In short:

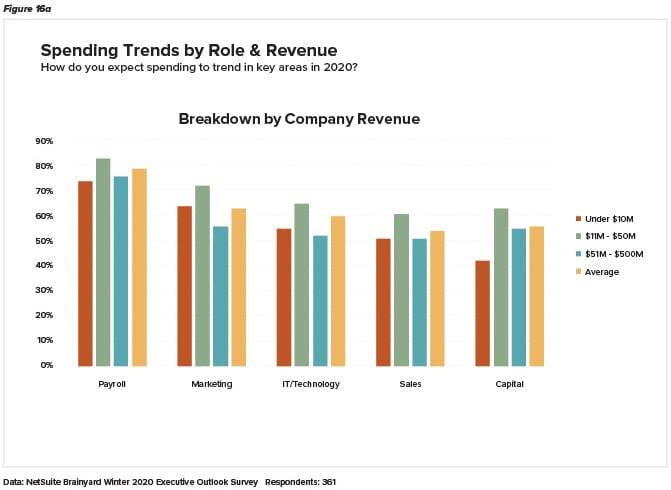

- Our new survey shows finance leaders expect to spend more on marketing, IT and sales, but payroll leads, with 80% planning an uptick

- 63% of non-finance execs expect higher capital outlays in 2020 versus just 51% of finance respondents

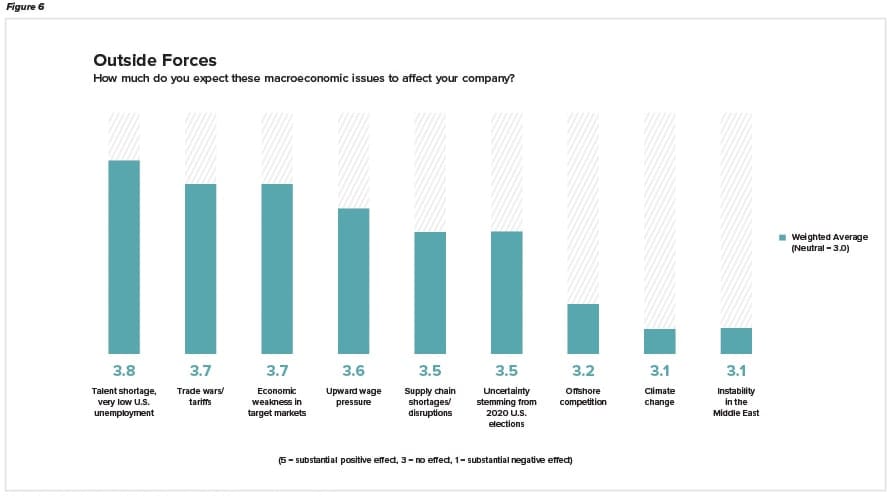

- What everyone agrees on: Trade wars and tariffs, a talent shortage and upward wage pressure are top worries for 2020

We had 361 executives complete our Brainyard Winter 2020 Outlook Survey. Of these leaders, 188 hold finance titles, while 173 are in non-finance roles. We expected to see some differences of opinion — and we did. We also looked at responses by company size and found even bigger variations.

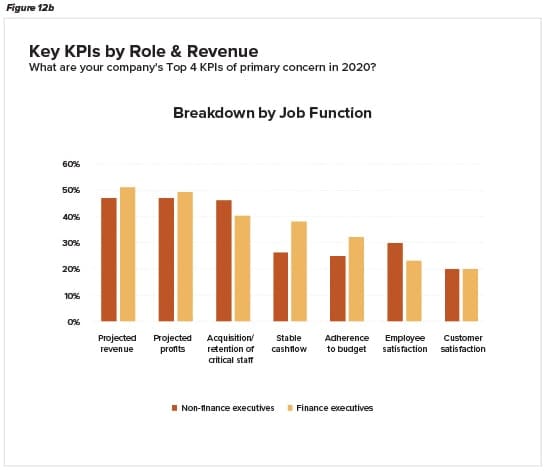

You can download the full report, including analysis and 28 charts with full results, below. The big takeaway on finance vs. non-finance execs is that the former worry a good bit more about stable cash flow, adhering to budgets and realizing projected revenue. Non-finance execs tend to be more concerned about hiring and retaining staff, improving the customer experience and employee satisfaction.

They are also much more likely to expect more capital expenditures in 2020.

In our last survey, which explored the evolving role of the CFO, we found that the job boils down to one top-line objective: managing to reality. That may not show up on anyone’s resume, or in fact be on the list of top things they want to do at work. No one likes puncturing high-flying marketing or capital infrastructure thought balloons. But the areas where our respondent camps diverge illustrate that, whether they like it or not, finance pros need to keep their colleagues tethered to reality.

Download the Report

Get the Brainyard’s complete Winter 2020 Outlook survey. Find out what 361 finance and non-finance business executives have to say about their priorities for the coming year.

Download Now

That grounded attitude showed up in responses to our open-ended question: “What keeps you awake at night? What makes you optimistic?”

Finance respondents weren’t hard to spot.

“Getting buy-in from non-finance departments to stick to their budgets and even come under where possible, rather than ‘spend to what you’re allotted,’” said one.

From another: “Stabilizing cash flow, implementation of new MIS and accounting systems. Once in place, we can make data-driven decisions for our organization that will result in improved management and strategic focus.”

Financial data driving strategy, or tail wagging dog?

Non-finance respondents, meanwhile, are much more about customers and sales: “Will companies continue to purchase our products, and what new products should we be focusing on to maintain our leadership in the market?” was a typical response.

“What keeps me up at night about 2020 is, will we execute our sales strategy successfully in a way that will make us grow fast enough to slow our cash burn,” wrote another.

What’s Happening in the CFO Suite?

We asked all respondents to rate six finance-department priorities. For three of our options — using data more effectively, identifying areas for savings and implementing or optimizing back-office automation — both groups were largely in agreement.

The three places we saw separation between finance pros and their colleagues:

- Producing better reporting on KPIs is a top priority for CFOs, less so for business execs;

- Improving data collection is a top job for non-finance execs but the lowest of six priorities for finance teams; and

- Identifying areas for new investment is a key area in which non-finance respondents want to spend, in line with their willingness to deploy capital.

There are also some stark differences among companies based on revenue. Respondents with less than $10 million in earnings are much less likely to plan capital projects versus those with $11 million to $50 million in revenue — 42% versus 63%. In fact, respondents in that earnings range have a gung-ho attitude and lead the pack in all areas of planned spending increases; see figure, below.

Those in the $51 million to $500 million band are off-the-charts more likely to plan to acquire one or more companies in 2020, with about half (47%) saying they’re in the market.

But where are the sellers? Just 11%, on average across revenue bands, expect to spin out a division. However, 22% on average say they’re looking/preparing to be acquired, with that number rising to 28% among respondents with less than $10 million in earnings.

A minority, 17%, are seeking private equity or venture funding despite an estimated half-trillion dollars in cash sitting on the sidelines.

There are some universal woes that both finance and business leaders, from all size companies, can commiserate over. At the top of that list are tariffs and political uncertainty.

“We can only raise prices so much, so the tariffs are negatively impacting our profit margins,” said one respondent. That company is coping by expanding sales efforts and launching new products.

“Our products from China continue to have 10% to 15% increases every few months — worried this will drive our customers away as we have to pass the cost on to them,” said another, adding that there are few alternative sources for these products as most are not made in the USA.

“We are a domestic transportation provider for international imports, so my worry will remain tariffs, tariffs, tariffs,” wrote another.