People often use “revenue,” “profits,” and “profitability” interchangeably, but the truth is they represent very different aspects of a business’s financial health. For hotels, revenue is money earned from sales of room bookings and other services while profits are what’s left after subtracting all expenses. And profitability is the link between the two—profitability measures how well the hotel converts its revenue into profit.

For the highly competitive hospitality industry, optimizing profitability is a must. Hotel owners and managers need accurate, timely insights into operations so they can make data-driven decisions that improve financial performance. It’s also the way external investors decide where to invest their capital. This article is a guide to hotel profitability analysis, explaining the key aspects and providing step-by-step instructions and best practices.

What Is Hotel Profitability?

Hotel profitability is the degree to which a property can generate revenue that exceeds its operating expenses, resulting in positive net income. It’s a crucial concept for hotel owners and managers because strong profitability provides the means for a hotel to sustain itself financially, reinvest in the business, and attract investors or lenders.

Maintaining or improving profitability requires a delicate balance between maximizing revenue and minimizing expenses, which demands continuous monitoring and analysis. By understanding the importance of profitability and the factors that influence it, hoteliers can make informed decisions that drive long-term success.

What Is a Hotel Profitability Analysis?

Hotel profitability analysis involves evaluating various financial metrics, such as revenue, expenses, and net income, to gain insights into the hotel’s overall financial efficiency. There are two main types of hotel profitability analysis: internal and external. Hotel managers conduct internal analyses to help them make data-driven decisions and optimize operations, while external analyses are performed by investors and lenders to assess the hotel’s financial viability and potential for return on investment (ROI). By regularly conducting profitability analyses, hoteliers can keep their properties competitive, financially sustainable, and poised for growth.

Profitability analysis is closely tied to revenue management, which is a strategic approach for maximizing hotel revenue through market segmentation, dynamic pricing, and inventory control. Hoteliers analyze profitability metrics alongside revenue management data to identify opportunities for modifying pricing strategies, optimizing distribution channels, and improving overall financial performance.

Key Takeaways

- Profitability analysis looks at how well a hotel turns its revenue into profits and identifies ways to improve financial performance.

- Revenue management strategies, such as dynamic pricing, inventory control, demand forecasting, and marketing, can be optimized to drive hotel profitability.

- Conducting a complete hotel profitability analysis involves seven key steps.

- The right technology improves hotel profitability analysis by automating data integration, calculations, and reporting, allowing hoteliers to focus on their guests.

Hotel Profitability Analysis Explained

A comprehensive hotel profitability analysis examines the property’s various revenue streams and key performance indicators (KPIs) to assess its overall financial health. The primary revenue stream for most hotels is room rentals. However, hotels often have additional revenue streams that contribute to their profitability, such as food and beverage sales from on-site restaurants, bars, and room service; spa services; parking; and resort fees. To conduct a thorough profitability analysis, hotel owners and managers typically focus on the following key components:

- Revenue analysis: Examination of the hotel’s various revenue streams to identify trends, patterns, and opportunities for growth. This involves reviewing room rental income, food and beverage sales, and other ancillary revenue sources to determine areas that perform well and areas that need improvement.

- Expense analysis: Assessment of the hotel’s operating costs, including labor, supplies, utilities, and maintenance, to identify areas for cost savings and efficiency improvements. By carefully monitoring and managing expenses, hoteliers can optimize their profitability without sacrificing quality or guest satisfaction.

- KPI tracking: Monitoring hospitality KPIs, such as occupancy rate (OC), average daily rate (ADR), and gross operating profit per available room (GOPPAR), provides valuable insights into the hotel’s performance and helps identify trends.

- Benchmarking: Comparison of the hotel’s financial performance and KPIs to industry standards and competitors to assess relative success and identify areas for improvement. This helps hoteliers make strategic decisions to enhance their competitiveness and profitability.

- Trend analysis: Tracking the hotel’s profitability metrics and KPIs over time to identify seasonal patterns, market shifts, and the positive or negative effects of prior strategic decisions. By analyzing historical data and highlighting trends, hoteliers can make informed forecasts and adjust their strategies accordingly.

What Impacts Hotel Profitability?

Several interconnected factors impact a hotel’s revenue and expenses and, therefore, profitability. Hotels can control—or at least influence—some factors, such as service levels, amenities, size, or brand reputation, while others are external, including market conditions, seasonality, and the local competitive landscape. By understanding the following drivers, property owners and managers can take steps to maximize profitability and seize growth opportunities as they arise:

- Type of hotel and occupancy: Luxury properties typically achieve higher profit margins from premium pricing and increased spending per guest, while economy hotels usually prioritize operational efficiency and volume. Occupancy levels compound these differences, as properties with higher average daily rates require fewer bookings to cover expenses and maintain profitability than those with thin margins.

- Market segment: Business travelers often pay premium rates and provide consistent weekday demand, while leisure guests seek value pricing during higher-volume periods, such as weekends or holidays. A hotel’s optimal guest mix depends on location, available business-focused amenities like conference rooms or high-speed internet, and the property’s ability to serve both business needs and volume-driven casual business simultaneously.

- Location of hotel: Urban properties or those near year-round tourist destinations benefit from constant demand but face higher labor and property costs. Resort hotels, on the other hand, may command peak-season premiums but must maintain core staff and operations all year. Regional factors also affect profitability—market constraints can drive up wages, utility costs, and tax obligations.

- Brand reputation: Recognizable brands often have their own loyalty programs, built-in customer trust, widespread marketing campaigns, and partnerships that allow hotels to charge high prices and maintain occupancy rates. Independent properties, on the other hand, have more operational freedom and avoid paying franchise fees, but they must make their own marketing and guest acquisition investments, which can impact profitability and hinder growth.

- Seasonality: Properties must maintain fixed costs, such as rent and administrative salaries, during slow periods, often covering cash gaps with savings left over from the peak season. Many hotels minimize off-season profitability drops by developing counter-seasonal strategies and flexible cost structures, such as discounted extended stays, partnerships with local attractions, extended vendor payment plans, or add-on packages.

- Competition: Market supply and evolving demand directly impact profitability, with oversupplied markets driving down prices and margins. New openings, competitor renovations, and alternative lodging platforms that bypass traditional pricing models—peer-to-peer rentals, for instance—all require hotels to continuously adjust their marketing and pricing strategies to meet profitability targets.

How to Measure Hotel Profitability

Regularly monitoring and benchmarking the full range of factors that affect hotel profitability is an excellent way for hotel owners and managers to enhance their bottom lines. These efforts provide early alerts to developing issues and potential areas for improvement. While there are dozens of KPIs that track various aspects of the business, the following eight are those most commonly used by hoteliers to assess their revenue generation, operational efficiency, and overall profitability:

- Occupancy rate measures the percentage of available rooms that are occupied over a given period. It’s an important metric due to the perishable nature of room inventory. The formula is:

Occupancy rate = (Number of rooms sold / Total rooms available) x 100

To illustrate, the hypothetical Seaside Motel has 75 available rooms during the month of June but sells only 50 per day, on average. Its occupancy rate would be 50 / 75 x 100, or 66.7%.

- Average daily rate (ADR) is the average rental revenue earned per occupied room per day. It helps hoteliers assess their pricing strategies and revenue generation performance. The formula is:

ADR = Total room revenue / Number of rooms sold

Suppose the Seaside Motel generated $262,500 in total room revenue for the month of June, having sold an average of 50 rooms per day for 30 days (or a total of 1,500 rooms sold). Its ADR would be $175 ($262,500 / 1,500).

- Revenue per available room (RevPAR) is a key metric that measures a hotel’s revenue generation efficiency by considering both occupancy and average daily rate. It helps hoteliers evaluate their property’s ability to fill rooms and generate revenue. The formula is:

RevPAR = ADR × Occupancy rate

The Seaside Motel’s RevPAR would be $116.73 ($175 x 0.667).

- Total revenue per available room (TRevPAR) is a comprehensive metric that considers all revenue sources, including room revenue and ancillary revenue. It helps hoteliers assess their overall revenue generation performance. The formula is:

TRevPAR = Total revenue / Total available rooms

Let’s say that the Seaside Motel generated $67,000 in ancillary revenue during June, so it had total monthly revenue of $329,500 ($262,500 + $67,000). Its TRevPAR would be $146.44 ($329,500 / 2,250). Total available rooms for the month—2,250—is calculated as 75 available rooms multipled by 30 days.

- Cost per occupied room (CPOR) measures the average operating cost incurred per occupied room, including expenses such as labor, utilities, and supplies. It helps hoteliers assess their operational efficiency and identify areas for cost optimization and profit improvement. The formula is:

CPOR = Total operating expenses / Number of occupied rooms

Suppose that total expenses for the Seaside Motel in June were $299,390. Its CPOR would be $199.59 ($299,390 / 1,500).

- Labor cost percentage represents the ratio of labor costs to total revenue. It helps hoteliers evaluate the efficiency of their staffing, one of the largest hotel costs. The formula is:

Labor cost percentage = Total labor costs / Total revenue x 100

In June, the Seaside Motel spent $72,490 on labor, resulting in a labor cost percentage of 22% (($72,490 / $329,500) x 100).

- Gross operating profit per available room (GOPPAR) measures a hotel’s overall profitability by considering both revenue and expenses on a per-room basis. It’s a holistic look at profitability for all departments and is often compared to internal targets, historical results, and industry benchmarks. The formula is:

GOPPAR = (Total revenue – Total expenses) / Total available rooms

The Seaside Motel’s GOPPAR would be $13.38 (($329,500 – $299,390) / 2,250).

- Profit margin represents the percentage of revenue that remains as profit after accounting for all expenses. It’s the most comprehensive measure of profitability. The formula is:

Profit margin = (Total revenue – Total expenses) / Total revenue x 100

Based on all the preceding data, the Seaside Motel’s June profit margin was 9% (($329,500 – $299,390) / $329,500) x 100).

Hotel owners, investors, and external analysts also use several investment metrics to measure profitability, ROI, return on assets (ROA), and return on equity (ROE). ROI measures the profitability of specific investments or projects, helping owners and investors prioritize initiatives that generate the highest returns. ROA indicates how efficiently a hotel uses its assets to generate profits, and ROE evaluates the hotel’s ability to generate returns on the owners’ equity investment.

What Is a Hotel Profit Margin?

A hotel profit margin is the percentage of revenue left as profit after accounting for all operating expenses, calculated by dividing net profit by total revenue and multiplying by 100. For example, if a hotel generates $1 million in revenue and spends $850,000 on expenses, its profit margin would be 15%, as shown below:

Net profit = Revenue – Expenses =

$1,000,000 - $850,000

= $150,000

Hotel profit margin = (Net profit /

Revenue) x 100

($150,000 / $1,000,000) x 100 =

15%

Hotel profit margins typically range from 10% to 30%. Budget properties traditionally operate toward the lower end while luxury hotels achieve higher margins through premium pricing and ancillary revenue sources.

Profit margins vary based on property type, location, and operational efficiency. A full-service hotel, for example, might bring in high revenues but earn lower profit margins due to increased labor expenses and staffing requirements for restaurants, spas, catering halls, and event spaces. On the other hand, limited-service properties with simplified operations and reduced overhead costs can charge lower room rates and still earn higher margins. Unlike gross revenue, which measures top-line performance, profit margins reveal how effectively hotels convert sales into actual earnings, providing a more comprehensive picture of financial success and sustainability.

Why Are Hotel Profit Margins Important?

Because profit margins are the primary indicator of a hotel’s financial health and operational efficiency, owners and investors use these metrics to inform financial decisions, property valuations, and creditworthiness. Properties with strong margins can reinvest in property improvements, build cash reserves for economic downturns, and demonstrate value to buyers or lenders. Conversely, those with weak margins often struggle to fund maintenance initiatives and upgrades, giving competitors opportunities to pull ahead. Monitoring profit margins can also provide early warning signals about rising costs, pricing issues, or operational inefficiencies before they threaten the property’s long-term viability.

How Revenue Management Impacts Hotel Profitability

Revenue management strategies focus on maximizing a hotel’s top-line sales, not profitability. But it’s clear that tactics to boost revenue can significantly improve profitability. Effective revenue management programs concentrate on the most profitable revenue streams, increasing their impact on the bottom line and supporting sustainable growth.

More specifically, revenue management involves analyzing market conditions, customer behavior, and revenue patterns to make strategic decisions. This includes identifying the most profitable customer segments, distribution channels, and pricing strategies that align with the hotel’s financial objectives. For instance, by implementing dynamic pricing and inventory control techniques, revenue managers can maximize revenue during high-demand periods while minimizing the impact of low-demand seasons on profitability. Revenue management extends beyond room revenue to encompass other revenue streams, such as food and beverage, spa services, and event spaces. By taking a holistic approach to revenue optimization across all departments, hotels can realize significant improvements in overall profitability.

Dynamic Pricing Strategies

Following the dynamic pricing model, hotel operators can adjust room rates in real time based on market demand, competitor pricing, and other factors. By continually adjusting prices to match evolving market conditions, hotels can maximize revenue and improve profitability. When implemented effectively, dynamic pricing allows hotels to capture the full value of their rooms during high-demand periods, leading to increased ADR and revenue. Conversely, during low-demand seasons, dynamic pricing allows hotels to adjust rates to stimulate demand and maintain occupancy levels, preventing rooms from going unsold. By striking the right balance between room rate and occupancy, dynamic pricing helps hotels optimize their revenue mix and drive higher profit margins.

For example, consider a hotel that typically sells rooms at $200 per night. With dynamic pricing, the hotel might increase rates to $250 per night during a peak holiday weekend, capturing additional revenue from customers without incurring additional incremental costs. During a slow midweek period, though, the hotel might lower rates to $150 per night to attract more price-sensitive travelers and boost occupancy. By managing rates in this way, the hotel maximizes revenue and increases its profitability across varied market conditions.

Inventory Management

Hotel inventory is perishable. In the Seaside Motel example discussed earlier, every day during June the motel lost revenue from the 25 rooms that went unsold—and that can never be sold in the future. This makes managing inventory for the highest possible level of occupancy a key goal for hotels. A primary strategy for doing so is to strategically distribute hotel room inventory across various booking channels. Effective inventory management considers the commission structures and costs associated with each channel. For example, online travel agencies (OTAs) typically charge higher commissions than direct booking channels, so using OTAs may expand reach and sales but reduce profitability.

Consider a hotel that receives bookings through its direct website, OTAs, and wholesale partners. The direct channel has the lowest distribution cost, while OTAs charge an average 15% commission, and wholesale partners have a fixed contracted rate. During high-demand periods, the hotel can limit inventory on OTAs and wholesale channels and allocate a larger portion of its inventory for direct bookings to minimize commission costs and maximize profitability. Conversely, during low-demand periods, the hotel can release more inventory to OTAs and wholesale partners to maintain occupancy levels and generate incremental revenue.

Demand Forecasting

Demand forecasting is a fundamental aspect of revenue management that involves predicting future customer demand, primarily for hotel rooms, based on analyzing historical booking patterns, seasonality, and market trends as well as external factors, such as events, holidays, and competitor activity. By anticipating demand fluctuations, hotels can plan out their pricing and inventory strategies to maximize revenue.

Demand forecasts can also help hotel managers better manage costs and improve operational efficiency. By predicting high-demand periods, the hotel can keep adequate staffing to maintain service quality. Similarly, demand forecasting improves supply chain management, reducing the risk of overstocking or running out of essential supplies. Often, demand forecasts use scenario analysis to help revenue managers determine pricing strategies and manage inventory across different demand situations.

To illustrate, consider a hotel that uses demand forecasting to anticipate a spike in bookings during a major sporting event in the city. By analyzing historical data from similar events and monitoring competitor pricing, the hotel can adjust its rates and inventory allocations accordingly. The hotel may choose to increase room rates during the event dates to capitalize on the high demand and maximize ADR. Furthermore, the hotel can strategically allocate inventory across channels, such as releasing more rooms to event-oriented OTAs while still maintaining a portion of inventory for direct bookings at premium rates. It can finesse weekly staffing schedules to backload on the event days for adequate staffing while avoiding costly overtime. And it can preorder supplies to capture bulk discounts and reduce costs.

Ancillary Revenue Optimization

Ancillary revenue optimization involves decisions about pricing, promotion, and resource allocation for a hotel’s non-room products, such as restaurants, convenience shops, and spas. To do this successfully, hotel managers must understand the unique profitability drivers of each revenue stream and their contribution to overall profitability. Each ancillary revenue stream has its own business model, cost structure, break-even point, and profit margin. Thus, each has a different impact on a hotel’s bottom line.

Hotels typically analyze the revenue potential and profit margins of each stream by tracking specific KPIs, such as TRevPAR, cost of goods sold (COGS), and departmental profit margins. This analysis helps identify opportunities to enhance profitability by adjusting pricing, managing costs, and improving operational efficiency within each ancillary department.

For instance, if a hotel discovers that its spa has a high profit margin but low utilization rates, implementing targeted marketing campaigns, offering special packages, and adjusting schedules can spur increased spa revenue to raise overall profitability. Similarly, regularly reviewing menu engineering and supplier contracts in food and beverage outlets can help optimize menu pricing, control costs, and improve overall profitability.

Enhanced Guest Experience

Exceptional service, amenities, and personalized touches create memorable stays for guests. Positive guest experiences lead to increased customer satisfaction, loyalty, and advocacy, which can significantly impact a hotel’s revenue and profitability. Satisfied guests are more likely to spend more during their stays, purchase ancillary services, and recommend the hotel to others. Moreover, by fostering guest loyalty, hotels can reduce customer acquisition costs and increase the lifetime value of each guest, resulting in improved long-term profitability.

To enhance guest experiences, hotels can implement various tactics, such as providing personalized service, offering unique amenities, and creating immersive experiences that align with the hotel’s brand and target audience. Consider investing in staff training for consistent, high-quality service; upgrading room amenities and technology; or developing experiences, like culinary events or local tours. By continually gathering and analyzing guest feedback, hotels can identify areas for improvement and tailor their offerings to meet or exceed guest expectations, ultimately driving revenue growth and profitability through enhanced guest satisfaction and loyalty.

Strategic Promotions and Marketing

Strategic promotions and marketing involve targeted campaigns and offers to attract guests, increase bookings, and raise revenue and profits. However, the costs associated with these initiatives can also affect overall profitability. Offering discounts and investing in marketing campaigns increase expenses, which may offset the associated revenue gains if not managed carefully. To develop strategic promotions and marketing that contribute positively to profitability, hotels must strike a balance between the costs of the initiatives and the incremental revenue they generate. This requires carefully analyzing the ROI of each campaign, factors such as the cost of acquisition and the average length of stay, and the potential for ancillary revenue. By leveraging data analytics and market segmentation, hotels can identify the most profitable customer segments and channels and allocate their marketing budgets accordingly.

For example, suppose a hotel launches a “Stay 3 Nights, Get the 4th Night Free” promotion to boost bookings during its shoulder season—the weeks or months between high and low seasons. While the promotion may attract more guests and increase occupancy rates, it also reduces the ADR and profitability for those bookings. To offset the drag on profitability, the hotel may focus on upselling guests during their extended stays, offering discounted spa treatments, dining credits, or room upgrades.

How to Perform a Hotel Profitability Analysis

Hotel profitability analyses should ideally happen monthly to monitor the business’s performance, with deeper dives performed quarterly or annually. The frequency of the analyses depends on the hotel’s size, market conditions, and management practices. During more in-depth examinations, hotel owners and managers develop strategies and goals for the general financial health of the property, with a particular focus on revenue and profitability.

Hotel profitability analyses are typically conducted by the hotel’s finance team, revenue specialists, and general managers. They collaborate to gather and interpret financial data from various sources, including the property management system (PMS), point-of-sale (POS) systems, and accounting systems. Insights from profitability analyses are used by owners, investors, department heads, sales and marketing teams, and other stakeholders to develop strategies, set goals, and monitor performance.

The following are seven key steps for conducting a comprehensive hotel profitability analysis.

1. Gather and Review Financial Data

The first step in a hotel profitability analysis is to gather and review financial data from various sources. The PMS provides data on room revenue, occupancy rate, ADR, and RevPAR, for example, while POS systems offer insights into food and beverage sales, spa services, and other ancillary purchases. Financial statements, such as the hotel’s income statement, balance sheet, and cash flow statement, are also vital sources of information. Payroll and labor management systems provide data on labor costs and productivity, while booking and distribution platforms offer information on channel performance and commission costs.

When gathering data, it’s essential to determine the appropriate timeframe for the analysis, considering factors such as seasonality, market conditions, and business cycles. Once the data is collected, it should be organized into a structured format, validated for accuracy and consistency, and aligned with Uniform System of Accounts for the Lodging Industry (USALI) standards. Finally, conducting an initial review of the data helps identify high-level trends, patterns, and any significant variances or anomalies that merit further investigation.

2. Calculate Key Profitability Metrics

Key profitability metrics help hotel managers assess the financial health of their properties and make informed decisions on how to improve operations and bottom-line performance. Regular monitoring and analysis of these metrics allow hotel management to improve operational efficiency, control costs, and make data-driven decisions about pricing, investments, and resource allocation.

In addition to GOPPAR and profit margin, two other critical profitability metrics are earnings before interest, taxes, depreciation, and amortization (EBITDA) and net operating income (NOI). EBITDA calculates the hotel’s overall profitability before accounting for various nonoperating factors, thus offering a clearer picture of the property’s core earnings potential. NOI, on the other hand, represents the hotel’s profitability after accounting for operating expenses but before debt service and taxes, helping to assess the property’s ability to generate income.

To gain a holistic understanding of a hotel’s profitability, management should compare these metrics against budgets, forecasts, prior periods, and industry benchmarks. This comparison helps them identify variances, spot trends, and assess the hotel’s financial performance and competitive position in the market. Dashboards and automated reporting tools can help fine-tune the process of tracking and analyzing profitability KPIs. With the ability to visualize data in real-time, management can quickly identify areas of concern, make data-driven decisions, and implement strategies that will improve profitability.

3. Analyze Operational Efficiency

The goal of analyzing operational efficiency is to maximize outputs—that is, revenue-generating activities—while minimizing labor, utilities, and other inputs, to reduce costs and increase profitability. Labor management is crucial because payroll often represents a significant portion of a hotel’s operating expenses. Hotels can actively manage labor costs by monitoring occupancy rates, adjusting staffing levels, implementing cross-training programs, and leveraging technology to automate tasks and refine processes.

Utilities are another large hotel expense commonly scrutinized when performing profitability analyses. Operational efficiency can come from conducting energy audits, investing in energy-efficient systems, implementing water-saving measures, and using smart technology to reduce energy consumption and costs. Other ways to improve operational efficiency include identifying and eliminating bottlenecks, redundancies, and inefficiencies in operations. Simplifying processes, automating manual tasks, outsourcing noncore functions, and leveraging data analytics can reduce errors while increasing productivity and profitability.

Hotels typically establish and track relevant KPIs and operating expense ratios to analyze and monitor operational efficiency, identify areas for improvement, and measure the success of their efficiency initiatives over time.

4. Evaluate Ancillary Revenue Streams

Ancillary revenue from sources such as food and beverage, spa services, and parking can significantly enhance a hotel’s profitability and lessen its reliance on room revenue. Diverse revenue sources help counteract the impact of market fluctuations for a more stable, resilient, and sustainable business. But without active management, ancillary revenue streams can also drain profitability. To evaluate ancillary revenue, hotel managers should identify potential sources of additional revenue and income and adhere to USALI guidelines for consistent and accurate reporting, performance tracking, and benchmarking of those activities.

Key metrics for analyzing the profitability of ancillary revenue streams include TRevPAR, profit margin, and percentage of total revenue generated by each ancillary stream. Comparing these against budgets, historical performance, forecasts, and industry standards helps identify strengths and weaknesses. To improve ancillary product profitability, consider enhancing guest experiences, promoting services effectively, and training staff to upsell and cross-sell. Hotels should also explore new opportunities for revenue generation based on guest preferences and market trends, such as introducing wellness programs or partnering with local businesses.

5. Assess Guest Satisfaction and Retention

Satisfied guests directly contribute to increased revenue and long-term financial success. Happy guests are more likely to return, recommend the hotel, and post positive online reviews, all of which lead to higher occupancy rates, increased ADR and, ultimately, greater profitability. Hotels use various methods to assess guest satisfaction, such as post-stay surveys, monitoring online reviews, and soliciting in-person feedback surveys. These methods also help identify areas for improvement, allowing hotels to fine-tune their services and amenities to better meet guest expectations. Furthermore, analyzing guest data to identify trends and patterns relative to satisfaction levels across different customer segments, such as business travelers, families, and leisure guests, allows hotels to tailor their offerings to suit the most profitable segments.

Retention rates directly impact profitability because repeat guests often have a higher lifetime value than one-time visitors. Hotels can track the percentage of guests who return for subsequent stays as well as the frequency and duration of their visits. Implementing loyalty programs that reward frequent stays, personalizing guest experiences, and proactively addressing issues or concerns can significantly boost guest retention.

6. Benchmark Performance

Benchmarking performance allows hotels to compare their financial and operational metrics against industry standards, competitors, and their own historical data. By understanding how a hotel’s performance compares to the competition, managers can identify areas of strength and weakness, set realistic targets, and make data-supported decisions that enhance profitability. KPIs such as RevPAR, ADR, occupancy rate, and GOPPAR can be compared against industry averages and direct competitors by using industry reports, competitive analysis, and market research. When benchmarking, hotels should keep unique characteristics such as location, target market, and property type in mind for fair and relevant comparisons. In addition to external comparisons, hotels should track their own performance over time to identify trends and the effects of specific initiatives or events.

7. Develop Strategic Recommendations

The final step of a hotel profitability analysis is to synthesize insights to create actionable strategies that aim to increase profitability. Recommendations are typically made by the team performing the profitability analysis and may include external input from consultants who specialize in the hospitality industry. Strategic recommendations should match the specific needs and goals of a hotel, taking into account its target market, competitive landscape, and available resources. Recommendations may relate to the various revenue management strategies used by the hotel, focus on improving operational efficiency, or blend both targets. Common recommendations related to profitability include investing in technology and automation, optimizing staff scheduling, and implementing energy-saving initiatives. Specific, measurable, achievable, and relevant recommendations with set time frames can increase the likelihood and feasibility of greater profitability.

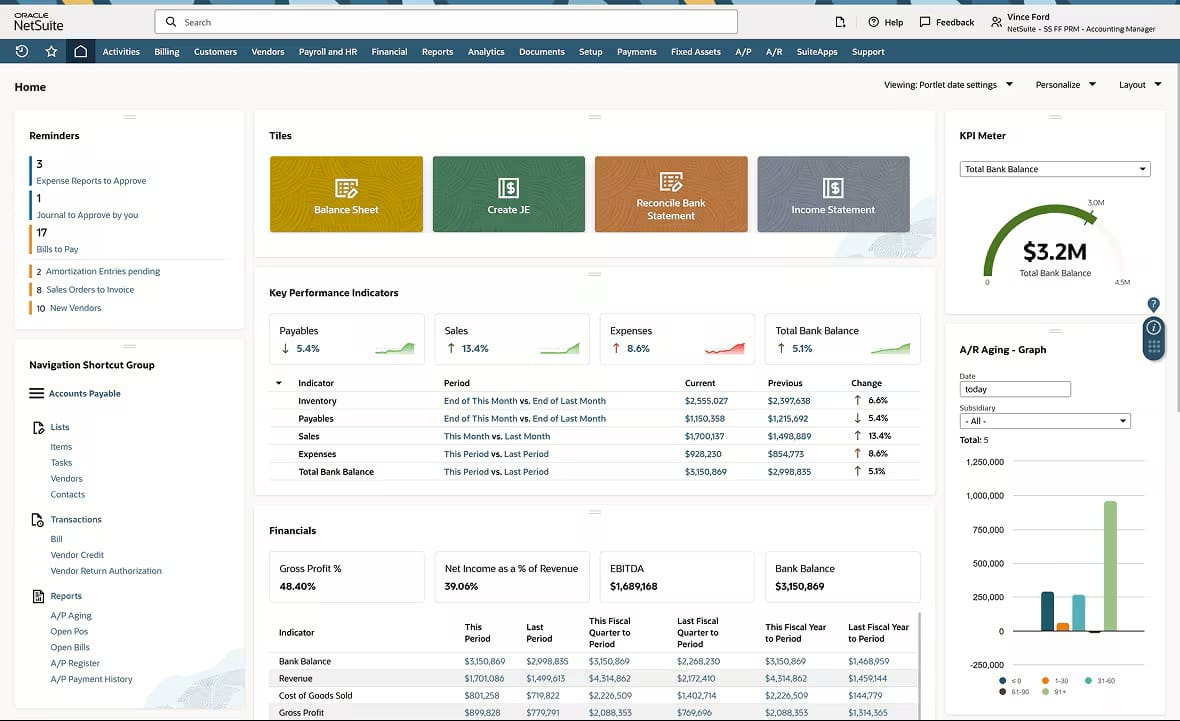

Drive Profitability in Your Hotel Operations With NetSuite

NetSuite’s hospitality accounting software is enhances financial processes for hotels with real-time visibility into essential KPIs and in-depth profitability analyses. With features like advanced financial reporting, budgeting and forecasting, and customizable, role-based dashboards, NetSuite empowers hotel managers and financial teams to monitor and analyze financial performance across multiple properties, departments and revenue streams. By integrating with other hotel management systems and providing a centralized platform for financial data, NetSuite helps identify opportunities for cost savings, revenue optimization, and operational efficiency improvements. In addition, it enforces compliance with industry standards and regulations, such as USALI, making it easier to benchmark performance against industry peers for informed strategic decisions that drive long-term profitability and success.

NetSuite’s Financial Dashboard

Hotel profitability analysis is a powerful tool that helps owners, managers, and investors understand the relationships between revenue, profit, and financial performance. Profitability is the linchpin of long-term success in the hospitality industry—it’s what allows hotels to reinvest in their properties, attract investors, and maintain a competitive edge. By following the steps outlined in this article, such as calculating key metrics, analyzing operational efficiency, and benchmarking performance, stakeholders can gain valuable insights into their properties’ financial health and make sound decisions that improve the bottom line. The right software can drive these initiatives further for sustainable growth in the dynamic and challenging hospitality landscape.

Hotel Profitability Analysis FAQs

How do you measure profitability of a hotel?

The profitability of a hotel can be measured using various metrics, such as gross operating profit per available room, which takes into account both revenue and expenses on a per-room basis. Another common metric is net operating income, which represents total revenue minus operating expenses, excluding interest, taxes, depreciation, and amortization. Additionally, hoteliers may use return on investment to evaluate the profitability of specific investments or initiatives, comparing the net profit generated to the capital invested.

What is the average profitability of a hotel?

The average profitability of a hotel can vary greatly, depending on location, market segment, size, operating efficiency, and other factors. According to industry studies, the average profit margin for US hotels is between 10% and 30%. That means that for every dollar of revenue, hotels retain an average of 10 to 30 cents after accounting for all expenses. The wide range reflects hotels’ specific circumstances and market conditions, with budget hotels’ profitability sitting on the lower end of that range and luxury hotels on the higher end.

What is the profitability ratio of a hotel?

The profitability ratio of a hotel is a financial metric that measures the ability of a hotel to generate profits relative to its revenue or assets. Common profitability ratios include the gross operating profit (GOP) margin, which is calculated by dividing the hotel’s GOP by its total revenue, and the net operating income (NOI) margin, which is calculated by dividing the hotel’s NOI by its total revenue. Other profitability ratios may include return on assets, which measures the hotel’s profitability relative to its total assets, and return on equity, which measures the hotel’s profitability relative to its owners’ investments.

What drives hotel profitability?

Hotel profitability is driven by a combination of factors, including revenue generation supported by inventory management, operational efficiency, and effective cost management. Revenue generation is influenced by occupancy rates, average daily rates, and the ability to maximize revenue through effective pricing strategies and sales of ancillary services. Operational efficiency involves automating processes, optimizing labor and resource allocation, and implementing technology to reduce costs and improve productivity. Effective cost management requires careful monitoring and control of expenses, such as labor, utilities, and supplies, while maintaining a high standard of guest satisfaction and service quality.