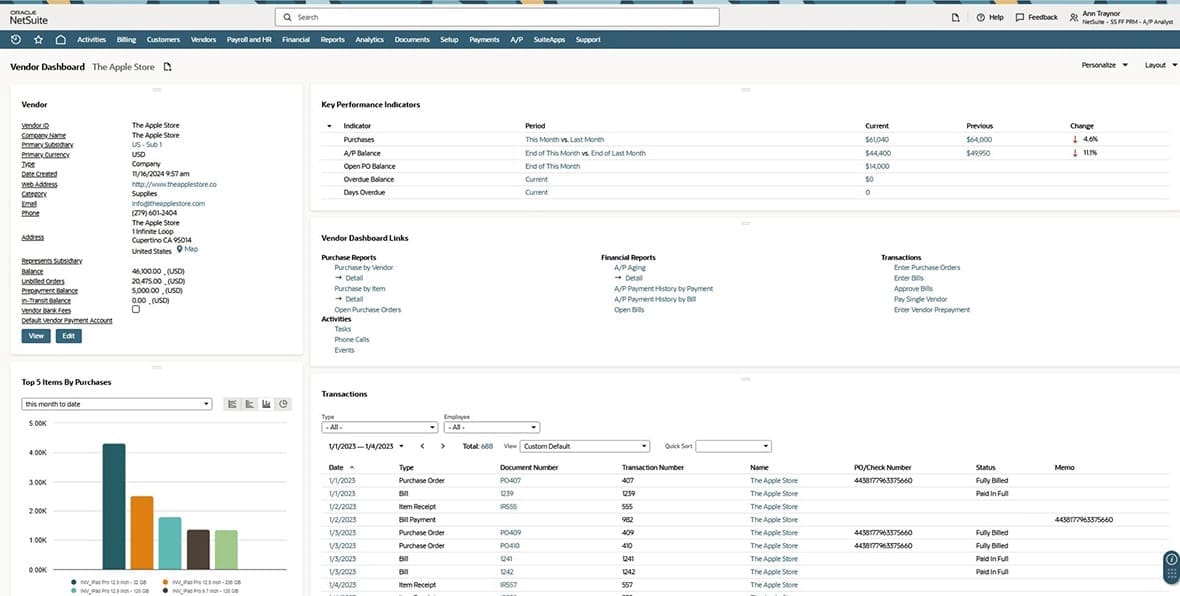

Keeping track of reams of data related to multiple suppliers can be an overwhelming task for any business. NetSuite vendor management software helps companies forge strong relationships with suppliers by pooling all information related to individual vendors in a central record, so managers can easily access the data they need to identify supplier risks, take the necessary steps to mitigate them, and keep supply chains running smoothly. In addition, NetSuite’s online portal allows suppliers to collaborate and stay closely connected with buyers, eliminating flurries of email threads. What’s more, vendor scorecards help companies track supplier performance and compare vendors with similar products to pinpoint ways to optimize purchasing with the goal of keeping costs down while boosting quality.

NetSuite Vendor Management

As disruptive events become more frequent, it’s critical for businesses to strengthen their supplier risk management plans. Doing so allows companies to build a supply chain that can anticipate vulnerabilities, such as geopolitical tensions, natural disasters, and compliance breaches, and either develop contingency plans or weather the storm with minimal damage. Effectively managing supplier risks involves identifying potential threats, assessing their impacts, planning targeted mitigation strategies, and using digital technology to continuously monitor supplier performance and keep an eye out for emerging risks. Popular mitigation strategies include diversifying suppliers, building redundancy into inventory and logistics routes, and creating strong contractual provisions to protect businesses.

Supplier Risk FAQs

How do you manage supplier risk?

To manage supplier risk, first identify and assess potential supplier-related threats, then evaluate their likelihood and potential impact. Next, develop targeted mitigation strategies, such as diversifying suppliers, creating contingency plans, and negotiating protective contracts. And finally, continually monitor supplier performance to proactively limit disruptions.

What are high-risk suppliers?

High-risk suppliers are vendors whose problems—such as financial troubles, poor performance, weak cybersecurity, or noncompliance with laws—could seriously disrupt a company’s operations, lead to legal issues, or cause reputation damage.

How do you identify supplier risk?

Identifying supplier risk starts with analyzing the threats related to each supplier, including financial instability, vulnerability to extreme weather, and exposure to geopolitical conflicts—any of which could disrupt a company’s operations. Then carefully vet suppliers by reviewing their performance history. Once suppliers are chosen, conduct regular audits and monitor them closely, adjusting risk levels according to changing circumstances.