Nonprofit organizations are central to the fabric of cultural, educational, religious, humanitarian and other mission-driven initiatives in society. Unlike a for-profit entity, which generates product or service revenue streams to create income for its owner, nonprofits primarily rely on donations and grants to fund their cause. They have no owners and aren’t allowed to make profits, so they reinvest leftover funds, if any. Because nonprofits have specific transparency requirements, nonprofit accountants must use a special approach to recording and reporting revenue and expenses, known as “fund accounting.”

Understanding these special accounting rules can help nonprofit organizations stay focused on their goals and adjust their fundraising, programming and long-term investments in ways that make the most of their donor funding — and keep their mission alive.

What Is Nonprofit Accounting?

Nonprofit accounting is a unique form of accounting used by charitable and mission-driven nonprofit organizations. Recording transactions from funding sources, such as donations, memberships and grants, requires reporting with transparency that lets donors and board members see how the money is being used toward the programs and purposes the givers intended. Donations may be restricted or unrestricted, based on the donor’s interest or relationship to the organization.

For example, a local company might give money to help buy a new refrigerator for a food bank as part of a special fundraising campaign; those are restricted funds, because the intent is specified. But a former volunteer might send a check to the same food bank at the end of the year to be used where needed; that is an example of unrestricted funds. Nonprofit fund accounting requires that the food bank create a separate account for funds from the refrigerator donation to track all the expenses related to acquiring and installing the refrigerator. In this way, nonprofit accounting rules help organizations correctly allocate their donations so that they can achieve their missions and grow, while providing confidence to donors that their gifts are being used as intended and the impact of their contributions is being maximized.

In the U.S., nonprofit accounting guidance is established by the Financial Accounting Standards Board (FASB) and follows Generally Accepted Accounting Principles (GAAP) — including a subset specific to fund accounting — to prepare financial statements required for reporting to board members and donors.

Nonprofit Accounting vs. Bookkeeping

In a nonprofit organization, accounting and bookkeeping functions are similar to those in for-profit companies but require additional recordkeeping and reporting based on unique nonprofit rules. For example, day-to-day expenses, payroll and deposits are tracked by the bookkeeping function, as they are in for-profit organizations; but, in nonprofits, these costs must be allocated to specific areas, or “funds.” Due to the complexity that can arise from fund accounting, nonprofit professional associations, such as the U.S.’s National Council of Nonprofits, encourage organizations to use reliable accounting software to provide better controls and accuracy.

Nonprofit accounting professionals use the transactional data recorded by bookkeepers to generate internal reports and assemble external documents, including tax forms and financial statements, for the government and for donors. They do so following GAAP’s specific accounting rules for nonprofits. These reporting documents allow the board of directors to evaluate the organization’s progress and make decisions regarding fundraising, funds allocation and expense reduction.

Comparing Nonprofit Accounting and Bookkeeping Responsibilities

| Nonprofit Bookkeeping | Nonprofit Accounting |

|---|---|

| Enters data | Verifies entries |

| Records donations | Interprets decisions |

| Manages payroll | Generates reports |

| Writes checks/executes electronic payments | Conducts internal audits |

| Matches invoices | Files IRS forms |

| Oversees GAAP and internal controls |

Key Takeaways

- Nonprofit accounting is a specific form of accounting unique to mission-driven organizations.

- Nonprofit accounting uses GAAP rules for fund accounting, which is not used by for-profit businesses.

- Accounting statements and reports required for nonprofit compliance provide information that internal managers and external stakeholders can use to analyze the organization’s operational efficiency and its adherence to its mission/goals.

- Nonprofit accounting ensures financial transparency and accountability, which helps build confidence among donors regarding the execution of an organization’s mission.

Nonprofit Accounting Explained

Nonprofit organizations have specific accounting requirements for tracking donations and expenses, known as fund accounting. Under fund accounting, money from different sources, such as donations, memberships, grants or investment revenues, is separated into different accounts, or funds, based on its intended use. Then, expenses are tracked and reported separately, by fund, so stakeholders — especially donors — can verify that the nonprofit is adhering to the restrictions established by donors or its own mission.

For example, a university may establish a scholarship fund specifically to support student nurses. Donations for this are considered restricted funds, meaning that they can be used only for the stated purpose. Conversely, the cash in a donation box at the entrance to a museum is considered to be unrestricted funds — in other words, the donation is meant to support the organization as a whole.

For nonprofits, communicating clearly how donations are used is especially important. Nonprofit accountants generate financial statements that demonstrate how their organizations are using their resources and that inform the decision-making of their own boards of directors and of major donors. This financial overview of the way an organization achieves its mission helps leaders determine whether and where adjustments are needed and provides the necessary transparency and accountability donors expect.

Main Differences: Nonprofit vs. For-Profit Accounting

Nonprofit accounting is a type of accounting that differs from others in specific ways. First, nonprofits are just that: They use all their revenues to achieve their mission. For-profit companies may reinvest some profits into growth, but their missions usually are to distribute profits to shareholders or owners. Nonprofits have no owners.

Accountability to donors is a key tenet of nonprofit accounting, and all monies received are recognized and organized into separate funds, or accounts, related to donor intent. This is where the biggest difference between nonprofit and for-profit accounting comes in: A nonprofit’s financial statements must align expenses with donations in order to show that the organization’s use of funds from restricted gifts conforms with donors’ intent. Funds are recognized as assets of the organization, and the nonprofit will show its net assets as the money left over after expenses are subtracted. Also, because nonprofits are generally not taxed, their financial statements must be prepared in accordance with state and federal tax-exempt requirements.

Despite the differences, however, some nonprofit organizations have furthered their mission by applying for-profit business approaches. For example, MANA Nutrition, which produces a nutrient-rich, ready-to-use therapeutic food (RUTF) used to treat severe acute malnutrition in children, is internally structured more like a profit-making entity than a nonprofit — but it reaffirms its pledge to produce GAAP-compliant external reporting.

Nonprofit and For-Profit Main Differences

|

For-profit entities |

Nonprofit entities |

|

|---|---|---|

|

Ownership |

Shareholders/Partners/Entrepreneurs |

None |

|

Primary mission |

Generate profits |

Provide a service/benefit to society |

|

Types |

Public/private corporation or sole proprietorship |

Humanitarian, educational, religious, clubs, etc. |

|

Guiding financial statements |

Balance Sheet, Income Statement, Statement of Cash Flows, Statement of Shareholder’s Equity |

Statement of Financial Position, Statement of Activities, Statement of Functional Expenses, Cash Flow Statement |

|

Net worth measure |

Shareholder equity |

Net assets |

|

Funding |

Revenue |

Donations, with or without donor restrictions |

|

Revenue examples |

Sales of goods or services |

Donations, memberships, grants, savings or investment income |

|

Expense categories |

Operating, nonoperating |

Overhead, programming, fundraising |

|

IRS Form 990 (except churches, which are exempt) |

Nonprofit Accounting Statements

Nonprofits typically produce four standard accounting statements to track and analyze their financial position. The four documents are:

- The Statement of Financial Position, which is similar to a for-profit balance sheet but shows assets instead of profit.

- The Statement of Activities, which is akin to a for-profit income statement but emphasizes reporting revenue and expenses rather than profit and loss.

- The Statement of Cash Flows, which shows money flowing in and out of various accounts.

- The Statement of Functional Expenses, which is a deeper dive into three areas of expenses: program, general and management and fundraising. It may be optional, depending on the organization.

Together, these financial statements enable nonprofit organizations to evaluate their monthly cash positions, prepare for IRS filings or support internal audits. Managers and boards use them to analyze the health of the organization. Key indicators, such as year-over-year donation growth, membership retention and clients served, can highlight whether the nonprofit is executing its mission, whether procedures are being followed and whether changes are needed to achieve the goals laid out in the organization’s strategic plan. Should marketing be ramped up? Should expenses be trimmed? The statements also enhance donor trust by providing visibility into how contributions are stewarded.

Nonprofit Budgets

Before any financial statements are prepared, however, there needs to be a budget in place to lay the groundwork. The budget for a nonprofit should be viewed as a guide, since donation and funding levels vary and adjustments to activities may be necessary.

Just like the budget for any organization, a nonprofit’s budget is a planning tool for the year ahead that predicts revenues and expenses — but the uncertainty of donations requires a nonprofit to start from scratch every year, unless it has multiyear endowments. Historical data around fundraising, expenses and programming costs can still be used to inform budget estimates, though. Having the ability to access actual, real-time information is helpful for the organization, so it can monitor donation levels and make operational decisions.

Nonprofits might also have other types of budgets, based on how the organization operates. Capital budgets, for example, can help when planning for growth and the upgrading of infrastructure for the long term. Program budgets, often tied to grants, are necessary when reporting to the granting agency, and they typically require detailed line items of expenditures before funding can be secured.

Whatever the type, nonprofit leaders should be sure to review budgets frequently.

Statement of Financial Position

A nonprofit’s Statement of Financial Position is used in place of the for-profit balance sheet. Nonprofit accounting tracks the assets and liabilities of the organization just as in a for-profit business, except that assets minus liabilities do not equal equity. Instead, since there are no owners — and, therefore, no distribution of profit and retained earnings as presented in a for-profit balance sheet — the remainder is known as net assets. The simple equation for the statement of financial position is: Assets – Liabilities = Net Assets.

For a nonprofit, assets are things it owns, such as historical artifacts in a museum collection, a vehicle used to deliver meals, office furniture, computers, cash in the bank. Nonprofits have liabilities in the form of payroll, utility bills and outstanding invoices. The net assets of a nonprofit refer to the accumulated value or holdings remaining after all the liabilities have been met. The Statement of Financial Position is a “point in time” image and is considered one of the essential nonprofit accounting statements for assessing nonprofit health.

Statement of Activities

The Statement of Activities is akin to a for-profit business’s income statement. All monies are meant to be used toward the nonprofit’s mission. This document displays how much money was received and how it was spent, using fund accounting. Nonprofit boards typically review the Statement of Activities on a monthly, quarterly and yearly basis. Stakeholders and donors can view the Statement of Activities to see how their contributions are being used.

As of a 2016 update to FASB’s nonprofit rules, there are two categories for listing funds received by nonprofits: unrestricted funds and funds restricted by donors. Unrestricted funds are donations made with “no strings attached,” to be used toward overhead, programming or any other general need. Restricted funds, which might include permanently and temporarily restricted funds, are meant for specific purposes, such as a scholarship or capital improvement.

Typically, organizations recognize donations, grants, memberships and other sources of funding in the revenue column, then record programming and administrative costs in the expense column, broken out by program or fund. Revenue categories could be sponsorships, cultural grants or a donation box, and expenses for specific programs might be equipment rental, food or printing. These costs are shown by fund, or program, so donors can be assured that their intentions are being met. In addition to showing how donations/funds were used, the Statement of Activities will show if the nonprofit is running at a deficit or at a surplus.

Statement of Functional Expenses

The Statement of Functional Expenses is unique to nonprofits. It’s a further breakdown of expenses in certain categories that expands on information in the Statement of Activities. Expenses usually cover three areas: administrative costs, such as rent, payroll and utilities; program expenses, such as tours, collections or outreach activities; and fundraising expenses.

To facilitate reporting within these categories, nonprofits use a detailed chart of accounts, just like any other business. The Statement of Functional Expenses allows for clear disclosure of how a nonprofit is distributing its expenses among different functional areas, providing transparency for donors and charitable rating agencies.

Cash Flow Statement

Like any Statement of Cash Flows, a nonprofit’s record shows how monies are coming in and going out of the organization. Understanding historical cash flow helps a nonprofit forecast whether it must spread out future spending or ramp up fundraising to smooth out any spikes or deficits in cash on hand over time. The statement divides cash flows into three categories: operating, financing and investing. Nonprofit organizations may use the direct method or the indirect method to prepare a cash flow statement, based on their size and complexity. The direct method builds cash flow statements from the ground up, by recording all transactions in which cash comes into or goes out of the organization, and is preferred by FASB. The indirect method, part of accrual-basis accounting and used by larger nonprofits, starts with the nonprofit’s deficit or surplus from the Statement of Activities and adds or subtracts non-cash changes during the period to determine the implied cash flow.

Nonprofit Accounting Compliance Requirements

As already discussed, nonprofits must adhere to GAAP requirements and its fund accounting rules for recording donations and expenses. To comply, they produce the four financial statements described in the preceding section. But nonprofits also receive special tax-exempt treatment from the IRS and, therefore, are required to provide additional information to the IRS and state authorities.

IRS Form 990

For most nonprofits, filing IRS Form 990 is an annual requirement. Organizations that are tax-exempt must file a Form 990 with the IRS if they receive more than $200,000 in revenue or have more than $500,000 in assets. Smaller nonprofits can fill out a Form 990-EZ. Form 990 collects information about the organization, such as its mission, goals achieved and finances, to be sure the nonprofit is still performing in accordance with its special status. Form 990 relies on the nonprofit’s financial statements as the source of its information.

It’s important for nonprofit accounting professionals to stay up to speed on filing requirements and submit documents in a timely manner. This helps avoid penalties and keeps the organization in tax compliance. Further, IRS Form 990 is a core document that charitable rating organizations use to evaluate the health of nonprofits, and it provides a critical transparency and accountability resource for board members and donors. Certain political and religious organizations are exempt from filing Form 990.

State Reporting Requirements

Nonprofits also may need to comply with state reporting requirements. A nonprofit must meet all informational registration and filing requirements for its state to ensure that the organization stays in good standing. Failure to comply with proper reporting can result in penalties and loss of nonprofit status. Nonprofits are usually required to provide states with a copy of Form 990 or an equivalent. Virginia and North Carolina, for example, accept audited financial statements, whereas North Dakota requires an annual report, so requirements do vary. It’s best to check your own state requirements to be sure of what is needed.

Donor Management in Nonprofits

Nonprofits rely on donors to fund their mission, so attracting and retaining donors typically is a key goal. Not only is it important to reach donors who share the vision of the nonprofit, but each donor needs to be acknowledged, thanked and encouraged to continue supporting the goals of the charity. And for major donors, financial reporting and accountability are crucial. Tracking donor details and their giving history from “pledge to payment” can help a nonprofit tailor its fundraising activities and outreach.

Some nonprofits supplement their accounting solutions with customer relationship management (CRM) software to interact their contributors and communicate with recipient organizations. One is Good360, which collects donated goods — e.g., apparel, furniture, computers, toys and office products — and distributes them to charitable organizations, such as shelters, schools and foster care programs.

Importance of Nonprofit Donor Management

Cultivating donor relationships, keeping them informed of activities and engaging them in ways that keep them committed to the mission is crucial to sustaining nonprofit financial health. And tracking donor data as part of fundraising activities is central to supporting donor cultivation because it illuminates the donor’s relationship to the nonprofit, and their funding preferences, and helps the organization track whether the donations come with or without restrictions. Automating the collection of that data so that it is reliable and consistent can later simplify reporting and accountability requirements, taking the stress of manual processes off the shoulders of volunteers and staff.

Types of Donors

Nonprofits derive funding from multiple types of donors, each with their own motives, personal connections and resources. Capturing the attention of a variety of donors can help increase sustainability and funding, in alignment with the long-term goals of the organization. In general, donor categories include:

- Individual: One-time or annual givers with whom the organization’s mission resonates.

- Major: Large givers who are typically cultivated over time and who may be personally connected with board members or founders or who simply share a passion for the cause.

- Corporate: Donations that come from companies that sometimes expect something in return, such as marketing consideration, or that give as part of a social responsibility program.

- Foundation/government: These donations usually come in the form of grants for a specific purpose, such as programming for underserved populations.

- In-kind: In addition to money, donors can make in-kind contributions of goods, services, time or expertise.

Accounting Strategies for Donor Management

Nonprofit accounting strategies should support donor confidence. For example:

- Maintain transparent financial records. Providing individual donors or granting authorities access to financials that show a rigorous commitment to accountability will enhance credibility and provide assurances donors need.

- Separate restricted/unrestricted funds. Donors want to know that the funding they’ve provided for a specific initiative is being used as intended. Recording program by program how resources are used is essential and allocating costs across the organization’s different programs is crucial.

- Optimize overhead expenses. Enable donors to see that administrative and overhead expenses are optimized and that the majority of their donation is used to positively impact the cause.

- Implement strong controls and external audits. Build trust with independent auditors and well-documented internal controls.

Importance of Donor Retention

For any nonprofit, retaining donors is key to keeping revenue predictable and fundraising expenses manageable. Involving donors in the mission, whether through frequent updates or onsite events, can yield recurring contributions. Thanking donors as personally as possible shows a real connection between their funding and those carrying out the mission. Special perks for donors can encourage return engagement. Tracking contributions by donor can reveal trends or campaigns that were particularly effective. Building relationships and trust to cultivate consistent donations can go a long way toward hitting fundraising goals in a given year.

Nonprofit Accounting Best Practices

Because of the strict GAAP and IRS reporting rules that nonprofits must adhere to, it’s crucial for nonprofits to follow accounting best practices. Moreover, using best practices also helps reassure board members and donors alike that the mission of the nonprofit is being carried out in the most transparent and accountable manner possible. Using fund accounting to segregate revenues and expenses, creating a budget, having a strategic plan and implementing internal controls that provide checks, balances and audit controls will provide access to data that helps conscientious nonprofits thrive. Nonprofit accounting experts agree that capturing financial details in a software system specifically designed for the unique needs of nonprofits can speed reporting and analysis for all parties involved.

All Nonprofits Have Overhead

No matter what the mission may be, it costs money for a nonprofit to achieve its objectives. Fundraising, general and administrative costs and program costs are all considered overhead and are reported on IRS Form 990. Watching overhead costs closely is a fiscally responsible activity. In fact, many donors make their funding decisions based on how much is spent on overhead. But nonprofits face a kind of catch-22: If overhead costs are constrained too tightly, that constraint could inhibit a nonprofit’s future growth. So, an important overhead practice is to communicate the reasoning behind expenditures and describe how they are tied to the nonprofit’s goals, allowing board members and donors to reap the insights necessary to accept those expenditures. A related practice is to emphasize “impact” as the key measure of how the organization is achieving its mission, so that stakeholders can go beyond using an overhead ratio as a metric of performance.

Check In With the Budget Regularly

It’s a good practice for nonprofits to regularly review how actuals compare to the budget forecast to see how things are progressing with regard to anticipated donations, other sources of funding and expenses. Using historical data for the budget, then updating with actuals, provides a picture for the board of where the organization is at any point in time relative to original estimates. Course correction could then be managed more efficiently, if a planned grant does not come through or a creative fundraising campaign yields more (or less) funds than expected. Access to real-time actuals is especially helpful when donations don’t materialize as expected.

Create a Long-Term Strategic Plan

Though budgets are indispensable for short-term planning, a long-range strategic plan that looks out three to five years can help position the activities of the organization to achieve sustainability and growth. For example, a nonprofit may be outgrowing its space and need to move to a larger building. Setting a capital plan that includes fundraising, staffing and outreach to donors can shape action plans that will keep the day-to-day activities moving toward the larger goal of a new home for the organization. It is important for the long-term strategic plan to be monitored for possible societal and environmental factors. Nonprofit boards should continually review the plan and use it to evaluate the organization’s strengths, vulnerabilities, opportunities and challenges.

Implement Checks and Balances Internally

Implementing a system of checks and balances is imperative for a nonprofit’s financial accountability. Not only do internal controls help prevent and detect theft or fraud, but they also reduce costly mistakes, improving financial accuracy. Simple steps, such as locking the cash drawer, segregating duties (for example, of writing and depositing of checks), securing computer passwords and regularly conducting asset inventories, can go a long way toward protecting the organization.

Audit Finances Regularly

Auditing the financial health of the charity, making sure that internal controls are being followed and examining the financial statements are all parts of making sure that the fiscal side of a nonprofit’s house is up to snuff. Preparation for an audit is less stressful when the organization has good record-keeping and strong financial practices. Nonprofits can minimize the strain of an audit by using accounting software designed for nonprofits to speed reporting and assist in the preparation of reports. Nonprofits want to avoid the “receipts in a shoebox” scenario.

Audits can also help provide required documentation for grants and state and federal funders, as well as for compliance with the organization’s own bylaws. Audits can be a way to share information about the operation with other funders, as well. Using an audit as an opportunity to explain details about how the nonprofit’s goals are being achieved can help improve buy-in from large donors.

Use Nonprofit Accounting Software

The unique accounting requirements of nonprofit organizations are not a fit for general-purpose accounting software. Using purpose-built nonprofit accounting software can be a game changer for charitable organizations, both for day-to-day revenue and expense tracking and for preparation of the financial statements required for compliance. For example, nonprofit accounting software should automatically track the expenses related to each restricted gift and report on them all separately. Shifting cumbersome accounting tasks to such an automated system can position a small or large organization for growth. It supports the nonprofit operation with improved workflows, reduced mistakes, increased transparency and quick access to the financial statements necessary for nonprofit compliance.

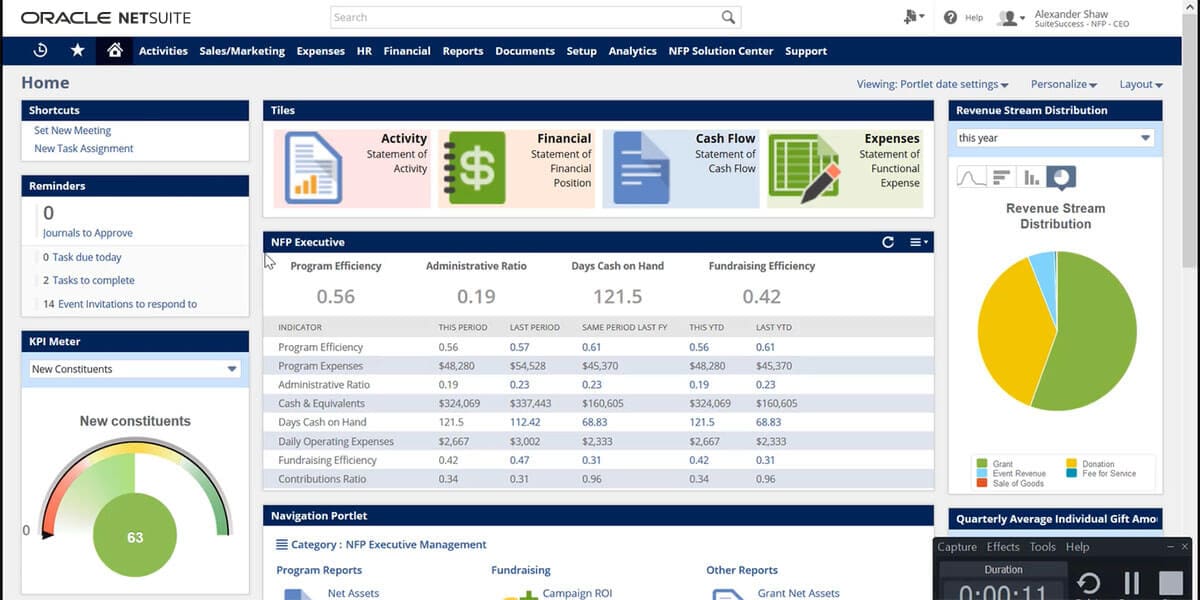

Easily Manage Your Nonprofit Accounting in NetSuite

Nonprofit and auditing professionals strongly encourage managing nonprofit core accounting tasks using an automated system. From setting up fund accounting through a flexible and multidimensional chart of accounts to generating required statements and providing internal controls and audit trails, implementing a solution like NetSuite for Nonprofits helps boost efficiency by automating required processes. With NetSuite, nonprofit management teams have access to real-time data and analytics that can help them keep the organization on course. And NetSuite’s cloud accounting software for nonprofits generates GAAP-compliant financial reports. Further, when it comes to donor management, NetSuite accounting for nonprofits integrates seamlessly with NetSuite’s CRM module, providing nonprofits a way to see a complete 360-degree picture of their donation ecosystem and more effectively communicate with donors and potential donors.

Nonprofit accounting is a specialized form of accounting and an essential part of nonprofit management that offers financial visibility to the leaders of mission-driven organizations and provides confidence to donors. The financial transparency that nonprofit accounting creates helps inspire donor engagement by demonstrating the direct impact of their philanthropy on a nonprofit’s stated mission. Nonprofit-specific accounting software can simplify the generation of key financial statements and reports that inform leadership of the financial position of their cause, support the requirements of state and federal regulatory authorities and provide donors with the accountability they seek.

Nonprofit Accounting FAQs

How do you do bookkeeping for a nonprofit?

Bookkeeping for a nonprofit must follow guidelines unique to the special nonprofit status and tax-exempt classification that mission-guided charitable organizations receive. Recording transactions using a chart of funds (similar to a chart of accounts), carefully following internal controls and capturing revenue in both unrestricted or restricted categories based on the intent of the donor are all foundational to nonprofit bookkeeping. Nonprofit bookkeeping provides the transactional support for the reporting that nonprofit accounting generates.

How is nonprofit accounting different than for-profit accounting?

Nonprofit accounting focuses on how the resources of the organization are used to achieve its mission, rather than reporting on profits for shareholders or owners as in a for-profit company. Nonprofits use fund accounting to show donors that their contributions are being used as the donors intended, whether for a specific use or for general support. And nonprofit accounting views donations (i.e., revenue) minus expenses as equal to the net assets available for current or future use, whereas for-profit accounting views revenue minus expenses as net income available to distribute to shareholders.

Do nonprofits have to follow GAAP?

In general, yes. Smaller nonprofits may use cash-basis accounting, which does not have to be GAAP-compliant. But as a practical matter, most nonprofits must comply with GAAP to be eligible for various grants and other funding sources, to satisfy to their state’s requirements, for auditing or simply as a matter of fostering public and donor trust.

What kind of accounting do nonprofits use?

Nonprofits use fund accounting to organize and allocate their money in accordance with the programs and activities the money was donated to support. Nonprofits can use either accrual- or cash-basis accounting to track the finances of their operation. Typically, larger organizations use the accrual method, as it is GAAP-compliant and aligns with the structure of fund accounting, a method in which costs and donations are designated for a specific use. Small organizations often use a cash-based system, which is less complex. In either case, using nonprofit-specific accounting software for capturing financial information and generating reports is considered an industry best practice.

What do nonprofit accountants do?

Nonprofit accountants prepare reports and analyze the required financial statements for charitable, tax-exempt organizations. Utilizing financial details of the organization, the nonprofit accountant prepares the required reports, tax filings and disclosures necessary for the board of directors, donors and government agencies to make decisions and determine if the nonprofit is or is not on track in fulfilling its stated mission.

What is fund accounting and why is it important for nonprofit organizations?

Nonprofit organizations, large or small, are required to set up a system of accounting for revenue and expenses called fund accounting. Fund accounting organizes and tracks nonprofit monies by allocating revenue and costs to different programs and activities. Fund accounting provides the necessary visibility internally and externally to show donors that dollars are being spent on the activities that donors intended.

How do you set up a fund accounting system for a nonprofit organization?

Setting up a fund accounting system for a nonprofit organization consists of creating separate funds (aka accounts) for the various programs and outreach efforts of the organization. Fund accounting provides tracking for nonprofits to reflect funds donated or granted, with and without restrictions. Using a chart of accounts, categories of expenses and revenues are established and donations or grants that may cover one or more categories can be allocated accordingly. Professional organizations strongly recommend that nonprofits use an accounting software system specific to nonprofit needs to keep accurate records and generate reports unique to nonprofits.

What are some examples of internal controls for nonprofit organizations?

Nonprofits can implement a variety of internal controls to avert mistakes or fraud, such as segregation of duties for cash management responsibilities, locking cash drawers and securing passwords. Routine financial report reviews and periodic internal audits can help detect errors. Setting up financial policies and procedures will keep the operation focused on its mission and keep corrective actions to a minimum.

What are the best practices for implementing and maintaining internal controls for nonprofit organizations?

At a minimum, implementing and maintaining internal controls for nonprofit organizations includes board oversight of financial procedures. Safeguarding assets of the nonprofit, such as cash donations, is a primary concern. Establishing controls for check signing, expense reimbursement, reconciliation of bank statements and accurate recording of donations is critical for preventing costly mistakes or theft. Directors or volunteers can spread out responsibilities and segregate duties across the organization, using cross-checks to catch errors before they become problems. Additional controls may be necessary in some cases, such as rules for handling donated art objects, implementing security protocols and oversight of the group’s technology infrastructure.

How can nonprofit organizations ensure financial transparency and accountability?

Nonprofit organizations, no matter the size, can ensure financial transparency and accountability through implementation of a system of checks and balances, frequent budget reviews and internal audits. Preparing nonprofit accounting statements for decision-makers and donors inspires confidence and reassures the public that the mission is on track.

What are the risks of poor nonprofit accounting practices?

The risks of poor nonprofit accounting practices go right to the core of the nonprofit’s mission. Nonprofit accounting practices must produce financials that give donors and regulatory agencies visibility and confidence that the nonprofit’s mission is being carried out and that assets are being used in accordance with their intended purposes. Risks of poor nonprofit accounting practices include loss of assets, loss of funding, penalties and loss of tax-exempt status.

How can nonprofit organizations ensure financial sustainability through effective accounting practices? Nonprofit financial sustainability is never a guarantee, but effective accounting practices can make a difference. Setting and revising budgets, evaluating cash flows, maintaining a strong donor base and consistently sticking to the mission can help decision-makers navigate an unpredictable funding stream and position the organization with reserves to help them get through tough times.

What are the emerging trends in nonprofit accounting and how can organizations stay up to date with them?

Nonprofits are increasingly emphasizing sustainability, donor retention, automation, efficiency, investing and diversifying to increase reserves. As budgets get tighter, leaning on volunteers to help with operational tasks helps ease payroll burdens and pulls donors closer by involving them in the day-to-day activities of the organization. Using an integrated software solution to streamline operational efficiency in the wake of employment challenges is another trend. And evaluating cash reserves to see if an investment strategy makes sense is another way nonprofits are looking to ensure sustainability.