Disruptions in distributed supply chains have made news in recent years because they have prevented customers from getting the products they want, when they want them, hurting companies’ finances and damaging their reputations. One way companies can exert more control over their supply chains is through vertical integration, whereby they take ownership of more steps in the manufacture and sale of their products and services.

In theory, vertical integration helps a company secure more aspects of the supply, production, and distribution functions, and, ultimately, the sale of its goods and services, improving efficiencies and reducing costs along the way. While some companies achieve significant competitive advantage through vertical integration, the approach requires sizable capital investments and can even limit the flexibility that comes from partnering with a federation of suppliers. Companies must consider the business case for vertical integration—the costs, benefits, and challenges—very carefully.

What Is Vertical Integration?

Vertical integration is when a company takes control of multiple supply chain stages, from raw material procurement to customer sales and delivery. By replacing external suppliers, manufacturers, distributors, or retailers with in-house operations, businesses gain more control over their products and the processes that create them.

For example, a clothing manufacturer might acquire its fabric suppliers to reduce costs and improve inventory management or open a retail store to sell directly to customers—or both. Vertical integrations like these often require significant capital investment, the ability to manage increased organizational complexity, and additional regulatory scrutiny. But, in the right circumstances, it can deliver long-term benefits, including reduced costs, tighter quality control, and greater supply chain visibility, especially during disruptions and shortages.

Key Takeaways

- Vertical integration involves a company taking ownership of two or more steps in its supply chain.

- The process is often categorized directionally: Companies can integrate upstream processes (backward integration), downstream stages (forward integration), or both (balanced integration).

- As vertical integration expands a company’s market footprint, it usually requires hefty up-front investment and can be operationally challenging.

- When done well, benefits include lower costs, greater control, improved visibility, and more.

- Weighing the pros, cons, costs, and return on investment for a vertical integration initiative requires access to high-quality supply chain data and analytics.

Vertical Integration Explained

To illustrate how vertical integration might proceed, consider the steps in a supply chain. Typically, the process begins with the purchase of raw materials, then proceeds through various stages of production. The result is a finished product, which then gets distributed and ultimately sold to the end customer. A nonvertically integrated company might implement just one piece in that chain of processes. If the company wants to vertically integrate, it must expand its operations to include steps before and/or after the step it already performs. The company may choose to acquire one or more of its suppliers in hopes of reducing manufacturing costs or gaining more control over production. Or it might invest in the retail end of the process, opening physical stores or introducing ecommerce capabilities to get closer to the customer and increase profit margins. It might invest in warehouses and vehicle fleets to take more control over distribution and logistics.

When a company decides to vertically integrate, it always faces a build-or-buy decision. The company may choose to build some part of the production, distribution or retail sales process from scratch, re-creating one or more aspects of the supply chain that it had previously outsourced. Alternatively, they may buy their way into vertical integration, acquiring or merging with suppliers, manufacturers, distributors, or retailers.

Whether they build or buy, vertical integration is a big investment. Companies must devote significant up-front capital, whether they are establishing their own capabilities or attaining them through mergers and acquisitions. They have to build or purchase physical facilities, hire additional employees and management, and invest in new business processes and technologies—all of which increases the size and complexity of the overall organization.

Vertical Integration vs. Horizontal Integration

Vertical and horizontal integration both deal with business expansion through acquisition or internal development but in different ways. Horizontal integration involves acquiring competitors or similar businesses within a company’s existing market to reach new customers but without expanding core competencies. Examples of horizontal integration include a grocery chain buying a rival store or an electronics company merging with another firm. Vertical integration involves moving beyond a company’s current focus to take control of different stages in the supply chain. Using the grocery chain example, the acquiring company can acquire its produce suppliers. Similarly, the electronics manufacturer can open its own distribution center.

Horizontal integration typically aims to increase market power, leverage economies of scale, and eliminate direct competitors. In contrast, vertical integration focuses on controlling the supply chain to reduce dependency on partners, improve profit margins, and increase visibility. Both strategies require investment and planning, but vertical integration often presents greater operational complexity, requiring businesses to oversee different types of processes rather than simply expanding their core expertise.

Why Do Companies Vertically Integrate?

Companies pursue vertical integration for many reasons, from securing supplies during shortages to capturing higher margins across the value chain. What and when companies integrate often stem from specific business pressures and opportunities, typically focused on these four primary drivers:

- To reduce costs: Eliminating supplier markups and distributor fees lowers overall production and delivery costs. When a manufacturer brings component production in-house, for example, it captures the profits that previously went to suppliers and reduces the indirect costs associated with negotiating contracts and managing external relationships.

- To better manage inputs: Direct material control helps companies maintain quality standards and have reliable access to critical supplies. This is especially valuable during supply chain disruptions and material shortages, as companies with integrated operations can prioritize their own needs over external customers and adjust production schedules without negotiating with third parties.

- To increase efficiency: Vertical integration eliminates delays between partners to more tightly align procurement, production schedules, inventory, and deliveries. A fully integrated company can adjust its entire supply chain to balance inventory holding costs with lead times, strengthening the bottom line without hurting customer satisfaction.

- To improve customer experience: Integrating downstream processes brings companies closer to end customers through more direct sales channels, tighter price controls, and hands-on customer service. These direct feedback channels give businesses detailed customer insights and eliminate intermediaries that might misrepresent products or lack the expertise needed to provide high-quality service.

Types of Vertical Integration

There are several types of vertical integration. A company may expand further “upstream” in the supply chain (backward integration), further “downstream” (forward integration), or move in both directions (balanced integration). Disintermediation can refer to the process when a company eliminates steps in the journey from raw materials through production to the customer. However, that term is usually reserved for when companies try to take over a step between themselves and the final customer.

Backward Integration

Backward integration happens when a company moves a process in-house so as to take control of earlier, or upstream, steps in the supply chain process. Fast-food restaurant McDonald’s is a good example of backward integration, having taken ownership of certain processes all the way back to the agricultural production that supplies ingredients for its eateries.

Forward Integration

By contrast, forward integration is when a company takes ownership of processes further along, or downstream, in the supply chain, perhaps by taking control of distribution or sales of finished goods and services. Nike, for example, took a forward integration approach in establishing its own retail stores. The Walt Disney Company’s launch of the Disney+ streaming service, which allows it to deliver its entertainment library directly to consumers, is another example.

Balanced Integration

When a company vertically integrates processes both upstream and downstream, it’s pursuing balanced integration. Naturally, this can occur only when a company sits somewhere in the middle of a supply chain (rather than at one end or the other). Balanced integration can be trickier to pull off but can also offer greater benefits when executed well. Apple, for example, extended itself both forward in the supply chain with the opening of its retail stores and backward, when it designed its own semiconductors.

Disintermediation

Disintermediation refers to the process of removing intermediaries—aka “middlemen”—from a company’s supply chain, usually to get closer to the customer but always to reduce costs and increase efficiency. Computer manufacturer Dell and electric-auto maker Tesla are examples. Both opted to exclusively sell their products direct to consumers rather than rely on distributors, dealerships, and retailers. Tesla also offers an example of balanced integration, as it operates its own plants and designs its own batteries and charging stations, in addition to its direct sales approach.

Benefits and Drawbacks of Vertical Integration

Vertical integration can help a company reduce costs, improve efficiency, and have more control over its supply chain, particularly when they have inherent capabilities to address issues such as existing supply or demand risk. However, when executed poorly or without a clear rationale, vertical integration can be a costly mistake. Vertical integration often involves trade-offs, requiring companies to carefully evaluate the advantages and disadvantages relative to their specific circumstances.

Benefits

The most notable potential benefits of vertical integration include:

- Greater economies of scale, as an organization’s fixed-cost base is spread across a larger range of operations.

- The migration of some fixed, external costs (e.g., logistics) to variable costs, over which the organization has greater control.

- Fewer supply chain disruptions, or at least more visibility, which gives the company an earlier warning when a possible disruption is coming.

- Lower lead time.

- Faster time to market because with more control over the supply chain, the company can prioritize new-product activities when it is advantageous to do so.

Thinking further, cases of forward integration could lead to improved customer or market insight; combined with greater control over supply chain inputs and processes, it can also lead to higher quality products and services. Taking ownership of more steps in a supply chain may even help a company deal with inflation. Together, all these benefits add up to an organization that is better able to synchronize supply and demand and capture more of the available profit margin in a given market.

Drawbacks

A successful vertical integration also means a company must manage multiple challenges, any one or combination of which could derail those benefits and leave the organization worse off. Vertical integration is not a quick fix—it’s a long-term strategy that requires significant up-front capital expenditures that may take a relatively long time before its returns are realized. Thus, the entire process requires a long-term commitment at all levels of the organization, especially the C-suite. By definition, vertical integration increases organizational complexity—it means a company must add to its existing operations, and, if it is to realize the potential benefits, it must thoughtfully integrate those operations with existing processes and systems. In some ways, it can decrease an organization’s flexibility relative to partnering because of the sunk investment in infrastructure. It can also decrease an organization’s focus on its original core competencies. And, in extreme cases, a company that is very successful at vertical integration can catch the eyes of antitrust regulators.

Degrees of Vertical Integration

Companies that pursue vertical integration should understand the risks and rewards of the strategy. They should also consider the degree to which vertical integration makes sense for the organization. Companies do not necessarily have to go “all in” with a vertical integration approach to achieve some significant benefits. Varying degrees of integration can be explored, from full integration to none at all.

Full Vertical Integration

For any given organization, full vertical integration can mean one of two things. Most often, it refers to an organization that seeks to acquire or build all the assets, resources, capabilities, and skills necessary to take over one entire step in its supply chain, either upstream or downstream. But it can also refer to an organization that takes full control over all the steps in its supply chain, from the raw materials to the customer’s doorstep.

Quasi Vertical Integration

Companies can employ a wide variety of strategies that stop short of total integration to secure some of the benefits of vertical integration via a more contained—and, therefore, less risky—investment. Often, this means acquiring a minority interest in one or more upstream or downstream companies. It could also involve joint ventures, strategic alliances, asset acquisitions, technology licenses, and franchising opportunities, all of which entail lower up-front costs and can offer greater flexibility than fully integrating a supply chain process.

Long-Term Contracts

Companies can exert more control upstream or downstream by signing long-term contracts with a partner, potentially increasing predictability and/or decreasing costs.

Spot Contracts

In contrast to long-term contracts, which offer some consistency and predictability, trading in the so-called spot market occurs when companies purchase supplies as needed for the next step in the production process. Sitting at the opposite end of the spectrum from full vertical integration, these are one-off transactions for satisfying immediate needs.

Vertical Integration Examples

Carnegie Steel was one of the first and most significant examples of balanced, full vertical integration. By the 1890s, the industrial giant had acquired all sources of supply, as well as logistics and shipping. The company wielded significant market power, owning and operating iron ore and coal mines, steel mills, coal processing plants, and even the ships and railroads that moved everything throughout the supply chain.

Historically, the telecommunications industry has been tightly integrated, initially to unlock end-to-end control of the complex infrastructure required to deliver telephone services. Throughout the 20th century, most telephone companies made their own telephones, telephone cables, and other supplies; they also sold and delivered their services directly to customers.

The oil and gas industry has been marked by extreme vertical integration (and, sometimes, disintegration). Exxon Mobil, for example, has integrated each stage of the industry value chain within its business units. Its upstream division owns and manages global production assets and processes. Its downstream division includes refineries and retail outlets. And its chemical division produces synthetic petrochemical products. Similarly, BP has an upstream segment responsible for oil and gas exploration, development, and production, as well as a downstream segment that includes a logistics and retail network to ship and sell its fuels, lubricants, and petrochemicals.

The merger of Live Nation and Ticketmaster in 2010 offers another case study in balanced vertical integration. For Ticketmaster, which sells tickets to events, the transaction represented forward integration, while for Live Nation (which produces events), it was a backward integration strategy.

SpaceX offers a more recent example of vertical integration. In contrast to competitor United Space Alliance (a joint venture between aerospace companies Boeing and Lockheed Martin), SpaceX manufactures most components in-house, which lowers its costs per launch.

Is It Time to Integrate? Your NetSuite Data Can Tell You

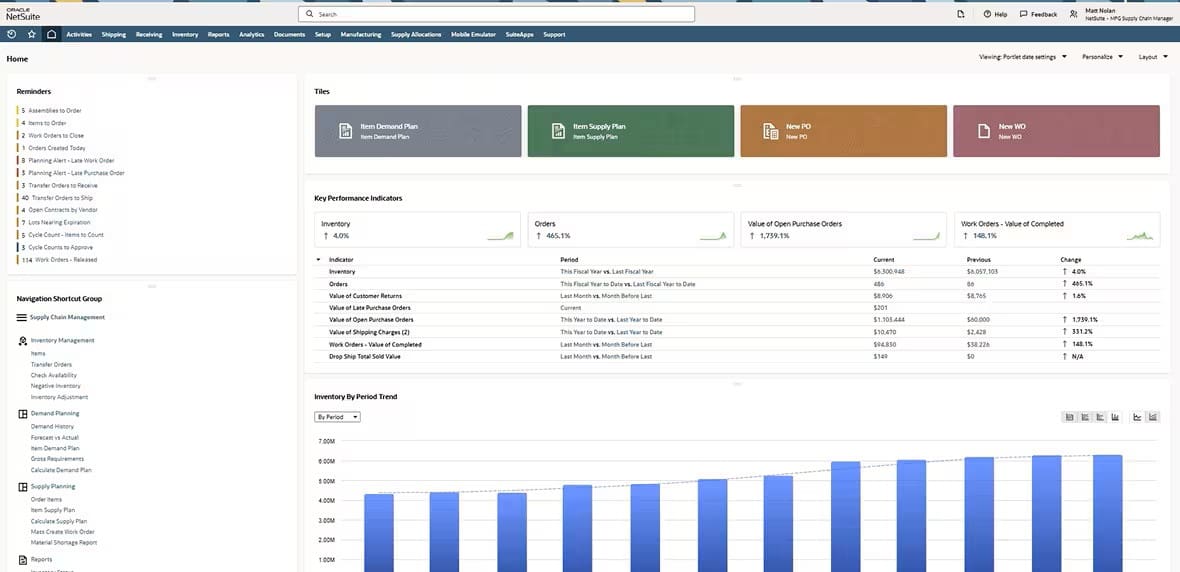

NetSuite’s Supply Chain Management capabilities make it easier for companies to track spending and monitor supplier performance over time, with an eye toward the potential benefits of vertical integration. For organizations making the leap, robust supply chain management software is critical to optimizing integrated operations and unlocking the full value of the investment. NetSuite software can empower vertically integrated companies to reduce the costs associated with planning and executing supply chain processes, improve inventory management, increase cash flow, and identify and mitigate risk with predictive analytics and scenario planning.

NetSuite’s Supply Chain Management Dashboard

Vertical integration can be difficult to capitalize on—it’s costly, complex, and not easily undone. However, when well executed, it can confer a number of advantages, including greater control, reduced costs, increased profitability, better product or service quality, increased customer and market insights, and more. Those companies with good supply chain visibility across either direction will be best equipped to explore the opportunities of vertical integration, particularly with integrated supply chain data analytics.

Vertical Integration FAQs

When is an acquisition considered vertical integration?

Not all corporate acquisitions result in vertical integration. However, when a company acquires a trading partner (either a supplier or a customer), it is an example of vertical integration because it results in the company owning and operating more steps in its supply chain.

When does vertical integration make sense?

Vertical integration makes sense when companies face supply chain disruptions, quality issues, or excessive costs from their partners. If a company has sufficient capital for the upfront investments and the operational capacity needed to manage additional operations, vertical integration can reduce expenses, improve quality control, and create long-term competitive advantages that outweigh the initial requirements.

Is vertical integration profitable?

In short, it depends. A number of variables can determine the profitability of a vertical integration strategy. Examples of successful and failed vertical integration abound. In addition, there are different approaches and degrees of vertical integration possible. A vertical integration strategy can deliver advantages, including greater economies of scale, lower variable production costs, decreased logistics costs and quality concerns, and—yes—increased profitability. However, full vertical integration takes time, requires significant capital investment, and can result in increased complexity and decreased flexibility. Companies must consider the advantages and costs of a specific vertical integration approach carefully. Some companies are able to secure significant competitive advantage via vertical integration, while others may determine that the costs of integration outweigh its benefits.

Is vertical integration a good strategy?

Vertical integration can be a worthwhile strategy for companies with clear objectives and strong operational capabilities. However, success depends on factors like industry dynamics, company size, available resources, and internal management expertise. Before integrating, companies should consider whether the benefits (increased control and potential cost savings) justify the significant investment and added complexity.

What is an example of vertical integration?

Carnegie Steel was one of the first examples of full vertical integration. By the 1890s, Carnegie owned mines for iron ore and coal, steel mills, and coal processing plants, as well as the ships and railroads that moved raw materials and finished products throughout the supply chain. Similarly, some of the world’s largest oil and gas companies control both downstream and upstream operations, from exploration and extraction to refining and logistics to retail and business sales. Technology giants Amazon and Apple have acquired steps preceding and following respective supply chains to pursue balanced integration opportunities over the years. Electric-auto maker Tesla embraced balanced integration from the start, running and operating its own plants and opting to sell its products directly to consumers.

What is a vertical integration structure?

A vertical integration structure involves a company taking over multiple stages of its production or sales processes rather than relying on external suppliers and trade partners.

What is vertical integration in economics?

In economics, vertical integration is the term used to describe a business strategy in which a company takes ownership of two or more key stages of its supply chain. A vertically integrated automaker, for example, might produce automobile components and vehicles and also sell directly to customers.