The financial controller plays a pivotal role in the success of any organization. Controllers handle a broad and diverse set of duties, centered on overseeing day-to-day accounting and finance operations but often also including responsibility for technology and compliance. The responsibilities can seem particularly daunting for new controllers who are stepping into the role for the first time, and for controllers at startups that haven’t yet established clear financial policies and processes. This checklist of 25 of the most important tasks for financial controllers is designed to help prioritize and manage the workload.

What Is a Financial Controller?

The financial controller is a key senior role within a company’s financial leadership team. Typically working closely with the CFO, the controller is the organization’s head of accounting and manages the nuts and bolts of day-to-day financial operations. The controller’s broad responsibilities may include putting in place accounting systems and processes, managing accounting and finance teams, handling regulatory compliance and collaborating with the CFO on strategy.

Financial Controller Checklist

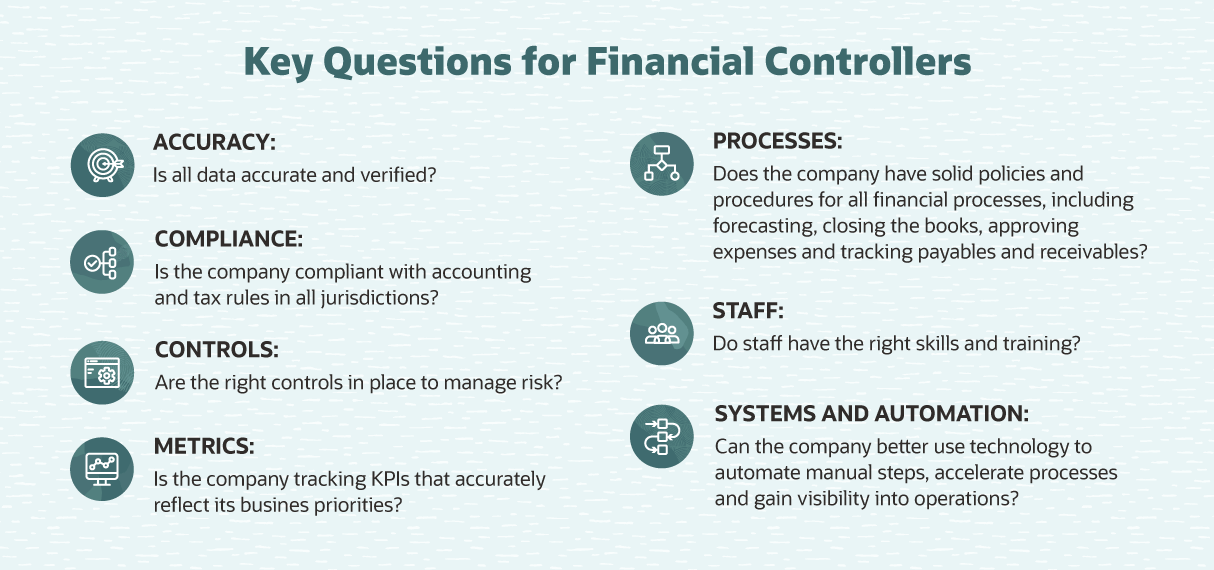

A financial controller’s list of priorities reflects the wide-ranging and complex responsibilities associated with the role — from overseeing day-to-day accounting and finance tasks to managing staff and technology. Depending on the organization, a controller may have to create new policies and processes from scratch, as well as ensuring that existing processes run as efficiently as possible.

-

Develop a short-term cash flow forecast. Creating an accurate short-term cash flow forecast should be one of the controller’s top priorities because the company needs to know that it will have enough cash in the near term to continue operating. This is not a one-time project but an ongoing task. The short-term cash flow forecast takes into account three critical elements: cash on hand, plus cash due to come in (receivables), minus cash due to go out (payables). The forecast typically covers a 13-week timeframe, but it can be adjusted based on the elements. For a new controller, the short-term cash forecast is also a crash course in learning how the company works. How does the sales pipeline work and how accurately does it predict sales revenue? Which departments are spending the most money?

-

Review accounts receivable. One of the financial controller’s most critical functions is to understand how much customers owe and when they pay. A clear picture of accounts receivable is also important for developing accurate cash flow forecasts. The controller should establish standard processes for reaching out to customers that are past due, if those processes don’t already exist. If processes exist but are not always effective, they may need to change.

-

Review accounts payable. It’s equally critical to gain a clear understanding of how much the company owes its suppliers and its processes for paying them. Review the processes for approving vendor invoices and the company’s payment obligations under current contracts. If the short-term cash forecast predicts lean times, it may be worth considering delaying payments — if it’s possible to do so under existing terms.

-

Understand debt payments. Companies with debt must pay special attention to ensuring the company makes the required payments and remains in good standing with its creditors. The controller should review each debt agreement to verify payment due dates, interest rates and any liens or other conditions that could result in bigger financial problems. A financial controller should also be aware of how the company uses the borrowed money.

-

Reconcile accounts. The controller’s job typically includes making sure reconciliations are conducted regularly — daily, in some cases — to verify the accuracy of the company’s accounts and cash balance. This includes reconciling the company’s internal financial data against external sources such as bank statements. Controllers need to pay special attention to any areas that involve manually transferring data between systems, since manual processes are ripe for human error. Automating these transfers can often improve efficiency and accuracy.

-

Optimize and accelerate the financial close. As the owner of the financial close process, the controller is charged with closing the books at the end of each accounting period in an accurate and timely way, as efficiently as possible. This can be a complex job, requiring the finance team to complete many sequential steps to assemble all the necessary information and prepare accurate financial statements. It’s critical to focus on optimizing this process, because disorganized and disjointed close processes can consume vast amounts of time and delay access to critical information about business performance. Cloud-based accounting and enterprise resource planning (ERP) software can help by providing better access to consistent data and automating time-consuming manual processing steps, minimizing errors, creating repeatable processes and reducing risk. With the time controllers save by automating manual processes, they have more time for strategic analysis they’re expected to provide.

-

Ensure accurate and timely tax returns. All companies — from large enterprises with global reach to small companies serving local markets — need to submit tax returns on a rigid schedule. Financial controllers may not directly prepare the returns, but they’re responsible for reviewing them and ensuring that they meet the requirements of each jurisdiction. This can be especially complicated for larger organizations with revenue and expenses in multiple countries, due to the different tax regulations in each area.

-

Review capital expenditures. Capital expenses often have a significant impact on the company’s finances, so it’s important that the financial controller review each planned expense before the company makes a purchasing commitment. A new controller should also review the company’s historical capital expenditures and the ongoing financial impacts, such as depreciation. Payment terms, whether the company pays cash or finances each purchase, can impact the company’s balance sheet and cash flow. It’s important for a financial controller to establish processes that ensure that capital expenditures receive review and don’t come as a surprise.

-

Examine contracts. The financial controller may need to review all important contracts to make sure the company’s financial obligations are clearly understood. The financial controller will need to check that contracts don’t contain hidden pitfalls that could result in unforeseen liabilities or potential lawsuits. Standard procedures for approving new contracts also need to be reviewed by the financial controller.

-

Review sales reports. The sales pipeline report provides critical information about the company’s future revenue, and the financial controller should be part of the team that reviews the report. The report shows information about in-progress deals, typically including the stage they’re at, the potential revenue and the probability that they’ll result in a sale. Financial controllers must pay special attention to the accuracy of the sales predictions, which are critical to the accuracy of the company’s cash flow and revenue forecasts.

-

Establish financial performance metrics. The controller plays an important role in determining which financial key performance indicators (KPIs) the company should monitor to track profitability, liquidity, solvency and efficiency. The choice of metrics will depend on the company’s business goals and current priorities. Typical metrics include gross and net profit margin, operating cash flow ratio, current accounts payable and receivable, and inventory turnover.

-

Create financial dashboards. Financial dashboards highlight key financial KPIs and other metrics, helping executives and the financial team track the company’s performance, monitor trends and spot any impending problems. Dashboards should be custom-designed to track the company’s chosen KPIs, and each employee’s dashboard should be tailored to their specific role. The controller should review any existing dashboards to be sure they accurately reflect the company’s most important metrics. At a startup, a new financial controller may need to get involved in defining dashboards from scratch.

-

Review staff capabilities and training. As a mid- to long-range goal, the financial controller should focus on enhancing one of the company’s most important assets: the financial team. It’s important to understand each person’s capabilities and career goals, and to facilitate any training that is needed. For example, new technology often affects the finance team even more than other parts of the organization, so it’s important for staff to be equipped with the right skills. As technology transforms financial operations, it makes sense to enhance the skills of existing staff whose domain knowledge, with proper training, could be a great benefit to a more modern finance organization.

-

Review department policies and processes. As a company grows, financial management and reporting become more complex and the legal ramifications of inaccurate reporting potentially become even more severe. Clear financial policies and procedures help the company consistently track performance and minimize problems. Established and documented processes also help bring new staff up to speed quickly and ensure continuity when experienced employees leave the company. Among other goals, finance department policies should include the following safeguards:

- All transactions are recorded accurately and reliably.

- All expenses are verified and supported with necessary documentation.

- Payments are made accurately and efficiently.

- Revenue can be traced back to its source.

- The company has a consistent and transparent audit trail.

-

Coordinate with an external auditor. External audits are a regulatory requirement for public companies and some other organizations. Independent auditors examine the company’s financial statements to determine whether they accurately reflect the company’s performance. Private companies may also hire external auditors to assess their performance and financial controls for a variety of reasons — for example, a clean bill of health may make it easier to attract funding. It is typically the financial controller’s responsibility to coordinate with the auditor, review the auditor’s report and instigate any action that is required as a result.

-

Review internal audit reports. Internal audits are designed to assess the company’s performance, internal controls and risks. They’re often carried out by members of the controller’s team. Internal audits may examine areas such as corporate governance, accounting processes, compliance, cybersecurity and suspected fraud. Typically, the financial controller needs to be closely involved, reviewing audit reports and implementing any recommendations.

-

Check financial controls and adjust where necessary. Financial controls are the company’s policies, processes and technology designed to manage risk and prevent fraud or other internal problems. Good financial controls also help the company maximize operational efficiency and maintain a healthy cash flow. After a thorough analysis of existing policies through internal audits or other means, the financial controller may need to add or change controls to cover any gaps. For example, young companies may not have a system to monitor and manage employee expenses. The controller may need to address the gap to ensure that expenses are valid and accurately recorded.

-

Review financial disclosures. Public companies are required to submit financial disclosures and reports on a schedule determined by authorities such as the Securities and Exchange Commission (SEC) in the U.S. The financial controller is typically responsible for reviewing and submitting these filings. These disclosures include:

- Securities registration.

- Annual 10-K and quarterly 10-Q filings.

- Annual shareholders reports.

- Tender offers (i.e., offers to buy a large number of shares of a corporation).

-

Review all management reports. A financial controller should review all management reports generated by the accounting and finance departments, assess their accuracy and relevance, and drive any necessary changes. Inaccurate information could cause problems, such as triggering spending plans for money the company doesn’t actually have. Relevancy is also a key consideration — reports that were useful earlier in a company’s lifespan may no longer reflect the company’s priorities. Another potential problem is duplication: Companies may be creating multiple reports that essentially serve the same purpose.

-

Review computer systems. Growing companies often outgrow the capabilities of the technology they start out with. A financial controller needs enough technological savvy to understand the role of each system, its limitations and how different systems interact with each other. For example, many companies initially use entry-level desktop accounting systems, but transition to higher-capability cloud-based financial management software as their needs expand. Growing companies also often replace a collection of disconnected applications with an integrated ERP suite that provides a real-time view of operations across the entire business.

-

Drive budgeting process. A reliable and accurate budget enables the company to plan its future activities. The budget sets out a company’s targets and priorities, and determines which projects will get funding. The financial controller should drive the budgeting process, in collaboration with managers across the company.

-

Perform periodic budget reviews. The budget is not a static document — it should be revisited periodically. The financial controller should drive periodic budget reviews — initially perhaps as often as monthly — to compare the budget forecast to actual events. This enables the organization to recalibrate its budget to more accurately reflect reality.

-

Review inventory. At some businesses, the financial controller needs to get involved in ensuring that the company’s financial systems accurately reflect the company’s inventory. For example, the company may need to periodically make changes to its general ledger based on the results of physical inventory counts. Market changes, spoilage and other losses can impact the value of inventory, requiring the company to adjust its records to maintain an accurate financial picture.

-

Implement document retention processes. The financial controller needs to review the systems and policies used for document retention needed to meet business needs and legal requirements. Companies need an effective retention policy for financial documents to comply with tax and other legal requirements, and to help settle any vendor and customer disputes. This policy dictates how long documents are held before they are destroyed. A document retention system can help manage the job of storing documents, classifying them, searching them and removing them when they’re no longer needed.

-

Automate, automate, automate. Automating basic financial tasks such as data entry and reporting can save companies an enormous amount of time and reduce manual errors. Finance leaders are heavily involved in implementing accounting and finance software, and believe 89% of financial tasks are automatable, according to Gartner Inc. Leading financial software solutions automate reporting, revenue recognition and other important everyday financial processes, helping to improve accuracy and compliance. Robotic process automation, chatbots and other tools can automate routine tasks, such as responding to basic requests from customers and vendors about invoices or payments.

Downloadable Checklist for Financial Controllers

This downloadable checklist lists 25 top priorities for financial controllers.

How NetSuite Can Help

NetSuite financial management software helps financial controllers drive greater business success, expedite daily financial transactions, reduce budgeting cycle times, ensure compliance and accelerate the financial close. NetSuite’s extensive capabilities enable companies to increase efficiency by eliminating time-consuming, error-prone manual processes and automating accounting and financial operations. The cloud-based software provides a real-time view of financial activities, helps accelerate the financial close and improves revenue recognition. Customized dashboards and automated reports enable controllers to monitor key metrics and drill into information about revenue, payables and receivables, expenses and more. Automatic upgrades and built-in features help companies stay compliant with tax and regulatory changes.

Because NetSuite financial management is part of an integrated suite of business software, companies have the ability to better track operations across the entire business and eliminate the need to manually transfer data between systems for analysis. Businesses switching to NetSuite reported improvements including a 45%-70% reduction in time to close and a 55%-80% increase in visibility across all operations. As businesses expand globally, they can take advantage of NetSuite’s built-in support for multiple subsidiaries, hundreds of currencies, dozens of languages and tax reporting in 50+ countries.

Conclusion

Financial controllers face a wide range of tasks and challenges every day of the week. Staying on top of a checklist of the most pressing priorities can help financial controllers achieve their ultimate goal: ensuring that the company stays in good financial health.

#1 Cloud

Accounting Software

Financial Controller Checklist FAQs

What should a financial controller do?

Financial controllers manage the organization’s accounting function. They have a broad set of responsibilities, including handling the financial close process and producing financial statements and reports.

What should I look for in a financial controller?

Financial controllers should have in-depth knowledge of accounting and finance operations, plus the ability to work closely with both senior management and members of the finance and accounting teams. They need to be able to understand the myriad everyday details of the company’s finances and how the accounting team can support the company’s broader business goals.

What are the 5 significant roles of a financial controller?

As the head of the company’s accounting function, a financial controller actually may have many significant roles within an organization. Five of the most important duties are preparing financial reports, managing the financial close, monitoring internal controls, participating in the budgeting process, and streamlining accounting operations.