The telecommunications industry is once again in the midst of transformation, building high-value platforms for a new generation of consumer and business services as it attempts to shed its legacy of providing simple connectivity. The technology trends driving this transformation range from upgraded wireless infrastructure and AI at the core of telecom operations to APIs that give business customers, developers, and resellers the keys to configuring advanced services. At stake is whether telecom remains a low-growth, low-return industry or evolves into a powerful engine for profitability and growth.

The State of the Telecommunications Industry in 2026

The industry’s current makeover isn’t its first attempt to rejuvenate itself—others have included unsuccessful forays into becoming media and content companies. But, instead of going head-to-head with giant media and tech companies, this latest effort focuses on monetizing the industry’s own unparalleled asset: its ubiquitous, recently modernized 5G network. Plus, telecom companies are adding wind to their sails by replacing legacy, monolithic telecom hardware with more capable and flexible cloud networks while also building computing power at the edges of their 5G grids. A crucial remaining challenge is for them to grow their B2B businesses without diminishing their strong B2C standing.

Developments in 2025 embodied the industry’s changes. For instance, AT&T, T-Mobile, and Verizon together announced they would deliver the US’s first advanced network APIs for business customers to use in improving application security and combating fraud that takes place over communications networks. This joint effort was part of a broader collaboration that includes telecom companies across the world.

In another example, Verizon and Nvidia partnered to develop a service called 5G Private Network with Enterprise AI. The resultant service will let private network customers run compute-intensive applications, such as large language models for generative AI on the edge of Verizon’s network.

Meanwhile, in its bread-and-butter consumer market, the telecom industry has been leveraging 5G capabilities for advances in fixed wireless access, which brings broadband into homes without the need to lay expensive fiber optics to every property. Other consumer improvements include 5G gaming and social media broadcasting. In these and other ways, telecom companies are looking to get ahead of competitors, such as virtual mobile network operators; over-the-top (OTT), internet-based messaging platforms; and others that have been eroding telecom’s profits from its traditional consumer offerings.

Telecom companies have been laying the groundwork for higher-margin business and consumer services with the rollout of 5G networks that have fiber-optic backhaul links, which provide higher speeds, lower latency, and greater reliability than older networks. These capabilities herald the potential for applications that require high-bandwidth, always-on, instantaneous communications and computing, such as autonomous factories, remote surgery, smart cities, and other long-dreamed-of advances.

Though the 5G rollout is largely complete in several developed countries, traffic is still managed, in part, on an older 4G network core. Upgrading that 4G core to the next 5G “standalone” (5G SA) configuration will soon enable more new applications and services. Internally, meanwhile, telecom companies have also been looking to reduce the cost of network operations, speed the provisioning of services, and improve customer services like billing by incorporating technologies that include cloud-native architecture and AI-powered automation.

12 Key Trends Driving the Future of the Telecom Industry

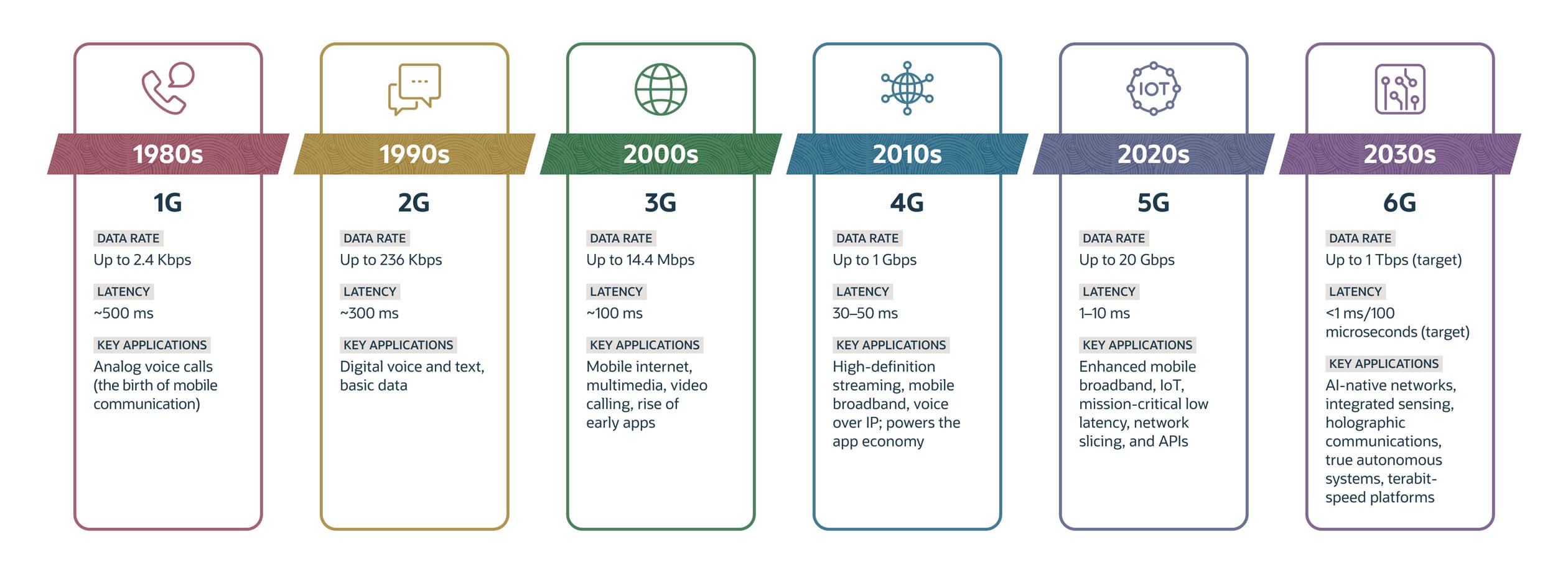

Each new generation of wireless technology represents more than a single improvement in mobility, speed, coverage, or capability; they are driven by diverse technological innovations that establish a new value-creation engine for progress in the digital economy. For example, the fundamental transition from wired landlines to wireless customer connections unfolded from 1G in the 1980s to 2G in the 1990s and 3G in the 2000s—but 2G and 3G also marked the digitization and acceleration of networks and services. In the 2010s, 4G brought voice-over-IP and high-definition streaming and also gave birth to the app revolution.

Looking at 5G, 5G SA, and beyond, here are 12 business and technology trends that are playing a role in reshaping telecom:

-

Digital Transformation

Telecom companies’ overarching strategy is to transform from connectivity companies to providers of integrated technology and managed customer experiences. Some refer to this transition as evolving from a “telco” to a “techco”—a service provider capable of deploying new products at the speed of a modern technology company. To achieve this transformation, telecom companies are replacing outdated, siloed operational models with agile, software-centric approaches. In a McKinsey & Company survey, C-suite telecom executives ranked the combination of digital, AI, and automation as their most critical opportunity for value creation, far outpacing any other focus areas.

-

Virtualization

Virtualization decouples network functions from the proprietary hardware that has long dominated telecom operations. Turning functions like user identification or routing into services accessed via APIs averts vendor lock-in, lets partners and customers scale capacity on demand, and enables all parties to test new applications and services in hours rather than weeks or months.

Virtualizing network functions into programmable building blocks also paves the way for companies to migrate to cloud-native architectures and deploy AI operations (AIOps), both of which are detailed below. Many telecom companies have already virtualized parts of their networks and are now working to complete the virtualization of their network core.

-

Cloud-native Solutions

Telecom companies’ spending on cloud infrastructure and software grew 12% in 2025—twice as fast as in 2024—according to the Omdia market research firm. The telecoms are investing billions of dollars per year in cloud-native solutions to curb network latency, automate operations, and accelerate new service launches. Cloud-native solutions involve building network functions entirely on cloud principles, using containers, microservices, and specialized platforms for network orchestration. This architecture is more flexible, lower in cost, and more resilient than traditional hardware-based communications systems.

-

Edge Computing

Edge computing involves strategically placing small data centers for compute power, storage, and network functions close to the business or consumer customer, instead of in the network core. Often located at cell tower sites or regional offices, these setups can deliver the ultra-low latency necessary for real-time applications by reducing the distance data must travel.

Telecom companies are leveraging the edge to host compute-intensive services like GenAI and private network applications directly on their 5G grids. Other potential applications include autonomous vehicles that process sensor and camera data in real time, smart factories that use edge computing to coordinate robotics, and supply chain shipment monitoring. Monetizing this geographically distributed compute power is a key telecom industry strategy for capturing high-margin B2B revenue.

-

AI-enhanced Network Operations

AIOps are becoming indispensable as telecom networks grow increasingly complex and surpass staff’s ability to manage them using manual, reactive processes. AIOps uses machine learning to incrementally replace manual network management processes with intelligent, predictive systems. It has already begun to trim maintenance costs while boosting network reliability and quality of service, and recent progress in GenAI and AI agents is accelerating the approach of full network autonomy.

-

Automation

Telecom companies are automating at different speeds for functions ranging from network management to customer service. In network management, for example, automation is the practical outcome of reimplementing network functions using AI and cloud-native architecture. In this operational upgrade, telecom companies are at level 1 or 2 of a 5-level autonomy framework established within the TM Forum industry association, meaning that they have achieved partial automation and are assisting staff with the simplest tasks and processes. In the business office, some technologies, such as robotic process automation and specialized AI agents, are taking on repetitive administrative tasks. By cutting down on human error and speeding up workflows, automation can decrease operational costs while improving internal efficiency.

-

Advanced Cybersecurity and Privacy

Telecom networks and the companies that run them are particularly vulnerable to cyberattacks, given their transmission of vast amounts of data, their stores of personal information on millions of customers, and their crucial roles in national security, economic stability, and critical services. What’s more, as networks become software-defined and interconnected via APIs, their attack surface is expanding. The size of this security challenge has already driven telecom companies to automate cybersecurity and privacy, in addition to operations and administration.

Going forward, telecom companies are deploying advanced, AI-powered security tools that help monitor traffic for anomalies and identify novel threats in real time. With decisions and actions driven by AI, staff’s role is evolving to focus more on oversight and validation than on intervention at every step.

-

Diversifying Business Models

More than half of telecom CEOs believe their companies will not survive another decade without business model reinvention, according to a PwC survey. To counter the long-term commoditization of their connectivity business, telecom companies are diversifying into adjacent markets that require their unique assets, such as cloud hosting and cybersecurity services. Their goal is to capture a larger share of overall enterprise and consumer digital spending to reap higher average revenue per user.

PwC’s research found that common strategies for becoming digital services players include separating infrastructure assets, such as cellular towers and fiber networks, into independent companies, with stakes sold to financial investors; creating “anything-as-a-service” (XaaS) platforms that aggregate cloud, edge, broadband, and digital infrastructure services for resellers to create their own products; and integrating payments, lending, and other financial services into telecommunications.

-

Enterprise and B2B Growth

Telecom companies are looking for the enterprise market to drive their growth, because their consumer growth has been eroded by low-cost providers and OTT services. They are looking beyond enterprise connectivity services to sell private networks and “slices” of their own networks, with APIs that let business customers access and control network functions, such as bandwidth allocation and quality control. In a smart factory, for example, a dedicated network slice can guarantee the ultra-low latency needed to control autonomous guided vehicles and robotic arms.

Other B2B offerings include managed cybersecurity, desktop management, “edge AI-as-a-service” for applications like real-time quality inspection, and more. Providing end-to-end solutions to the manufacturing, logistics, healthcare, and other industries is expected to command higher margins and help sustain infrastructure investment.

-

Personalized Customer Experience

Despite weak growth, the consumer market still provides the bulk of telecom companies’ revenue. To retain and reinvigorate consumer growth, many companies are focusing on transforming customer experiences, which have been historically weak. They’re using GenAI and predictive analytics to personalize service interactions and marketing offers. For instance, identification of early churn signals, such as reduced app usage or changes in payment patterns, can prompt telecom companies to reach out—before a customer complains—to offer service recovery options, such as credits. AI-powered marketing might use real-time data to extend context-aware micro-offers, such as one-day speed boosts or streaming add-ons delivered precisely when the customer needs them.

-

LEO Satellites

This December 2024 headline from the European Space Agency sets the stage: “World-first direct 5G connection to low earth orbit [LEO] satellite opens new era for mobile coverage.” LEO satellites are expected to be instrumental in extending the reach of global mobile networks beyond current terrestrial limitations. They promise to close coverage gaps in rural communications, provide essential low-latency, high-speed services in remote areas, and act as a connectivity backbone for enterprise Internet of Things devices deployed across vast regions.

Partnerships between telecom companies and LEO operators aim to integrate satellite connectivity into smartphones for seamless switching between ground-based networks and satellites to achieve continuous coverage. Time will tell whether LEO satellites become an integral part of a blended telecom model, along with fiber and wireless networks, or evolve into a full-scale competitor to terrestrial telecom companies.

-

Looking Beyond 5G: Here Comes 6G

The telecom industry is already investing heavily in the next generation of wireless technology. In the 2030s, 6G is intended to bring terabit speeds and microsecond latency, in contrast to 5G’s milliseconds—that’s one-millionth of a second versus thousandths of a second. But it’s not just about speed and response time. As an AI-native network, it will be self-optimizing, self-healing, and autonomous. And by simultaneously transmitting data and sensing its physical environment, such as location, movement, and presence, it is expected to create new high-value applications, including holographic communications, autonomous drone fleet management, and high-fidelity digital twins that are real-time virtual copies of smart factories or cities.

All that said, a 2025 report from the US Federal Communications Commission cautioned that the industry must address the challenges of fully realizing the potential benefits of 5G in order to get the most out of 6G. “As each new wireless generation has introduced new services, lowered costs, and improved performance, telcos have increasingly struggled to benefit from the unprecedented value creation,” the agency said.

Telecom Network Evolution from 1G to 6G

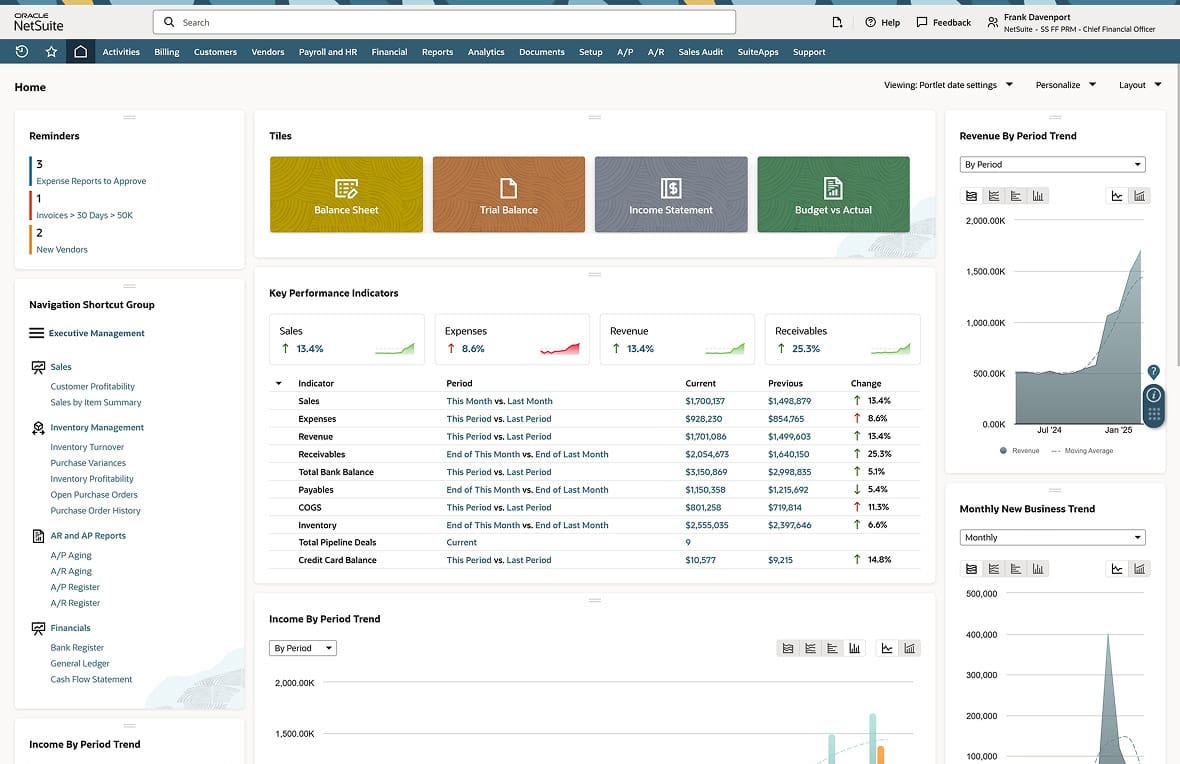

Enable Operational Efficiency With NetSuite ERP

Across the telecom industry, from equipment providers and systems integrators to network operators and resellers, NetSuite Telecom ERP cloud-based software is helping companies automate previously manual processes to enhance business efficiency, gain better controls, and extend visibility across their enterprises.

During this telecom transformation, virtualization, AIOps, and other network innovations will be profitable only if they are integrated with updated business systems. NetSuite’s ERP provides the unified data foundation that legacy systems lack, so it can automate complex financial and operational workflows throughout the organization. Its centralized platform helps eliminate the data silos that slow innovation, delivering the single source of truth essential for handling the complexity of billing for network slicing, for example, as well as consumption-based pricing and the provisioning of new services. The result is accelerated ROI for a new generation of telecom services.

The telecom industry’s future profitability hinges on its ability to execute a fundamental shift from being a connectivity provider to becoming an integrated value-creation engine. The days of simple data selling are over; telecom’s new competitive battleground lies in higher-margin B2B and B2C solutions. However, to fully realize the promise of 5G and 6G networks—and raise their current low, single-digit margins—telecom companies must deploy cloud-native operational and administrative systems and embed AI automation across back-office functions. AIOps must enable autonomous networks and sophisticated billing must support complex XaaS offerings. In this way, telecom companies can successfully complete their ambitious transformation—and sustain the enormous infrastructure investments that underpin the entire digital economy.

Telecom Future Trends FAQs

How is AI being used in telecom?

AI is being applied across the telecom value chain, primarily through AI-enhanced network operations (aka AIOps) and generative AI. In the network, AIOps uses machine learning to create predictive, self-healing systems that analyze traffic in real time, anticipate equipment failures, and dynamically optimize capacity. On the customer-facing side, AI powers predictive analytics that spot early churn signals to trigger proactive customer outreach. AI agents also assist staff members, thereby accelerating efficiency and enhancing the personalized customer experience.

What are three major trends in telecommunications and networking?

The first strategic telecom industry trend is a pivot to becoming a platform business, where telecom companies monetize their network capabilities beyond basic data transfer by selling APIs and network slicing. This move drives high-margin B2B services like private networks and addresses the commoditization of connectivity services.

The second core trend is an AI-native operational shift. AI and automation are being embedded throughout telecom businesses—from AI-enhanced operations creating self-healing networks to generative AI providing context-aware service support—to reduce operational costs and accelerate the deployment of new products.

Third, the industry is integrating low earth orbit satellites with its terrestrial wireless networks to provide ubiquitous network coverage.