Every invoice your business receives contains a hidden cost—the overhead to process and pay the bill. The exact price depends on whose research you’re reading, but the trendline is clear: Compared with manually reviewing and paying invoices, automating invoice processing saves companies a substantial amount of time and money. Invoice automation can lead to other savings for businesses, too, such as eliminating late fees that are incurred when a payment misses its due date. Invoice automation also tends to lead to happy vendors, who appreciate being paid on time, and happy employees, who can be redeployed to work on more interesting and high-value projects.

What Is Invoice Automation?

Invoice automation, also called automated invoice processing or automated invoicing, relies on software to handle the end-to-end receipt, management, and payment of vendor bills. Automating accounts payable (AP) substantially reduces the time it takes to process invoices versus doing the work manually, which in turn lowers operational costs, fosters better relationships with vendors, and, according to a survey of 450 finance professionals, even leads to higher job satisfaction for finance staff.

Key Takeaways

- Invoice automation reduces the time and costs involved in (sometimes error-prone) manual processing.

- At the heart of an invoice automation system are a series of business rules and tolerances that mandate how and whether an invoice proceeds through the AP workflow.

- Invoice automation helps a company manage its cash flow.

Invoice Automation Explained

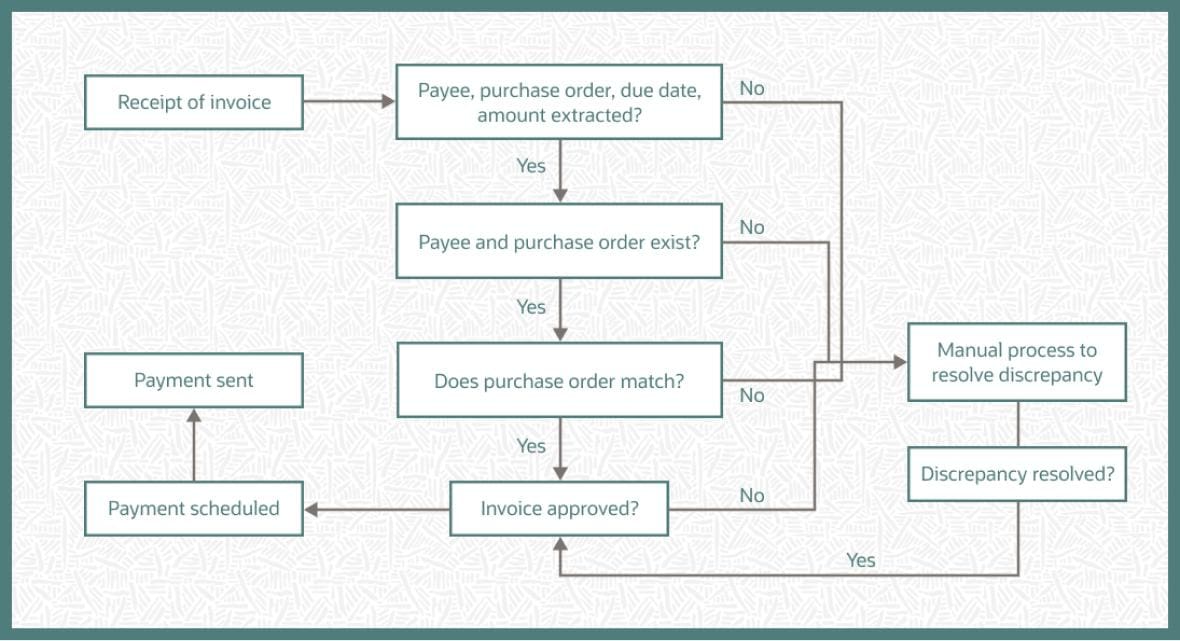

An automated invoicing system receives vendor invoices and automatically manages their processing through to payment via a specific workflow that is constructed around a series of “if this, then that” business rules. To understand invoice automation, consider how an email goes through a series of security tools, such as antivirus and anti-malware software, before it’s deemed safe to land in the intended recipient’s inbox.

With invoice automation, when a business receives an invoice—either electronically or a paper bill that must be scanned—software parses different bits of information from it and then decides what happens next based on predetermined rules. For instance, when the software identifies the purchase order on the invoice, it might query the purchase order database to ensure a matching number is on file. Then it moves to the next step in the process.

Think of invoice automation as a workflow. At each step, the software makes an either/or binary decision and, based on the result, moves to the corresponding next step.

How Does Automated Invoicing Work?

As a business grows and the volume of invoices it receives increases, the more time-consuming and labor-intensive it becomes for accounting teams to manually process and pay them. Automated invoicing shoulders the load, slashing processing time (and associated costs) and helping the business better manage cash flow by appropriately timing payments.

The automated invoicing process begins when a company receives a vendor invoice for goods purchased or services rendered and concludes when a payment is sent. The steps in between comprise the business’s workflow—such as extracting data and routing invoices to approvers—all of which are accomplished using robust AP automation software that goes through a series of predetermined checks, or rules, to determine whether the invoice is correct and can be paid.

Automated Invoicing Workflow

Increasing efficiency was cited as the top priority by 78.5% of AP leaders, according to a 2024 report by the Institute of Financial Operations and Leadership. Correspondingly, AP workflow automation was the No. 1 area of investment to tackle that challenge. Automation also addresses other common invoicing problems, such as lost or missing invoices, fraudulent invoices, and the inability to approve invoices in time to capture discounts. While the workflow from invoice receipt through payment can differ from one company to another, it typically includes the following steps.

-

Invoice received:

The vendor bill arrives, either in paper format to be scanned or in electronic format. The text is extracted courtesy of optical character recognition (OCR) technology, and pertinent data, including the vendor (payee), purchase order number, payment due date, and amount, are entered into the AP system.

-

Invoice accounted for:

The data is entered into the company’s accounting system and recorded as a credit in the AP account of the general ledger.

-

Data verified:

The system verifies that the payee exists and that the purchase order listed on the invoice is the same as the number on the original purchase order.

-

Data matched:

The AP system tries to match other invoice information to the purchase order information already on file. This is called two-way matching. If the company also tracks delivery data, then invoice automation could go one step further to verify a three-way match across the invoice, purchase order, and delivery.

-

Invoice approved:

Assuming everything matches, the vendor bill is automatically approved or, if the amount exceeds a predetermined threshold or another issue crops up that requires human attention, routed to the appropriate person for assessment and approval.

-

Payment scheduled:

Approved invoices are automatically scheduled for payment. That payment might be issued on the due date indicated on the invoice, or it might be sent at an earlier date depending on specific terms or to capture incentives, such as an early-payment discount.

-

Payment sent:

The workflow culminates with a payment issued to the vendor. The invoice is closed out as settled, after which it is removed from the AP account as a debit and added as a credit in the company’s cash account.

Why Is Invoice Automation Important?

Invoice automation is important for any growing business because it can decrease the costs associated with processing a single invoice, and these savings multiply across an increasing number of vendor bills a business naturally receives as it expands. With their time freed from the mundane, error-prone tasks that are a reality for processes handled manually, AP staff can be reassigned to more strategic projects. Invoice automation also helps a company manage its cash flow, pacing payments so as not to drain its coffers.

Benefits of Automated Invoice Processing

An invoice automation system offers many benefits besides easing the burden of handling the AP process manually. Among these advantages, automated invoice processing delivers upsides including:

-

Improved accuracy:

Automated invoice processing significantly improves accuracy by minimizing the human error inherent in manual data entry and handling. With fewer typos, misplaced digits, and incorrectly filled in data fields, it becomes easier to automatically match invoices against their corresponding purchase orders and verify quantities, prices, and other details. This helps identify discrepancies and prevent overpayments or incorrect payments.

-

Reduced costs:

While eliminating the time-consuming process of manually entering and routing invoices saves money, that’s not the only source of savings. Digital invoices and automated workflows minimize the need for paper, printing, postage, and physical storage, and automated systems ensure right-on-time payments, minimizing the risk of late penalties and capturing early payment discounts.

-

Reduced idle time:

People take holidays, sick days, and get caught up in other projects that are more engaging than invoice processing. These delays can lengthen the time between invoice processing steps, slowing progress and putting the company at risk of incurring late fees or missing out on early payment discounts.

-

Streamlined audits:

Automated systems create detailed digital trails, capturing every step of the invoice processing workflow, including timestamps, user actions, approvals, and any modifications made to invoices. These digital document trails, centralized repositories, and improved compliance via automated workflows may reduce the time and costs associated with audits. Quickly retrievable matching source documents, reports, and other data stored in a standardized format make it easier to compare and analyze information across invoices and vendors, so auditors can be in and out quickly.

-

Increased productivity:

Automated systems can generate reports on key performance indicators (KPIs) that provide insights into where invoice processing might run into bottlenecks. These reports can help CFOs identify areas for improvement, whether adding staff or additional automation. And by automating repetitive tasks, AP/AR staff can focus on higher-value activities, such as vendor relationship management, financial analysis, and process improvement.

-

Fosters consistency:

By routing all invoices following preset rules and establishing criteria for approvals, companies can minimize the variables introduced by humans. Using OCR and AI, automated systems extract data from invoices with low error rates and in a consistent manner.

-

Eliminates late fees:

When bills aren’t paid on time, that costs companies not only money they didn’t need to spend but goodwill with suppliers. Automated systems can be configured to track individual vendor payment terms and schedule payments based on the dates specified on invoices or in contracts. If required approvals are not received in a timely manner, the system can automatically remind stakeholders to help ensure invoices are processed before the due date.

-

Helps time cash outflows:

Late fees aren’t the only financial factor tied to the timing of invoice processing—companies that remit in a shorter timeframe may receive early-payer discounts. Because an automated system provides real-time visibility into the status of invoices, AP staff can track due dates to avoid losing out. More granular insights also enable companies to delay payments until closer to due dates to maximize cash on hand and create more accurate cash flow forecasts.

-

Promotes positive relationships with vendors:

Everyone appreciates being paid on time. Solid relationships with suppliers can result in favorable extended payment terms, which improve cash flow by delaying outflows. Other potential benefits include prioritization of orders, prompt attention to problems, volume discounts, and advance notice of price increases, product changes, or potential disruptions.

-

Manages cash flow:

Automated invoice management systems that are integrated with accounting software can make timely updates to the general ledger, providing an accurate and up-to-date picture of cash flow. These systems can generate reports on spending patterns, vendor performance, and payment trends to help identify ways to improve cash flows.

-

Bolsters security:

By flagging potentially fraudulent invoices and errors, an automated system can save companies money. For example, these tools can automatically compare vendor information to what’s in accounting systems and databases and flag suspicious entries or inconsistencies. In addition, because every action within the system is logged, companies are left with a comprehensive audit trail, making it more likely that fraudulent activities will be detected. Role-based access controls limit who can access and modify sensitive data, and

-

Reduces carbon footprint:

By decreasing or even eliminating paper processes.

Invoice Automation Features

As with any software, it’s important that it not only meets an organization’s immediate needs but also addresses potential future needs as the company grows. Businesses may want to consider software automation features that:

-

Import vendor invoices:

Electronic invoices flow directly into the invoice automation system, sometimes straight out of an email.

-

Match information:

Vendor invoices are automatically matched against their purchase orders and delivery logs to ensure that the correct amount is being billed, the purchase was authorized, and the company has received it.

-

Apply customizable rules:

At each step of the AP workflow, the invoice automation system applies customizable business rules to determine the next step. For example, if the system matches the invoice to its purchase order, the invoice can be routed for approval.

-

Accept tolerances:

The system allows for tolerances that permit invoices to move through the workflow despite a slight discrepancy, aligned with a company’s materiality thresholds. For example, an invoice that is 3% above the amount on the purchase order might be considered close enough to merit automatic approval.

-

Flag exceptions:

The system automatically routes an exception, meaning a seemingly problematic invoice, to an authorized person to manage the approval—for instance, when an invoice arrives that is substantially higher than its corresponding purchase order indicates.

-

Support robust reporting:

The invoice automation system offers access to prebuilt and customizable templates to report on key metrics, such as invoice processing rates, payment status, invoice volume, vendor performance, and outstanding invoices. Advanced analytics can also be tapped to report on invoicing trends, catch bottlenecks in the invoicing process, monitor cost savings, and make informed AP-related decisions.

-

Provide a unified control console:

The system creates a centralized view of invoicing activity across the company for greater transparency and centralized financial control, management, and decision-making. It may also offer visual dashboards to keep tabs on key metrics in real time and the ability to drill down for detailed insight to underpin timely decision-making and interventions regarding invoice and AP activity.

-

Integrate with other tools:

When the invoice automation system can connect to other back-office software and tools, it exponentially increases efficiency, reduces errors, streamlines processes, and improves visibility across functions within the organization. Systems that a company might want to integrate with invoice automation software include:

- Accounting software to enable invoice reconciliation and data synchronization.

- Enterprise resource planning (ERP) software to share data for financial and supply chain management.

- Payment gateways to enable automated payment collection and processing.

- Customer relationship management (CRM) software to synchronize client information and improve the customer experience.

- General ledger systems to increase financial reporting accuracy.

- Supply chain management systems for easier data sharing between procurement and financial tools.

- Project management software to streamline invoicing/billing for project-based work.

6 Invoice Processing Tasks to Automate

There is no shortage of articles and reports about the value of automation—how it saves companies money, makes for a more efficient workflow, and frees staff of time-consuming, monotonous work so they can apply their talents to higher-value projects. These benefits apply to invoice processing, including these six tasks:

-

Invoice receipt:

With automation, the task of opening and sorting digital invoices and parsing scanned copies of paper receipts can be completed more quickly.

-

Vendor verification:

When verification is automated, it’s one less piece of information that AP staff has to double check. Plus, additional information associated with a vendor, such as a promised discount for early payment, may slip through the cracks otherwise.

-

Purchase order lookup:

Automation allows companies to quickly locate the purchase order that goes with the just-received invoice.

-

Two-way and three-way matching:

Automatically comparing information across the vendor invoice and purchase order (two-way matching) or extending it to the delivery data (three-way matching) can be a significant time-saver.

-

Invoice routing, approval and payment:

Once the contents of an invoice have been verified, it can be automatically routed to the appropriate person for signoff, if required.

-

Payment:

Payment can be automatically scheduled and sent based on several factors, including when the invoice is due and cash flow considerations.

Choosing the Right Invoice Automation Software

Take a look at how invoices flow through your organization today. What is and isn’t working? What capabilities would be helpful now—or in the future—that you don’t already have? Analyzing your current process can help you narrow down the field of solutions to evaluate and ultimately select the right invoice automation software for your business. Key questions to ask include:

- Can the software accurately capture invoice data from the various formats (such as emails and scanned paper bills) that I might receive from vendors?

- Does the software include reporting capabilities and dashboard views so I can easily locate and track invoices? Is reporting customizable?

- Does the software seamlessly integrate with other cloud accounting and ERP systems I have now or may acquire in the future?

- How quickly can the software handle my invoice flow as it currently stands?

- Can the software automatically issue payments?

- Can I configure the software to match my workflow? For example, can I add a business rule?

- Does the system scale? What will happen when my volume of vendor invoices grows?

- Can staff access the software across different devices and from remote locations?

- Are there other companies like mine that use, and are satisfied with, the automated software?

Implementing Invoice Automation: A Step-by-Step Guide

Automating invoice management can offer a number of business benefits, but these systems are not a magic wand. Only with proper planning, rollout, and adoption will the company see real efficiency improvements, reductions in errors, cost savings, enhanced compliance, and improved cash flow.

The following steps will increase the likelihood of a successful invoice automation software implementation:

Step 1: Assess Your Workflow

As a first step, the company should look at its current processes. Evaluating invoice-related workflows will help the organization determine which ones are currently working well and which ones may need improvement. Simply automating existing inefficient or ineffective workflows will limit the positive impact of introducing invoice automation capabilities into the organization.

It may make sense to map out each step in the process, indicating who does what and how long it takes—noting approvers, bottlenecks, and other sources of delays. Some companies will go further to look at the volume of invoices processed during a given period, where there may be surges or dips in those volumes. They’ll also review AP KPIs—such as average cycle time, average error rates, and delayed payment rates—to uncover opportunities for improvement.

Step 2: Define Your Objectives.

Automation for automation’s sake may deliver some improvements, but it’s far better to first consider and articulate clear and specific goals for automating invoicing processes. These might include eliminating errors in data entry or calculations, increasing visibility into invoice submissions and approvals, speeding up invoice processing, or improving cash flow. These aims will then help guide other implementation steps, such as software selection, workflow design, and ongoing system reviews and improvements. At this stage it can be helpful to create some KPIs based on these goals to measure the impact of invoice processing automation efforts over time. Some common metrics companies track include invoice processing time, invoice exception rates, reductions in procurement cycle times, cost savings, and cash flow.

Step 3: Choose Your Software

Not all invoice automation software is created equal. It’s important to select a solution that best aligns with the business objectives outlined in the previous step. Another consideration might be the software’s ability to integrate with existing financial or ERP systems. In addition, software options should be assessed based on business-specific requirements or needs, such as mobile access, automated invoice capture from emails or other sources, compliance capabilities, two- or three-way matching support, or automatic invoice approval routing.

Step 4: Design Your New Workflow

Once the organization has decided on the software best suited to its needs, it’s time to consider workflows. Designing a new invoice workflow offers the opportunity to customize the automated system to meet the organization’s needs and processes. As they design the workflow, the implementation team will want to consider what the invoice approval process should look like (how invoices will be routed based on predefined rules), any data validation that needs to happen along the way, and how the system will integrate with other existing software. This will involve defining the hierarchy for invoice approvals. While the workflow should be similar for most transactions, there may be different approaches or the need for multiple or higher-level approvers when it comes to big capital investments versus, say, office supplies.

Step 5: Prepare Your Data

The familiar adage “garbage in, garbage out” holds true for invoice automation. Invoicing software depends on data availability and integrity to deliver anticipated benefits. If the organization previously performed all invoice management manually, preparing the necessary data to automate the process will take some work. First, the team will need to evaluate its existing data and any issues with data silos or access. Then they must collect and organize the necessary invoice and vendor information. Experts suggest the previous six months of invoice data is necessary for the implementation team to get the system up and running and begin to automate invoice processing, verification, and payments. Finally—and most importantly—it’s critical to focus on data integrity, making sure any data being migrated into the new software is clean and accurate.

Step 6: Test Your New System

Once the data has been imported into the new system, it’s time to make sure it’s working well. As with any new software, this implementation phase should include rigorous quality assurance (QA) testing to ensure that the system is functioning correctly and capable of achieving the organization’s goals. The IT team may also want to test the system’s integration with other existing systems, such as accounting or ERP software, to make sure the connections are functioning properly. Beyond this QA work, conducting pilot tests with a select group of users from key departments is also recommended to see how well the software is working from their perspective and whether it meets their needs. Then adjustments can be made based on their feedback before the wider rollout to the larger organization.

Step 7: Train Your Employees

Before launching the invoice automation software companywide, it’s important to train employees who will need to adopt the new system. A comprehensive training program that offers a variety of learning options (self-service modules, classroom training, on-the-job learning) and is designed to address the specific needs and questions of different types of users and stakeholders is an important investment. Such training should cover system functionality and any new processes and workflows. Employees must also personally recognize the system’s value for wide and effective adoption, so demonstrate how the new software will increase efficiency, reduce errors, increase visibility, and make their lives easier. If employees are unsure how or why to adopt the new software and processes, they will find workarounds that may limit the benefits of automation.

Step 8: Launch

Once the software has been tested thoroughly, any issues have been addressed, and employees have been educated about the new system and its benefits, it’s time for rollout. Some companies will initially take a phased approach, starting with certain user groups, business units, or functions. However, grasping the system’s full benefits requires full-scale deployment across all relevant users, locations, and departments. At this stage any integration with other systems will also go live. Launching new software involves some risks that are important to mitigate. The company may want to set up proactive monitoring processes to quickly identify any issues, institute a backup plan to revert to previous invoice management processes should significant issues arise, and set up a dedicated help desk to help employees with issues in the early months of usage.

Step 9: Monitor Performance and Collect Feedback

The hard work of software implementation doesn’t end once the system goes live. Next it’s time to begin monitoring the new invoice automation system and processes to make sure there are no glitches and working effectively. KPIs established earlier in this process should be tracked regularly to determine the extent to which automation is delivering the desired results, whether that’s cost savings, a reduction in error rate, an increase in cycle times, improved cash flow, or something else. Keeping tabs on these metrics will help the company identify where the new automated system is providing expected benefits and where further work is necessary—whether that’s changes to the system, tweaks in new processes and workflows, or further training for users. It’s also essential to gather employee input to uncover any other issues that require remediation.

Troubleshooting Common Invoice Automation Challenges

Although the potential benefits of automating invoice management are clear, companies should understand and be prepared to address some common challenges associated with their efforts. Following are four obstacles that can arise when automating invoice management and the steps companies can take to address them.

Change Management Concerns

Any new system or process will likely encounter resistance from some employees who are accustomed to their manual processes. A bit of fear, uncertainty, and doubt about automation and its intended impact may also exist. Indeed, some employees may fear being automated out of a job. Finally, without the proper training, understanding and adoption of the new software, associated processes, and new workflows will be limited.

Solutions

- Make change management a priority: This will include clear communication with employees about the benefits of automation—not just for the company but for them personally.

- Involve employees in implementation: Include representatives from key user groups throughout the implementation process to reduce resistance and increase buy-in from key populations. This may include determining goals for the new system and selecting the software to test the system.

- Invest in extensive training: Once buy-in is established, employees need to be comfortable using the system in order to make the shift.

- Establish support systems: Help lines or dedicated systems support teams will go a long way in helping the organization transition to the new automated system.

Data Integrity Challenges

Inaccurate, incomplete, or inaccessible data will thwart any invoice automation effort. Data integrity issues can lead to errors, delays, and frustration (for employees and vendors). Variability in data or invoice formats can also cause significant problems.

Solutions

- Prioritize data standardization: Implementing standard data formats and procedures across all departments takes time but will help to ensure that data issues don’t thwart automation efforts or impact operations.

- Consider investing in data validation tools: Artificial intelligence (AI) based technologies can automatically scan for and fix data issues.

- Schedule regular audits: Conducting frequent audits of invoice data can help identify and address data integrity issues before they lead to bigger problems.

Integration Issues

Integrating modern invoice automation systems with preexisting software, such as ERP, accounting, or CRM systems, is not always easy or straightforward. It can be a particular challenge when an organization has older, legacy software in place. Any issues with integration or compatibility can lead to implementation delays, additional costs, or errors.

Solutions

- Select an adaptable system: Picking an invoice automation solution that is designed to integrate seamlessly with existing systems will minimize issues involved with connecting disparate systems.

- Utilize application program interfaces (APIs): APIs are designed to integrate different software platforms with minimal issues.

- Invest in integration expertise: Working with IT professionals or consultants who have performed similar integration tasks before can be well worth the investment to make sure that systems are compatible, integration goes smoothly, and any unexpected issues are addressed promptly.

Exception Handling

If a significant number of invoice exceptions occur in the new automated system—as a result of errors, data discrepancies, or other issues—the company may have to revert to manual interventions or processes. Exception handling requires added time and resources, leading to significant delays in invoice processing, which isn’t good for the company or its vendors. It also increases costs.

Solutions

- Consider automating exception management: Some automated systems can identify, investigate, and resolve exceptions efficiently and may be worth the investment. In addition, the automation software itself may have some built-in capabilities to explore.

- Create exception processes: Clear, documented, and well-understood processes for dealing with exceptions, including escalation protocols for thorny issues, can streamline exception management and take some of the sting out of it.

- Explore AI solutions: Machine learning capabilities can be applied to learn from past exceptions and continually improve the invoice automation process over time.

Accelerate Invoice Processing With Automation

If you think your AP process is costing you more than it should, you’re probably right. As a business grows, manually processing vendor invoices can drag down the entire workflow and increase associated costs. Automation changes the game. NetSuite Accounts Payable speeds the entire AP process by automating all steps involved in processing and paying an invoice, including automating journal entries and handling approvals. The software also includes configurable dashboards that display KPIs—such as invoice aging, invoices in-process, and payment in transit—as well as an integrated vendor database that contains all the information needed to make payments. These capabilities, and more, can help a company better manage its cash flow and grow.

The amount listed on a vendor invoice doesn’t represent a business’s actual expense but rather the expense associated with necessary accounting processes. It’s only after adding in the time and cost of manually processing that the true amount emerges. Invoice automation slashes most of that hidden cost by taking over the accounts payable workflow, which begins the moment a business receives a vendor invoice, winds its way through verification and approval, and culminates in payment. Fraudulent invoices are more likely to be flagged, cash flow can be better managed, and accounting staff is freed to focus on more valuable work. Using robust AP automation software, manual, error-prone processes become a thing of the past.

Invoice Automation FAQs

What is automated invoicing?

Invoice automation, also called automated invoice processing or automated invoicing, relies on software to handle the end-to-end receipt, management, and payment of vendor bills.

How do you automate an invoice process?

Software is required to automate an invoice process. Automation substantially reduces the time it takes an AP team to process invoices manually, which in turn lowers operational costs and fosters better relationships between vendors and customers.

What is automated invoicing software?

Automated invoice software is programmed to handle the receipt of vendor invoices, confirm their accuracy, route them for approval, and pay them. Think of invoice automation as a workflow. At each step, the software makes an either/or binary decision and, based on the result, will move to the corresponding next step.

What is an AI invoice?

An AI invoice uses artificial intelligence to identify and extract its components, such as the purchase order number and amount due. AI can lead to greater business efficiencies, higher levels of productivity, and significant cost savings.