Telecommunications is undergoing a transformation, with new technologies and business models redrawing the landscape. Fifth-generation (5G) wireless communications, cloud computing, decentralized telecom networks, virtualized network services, and artificial intelligence (AI) are among the technologies ushering in innovative services for customers and new business prospects for telecom companies large and small. But while innovation can deliver rewards, it also carries risks. Consider how the IT industry has made inroads into telecom’s traditional turf via the cloud, social media messaging, and collaboration platforms. This article describes how the U.S. telecom market is evolving, tackling challenges, and creating new opportunities.

What Are Telecom Industry Challenges?

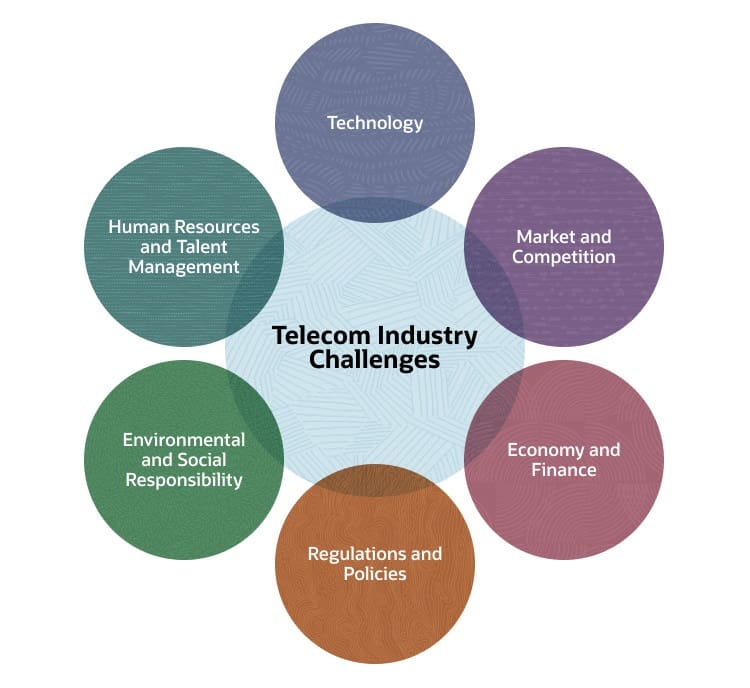

Telecom industry challenges are the competitive and technological pressures that shape how telecommunications companies operate and grow. Most challenges arise from changing market forces, intense competition, and the constant need to expand and modernize networks.

For instance, as the dominant telecom service providers, giant U.S. mobile and cable operators are using new technologies to ratchet up their battle with each other for market share. At the same time, companies ranging from major cloud providers to systems integrators and smaller network services businesses are expanding their competitive footholds. In the telecom equipment and software markets, meanwhile, established and new suppliers are competing to share in the demand for ongoing network expansion and transformational solutions. Technology-fueled competition represents the predominant dynamic in the telecom industry, promising business growth even as it brings with it myriad challenges.

Key Takeaways

- The telecom industry is undergoing a technology-driven transformation.

- With new technologies come advanced services and more business opportunities.

- In this fast-evolving landscape, challenges have also emerged in areas that include market competition, regulation, business performance, and talent management.

Telecom Industry Challenges Explained

For all the opportunities that come with an industry transformation, enormous challenges also arise, including competitive, regulatory, financial, and environmental—as well as technological. For example, 5G is a major change agent that demonstrates how technology and competition are revamping the state of play in the telecom industry. Major U.S. telecom companies began rolling out this latest generation of wireless technology in 2019 amid great fanfare, since its higher performance could catalyze new types of services for consumers and businesses. However, this hasn’t been without its challenges. Among them: some of the most exciting new services that were promised didn’t materialize, leading to a more recent rollout of a technology called 5G Advanced (5GA, more on this later). Still, 5G was already covering 88% of the North American population in the first half of 2025, according to 5G Americas, and making a big difference in the following ways.

- New services: 5G wireless technology delivers faster speeds (with top download speeds of about 300 Mbps), lower transmission delays (aka latency) and greater reliability (advertised at 99% or better) than previous technologies. 5G’s use is growing as a replacement for wireline access to homes and offices, as well as for mobile broadband services. The technology opens the door to many possibilities that have yet to be tapped—and other applications still to be defined. For consumers, new capabilities are expected to include augmented and virtual reality gaming, as well as more immersive live video streaming. Examples of 5G’s application in business include diagnostics for industrial equipment and remote patient monitoring in healthcare. The benefits of 5G are being bolstered by edge computing, which decentralizes telecom network control as it moves powerful data processors closer to customers and connects billions of devices on the Internet of Things (IoT).

- More business opportunities: 5G, in turn, is disrupting the dominant wireless telephone and cable companies’ historical hold on the U.S. telecom market. The technology increases opportunities for competitive service providers, such as mobile virtual network operators catering to consumers and network-as-a-service (NaaS) providers of enterprise services. Meanwhile, small and midsize businesses have also tapped into new opportunities created by the scale of the buildout of the 5G network and IoT as equipment and software suppliers.

Keep in mind that 5G is just one of the technologies leading to new services, applications, and business opportunities. Cloud computing has also fueled competition between the major cloud service providers and telecom companies, for example, and edge computing is expanding this competition in IoT and other areas.

27 Challenges Facing the Telecom Industry

Back in the day, telecom companies placed telephone calls and cable companies delivered TV channels. Over time, digital transformation in business and at home has eroded the profitability of these core services even as it has generated new sources of revenue, including bundles of integrated voice, internet, and entertainment services. Telecom companies need to achieve profitable growth amid technological disruption and related competitive, regulatory, and other challenges.

Technology

Recent statistics paint a dramatic picture of accelerating technological change. Americans used 132 trillion megabytes of wireless data in 2024, shattering the previous year’s record by 32 trillion megabytes, according to CTIA, the US telecom trade association. At the same time, the number of 5G devices in the nation reached over 259 million, a 43 million increase from the previous year, including everything from smartphones and smartwatches to environmental sensors and autonomous robots. Wireless broadband-to-the-home has also expanded rapidly. Handling all of that traffic is not just a matter of speed and capacity, but also complexity, given the variety of devices, increase in service types, and explosion of applications placing unique demands on telecom networks. Technology challenges include:

1. Need for constant upgrades and innovations: The U.S. wireless industry invests tens of billions of dollars every year to expand and improve its networks, the CTIA said. In addition to wireless, expensive fiber optic cables provide the backbone for 5G and expand cable companies’ fiber-to-the-home and -office installations at ever-higher speeds. Telecom companies’ challenge isn’t just implementing network upgrades but paying for them. Telecom companies hold a lot of debt, with the biggest two U.S. industry players—AT&T and Verizon Communications—perennially listed among the world’s most indebted companies.

2. Investment in research and development: Whether it’s to advance wireless or wireline technology, innovation never ceases. Even before 5G wireless coverage has been made available worldwide, mobile equipment suppliers have begun to roll out its successor, 5GA, and have been working on 6G. Meanwhile, wireline networks operated by cable companies are being upgraded to deliver 10 gigabits in both directions, into and out of homes and offices. Smaller telecom companies are also developing leading-edge hardware and software. A list of “telecom startups to watch in 2025” includes one that is building a 5G monetization platform with multi-operator integration for IoT, another delivering AI-powered 5G standalone networks that can be deployed quickly, and a third advancing virtual SIM technology and energy-efficient wireless links. Amid all this innovation, a big challenge for the dominant telecom service providers is that they have largely ceded leadership in R&D to equipment makers, software companies, and cloud providers. Experts say this makes it hard for them to competitively differentiate themselves.

3. 5G implementation and development: Even with 5G on track to hit 100% market penetration in North America by 2026, concern surrounds the slower growth of newer consumer applications, such as virtual reality, and business use cases, such as private networks in highly automated factories. This is where 5GA comes in. While nearly all of the current 5G services today run on older network infrastructure, 5GA will run on a standalone network with a more advanced core of software. This “all-5G” setup is expected to unlock the promised network capabilities, such as ultra-low latency and dynamic network slicing, that are needed for the newer consumer and business apps. 5GA is just now being rolled out, along with devices, such as the latest smartwatches, that have lower battery consumption, smaller form factors, and other improvements.

4. IoT and the rise of connected devices: IoT devices, which enable remote sensing and other capabilities in supply chains, electricity grids, and security surveillance systems, already number in the billions—and counting—in the United States. For all those devices, it’s services that constitute the largest area of spending on IoT, according to market research from IDC, with telecom companies, systems integrators, cloud providers, and others all vying to provide the required design, connectivity, data management, and analytics for businesses. Big telecom companies have been driven to partner with competitors to handle the sheer scale and complexity of implementing IoT.

5. AI and machine learning applications: Like other technologies, AI and machine learning present telecom companies with both opportunities and challenges. For instance, AI can improve network operations, improve customer support, and enhance service offerings. Machine learning, meanwhile, can optimize network performance, predict and prevent outages, and perform predictive maintenance. At the same time, however, telecom companies need to overcome the challenges presented by AI and machine learning, such as integrating them into legacy systems even while the skills to do so are in short supply.

6. Increasing prevalence of cyberattacks: Telecom networks represent critical infrastructure that is subject to cyberattacks from hostile nations as well as cybercrime syndicates. As cyberattacks on all types of companies continue to multiply, telecom companies’ increasingly complex digital environments, multiplying access points, and growing stores of customer data make them more vulnerable and more attractive to cyberattackers than ever. Smaller telecom companies may be particularly vulnerable to network security threats, while lacking the resources of their larger peers to deflect them.

7. Maintaining network reliability: Despite network upgrades, more than one in four households often experience unreliable fixed broadband connectivity, with no improvement year after year, according to EY. Both perceptions and tests also show mobile data reliability and throughput in decline, EY said. 5GA and AI upgrades herald better performance management, but have been slow to materialize.

Market and Competition

The U.S. telecommunications market is enormous, with hundreds of billions of dollars in annual revenue. Competitors continually emerge to reach for nearly every slice of that pie. On one level, social media messaging and collaboration and conferencing platforms have eroded dominant telecom companies’ text and voice revenue. On another level, telecom equipment providers, systems integrators, and managed service providers compete with the leading telecom companies to sell private networks to enterprise customers. Cloud service providers, meanwhile, represent the prime example of what’s called over-the-top services. These represent a significant drain on telecom network traffic and revenue because they deliver services via the internet with minimal to no involvement of a telecom operator. Meanwhile, mobile and cable companies aggressively compete against each other in these and other services markets. Other competitive challenges include:

8. Intense competition leading to reduced profit margins: Telecom companies’ net profit margins tend to run in the high single digits to low double digits, which is far below average IT sector margins but still considered healthy. Intense competition is among the main factors keeping profits at this level—and sometimes lower, as is the case when major wireless operators and cable companies get into price wars.

9. Struggle for market share among industry giants: The basic unit of competition among wireless and cable industry giants is the bundle. The major U.S. wireless and cable companies compete with each other by bundling broadband Internet access, TV channels, streaming services, and mobile and landline voice services. They cross over into each other’s markets in various ways. Among them, wireless companies are building 5G fixed wireless access connections into homes, while cable companies buy wholesale wireless capacity and resell services to their customers as mobile virtual network operators. Meanwhile, the 850 independent U.S. telephone companies and 700-plus independent U.S. cable companies have found it challenging to offer bundled services like these, but they are seen to be moving in the same direction.

10. The emergence of over-the-top (OTT) services: OTT services—like streaming channels, messaging apps, and online conferencing—erode telecom revenue. Running “over the top” of the telecom network, they compete directly with telecom companies’ own voice and video products. For example, this has created a “frenemy” relationship with hyperscalers like Amazon, Google, and Microsoft. Telecom companies compete with these hyperscalers, who deliver many OTT services. At the same time, telecom companies are also massive customers of hyperscalers, migrating their own internal IT and network functions to the cloud.

11. The importance of quality customer service: Intense competition increases the need for telecom companies to provide a positive customer experience, which has not historically been their strong suit. What’s more, the seamless online experiences of companies such as Uber and Netflix have heightened customer expectations and forced telecom companies to redefine their customer relationship management. “It is becoming extremely difficult for operators to differentiate, leading to the commoditization of connectivity, fierce competition, and eroding margins,” according to management consulting firm McKinsey. “Against this backdrop, customer experience is emerging as the primary competitive differentiator.” Unfortunately, improving the customer experience will require wide-ranging transformational changes, McKinsey says, including a refresh of customer service agent management.

12. Shifting consumer preferences: In the consumer market, the home often doubles as the workplace in today’s era of remote working. The home might be a smart home, with devices for automated security, energy, and cleaning. And, various members of the household could be using increasingly sophisticated digital devices and services for entertainment, healthcare, and education. Telecom companies are delivering higher-speed broadband services to fulfill all this demand, as well as wireless routers, phones, tablets, watches, and even smart vacuum cleaners, thermostats, and security cameras. While telecom companies are considered to be well-positioned to cater to markets such as the smart home, many of the devices still aren’t entirely DIY, requiring more customer interaction than telecom companies typically engage in.

13. Rising customer expectations and demands: Business customers’ need for NaaS poses another set of challenges. For example, many telecom and IT companies see private networks as a growth market amid declining returns on their other product lines, according to Analysys Mason, a management consultancy. New telecom technologies, such as network slicing, are coming online to combine customized “slices” of telecom network resources for computing, storing, and networking to meet specific business needs. Nevertheless, competition for conventional private networking is already intense among traditional telecom companies, network equipment providers, specialized network service providers, systems integrators, and others. And no single type of provider is seen to be strong in all the areas in which businesses need solutions.

14. Handling customer churn: Telecom customer retention rates are low compared to other industries. In fact, various sources cite annual churn rates in the low double-digits, depending on factors such as type of service and payment arrangements. Subscribers churn for reasons including poor customer service, competitive offers, billing issues, and network reliability issues.

Economy and Finance

When the economy is uncertain, telecom companies must overcome several economic and financial challenges to their profitability and growth. In this capital-intensive industry, for instance, network operators currently face higher interest rates on their significant levels of debt. But even if there’s an economic downturn, people and businesses still need to connect, which guarantees a certain level of recurring revenue. Other economic and financial challenges include:

15. High capital expenditure for infrastructure development: The competitive race to build out 5G infrastructure has abated, though software and cloud service upgrades to the 5GA core network are in progress to deliver advanced capabilities and services. But the capital intensity of telecom remains higher than in most other industries, averaging 15 cents or more of capital investment per every dollar of revenue. With high CapEx (capital expenditures) come high debt levels and interest payments. Meanwhile, for smaller telecom companies, the high cost of telecom equipment also presents a challenging business case and even a barrier to market entry. But virtualized network services, such as NaaS, can provide a less capital-intensive alternative.

16. Financial sustainability and profitability concerns: To cover their high costs, major telecom companies need to make operations more efficient and monetize their 5G and fiber investments by developing new products and services. They have suffered from their “build it and they will come” attitude, according to research firm Frost & Sullivan. As for current services and ongoing price wars, accounting firm PwC concludes that telecom companies have less and less pricing power on increasingly commoditized connectivity and data services. They’ve also seen their costs driven higher by inflation, eroding profitability.

17. Impact of economic downturns on the telecom industry: For all its challenges, the telecom industry has advantages that could help shield it from the impacts of an economic downturn. One such advantage, as mentioned above, is that consumers prioritize connectivity, providing steady revenue despite price increases. That said, telecom companies face significant pressure from shifting tariffs and other geopolitical rifts, according to PwC.

18. Strategies for mitigating economic risks: Experts point to several telecom strategies to mitigate economic risks, such as companies’ current slowing of capital investment and a continued focus on cost-cutting. Telecom companies are pursuing digital transformation, including data analytics to reduce customer churn and increased automation to downsize their workforces amid pressure to increase wages. Companies also see pockets of growth in areas like IoT and private 5G networks for businesses. Whichever route they take, companies need to stay vigilant about watching for recession indicators and remain poised to realign their strategies, given the ongoing debate about whether or not a recession is coming.

Regulation and Policies

Telecom is a highly regulated industry, and policymakers’ priorities have been shifting, in line with economic, political, and societal changes. For example, cybercrime, geopolitical conflict, and a cost-of-living crisis have brought greater regulatory oversight of network security, network supply chains, and the digital divide between those who have access to broadband and those who don’t. Also at the top of the agenda is spectrum availability and how regulators will make more airwaves available for continued wireless expansion and innovation. Other regulatory challenges include:

19. Impact of regulations on industry dynamics: Regulation is a double-edged sword. Policies can accelerate innovation with subsidies and radio spectrum, as they have with 5G; but regulation can also inhibit innovation in other areas, as it limits big industry players from experimenting with new business models.

20. Meeting varied regulatory standards: The range of telecom regulations is wide—from requiring U.S. telecom companies to replace Chinese equipment in their networks to demanding new broadband labeling that helps consumers better understand their service options. Other varied areas of regulation cover spam texts, rural broadband service, subsidies for Wi-Fi on school buses, and “net neutrality,” the latter of which embodies the principle that telecom companies must treat all data on the internet the same way and not discriminate or charge differently based on user, content, website, or application. Beyond Washington, some regulations that originate abroad become ad hoc global standards, such as data privacy rules or, as observers predict, Europe’s AI Act. And for telecom companies operating in different countries, diverging regulations and technical specifications can complicate market entry, regulatory compliance, and operational efficiency.

21. Handling user data and privacy concerns: Telecom companies handle an extraordinary volume of data on customers, from standard personal identification and payment information to their real-time location to the very content being transmitted. Companies use some customer data (though not the content) for marketing insights and product development, and as allowed by the Federal Communications Commission, they also sell certain types of anonymized customer data to enterprises looking to analyze consumer behavior so they can target ads. Customers can go online and opt out/opt in to some of these programs. But telecom companies’ handling of data privacy is often a hot-button issue with consumers and privacy advocates, especially following cybersecurity breaches involving customer data. Although the United States doesn’t have an overarching national data privacy policy, various state and federal agencies cover aspects of consumer data. Also, Europe’s General Data Privacy Regulation, which includes hefty fines for noncompliance, set the global standard in 2018 and provides the model for state data privacy laws, such as the California Consumer Privacy Act.

Environmental and Social Responsibility

The telecom industry has work to do on environmental and social responsibility. In fact, EY listed telecom companies’ poor management of their sustainability agendas as one of the industry’s top 10 risks for 2025. As for social responsibility, the two biggest U.S. telecom companies merited a social score of only a “C+” on Newsweek magazine’s list of America’s most responsible companies for 2025. Some of the challenges facing telecom companies in this area include:

22. Implementation of green technologies: 5G is touted by the industry as an inherently greener technology, but the jury is still out. On the one hand, 5G can reduce energy consumption in some industrial applications, such as supply chains in which goods are tracked in real-time to reduce spoilage and optimize transportation efficiency. Inherently, 5G is more energy-efficient per bit of data. But on the other hand, 5G networks require a dense network of energy consuming antennas and advanced technologies such as AI in their core operations. And their rollout is expected to greatly increase customers’ data use at an additional energy cost.

23. Waste management and reduction strategies: E-waste is the world’s fastest growing waste stream and one of the telecom industry’s biggest waste-management challenges. Verizon reported reusing or recycling over 92 million pounds of e-waste in 2024, including cellphones, chargers, set-top boxes, network equipment, batteries, and plastic components. According to STL Partners consultancy, tackling the e-waste challenge will take significant partnerships to set and achieve ambitious goals for recycling, reusing, and championing the use of longer-lasting equipment within supply chains.

24. Role in bridging the digital divide: In 2024, about one in six U.S. households lacked internet access, according to the U.S. Commerce Department. In providing fixed wireless access to homes, 5G holds the promise to narrow that gap. Rural telecom often lags behind the rest of the country when it comes to the implementation of broadband, due to the high cost of covering sparse populations with wireline networks. Federal funding is being made available to close the digital divide. The current administration in Washington announced a new $43 billion program this year, while cancelling the previous administration’s programs.

25. Ethical considerations in technology deployment and service provision: The CompTIA trade association recently created a list of ethical issues to watch for, including the misuse of personal information, careless use of AI, and a general lack of oversight and acceptance of responsibility. In other words, the group advised against the invasion of privacy in marketing strategies and product development, irresponsible adoption of disruptive technology without putting protections in place, and lack of clarity among telecom companies and their vendors about where responsibility lies in certain areas, such as cybersecurity.

Human Resources and Talent Management

The telecom industry needs to strike a balance between profitability and employee welfare, as one recruiter put it, with many moving parts on both sides of the equation. Talent challenges facing telecom companies include:

26. Need for a skilled workforce in evolving technologies: Telecom companies face a skills shortage that hinders the development and implementation of emerging technologies and innovative business models. This challenge persists, in spite of layoffs in both the telecom equipment and services sectors. Sought-after skills tend to be on the cutting edge of technologies, such as big data and AI, while other jobs are on the cutting block as automation replaces back-office workers in customer service.

27. Ensuring employee satisfaction and motivation: When it comes to employee retention, telecom companies were given an average score by Culture Amp, a maker of employee experience platforms. That means that 71% of telecom employees are engaged, emotionally committed to their organization, likely to stay longer, and apt to be more productive and effective.

How Telecom Companies Can Mitigate Challenges and Risks

Mitigating challenges and risks requires a multi-faceted strategy for simplifying operations, modernizing infrastructure, and diversifying revenue while reinforcing security, sustainability, and workforce skills.

- Identify automation opportunities: Begin by targeting repetitive, high-volume tasks like billing, service provisioning, and network diagnostics for automation. This step can serve as a catalyst for larger digital transformations.

- Prioritize technology that will modernize and enhance services: Priority technologies today include AI-driven network management as telecom companies upgrade to 5GA, finally delivering long-promised services such as network slicing for businesses and virtual reality for consumers.

- Consider new revenue streams: Related to the bullet above, telecom companies need to develop and scale new business-to-business digital services in areas like IoT, private 5G networks, and edge computing. This is an area they have often ceded to competitors.

- Shore up cybersecurity and compliance protocols: Cybersecurity risk is a double-edged sword. On one side, bad actors are constantly trying to break into telecom networks. On the other, regulators threaten penalties for weak security and personal data privacy.

- Embed sustainability goals into new infrastructure: Some telecom companies are delivering 30% reductions in energy consumption by stepping up the decommissioning of their legacy copper networks, according to the Roland Berger Telco ESG Index. 5GA and fiber technologies are inherently more energy efficient. The core network also needs to operate more efficiently, relying more on technologies such as AI to move from static, always-on networks to dynamically managing power and resources based on real-time traffic.

- Cross-train and upskill workforce: The telecom industry’s requirement for re-skilling and fresh talent has never been higher, according to EY. Many telecom companies are accustomed to designing fixed assets, made to function for a decade, PwC said. They must now pivot to software and cloud development cycles that happen in months—and sometimes weeks, to unlock new growth, modernize the back-office and legacy systems, and work at the pace of new technologies.

Manage Your Telecom Challenges With NetSuite ERP

Small and midsize companies in the telecom sector can step up to industry opportunities and challenges using enterprise resource planning (ERP) systems with integrated software for financial management, customer relationship management, and human resources. NetSuite ERP can help telecom companies provide seamless customer experiences across products and services, ease consolidation of financial data, and manage multiple subsidiaries efficiently. Specific benefits of a NetSuite ERP implementation for a telecom company include support for diversification of services through billing, the handling of customer relationships in call center environments, and management of new and existing employees.

The telecom industry’s technology-fueled transformation is elevating the level of competition for existing and emerging services. To succeed, telecom players, large and small, must overcome a host of challenges in mastering new technologies, besting the competition, navigating regulatory requirements, rising to new mandates for environmental and social responsibility, and attracting and retaining the necessary talent.

Telecom Industry Challenges FAQs

What are the challenges of the telecommunications industry?

The telecom industry has been characterized by very high capital expenses, stiff competition, and uncertain growth in recent years, dampening telecom companies’ business performance.

What is the biggest challenge facing the rural telecommunications industry?

About one in six American households still don’t have broadband access, largely in rural areas. These places often lag behind the rest of the country when it comes to broadband implementation, due to the high cost of covering sparse populations with wireline networks. 5G holds the promise to narrow that gap, with its ability to provide fixed wireless access to homes. The U.S. government subsidizes some rural broadband buildouts, but NTCA–The Rural Broadband Association has also expressed its members’ concerns about how to operate such networks on an ongoing basis and provide affordable services once they’re installed.

Why is the telecom industry so competitive?

The telecom industry involves many competitors, large and small, as the result of technological convergence in areas such as voice, internet, and entertainment services, as well as the kinds of cloud computing and edge networking capabilities needed for the Internet of Things and other services that are considered the future of the industry.

What are the risks of telecommunication?

The telecom industry faces many challenges: technological, competitive, regulatory, financial, and environmental. The telecom industry is a capital-intensive business in which competition, macroeconomic pressures, and uncertain demand for new services have combined with shifting regulatory requirements and new environmental mandates to elevate business risk.