Media companies have just three ways to monetize content: sell per instance rights-to-use or recurring subscriptions, sell ads around the content or sell data on consumers. That’s it. Every revenue model essentially devolves down to one of these three. That we’ve developed endless permutations of these three model speaks to both the challenge of sustaining a media business as well as our insatiable appetite for information, entertainment and anything else that exercises our senses and brains.

Since the dawn of human writing, content creation as a business only grows, but making a well-sustained business… that’s increasingly tricky.

It’s the universal appeal that makes media so interesting and at the same time so cutthroat. New formats constantly drive old formats toward unsustainable business models. Technology has been an accelerant. Book sales, which dominated the first few centuries of media now account for just a fraction of it. Newspapers gave way to magazines, which were eclipsed by radio, which gave way to TV, which has now given way to digital media.

Digital advertising(opens in new tab) will eclipse traditional advertising spending for the first time in 2019, according to eMarketer. You’d think that would be great news for the Google-Facebook duopoly that has ruled digital advertising for so long, but eMarketer also predicts that Facebook and Google will both lose market share for the first time. The two are still by far the biggest players in digital media, but the market is broadening.

The diversity of content delivery channels can seem trendy and capricious, but the magic of digital is that it offers video for visual learners, radio and podcasts for audio fans, and pixels on a page for lovers of the written word. Content creators increasingly need to meet their audience in their preferred medium, often taking each piece of content and creating a variety of ways for potential audiences to find and consume it. For media companies, it can feel like the audience wants the latest platform first and foremost, but it’s more nuanced than that. Consumers will tend to find their home and settle in. The bigger question is how to monetize these platforms.

Anyone who’s thought about media diversification has probably dabbled in video. But it’s difficult to just dip a toe into this medium. It takes some stamina to put up your first few videos on YouTube only to find that you’re getting a few hundred non-monetized clicks for each. Meanwhile, the Dolan Twins get 20 million views of a video where they’re getting their wisdom teeth removed. That’s video at first blush: hard to monetize and even harder to attract a following. Your CFO will love the idea of building a studio to support that. You need data, management support and a solid plan that includes paths to monetization beyond simple ads, or else that revenue stream is going to look pretty small. Unless your team includes cute Gen Z twins, like the Dolans, willing to do pretty much anything for their followers.

The Art of Evolution

For established media companies, it can easily feel like the revenue pie is forever shrinking. But whenever one market or revenue stream shrinks — say newspaper advertising — a new stream grows, like podcasting(opens in new tab). This makes sustained growth and profitability in media an effort in constant rediscovery and evolution. For those who can do it, there’s plenty of money to be had.

Ad revenue in particular continues to grow unabated: current spending puts global ad revenue on a path to double in less than a decade, according to eMarketer. The story is similarly strong for direct purchase and subscription revenue. For purists, it’s the holy grail of media revenue. The relationship is between you and your subscribers. Advertisers might be welcome, but when the primary revenue is from consumers, it frees media creators to focus on exactly what the audience wants without concern for what sponsors might think.

The revenue stream with the most challenges is content-driven audience data sales. New privacy laws are popping up worldwide that promise to put data control back in the hands of individuals. These laws are game changers for everyone who traffics in sales leads and could easily change the rules for some of the largest and most profitable parts of digital advertising. The days of unfettered data collection on content consumers are numbered.

The EU is using its General Data Protection Regulation (GDPR)(opens in new tab) to pass out fines to the biggest or most shady companies collecting data. The US has similar laws in California and Massachusetts(opens in new tab), set to take effect in 2020, with more on the way.

Most enforcement is in the hands of state attorneys general, but there are those arguing for giving consumers the right to sue. If your college-age child is wavering between journalism and privacy law, you know which way to nudge.

Check out this Brainyard article to learn more about data privacy and regulations. Suffice to say that no growth strategy should be considered fully formed without a careful look into the effects of these laws. They will change the calculus for monetization in many corners of the media and publishing business.

Technology and the Increasing Importance of Revenue Diversity

For established media companies, survival has meant revenue diversification. It’s also meant questioning everything, right down to how to create a story. The Washington Post and Reuters have tested models where bots write some basic stories, sometimes using a bit of artificial intelligence (AI), where the goal is to help the bots improve their writing over time. When it comes time to cover high school sports or small-town politics, those short 300 - 500 word, zero-day stories are pretty formulaic. It’s just a matter of time until computers get those assignments full time. The next generation of cub reporter may need to find a new way to cut their journalism teeth.

But humans aren’t out of the picture even in the presence of bots. Reuters’ Lynx Insights automation tool is designed to augment reporting by surfacing trends, facts and anomalies in data, which reporters can then use to accelerate the production of their existing stories or spot new ones. Reuters has actually experimented with fully automated stories since 2015, but the company found that those articles were too clearly written by a machine and felt strongly about the necessity of having human judgement behind each story.

The Washington Post employs its Heliograf tool(opens in new tab), which generates short stories based on structured data about topics like election results and sporting events. The Heliograf tool started out as an automated content model to cover local football games. Each story draws from scoring plays, individual player statistics and quarterly score changes, along with The Post’s own weekly Top 20 regional rankings. The stories are automatically updated each week using box-score data submitted by high school football coaching staffs. The Heliograf tool has generated thousands of stories since it was introduced two years ago, and it won a Global BIGGIES Award for Excellence in Use of Bots in 2018.

More broadly, data can help dictate how content should be channeled and thus monetized. In order for publishers to feel comfortable making these leaps into new content channels and revenue streams, they’ll need technology in place to support data collection, ensuring that consumer demands are being answered. Although current technology can track reader reception nearly instantaneously, measuring views and click paths and even user experience, analysis will continue to improve with advancements in machine learning and artificial intelligence technology built specifically for the media and publishing industry.

Forbes is developing(opens in new tab) an AI assistant for writers called Bertie. Bertie learns from writers’ style, topic choices and platform publishing preference and then generates personalized suggestions on how to optimize readership and improve quality for the intended audience. Technology like Bertie will help publishers cultivate and cater to their audiences, ultimately driving the success of content-based revenue streams and informing ad placements for more niche targeting. The data from AI will also unearth new monetization opportunities, including the ability for media companies to re-activate the earning potential of existing assets by automatically updating metadata to refresh SEO opportunities and enable more interactive experiences.

Overall, these new technologies will allow media companies to make more informed decisions when choosing which revenue streams to heavily invest in and which to lay to rest.

If You Can’t Build Diversity, Buy It

For most, diversification is less about changing up how stories are created and more about serving diverse audience desires. Mergers and acquisitions are standard fare in the media business, but devising a winning M&A strategy is a challenge whether you’re trying to build market share or acquire new key technologies.

Buying market share typically means that the number one or two player buys up the third or fourth player in hopes of eventually owning the space. But success in media is as much about technology as it is about content and audience. Companies that succeed in a given space will have created a software-based platform for sales and delivery that usually includes a customized content management system with ties to CRM software, billing and ad management tools, and in some cases cool toys like Bertie. Smart, customized technology lets companies efficiently deliver their products to subscribers and sponsors, and the value of that tech is built into the acquisition cost. If the buying company is dedicated to its own technology, it means throwing away the technology of the acquisition and migrating the acquired company’s content to existing platforms. Otherwise, it means the company will eventually own many platforms that mostly do the same thing, each incompatible and each with its own staffing needs. In businesses with tight margins — which certainly describes the business of media — either prospect is pretty grim over time.

If the goal is to diversify revenue streams, then acquiring new technology is more palatable, since efficiency of scale isn’t the primary goal. The New York Times paid(opens in new tab) more than $30 million in 2016 to buy The Wirecutter, a site that provides recommendations for electronics and other gadgets. The Wirecutter also owned The Sweethome, which provides recommendations for home appliances and other gear. Both sites make their money via affiliate links, which generate revenue when consumers click on them and make purchases via ecommerce sites like Amazon.

This is certainly a diversification play for the Old Gray Lady, and represents a small but growable revenue stream alongside the company’s $1.2B revenue. A year after the acquisition in 2017, the Times reported $26.4 million in “other” revenues, a 20.9% increase it attributed to affiliate referral revenue associated with The Wirecutter and The Sweethome. Its second, third and fourth quarter earnings saw continued growth in this area, at a clip of 12%, 17% and 12%, respectively.

The Wirecutter example is just part of the Times acquisition strategy. It’s made a dozen acquisitions and started other subordinate businesses, some hueing close the Times’ historic business model and some further afield.

The Case for Organic Growth

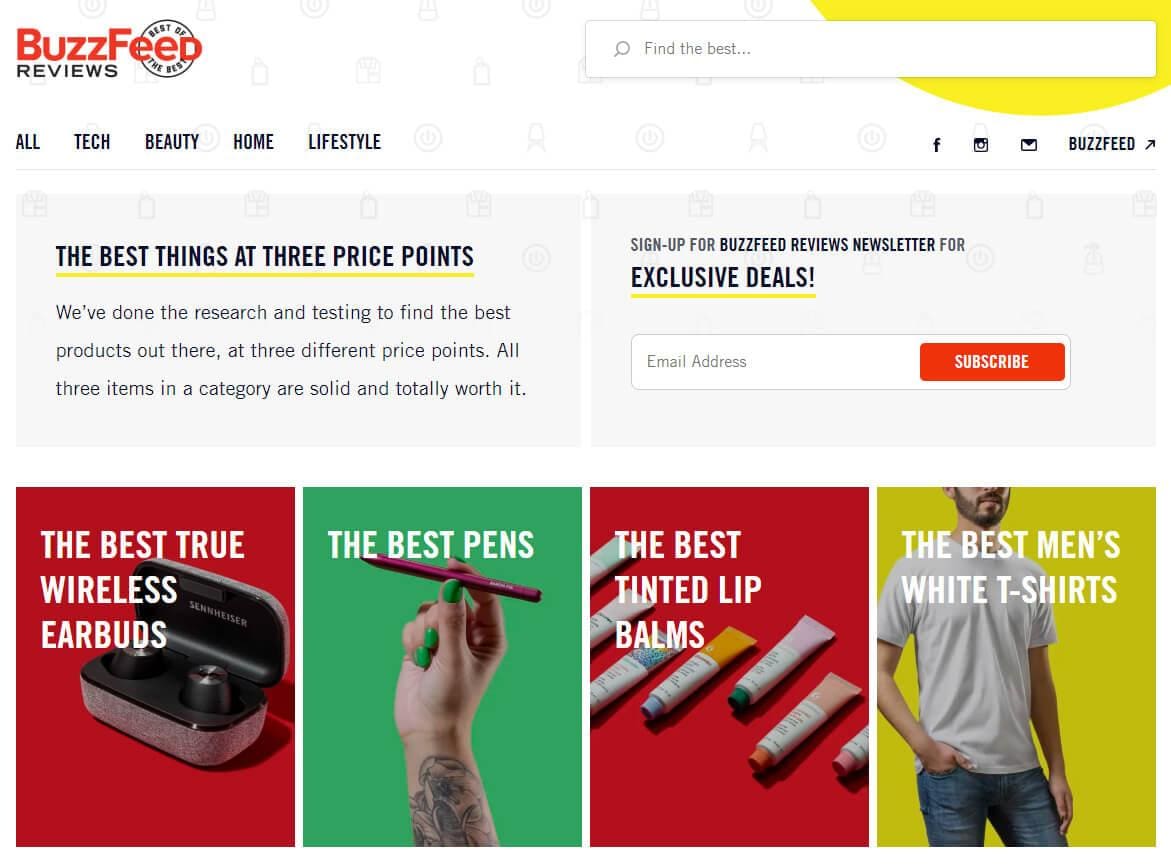

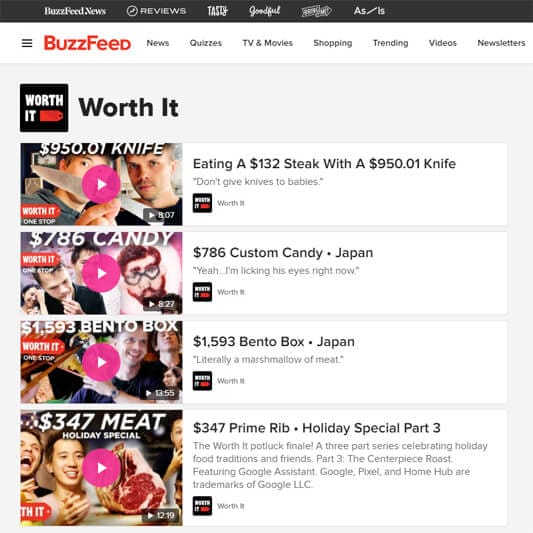

It might not get the attention from Wall Street that boards of directors crave, but there’s a lot to be said for organic growth and building on existing platforms. In the summer of 2018, Buzzfeed launched BuzzFeed Reviews, a step into the commerce world monetized through affiliate commissions(opens in new tab), programmatic advertising and content licensing. Heading down this path was predicated on the popularity and success of BuzzFeed’s video restaurant review series “Worth It”, launched in 2016. In 2018, viewers watched 1.5 billion minutes(opens in new tab) of the show on YouTube, and Worth It’s popularity has led to it being described as a Zagat guide for millennials. The video series has also created extreme upticks in patronage for some restaurants featured on the show.

Worth It’s successful business model made a more generalized review site a clear path to success for BuzzFeed, and while the reviews site and Worth It represent diversified income, they both also leverage BuzzFeed’s strong affiliation with the millennial generation. The availability of a proven platform combined with a well understood audience is a clear recipe for success. But even with these ingredients, success takes a while, and not every internal launch will be a winner. Look no further than Google to see that market share and technical prowess don’t always equate to can’t-miss offerings. Google Plus, Google Wave, Google Glass and Google Buzz are just a few of the company’s failures. Whether they were half-hearted attempts to take on other behemoths or ideas before their time, Google has the appetite, track record and the coffers to fail fast with new initiatives. Your company may need to be a little more diligent about determining the market viability of new ideas.

Margins and Discipline

It’s probably fair to say that most publishers would love to simply stick to their original business models: usually HTML stories with ad and/or subscription revenue on a highly specific subject, or serving a well-defined audience, or both. Competition and audience preferences will invariably lead to margin erosion. Diversification keeps operating profit where it needs to be. It’s unlikely that the management of New York Times was dying to get into the gadget review space, but the margins are better, and that can help support the core mission.

Newspapers are the extreme example of media businesses with unsustainable margins. So much so that billionaires are coming to the rescue, not necessarily because they can turn the business around, but because they want the mission to go on despite revenue obstacles. Jeff Bezos came to the aid of the Washington Post (and did shore up its margins) as did Paul Huntsman (his more famous brother Jon Huntsman was ambassador to China and Utah Governor among other political posts) with the Salt Lake Tribune.

The Huntsman family’s foundation bought the Tribune in 2016, hoping to rejuvenate the state’s oldest paper. It was not to be. After layoffs and other efforts to cut costs, even the deep pockets of the Huntsmans can’t sustain the business. The latest thought is to turn the Tribune into a 501 (c)(3) nonprofit(opens in new tab) and cede control to a public board. Currently the paper can’t accept tax-deductible donations because it’s a for-profit entity. The Huntsmans apparently still want to support the paper, but if it’s a charitable cause in essence, they’d like it to be charitable cause in fact.

It’s an interesting path for the nearly 150-year-old paper and one that isn’t available to most publishers. The trick is to find adjacent markets that are more profitable than the core business. If you closely analyze your business and foresee a day in the next few years when gross margins will dip below 20%, you’d better have a plan. If that analysis shows margins in the single digits in a few years and your company is publicly traded, congrats, you’re an acquisition target, and a poor one at that. Ernst and Young says that the average operating profit margin for media companies(opens in new tab) is 23%, which puts gross product margins closer to 40%. That doesn’t sound so bad, but in E&Y’s calculation are cable companies whose operating profit margins are about 40% and thus skew E&Y’s numbers up. Pure publisher operating margins run less than 20% and electronic game producers are even lower than that.

Finding the right market to move into means understanding the long-term margin potential. One obvious direction is to start up related events where gross margins are pretty amazing. In industries like finance, where you can charge both exhibitors and attendees, gross margins can top 80%. For industries where audiences won’t pay, or won’t pay much, margins above 60% are still possible. Gross margins of 60% should allow for an operating margin around 30%. Wall Street will like that a lot.

Plan & Forecast

More Accurately

Face to Face Is Good Business

Events aren’t a slam dunk. Competition for exhibitors, speakers and attendees can be intense. Even more than in traditional forms of media, the audience has to have a high affinity for content and for your sponsors. The one built-in advantage that legacy media businesses have is, presumably, a loyal audience.

How good is the event business? Here’s back-of-the-napkin analysis. For a two-day event with 30 sponsors and 300 attendees — which would be a solid first year in the B2B event space — major costs include venue and decorating, A/V, food and beverage, and marketing and other aggregate small costs. In the US, that adds up to about $120k for the two days in a tier-one city. You’ll charge each sponsor between $5,000 - $30,000; figure $10k on average. It’s our first year, so calculate only $100 per attendee. That’s $300k from sponsors and $30k from the audience. Gross profit is $210k and gross margin is 63%.

If you’re more generous with food and booze, need a marquee speaker or can’t count on the audience to pay, you might get closer to a 50% margin, but that’s still likely better than your typical media margins. If the audience is willing to pony up $500 or so, then your margins push toward 75%. Growing that total revenue into the millions will take time, but if you put on a great first event, it’s not unusual to grow at 20 - 50% a year or more when the idea is fresh.

How big is big? South by Southwest (SXSW) is a unicorn event(opens in new tab) of the first order. It’s an amalgamation of film, music, food and interactive media, and it’s the biggest revenue producing event outside of athletics. It started in 1987 with just 700 attendees, and today it brings in more than 300,000 participants spread over three distinct sub-events (film, music and convergence). The total economic effect in Austin is pushing toward a half billion dollars. The audience is a big part of this; average ticket prices are around $1,000. The me-too copycats are everywhere, and needless to say, most are challenged because of both audience and sponsor fatigue. Still, many are successful within their local markets.