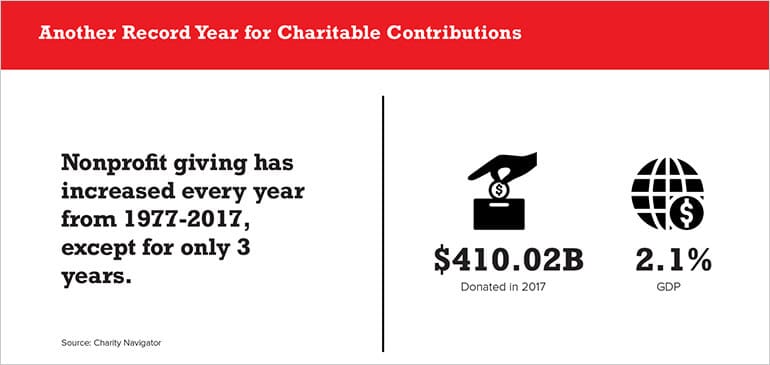

From 1977 through 2017(opens in new tab) , nonprofit giving increased in all but three of those years. On its own, 2017 proved to be another record year for charitable contribution, as donors contributed an estimated $410.02 billion, accounting for 2.1% of GDP.

Although the growth opportunity for nonprofits is clear, the path to effectively achieve that growth is less so and requires a delicate balance of funds. On the one hand, charities are praised for increasing program investments; on the other, they’re scrutinized for raising overhead.

And herein lies the dilemma of nonprofit growth. Donors want to see nonprofits grow without raising overhead, but nonprofits can’t expand and add programs without additional staff and resources.

Efficiency Over Impact

With more than 1.6 million tax-exempt organizations in the United States alone, potential donors and board members look to third-party, nonprofit information aggregation sites like BBB Wise Giving Alliance(opens in new tab) , CharityWatch(opens in new tab) , GuideStar(opens in new tab) and Charity Navigator(opens in new tab) to identify organizations to support. These websites provide insight into a charity’s financial performance, adherence to its mission, and in the case of Charity Navigator and CharityWatch, assign a rating based on several performance indicators. Reviewers of these metrics look for organizations that indicate high efficiency and responsible use of donor funds rather than how much they’re increasing impact.

Watchdog sites like these began by publishing limited financial metrics like program expense percentage and administrative expense percentage. Program expense percentage represents the proportion of costs related to supporting programs in alignment with its defined mission statement. While, administrative expense percentage refers to the percentage of expenses associated to paying certain employee salaries, payroll taxes, benefits, office rent, utilities and office supplies. In the eyes of potential donors, the higher the program expense percentage and the lower the administrative expense percentage, the better.

Ideally, nonprofits will dedicate 100% of resources towards achieving its mission, but it’s hard to avoid the nonprofit administrative costs like employee salaries, office space, technology and supplies in the quest to fulfill an organization’s goals and expand. Unfortunately, many donors see these increased expenses as a red flag when reviewing charities.

Nonprofit information and rating sites recognized this challenge and in 2013 GuideStar, Charity Navigator and BBB Wise Giving Alliance co-authored an open letter to donors and nonprofits attempting to end the “overhead myth.” They urged donors of America to look beyond a nonprofit’s overhead costs, and instead focus on other factors like transparency, leadership, governance and results. These sites began scoring on and publishing additional non-financial information like whether the CEO’s salary is listed on the Form 990, if they have a whistleblower or conflict of interest policy, if their financials are audited and whether board members are listed on the nonprofit’s site.

Despite the effort to dispel the myth, donors are still very much concerned and skeptical of nonprofit overhead costs. In a 2017 nonprofit trust survey(opens in new tab) conducted by BBB Wise Giving Alliance, donors cited greed and high overhead as the top reason they don’t trust certain charities.

Despite efforts to expose data that lessen the emphasis on overhead, administrative cost is still a major factor used to calculate the overall rating of a nonprofit. Charity Navigator(opens in new tab) , for example, awards the highest score in the administrative expense category to nonprofits with an administrative expense between 0% and 15%, and it gives no points when the percentage is greater than 30%. Even though the “overhead myth” is well documented, it’s difficult for donors, rating agencies and even nonprofits to stop using administrative expense as a signal for organizational efficiency.

Because of the continued reliance on this metric, nonprofits feel pressure to maintain low overhead and in turn look to cut costs in areas like office supplies and furniture, employee training and technology infrastructure. The result is a starvation cycle(opens in new tab) that perpetuates underfunding in essentials and restricts growth. The cycle starts with a donor’s unrealistic expectations of the costs to operate a nonprofit; nonprofits feel pressure to conform to these unrealistic expectations; in response, nonprofits spend too little on overhead and underreport expenses on tax forms. The underreporting then fuels unrealistic expectations and perpetuates the cycle.

Breaking the Starvation Cycle

How can nonprofits break free from this destructive cycle?

First, be more transparent with funders and board members. Help them to understand the overhead required to accomplish growth or add a new program, and report true overhead costs. With a more realistic understanding of costs required and accurate reporting, expectations will start to adjust. Continue to emphasize accountability and transparency metrics like listing your CEO’s salary, having a whistleblower or conflict of interest policy, maintaining a financial auditing process and listing board members on your site so donors are confident in the processes you have in place.

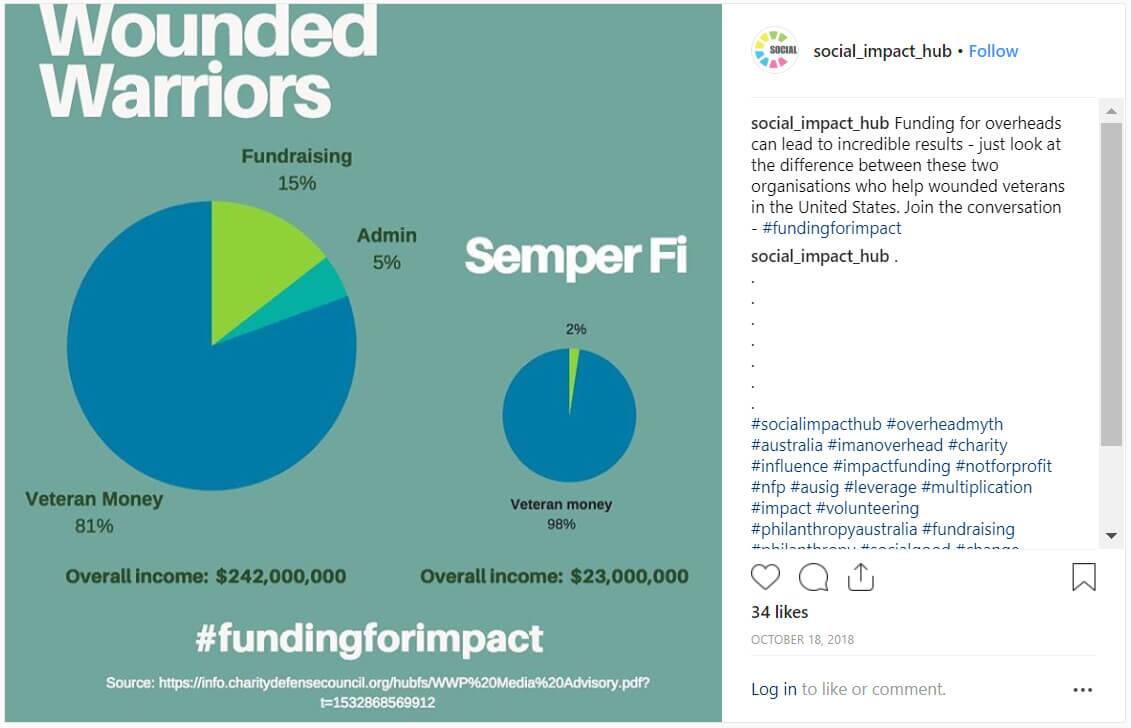

Communicate outcomes so donors know how the added overhead expense helped to produce results. More funding on overhead can lead to better results. Take Wounded Warriors and Semper Fi, two organizations aimed at supporting US veterans. Wounded Warriors spends 20% on fundraising and admin costs and brings in $242 million in income. Whereas, Semper Fi only spends 2% on fundraising costs but only brings in $23 million in income.

Next, look at ways to improve efficiency to achieve a better use of overhead funds. For almost any growing business endeavor, time is a high-value currency. As nonprofits free up resource time through improved processes, technology and training, they can spend more time on mission-forward tasks. Instead of focusing on reducing overhead costs, shift focus to rearranging overhead costs to more effectively accomplish mission goals.

Nonprofits shouldn’t fear growth because it will increase administrative costs or lower their rating on watchdog sites. The most critical outcome of nonprofit growth is a bigger impact. Measure this impact, clearly communicate successes and appreciation of the growth will follow.