Accounting is at the core of a business’s success or failure. That makes the person who leads the accounting operation equally as important. This senior-level executive, known as the financial controller, is in charge of the company’s financial reporting, record-keeping and day-to-day accounting tasks. Financial controllers make sure work completed by the teams they oversee is accurate and in compliance with myriad accounting regulations. In addition, the controller may play a role in strategic planning, and — depending on the size of the company — may also work with or double as the company’s chief financial officer.

But regardless of the exact job description, the bigger point is this: Life as a financial controller is irrefutably demanding and takes many years to achieve. At the same time, it’s also a prestigious, rewarding and coveted career.

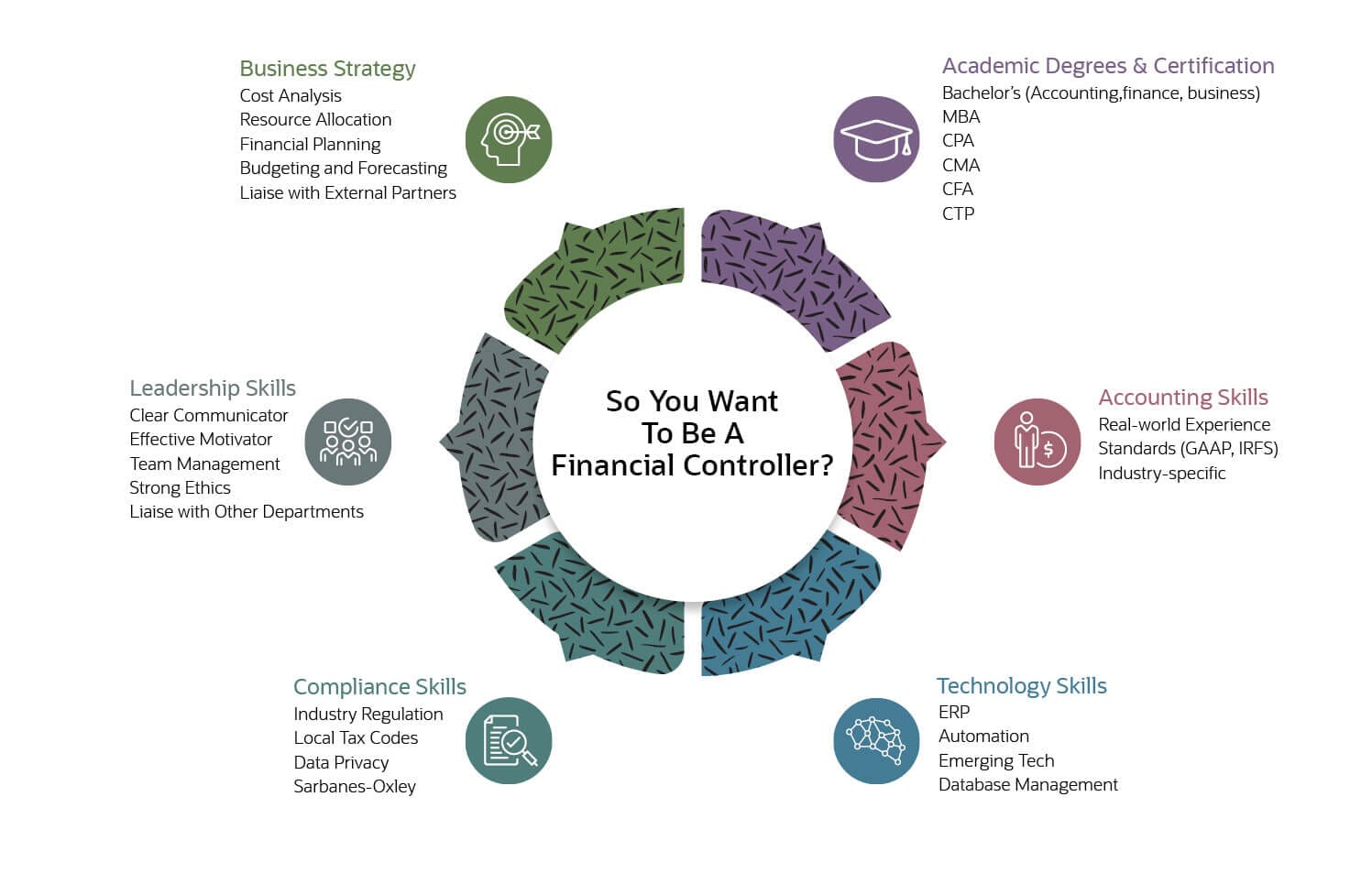

What Skills and Qualifications Should a Financial Controller Have?

A financial controller is the company’s lead accountant. As such, these executives must possess both a deep-rooted knowledge of accounting and business acumen — the kind that comes from years of experience, promotions and unwavering tenacity. Because they liaise with multiple departments and stakeholders inside and outside of the company, controllers must be effective communicators, able to work with different personality types and explain complex concepts so they’re easily understood by colleagues with no accounting or financial training.

Other traits associated with this critical company position include the ability to think strategically, lead teams and delegate work. Strong analytical, problem-solving and organizational skills, a devotion to details and impeccable ethics are also important.

20 Must-Have Controller Skills & Qualifications

For anyone contemplating a career as a financial controller, the good news is that opportunities are on the rise, with the role spanning most industries, according to the Bureau of Labor Statistics. Rising to that position, however, requires a mix of hard and soft skills, years of experience and a willingness to work hard in order to advance. Let’s take a closer look at the necessary skills and qualifications.

Academics and certifications.

The right education is a necessary foundation for future financial controllers. Employers also look favorably on continued education.

-

Degree in accounting or related field: A bachelor’s degree in accounting, business or finance is typically required. Hiring companies also prefer that job candidates have a Master of Business Administration (MBA) degree in accounting or a related field.

-

CPA and other post-degree certifications: Acquiring post-degree titles, such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA), while working in the industry can bolster a person’s level of expertise. A CPA can be earned through the American Institute of Certified Public Accountants, while a CMA is offered by the Institute of Management Accountants. Other certifications to consider include Chartered Financial Analyst (CFA), offered by the CFA Institute, and Certified Treasury Professional (CTP), via the Association for Financial Professionals.

Work experience.

The chances of landing a job as a financial controller straight out of college are practically unheard of. Indeed, companies expect — insist, even — that job candidates will have spent a lot of time in the accounting and finance trenches.

-

Five to 15 years’ worth of experience: Most companies expect a financial controller to have as many as 15 years of work experience in accounting or finance. The amount of experience sought often depends on the size of the company, with smaller companies more open to choosing a candidate with less service time than their bigger counterparts.

With relevant work experience comes a deep level of understanding about how an accounting department works, concrete ideas about how to run one efficiently and extensive knowledge of the industry and best practices. Financial controllers often begin their careers as a staff or cost accountant, then are promoted to accounting manager and, next, assistant controller. Time spent at a large public accounting firm, which provides accounting and auditing services to clients, is also advantageous — especially one of the “Big Four” (Deloitte, PricewaterhouseCoopers, Ernst & Young and KPMG).

Accounting.

As leader of the accounting department, a financial controller must demonstrate a complete understanding of the function and its many processes.

-

Traditional accounting knowledge: A financial controller is expected to have hands-on experience in everything accounting entails — often a given, since most who fill this role have risen through the accountant ranks and are CPAs. At larger organizations that also employ a CFO, a financial controller spends a great deal of time on traditional duties, such as closing the company’s books. At smaller organizations where the role of financial controller is combined with that of the CFO, a financial controller also assumes more strategic responsibilities, such as financial planning and analysis.

-

GAAP and IFRS: A financial controller should be thoroughly familiar with the Generally Accepted Accounting Principles (GAAP), which standardize how publicly traded companies in the U.S. report their financial statements. Companies that operate in the European Union and elsewhere abroad follow the International Financial Reporting Standards (IFRS).

-

Industry specifics: Financial controllers should be well-versed in industry- or company-specific accounting requirements. For example, a multinational firm would expect a financial controller candidate to possess a thorough understanding of international tax rules — such as pricing calculations and country-by-country reporting (CbCR) — while a project-based construction company might prefer someone steeped in the accounting nuances of that industry.

Technology.

Technology can work wonders to help a business and its internal departments (including accounting) run efficiently and profitably.

-

ERP systems: A sophisticated enterprise resource planning (ERP) system provides stakeholders with high-level visibility across an entire business and its many departments. For the financial controller, the insight derived from this can lead to more-informed decision-making about financial planning, ways to increase cost efficiencies across the business and better overall management. Within the accounting department specifically, an ERP system can assist with account reconciliation and financial reporting, for example. It also can be used to develop internal controls that ensure data accuracy, pick up on fraud, confirm regulatory compliance and safeguard company resources.

-

Move with the tech times: Technology is constantly advancing, so it’s important for financial controllers to stay on top of what’s available and what’s emerging. The more they can fully grasp how artificial intelligence (AI), machine learning and robotic processing automation, for example, can help their department and the business at large, the more instrumental they can be in managing the company’s finances.

-

Data analysis: Data is the basic building block of accounting and finance. The ability to effectively track and analyze information from across an organization is a crucial financial controller skill — and one that must be developed over many years. These days, a modern ERP can handle heavy-duty calculations and advanced analysis; but it falls on the financial controller to interpret the results’ business implications and use them to inform strategic decisions. Database management is another important skill.

-

Spreadsheets: Even the most brilliant of writers had to learn the alphabet first. Consider spreadsheets the equivalent basis for accountants. Using spreadsheets provides a hands-on, fundamental understanding of all that goes into the preparation of financial reports, statements and analyses.

Regulations and compliance.

Finance and accounting are governed by many outside rules and requirements that, if not followed, can result in costly penalties. The financial controller is responsible for ensuring adherence.

-

Regulatory changes: Accounting and financial regulations change frequently. The financial controller must stay on top of new and evolving rules and communicate them to their teams and to colleagues up the company’s financial ladder. They must also make sure the company’s financial reporting complies with the proper accounting and reporting standards, such as GAAP, in addition to local laws and tax codes and industry-specific regulations.

-

Internal controls: But compliance goes beyond following financial rules. Consider, for example, the growing set of rules surrounding data privacy and protection. A controller might work with the organization’s IT leaders to establish internal controls for managing that data as well.

-

Sarbanes-Oxley: The Sarbanes-Oxley Act (SOX) was passed in 2002, aimed at ensuring the accuracy and reliability of public companies’ financial disclosures. In large organizations, that responsibility belongs to the CFO and an internal audit team; in smaller, growing businesses, where one person is both the financial controller and CFO, that person is directly responsible. Penalties for fraudulent activities can reach millions of dollars and include time in jail for stakeholders.

Leadership.

The financial controller is the main point of contact for the accounting department internally and, in small or growing businesses, externally. As such, a good controller must handle more than numbers and be able to manage people, communicate clearly and act as a leader in both business and interpersonal areas.

-

Strong communication skills: Numbers are cool, but a financial controller needs to be able to turn them clearly into words that explain their meaning and implications to nonfinance-savvy colleagues. Effective communication also works in reverse: Listen to what people are saying. The more open the lines of communication are, the easier it will be to address challenges.

-

Effective manager: Managing teams is a job in itself, and a financial controller oversees many areas, such as accounts payable and receivable, inventory, payroll and tax compliance. Successful financial controllers make the effort to learn their teams’ work preferences and hear their ideas. They also find out what motivates workers in order to maximize their potential, improve productivity and help the business grow.

-

Cool under pressure: Accounting is known for its tight deadlines and elevated stress levels, especially during peak workload times. An effective controller can set the tone with a calm demeanor through pressure-packed deadlines.

Business strategy.

In smaller, growing companies, the role of financial controller extends beyond minding the books to helping the business form and accomplish strategic short- and long-term goals. Top-tier controllers also possess the business acumen to advise fellow executives on how to use their resources more effectively.

-

Data analysis: Data and financial analysis are at the heart of the financial controller role. Traditionally, this has meant analyzing events that have already happened. But used strategically, a financial controller can detect trends, flag potential risks and provide recommendations that guide strategic-planning processes.

-

Cost analysis: Cost analysis can be considered a subset of data analysis. Standard business strategy dictates minimizing expenses while maximizing profits. A talented financial controller finds more cost-efficient ways for a company to work, invest and stay in the budget. The financial controller’s weigh-in on resource allocation represents a big part of this process.

-

Financial planning: Given how intrinsically a financial controller is tied to a company’s finances, it’s clear that the financial controller plays an important role in long-term financial planning decisions. This is all the more so in growing businesses where the roles of controller and CFO are combined.

-

Develop and maintain partnerships: As the face of the company’s accounting department, a financial controller works collaboratively with departmental and company leaders. They may also engage with external partners, such as auditors, to ensure that the proper controls are in place to maintain accounting and tax accuracy, as well as regulatory compliance.

Conclusion

The need for financial controllers is growing, but becoming one takes a solid combination of education, experience and plenty of hard work. Today’s successful financial controller is a senior-level executive who knows how to crunch the numbers, interpret the data, and operate modern financial management software. This position requires strong communication and managerial skills — someone who can move comfortably amid both fancy chairs in the boardroom and the cubicles on the main floor. Depending on the size of the company, a financial controller may also play a key role in technology decisions and strategic planning.

#1 Cloud

Accounting Software

Financial Controller FAQs

What are the skills of a controller?

A financial controller is a numbers whiz with an impeccable accounting background, a strong communicator, an effective leader and a strategic planner. The position also requires good ethics and business acumen.

What are the 5 significant roles of a financial controller?

A financial controller can wear many hats within a business. For example, a controller prepares a company’s financial reports and analyzes the data to help a company assess its costs and risks. A controller also makes sure the company’s accounting and reports comply with all necessary regulations, often working with external auditors and tax experts. In addition, a controller often seeks ways to use technology to improve efficiencies and reduce costs. Controllers are also effective communicators and leaders in the company.

What are financial controller responsibilities?

The size of a business often dictates a controller’s responsibilities, with smaller, growing businesses more likely to combine the position with that of the chief financial officer. In general, a financial controller oversees a company’s accounting department. That includes ensuring the accuracy and timeliness of financial reports, particularly during the financial close of specific periods. The controller also acts as a liaison within the company, as well as with external auditors, tax experts and regulatory personnel.