Pricing is one of the most important growth drivers for a business’s sales and profits. It’s also an area in which business owners and managers can go wrong. There are lots of factors that go into pricing, which is why the process has so many pitfalls. Too much focus on what competitors charge, for example, could make business managers lose sight of their own costs—to the detriment of profitability.

This article examines common mistakes that companies often make with their pricing, plus how to identify and address them. By staying in tune with the market, prioritizing business goals, and relying on data and technology, businesses can develop pricing strategies that attract customers and keeps them coming back.

What Is a Pricing Strategy?

A pricing strategy is a plan that a company creates to determine how much it should charge for its offerings, with the goal of maximizing overall profits. Strong pricing strategies should factor in supply and demand, market and competitive analysis, and costs.

Because pricing encompasses so many competing priorities, the best pricing strategies are well rounded. They strike the right balance in all important factors to enable a business to get the most out of every sale. But common pricing mistakes, such as miscalculating costs or relying on intuition instead of data to set prices, can throw a major monkey wrench into a business plan.

It’s important for businesses to “nail” their pricing for a variety of reasons. The right pricing helps ensure that the business makes enough money to cover its expenses, creates opportunities to invest in future growth, and acts as a signal to your target customers about the perceived value of your products. And it builds trust in the brand. The wrong pricing, however, can have adverse effects in all of these areas, and more.

Key Takeaways

- There are many costs of running a business, and product/service pricing must account for all of them.

- Not baking overhead and other costs into product pricing makes it harder to achieve profitability.

- The factors that go into pricing calculations change over time. Companies that stand still as their markets evolve often find they’ve mispriced their products.

- Modern software can ingest and analyze data from multiple systems to help businesses determine the best prices for maximizing profits and achieving other important goals.

Pricing Mistakes to Avoid

Even small pricing mistakes can have major negative consequences for a company’s sales, profits, and reputation. Set prices too low, and customers may question product quality. But in a world where 74% of consumers are concerned about rising prices, you may turn people off by charging too much.

Businesses can avoid such pitfalls by implementing data-backed strategies that reflect the current realities of the company and its market. Here are 14 common mistakes that business owners and managers make regarding their pricing decisions, plus tips to help avoid or fix them.

1. Failing to Segment Your Customers

One of the most common—and most consequential—pricing mistakes is to treat all customers the same. If a business offers various types of products and services, chances are it is selling them to multiple customer profiles and/or into diverse markets. But it will be difficult, if not impossible, to come up with one pricing strategy that’s equally effective across all these segments. A company that tries this approach is likely to leave sales and profit on the table as a result.

Solution: Segment customers and develop unique pricing for each segment. Start by analyzing data on customers and prospects to identify the different types of people who buy your offerings, then group them by purchasing behaviors, budget limitations, and other factors that affect how and why they do business with your company. From there, create pricing strategies tailored to each segment. This approach means more work, but it should increase your products’ appeal among all potential buyers and help your company make the most of every sale.

2. Overcomplicating Pricing Practices

In contrast to No. 1, having too many pricing options—without clear reasons for doing so—can also cause problems. “Fake” sales and constant discounting are among the biggest offenders. Some companies assume these tactics lead to more sales, so they turn to them for a quick fix when business is down. But, in reality, they often cause confusion about pricing and can even damage the brand. People may wait for sales, which makes cash flow less consistent and reduces profit margins. They might lose trust in your pricing or start to view the entire company as untrustworthy.

Other ways some businesses tend to overcomplicate pricing include hidden fees, inconsistent pricing across channels, frequent price changes, convoluted bundling, and confusing loyalty programs. These practices not only confound customers but also create challenges in accounting, including complex revenue recognition and inaccurate financial forecasting.

Solution: To maintain both customer satisfaction and financial clarity, businesses should balance strategic pricing with simplicity: Offer simple pricing and be transparent with customers. Sales can be effective if they run occasionally and for legitimate reasons, such as a semiannual clearance event to help clear out inventory. Explain the exact details of deals and when the deals expire—then stick to those cutoffs. There’s no better way to erode customer loyalty than to make someone feel like they’ve gotten a deal and then take that feeling away by cutting prices further or extending a “limited time only” sale.

3. Not Accounting for Overhead and Associated Costs

Most companies factor the cost of producing a product into its pricing. But some stop there. There are so many other costs of running a business, and prices must account for those expenses, too. By not including overhead and other costs in prices, businesses find it harder to achieve profitability.

Solution: Develop a pricing strategy that accounts for all costs. Include everything in pricing calculations, from rent and payroll expenses to banking and credit card processing fees. By doing so, your pricing will fully reflect all of the resources that play a role in serving customers, making it easier for the business to grow.

4. Not Understanding Your Product’s Value

Cost typically determines the baseline for most companies’ pricing. At the very least, businesses must charge enough to cover their expenses. Companies that don’t factor in the value of their products on top of that baseline are making a pricing mistake. They must ask themselves, “What is the most our customers are willing to pay for the product?” The difference between that answer and the product’s cost is the product’s value—and sometimes it can be very different from the cost. When prices are lower than indicated by product value, the business is not maximizing its revenue. When pricing exceeds value, sales volume usually declines.

Solution: Consider value-based pricing. Analyze customer data and conduct market research to determine how much different customer segments are willing to pay for certain products, then adjust product pricing to be more in line. It’s also important to reinforce the product’s or brand’s value proposition through the company’s marketing efforts—explicitly explaining how the product helps or appeals to customers. Value-based pricing requires hard, smart work, because it’s not as straightforward as other pricing models that use standardized processes and formulas. It’s more challenging to accurately quantify the value of each individual offering, but often worthwhile.

5. Ignoring the Market and Competition

Another important question that many companies fail to ask when pricing their products is “What does our competition charge?” No matter how a business arrives at its pricing, customers may not want to buy if its prices are too far out of whack with other options that they consider comparable.

Solution: Strike a balance between costs, perceived value, and competitors’ prices by using demand-based pricing. With this flexible approach, businesses adjust their prices so that they always reflect current market conditions—i.e., raising prices when demand is high and lowering them when demand is low. Demand-based pricing takes competitor pricing into account but doesn’t overemphasize it. In this approach, software tracks competitors’ pricing in real time and considers it in conjunction with other demand data, such as market conditions and customer behavior. Businesses can choose to have their prices be below that of competitors, match them, or be above, and can apply different strategies to their various product categories or customer segments.

6. Basing Pricing on Intuition

Nowadays, there’s no shortage of data on which to base a pricing strategy. Yet, some companies turn a blind eye to it all. Instead, they determine prices through gut feelings and guesswork. They might ask themselves (or their friends and family) how much they’d pay—even though they’re not their target customers. These types of intuition-based pricing decisions rarely hit the mark.

Solution: Rely on real data to set pricing. If you’re going to ask people how much they’d pay, ask actual customers. Even a brief, informal email survey will provide more actionable insights than intuition. Motivate customers to respond by offering discounts or rewards to allow you to collect a large enough sample size to yield valid results.

7. Setting Prices Too Low

Low prices don’t necessarily create more sales. Over time, customers may come to view underpriced products as being of low quality, especially if the company consistently emphasizes price over features and benefits. Despite this, businesses often set prices too low, particularly when they’re just starting out or otherwise lacking confidence. Typically, their plan is to raise prices over time. But if they can’t make enough sales and generate enough profit out of the gate, that day may never come.

Solution: Price products competitively from the get-go. You can go lower than competitors, but don’t go so low that price is the only thing customers talk about. Demonstrate actual value, so your products will become more likely to generate profits that you can use to further grow the business.

8. Failing to Review and Update Prices

The factors that go into pricing calculations—market and competitive dynamics, customer demand, cost, etc.—change over time, sometimes quickly. As a result, a strategy that successfully drove sales at a product’s inception may not work so well later on. Companies that stand still as their markets evolve will sooner or later find themselves at a disadvantage.

Solution: Regularly review pricing and update it accordingly. Still, be cognizant of the fact that frequent price changes may confuse or upset customers. Raise prices strategically and always clearly communicate any increases in advance, which will mitigate at least some customers’ disappointment.

9. Setting Prices That Don’t Align With Business Goals

Even the most disciplined companies may stray from their main objectives from time to time. They might feel they need a quick win or that they must hop on a new trend. When this affects pricing, it can quickly become a problem. A startup company, for example, may intentionally set initial prices low to gain a foothold in a market. But that could attract cost-conscious shoppers, when the company’s goal is to become a premium brand.

Solution: Always keep prices aligned with business goals. It’s easy to lower prices, but it’s not always easy to raise them again if customers grow accustomed to paying less. What you think is a short-term adjustment can turn into a long-term problem that affects revenue, profit, and brand reputation.

10. Poor Forecasting and Planning

Pricing mistakes often stem from inaccurate forecasts that have created a lack of foresight. When businesses fail to consider market fluctuations, rising costs, or changing consumer behaviors, or they base forecasts on incomplete data, they risk misaligning pricing and demand. And that can hurt their long-term growth.

For example, if a company neglects to forecast a spike in demand during a holiday season, it might set prices too low and miss out on potential revenue. But if it relies on outdated data and overestimates demand, it could raise prices too high, pushing customers away.

Solution: Create a pricing strategy that relies on real data to account for historical trends in sales, market conditions, and customers’ shopping behaviors. Use analytics software to accurately forecast demand and proactively adjust pricing in response. Businesses that emphasize strong forecasting and planning can avoid making reactionary changes and other serious pricing mistakes.

11. Not Testing Different Price Points

All the forecasting and planning in the world can’t guarantee a successful pricing strategy. Customers are human beings, and the only way to know for sure how they’ll respond to pricing changes is to see them in action. But many business owners and managers fail to sufficiently test different pricing options. Some are afraid that experiments will confuse or alienate customers; others might assume their pricing is already optimal, even though they don’t have the data to prove it. In some cases, the company just doesn’t have the time or the right tools to run experiments properly. Whatever the reason, they’re not getting valuable insights they could otherwise use to improve their pricing.

Solution: Use various forms of testing to optimize pricing. A retailer with an online store or multiple physical locations can run A/B testing by setting different prices for the same product and analyzing customer response. Then, once armed with concrete data, they can determine optimal pricing and implement it everywhere. Psychological pricing is another effective way to test buyer behavior. It’s easy, inexpensive, and doesn’t require additional tools. By making small, subtle changes to a product’s price (e.g., marking down a necklace from $100 to $99.99), retailers can dramatically increase that product’s perceived value and drive more sales.

12. Trying to Achieve the Same Profit Margin Across Products

Cost-plus pricing is one of the most popular pricing models, mainly because of its simplicity. With cost-plus pricing, companies take the cost of a product and add a fixed markup percentage to determine its selling price. But applying the same markup to all products can be a major pricing mistake, because it doesn’t factor in each product’s individual value. Although markup and margin are calculated differently—markup is calculated off the cost of a product and margin off its selling price—in most cases, the business ends up with similar margins for all of its products. In that case, a company would usually end up pricing some too low (which eats into profit) and others too high (which can hurt sales).

Solution: Don’t sacrifice optimal pricing for simplicity by using the same margin across the board. Make the extra effort to set pricing that reflects each product’s value to its customer base. This approach gives a business the best chance of maximizing sales and profits for its entire product line.

13. Focusing Solely on Units Sold

Businesses often fall into the trap of prioritizing sales volume above all else. They might equate high unit sales with business success, prioritize market share gains, or simply find that unit sales is an easier metric to track than more complex financial measures. But myopic focus on units sold ignores crucial factors, such as profit margin, production cost, and overall revenue, which can lead to misguided pricing decisions that undermine profitability, cause cash flow problems, or even trigger price wars. This kind of mistake can be a particular issue in sales departments, especially when sales reps’ compensation is tied to sales volume.

Solution: Adopt a more holistic approach to pricing. Consider a balanced scorecard of metrics, including gross profit margin and net profit, to allow for more strategic pricing decisions that juxtapose volume against sustainable, profitable growth. For instance, consider tiered pricing strategies that cater to different customer segments or value-based pricing that reflects the true worth of the product to customers. And, align salespeople’s incentives with overall business goals as part of the pricing process. For example, you may create multiple incentives that counterbalance volume and margin in the salesperson’s mind.

14. Failing to Leverage Technology and Automation

A multitude of factors go into creating successful pricing strategies, and many require data from multiple sources. Plus, the companies that do pricing strategy well regularly update their data so they can maintain a competitive edge. Therefore, doing pricing strategy analysis manually is virtually a nonstarter. But many small and medium-sized companies do exactly that because they don’t believe that they can afford technology solutions, or that their data is good enough, or that they have the expertise to implement the systems.

Solution: Bite the bullet and automate the pricing process. Modern software can ingest and analyze data from multiple systems and perform several kinds of analyses to help a business determine best prices. The software can even automatically update prices based on changing conditions. This approach, a supercharged version of demand-based pricing known as dynamic pricing, is especially popular in the restaurant and hospitality industries.

How to Identify if Your Business Is Making a Pricing Mistake

Pricing mistakes aren’t always obvious—especially if you’re not relying on technology and automation to analyze business finances. But the signs are there, if you know where to look. Declining sales and changing behaviors from customers and competitors may be signaling problems with your pricing strategy. Here are five ways to identify issues early on, before they become serious problems.

- Your sales are down: An unexpected drop in sales is a potential indicator of a pricing mistake. Something has changed with regard to how customers value the product, and your pricing no longer reflects this new reality. In this case, it’s time to reassess not only product pricing but also brand positioning.

- Your competition is outperforming you: Pressure from the competition is often the cause of an unexpected drop in sales. Maybe there’s a new product that benefits customers more than your product does. Or maybe a competitor has found a more efficient supplier so it can sell the same product at a lower price while earning a higher profit.

- Your sales don’t align with expected profit margins: The company’s sales volume is meeting expectations, but profit isn’t. This usually means the pricing strategy has not properly accounted for all costs—a common pricing mistake. Make sure to factor all operating expenses into pricing calculations so margins can be accurately forecasted.

- You see changes in sales behavior: If salespeople start regularly offering discounts to close deals—or suddenly cease discounting—it could be a sign that your regular pricing no longer resonates with customers. Get feedback from the team and reexamine market dynamics to determine whether prices need to be adjusted.

- You see patterns in customer feedback: The clearest sign of a pricing mistake is when customers tell you so. If you’re regularly getting price-related feedback, ask follow-up questions to determine why customers feel prices are off base.

Protect Profit Margins With NetSuite

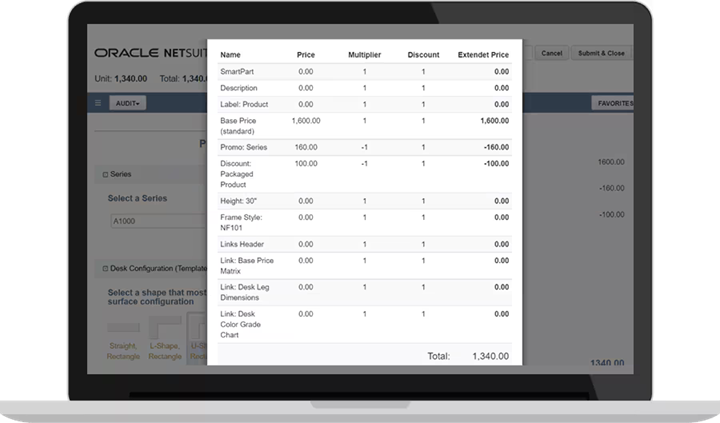

Accurately calculating prices is one of the keys to maximizing profit margins. But many companies make pricing mistakes because of insufficient data analysis, error-filled manual processes, or disconnected systems. NetSuite’s configure, price, quote (CPQ) software helps businesses avoid these pitfalls through automated workflows and integrated data management.

With NetSuite CPQ, for example, businesses can stay on top of changing market conditions by setting the software to automatically adjust prices in line with real-time demand signals and competitive data. Because it integrates seamlessly with NetSuite’s broader enterprise resource planning system, NetSuite CPQ can take advantage of customer segmentation capabilities that allow business managers to create targeted pricing strategies for different market segments. Furthermore, it can help avoid cost-oversight errors by pulling in data from throughout the business—including overhead, labor, and materials—to calculate accurate margins for each product configuration. Sales teams can quickly generate quotes that accurately reflect current costs and market conditions. And automated approval workflows can help ensure consistent pricing across channels—while still supporting strategic discounting, when appropriate.

The result: a data-driven pricing strategy that maximizes profitability while avoiding common pricing mistakes.

Pricing is a powerful but complex lever for driving business growth. Successful pricing strategies balance costs, customer and competitive analyses, and product value—but they are difficult to achieve without modern technologies and automation. By avoiding common mistakes and relying on data-driven insights, business owners and managers can align pricing with their business goals and maximize profitability.

Pricing Mistakes FAQs

What are the three most common pricing strategies?

The three most common pricing strategies are competition-based pricing (matching or slightly beating competitors’ prices), cost-plus pricing (adding a markup to the cost of the product or service), and value-based pricing (basing prices on what customers are willing to pay).

How can pricing hurt a business?

Pricing can hurt businesses in several ways. Poorly priced products can lead to lower sales and allow competitors to leapfrog your company. Pricing that is too low may degrade the brand, erode customers’ trust, and eat into profit margins. Pricing that is too high may drive customers away.

What would be the problem with pricing a product too high?

Pricing a product too high risks losing new and existing customers that don’t believe the product or service is worth the money. In addition, the problem of lost sales because prices are too high can be compounded by the costs of storing surplus inventory for products that remain unsold.

What would be the problem with pricing a product too low?

Too-low pricing can diminish a product’s perceived value among potential customers. It is also impossible to turn a profit if prices are so low that they don’t cover all business costs. Raising prices later may also be a challenge if customers get accustomed to the lower amount.