Picture this: You walk into your favorite store, intent on buying a new pair of shoes. As you browse through the aisles, you come upon a section with shoes priced at $99. Instantly, you’re drawn to them, thinking, “What a steal!” You hadn't planned on spending that much, but somehow the price seems too good to pass up. This scenario encapsulates the essence of psychological pricing — a phenomenon where subtle pricing techniques influence our purchasing decisions in ways we might not even realize.

In this article, we delve into the world of psychological pricing, exploring how businesses employ cognitive biases and psychological factors to shape consumer perceptions and drive profitability. From price anchoring to charm pricing and beyond, discover the secrets behind why we buy what we buy, and how businesses can harness these strategies to their advantage.

What Is Psychological Pricing?

Psychological pricing encompasses a set of strategies that businesses use to influence consumer behavior and purchasing decisions through subtle pricing techniques. These tactics exploit various cognitive biases and psychological factors to create perceptions of value, affordability and prestige. By understanding and implementing psychological pricing, businesses can optimize their pricing strategies to resonate with customers and drive profitability. Psychological pricing strategies are inexpensive and easy to implement, making them accessible to businesses across industries, and they can be seamlessly integrated with other pricing approaches to enhance effectiveness.

Key Takeaways

- Psychological pricing, a subset of pricing strategies, is commonly used to impact customer behavior.

- Research has shown that certain ways of formatting prices can spark a subconscious response from a customer and encourage a purchase.

- Inexpensive and easy to implement, these tactics can be used in addition to pricing strategies to boost their effectiveness.

Psychological Pricing Explained

Psychological pricing capitalizes on human cognitive biases and behaviors to influence consumer perceptions of product value and pricing. It involves setting prices in a way that triggers specific psychological responses, such as the perception of a “deal,” affordability or esteem. Tactics like charm pricing — for example, pricing a product at $9.99 instead of $10 — exploit the left-digit bias, leading consumers to perceive a lower price. Other strategies, such as price anchoring and decoy pricing, manipulate consumers’ reference points and comparison processes to sway their purchasing decisions. By understanding the psychological factors that drive consumer behavior, businesses can strategically set prices to maximize sales, profitability and competitiveness.

Why Psychological Pricing Is Effective

Psychological pricing is effective due to its ability to tap into fundamental aspects of human psychology and decision-making processes. By leveraging cognitive biases and psychological factors, businesses can shape consumer perceptions, ultimately influencing their purchasing decisions. These tactics create an environment in which customers are more likely to perceive offerings as desirable and make purchasing decisions that align with the company’s objectives. Moreover, psychological pricing strategies are cost-effective and easy to implement, making them accessible to businesses across various industries.

5 Psychological Pricing Tactics

Understanding the psychological aspects of pricing is important for businesses aiming to increase revenue and optimize their market position. By mastering the following five psychological pricing strategies, companies can craft compelling pricing strategies that resonate with customers and drive profitability.

-

Price Anchoring

Definition: Price anchoring recognizes that consumers tend to depend too heavily on an initial piece of information (the anchor) when decision-making. For instance, a jeweler might first present an engagement ring worth $18,000 as the price anchor. It then presents a ring worth $15,000, which to the customer seems much more reasonable and a “good deal” in comparison to the anchor. Thus, the customer is more likely to purchase the second ring than if they hadn’t seen the anchor.

Best for: companies with a tiered pricing model that offers various versions and associated features of the core product, at different prices.

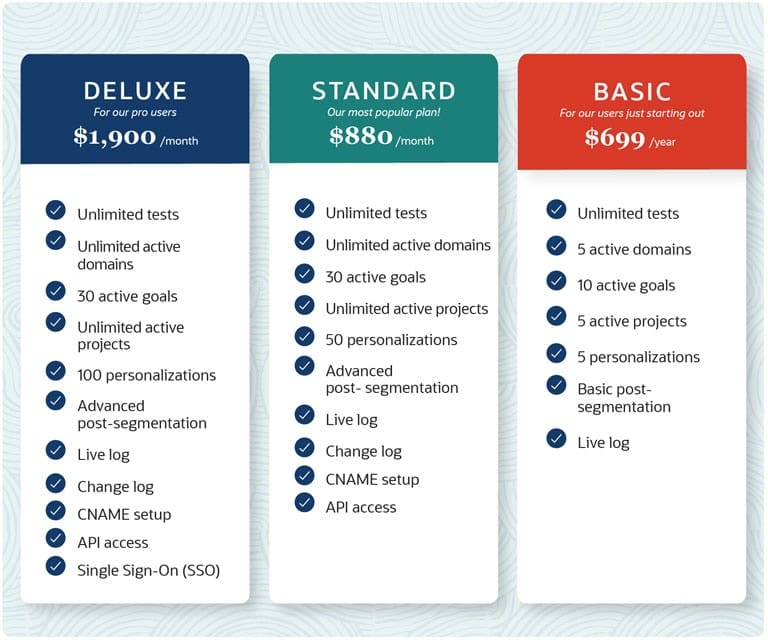

Example: A company sells its A/B testing tool in three price tiers. Below, you can see the price anchoring strategy on full display: The first option listed, Deluxe, serves as the customer’s initial piece of information, since most tend to look at the left-hand side of a graphic first. It’s more than twice the price of the next option but only a little bit different in features, setting the stage for the next tier, Standard, to seem like a great deal.

This imaginary company’s pricing chart is an example of price anchoring. Advantages: The price anchoring tactic can direct users to your preferred price tier and help them make the decision to buy your offering.

Requirements: To use price anchoring, you’ll need an offering with multiple pricing options which customers can easily compare.

-

Charm Pricing

Definition: Charm pricing refers to the use of prices ending in the number nine because of the “left-digit bias,” a phenomenon in which consumers’ perceptions and evaluations are disproportionately influenced by the left-most digit of the product price.

Research shows ending prices in “99” (e.g., $599) can result in more sales than rounding up to the nearest round price point (e.g., $600). The human mind subconsciously rounds that $599 to $500, as opposed to $600 — even though it’s unreasonable. In a study noted in the book “Priceless(opens in new tab)” , charm prices outsold rounded prices by 24%.

Best for: companies with non-luxury products that want to convey a “deal.”

Example: A transcription software costs $9.99 a month. Due to that left-digit bias, many consumers think, “This product is significantly less than $10. It’s a great deal.”

Advantage: With charm pricing, you can use the difference of one cent to majorly impact the users’ perception of your offering’s price.

Requirements: To use charm pricing, your company must want to give the impression of a “deal” for its products. The tactic doesn’t work well with luxury or recreational goods, which actually benefit from rounded prices(opens in new tab).

-

Odd-Even Pricing

Definition: Odd-even pricing is similar to charm pricing but applied on a broader scale. This tactic leverages the belief that, psychologically, buyers are more sensitive to certain ending digits.

“Odd pricing” refers to a price ending in 1,3,5,7,9 (e.g., $9.93). “Even pricing” refers to a price ending in a whole number or tenths (e.g., $20.00 or $20.50). Odd pricing tends to be more popular because it indicates a deal in a customer’s mind, making them more likely to buy. That doesn’t mean even pricing doesn’t have a place, though. Luxury brands tend to use even pricing to create perception of premium. Check out pricing on men’s activewear at Old Navy(opens in new tab) versus Nike(opens in new tab) : Old Navy uses a mixture of odd and charm pricing, whereas Nike uses even pricing.

Companies aren’t limited to either odd or even pricing, though. For instance, Nike uses even pricing on all of its full-price products. However, its sale section(opens in new tab) uses odd pricing to indicate the deal.

Best for: Even pricing works best for luxury items, while odd pricing tends to work best for most other products.

Example: A wine subscription company offers two types of monthly boxes: For $29.43 a month, the standard box delivers four bottles of wine curated to your taste. For $60 a month, the same company will send four curated bottles that are considered “premium.” While $29.43 indicates a good deal and will likely attract customers who subconsciously round the price down, the $60 option embraces the expense to further the impression of luxury and exclusivity.

Advantage: Odd and even pricing can help create the perception of a deal and of luxury, respectively.

Requirements: There are no strict requirements, but companies should ensure their odd-even pricing use resonates with customers and creates the desired value perception of their product.

-

Decoy Pricing

Definition: The decoy pricing tactic is based on the “decoy effect,” by which individuals tend to have a specific change in preference between two options when also presented with a third option that is inferior in every way except one. The presence of the “inferior” third option makes the first two seem more attractive.

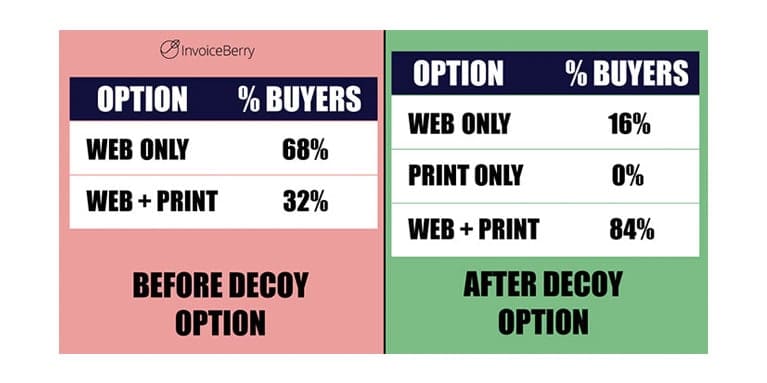

Best for: Companies that have a preferred option(s) to which they want to direct customers. For instance, decoy pricing has become more popular in the news media industry as companies try to move customers from print to digital. In his book “Predictably Irrational(opens in new tab)”, author Dan Ariely notes that, at one time, the Economist had three magazine offerings:

- Web only for $59 a year

- Print only for $125 a year

- Web and print for $125 a year

It doesn’t exactly take a savvy businessperson to recognize that “print only” is a terrible option, to the point it seems silly to include it. However, the Economist included this option because it caused consumers to view the web and print options much more favorably in comparison.

Here were the results:

This chart shows the effect of decoy pricing on the Economist’s magazine sales.

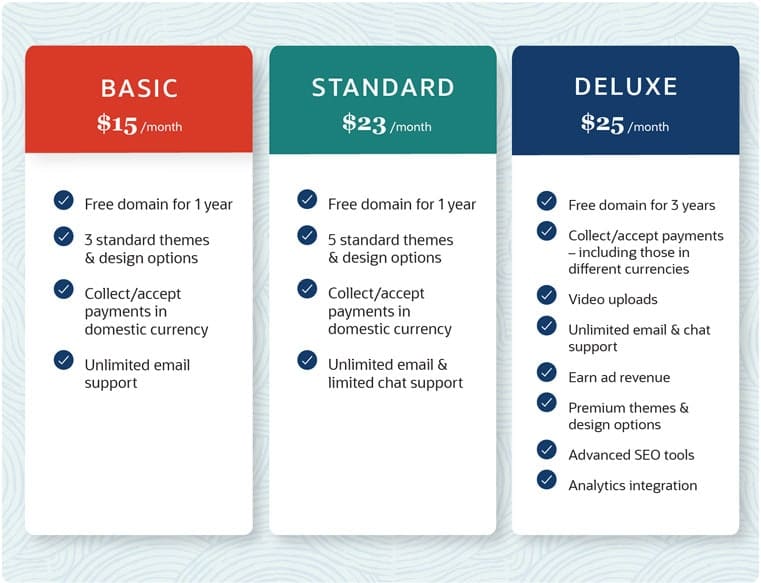

(Image credit: InvoiceBerry via The Grasshopper Blog )Example: A website design platform has three pricing tiers:

This imaginary company’s pricing chart is an example of decoy pricing. Can you spot the decoy? If you guessed Standard, then you guessed right! Since it’s only $2 less than Deluxe — but with far less functionality — customers looking for capabilities or features would likely opt for Deluxe. And those looking for less functionality would tend to gravitate towards the Basic option since it has similar functionality to Standard at a lower price point.

Advantage: You can use decoy pricing to direct customers to your preferred pricing plans.

Requirements: To deploy decoy pricing, you’ll need an offering with multiple pricing options, including a less-appealing, “inferior” option.

-

Center Stage

Definition: This tactic is based on the center stage effect, which dictates that, out of a range of products presented side-by-side, we tend to be drawn to the one situated in the middle(opens in new tab).

Best for: any company, as long as it has multiple pricing options to choose from and a preference on which one(s) get chosen.

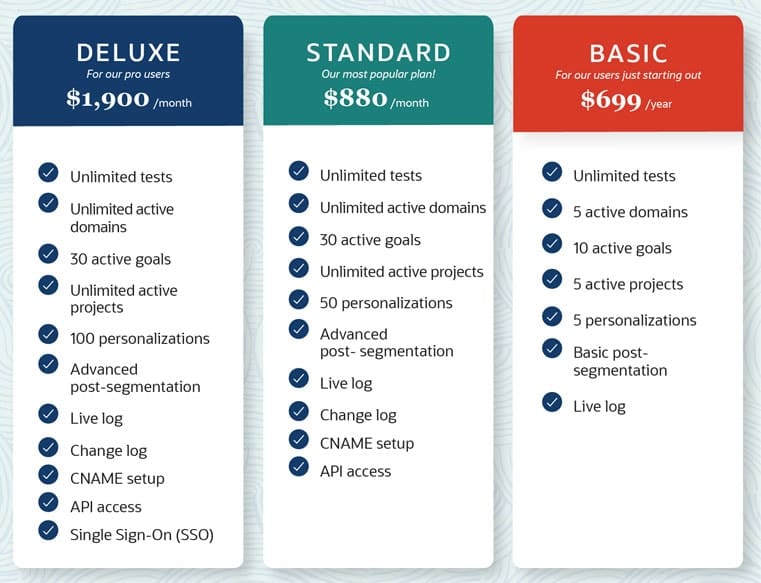

Example: We can bring the A/B testing company from our price anchoring example back to illustrate the center stage-based tactic. This company wants consumers to gravitate toward the Standard plan because they’ve seen Deluxe drive folks away with its high price point, and Basic doesn’t have the same earning potential. So, the team places the Standard plan in the middle of the pricing sheet, where consumers gravitate.

This imaginary company’s pricing chart makes use of the center stage effect. Advantages: Taking advantage of the center stage effect can attract customers to your preferred or most popular plan with no alterations to other prices or offerings.

Requirements: Again, companies must have multiple pricing options to choose from.

Implementing Psychological Pricing Tactics

Psychological pricing tactics are most effective when used at the appropriate time and place. When choosing which tactics to implement, consider your product or service, business model and goals — as well as the subscription pricing model and pricing strategy previously chosen.

The Price Is Right With NetSuite

NetSuite ERP manages real-time data from all parts of the business in a single, unified database. Such comprehensive visibility and access to easily digestible summaries and analyses turn what could be a pricing guessing game into a science. In addition, NetSuite ERP’s modular design means that the system can easily expand (and scale) as the business’s requirements increase. And, because the solution is designed specifically for the cloud, business users have anytime, anywhere access to their applications through a simple internet connection.

Psychological pricing involves the interplay between consumer psychology and business strategy, where subtle pricing techniques wield significant influence over purchasing decisions. From exploiting cognitive biases to shaping perceptions of value and prestige, businesses can use an array of pricing tactics to drive profitability and competitiveness. Understanding the psychology behind consumer behavior empowers businesses to strategically set prices that resonate with customers, ultimately maximizing sales and enhancing market position. As businesses continue to implement these psychological pricing tactics, they must consider their product offerings, business models and goals to effectively use these strategies and stay ahead in today’s competitive market.

Psychological Pricing FAQs

What companies use psychological pricing?

Companies across industries use psychological pricing tactics to influence consumer behavior and drive sales. These tactics allow business to leveraging cognitive biases and psychological factors to shape perceptions of value, affordability and prestige.

What is the psychology behind 99 pricing?

The psychology behind 99 pricing lies in the left-digit bias, where consumers perceive prices ending in .99 as significantly lower than rounded prices. This leads them to view such prices as better deals and increasing the likelihood of purchase.

Why would you use psychological pricing?

Businesses use psychological pricing because it taps into fundamental aspects of human psychology and decision-making processes, allowing them to shape consumer perceptions and behaviors. This ultimately drives sales, maximizes profitability and enhances competitiveness.