Companies worldwide, large and small, are scenario-planning around the potential impacts of rising tariffs. While tariffs can raise the prices companies pay for select imported materials and components, as well as the prices consumers pay for imported finished goods, they can also help domestic companies by putting foreign-based competitors at a price disadvantage. This article will lay out the basic concepts behind tariffs and take a close look at the implications of today’s tariff environment for businesses involved in international trade.

What Are Tariffs?

Tariffs are border taxes imposed by governments on goods imported from other nations. They can affect businesses from two directions.

- Imports: When importing raw materials, components, or wholesale goods, US companies, for example, pay tariffs to US Customs and Border Protection (CBP), leading to higher business costs. The Tax Foundation estimates that US import tariffs implemented or under discussion in 2025 could drive the average American tariff rate from 2.5% to 8.4%, the highest since 1946. These estimates are constantly evolving, as ongoing negotiations affect current tariff rates.

- Exports: The second direction is when US companies export their products, foreign governments may impose retaliatory tariffs, making American goods more expensive—and less competitive—in those overseas markets. Academics say that during trade disputes in 2018, foreign trading partners imposed retaliatory tariffs affecting an estimated $121 billion of American exports.

Governments typically impose tariffs to protect domestic companies and industries, especially ones vital to the national interest, from foreign competition. They’re sometimes levied to punish another country for “unfair” trade practices—that is, when the foreign government subsidizes producers in that country so that they can sell their goods in overseas markets below the manufacturing cost or below the price they sell their goods for domestically. Countries also use tariffs to raise incremental revenue and to apply pressure on other countries during trade negotiations.

Businesses everywhere are finding it difficult to analyze the situation and develop contingency plans, especially because of uncertainty over whether announced or in-effect tariffs are permanent or merely temporary negotiating tactics.

Key Takeaways

- Rising tariffs are increasing costs and supply chain complexity for businesses involved in international trade.

- On top of that, businesses must manage volatility and uncertainty surrounding global tariff policies.

- Companies can mitigate tariff impacts through strategic planning, smart pricing, supply chain optimization, and market diversification.

Tariffs Explained

Tariffs increase the cost of doing business. In turn, companies tend to pass along some or all of the expenses incurred from import tariffs to customers. As for retaliatory tariffs abroad, studies have shown that US companies absorbed about half of these added costs during previous trade disputes to remain competitive in foreign markets.

Uncertainty surrounding tariffs can add to compliance management burdens and disrupt business planning and investment. Companies often conduct scenario-planning to develop strategies that blunt the negative impact of tariffs. Notably, some US companies may benefit from reduced foreign competition in their home market. Examples include agriculture, steel, and oil companies with substantial US-based production, as well as suppliers of components to domestic manufacturers.

Why Are Tariffs Important? Why Are Tariffs Used?

Because tariffs can create winners and losers, the stakes are high, with global trade hitting a record $33 trillion in 2024. Here are two main ways tariffs are used.

- In the competition among nations, tariffs are used to support national industries against foreign competitors and reduce trade deficits by making imports less price-competitive than domestically produced goods. Governments also use tariffs to strengthen their position on the world stage by bolstering not only their national treasury, but also their bargaining power in international negotiations.

- In business, tariffs can disadvantage certain companies by putting pressure on their costs, revenue, or both. That said, some domestic companies may come out on top when import tariffs drive up the cost of foreign competitors’ goods in their home market. Examples of winners include domestic suppliers of components to manufacturers, whose foreign competitors have suddenly become more expensive. This advantage could change, though, if retaliatory tariffs on component imports abroad make domestic suppliers less competitive in those markets.

How Do Tariffs Work?

Because tariffs are taxes imposed on imported goods, they’re generally collected as the goods cross a country’s border. The importer typically pays this tax to the customs authority before the goods can enter the domestic market. But the number of different types of tariffs is growing, and each works somewhat differently.

Tariffs can be structured in several ways: as a percentage of the product’s value (ad valorem tariffs), as a fixed amount per unit (specific tariffs), or as a combination of both approaches (compound tariffs). Some tariffs are imposed across the board, applying to many product categories, while others apply only to selected imports, such as steel or aluminum. Implementation varies by country, with some nations maintaining complex tariff schedules that adjust rates based on a product’s origin, components, or intended use.

What Are the Objectives of Tariffs?

Economists say that tariffs have intended and unintended consequences. The main intended objectives include:

- Protection: By making imports more expensive, proponents say, tariffs help domestic industries gain market share, increase production, and hire more workers. Similarly, they support national security objectives by helping to ensure that critical technologies and defense equipment are reliably available from domestic rather than foreign sources.

- Revenue: Import tariffs promise to raise tax revenue for the country imposing them. For example, US tariffs introduced in early 2025 could raise up to $1.5 trillion by 2035, according to the Budget Lab at Yale University. But the volume of tariffed imports can drop as their prices increase and customers buy less. In addition, corporate tax collections can fall should foreign countries retaliate, shrinking domestic exporters’ addressable markets and taxable profits.

- Balance of trade: National trade deficits are associated with slow economic growth, job losses, higher sovereign debt, and other economic ills. Trade deficit reduction has been cited as a motivation for increasing tariffs, though many economists argue that unintended consequences, such as retaliatory tariffs, can undermine this objective. The United States registered a negative trade balance of $1.2 trillion in goods with the rest of the world in 2024, but it had a trade surplus of almost $300 billion in services.

- Retaliation: Unfair trade practices, including export subsidies and dumping (selling below cost), can provoke trade disputes that lead a country to impose tariffs for retaliatory purposes. This can create a tit-for-tat cycle that harms both economies and disrupts global trade.

- Leverage: The threat of tariffs can be used as leverage, not only in trade negotiations, but also to pressure other countries to make concessions on non-trade issues. Current examples include immigration and drug enforcement.

Who Is Impacted by Tariffs?

Consumers often bear the brunt of tariffs, as companies raise prices to cover the increased cost of doing business. Domestic manufacturers and retailers are among those companies most exposed to import duties on their foreign suppliers, while agricultural producers are particularly vulnerable to retaliatory tariffs on their exports to other countries. Tariffs tend to apply to goods rather than services, though governments may impose nontariff barriers to trade in services, such as complex licensing requirements, foreign ownership restrictions, and regulations that favor domestic service providers.

Entities affected by tariffs include:

- Importers: Companies importing from countries that are subject to tariffs face higher costs for raw materials, components, and finished goods. The US National Association of Manufacturers (NAM) cited the example of a large consumer goods manufacturer facing an immediate $200 million in added costs due to new US tariffs on Mexican goods.

- Exporters: Businesses that export can find that retaliatory tariffs make their products less price-competitive in foreign markets. The same US manufacturer cited by NAM above said it faced another $31 million in export losses due to Canada’s retaliatory tariffs.

- Consumers: Importers tend to pass on the cost of tariffs to consumers. For US consumers, the Canada, China, and Mexico tariffs imposed in early 2025 are expected to trigger an average per-household cost of $1,600 to $2,000 in 2024 dollars, according to the Budget Lab at Yale.

- Business customers: Likewise, importers often pass on the cost of tariffs to their domestic business customers through direct price increases, surcharges, and contract renegotiations. Sometimes, importers can be persuaded to at least share the cost.

How Are Businesses Impacted by Tariffs?

Businesses have options for dealing with tariffs, such as substituting products from their home market or an unaffected country, increasing prices to cover some or all of the tariff, and pruning product catalogs. Still, the impacts are hard to manage, especially given geopolitical uncertainty. They include:

- Higher costs: Import tariffs increase domestic companies’ costs of purchasing raw materials, components, and finished products. Even if the same product is available from domestic suppliers, the reduced competitive pressure from imports, together with the increased demand for domestic goods, has been known to cause price hikes.

- Increased export prices: Tariffs can drive up the price of exports, making them less competitive. The Tax Foundation cites three causes: retaliatory tariffs on the products a company sells abroad, higher costs for making those products due to import tariffs on production inputs in a company’s home market, and tariff-driven currency appreciation.

- Business uncertainty: Uncertainty about whether, where, when, and for how long tariffs might be imposed makes it hard for businesses to plan, especially regarding investments. In early 2025, for instance, The Wall Street Journal cited a slump in mergers and acquisitions due, in part, to trade policy uncertainty.

- Supply chain disruption: New tariffs are forcing companies to reconsider established supply chain configurations and supplier relationships in order to manage tariff-related costs. In a survey by a major logistics provider, companies cited tariffs and trade policy as the top risks to their supply chains in 2025.

- Share price volatility: Goldman Sachs research shows that every 5-percentage-point increase in the average US tariff rate reduces S&P 500 earnings per share by 1% to 2%, with a knock-on effect on company share prices. US tariffs were implicated in stock market volatility in early 2025.

- Compliance burdens: Lawyers report that companies face severe civil or criminal penalties for failing to comply with US tariff policies. They cite recent prosecutions and settlements for tariff evasion, such as fake country-of-origin claims and underreported import values. Companies should reevaluate their compliance policies and procedures to avoid mistakes, such as improperly reporting the country of origin when imports are routed through third-party countries. The cost of compliance is high, but the cost of noncompliance can be higher.

Who Uses Tariffs? Who Pays for Tariffs?

Tariffs have historically been used by governments worldwide as a tool to regulate trade, protect domestic industries, and/or generate revenue. Though the immediate cost of tariffs is typically paid by importers, the financial burden often ripples through the economy, affecting businesses and consumers in the following ways.

- Governments impose tariffs to protect local industries, address trade imbalances, or generate revenue. Recent tariff rationales have expanded into non-trade issues, such as border control, drug enforcement, and other policy goals.

- Importers pay tariffs up front when bringing goods into a country, often passing the cost to consumers and business customers through higher prices.

- Exporters to foreign countries may face reduced demand for their goods due to higher prices in the importing market.

- Consumers ultimately bear the cost of tariffs through increased prices on imported goods and potential inflation.

Who Authorizes Tariffs in the US?

In the 1930s, the US Congress delegated the setting of tariff rates to the president. That said, Congress can still step in, if it so chooses, according to the National Constitution Center. The US Treasury establishes tariff regulations and the CBP collects the tariffs. Specifically, imports are classified and tariffed according to the Harmonized Tariff Schedule of the United States. When crossing the border, companies self-classify and declare the value of their imports based on this table, subject to CBP review and audit.

How Do Businesses Mitigate the Effects of Tariffs? 6 Strategies to Use

Companies can use many strategies to blunt the cost of tariffs. Short-term mitigation strategies include lobbying the government for exemptions, negotiating with current suppliers to share tariff burdens, and building strategic inventory reserves. For the longer term, some US businesses are already diversifying suppliers, shifting production locations, and exploring new export markets. Here are six tariff mitigation tactics companies can explore.

- Price strategically: Although most companies pass on the cost of tariffs to customers as price increases, they need to exercise caution. Higher prices could threaten sales volumes, as customers begin to look elsewhere for savings. Yet absorbing the cost of tariffs can erode operating margins, which may not be palatable for publicly traded companies or low-margin businesses. Consultancy Bain & Company advises affected companies to conduct a competitive analysis and risk assessment—by product, region, and sales channel—to figure out how much they can raise prices without losing customers. In addition, according to consultancy Revenue Management Labs, they should explore creative approaches such as coupling gradual price increases with targeted offers, 0% financing or volume discounts.

- Negotiate with suppliers: Importers should consider working with suppliers and distributors to share the tariff burden and streamlining their supply chain by eliminating intermediaries. One trade adviser noted that many Chinese manufacturers helped US buyers absorb tariff costs during the 2018-2019 trade tensions. Suppliers with higher profit margins are more likely to negotiate tariff-sharing than those with lower margins. Importers can incentivize these agreements by offering adjustments to contracts, such as extended terms or bulk purchasing commitments.

- Optimize supply chains: Short-term responses to recent tariffs have included stockpiling, with the Logistics Manager’s Index showing a rapid rise in US inventory levels in early 2025. For the longer term, companies should consider relocating production or sourcing to countries with low or no tariffs, according to Boston Consulting Group. In doing so, they should keep in mind the significant initial capital expenditure and long lead time required, alongside tradeoffs, such as reduced economies of scale across multiple suppliers and production facilities. And it may be wiser not to make such big moves right away, advisers say, but to wait for greater stability and clarity about which tariffs will be negotiated away and which will remain. Meantime, for both the short and long terms, streamlining and automating supply chain operations can squeeze out savings to cover some tariff costs.

- Find new markets: Exporters should seek out friendly markets for their products to avoid retaliatory tariffs. Given today’s volatile trade policies, though, that could prove challenging. For example, a US proposal has been floated for blanket reciprocal tariffs on every country worldwide. In its proposal, the White House cited a 2019 report analyzing tariffs imposed by 132 countries on more than 600,000 product lines, concluding that US companies faced unfairly high tariffs more than two-thirds of the time.

- Change product lines: Changes at the product level can also mitigate tariff impacts. Companies can increase the percentage of domestic components in their products, for example, or modify product designs to replace materials targeted by tariffs. Some companies have said they plan to discontinue products that tariffs render too costly.

- Seek exemptions: Another tariff management strategy is to seek an exemption. Companies need to know, however, that about 53,000 companies applied to the US Trade Representative for tariff exclusions from 2018 to 2020, according to the Government Accountability Office, with 87% of the requests denied.

History of Tariffs

Tariffs, which date back to ancient civilizations and trade routes, such as the Silk Road, have fallen in and out of favor over time. In the United States, tariffs and other customs duties were the largest source of federal revenue in the 18th and 19th centuries, until a constitutional amendment ushered in the federal income tax. Tariffs then waxed and waned but generally remained high, until they reached a tipping point. That came with the Smoot-Hawley tariff of 1930, which raised US import duties to historically high levels in an effort to protect American industries and farmers. However, the tariff worsened the Great Depression by triggering retaliatory tariffs and reducing global trade, according to historians.

After World War II, the United States and its trading partners entered an era of lower tariffs and fewer trade barriers, along with bilateral and multilateral trade agreements, such as those creating free trade zones and the World Trade Organization’s global trading rules. Although these arrangements have been subjected to different pressures, until recently the United States has generally pursued low-tariff, rules-based global trade, according to the Congressional Research Service, with tariffs accounting for under 2% of federal revenue.

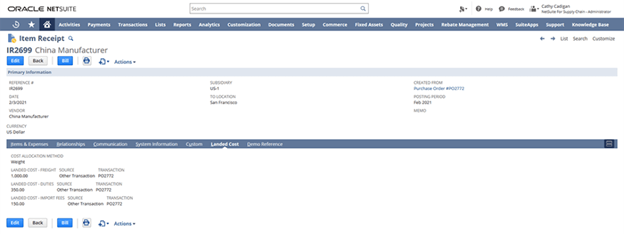

Minimize the Impacts of Tariffs With NetSuite

NetSuite provides tools to help businesses navigate the challenges of tariffs and trade uncertainty. Its enterprise resource planning (ERP) system gives companies the visibility to understand how tariffs impact their expenses and profitability by providing a detailed breakdown of the landed costs associated with each import, including tariffs, shipping, and other expenses. Furthermore, using embedded AI capabilities, NetSuite ERP helps businesses explore different options, such as alternative suppliers or products, to find the best strategies for mitigating tariff costs. The system also helps companies analyze the potential impact of absorbing costs versus passing them on to customers.

NetSuite’s supply chain management software help companies identify efficiencies and cost savings that can offset the burden of tariffs. With these capabilities, businesses can make informed decisions to minimize the impact of tariffs, develop flexible strategies, and build more resilient supply chains.

Tariffs are increasing worldwide, raising costs and causing complications for companies that import and export. With trade policies in flux, some businesses are stymied by uncertainty while others are scrambling to adapt. To avoid getting squeezed, they’ll need to find ways to lessen the impact. This could mean finding new suppliers, adjusting prices, working closely with existing suppliers, or even selling products in different countries. The global marketplace is changing fast, and companies need to stay agile.

Tariffs FAQs

What is a tariff best defined as?

A tariff is a national tax that companies pay on imported goods.

Is a tariff a tax?

Yes, a tariff is a tax. Specifically, it’s a tax imposed by a government on goods imported from other countries. Companies must pay these taxes.

How are tariffs calculated?

Tariffs are typically calculated as a percentage of the value of imported goods or, less often, as a fixed dollar amount per unit.