A company’s long-term financial success depends almost as much on paying its debts in a timely manner as it does on collecting revenue. To that end, businesses need to excel in managing accounts payable (AP), the accounting term for money a company owes to its creditors.

Over time, accounts payable best practices have evolved. By following them, any company can improve its cash flow and reduce inefficiencies and errors, among other benefits.

Why Should You Optimize Your Accounts Payable Processes?

Unfortunately, paper records, receipts and manual processes are still commonplace for too many accounts payable teams—and that’s no way to run an AP department.

By optimizing the invoice processing cycle and moving away from using paper for everything from check issuances to receipt recording, the accounts payable team can better control costs, minimize a variety of risks and gain more timely financial insights.

Further, these improvements can free up much-needed working capital to fund growth or R&D or build up a cash reserve for hard times.

As a finance leader, optimizing accounts payable processes is one of the most important things you can do to improve your company’s financial standing, minimize fraud and errors, and make your team more efficient.

How Do AP Best Practices Vary for Small vs. Enterprise Businesses?

Large enterprises are more likely to capitalize on contract incentives and take advantage of favorable payment terms, such as discounts or other rewards for paying early. If there is an incentive, an enterprise can mark the invoice for early payment; if not, the company doesn’t pay until the due date so that cash remains available for other purposes.

Enterprises also take advantage of AP automation to identify those details in contracts and invoices and act on them, with little to no human intervention. Additionally, some enterprises are using advanced robotic process automation (RPA) systems, which can help refine accounts payable processes further and automate additional processes. For example, RPA can be used to sort invoices that come from different channels, like email or a vendor portal, and route them to the appropriate team for approval and payment, saving considerable manual effort.

In contrast, small businesses are more likely to take a “first come, first paid” approach to bills. While it may seem efficient to pay bills as you receive them, that tactic is costing you money for very little reward.

A list of AP best practices for all businesses starts with eliminating unnecessary costs and inefficient processes and strategically paying bills to maximize cash flow. However, the steps and goals within an accounts payable strategy may differ between smaller and larger companies due to their respective financial constraints.

How to Take a More Strategic Approach to AP Management

Along with having the right team and processes in place, technology is key in helping finance teams take a more strategic approach to managing accounts payable. Historically, only those large enterprises we mentioned had access to ERP systems that offered robust automation for accounts payable tasks. These solutions were expensive and beyond the reach of most small businesses.

However, subscription-based cloud ERP software allows smaller firms to access advanced ERP functionality at a manageable cost.

Small businesses have begun to see the opportunity—and need. In one recent study (opens in new tab), 60% of companies said they lacked automated invoice approval workflows, meaning there’s a lot of email flying around. Meanwhile, it takes smaller businesses about 25 days to process invoices manually, and they waste an average of $12,000 monthly on duplicative bills.

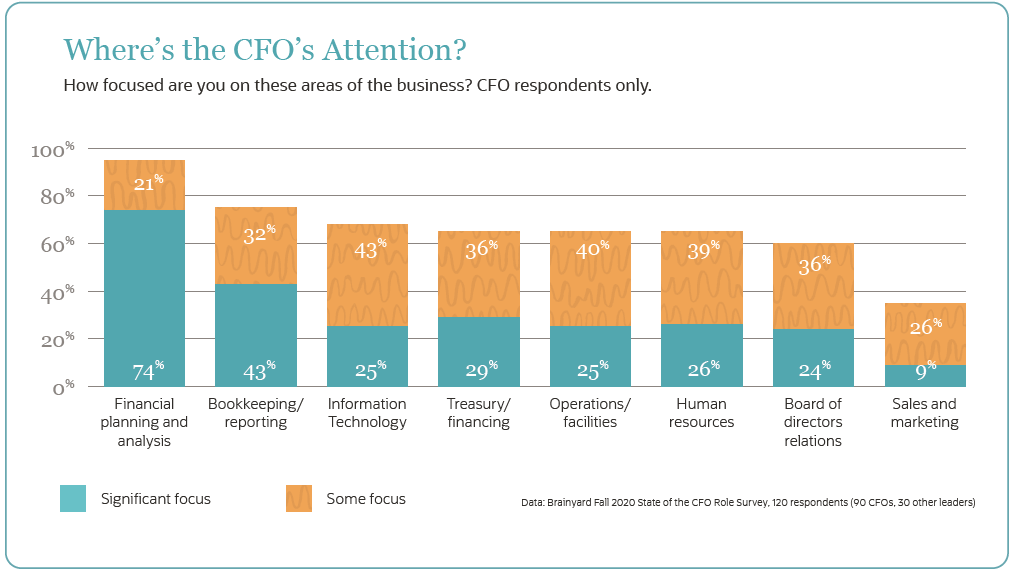

Our Brainyard Fall 2020 State of the CFO Survey shows that better financial planning and analysis (FP&A) and bookkeeping/reporting are bubbling up in terms of finance leadership’s focus.

Handling accounts payable through an ERP system is a great way to drive efficiency and productivity gains while answering the call for both more effective accounting and more accurate FP&A.

13 Accounts Payable Best Practices

-

Ditch the paper-centric way of working

Paper processes have higher costs to the business, and they’re also representative of old, linear AP workflows that rely on a multitude of manual, repetitive processes and produce only static snapshots of the company’s cash status.

Ready to go paper-free, or at least paper-less? Best practices start with digitizing AP documents, which enables real-time reporting and data sharing while eliminating redundancies. This also eliminates the risk of a fire or natural disaster destroying paper records, including paid invoices. Loss is much less likely when financial data is available digitally and continuously backed up. And, finding a particular PO is a matter of a few clicks.

Using more modern payment methods is another way to reduce reliance on paper. Checks cost businesses more than electronic data interchange (EDI) and other digital payment methods like direct deposit, so stop thinking about payments as checks and start thinking about them as cash transfers.

-

Automate invoices

Self-service supplier portals that allow partners to input or confirm contact, term and payment information themselves leaves even less work for your AP department. Portals also help ensure this data is accurate and should reduce questions when it comes time to pay vendors.

-

Regularly monitor reports and KPIs

Relying on spreadsheet-based reports can lead to missed opportunities, especially when business conditions are changing. Constant visibility into the latest financial data, like your AP turnover ratio, via an ERP system enables better decision-making in the moment and in the future.

Access to up-to-date AP information will enable finance teams to better control cash flow, spot and reduce fraud, identify important trends in expenditures, find bottlenecks in AP workflows and minimize compliance issues. It can also help a company decide whether to get a bank loan to cover a budget shortfall or negotiate with vendors for extended payment terms.

-

Establish controls and processes

The right controls and rules can head off problems before they occur. That will make the AP team much more efficient—and it’s a much better approach than waiting until an error or delay happens and then spending valuable time fixing the damage. Businesses should limit access to their financial information, have a clear separation of duties and set internal controls to automatically flag suspect behavior and activities that could indicate fraud.

-

Delegate work to more than one touchpoint

Avoid having a single point of failure that could result in late fees and penalties, contract breaches, or loss of priority status with key vendors. Cross-train financial staff so someone capable of managing AP is always available, no matter who is on vacation, sick or has left the company.

Cross-training also means more experienced people can concentrate on improving processes and resolving exceptions and bottlenecks.

-

Monitor for duplicate payments

Keep an eye out for duplicate payments to avoid having money tied up in a vendor’s refund process—or losing it for good. A system that compares more than invoice numbers, such as invoice contents, can catch double-billing mistakes before duplicate payments go through.

A supplier portal can also standardize invoice formats and fields so that duplicate billing and payments are far less likely.

-

Track invoice disputes and resolutions

Invoice disputes can easily escalate if they’re not resolved quickly. Sometimes a partner promises a resolution, but it never materializes. It’s a best practice to have vendor contracts, communications, work orders, bills of sale and other relevant documents readily available so you can review them at the first sign of an invoice dispute. This will give you the objective information you need to settle a dispute—and a trail of evidence should it escalate to litigation.

-

Ask why checks go uncashed

Uncashed checks can come back to crush your cash flow later—sometimes much later, if there is no expiration date on the check. On the flip side, an uncashed check may signal a problem in issuance or shipping, or an oversight on the vendor side. This could lead to increased costs for your company in the form of late fees or other penalties and may harm your relationship with the supplier.

Set a standard time period after which you follow up and ask why checks have not been cashed. An automated system that automatically flags uncashed checks enables you to take action sooner rather than later.

-

Reconcile accounts frequently

Money can slip through gaps in account reconciliations. For example, if you paid a vendor more than what’s recorded in the ledger, perhaps due to a late fee or an additional charge for an increase in order size, then you don’t have an accurate view of how much money you have in the bank. This could lead to bounced checks and other financial issues that negatively affect your company’s credit rating. Avoid this with a solution that automatically reconciles the ledger frequently.

-

Review contracts regularly

Contracts may expire, leaving your company open to unexpected increases in costs or less favorable terms. Conversely, poorly negotiated current contracts may come with high interest rates, short payment terms and a lack of incentives.

By investing some time and attention, you may be able to negotiate more favorable terms that could help you better manage your finances. Organizations should proactively look for opportunities by reviewing all contracts regularly.

-

Audit your procurement processes

Accounts payable fraud is a huge problem. According to a 2020 report (opens in new tab) by the Association for Financial Professionals (AFP), 82% of businesses were targets of fraud in 2018, and that number has climbed steadily in recent years.

Audit your procurement processes regularly, and take measures to remediate vulnerabilities. Proactively look for ways to make procurement more efficient and accurate and tighten compliance and security controls. Housing all documents in a single AP system that has multiple checks and balances, dual-factor authentication, automated purchase order matching and strong user and permissions controls will help prevent fraud.

While external fraud threats are on the rise, internal fraud is a concern, too. Don’t forget to take T&E expense management into account—the Association of Certified Fraud Examiners (ACFE) says 20% of small businesses and 13% of larger firms have reported fraudulent expense reimbursements.

-

Look for flaws in your invoicing processes

No system stays perfect, even if it starts out that way. An AP system that suited your needs perfectly when you had 100 employees and 20 suppliers may not be quite so wonderful as your company grows. Don’t wait until AP is a consistent source of problems.

Typical AP process flaws include no way to spot data-entry errors, lost documentation or late payments that will end up costing the company fees and an inability to handle exceptions and nonstandard invoices.

-

Find a software solution to manage it all

It’s difficult, especially for a small team, to maintain best practices on an ongoing basis, especially as the business grows. The answer is to use software and automate as many processes as possible. That will prevent many of the issues we’ve discussed without demanding constant attention from your accounts payable staff.

4 Top AP Processes to Make You Money

In a new report, Deloitte suggests a series of processes that can lead to more free cash flow. They include:

- Limit the number of suppliers you work with to enable the business to negotiate more favorable terms. As a bonus, AP teams minimize the number of contacts, saving time.

- Be diligent about data accuracy. Keep information on volume and early payment discounts, SLAs and key contacts up to date so you can take full advantage.

- Require detailed invoice and purchase order matching. It’s time well-spent to track who placed an order, eliminate duplicate payments and ensure that suppliers bill in accordance with agreed-on terms. Kick back inaccurate POs so you reset the payment due clock.

- Define SLAs for payment processing. Unless there’s a financial benefit to do so, don’t pay invoices until required. But don’t be late, either—set expectations for departmental approvals and AP team processing.

#1 Cloud

Accounting

Software

How NetSuite Can Help

NetSuite is a unified ERP system that has all the tools you need to follow best practices for AP and other key financial processes. NetSuite lets companies create a vendor list, track bills and make payments via various methods (check, bank transfer, wire), managing AP processes from purchase order to payment in a way that reduces the workload for employees. The solution can track purchase orders, bills, cash payments and expense reports from employees; automatically route these transactions through the appropriate approvals; and finally record them in the general ledger.

NetSuite also has extensive reporting capabilities, giving AP teams convenient access to the information they need most. Configurable dashboards can list invoices requiring approval, pending bills with due dates or other pertinent data to help companies manage their cash while staying on top of their expenses.