When comparing enterprise performance management (EPM) and enterprise resource planning (ERP) systems, it’s not just the acronyms that might feel the same. At first, the capabilities of the two systems also seem similar. But a closer analysis shows that these two important applications serve distinct but complementary roles in helping businesses maintain operational efficiency and plan future growth. For most companies, EPM and ERP systems aren’t an either/or proposition. If and when to implement them often depends on where companies are in their growth cycles, as well as their specific operational and analytical needs.

This article explains the different strengths of EPM and ERP systems and how they can be used together to improve operational efficiency and strategic decision-making.

What Is EPM?

EPM systems encompass a suite of integrated software applications designed to help businesses plan, budget, forecast, close and report on their business performance, as well as consolidate and finalize financial results. By aligning financial and operational metrics, EPM systems ensure business goals are consistently met with efficiency and agility. EPM systems often include business intelligence and advanced data analysis tools for in-depth financial and operational planning, forecasting, scenario modeling, and reporting. This enables a deeper understanding of financial results and drivers, empowering organizations to shift quickly in response to market changes. Some systems also use predictive analytics and machine learning algorithms to provide insights into trends and potential outcomes, enhancing decision-making.

A wide array of organizations can benefit from EPM systems, but they’re especially valuable for companies with complex financial processes and those requiring detailed financial reporting and analysis. Rapidly growing companies or those facing market volatility can also benefit from the predictive modeling and scenario-planning capabilities of EPM systems.

What Is ERP?

ERP systems integrate multiple core business processes, such as finance, human resources (HR), customer relationship management (CRM), supply chain management (SCM) and manufacturing, into a unified system. ERP systems centralize data from all of those operational groups, making it easier to collect, manage and interpret companywide information from various departments. Centralized data also eliminates data silos and reduces the redundancy and inconsistency that often plague organizations that use multiple, disparate systems for various operational functions. Companies can also embed their custom workflows into ERP systems and automate many core processes to improve process efficiency and increase cost savings and productivity.

Today’s ERP systems can support companies of all sizes and in almost any industry. They’re particularly well-suited to growing businesses that need to manage increasing volumes of customer and/or employee data, as well as companies managing more complex supply chains or extensive inventory requirements.

Key Takeaways

- EPM and ERP systems are distinct enterprise applications that companies use to manage daily operations and guide forward-thinking business strategies and decisions.

- ERPs integrate companies’ core operational functions, such as finance, HR, customer relationships and manufacturing processes, in one system.

- EPMs are more narrowly focused on building detailed analyses around financial management, budgeting and forecasting to drive strategic decision-making.

- The systems complement each other, with ERP systems often providing the detailed operational data that fuels greater insights from EPM systems.

EPM vs. ERP Explained

The evolution of ERP and EPM systems began in the 1960s and 1970s with the launch of on-premises material requirements planning (MRP) systems. In the 1990s, ERP systems evolved from MRP systems as they began to support capabilities for finance, HR and more. The first cloud-based systems for finance, which eliminated the need for expensive on-premises hardware, began to appear in the late 1990s with the launch of NetLedger, which eventually grew to become ERP provider NetSuite. Around the same time, EPM systems emerged and enhanced strategic planning by offering advanced tools for budgeting, forecasting and financial reporting.

EPM and ERP systems differ in focus and functionality. ERP systems are designed as a central, integrated system to automate core business processes, such as finance, HR, manufacturing and supply chain management. EPM systems focus on the strategic management of business performance. In practice, companies use ERP and EPM systems for different, often complementary purposes. ERPs are the workhorses, handling day-to-day operational data and processes and ensuring smooth business operations. ERP systems often have financial management capabilities, such as invoicing, accounts payable and receivable, budgeting and forecasting, while EPM systems offer features for higher-level analysis, planning and performance monitoring. EPMs typically leverage data from ERP systems and other sources to provide strategic insights.

Main Differences Between EPM and ERP

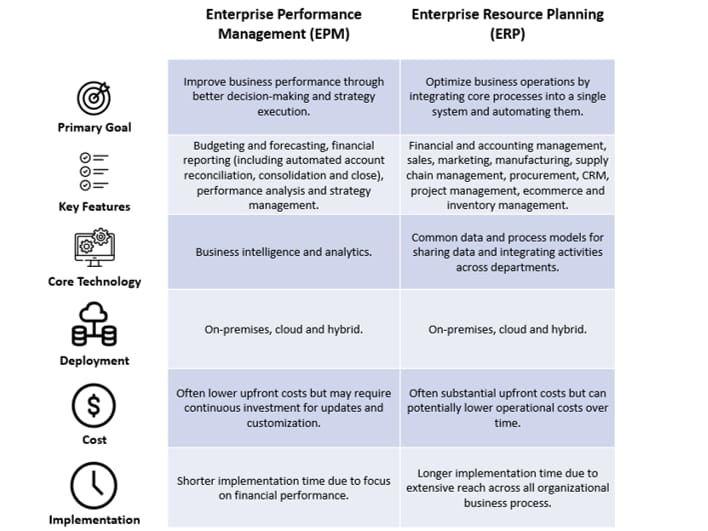

Because EPM and ERP systems both offer financial data management capabilities, it can be easy to confuse them. In reality, however, the two systems serve different purposes. ERP systems focus on transactional data, operational efficiency and workforce productivity. EPM systems use this data to provide a forward-looking view, emphasizing financial planning and strategic analysis.

The complementary nature of EPM and ERP has clear benefits when the two systems are used together. ERP systems optimize internal processes and day-to-day operations, and EPMs leverage their data to drive strategic decision-making and performance improvement. The synergy between the two systems enables businesses to not only run efficiently, but also plan effectively for future growth and success. The following key differences between each solution illustrates how to use the systems together for maximum benefit.

-

Areas of Focus

In general, ERP systems focus more on integrating and automating daily operational functions, such as inventory management, order processing and HR, while EPM systems excel in guiding future performance and strategy. ERP systems capture the pulse of a company’s daily activities, while EPM systems use historical transaction processing or operational data from various sources, including ERP systems, to forecast, budget and analyze financial outcomes.

Companies shouldn’t view the two systems as mutually exclusive. If the goal is to streamline operations and consolidate process management across departments, ERP systems are a foundational tool. Companies can use EPM systems to sharpen their strategic financial vision, refine performance metrics and drive better-informed decision-making — all of which serves to bolster the capabilities of their ERP systems. With an ERP system managing complexity and scale, and an EPM system providing financial insights to help navigate strategic decisions, companies can cover all aspects of enterprise management.

-

Implementation Timeline

Implementing EPM and ERP systems often involves different timelines due to the differences in scope and complexity of each system. Because ERP systems can weave virtually every function in an organization into a single system, they require a lengthier, more careful rollout to avoid disrupting day-to-day operations. For the same reason, they’re likely to involve greater degrees of customization, data migration and synchronization across departments than EPM systems. That’s why many companies take a phased approach to ERP implementation, using change management processes to prepare users for new workflows and processes. EPM systems generally don’t require business process change across so many departments, so they can be implemented more quickly and easily.

Still, securing executive sponsorship, fostering cross-departmental collaboration and setting realistic expectations are crucial for timely and effective deployment across both types of implementations. Companies should consider the value of partnering with experienced implementers that can tailor each implementation to their specific needs and timeline constraints.

-

Operating Scope

The operating scope of business software like EPM and ERP systems refers to the breadth and depth of processes, functions and organizational units that a system encompasses or influences. For example, EPM systems target strategic business operations, leveraging financial data, managing budgets and driving high-level strategic decision-making. To do this, EPM systems customarily automate financial processes, such as account reconciliation, close management and consolidation, corporate tax reporting and profitability analysis. Users of EPM systems — typically finance professionals and executive management — don’t delve into the granular details of daily business processes, but rather take a bird’s-eye view of performance metrics and outcomes.

ERP systems, on the other hand, impact a wider range of daily business activities and users because they integrate multiple functions into a single, cohesive system. ERP system users may span the entire organization, from finance to manufacturing, HR and sales, and usually access the system daily to execute business processes.

-

Complexity

With their narrower scope and focus, EPM systems are commonly less complicated than ERP systems to deploy, maintain and integrate with existing business processes. EPM systems focus on financial data aggregation, analysis and strategic planning, so they don’t delve deeply into daily operational tasks. But they still can be complex due to their sophisticated analytics, which need to draw from diverse data sources for accurate forecasting and reporting. Companies frequently must integrate their EPM systems with many data streams, including ERPs and/or other financial systems. EPM users require analytical skills to interpret complex data models and translate insights into strategic actions. Top of Form.

ERP systems often involve customization and changes to existing business processes, presenting organizations with a higher degree of overall complexity than EPM systems. For example, the comprehensive nature of ERP systems, which create a unified platform for all operational processes across an organization, will likely involve more integration — and, therefore, more data migrations — than EPM systems. Managing the complexity of ERP systems requires planning and training. With EPM systems, the complexity comes from having to interpret financial analyses and ensure data quality and accessibility.

-

Scope of Reporting

The difference in scope of reporting between EPM and ERP systems reflects the difference in their distinct operational and strategic roles. Because of the operational nature of ERP systems, for example, they offer a wide range of transactional reporting capabilities, including detailed operational reports that cover day-to-day activities, such as sales performance, inventory levels and the status of accounts receivable and payable. EPM systems have a more strategic reporting focus that is better-suited to helping business leaders model different strategies, build budgets and operational plans, and consolidate financial reporting from multiple subsidiaries, for example. They’re less about the minutiae of operational data and more about high-level outcomes and trends that inform strategic decision-making and long-term planning. As in many aspects of EPM and ERP systems, their different reporting capabilities complement each other. An ERP system’s operational reports are crucial for managing the present, while an EPM system’s strategic reports are designed to navigate the future.

Whether You Need EPM or ERP, NetSuite Has You Covered

NetSuite’s unified, cloud-based suite of enterprise software bridges the capabilities of ERP and EPM systems to offer a robust solution for managing daily operations, as well as for driving high-level strategic planning and decision-making. NetSuite ERP manages financials, HR, CRM, ecommerce and inventory management, streamlining processes and delivering real-time visibility into operational metrics that drive daily business activities. NetSuite also offers an EPM solution with robust strategic financial planning and reporting capabilities. NetSuite EPM integrates financial and operational data from across the business, connecting budgeting, forecasting and reporting processes to deliver insights that drive informed, strategic decisions.

NetSuite’s natively integrated suite of enterprise modules eliminates the need for separate systems, ensuring that strategic financial analyses are based on up-to-the-minute, consistent data. As a result, NetSuite delivers higher accuracy in forecasting, a streamlined approach to budgeting and an enhanced ability for companies to engage in sophisticated scenario planning. With its cloud-native infrastructure, it also scales easily for companies of various sizes, from startups to fast-growing enterprises, with the ability to tailor the system to evolving needs.

As with any significant software purchase, choosing whether to implement EPM and ERP systems depends first and foremost on a clear understanding of the problems they’re intended to solve. For companies looking to transform their daily operations and improve efficiency, ERP systems can provide tremendous benefits. For organizations seeking greater insight into performance to build winning long-term strategies, EPM systems can make all the difference. Combined, the two systems offer a powerful way to effectively manage businesses today while also building for tomorrow.

EPM vs ERP FAQs

Is EPM part of ERP?

Enterprise performance management (EPM) systems aren’t inherently a part of enterprise resource planning (ERP) systems. EPM systems focus on strategic financial planning, financial close and consolidation, reporting and analysis, while ERP systems centralize and automate core daily business operations. Some ERP systems, however, include EPM capabilities. In many cases, companies integrate EPM and ERP systems to take advantage of the two solutions’ complementary nature.

Is ERP and ERM the same thing?

No, enterprise resource planning (ERP) and enterprise risk management (ERM) systems aren’t the same. ERP integrates and automates core business processes, such as finance, supply chain, customer relationship management (CRM) and human resources (HR). ERM systems, on the other hand, help business leaders identify, assess and prepare their organizations for any potential risks that could interfere with their operations and objectives. Both systems are crucial for organizational management but serve distinct functions.

What is an EPM software?

Enterprise performance management (EPM) software helps organizations streamline and oversee financial management and operations, including planning, close and reporting functions, such as budgeting and forecasting, account reconciliation, close management and consolidation, tax reporting, and narrative reporting. Companies typically use EPM software to set financial goals, measure progress and make informed decisions to improve business performance. In many cases, companies integrate EPM systems with enterprise resource planning (ERP) systems, which provide detailed operational data to support the strategic analysis provided by an EPM system.

What is EPM methodology?

Enterprise performance management (EPM) methodology includes a set of processes and practices to guide how companies manage and evaluate performance, ensuring they consistently meet their goals. It leverages technology, such as EPM and enterprise resource planning (ERP) systems, to provide a structured approach to budgeting, forecasting and financial reporting. It aligns resources, actions and metrics with an organization’s strategic objectives to support decision-making and execution.