A shopper with a pounding headache stops at CVS to pick up some Tylenol. They notice a pain reliever with a “CVS Health” label on the same shelf, formulated with the same active ingredient—acetaminophen—at a much lower price point and figures, why not spend much less for a similar product that will do the trick and ease the pain?

Ultimately, that’s the power of a private label. As consumers have grown increasingly price-conscious during an extended period of economic uncertainty, many shoppers are choosing to purchase more store-brand pasta sauce, potato chips, and paper products that look, feel, and even taste like popular name brands but carry the store’s private label and cost much less. From Costco and Amazon to Target and Trader Joe’s, companies have turned private labels into a competitive advantage by offering products tailored to their customers’ preferences, boosting stores’ profit margins in the process. This article explains how private labeling works, explores the advantages and disadvantages of selling private-label products, and provides tips for building an effective strategy.

What Is a Private Label?

A private label is a product that’s manufactured by one company but sold under another’s brand name. This enables retailers to offer exclusive goods without owning factories or managing production lines, which, in turn, lets them sell the products at a lower cost than competitors. For example, Costco’s Kirkland Signature label is stamped on everything from vodka to vitamins, all produced by various manufacturers and sold only at Costco, often at a lower price than competing vodka and vitamins sold by other major name brands. Private labels are commonly found on a variety of products, including groceries, apparel, and electronics.

Key Takeaways

- Consumer demand for high-value products at a lower price has continued to grow, making private labeling an increasingly popular strategy for retailers.

- The advantages of private labeling include stronger cost controls, increased customer loyalty, and higher profit margins than retailers typically see with national brands.

- To build an effective private-label strategy, retailers must conduct market research to understand consumer needs and identify gaps.

- Retailers need to vet their manufacturers carefully, making sure to test products to evaluate whether the quality of the outcome justifies the price.

Private Labeling Explained

A business that embraces a private-labeling strategy sells products manufactured by a third party under its own brand name. Instead of investing in factories and manufacturing products in-house, the business allows a separate manufacturer to handle production while the business manages the product’s packaging, labeling, pricing, and sales. Private-label products tend to appear on store shelves alongside well-known national brands and are typically sold at lower prices.

Companies choose private labeling for a variety of reasons: It’s cost-effective, saves the business from worrying about production, provides the company with full control over the branding and marketing of products, and often generates stronger profit margins. As consumer demand for high-quality, high-value products continues to grow, private labeling has become increasingly popular among large retailers, small businesses, and ecommerce companies launching new and premium private labels in a wide range of sectors, such as food and beverage, health and beauty, fashion, pet care, and household goods.

Indeed, annual sales of store-brand products reached $271 billion in 2024, an all-time high in annual revenue, according to the Private Label Manufacturers Association (PLMA). This figure represents a 3.9% increase over 2023, outpacing the growth of national brands, which increased 1% during the same period. Plus, the majority of shoppers who try store brands in categories where a national brand had been their previous choice end up staying with the private label after a positive experience, the association said.

Private Labeling vs. White Labeling: What’s the Difference?

Private labeling is similar to white labeling in that both processes give retailers the ability to sell products made by third-party manufacturers under their own brand—but they differ in terms of exclusivity. With private labeling, a retailer works with a manufacturer to create a product that is exclusive to that brand, often customizing features, ingredients, and packaging to meet the needs of its target market. For example, Trader Joe’s snacks are made specifically for that retailer, with unique recipes and packaging a shopper won’t find anywhere else.

White labeling, on the other hand, involves a manufacturer producing a generic product and selling it to multiple retailers, who then rebrand it as their own with few or even no changes to the product itself. For example, a bottled water manufacturer might sell the same water to several supermarket chains, and each grocery store might put its own label on its bottles. Essentially, the same product can appear under many different labels in several stores.

How Does Private Labeling Work?

Private labeling involves a company, often a retailer, partnering with a manufacturer that produces a product that the company then sells under its own brand name. The retailer collaborates with the manufacturer to customize the product; once the product is finalized and produced, it’s shipped to the retailer, which markets and sells the item as its own, often alongside name-brand alternatives.

Depending on a company’s particular goals and target audiences, a business may employ a variety of private-label strategies. Here’s a look at some of the most common:

- Value-focused labels focus on low-cost, no-frills products that compete with name brands, primarily on price. A retailer like Walmart, with its Great Value line, will use this strategy to attract budget-conscious consumers looking to save on purchases of groceries, over-the-counter medications, and other household staples. Retailers using a value-focused strategy often seek to generate large volumes of sales through highly competitive pricing.

- Premium labels elevate store bands by focusing on better-quality ingredients and materials to attract shoppers seeking higher-end products at reasonable prices—a strategy used by Target with its Good & Gather brand. A retailer might use this strategy to differentiate a brand by offering products that are considered on a par with, or even superior to, national brands.

- Niche or specialty labels provide specialized offerings, such as organic, gluten-free, or eco-friendly products. A retailer will use this strategy to cater to specific consumer segments with certain needs or interests, such as people with special dietary requirements or those who prefer sustainable products. For example, the Whole Foods 365 Everyday Value brand specializes in organic and natural foods, appealing to health-conscious consumers seeking affordable, high-quality options.

Before launching a private-label product, businesses must develop a thoughtful, detailed plan to guide their decisions and increase the chances of success by carefully following these steps:

- Conduct market research: Analyze consumer trends, as well as competitors’ offerings and pricing norms, to identify gaps in the market and choose product categories with strong sales potential that are likely to meet customer needs.

- Identify manufacturers: Search for and vet third-party manufacturers that can make products to meet your required specifications and deliver products at an acceptable cost.

- Develop products: Collaborate with the chosen manufacturer to outline the product’s features, ingredients, and packaging and review samples to make sure the product meets quality standards and aligns with the target market before moving forward with full production.

- Create and market the brand: Create a distinct identity by selecting a compelling name and designing enticing packaging. Effective marketing—through strategic pricing, limited-time promotions, and in-store shelf placement—helps build trust and convince customers to give private labels a try.

- Launch products: Finalize logistics, set prices, distribute the product through sales channels, and monitor customer feedback to refine offerings and drive sales.

What Are the Advantages of Private Labeling?

Rather than relying on selling only established national brands, retailers have increasingly adopted private labeling because it helps them reduce costs and increase revenue. After all, a growing number of consumers are clamoring for private-label products. In fact, 55% of shoppers in 2024 said they increased their purchases of private-label products over the previous year, compared to only 28% who have bought more name brands, according to FMI–The Food Industry Association. While 71% of consumers chose to buy private brands due to value and price, quality and taste were also top motivators when selecting private-label products. For retailers, private labels offer a range of advantages that let them create products exactly as they envision them to be while handing off the manufacturing piece to a third party.

-

Better brand control:

Private labeling gives businesses complete authority over product design, quality, packaging, and marketing, so they’re able to craft a brand identity that resonates with their target audience. Because they have greater control, companies can quickly make changes to their products based on customer feedback or emerging trends, such as adapting ingredients to meet customers’ specific dietary needs or introducing eco-friendly packaging to appeal to environmentally conscious consumers. For example, a skincare brand can work with manufacturers to develop formulas that include natural, cruelty-free ingredients to differentiate its products from competitors’ and build a positive brand image.

-

High profit margins:

Private-label products often deliver significantly higher profit margins than national brands, largely by enabling businesses to reduce production costs, eliminate middlemen, and set their own pricing. In fact, private-label products can generate about twice the gross margin of national brands in many industries, according to McKinsey. What’s more, as inflation and economic pressures compel shoppers to seek more affordable options, cost-conscious consumers are increasingly seeking private-label products. Indeed, one of every four food and nonfood grocery products purchased in the United States in 2024 was a store brand, according to PLMA. Furthermore, annual store-brand dollar sales have surged by more than $51 billion in the past four years, a 23.6% gain. Through 2030, PLMA forecasts that private-label sales will grow nearly 6% annually, providing healthy profits for retailers.

-

Improved cost controls:

Businesses are better able to manage costs with private labels than with national brands, primarily because they don’t need to incur the costs of owning factories and handling the production process. Plus, they gain greater control over the marketing and distribution of their products. Unlike national brands, which often invest heavily in advertising and rely on third-party distributors, retailers that go the private-label route have manufacturers mass-produce products through streamlined supply chains. They also spend much less on advertising due to the exclusive availability of these items through the retailer’s own in-store and online channels. Private-label products rely more on the retailer’s shelf space and reputation to make a sale than on advertising. This leaner cost structure has contributed to the steady growth of private-label brands, not only among large retailers like Walmart and Amazon but also among startups and ecommerce sellers looking to offer branded products without having to own their own factories.

-

Ease of scalability:

Private labeling offers businesses the flexibility to start small and scale rapidly as demand grows, making the strategy ideal for testing new products and consumer markets. A business can launch pilot runs of new private-label items, gather customer feedback, and quickly adjust formulations or packaging designs before committing to larger production batches. This agility is especially valuable in fast-moving categories, such as snacks and beverages, where trends can shift quickly. Once a company identifies products that are the right fit for its customers, it can scale up those successful products quickly to meet rising demand.

-

Increased customer loyalty:

Private-label products foster stronger customer loyalty by offering high-quality goods that are available only at a particular retailer, encouraging repeat visits and deeper brand engagement. When customers associate a retailer with reliable, exclusive products that meet their needs, they’re more likely to return to that store and make repeat purchases online or in person. Besides, store-brand products have come a long way since the days when generic “cola” struggled to compete with Coca-Cola on taste decades ago. Today’s shoppers are noticing the consistent quality and value they get from private labels, with 74% of consumers saying private-label brands are just as good as name brands, according to a 2025 Ipsos study. As a result, private-label brands are not only eroding loyalty to national brands, but they’re also building their own devoted customer base.

What Are the Disadvantages of Private Labeling?

While private labeling offers many potential benefits, the strategy also presents some challenges. After all, building brand recognition often takes time and investment, and retailers may risk seeing unsold inventory sitting on store shelves. Here are four challenges poised to ambush private labeling that businesses should be aware of.

-

Establishing brand recognition:

A shopper might be tempted to reach for a store-brand dishwasher detergent that’s much cheaper than the popular name brand the customer has always purchased, but then might hesitate and wonder: Will the dishes emerge as clean from the dishwasher with this cheaper soap? Building brand recognition and trust is a significant hurdle for private-label products, especially in markets where established national brands have invested heavily in marketing, built strong reputations, and cultivated customer loyalty over time. Tempting customers who have used national brands for years to try a new product can be challenging, to say the least, no matter the price difference, since consumers often worry that private-label products might be lower in quality, even when they’re not.

-

Potential for dead stock:

Because private labeling requires retailers to forecast demand and manage inventory levels without the advantage of sales history or predictability of established name brands, private-label products carry a greater risk of dead stock—that is, unsold inventory that ties up capital and eats up storage space. Businesses may miscalculate consumer preferences, overestimate demand, or encounter unexpected market shifts that can result in excess stock that then must either be heavily discounted to unload or written off completely, which can impact profitability. Sticking products in the clearance section can also hurt the brand’s image, making the private label appear unpopular. Retailers often run this risk when they’re launching new private-label products, especially seasonal items, where demand can be highly variable and tough to predict.

-

Manufacturer ownership:

Businesses that engage in private labeling are heavily dependent on third-party manufacturers to execute production. This means that any disruptions, such as production delays, equipment failures, labor shortages, or changes in the manufacturer’s business priorities, could directly impact the retailer’s ability to deliver products to market on time and meet demand. And if the manufacturer decides to suddenly raise its prices or stop production altogether for any reason, retailers have little recourse, aside from searching for new manufacturers to produce their goods.

-

Quality control risks:

Unlike national brands, whose makers often have direct oversight over the manufacturing process, retailers selling private-label products must rely on external manufacturers to meet their quality standards throughout the production process. Because retailers don’t own the physical means of production, they may face limitations in their ability to quickly switch suppliers or maintain product consistency across batches, which could lead to inconsistencies or defects. Even worse, more serious quality issues can lead to product recalls or regulatory violations that could harm the company’s reputation and lead to financial losses.

Examples of Private Labeling

About 84% of food retailers and manufacturers said in a recent survey by FMI that private-label brands are extremely important to their organizations. In fact, 93% said they plan to moderately or significantly increase investment in private brands through 2026. Several retailers stand out in their efforts to create trusted store brands that often rival national brands in quality while undercutting them on price:

- Walmart’s private-label strategy has evolved from offering basic, low-cost private-label products to building trusted, innovative brands that appeal to diverse consumer segments. The company has a wide variety of private-label brands, including Great Value for grocery and household essentials, Equate for health and personal care products, Marketside for fresh and prepared foods, and the recently launched bettergoods, which focuses on premium, sustainable food options.

- Trader Joe’s is renowned for its private-label strategy, with the vast majority of its products sold under its own brand name, rather than national labels. Its private-label items include snacks, frozen foods, fresh produce, dairy and bakery items, beverages, and household goods. Trader Joe’s sources these products from well-known manufacturers, including McCain Foods and Snak-King, that produce items specifically for the retailer, often using Trader Joe’s own special recipes and packaging.

- Costco’s private-label brand, Kirkland Signature, has become a major force for the business, covering a vast array of sales categories, including groceries, household goods, health and beauty, apparel, electronics, and pet food. The retailer is known for delivering high-quality private-label products at lower prices, often partnering with top national manufacturers, such as Starbucks for its coffee, Duracell for batteries, and Diamond Pet Foods for dog food, all sold exclusively under the Kirkland name. The retail giant offers more than 300 Kirkland Signature items that, in sum, generated $56 billion in revenue last year, representing 23% of the store’s business. Consider this: If Kirkland were a standalone company, its sales would exceed those of Nike, Coca-Cola, and United Airlines, according to PLMA.

- Amazon sells more than 100 private-label brands, but Amazon Basics remains its most successful, encompassing more than 1,500 products in categories that include home goods, office supplies, tech accessories, electronics, and kitchenware. The brand is designed to provide customers with reliable, affordable alternatives to national brands, often with many of the same features as best-selling items on the site but at lower prices, making it a formidable competitor to established brands.

Tips for Building a Private-Label Strategy

Before diving into the private-label market, companies must devise a well-thought-out strategy to make sure they pursue the appropriate products, keep quality standards high, and differentiate their offerings from competitors’ products to appeal to their target base. Take the following six steps to build an effective private label strategy.

-

Be Thorough in Your Market Research

Launching a private-label product without doing your homework is a surefire path to failure. Understanding your customers’ preferences, current market trends, pricing structures, and the competitive landscape is essential to identifying gaps in the market before choosing products to private-label. Also, researching consumer feedback on existing products can provide insights into improvements or innovations that could help your private-label product stand out. It’s also important to consider how seasonality and the demographics of your target market are likely to influence buying behavior. Advanced technology can provide data-driven insights into customer preferences and pain points, market trends, and competitors’ offerings, helping businesses identify high-demand products, avoid overly saturated markets, and optimize pricing to appeal to consumers.

-

Vet Your Manufacturers Carefully

A poorly chosen manufacturer can derail a product’s quality, cause shipping delays, and negatively impact customer trust. When researching manufacturers, it’s important to look for third-party certifications, review a company’s past work, request product samples, evaluate the quality of the company’s output against its price, and even ask for references. Visit the factory or consider hiring a local inspection agency to check it out. Don’t be afraid to ask tough questions about production timelines, materials sourcing, minimum order requirements, and contingency planning for times when supply chains are disrupted. You’ll want to look for a manufacturer that is responsive and reliable and communicates immediately and clearly about any issues that crop up. It’s also important to choose a solid manufacturer with strong quality control practices that align with your own long-term scaling plans: Could the company handle a significant uptick in orders without compromising on quality?

-

Understand Your Regulatory Obligations

Certain products must comply with specific regulatory guidelines, and it’s important to stay on top of these requirements to avoid legal penalties and product recalls. For example, cosmetics, nutrition supplements, and food products are heavily regulated in most countries. Regulations may apply to labels, packaging, ingredient sourcing, and product-testing standards. Businesses should also be aware of customs regulations and certifications that are required in different regions, especially if products are manufactured overseas. Consult with a compliance expert or regulatory attorney early in the private-label process to not only prevent compliance issues but also enhance the company’s reputation as a trustworthy brand.

-

Take Measures to Protect Your Intellectual Property

Many businesses make the mistake of failing to protect their intellectual property. Registering trademarks for your brand name, logo, and packaging design prior to partnering with a manufacturer can help protect your company against anyone that attempts to mimic your products. In some cases, design patents or utility patents may be appropriate. It’s also wise to draw up strong contracts with manufacturers, including nondisclosure agreements, noncompete clauses, and manufacturing agreements that clearly define the company’s intellectual property ownership to avoid imitation and protect your assets.

-

Prioritize Building Brand Awareness and Brand Trust

Your private-label peanut butter might taste just as good as the major name brands, but customers aren’t likely to buy a jar if they don’t know and trust your brand. Building brand awareness and trust requires more than applying a colorful logo to a product; it entails providing a satisfying customer experience and communicating the value and quality of your products. Investing in good product photography, persuasive copywriting, and consistent packaging can help create a memorable, positive brand identity. Sharing glowing customer reviews, being transparent about product information, and engaging with consumers on social media can also serve to build trust and credibility.

-

Account for All Potential Costs

Launching a private label can be more expensive than retailers realize. Besides the costs of manufacturing and shipping, businesses need to budget for design and packaging expenses, compliance testing, storage fees, advertising, potential product returns, and overhead expenses. It’s smart to build a buffer into your budget to account for unforeseen issues, such as delays, redesigns, or marketing pivots. Inventory management software, cost calculators, and accounting tools can help companies account for all potential costs by providing ways to track, calculate, and forecast expenses across the supply chain.

Growing Businesses Need an Agile ERP

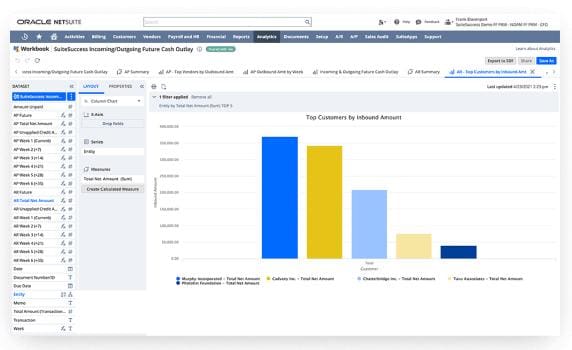

As private-label businesses scale, managing inventory, financial controls, and customer data often becomes increasingly complex. NetSuite ERP provides a unified platform that integrates key functions, including procurement, production planning, order management, and accounting, to give companies tighter control over their businesses.

For private-label brands juggling multiple products and manufacturers, NetSuite’s cloud-based ERP solution provides real-time visibility into operational and financial performance so companies can make data-driven decisions and adjust their strategies quickly based on changing market dynamics. In addition, artificial intelligence is embedded in NetSuite ERP, offering ways to automate tasks, streamline operations, and enhance financial controls. Meanwhile, advanced forecasting and demand planning features give growing private-label brands the agility to scale efficiently while pinpointing the precise amount of products a company needs at any given time to avoid stockouts or overproduction.

NetSuite ERP

As consumers become increasingly price-conscious, private labeling offers retailers a powerful way to stand out, improve profit margins, and build loyal relationships with customers by offering less-expensive, high-quality products as alternatives to name-brand items. Although launching a distinctive label under a company’s own brand comes with challenges—such as building brand recognition and closely managing manufacturer contracts—the rewards often outweigh the risks for businesses that take the time to develop a careful plan. With the right strategy, trusted partners, and modern technology, private labeling can become a major growth engine.

Private Labeling FAQs

What’s the difference between retail and private label?

Retail and private labels differ primarily in terms of who owns and manufactures the products that are sold. In a traditional retail model, stores sell products made and branded by third-party companies. By contrast, private-label products are owned and branded by the retailer but produced by third-party manufacturers.

How is a private label different from a brand?

A brand is a broader entity, representing the identity and values of a product or company. A private label, on the other hand, is a type of brand that’s owned and controlled by a retailer or seller, not the original manufacturer.

What are the four types of private labels?

The four main types of private labels are:

- Value: No-frills products offered at the lowest possible price point to appeal to cost-conscious customers.

- Standard: Products that mirror the quality and features of national brands but at a lower price.

- Premium: Products with higher-quality features that can exceed those of national brand products.

- Niche: Highly targeted brands created to serve a specific customer segment.