With the rise of digital wallets and mobile payment apps, property management companies face increasing pressure to accept diverse payment methods from renters, yet avoid compromising security or compliance standards. As businesses grow and tenant expectations evolve, traditional payment methods, such as paper checks and cash, often create unnecessary delays, administrative burdens, and cash flow issues. Fortunately, modern payment processing solutions that facilitate digital payments can help property managers overcome these challenges by automating routine tasks, reducing manual errors, and providing real-time access to financial data.

The right approach can significantly improve a property management company’s operational efficiency, scalability, and financial health by streamlining rent collection and minimizing missed payments. As a result, property managers can focus less on administrative tasks and more on serving their tenants and growing their business.

What Is Property Management Payment Processing?

Broadly speaking, property management payment processing consists of the systems and procedures used by property management companies to handle financial transactions from their tenants or clients. This includes collecting and verifying rent payments, security deposits, maintenance fees, and any other property-related charges. The approach to payment processing varies with the size and complexity of the business, ranging from straightforward and limited tools that only accept payments, such as PayPal or Apple Pay, to robust business systems that automatically sync receipt of payments with other aspects of a larger enterprise resource planning (ERP) platform, such as accounting systems. However a business processes payments, the primary goal is to turn payments—cash, checks, credit cards, bank transfers, or digital payments—into cleared funds in the company’s account, recording transactions as they occur and ensuring regulatory compliance.

Modern payment processing practices seek to eliminate the inconveniences of more traditional payment methods, such as paper checks or cash, favoring digital payments that create a more efficient and simplified procedure for managers and tenants alike. Property managers benefit from faster access to funds, automated recordkeeping, and reduced administration, and tenants gain the convenience of having multiple payment options, automatic recurring payments, and immediate confirmations. This mutually beneficial approach has led to the increased adoption of digital payment processing throughout the property management industry.

Key Takeaways

- Modern payment processing tools help property managers improve cash flow and reduce administrative work while providing tenants with convenient, secure payment options.

- Successful payment processing requires a balance of multiple payment methods and operational efficiency.

- By regularly assessing and adjusting payment processes, companies can be sure their systems meet both business needs and tenants’ preferences.

- Property managers should establish clear payment policies and procedures, and communicate them to staff and tenants, to maintain regulatory compliance and minimize misunderstandings, late payments, and disputes.

Property Management Payment Processing Explained

Digital payment processing tools operate within an interconnected network of financial institutions to move funds from a payer’s account to the business’s. This is typically done automatically, with both parties notified when the transaction is completed. When a tenant initiates a payment, the payment processor—a third-party company that facilitates electronic transactions between tenants and property managers—authorizes, processes, and settles that payment through the banking system before it finally reaches the property manager’s account. The processor also encrypts and records the transaction to ensure that payments are validated and traceable throughout the process, that all parties’ financial information remains private, and that regulatory compliance is maintained.

By leveraging payment processors to handle these technical aspects of transactions, property management companies can instead focus on providing high-quality services and maintaining their properties. Furthermore, many payment processing tools integrate with property management software to automatically update company ledgers. This integration creates a seamless flow of both funds and data, enabling property managers to generate accurate financial records in real time, without sacrificing speed or convenience.

Why Is Payment Processing Important for Property Management?

Effective payment processing directly impacts a property management company’s financial health and operational efficiency. According to the U.S. Census’s Household Pulse survey of August/September 2024, 13.5% of renters were behind on rent payments, which can create significant cash flow problems for property managers. However, by offering tenants more options and being able to process payments, security deposits, and other fees quickly, companies gain better control of their finances and reduce the time spent on following up on payments and other administrative tasks.

Beyond operational benefits, modern payment processing systems helps property management companies stay competitive in an increasingly digital market. Many tenants expect the same convenient payment options they use for other services, such as mobile payments and autopay. Companies that fail to offer these options risk losing potential tenants to competitors that do. Additionally, clear and comprehensive payment processing helps reduce payment disputes and upholds compliance with financial regulations that protect the business and its renters from fraud and liability.

How Property Management Payment Processing Works

The payment processing cycle begins when a tenant initiates a payment through their preferred method, typically via an online portal, mobile app, or in-person terminal. This encrypted payment gateway verifies the payment information before sending it to the payment processor, which then communicates with the tenant’s bank to confirm fund availability and initiate the transfer. Once confirmed, the processor deposits these funds into the property management company’s merchant account. The deposit typically takes one to three business days, depending on the payment method and processor, but relevant parties usually receive near-immediate confirmation when the processor verifies the payment. The payment processor sends steady real-time updates to the property management company and tenants, and automatically records all the financial information property managers need to calculate tax obligations and complete their accounting records.

Common Payment Methods in Property Management

By offering multiple payment options, property management companies can accommodate a variety of tenant preferences and needs, as well as any pertinent regional rules about accepted payment methods. A 2024 Illinois law, for example, states that landlords “shall not require a tenant or prospective tenant to remit any amount due to the landlord under a residential lease, renewal, or extension agreement by means of an electronic funds transfer.” Put simply, landlords must accept cash. Some common payment methods used in property management include:

- Debit card processing: Debit cards provide a direct link to tenant bank accounts, often offering immediate payment verification and relatively quick settlement times. Debit cards maintain the convenience and security of card payments, appealing to tenants who prefer to pay rent directly from their checking accounts or who don’t have any credit cards with high enough credit limits to reliably cover rent.

- Credit card processing: Credit cards offer tenants payment flexibility and potential rewards points on significant monthly expenses. Though processing fees are typically higher than on other payment methods, many tenants value the ability to manage their cash flow when paying rent by paying off card balances at a later date.

- ACH payment processing: Automated Clearing House (ACH) transfers move funds directly between bank accounts and are often used for recurring rent payments. This method tends to incur lower processing fees than card payments and allows property managers to set up automatic monthly withdrawals from tenants, which reduces late payments and administrative follow-up.

- Digital wallets: Services such as PayPal, Apple Pay, and Google Pay are becoming increasingly popular, especially among younger tenants who prefer making mobile payments. Many of these services can be integrated with property management systems, offering quick processing times and enhanced security features. These payment methods also typically add protections for both renters and businesses engaged in payment disputes.

- Paper checks and money orders: These traditional payment methods are declining in popularity, but some tenants still prefer them. Businesses must carefully track these payments, as they can generate significant processing delays, hurting cash flow. To give tenants and staff more flexibility when sending/receiving payments, property managers may use lockbox services or mobile check deposits.

- Cash: Though less common nowadays in property management, some tenants do prefer to pay in cash, and, depending on the location’s laws, landlords may need to accept it. To simplify this process, property managers can set up centralized drop boxes or partner with retail payment networks to accept cash payments at convenient locations. When working with cash, businesses must carefully maintain proper documentation and follow compliance requirements for all transactions.

Benefits of Effective Payment Processing Solutions

Modern digital payment processing solutions offer advantages beyond simply collecting rent, such as refined daily operations and long-term business growth. Through strategic implementation planning, property managers can get the most out their chosen payment processing approach. Here are several common benefits to expect.

- Increased convenience: Secure digital payment processing eliminates the need for tenants to physically deliver payments or for property managers to personally make deposits at the bank. Digital payment options extend the payment window beyond business hours, allowing tenants to schedule payments at any time. Additionally, property managers can monitor transactions in real time and generate reports whenever needed.

- Reduced days sales outstanding (DSO): Efficient payment processing significantly reduces the time elapsed between billing and receiving cleared payments. With multiple payment options, easy-to-use portals, and automated reminders, property managers can decrease late payments to speed up their collection cycles and improve their DSO metrics and overall financial health.

- Improved cash flow: Faster payment processing and settlement times allow property managers to access funds more quickly than is possible with traditional payment methods. Improved cash flow facilitates better financial planning and more timely vendor payments, making it more likely that businesses will be able to invest in property improvements or expansion opportunities.

- Automation of billing: Automation eliminates the need for manual invoicing and payment tracking, reduces errors, and frees up staff for more productive tasks. Property managers can set up recurring billing schedules with automatic late-fee calculations and payment reminders to keep rent payments on time and accurate.

- Detailed reporting: Modern payment solutions often include built-in and comprehensive financial reporting capabilities that use real-time transaction data to track payments and analyze historical trends. Such insights help property managers simplify tax preparation and audit processes, as well as identify any potential issues that might affect payment policy decisions.

- Scalability: As property management companies expand, more sophisticated payment processing solutions can easily keep up with increasing transactions without proportional increases in accounting staff. Scalability allows property management companies to take on new properties or expand into new markets without sacrificing service quality, consistent recordkeeping, or efficiency.

- Lower transaction costs: Bulk payment processors often provide volume discounts and more competitive rates than can be achieved with simpler tools that process transactions—and charge businesses—one at a time. By consolidating payment processing through a single processor, property managers can reduce their per-transaction fees and increase margins. Additionally, automated reconciliation helps staff spend less time processing and verifying payments.

- Customer support: Payment processor contracts typically come with access to support teams that can help quickly resolve technical issues and payment disputes. This professional support helps property managers maintain convenient and reliable rent processes, which directly contributes to positive tenant relationships. And, if issues do arise, quick and transparent resolutions help keep all parties confident and trusting going forward.

- Improved tenant experience: Digital payment processors give tenants the flexibility to choose how and when they pay their rent, offering features such as automatic payment confirmations, secure transactions, detailed account histories, and mobile accessibility. Property managers can leverage these systems to create a more professional and convenient rental experience that can increase tenant satisfaction and retention, while also attracting new renters.

Challenges of Payment Processing for Property Managers

Payment processing solutions offer many benefits, but property managers should be aware of some inherent challenges. With careful planning and targeted strategies, however, businesses can mitigate these risks and maintain smooth operations. Challenges to be prepared for include:

- Delayed payments: Late rent payments can lead to cash flow problems and increase administrative workloads as staff members chase down overdue balances. Even if tenants eventually pay, delays in processing or settlement times can affect a property management company’s ability to meet its own financial obligations—taxes, mortgages, wages, and more—in the meantime. To address this, digital payment solutions tend to process payments more quickly than traditional methods.

- Payment discrepancies: Transaction errors, including mismatched payment amounts, incorrect account numbers, or incomplete financial information, can lead to verification issues and disputed charges. These discrepancies often require manual investigation and reconciliation, taking up valuable staff time, delaying payments, and potentially straining tenant relationships. Thanks to automated reconciliation features, digital tools can reduce discrepancies and increase transaction transparency.

- Security concerns: Property managers must protect sensitive financial information when processing payments, especially if receiving payments through multiple channels. To do so they need robust security measures, regular system updates, and careful attention to compliance requirements, all of which add complexity and cost to payment operations. More advanced payment processing solutions often have built-in security features that are part of a larger cloud-based ERP system that maintains and updates its own security standards.

- High transaction fees: Processing fees can eat into profit margins, especially on properties with high rental rates or a large number of units. To reduce these fees, property managers can look for lower-fee methods, such as ACH payments instead of credit cards; negotiate volume discounts with processors; or pass on convenience fees to renters (where legally permitted).

- Integration issues: Not every payment processing tool can be properly integrated with existing property management software, creating potential information gaps, reconciliation errors, and extra work for property managers. Before upgrading to a new payment processing solution, businesses should carefully evaluate potential candidates’ integration capabilities with existing systems to ensure seamless data flow and accurate recordkeeping.

- Lack of payment options: By not accepting renters’ preferred payment methods, companies risk frustrating tenants, delaying payments, and driving away potential business. But supporting too many options increases complexity and administrative overhead. Property managers must find a way to balance tenant preferences with efficiency targets, prioritizing the most-used payment methods for their property type or tenant base.

- Manual processing: Relying on manual payment processing hinders productivity and increases the risk of human errors. While some traditional payment methods may still be necessary or appropriate for some situations, automated systems can help streamline these processes and reduce the administrative burdens on staff. Businesses should regularly assess their workflows and identify areas where automation could improve efficiency and compliance.

- Inconsistent reporting: Different payment methods may include varying levels of transaction detail, making it difficult to maintain standardized financial records across an entire organization. Property managers can invest in comprehensive reporting systems to consolidate data from multiple payment sources. These systems can create consistent financial reports, tax preparation documents, or customizable ad hoc reports for more targeted analysis, including side-by-side property comparisons.

- Tenant communication: Payment-related misunderstandings about due dates, late fees, and payment status require clear and timely communication with tenants. But tenants aren’t always available, especially those with atypical schedules or lifestyles. By implementing automated notification systems and payment portals, property managers can establish more consistent and accessible communication channels that allow tenants to more easily answer questions and clarify any inconsistencies or issues.

10 Key Features of Property Management Payment Processing Solutions

When upgrading to a more sophisticated payment processing solution, property managers should prioritize comprehensive features that will bring real value. These features can support not only tenants’ preferences and needs, but the company’s operational efficiency and growth as well. Here are 10 essential features that can streamline payment processing and improve financial management.

- Unified payment management: A centralized dashboard gives property managers full visibility into real-time financial data, important documents, and multiple payment methods from a single interface. This consolidation helps ensure consistent processing procedures across all properties, while keeping financial records organized and accessible.

- Multiple payment options: The solution should support all desired payment methods, including credit cards, debit cards, ACH transfers, and digital wallets, and integrate each method with the company’s accounts. By offering diverse payment options, such as contactless payments, businesses can accommodate tenant preferences while ensuring timely rent collection, all in one unified system.

- Automated billing and invoicing: Automated payment solutions typically have built-in features for automatically collecting recurring payments, as well as any additional fees, without the need for manual intervention. The system should also automatically generate and distribute professional invoices, receipts, and payment confirmations to maintain clear financial records. Additionally, it should store all important documents, such as receipts and contracts, for future reference.

- Enhanced security: Effective payment processing solutions should provide encryption, fraud detection, and secure data backups that comply with financial industry standards and protect both renters’ and the business’s personal information. According to the 2023 U.S. News & World Report Identity Theft survey, 73% of respondents have experienced one case of identity theft; payment processing features, such as multifactor authentication, sensitive data tokenization, and regular security audits/updates, help protect data from unauthorized access.

- User-friendly interface: Payment processing systems often prioritize intuitive design features that make it easy for both staff and tenants to process payments accurately and to access account information. By emphasizing clear navigation, simple payment workflows, and accessible help resources, these systems reduce training time and support requests, while improving user adoption.

- Real-time reporting and analytics: Comprehensive reporting tools provide instant access to transaction data, payment trends, and financial metrics, typically through customizable dashboards and automatically generated financial statements. These analytics features are often hosted on the cloud, allowing property managers to track payment patterns, identify potential issues, and make data-driven decisions about their payment processing strategies, regardless of whether they’re in the office, on site, or at home.

- Integration capabilities: The right payment solution should seamlessly connect with existing property management and accounting software. Alternatively, when upgrading systems, some businesses choose to instead implement an ERP system with integrated payment capabilities. Either way, full integration breaks down data silos to eliminate double data entry, reduce reconciliation errors, and ensure that all financial systems maintain accurate, up-to-date information.

- Mobile access: Many modern payment systems are optimized for mobile applications that allow both property managers and tenants to handle transactions on the go with device-specific features, such as push notifications or offline/auto sync capabilities. Mobile tools should provide the same security and functionality as desktop versions, protecting users’ data when they make payments, check payment status, and access account information, no matter what device they use.

- Recurring payment options: Recurring payments give property managers a more accurate cash flow forecast and provide tenants with flexible scheduling options that accommodate different preferences and lease terms. By setting and adjusting payments based on their own cash flow, tenants can more easily stay on top of rent payments and can reduce the risk of payment disputes, manual errors, and late fees.

- Customizable payment rules and fee structures: Different tenants, property types, rental periods, and payment methods may require their own unique rules, including payment windows and surcharge/late-fee calculations. Payment systems’ customizable templates allow property managers to create and update payment policies that work for their specific accounts, down to the individual renter. However, businesses must carefully consider local regulations when establishing fee policies. For example, the Commonwealth of Massachusetts prohibits sellers from imposing “a surcharge on a cardholder who elects to use a credit card in lieu of payment by cash, check, or similar means.”

Best Practices for Property Management Payment Processing

By following established best practices, property managers can maximize the benefits of payment processing and mitigate potential challenges. The eight strategies outlined below work together to give businesses a comprehensive payment processing approach, ultimately creating a more efficient, secure, and tenant-friendly payment environment.

1. Offer Multiple Payment Options

To attract the widest range of potential renters and improve collection rates, property managers should provide as many payment methods as realistically possible, prioritizing those that match the majority of their tenants’ preferences and financial capabilities. While digital payments often provide the most efficient processing, maintaining some traditional payment options ensures accessibility for all tenants and may be required by law. Depending on local regulations, businesses may be able to offer incentives, such as discounts or fee waivers, to convince tenants to switch to preferred methods. The key is to regularly assess current workflows and listen to tenants’ feedback to find the right balance between convenience and operational efficiency.

2. Automate Billing and Reminders

By implementing automated billing with scheduled payment reminders, companies can keep renters and managers informed of upcoming payments. Thus, renters can make sure they have sufficient funds available in their accounts before deadlines approach, and businesses can forecast cash flow to meet upcoming obligations. And after the payment processing system verifies payments, it should send another set of notifications, either to confirm successful payment or to alert both parties of any issues. Businesses can also set custom reminders when appropriate, such as prior to lease renewals or before regularly scheduled maintenance. This level of consistent, automated communication keeps both sides of the transaction informed and strengthens consistent and professional payment processes.

3. Implement Clear Payment Policies

Property managers should clearly communicate detailed payment policies to their tenants, explicitly explaining accepted payment methods, processing times, and fee structures. These policies should also outline updated policies, due dates, grace periods, late fees, and any additional charges, including those associated with specific payment methods. By making these policies easily accessible through tenant portals and including them in lease agreements, property managers can prevent misunderstandings, increase transparency, and protect themselves from legal liability.

4. Ensure Data Security

To effectively protect sensitive financial information, businesses must implement comprehensive security measures across all payment channels. This includes leveraging encrypted payment gateways, requiring strong passwords and multifactor authentication, and regularly updating file backups and security protocols to adapt to new threats. Property managers should also teach staff and tenants security best practices and maintain detailed documentation of all security measures to demonstrate reliability and build tenant trust.

5. Provide Excellent Customer Support

Companies should have knowledgeable support staff on hand to quickly resolve problems should payment issues arise. Property managers should train support teams on their payment processing solution’s features, common troubleshooting steps, and how to maintain clear communication channels through multiple means, such as phone, email, and tenant portals. By quickly resolving and documenting payment problems, businesses not only improve tenant satisfaction but also prevent minor issues from escalating into serious disputes or spreading to other tenants.

6. Regularly Review Fees and Rates

Property managers should periodically analyze and update their payment processing fees, including transaction fees, monthly service charges, and seasonal adjustments, by comparing them with current market rates and cash flow forecasts. This regular assessment helps companies ensure that they’re competitively pricing rentals and effectively generating revenue. Consistent policy reviews also help decision-makers identify opportunities to negotiate better rates with vendors or implement new cash flow strategies, such as by offering early payment discounts or other incentives to shift tenants toward more cost-effective payment processes.

7. Educate Tenants

Clear instructions and resources about payment processes help tenants conduct smooth transactions and reduce late payments and support requests. Property managers should create easy-to-follow payment guidelines that explain the benefits and shortfalls of each payment method and outline security measures protecting tenant information. These instructions, as well as any updates about new features or process changes, can be posted in offices, throughout properties, and directly emailed to give tenants the information they need to effectively use the payment system.

8. Maintain Consistent Communication

Beyond payment reminders, property managers should establish regular communication channels to keep tenants informed about payment policies, system updates/downtime, and potential or common issues. This includes providing advance notice of any changes to payment methods, fee structures, or processing procedures. Communication should also go both ways, giving tenants an opportunity to provide feedback or request new payment methods, so property managers can gain firsthand insights into their current system and any new payment trends.

Upgrade Your Payment Processing With NetSuite Accounting

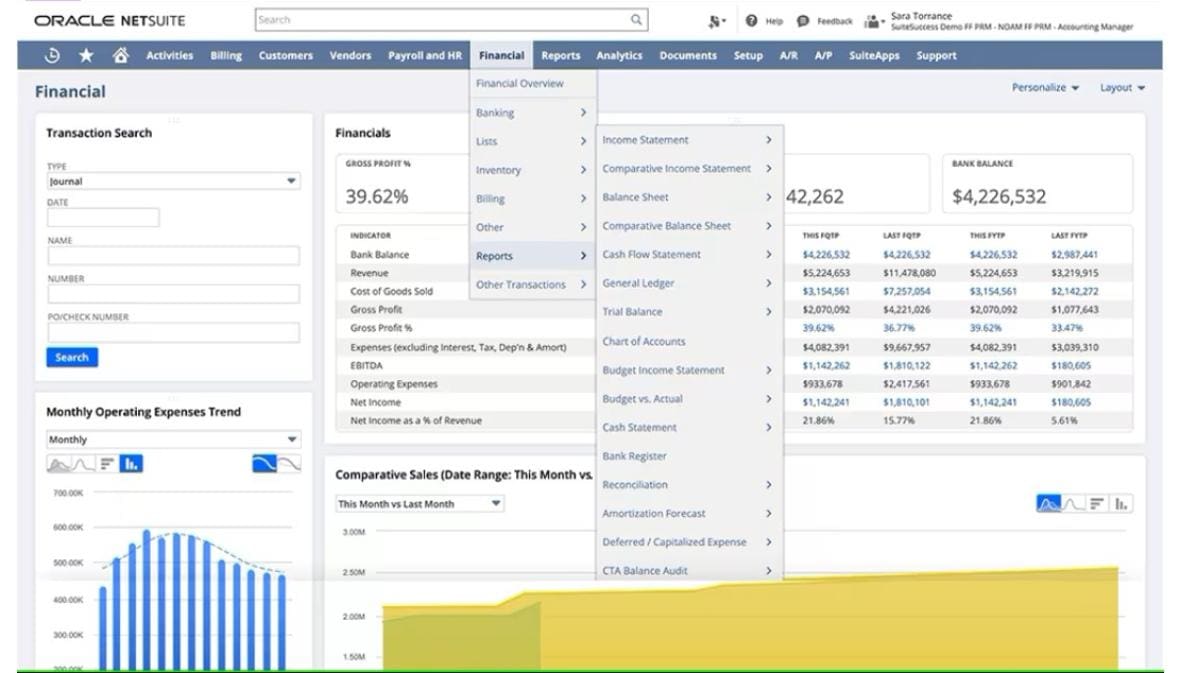

As property management companies grow, managing payment processing across multiple properties becomes increasingly complex and time-consuming. NetSuite cloud accounting solution streamlines payment processing and provides real-time visibility into financial performance. The system’s automated billing and invoicing capabilities help property managers reduce manual data entry and reconciliation tasks, while built-in controls facilitate accurate revenue recognition and compliance with accounting standards. Features, such as customizable workflows, automated revenue management, and comprehensive audit trails, empower property managers to process payments more efficiently, while maintaining detailed and accurate financial records.

NetSuite’s unified, cloud-based platform integrates accounts receivable, accounts payable, cash management, and fixed assets into a single source that authorized users can access anytime, anywhere. Property managers can then use this data to ensure consistency across the business, generating detailed financial reports quickly and as needed. NetSuite’s comprehensive solution helps property management companies reduce costs, improve cash flow visibility, and make more informed financial decisions without sacrificing tenant satisfaction or convenience.

Property management payment processing has evolved beyond simple rent collection into complex workflows that can significantly impact a property management company’s financial health. From improving cash flow and reducing administrative workloads to enhancing tenant satisfaction, effective payment processing solutions help property managers run more efficient operations while maintaining security, regulatory compliance, and accurate records. By implementing the right combination of payment methods, automation tools, and best practices, companies can create secure and tenant-friendly payment environments that enable them to better position themselves for future growth and expansion. Whether managing a single property or an extensive portfolio, robust payment processing capabilities help property managers focus less on administrative tasks and more on providing quality service to their tenants.

Property Management Payment Processing FAQs

How does payment processing work?

Payment processing involves a series of steps that starts with a tenant making a payment and ends with cleared funds in the property management company’s account. When a tenant initiates a payment, the payment gateway encrypts and verifies the payment before a payment processor coordinates with banks to transfer the funds. The system automatically records these transactions and updates all relevant users and accounts.

How long does it take for payment processing to process?

Depending on the payment method and processor, most processing takes between one and three business days. Some methods, such as credit card payments and ACH transfers, may process faster than traditional methods, such as paper checks. Some modern payment processors offer instant payment verification, even if the actual fund transfer takes several business days to settle. Exceptions, such as holiday or weekend hours, may slow down payment processing.

What are payment processing fees?

Payment processing fees vary by payment method and provider but often include a fixed per-transaction fee plus a percentage of the payment amount. For example, a credit card processor may charge 2.5% of the total amount, plus 25 cents per transaction. However, some processors may charge a flat monthly rate for transactions up to a maximum threshold. Some property managers pass on these fees to tenants as convenience fees, while others absorb them as a cost of doing business. Companies should check local rules and regulations on these fees before establishing policies, as rules can vary.