Applied behavior analysis (ABA) practices exist for one reason: to help children with autism and other developmental disorders live richer and more independent lives. But when practice management overwhelms staff, client care can suffer. Faced with this problem, an owner of an ABA practice in Pompano Beach, Florida, developed a solution.

Central Reach (opens in new tab) is the leading provider of electronic medical records, practice management and clinical solutions for ABA practices. Practices around the country use the company's products to automate time-consuming management tasks like billing, scheduling and clinical documentation, which allows care providers to spend more time focused on their clients.

After launching in 2012, CentralReach quickly expanded to over 500 customers and a team of 100 employees. In 2018, in preparation for more expansion and several acquisitions, the company hired a team of executives.

At the time of the new hires, CentralReach used Quickbooks, Excel and its own software to manage the business. Unfortunately, that technology stack wasn’t cutting it. The incoming executive team needed a better way to track multiple revenue streams and reduce financial bottlenecks.

For controller Ian Larkin, a new executive familiar with ERP software's benefits, an ERP platform was the clear remedy.

“The company was experiencing a ton of growth, and we needed a solution to support that growth,” he said.

A new controller seeks consolidated reporting

For Larkin, getting the company’s finances under control meant replacing CentralReach’s current financial management system and consolidating invoice processing for multiple business units.

“We had multiple legal entities with no way to have consolidated reporting,” Larkin said. “We used Excel to share data across spreadsheets, then manually created reporting systems.”

CentralReach wanted a connected system that could sift through data to display sales by business unit, as well as forecast sales revenue. Larkin, who had used NetSuite at other companies, felt the platform could provide these insights. Leaning on his experience with past ERP implementations and help from the NetSuite team, CentralReach went live in under three months.

After the switch from QuickBooks to NetSuite

CentralReach’s switch to NetSuite produced several benefits:

● Faster reporting

Before NetSuite, Larkin spent hours each month creating profit and loss statements and reports for individual business entities, then adding them to Excel and consolidating data for leadership.

"Now, I can get all that by clicking a button," he said. "It's night and day."

Of all the features, Larkin said NetSuite's reporting capabilities, like the ability to pull a P&L statement in seconds versus taking hours to assemble one, had the most significant impact at CentralReach. Faster reporting allows employees to use time more effectively.

● Easier billing and invoicing

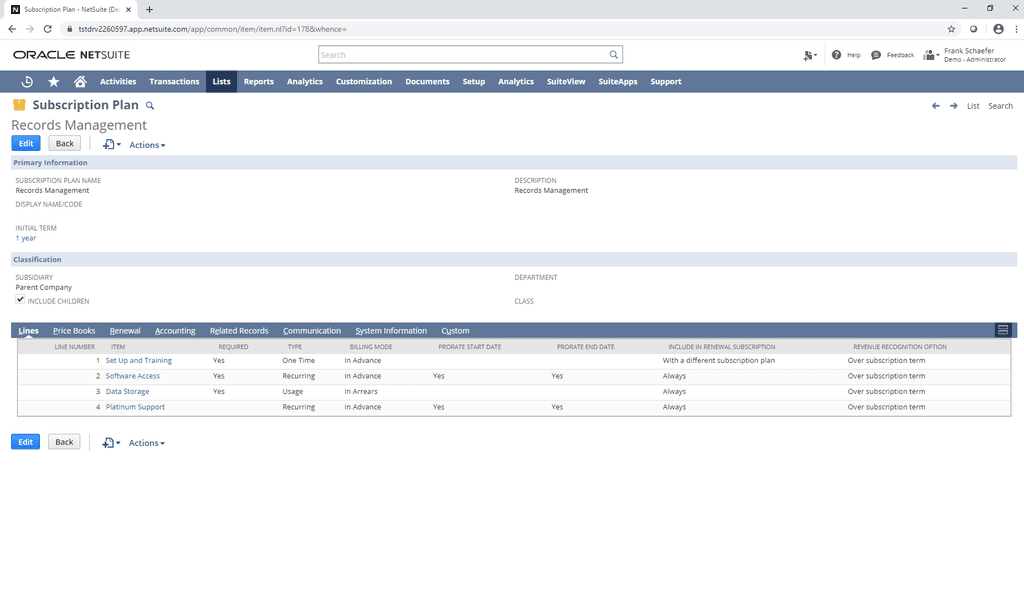

CentralReach has to track and manage subscription payments, the amounts of which change depending on a given customer’s number of users and subscription service levels. Before NetSuite, a disjointed billing system forced CentralReach to send customers separate bills for each of its software solutions, which include practice management, billing, employee education and reporting. CentralReach’s customers, which include small ABA clinics, multi-clinic chains and those based in schools, didn’t enjoy this system any more than the company’s finance team.

Under QuickBooks, "customers were frustrated with multiple invoices, and billing was a lot of work," Larkin said.

By adopting SuiteBilling (opens in new tab), CentralReach was able to add all its subscription services as separate items in one connected system, send single invoices to customers and greatly simplify the billing process.

● Better customer experience

NetSuite implementation improved the customer experience at CentralReach, Larkin said. Instead of logging into multiple systems to view subscription details, customers now use NetSuite's customer portal to see invoices and access all CentralReach products in a central location.

"Customers can see all account details in one place, but they can also update information such as contact person, address or billing [information],” Larkin said.

CentralReach’s sales reps get the ability to view and answer pending questions from customers and are notified of any changes to subscription services in real time, which leads to a more knowledgeable salesforce.

● Multi-entity management

CentralReach uses NetSuite OneWorld (opens in new tab) to standardize processes across its evolving business, which includes acquisitions (opens in new tab) of companies that offer complementary products in the ABA space since 2018.

The software comes in handy during acquisitions, such as the one that took place four days after CentralReach’s go-live date. CentralReach used OneWorld to export data from the newly-acquired subsidiary and quickly merge it into the company’s general ledger.

"After acquiring the company, we were able to import it straight into NetSuite," Larkin said. "After a few months, we were back up to speed."

"After acquiring the company, we were able to import it straight into NetSuite. After a few months, we were back up to speed."

—Ian Larkin, controller at CentralReach

● Easy app plug-ins

CentralReach is free to add new tools to its mix, Larkin said, since NetSuite allows for easy integrations with other business systems such as Avalara (opens in new tab), which the company uses to manage sales tax.

"Having applications that plug into NetSuite makes our job easier," he said.

● Automatic updates

A cloud-based ERP results in regular software updates with new features, such as the new revenue summary feature in NetSuite 2020 Release 1, which Larkin found particularly helpful. Larkin can also vote on platform enhancements and submit ideas.

“Knowing you will always get the latest benefit is extremely important,” he said.

CentralReach takes its software mobile

From the time CentralReach implemented NetSuite in June 2019 to the start of 2020, its customer base increased rapidly. The company could have handled the growth without an ERP system, but “we would have been forced to hire a lot more people,” Larkin said.

CentralReach is staying focused on bringing its products to more ABA practices and mental health practices. It’s also taking CentralReach solutions mobile, extending the reach of its HIPAA-secure software and giving customers a way to check in and out of appointments throughout the day and capture parent signatures on the go.

And client care will stay stellar through it all.