The most successful construction businesses are those that can navigate the delicate balancing act between outgoing expenses and incoming payments—all while juggling the day-to-day, natural impediments that crop up, such as bad weather, supplier delays or mistakes, or change orders demanded by customers or the exigencies of the project.

Whether overbilling is strategic cash flow optimization or incidental fraud, it opens the door to other serious problems, including strained client relationships and legal disputes. Therefore, a construction company would do well to try to avoid inadvertent overbilling, an all-too-common result of miscommunication, inaccurate documentation, and/or improper project tracking.

But with the right approach, contractors can prioritize transparency, strengthen customer trust, and maintain their long-term financial health.

What Is Overbilling?

Overbilling is when a company charges a customer more than they should, based on the goods or services provided. In some cases, overbilling is negligent or fraudulent. For example, a consultant who doesn’t accurately track their hours may charge a client for more time than actually worked, or a healthcare provider may attempt to defraud an insurance company by billing for services not rendered.

Overbilling is a common—and tricky— challenge for construction firms, contractors, and their customers. In an industry where payment delays and high up-front costs are the norm, cash flow’s role in success or failure is paramount. But companies may intentionally overbill for legitimate business reasons or unintentionally overbill due to poor project tracking, incorrect estimates, and a number of other reasons detailed below. Even when intentional, though, without transparent customer communication and expectation-setting, overbilling can cause significant problems with clients.

Key Takeaways

- To avoid overbilling disputes, contractors should clearly communicate to customers about milestones and payment expectations.

- Customers often tolerate some overbilling because they recognize that large projects can have significant up-front costs that shouldn’t fall entirely on contractors.

- Too much overbilling, however, can rapidly alienate customers.

- Contractors can avoid excessive overbilling by reconciling their invoices with the work they’ve completed and regularly inspecting the jobsite to verify that work.

Overbilling Explained

Overbilling is a frequent source of conflict between customers and contractors that rely on progress billing, which is a standard approach for invoicing long-term projects—particularly in cases where there are up-front and ongoing costs for labor and supplies. With progress billing, contractors set a timeline for completing specific milestones, usually in a formal, written contract, and invoice customers accordingly. Overbilling occurs when a contractor charges a customer more than is warranted by the milestones achieved to date.

It’s important for contractors to clearly communicate with their customers about milestones and payment expectations to avoid overbilling disputes, even when the overbilling is designed to cover cash flow. Otherwise, they may face damage to their reputation and even legal trouble should a customer decide to sue.

How to Calculate Overbilling

Because positive cash flow is so crucial to their financial health, large construction companies that take on multiple simultaneous projects regularly track the overbilling status of each job. It’s equally important for smaller contractors, though, as they can be even more sensitive to cash flow fluctuations. Regardless of size, they all calculate overbilling using a formula derived from the percentage of completion accounting method (PoC) used for recognizing earned revenue on construction projects.

Contractors use PoC because it is the method preferred by public accounting standards (like GAAP) for calculating interim revenue during the course of a project. PoC uses the proportion of costs incurred so far as a proxy for the percentage of the project that has been completed. Matching revenues to expenses with PoC gives an accurate financial view of the companies’ projects at a given time and supports financial management of multiple projects. There are several methods of the PoC formula such as units delivered, effort expended, and cost-to-cost; but each one fundamentally divides the expenditure to date by the estimated expenditure. For example, the cost-to-cost formula for PoC is:

Percentage of completion = (Costs incurred to date / Total estimated project cost) x 100

For example, if a contractor estimates that its costs for a $125,000 project will be $100,000, and has spent $30,000 so far, the project is 30% complete [($30,000 / $100,000) x 100]. The contractor can recognize 30% of the contract price as earned revenue, or $37,500 (30% of $125,000).

To calculate overbilling, then, the contractor first determines the percentage of project completion using the formula above and then uses the result in this overbilling formula:

Overbilling = Total billings to date - Earned revenue to date

If the contractor in the running example had billed $37,500 so far, then it had no overbilling. If it had billed $42,000, though, it would be 3.6% overbilled because $42,000 is 33.6% of the total contract price of $125,000, but the job is considered only 30% complete based on PoC. If the result of the formula is a negative number, that would be an example of underbilling.

Potential Causes of Overbilling

Overbilling can happen for a variety of reasons. Sometimes it’s a conscious choice by a contractor to ensure positive cash flow throughout long projects with large up-front costs. Other times, it occurs because of inaccurate cost estimates, accounting and project management errors, or incorrect documentation.

-

Manual errors and miscommunication:

Accounting mistakes, such as incorrectly documenting expenses, often lead to overbilling. Even a seemingly minor error, such as transposing numbers in the unit price of a particular supply, can bring about major discrepancies between how much a customer should be, and is, invoiced. Automated accounting can help reduce these errors.

Miscommunication—say, a contractor failing to update a customer about changing milestones or updated costs—is another common cause of overbilling.

-

Billing for undocumented change orders:

A specific example of miscommunication is when a contractor invoices for work that a customer hasn’t approved. Construction work often runs into unexpected issues, such as problems with the condition of a site or midproject changes to local codes. Contractors should always use a formal change order to notify customers about these issues and get their authorization to address them. This ensures that billing and the work being performed are always aligned.

-

Taking incorrect measurements:

Incorrect measurements are a common example of a manual error that can lead to overbilling. They often happen when a contractor relies on the wrong tools or fails to follow the proper procedures for measuring or calculating the amount of needed materials. They can also occur when a contractor incorrectly reads a blueprint or other project specs. If the amount measured is too high, it results in the customer being billed for unneeded supplies.

-

Overestimating cost estimates:

Cost estimates are just that: estimates. Contractors and construction firms tend to err on the side of higher estimates, so they don’t have to go back to their customers to ask for more money. Because of this approach—or, sometimes, because of changing market conditions or more efficient purchasing practices—the actual cost ends up being lower than quoted. If a contractor doesn’t adjust invoices accordingly, it will end up overbilling the customer. Contractors should also make sure to update any other relevant financial statements to explain cost differences.

-

Poor project tracking:

It’s essential to track the progress of every task in a project, as well as any shortages or overages of materials. Without doing so, it’s impossible to align the degree of work completed with the amount of money billed to the customer—an absolute must for accurate billing. Construction job costing is a process that can help contractors properly track their tasks, plus their budget and cash flow, to avoid overbilling.

-

Unrecorded accounting accruals:

In cases where a general contractor (GC) relies on a subcontractor to perform part of a project, the GC may bill the customer before receiving the sub’s invoice. Similarly, the GC may receive materials at the jobsite before receiving the invoice for those materials. These are called unrecorded accruals, because the actual cost of the sub’s work is not yet formally recorded in the GC’s accounting system. They can lead to the GC billing the customer for more than the sub is actually owed or more than the materials actually cost. Contractors should always make sure costs are accurately accrued in their accounting systems before billing for them.

-

Inaccurate documentation:

Incorrect measurements, nonexistent change orders, poor project tracking, and unrecorded accruals are all examples of inaccurate documentation. Any incorrect information about the amount of work completed and its actual cost, no matter how minor, can end up with a customer being charged more than they owe. Keep updated records and double-check all measurements and calculations to avoid these errors as much as possible.

-

Short-term cash flow pressure:

The up-front costs that typically come with large projects can create significant cash flow issues for contractors. For example, contractors may suddenly find they don’t have enough cash to pay employees on time, or to pay suppliers and subcontractors. Or, they may not have enough to keep up with debt payments. So, overbilling can sometimes be an intentional strategy to maintain positive cash flow. It’s important to strike a balance between healthy cash flow and customer transparency.

Risks of Overbilling

Overbilling comes with some major downsides that can outweigh the short-term cash flow benefits. Contractors and construction firms can hurt their valued relationships with customers and could even end up in court to settle those disputes. And overbilling can expose larger operational problems within a company, jeopardizing its overall stability and success. Here are some of the biggest risks of overbilling for contractors and other construction firms.

-

Legal risks:

Customers who discover they’ve been overbilled may seek to recover their money through the courts. Contractors that are sued not only risk losing the overcharged amount of money but may also have to pay legal fees, penalties, and any awarded damages. In extreme cases, these costs may prove insurmountable for a small firm.

Furthermore, law enforcement agencies may even pursue criminal prosecution in some overbilling cases. A rare visible example came in 2008, when two managers of a subcontractor on Boston’s Central Artery/Tunnel Project (“the Big Dig”) pleaded guilty to conspiracy to commit highway project fraud. The subcontractor overbilled by charging higher “journeyman” rates for work done by apprentice ironworkers.

-

Reputational risks:

Improper overbilling leads to unhappy customers. At the very least, they might not want to do business with that contractor again. But they may also share negative reviews and warnings, both online and with other potential customers they know. In construction, where so much business relies on word of mouth, a contractor’s reputation is one of its most important selling points. Firms that leave a bad taste in customers’ mouths cause serious damage to their reputations, which can limit their business opportunities.

-

Job borrow:

Job borrow refers to a construction industry practice in which funds from one project are used to finance another project or to cover general expenses. It usually stems from overbilling and, like overbilling, can exist on a spectrum from minor, temporary fund transfers to severe cases that threaten project completion or the financial solvency of the firm.

One customary way job borrowing occurs is when a firm has overbilled by so much that the cost of completing a project is higher than the amount left to bill. For example, say a $10 million project is 75% complete, but the firm has already billed for $9 million. That means it has only $1 million left to do $2.5 million worth of work—in other words, the firm is cash flow-negative by $1.5 million.

In these cases, the firm may borrow money from another one of its jobs to maintain positive cash flow. But that’s not always a real solution, because it only pushes the problem off to the other project. To avoid this dangerous cycle that job borrow can create, contractors and construction firms should monitor their expenses and make sure they have enough money to complete all contracted work.

Tips to Reduce Overbilling

The keys to reducing overbilling are communication, documentation, and standardized processes—for all employees, subcontractors, and clients. Construction firms can strengthen their customer relationships and build more efficient companies by prioritizing accurate and transparent billing. Here are some practical tips to help stay on track with accounting, minimize the risks of overbilling, and ensure consistent project success.

- Reconcile invoices regularly: The best way for contractors to avoid excessive overbilling is to make sure the work they’re invoicing for matches up with the work they’ve completed. And it’s not enough to rely on project-tracking systems, which may contain inaccurate, incomplete, or outdated information. Inspect the jobsite regularly to verify that information. Only then can contractors truly ensure alignment between their invoices and their completed work.

- Standardize project tracking and billing: Large construction projects have many moving parts, both literally and figuratively. And too many contractors rely on undocumented processes and disparate systems that increase the chances of errors and omissions that can result in overbilling. The way to make sense of it all is to use standardized processes and a unified system that tracks all project tasks, their associated labor and materials costs, and their billing.

- Require all change orders be documented: No matter how well planned a project is, unexpected issues will pop up and require changes in scope. This shouldn’t be a problem. The problem arises when firms don’t document these changes and communicate them to customers, because it leads to customers being billed for work they weren’t aware of and never signed off on. To avoid these instances of apparent overbilling, document all change orders and get customer approval before moving ahead with the relevant work.

- Ensure that employees, contractors, and subcontractors understand billing practices: Because of the construction industry’s unique project-based accounting requirements, any small change can have serious ramifications. Contractors must explain to their employees and subcontractors how any deviation from the scope of work can create discrepancies that lead to overbilling—and stress the importance of documenting and seeking approval for these changes in advance. Stay in constant communication with all stakeholders to avoid any misunderstandings regarding the scope of the project and its associated costs.

- Monitor adherence to billing protocol with internal audits: In addition to regular reconciliation, internal audits can help contractors ensure accurate billing. Create a system for documenting, reviewing, and approving all expenses—including labor and materials, plus those generated by any subcontractors—before creating invoices. Implement reviews and approvals for the invoices as well, to enact one final accuracy check before sending them out.

- Leverage your accounting software: Spreadsheets and basic accounting tools are no longer enough to track and manage today’s complex construction environments. The risk of incomplete documentation, incorrect information, and other errors is simply too high.With cloud-based, integrated accounting software, contractors can automate reconciliation, standardize processes, and improve accuracy, decreasing the risk of overbilling that can damage their reputation and hurt their business.

Accounting Automation Reduces Errors

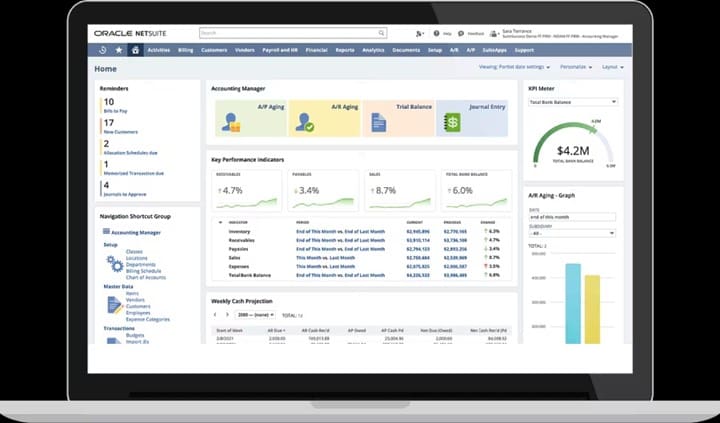

If you sometimes feel like construction accounting requires as much manual labor as the construction work itself, you’re probably not alone. But a cloud-based enterprise resource planning (ERP) system, such as NetSuite’s ERP solution for construction, automates day-to-day accounting tasks and is built to handle the industry’s unique project-oriented requirements. NetSuite helps construction firms and contractors optimize their expenses, operate more efficiently, and get in-depth insights into business performance—including cash flow—so they can make better business decisions.

More specifically, NetSuite automates billing processes, provides real-time project tracking, and includes precise job-costing features, all of which helps to minimize human error and ensure that invoices accurately reflect completed work. What’s more, NetSuite’s automated billing processes support compliance with the American Institute of Architects’ billing guidelines, which emphasize standardizing invoices and improving transparency. The system’s customizable revenue recognition policies and real-time analytics enable firms to closely monitor project financials, quickly identify discrepancies, and maintain tight control over billing practices. These capabilities not only safeguard against unintentional overbilling but also foster trust with clients and improve overall financial management.

By understanding the causes of overbilling—including miscommunication, inaccurate documentation, and poor project tracking—construction firms and contractors can proactively begin to address its risks. Clear processes and consistent, open dialogue with customers are key parts of an overbilling solution. Regularly reconciling invoices with degree of completed work and adoption of standardized project management and change-order approval systems can reduce the chances of accidental overbilling. Plus, a focus on transparency among employees, subcontractors and clients will go far toward ensuring alignment and accountability throughout the life of a project.

Overbilling FAQs

Is overbilling the same thing as overpayment?

No. Overbilling is when a vendor charges a customer more than they should owe, based on the goods and services they’ve received. Overpayment is when a customer pays a vendor more than they owe, based on the invoice they received.

What’s the difference between overbilling and price gouging?

Overbilling is when a company, intentionally or unintentionally, bills a customer for more than the customer actually owes. Price gouging is when a company intentionally and significantly raises prices for a specific offering, often when demand for that offering spikes due to a natural disaster or other state of emergency. A grocery store doubling its prices on bottled water before an impending hurricane would be an example of price gouging.

What is an example of overbilling?

An example of overbilling is when a construction company completes 40% of a $10 million project but bills the customer for 50%, or $5 million. The company has overbilled by 10%, or $1 million, which improves its immediate cash flow but may lead to a cash shortage further down the road.