If you’re struggling to understand the difference between “fixed prices” and plain-old “prices,” you’re not alone. The difference often comes down to a nuance in which time plays the key role — if two businesses sign a contract that sets a nonnegotiable price for a certain period of time, that’s a fixed price. An online ride-sharing marketplace’s prices, on the other hand, are anything but fixed: They generally fluctuate in real time based on momentary changes in demand.

In today’s fast-paced, competitive business world, where pricing is key, many business managers must decide whether to fix prices or allow them to rise and fall based on external forces, such as supply and demand. To help managers choose, this article explains the different types of fixed prices, how they work and the benefits and challenges they create.

What Is Fixed Price?

A fixed price is one that does not vary in response to external factors and cannot be reduced through bargaining. Fixed price does not mean the price can never change; it simply means it does not fluctuate. Some prices may be fixed for only a specified period of time, after which they become variable: An excellent example of this is a credit card with an introductory 0% interest rate lasting a year, after which the rate becomes variable in accordance with the standard credit card account terms and conditions. Contracts that allow for prices to be fixed for a certain time and then adjusted periodically are still called fixed-price contracts.

Key Takeaways

- Fixed prices create cash flow certainty for businesses and customers.

- Setting fixed prices involves careful consideration of costs, desirable profit margins, customer demand and competition.

- Fixed-price contracts can permit periodic price adjustments, and/or can set a ceiling or target price.

- Benefits of fixed prices can include customer satisfaction, ease of accounting and higher sales.

- Challenges of fixed prices can include cost overruns, falling real profits in times of inflation, and exposure to volatile supplier prices.

Fixed Prices Explained

Most business pricing strategies fall into two broad buckets: fixed and variable.

When the price is fixed, buyers pay the same price per unit regardless of the quantity purchased, the time taken to deliver it or the cost of producing it. Some fixed-price contracts permit the price to be adjusted periodically, or they might set fixed prices for components, such as labor and materials, rather than a total price.

Perhaps the most familiar type of fixed price is that exemplified by the price of goods in a retail shop. Retailers may discount a price to attract sales, but that new price, once advertised, is the price the customer will expect to pay. In most Western countries, prices in retail shops cannot generally be reduced through bargaining. However, in informal settings, such as street markets, retail prices customarily vary as customers bargain them down and vendors offer discounts for larger quantities or to sell off remaining stock at the end of the day.

When setting prices, businesses need to consider their costs, their desired profit margin and competitors’ pricing. At its most basic, a fixed price must cover the business’s cost of sales and generate sufficient operating profit to pay overheads, interest and taxes. Too low a price may generate more sales, but this can come at the expense of profits, especially if competitors respond by also cutting prices. However, deliberately setting a fixed price for a limited time that does not fully cover costs can kick-start sales of a new product or service — this is known as “loss leading.”

Conversely, setting too high a fixed price can flatter the business’s profit margin in the short term but may drive away customers, especially in a highly competitive marketplace. To retain customers, businesses that set high fixed prices relative to the competition must demonstrate that their product or service is superior. In markets for luxury, unique or distinctive goods, high fixed prices can themselves signal superiority; pricing strategies for these goods can be based on what the customer expects to pay, rather than on production cost or time and materials.

Variable prices change with quantity, time, cost or customer demand. This kind of pricing can protect businesses from losses if costs rise, but the uncertainty that variable prices create for customers can make products more challenging to market.

Fixed Price Types

In addition to pricing found in retail shops, types of fixed prices include the fixed-price leg of an interest rate or currency swap, and fixed-price contracts.

Swaps

Businesses concerned about lowering their exposure to risk associated with volatile interest rates or foreign currency exchange rates are familiar with swaps. Although market investors may use swaps to try to make a profit by betting on the direction of future interest or currency rates, businesses use them to hedge against adverse rate changes.

An interest rate swap typically consists of a fixed-price leg and a floating-price leg. The fixed-price leg is an agreed-to, unchanging interest rate, while the interest rate on the floating-price leg varies with a benchmark rate, such as the London Interbank Offered Rate (LIBOR) or its replacement, the Secured Overnight Financing Rate (SOFR). The parties to a swap agree to exchange the cash flows from loans at the fixed and floating rates. For example, imagine a commercial bank has a portfolio of 10-year fixed-rate loans that it is funding by borrowing overnight at SOFR plus a few basis points (fractions of a percent). If SOFR rises, its profit from the loans will fall. To mitigate this risk, it enters into an interest rate swap with an investment bank. The commercial bank exchanges the fixed-rate cash flows from its loans for cash flows from the investment bank at SOFR plus a margin. The commercial bank is now protected against loss of profits due to changes in SOFR.

A currency swap exchanges the principal and interest cash flows on a loan in one currency for equivalent cash flows in another currency. It’s usual for both legs of a currency swap to have fixed interest rates. Typically, the businesses that are parties to this type of swap are seeking to hedge currency exchange-rate risk or speculate on currency exchange-rate movements, rather than to eliminate or speculate on interest rate risk.

Fixed-Price Contracts

A fixed-price contract is a commitment to deliver goods and/or services at an agreed-upon price. If the price is established up front and cannot change, this is known as “firm fixed price.” Firm fixed prices create cash flow certainty for businesses and customers and can make products and services easier to market. However, when costs rise, firm fixed prices can mean reduced profits, or even losses. For this reason, some fixed-price contracts set a ceiling or target price, rather than a firm fixed price. Sometimes, a fixed price contract sets a target cost instead. This is called “firm target cost.”

An example of a firm fixed-price contract would be one for installing replacement windows in a building. The supplier visits the property to identify what is required and take measurements and, following this inspection, quotes a price. The customer agrees to the price and pays a deposit, with the balance due on completion. If, during installation, the installer discovers unexpected problems or the customer asks for additional work to be done, the contract can be renegotiated, and a new price determined, or an additional fixed-price contract can be created.

The window-replacement example models a simple fixed-price contract. However, many fixed-price contracts are more complex, especially for riskier projects, such as IT development, where the scope of a project can be uncertain and the time scale long. Such contracts may include clauses to identify liability for problems, limit “scope creep,” permit early termination by either side and specify delivery requirements. They can include performance requirements, with penalty clauses for late delivery or bonuses for early completion. Good project management is particularly important for complex fixed-price contracts to prevent costs rising and ensure that targets are met.

Utilities, such as gas and electricity, may be supplied under fixed-price service contracts to protect buyers from volatility in market prices, but this can mean customers end up under- or overpaying. This type of contract is normally reviewed periodically and the price adjusted as needed to eliminate payment discrepancies.

A term loan at a fixed interest rate is a fixed-price contract. Typically, a regular payment schedule is set at the beginning of the loan so the borrower knows the amounts that must be paid and when they are due. Payments made during the life span of the loan can be interest only, in which case the entire principal must be repaid when the loan expires; or they can include principal repayments calculated to ensure that the principal will have been repaid by the time the loan expires.

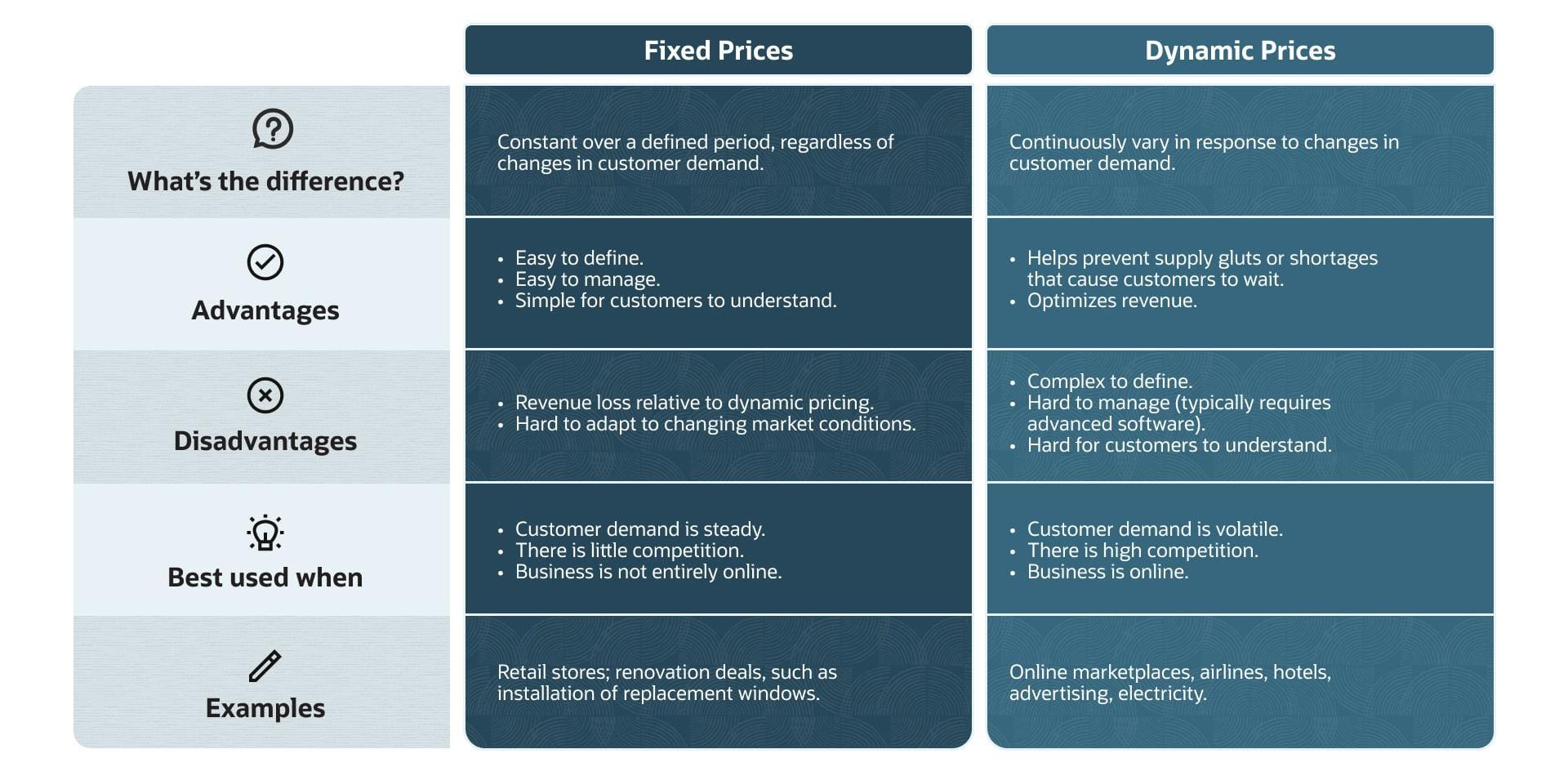

Fixed Pricing vs. Dynamic Pricing

When customer demand is volatile, fixed pricing can result in periodic supply gluts or scarcity, causing customers to wait in line for product availability. Demand or “surge” pricing is a variable-pricing strategy that aims to smooth out volatile customer demand by raising prices when demand is high and cutting them when it’s low. An example lies in the mobile app taxi service Uber, which automatically increases ride charges at times when many people are calling for rides and reduces them as demand falls. By smoothing out demand in this way, dynamic pricing optimizes revenue.

Dynamic pricing is best suited to markets in which customer demand is volatile, competition is fierce and the business has a significant online presence; think of ecommerce marketplaces, airlines and hotels that all use algorithms to process a variety of demand signals and that can adjust prices in real time.

The simplicity and predictability of fixed prices are most effective when customer demand is consistent, competition is low and the business operates partially or entirely offline, as in the case of traditional retail stores or local contractors. But this pricing structure may lead to potential revenue loss (compared to dynamic pricing) if market conditions change suddenly and the fixed price is no longer competitive or fails to capitalize on periods of peak demand. It’s challenging to adapt quickly to changing market conditions with a fixed-pricing model.

Comparison: Fixed vs. Dynamic Pricing

Benefits of Fixed Prices

Fixed prices can’t guarantee cash flow with certainty because demand can always rise or fall, affecting the volume of a product sold, and other factors can intervene. But fixed prices certainly increase cash flow predictability for businesses and their customers. Fixed prices can bring numerous other benefits, too, including:

-

Simplicity and transparency : Fixed prices are simple to understand, and there’s little risk of clauses in the small print triggering sudden price changes farther down the line. For example, customers know that their neighborhood coffee shop’s fixed price for an espresso won’t suddenly rise because of post-lunch demand.

-

Budgeting and financial planning : It’s easier to budget and plan future expenditures if you know the prices charged by suppliers and paid by customers will not be subject to change without warning. A business with a fixed monthly fee for its internet service can accurately forecast its annual internet expense.

-

Reduced complexity in sales process : It can be much easier to close a sale when the customer knows exactly what the cost will be and is confident that there will be no additional costs or price increases. It’s also easier to administer the sales process when complexity is minimized. A car dealership with a no-haggle price policy simplifies the purchase experience for the buyer and streamlines its own sales process.

-

Consumer trust and loyalty : Setting reasonable fixed prices — and not imposing sudden price changes —encourages customer trust, which can generate repeat business and, over time, build a loyal customer base and a good reputation. Streaming video subscription services customarily charge a fixed monthly rate, inspiring subscribers to continue their service without fear of unexpected price hikes.

-

Market positioning : When businesses choose fixed prices, it’s easier to see how their products and services are positioned relative to the competition and whether they’re priced for optimal market share and revenue. A headset manufacturer may deliberately set a fixed price higher than that for budget-minded products but lower than premium brands, effectively communicating a quality-based, value-oriented market position.

-

Ease of marketing and advertising : Pricing psychology shows that it’s easier to market and advertise products and services when you show a price and promise that the price will not change. Consider flat-rate, fixed-price mobile phone contracts promoted through appealing advertisements that make it clear that the price customers see is the price they will pay.

-

Protection against market volatility : Fixed prices, particularly in raw materials and energy, can help smooth out businesses’ cash flow, eliminating the need to impose frequent price changes on customers. A manufacturer, for example, might prefer a long-term contract for steel at a fixed price to protect itself from market swings in steel prices; an airline might extend fixed-price fuel contracts to guard against oil price volatility.

-

Efficiency in operations : When a business knows that its costs and income will not be subjected to sudden swings caused by volatile prices, it will be better able to organize its operations to achieve maximum efficiency. A long-haul trucking company with fixed diesel prices can plan routes and pricing for deliveries, without worrying about fluctuating fuel costs.

-

Customer satisfaction : Customers that understand that prices will not be buffeted by sudden price changes are more likely to feel satisfied with the service provided by the business. For example, consider a home security company offering surveillance and alarm systems for a fixed monthly price that covers initial installation and ongoing monitoring and maintenance. Customers know the cost up front, with no hidden fees or surprise charges; they feel confident because the simple pricing lets them choose among service tiers, without the confusion that variable pricing at each tier would impose; and, knowing that their price won’t increase, they’re motivated to remain loyal for the long term. What’s more, satisfied customers are likely to spread the word by recommending the company to friends and family.

-

Predictable demand : It’s easier to predict demand for a product whose price is fixed, because there are no variable pricing incentives that might alter a customer’s natural demand. Fixed prices also make it easier not only to benchmark prices against the competition’s but also to get better information from customer surveys (because they can explicitly discuss price).

Challenges for Fixed Prices

Despite their many benefits, fixed prices also can create challenges for some businesses and projects. Here are a few of the difficulties that can arise.

-

Managing volatile costs : When a product or service is exposed to sudden swings in input prices due to rapid changes in local or global supply chain conditions, fixed prices for customers can create cash flow difficulties for the business. A variable pricing strategy that links the customer’s price directly to the input prices can smooth out the business’s cash flow. However, passing such input price volatility directly through to customers in that way can be unpopular with the customers.

-

Projects with high levels of uncertainty: When a fixed-price contract is applied to a project with an uncertain scope, time scale or cost, there is a considerable risk that the project will exceed expected parameters and the price will prove too low. A time and materials pricing strategy, in which the unit prices for labor and materials are set at the start but the total price for the project is not determined until completion, can be better for such a project. Rather than agreeing to a fixed price, the client may set a maximum price they are willing to spend.

-

Long-term contracts in times of inflation: When inflation is high, businesses using fixed prices can lose money because customers may end up underpaying for products and services. Long-term fixed-price contracts, such as long-term loans and utility contracts, are particularly at risk. For this reason, many businesses prefer to keep fixed-price projects short and use time and materials or cost-plus pricing for longer term projects. Meanwhile, banks can institute interest rate swaps to hedge the risk from long-term fixed-rate loans. Utilities typically build price adjustment points into long-term contracts, or they might opt for renewable contracts where the price can be adjusted when the contract rolls over.

Manage Your Pricing and Financials Easily in NetSuite

Whatever pricing strategies your business uses, they must be executed effectively to be successful. Whether a company prefers fixed or dynamic pricing, NetSuite’s cloud-based financial management software will have the right tools to manage pricing strategies, optimize pricing and expenses, and improve overall financial performance. NetSuite lets businesses set and evaluate pricing strategies, then monitor sales, revenue and costs to maximize profits. NetSuite can help businesses that use fixed prices carefully plan and budget, ensuring that prices cover costs and that cash flow is stable. For businesses with dynamic pricing models, NetSuite provides the speed and automation necessary to quickly adapt to fluctuating market conditions. Real-time data and insights inform pricing decisions, and automation simplifies financial tasks that boost a company’s ability to change pricing on the fly.

NetSuite’s integration with other business applications, such as order management, inventory, ecommerce and customer relationship management, means that pricing management becomes a seamless part of the business that can be automated to quickly adjust prices based on internal and external triggers. Additionally, as businesses grow and pricing strategies change, NetSuite’s platform scales to support more complex requirements without disruption.

Fixed prices can create cash flow certainty and simplify accounting and marketing for businesses. Meanwhile, for customers, fixed prices help to generate confidence in the business and satisfaction with its products and services. However, fixed pricing comes with risks and challenges that demand careful consideration and management. To navigate these opportunities and risks, businesses must balance the stability that fixed prices provide with operational flexibility to adapt to market changes. By doing so, companies can harness the full potential of fixed pricing to foster long-term customer relationships and sustainable growth.

Fixed Price FAQs

What is an example of a fixed-price system?

A subscription service, such as a gym membership, is a simple example of a fixed-price system. The price is typically fixed for a year and then adjusts to account for any inflation during the year.

What does firm fixed-price mean?

The “firm fixed-price” is the price agreed upon between a supplier and customer in a fixed-price contract. Once agreed, it cannot be changed by either side, though it can sometimes be renegotiated. This type of contract places the maximum risk on the seller, which must cover any additional costs that exceed the agreed-upon price. It is best suited for projects with well-defined scopes where costs can be accurately estimated in advance.

What is an example of a fixed-price method?

A fixed-price method is used when a service provider agrees to deliver a project for a set price, regardless of the actual costs. To illustrate, consider a construction company that agrees to build a small office building for $500,000. This price is fixed and will not change, even if the materials or labor end up costing more than the company initially estimated. This gives the client cost certainty for its budgeting purposes, while the construction company takes on the risk of cost overruns.

What is the fixed amount price?

The fixed amount price is the total value of a fixed-price purchase or contract.