Physical retail isn’t dying, it’s just changing. Today’s innovative retailers have come up with ways to blend digital and physical experiences for consumers to offer a highly personalized one. Retailers like Lowe’s, Nike, Aldo and Peloton have found ways to make their physical stores a significant part of their enhanced and personalized digital customer experience. This is a smart path since 97% of consumers still see the need to go to physical stores, and 70% welcome a streamlined experience once there. If leading retailers are successful, consumers will like it even more when companies enhance the experience phone in hand.

That blended online and physical experience expectation that consumers have means retailers must align inventory, item information (such as reviews, images, videos, how-tos), order history, support tickets and more to create a true multichannel experience. The benefits for retailers are extensive, because multichannel shoppers spend considerably more than single-channel shoppers: multichannel shoppers spend an average of 4% more every time they are in a brick-and-mortar store and 10% more when shopping online(opens in new tab). For some retailers, these numbers are significantly higher.

For consumers, the benefits of a multichannel experience include:

- Convenience. When customers need an important product not found in stores, they can order online and collect it from the physical store or have it delivered.

- More Choice. A multichannel experience gives consumers insight into inventory available both on and offline and gives retailers the ability to significantly broaden what they offer well beyond the inventory of a typical store.

- Better In-Store Experience. Retailers can create a store experience focused on the benefits of products and worry less on stuffing as much inventory as possible into the available space.

Aldo Focuses on the Buying Experience

Aldo Group, a Canadian retailer that operates a worldwide chain of shoe and accessories stores, embraces the blending of the online and physical store. The retailer has recently implemented a number of innovative technology solutions to give its customers an enhanced multichannel experience, including:

- Store associates have mobile applications that provide access to inventory so they can summon runners at the back of the store to bring out shoes immediately.

- Customer-facing mobile applications allow shoppers to see available shoe sizes and styles when they walk into a store.

- Mobile applications can also recommend product alternatives or suggest products in another store.

- A notification system for customers who are not sure about a product they tried on lets the customers opt-in to for reminders to purchase the product later.

In addition to the sales associate application, Aldo stores have touchscreens where customers can browse products and request specific sizes. Most stores in North America are also equipped with beacons that notify the consumer application to switch to in-store mode, enabling the size-requesting functionality.

Aldo has pilot programs where the retailer tests new technology in a certain number of stores. If the pilots prove successful then they roll out the technology to other locations.

Peloton Stores Deliver What Online Can’t

Physical stores can serve a completely different purpose in a multichannel world. Peloton sells high-end home fitness equipment, primarily online. To improve the buying experience, the retailer is bringing its sports equipment to new showroom-style stores that highlight the experience of owning its product, something you can’t get online.

Peloton’s physical store experiences can only exist alongside an online presence (that also includes a subscription model as well). Because of these innovations, the contribution of a physical store is now measured more by metrics like influence on the consumer (potentially measured through social media sentiment) rather than the age-old dollar-per-square-foot or same-store sales. ROPO metrics, or research online/purchase offline and vice versa, can help retailers understand the overall effectiveness of blending the physical and digital shopping worlds.

KPIs such as foot traffic, conversion rate and average transaction value are supplemented by metrics like Clicks to Call (call button on a mobile search), Clicks to Directions and Viewed Store Location/Opening Hours page. Another way retailers can connect online and offline behavior is by linking loyalty cards to the unique user ID their website visitors get in a tool like Google Analytics. Through such a connection, retailers will have information on the in-store behavior of people who have visited the ecommerce website and used online options for joining a brand’s loyalty program. As long as retailers keep the in-store experience valuable, consumers will keep shopping in-store.

But linking these metrics to fully track the buying journey without the explicit involvement of the consumer is not as complete as it could be. Nor is the shopping experience changed much. Successful multichannel retailers think of their loyalty programs very differently than do retailers whose focus is just online or just physical stores. With the proper incentives, customers readily identify themselves online and in the store, allowing behavior tracking that starts with casual browsing — probably online — and ends in sales either in store or online.

Suddenly, Big Box Stores Come With a Guide

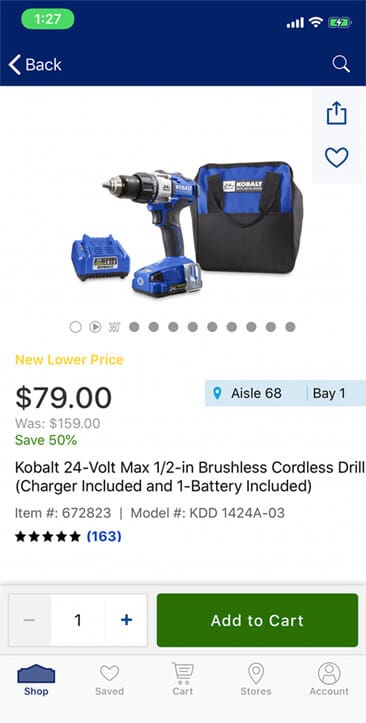

The incentives can vary broadly depending on the nature of the industry, and in some cases the increased value of information at the point of sale is enough. Stores with premium brand identity and premium prices can reward repeat business. Big box stores like Home Depot and Lowe’s tie inventory and in-store locators to their mobile apps. So, if you’re looking for a particular plumbing fixture, not only will the app help you know in-store inventory, it also identifies which aisle and bin to go to once you’re in the store.

The big box retailers have also used their apps to extensively broaden their inventory. Where once Home Depot only had a limited tile selection, largely giving up that market to specialty stores, it now stocks a few dozen options in store and adds hundreds more online.

Other stores tie philanthropy to their customer loyalty cards, donating a fraction of sales to causes likely to appeal to target customers. Amazon’s “Smile” program(opens in new tab) is a successful online example, but others are cropping up as well. There are obvious ties for businesses that work toward sustainability, where they can further customer loyalty by giving back to improve sustainability in supply chains and original sourcing.

Nike Revamps Stores to Integrate App, Ecommerce and Lifestyle

But perhaps the best examples are of those retailers who’ve completely transformed the in-store experience. Take a quick journey back a decade when NikeTown stores were hardly discernible from any other athletic footwear and sports apparel store.

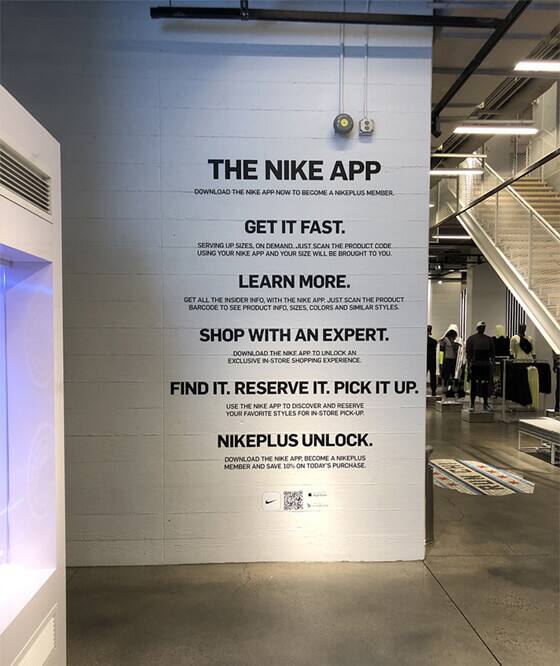

Now flash forward to the recent opening of its flagship store in New York (November 2018) and subsequent store make-overs since, and you’ll wonder whether you’ve mistakenly walked into a Bloomingdale’s-meets-Apple-Store dreamscape that can only be properly experienced with your smartphone in hand and the Nike app open. Bloomberg dubbed the new New York store the “front porch” to all things Nike, but it’s more like a portal that combines the sort of sparse merchandising usually reserved for high-end retail with an app that brings in the vast array of Nike merchandise that sits both in the back room and online.

Want those shoes a half size smaller? Summon a Nike Athlete (the company’s name for sales associates) to bring them to your dressing room. Want them in iridescent chartreuse with a zebra stripe swoosh and your initials embroidered on the back? Order them to be custom made and delivered to your door once you’ve decided on the pair that fits you perfectly.

Nike’s app, called NikePlus, is already hugely successful. Online, those registered in the app typically purchase three times as much as the typical online guest. So, when the company set out to transform its 68,000 square feet New York flagship, it took time to rethink the store experience and to go far beyond a simple online/brick-and-mortar integration. It’s much more about who shops where and for what.

The level to which Nike has integrated its app with the store is both daring and controversial. The New York store, dubbed House of Innovation 000, is best experienced phone in hand. The store sits on 5th Avenue and 52nd, putting it smack dab in one of the most upscale shopping districts in the country. New York shoppers are likely enough to have their phones with them, but would they use the app and become “members” in Nike parlance? Further, what to do about international shoppers? The store is a block away from Rockefeller Center, just north of Times Square, putting it in a prime tourist location. Would foreign visitors go online, and would they have the necessary data plan to participate? It took a few months, but the answer has been a resounding yes, validating most of what Nike wanted out of its store renovation.

Getting customers to pay hundreds for sport shoes or to adopt a sport-casual clothing style at work and away requires some inspirational guidance. For Nike, it started with the likes of Michael Jordan, Tiger Woods and Wayne Gretzky, and continues on with their contemporaries as well as more subtle approaches to influencing sportswear selection. Nike understands that shoppers on the Upper East Side are used to high-end experiences. Why should 5th Avenue neighbors like Michael Kors, Saks, Louis Vuitton or Burberry bring a more elevated experience?

And so, Nike set out to create a sparse environment reminiscent of a New York boutique for its female customers. The women’s floor at the six-story House of Innovation has high ceilings, white and light grey accents and an open environment that is anything but rushed.

QR codes on the mannequins let consumers “shop the look” on their phones, and since the Nike app already knows the appropriate sizes, it becomes a matter of choosing a color story and having merchandise sent to a dressing room or for pickup. The app allows consumers to click to learn, click to try or click to buy. And if customers don’t feel like having someone fold and bag their selections, checkout happens with your stored credit card number at a self-service kiosk.

The men’s floor is just as thoughtfully merchandised. Lower ceilings and more merchandise-packed than the women’s floor, the layout is a bit less about inspiration and a bit more about guiding selection.

Nike’s choices in its flagship are right in line with customer desires. A recent NetSuite retail survey(opens in new tab) reveals that:

- 63% of consumers would pay more for a product if they had a more personalized in-store experience.

- Three top features attracting online consumers to physical stores include online consistency (36%), simpler store layouts (35%), and staff orders on a mobile device (29%).

- There are three top technology advancements that consumers want to utilize when shopping in store: self-checkout kiosks (38%), VR try-on (23%) and mobile payments (15%).

- Only 5% of consumers selected robots and chatbots as the technologies they most want to use.

The online connection also allows Nike to further tailor the in-store experience at each location. Freed from needing to show the entire array of its inventory, stores can be crafted for their community. So, while the New York flagship has been designed to fit in with the upscale shops around it, Nike’s other stores look completely different. Its Santa Monica store has an earthier look that fits with the beach community. There, merchandising is similarly tailored to the locals, but the same sparse design used in New York can be found there too. This approach allows for a more inspirational in-store experience while simultaneously getting shoppers to consider a wider range of product.

Like Aldo, many of its stores are testbeds for new online connections. BOPIS (buy online, pickup in store) is being piloted in Santa Monica. Through the BOPIS program, shoppers can both buy and pickup, or reserve and try on. It’s not a new concept, but Nike is running pilots to find out how shoppers will use the program and how much store real estate needs to be dedicated to it.

Bottom Line

For retailers, blending the online and physical store is not a matter of if, but when. For many, it’ll be required to stay in business five years from now. In the brick-and-mortar space, you will see further adoption of the “live, work, play” model with retail centers that combine not just shopping, but housing and entertainment venues as well. Restaurants, bars, gyms and workout classes, theaters and music, all combined with shopping and housing — these non-traditional retail experiences provide unique opportunities for brands to leverage business models that are not just about coming into a store but being part of the culture and the daily lives of customers to drive influence over buying and even lifestyle decisions.

Retail is going through a fundamental change that will leave any retailer that is not up to the challenge of changing, out of business. The best piece of advice for a brand or retailer questioning which direction their investments should go would be to use the tools and systems and creative thinking that will best leverage a combined experience that includes all channels. This is not optional, it is a necessity and needs to be part of a retailer’s three-year plan.

If retailers are not making that investment, other brands and retailers in their space will. As the retail industry sees some traditional retailers like Macy’s, JC Penney and Sears closing hundreds of physical locations, it also sees retailers like Aldo and Peloton either transforming or opening new stores. It sees big box stores like Lowe’s and The Home Depot expanding their offerings and simplifying shopping with their online connection. And finally, there’s Nike and its complete reimagining of the customer journey.

These brands are examples of retailers using their brick and mortar wisely by blending technology, customer service and personalization that continues to set the bar high for consumer expectations today and in the future.

Bolster In-Store Sales With NetSuite

Ecommerce has raised customers’ expectations for a seamless shopping experience, and that extends to inside physical stores, too. With NetSuite SuiteCommerce InStore, in-store associates are freed from behind the counter to become walking transactors, with touch-enabled mobile devices that enable them to locate inventory across all channels and physical locations in real time.

The point-of-sale (POS) solution also provides a single view into customers’ orders and their purchase preferences so that associates can make relevant, personalized recommendations and drive sales. In addition, SuiteCommerce InStore creates a “continuous buying experience,” so that shoppers can access products saved in their online shopping carts and purchase them in store; conversely, shoppers can add future purchases to their online wish lists while in the store. Combined with SuiteCommerce, NetSuite’s ecommerce solution, retailers are able to deliver a holistic, omnichannel experience that leads to repeat business and happy customers.