Construction accounting is a specialized practice, subject to unique financial reporting methods and tax rules. The nature of the construction business — with long contract terms, unique deliverables and “asynchronous” billing that can be disconnected from the pace of job progress, fiscal reporting periods or both — creates complicated issues for accounting and tax treatment. Accounting standards bodies and the IRS have responded with many optional methods for construction industry accounting.

Further, recent changes in regulatory standards from accounting bodies and the federal government may influence construction companies’ choice of accounting method; they are still in the process of being adopted by a good number of companies in 2021.

Here’s how to choose the right accounting method for a construction business or for individual projects within a construction business.

How Is Construction Accounting Different?

Construction accounting has its own set of unique rules for both generally accepted accounting principles (GAAP) and taxes. The rules adapt the central principles of GAAP and taxation to the unique characteristics of the construction business, including a project-based workstyle; decentralized production, with operations at job sites instead of inside a factory; and long-term production cycles.

In the construction world, revenue comes from building contracts with custom terms, specifications and deliverables, which complicates revenue and expense recognition. To help organize each project, contractors use job costing, a process where revenue and expenses for each project are segregated into distinct profit centers. This process is quite different from that of a typical manufacturer, which might think about product profitability based on sales and production expenses. Job costing applies to both direct costs, like materials and labor, as well as indirect costs, such as equipment and utilities.

Further, construction doesn’t happen in a warehouse or on an assembly line — it occurs on various job sites. This difference requires a unique set of controls surrounding materials, labor and work in process. Careful supply chain management and labor oversight are necessary to keep projects moving along.

Moreover, the costs involved to deliver on the project need careful management, something that can be accomplished with a specialized construction ERP.

Lastly, the nature of construction is that the product is built over time — the majority of projects last more than a year. Production cycles of less than a year are considered short-term. The long-term nature of the construction business causes accounting and tax challenges when it comes to fiscal period cut-offs. It also exacerbates the disparity between when revenue is earned and when it is billed, which in turn impacts cash flow. Common industry practices like change orders and retainage — not to mention disputes — lead to unique accounting and tax complications.

Construction Accounting Methods

To address those accounting challenges, construction companies may choose from several accounting methods. Choosing among them depends on several criteria. Keep in mind that construction companies may be able to use different accounting methods for the same project for general accounting and for tax purposes.

Cash Basis Method

How does cash basis work? Cash basis accounting is a method that recognizes revenue when cash is collected and expenses when cash is spent. Income or loss is the difference between cash in and cash out.

Example: A customer pays a deposit upon signing a contract for an office building to be built over the next two years. Under the cash basis method, the contractor recognizes the amount of the deposit as revenue when it is received, regardless of whether the project has begun.

Limitations of cash basis: Cash basis accounting can cause large swings in results simply due to the timing of cash receipts and expense payments. This disconnects financial results from the actual activity of the project and can make comparative analysis less meaningful.

Advantages of cash basis: The biggest advantage of the cash basis method is its simplicity. Additionally, this method avoids potential cash flow timing issues, since a business pays taxes only on cash that has been received. In fact, cash basis accounting affords some businesses significant flexibility to manage their income levels by timing disbursements around period deadlines. By delaying receipts, income can be deferred to another period.

On the other hand, by accelerating payments, profitability may be reduced in a period, which impacts tax liability.

Accrual Basis Method

How does accrual basis work? The accrual basis follows the matching principle of accounting, recognizing revenue in the period earned, not when received, and expenses in the period incurred, not when paid. This method uses revenue accruals, such as accounts receivable, and expense accruals, such as accounts payable, to capture transactions regardless of when money changes hands.

Example: A contractor whose fiscal year coincides with the calendar year bills a customer for a completed job on Dec. 15, with 30-day payment terms. The contractor recognizes revenue by creating a receivable account when sending the invoice, even though the bill remains unpaid at the end of the fiscal year, on Dec. 31.

Limitations of accrual basis: Accrual basis is more difficult to maintain than cash basis and is even more challenging in the construction industry because contracts often span more than one fiscal period. Job costing under the accrual method requires adjusting journal entries and a high level of vigilance. By its nature, accrual basis is disconnected from cash flow, requiring companies to separately monitor cash so they can meet their obligations. For example, a company may owe taxes on revenue that was earned and accrued, but where the cash has not yet been collected.

Advantages of accrual basis: The primary advantage of the accrual basis is that it provides a full, more accurate picture of financial results. It is the only method that complies with GAAP and therefore may be required by lenders and investors. Within the accrual basis, small construction companies can establish a policy for handling retainage — money earned by the contractor for services rendered but withheld by the customer pending final project approval — that defers tax liability on the retainage portion of revenue.

Cash vs. Accrual

Choosing between cash basis and accrual basis accounting should be a non-issue for many construction companies given that any firm that needs to produce GAAP financial statements must use accrual.

Additionally, contractors that meet the definition of a “large company” (over $26 million) must also use accrual basis methods for tax purposes. For all others, issues to consider when choosing between cash versus accrual include:

Project terms: Short-term projects, completed within a single fiscal year, might be appropriate for the cash basis. However, if contracts are long-term, the accrual method will provide better financial data to analyze the health of the business.

Capital machinery: Construction companies that purchase expensive machinery can capitalize and depreciate those costs in the accrual method. This approach spreads equipment costs out over time, based on the life of the equipment; if using cash basis, the company would recognize the entire expense in the period the equipment was paid for.

Customer payments: If customers pay in cash soon after the work is completed, then the cash method may be easier to use. However, when billing schedules are more complex and asynchronous, such as the American Institute of Architects (AIA) billing process that provides for retainage, scheduled payments and stored materials concerns, then the accrual method is a better fit.

Accounting support: Consider your available accounting expertise and tools. Without the support of a qualified construction accountant and capable accounting software, the accrual method may necessitate an inordinate amount of effort from owners or business managers.

Long-Term Contracts Method

Long-term contracts are those that span more than one fiscal year and require special treatment for both GAAP accounting and IRS tax purposes. Two common methods for accounting for long-term contracts are the percentage of completion method and the completed contract method, which are both accrual-based.

Percentage-of-completion method (PCM): PCM is the most common way construction companies recognize revenue and expenses because it apportions both over time, using a ratio aligned with the project’s progress. Most lenders and guarantors require it.

PCM estimates the total amount of inputs or outputs for a construction project and applies a ratio of actual activity in a period to the project’s total estimated activity. Construction accountants must make journal entries to reconcile the differences between revenue and expense amounts calculated using PCM and revenue amounts billed and expenses accrued. This may result in balance sheet assets or liabilities, depending on whether the project is overbilled or underbilled compared with the percent of activity completed when a fiscal period ends.

Completed-contract (CCM): Under CCM, all financial activities are deferred until a project is completed. In other words, no revenue or expenses are recognized until the accounting period in which the contract is fully or substantially completed. At that time, all accumulated accrued revenue and expenses are recognized on the contractor’s income statement. CCM is most appropriate for short-term projects but is not GAAP- or tax-compliant for most long-term contracts.

New GAAP Rule: Accounting Standard Codification 606 “Revenue From Contracts With Customers” (ASC 606)

The Financial Accounting Standards Board (FASB) issued a new rule, ASC 606, that affects general construction accounting. ASC 606 is already in effect for most companies, although some were given an extension due to the COVID-19 pandemic. ASC 606 does not change tax accounting.

Fundamentally, ASC 606 changes the parameters around revenue recognition, shifting from PCM’s stage of completion to fulfilling performance obligations and transfer of control from the contractor to the customer. Then, based on whether the transfer of control happens at a point in time or over a period of time, revenue is recognized in total or proportionally, as with PCM. ASC 606 provides detailed definitions and guidance around each step in its five-step model of revenue recognition:

Performance obligations are distinct deliverables within a contract that provide benefit to the customer. Construction contracts can have one or many performance obligations. For example, a contract that promises construction of two office buildings is likely to have two performance obligations. The components of building activities, like plumbing, electrical work and painting, would not be considered performance obligations.

The overall transaction price in the contract is determined and then allocated among the performance obligations. Contract price might simply be a fixed price, or it may include agreed-on variable compensation, such as incentives, discounts or change orders. Allocation of the total transaction price to the various performance obligations is based on estimates of standalone pricing for each obligation.

Finally, revenue can be recognized at the time when control of each performance obligation transfers from the contractor to the customer. It’s important to address the control criteria in the contract. If control of all the performance obligations transfers at a single point in time, then all revenue and expenses are recognized at that point — as in CCM. However, if control transfers over time, then revenue for each performance obligation is recognized as it is completed. Contracts may dictate that control phases in for each performance obligation, rather than when the obligation is completed. In that scenario, financial results for the obligation would be recognized using a PCM approach.

How to Choose the Right Construction Accounting Method

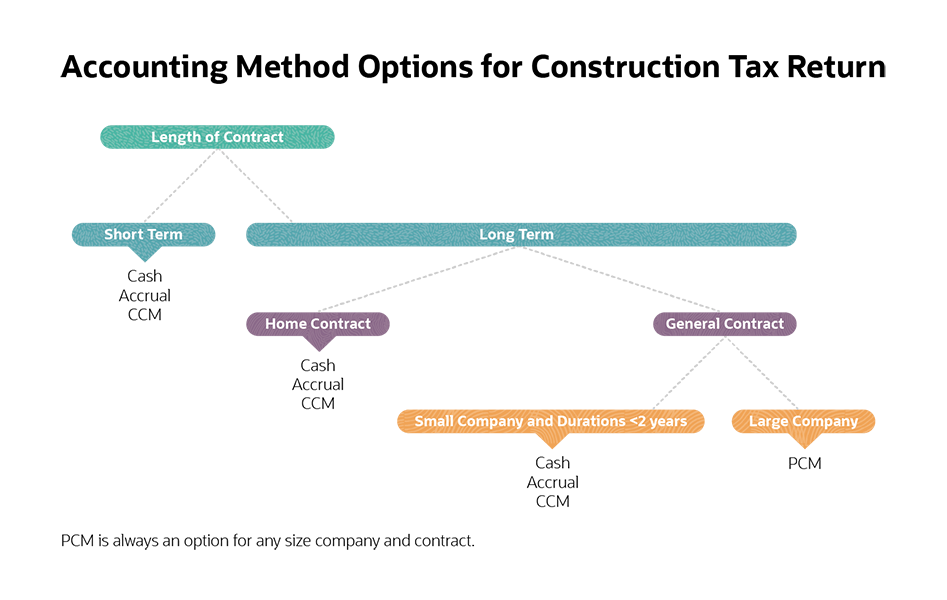

Beyond GAAP considerations, contractors need to consider tax rules when deciding which accounting method is right for them, using the guidelines of Internal Revenue Code section 460 (IRC 460). IRC 460 provides industry-specific tax rules and includes several exceptions.

Tax treatment can be determined on a contract by contract basis, so a company can use several methods simultaneously. Selecting the right method includes analyzing each contract though the following three filters:

Classify construction contracts by length

Short-term: The IRS defines short-term contracts as those entered into and completed within the same tax year. Short-term contracts can use cash or accrual methods.

Long-term: Long-term contracts span more than one tax year. IRC 460 requires long-term contracts to be accounted for using PCM. Two notable exceptions include small contractors that have contracts shorter than two years and home contracts, as we’ll discuss.

Classify long-term contracts as home or general construction contracts

Home contracts: Home contracts involve fewer than five dwellings. Home contracts enjoy several exceptions. First, construction companies of any size are not required to use PCM for home contracts. Second, home contracts do not require a “look back,” which is an IRS provision that requires a true-up of tax liability from prior periods using actual data rather than PCM estimates. Look backs are triggered when the actual contract income is greater than 10% of the amount reported in each prior year. This exception can be a significant benefit, since contractors are required to pay interest on any prior period taxes that were underpaid.

General contracts: For general contracts, PCM is required for long-term contracts except for small construction companies. Additionally, PCM is used to calculate alternative minimum tax regardless of the method used for regular tax reporting.

Classify yourself as a small or large contractor.

This classification is important because there are several advantages to being classified as a small contractor. A small contractor is defined as having three-year-average revenue of $26 million or less. Historically, this threshold was much lower; it was raised to $25 million for 2018 and indexed to inflation as part of the 2017 Tax Cuts and Job Act (TCJA).

According to the IRS, small companies can use the cash method of accounting for tax purposes, but large companies cannot. Plus, small companies can use CCM, avoiding PCM, for contracts up to two years, whereas large companies must use PCM for long-term contracts. And small companies can avoid the IRS look back for contracts up to two years.

Make Construction Accounting Easier With Accounting Software

With all its specialized rules, construction accounting can be very labor intensive. Each project is normally treated as a separate profit center to assist with job costing. Each contract can be accounted for using different accounting methods. And the same project can use different methods for general accounting versus tax accounting. Further, the specialized billing used in the construction industry, such as AIA progress invoicing, increases the workload.

NetSuite’s construction ERP and construction accounting software can help make this process easier. It organizes job costing, tracks profitability and helps with tax compliance. It can support multiple revenue recognition methods and billing schemes. Choosing the right software will reduce administrative burden, provide meaningful analysis and improve overall efficiency. Further, cloud-based systems enable access at decentralized job sites.

Construction accounting is a specialized form of accounting that reflects the unique characteristics of the construction business. Job costing is the underpinning of this specialty, reflecting the unique components of each construction contract. New GAAP guidance — ASC 606 — has introduced the concept of performance obligations and transfer of control into the variety of existing methods for revenue recognition. And the Tax Cuts and Jobs Act of 2017 made significant changes in classification criteria for small and large contractors. Together, there have been significant changes in the methods of accounting available for contractors, mostly increasing the options available.

Construction Accounting FAQs

What are the different types of accounting methods?

Accounting methods used in construction accounting include cash basis, accrual basis, the completed contract method (CCM) and the percentage of completion method (PCM). ASC 606 from the Financial Accounting Standards Board (FASB) provides updated guidance for revenue recognition for GAAP purposes.

How do you become a construction accountant?

A construction accountant typically earns a bachelor’s degree in accounting followed by on-the-job training to develop construction industry experience. Some construction accountants hone their specialty by taking industry-specific training courses given by construction associations or accounting societies.

What is construction contract accounting?

Construction contracts are agreements that spell out the details of a construction project and the obligations of all the parties. Construction contract accounting is a specialized type of bookkeeping and reporting for the building projects outlined in the construction contracts.

What are the three methods of accounting?

Three methods of accounting include the cash basis, the accrual basis and the hybrid method. The cash method recognizes transactions based on timing of cash inflow and outflows. The accrual basis reflects revenue when it is earned and expenses when they are incurred. Hybrid methods are specialized approaches that use aspects of both cash and accrual and are unique to a specific situation. The guidelines under ASC 606 and the percentage of completion method (PCM) in construction are hybrid accounting methods.

What are the two methods of revenue recognition for construction contracts?

Completed contract (CCM) and percentage of completion (PCM) are two revenue recognition methods used in construction accounting.

How do you account for a construction project?

Construction projects are accounted for using job costing, an approach that captures the details of each project in a separate profit center. There are several methods of accounting for construction projects, which can be selected based on the specific criteria of each contractor and project.