Small businesses face myriad challenges that can impact their growth and sustainability, and many of these challenges have been exacerbated by the highly competitive nature of today’s business landscape of swift market shifts and economic uncertainties. For small business owners, understanding and managing financial risks requires more than just safeguarding assets; it involves defining a strategy that can create a more efficient operation and grant businesses competitive advantages that continue to reap returns far into the future.

Whether it’s deciding which credit terms to offer customers, navigating market fluctuations or ensuring compliance with ever-changing regulations, the ability to manage these and other financial risks effectively can be the difference between barely surviving the quarter and earning record profits. This article is a comprehensive guide to identifying, understanding and mitigating 21 of the most pressing financial risks facing small businesses.

What Are Financial Risks for Small Businesses?

Businesses of all types and sizes face a bevy of financial risks, as monetary losses can stem from a variety of sources, all of which impact a business’s overall health and sustainability. For small businesses, which often have tight margins and limited resources, identifying and managing these risks is essential for survival. Financial risks range from internal issues, such as cash flow challenges and credit issues, to external pressures, including market fluctuations and macroeconomic trends.

Regardless of where financial pressures stem from, small businesses need a plan to recognize and strategically handle these risks, as they can directly affect a business’s profitability, competitive advantage and how effectively the business serves its customers. Through proactive financial risk management, small businesses can safeguard their operations and position themselves to better capitalize on potential growth and expansion opportunities.

Key Takeaways

- Effective financial management is crucial for small businesses and involves meticulous planning, monitoring and evaluation of financial resources. This strategic approach helps businesses predict challenges, allocate resources efficiently and maintain a healthy cash flow.

- To minimize financial risks, businesses must adjust to changes in revenue streams, funding sources, customer behavior and market dynamics. By proactively addressing vulnerabilities, companies strengthen their financial performance, better positioning themselves to seize opportunities as they arise.

- Small business financial risks are as diverse and varied as the businesses themselves, and leaders should carefully consider the potential impact of each risk when prioritizing which to address first. This prioritization is especially important for businesses with limited resources or startups, as doing too much at once can strain resources and create cash flow problems.

Small Business Financial Risks Explained

Understanding and mitigating financial risks goes beyond playing defense; companies must take a strategic and proactive approach that fortifies the business against future uncertainties and internal financial weaknesses. By identifying and acting on these risks, business leaders can make informed decisions on a wide range of topics, including pricing, customer credit policies, vendor selection and investments. Detail-oriented risk management strategies ultimately help businesses develop robust financial management practices, minimizing the impact of potential losses and enhancing performance.

For instance, a well-managed small business that extends credit to customers will likely offer clear terms and conditions for customer payments, ensuring a steady cash flow while giving customers several payment options to choose from. Additionally, this savvy business owner can diversify their product offerings, reducing dependence on a single revenue stream and minimizing the risk of heavy losses if market demand shifts unexpectedly. Through clear financial guidelines and detailed market analysis, alongside other risk management strategies, business leaders like this can align their goals with realistic expectations and balance growth decisions with maintaining a resilient financial foundation.

21 Types of Financial Risks Faced by Small Businesses

To run a successful small business, owners and managers must carefully consider potential risks when making financial decisions. Hasty or uninformed decisions often lead to mismanaged or strained resources, cash flow issues, frustrated customers and, ultimately, revenue losses. Understanding these risks is the first step toward mitigating them effectively. Here, we explore 21 common financial risks faced by small businesses, as well as strategies to identify and overcome them.

- Underpricing products/services occurs when businesses set the prices of their products or services too low, failing to cover costs or generate a reasonable profit. New businesses — or established businesses breaking into a new market — often price low to quickly pull customers away from rivals, but this can be unsustainable in the long term, especially during periods of rising costs. Small businesses should regularly review their prices alongside costs, demand and competitor pricing to set prices that reflect the true value delivered to customers.

- Accounts receivable mismanagement can lead to cash flow problems, directly affecting a business’s ability to meet its current and future financial obligations. When a business isn’t efficiently collecting payments, there’s a lag between paying expenses — such as vendor bills, utilities and wages — and recouping those costs through customer sales. Small businesses can monitor their average collection period and compare it with cash on hand to ensure that they have the funds necessary to satisfy their obligations while they wait for customers to pay. To enhance accounts receivable, businesses should establish clear credit policies, run new client credit checks, incentivize early payments through rewards or discounts and implement follow-up procedures for late payments.

- Unnecessary loans for small businesses typically involve borrowing funds without a clear, profitable purpose, leading to excessive debt and financial strain. Small business owners are often drawn to the immediate availability of funds, especially for new businesses or those experiencing a slow season. However, not all loans are created equal, and businesses must carefully consider the loan amount, the repayment terms, future return expectations and how the loan will be used. But with thorough financial planning, often through a detailed exploration of alternative funding options, small businesses can manage their cash flow without overburdening themselves with debt.

- Reliance on limited funding sources exposes businesses to significant risk if those sources dry up. According to the April 2023 10,000 Small Business Voices survey by Goldman Sachs, “77% of small business owners are concerned about their access to capital.” By diversifying funding sources through various options, including loans, equity financing, crowdfunding, grants and credit lines, small businesses can ensure that they’re not overly dependent on a single source, increasing timely access to funds when needs arise. However, it’s important to also consider the benefits of repeatedly relying on trusted funding sources, as long-term relationships and proven track records can lead to better lending terms and repayment options.

- Premature hiring occurs when candidates aren’t fully vetted or are rushed into a position that they’re ill-suited for. To maximize productivity, businesses should carefully choose their hires for each position and ensure that they’re properly using employees’ talents and skills. For example, a grocery store may be desperate to fill a cashier position and rush to hire someone without checking their references or conducting follow-up interviews, leading to a risky and potentially unqualified hire in a customer-facing position. On the other hand, additional interviews may reveal skills better used in another, harder-to-fill position, such as restaurant experience translating to a job at the deli counter. By conducting full assessments of every hire, businesses can better allocate their labor and plan more detailed and personalized training for incoming staff.

- Impulsive staff expansion can result in unsustainable payroll expenses and a cash crunch if businesses expand their team faster than they increase their revenue. To prevent this, businesses should closely monitor revenue growth, often through financial software with forecasting capabilities, and ensure that current figures and future projections align with hiring plans. Businesses can help mitigate premature hiring risks by outsourcing noncore roles to contractors or hiring part-time workers with the option to move to full-time employment as the company expands and revenue grows.

- Dependence on a single revenue source exposes small businesses to significant financial vulnerability if that source is slow to pay or ceases entirely. Small business leaders can list and analyze their revenue streams relative to their total income and develop diversification strategies accordingly, ensuring that no single source accounts for an overwhelming majority of revenue. These strategies include expanding product lines, exploring new markets and developing additional services, with the goal of creating multiple reliable revenue streams and reducing the impact if one source underperforms or fails. This is especially important for businesses that offer credit terms, as slow-paying customers can leave businesses in a cash crunch if they make up a large portion of revenue.

- Ignoring liquidity risks can leave a business — even one successful on paper — without enough cash on hand to meet short-term obligations. If a business earned record sales this quarter, for example, but customers don’t have to pay their bills for six months, the business must find other ways to pay its expenses in the meantime, including ordering new materials and paying workers to produce the goods that will make up next quarter’s sales. Businesses can assess their liquidity risks by maintaining an accurate cash flow statement, a key financial document. To mitigate these risks, businesses can use safety net strategies, such as creating emergency cash reserves, enhancing accounts payable and receivable (as described above) and opening a line of credit from a financial institution.

- Inappropriate investor selection can lead to misaligned business goals, unexpected pressure to deliver short-term gains and loss of operational control. Small businesses should thoroughly vet potential investors to fully understand their investment philosophy, track record and what they expect to gain in return for their investment. To minimize risk, a company should seek out investors that can provide the resources it needs, while also sharing its vision and respecting the company’s goals. Additionally, the right investor may offer valuable industry connections or expertise, which, for many small businesses, may be even more valuable than cash.

- Noncompliance with legal frameworks is a risk that varies from industry to industry, one that encompasses all relevant laws and regulations regarding how a business conducts its operations. For example, a healthcare provider must follow specific privacy rules when handling documents, while a construction company must abide by local building codes. Failure to comply with these rules can result in reputational damage, fines and legal disputes or consequences. If they don’t have their own internal legal experts, small businesses often bring in outside auditors to assess compliance and inform them of any recent and relevant regulatory changes. By regularly monitoring compliance and making necessary adjustments, businesses can create a continuously improving culture of compliance, ensuring that the company meets every relevant standard as it expands.

- Credit risk management is a critical strategy for small businesses that extend credit terms to their customers. Before offering any terms, businesses must assess the default risk for all customers or clients by conducting credit checks and continuously monitoring their creditworthiness over time. Credit risk management should be an ongoing strategy, as even established customers can fall behind on payments and create a cash flow problem for companies, warranting an update to credit policies. For example, if a business typically offers a 60-day payment period but is struggling to pay its bills, it may want to shorten the terms to 45 or 30 days. However, when making these changes, businesses must be transparent and clear with customers to avoid creating confusion and/or pushing customers away.

- Market risk exposure includes all potential losses a small business might face due to changing market conditions, such as demand fluctuations, pricing pressures or economic downturns. Because these conditions are generally outside of their control, small businesses must diligently monitor industry trends and economic indicators, such as inflation and supply chain delays, and adjust their strategies as needed. By maintaining flexibility in their operations and pricing strategies, businesses can quickly adapt as these indicators change, safeguarding their bottom line against potential losses. For example, many restaurants sell some dishes at “market price” rather than a set figure that can lead to losses if prices rapidly increase.

- Interest rate fluctuations can significantly impact small businesses, especially those that rely on loans for capital. When interest rates rise, the overall cost of borrowing increases, impacting loan repayment terms and the potential resource strain until the loan is paid off. According to the Federal Reserve’s 2024 Report on Employer Firms, 54% of surveyed businesses said that higher interest rates have led to increased costs/payments on debt. Businesses should regularly review their financial obligations and the current economic landscape when deciding if and when to take out loans. During low-interest periods, for example, businesses can more affordably borrow funds to fuel growth initiatives, often through fixed-rate loans. Businesses can also reduce risk by maintaining a strong credit rating to increase the likelihood of favorable terms when borrowing.

- Operational inefficiencies lead to increased costs and reduced productivity, hurting the overall profitability of a business’s operations. Through regular operational and workflow audits, businesses can identify workflows that can be streamlined to create a more efficient operation. For instance, a manufacturer may have unnecessary downtime caused by an inefficient floor plan when moving goods between production steps. By reorganizing the factory floor, managers can reduce these delays, increasing overall productivity and output without increasing costs. Additionally, businesses can implement new technology, such as automation, and train staff to effectively leverage these tools to enhance their work, ultimately increasing the bottom line for the entire operation.

- Tax compliance and liability is a financial risk that requires leaders and financial teams to follow every relevant law and regulation, including sales, payroll and income taxes, as well as industry-specific tax obligations. If businesses fail to meet these obligations, they may face penalties, including fines and legal consequences. Therefore, companies must maintain rigorous and detailed financial records and stay on top of any changes to tax law, often with the help of accounting software or expert accountants and consultants.

- Expansion risks include all the hurdles and uncertainties that small businesses face when growing, such as misjudging new markets or overextending limited resources. Before expanding, businesses should conduct careful market research and financial forecasts to develop a detailed plan with realistic goals and financial commitments. Additionally, businesses with limited resources can gradually scale operations and leverage strategic partnerships to minimize potential loss and spread out responsibilities, ensuring that the company doesn’t overextend its finances or workforce too quickly.

- Intellectual property risks occur when someone uses creative assets or proprietary information without permission. These risks go both ways, as businesses must protect their own intellectual property without infringing upon anyone else’s. Small businesses can conduct regular audits of their intellectual property to identify any unauthorized assets, including logos, images and brand names. On the other hand, businesses should also monitor the market for any unauthorized use of their own property and take legal action when necessary. To fully protect their assets, companies should be sure to secure all appropriate intellectual property rights, such as patents, trademarks and copyrights, and implement access controls while educating employees about what is and isn’t protected.

- Ownership disputes can arise from unclear agreements or misunderstandings regarding the rights and responsibilities of business partners or stakeholders. These disputes can lead to costly legal battles and disrupt operations when strategies are contradictory or employees don’t know which instructions to follow. Small businesses can avoid these disputes by carefully crafting partnership and shareholder agreements and reviewing them openly with all parties, often with the aid of legal counsel. Each party should explicitly acknowledge the terms of the agreement to guarantee that everyone is on the same page and understands the specific rights and responsibilities of all involved. And after contracts are signed, all parties should keep copies accessible for regular review if any conflicts or disagreements arise.

- Employee misclassification penalties can lead to legal consequences and costly back payments, including wages, overtime and benefits. Small businesses should regularly review their workforce management practices and employee lists to ensure that they comply with up-to-date labor laws. Additionally, when bringing on new hires or promoting workers, businesses should be careful to classify workers correctly from the start, based on the nature of their work and relationship with the business. This distinction includes categories such as part-time vs. full-time, salaried vs. hourly and employee vs. contractor.

- Cybersecurity threats, such as data breaches, hacking and other cyberattacks, compromise sensitive business information and bring a business’s operations to a halt. Businesses should regularly update their security protocols to adapt to evolving threats, as well as create backups and contingency plans for when incidents occur. But many small businesses lack the resources to maintain a fully staffed team of IT, networking and cybersecurity experts, relying instead on external service providers to assess their vulnerability, monitor their networks for unusual activity and quickly respond to any threats or security gaps. Many of these third-party experts also offer cybersecurity training for employees, as well as cloud storage and regular security updates, to keep their customers’ data safe.

- Neglecting digital profile management leads to outdated or incorrect online information, potentially causing customer confusion, reduced sales and reputational harm. For example, if a customer searches for a business and finds incorrect operating hours, they may waste time traveling to a closed store and decide to shop elsewhere, rather than wait until the shop is open again. This same scenario can apply to online information about store locations, in-stock products and store layouts. To manage this risk effectively, businesses can actively manage their online presence by assigning responsibilities for updating digital profiles, rather than treating the task as an afterthought. Additionally, regular assessments of online content, especially feedback and reviews, can help businesses see themselves from their customers’ perspectives and inform improvements to increase brand value and attract more customers.

How to Minimize Small Business Financial Risks

For small businesses, the path to success is filled with risks, and few issues are more pressing and far-reaching than financial management. The key to a smooth journey lies in minimizing these dangers before they become insurmountable. The following proactive risk management strategies can help companies safeguard their assets while better positioning themselves for growth and success.

-

Implement Strategic Financial Management

Strategic financial management, which involves the meticulous planning, monitoring and evaluation of financial resources, can go a long way toward helping small businesses predict potential financial challenges and opportunities by ensuring that resources are proactively allocated before these challenges significantly impact customer satisfaction or financial health. A strategic approach allows companies to maintain a healthy cash flow, invest wisely and avoid unnecessary debt, empowering them to have a stronger and more sustainable financial base as they grow.

-

Diversify Revenue and Optimize Funding

By diversifying their revenue and funding streams, small businesses can reduce their vulnerability to market fluctuations and limit the impact if one source runs dry. Diversifying revenue often involves expanding into new markets, developing new products or services or exploring alternative business models, each opening up new opportunities while minimizing the overall revenue percentage each source comprises. Additionally, to optimize funding sources, many companies combine traditional loans with other funding models, such as grants, crowdfunding or investors. These funding sources can provide cash injections as needed, ensuring that the business has access to capital even if one source runs low on funds.

-

Streamline Operations and Enhance Security

Operational inefficiencies, even small ones, can compound financial losses and become a significant financial risk. By analyzing workflows and improving these inefficiencies, often through automation, businesses can streamline processes and eliminate redundancies, significantly reducing operational costs and improving profitability. This detail-oriented process analysis can also help improve the digital realm, where security gaps can lead to significant financial losses from data breaches and cyberattacks. By investing in cybersecurity and data protection, businesses can close those gaps and better protect their financial well-being.

-

Ensure Compliance and Legal Protection

Compliance with legal and regulatory requirements is non-negotiable for businesses that want to avoid costly fines or other legal penalties. Staying on top of ever-changing rules can be especially difficult for small businesses, as they typically can’t dedicate a whole team of employees to constantly monitor evolving regulations and compliance. However, many businesses implement software, such as an enterprise resource planning (ERP) solution, to record data from throughout the organization and generate reports that track and prove compliance when necessary. Furthermore, businesses may also take out insurance against liability or other compliance risks, often under the guidance of legal advice from experts in their industry.

-

Adapt to Market Changes and Plan Proactively

Many of yesterday’s trends have been replaced with modern techniques — think catalogs turning into marketing emails. To keep up with this evolution, business leaders must keep one eye on today’s problems and the other focused on tomorrow’s. Customer buying habits can change rapidly, especially in the highly competitive ecommerce market, and businesses must monitor trends to anticipate and quickly respond to changes. Through proactive strategies, including scenario modeling and contingency planning, businesses can prepare for market volatility and seize revenue opportunities without exposing themselves to additional financial risk.

-

Hire Prudently and Manage Human Resources Effectively

For many small businesses, labor costs are their greatest expense. Prudent and careful hiring is critical for these companies, as too many employees will drain resources and too few can lead to dissatisfied customers and overworked and burnt-out staff. But through careful training, clear guidelines and effective human resource (HR) management, businesses can enhance productivity and reduce turnover, ultimately creating a more reliable and profitable workforce. If a business can’t handle HR effectively in-house, it can opt to outsource its HR needs to a specialized firm.

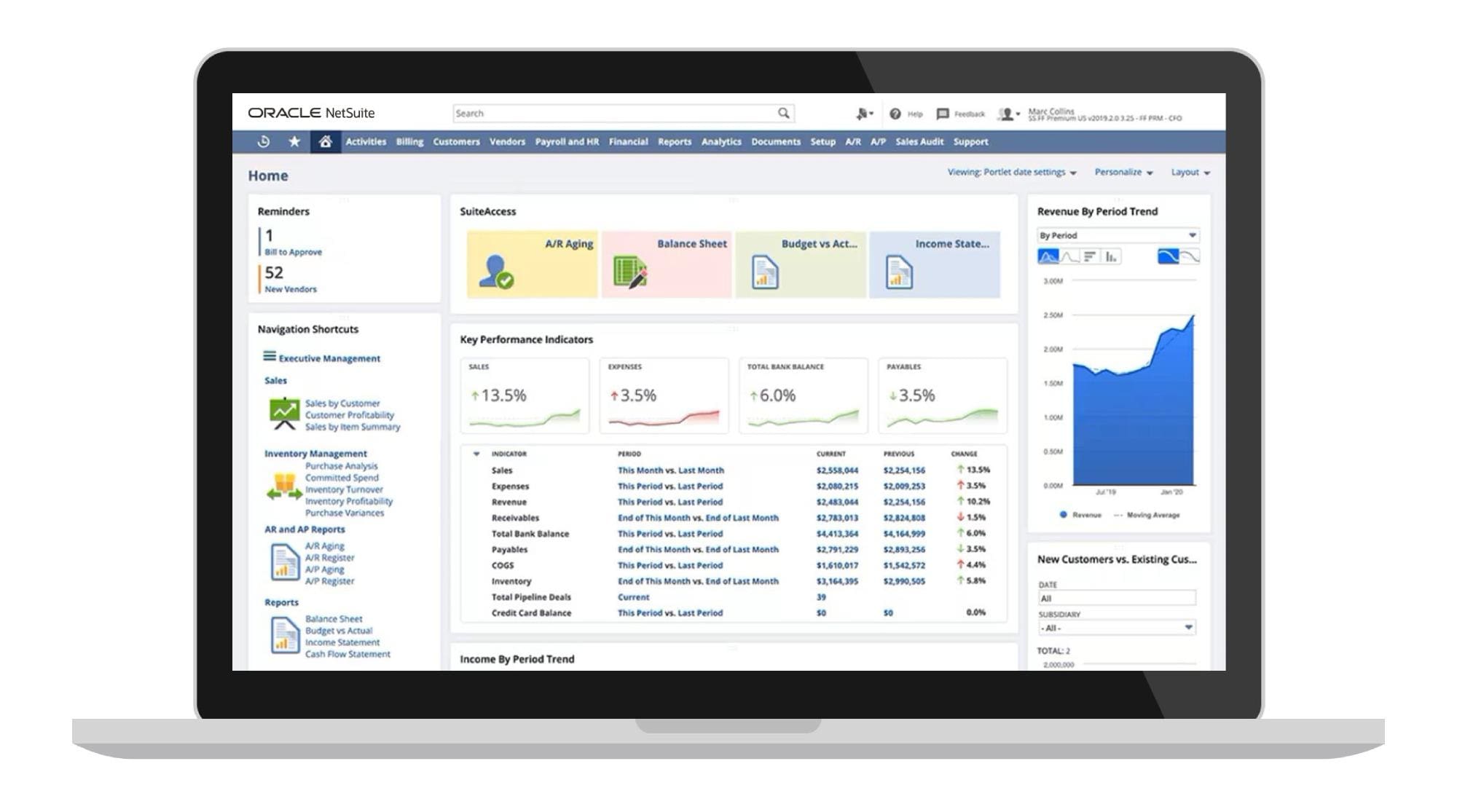

NetSuite: Financial Management for Small Businesses and Beyond

Minimizing financial risk requires lots of financial data — often more data than a small business can collect and analyze quickly enough to solve the problems it faces. NetSuite financial management is a comprehensive solution for small businesses looking to mitigate and manage their financial risks effectively. With built-in real-time financial reporting, automated finance processes and detailed performance insights, NetSuite empowers small business owners to close their financial periods with confidence, while maintaining compliance with accounting standards and customizable rules.

Businesses can leverage NetSuite’s dashboards to drill down into underlying transaction details, enhancing reporting accuracy and helping businesses proactively identify financial risks. Moreover, by integrating operational data with financial information, NetSuite’s cloud-based platform gives leaders a holistic view of the business whenever and wherever they need it, facilitating informed decision-making and strategic financial planning. And with NetSuite’s advanced forecasting and budgeting tools, businesses can better prepare themselves for almost any eventuality.

Managing financial risk is a crucial part of building a sustainable small business. By understanding and addressing the diverse risks facing these companies — from internal factors, such as pricing and credit decisions, to external pressures, such as changing regulations and interest rates — business leaders can build a stronger financial foundation for their operations. And through proactive strategic financial management practices, including vigilant oversight of operational and market dynamics, businesses can gain the upper hand over competitors as conditions change, better positioning themselves for successful growth and long-term profitability.

Small Business Financial Risk FAQs

How do you identify financial risk?

Businesses can identify financial risks by analyzing financial statements, as well as assessing external market conditions and monitoring changes in regulatory landscapes. Regular audits, by both internal and external financial experts and often aided by risk assessment tools and software, can also help pinpoint areas where a business is especially vulnerable.

What is financial risk most associated with?

Financial risk is most commonly associated with the potential loss of capital and the inability to meet financial obligations. This includes risks related to creditworthiness, market fluctuations, liquidity issues, operational failures and regulatory noncompliance, all of which could lead to financial losses.

What is an example of a financial risk in a business?

An example of financial risk in a business is credit risk, where a company faces potential losses from a customer’s failure to meet payment obligations as agreed. This delay in payment can lead to cash flow issues and increased collection costs. Businesses can mitigate this risk by running credit checks, creating incentive programs for early payment and reducing the length of credit terms.

What are five types of financial risk?

Five types of financial risk are:

- Credit risk: Risk of loss from a borrower’s or business’s failure to make timely payments or meet contractual obligations.

- Market risk: Risk of loss from fluctuations in market prices, rates and demand trends.

- Liquidity risk: Risk that a company won’t have enough cash on hand to meet its short-term financial obligations.

- Operational risk: Risk of loss resulting from inadequate, inefficient or failed internal processes, staff or systems.

- Legal risk: Risk of loss due to noncompliance penalties, legal proceedings or adverse judgments.

What are the top three financial risks?

The severity of each financial risk varies with industry, type and size of business, current market conditions and individual properties of the business itself. Generally, small businesses are likely to experience losses from credit risks, market risks and liquidity risks, but they should consider their specific business conditions and features when prioritizing financial risk management.