New FASB standard offers guidance on accounting for cloud computing license costs and implementations.

I am frequently contacted by customers and our internal team about how to account for NetSuite costs. As cloud computing became more popular, businesses took different approaches to how they accounted for it on their financial statements. A few of the popular ideas were:

- Treat a cloud computing arrangement as a fixed asset and depreciate it. Capitalize everything.

- Present the contract as prepaid and amortize it as an intangible asset.

- Amortize the contract as an expense and capitalize all of the implementation costs.

- Reference the contract to lease accounting standards and follow those as an analogy for cloud computing.

- Treat the cloud computing arrangement as internally developed software.

Enter ASU No. 2015-05

Each of these ideas had some merit. However, as the percentage of businesses using cloud products increased, the FASB and other standard setters realized that the “diversity” in practice was growing too large.

So, in 2015, the FASB issued ASU No. 2015-05, “Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement,” to simplify to process. The goal was to help a business determine what kind of contract their arrangement included.

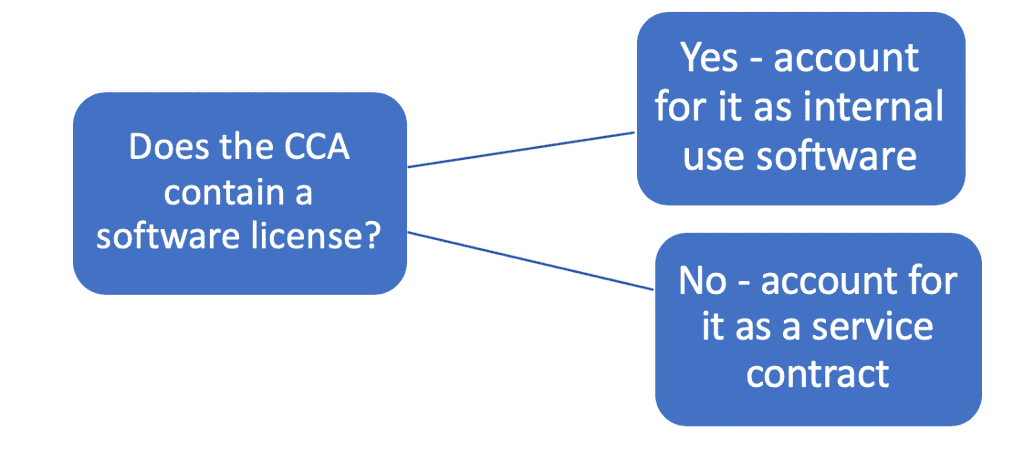

The key determination was to help a user know if their arrangement contained a software license or not. Using the guidance under ASC 985-605, customers are required to determine if their cloud arrangement contains a software license. If the answer is yes, then treat the contract as an internal use software intangible under ASC 350-40. If no, then account for the arrangement as a service contract.

The release of No. 2015-05 clarified several of the key questions presented above. If the cloud computing arrangement included a software license, then the contract was treated as internal-use software. This allowed the purchaser to capitalize the license and related implementation costs. It also clarified that when an arrangement didn’t have a software license embedded, that it was a service contract and should be treated as an operating expense. This clarification put an end to treating service contracts as fixed assets, etc.

However, ASU 2015-5 didn’t determine the process for handling the implementation costs of a service contract. Many of the same questions existed, such as whether you can capitalize implementation costs, or must they all be expensed?

ASU No. 2018-15 Addresses Cloud Computing Implementation

To clarify the process of handling service contract implementations, FASB issued ASU No. 2018-14, effective for all filers after Dec 15, 2019.

Key Provision 1 – Apply Internal Use Software Guidance

When entering into a cloud computing contract that is a service contract, entities will now apply the same guidance toward implementation costs that are used for internal use software. Here are the key guidelines to be aware of when applying this new guidance:

- Project costs to purchase, develop or install the software generally can be capitalized.

- Activities related to testing, customization, configuration and scripting can be capitalized.

- Training and data conversion costs are to be expensed as incurred.

- These costs can be both internal and external, such as payroll, contractors and travel expenses.

Key considerations here are to consider how you define the different terms and the quality of your project timekeeping/management to identify the type of work performed.

Amortization of Implementation Costs

ASU 2018-15 states that implementation costs should be amortized over the term of the associated cloud computing arrangement service on a straight-line basis. In addition, it states that the usage rate (number of transactions, users, data throughput) should not be used as a basis for amortization.

In section 350-40-35-14 the guidance states additional periods to be included in the amortization period:

- An entity (customer) shall determine the term of the hosting arrangement that is a service contract as the fixed noncancellable term of the hosting arrangement plus all of the following:

- Periods covered by an option to extend the hosting arrangement if the entity (customer) is reasonably certain to exercise that option

- Periods covered by an option to terminate the hosting arrangement if the entity (customer) is reasonably certain not to exercise that option

- Periods covered by an option to extend (or not to terminate) the hosting arrangement in which exercise of the option is controlled by the vendor.

- When reassessing the amortization term, an entity shall consider the following to reassess the term:

- Obsolescence

- Technology

- Competition

- Other economic factors

- Rapid changes that may be occurring in the development of hosting arrangements or hosted software

Presentation

The new ASU makes a few critical changes to the presentation of cloud service contracts. A few highlights include:

- 350-40-45-2 An entity shall present the capitalized implementation costs described in paragraph 350-40-25-18 in the same line item in the statement of financial position that a prepayment of the fees for the associated hosting arrangement would be presented.

- 350-40-45-1 An entity shall present the amortization of implementation costs described in paragraph 350-40-35-13 in the same line item in the statement of income as the expense for fees for the associated hosting arrangement.

- 350-40-45-3 An entity shall classify the cash flows from capitalized implementation costs described in paragraph 350-40-25-18 in the same manner as the cash flows for the fees for the associated hosting arrangement.

The key takeaway for presentation in the new guidance is that no costs associated with a CCA Service Contract should be treated as depreciation or amortization and should all be included in operating income.

Disclosure Requirements

There are a few key disclosures required from the new ASU. Specifically they are:

- The nature of its arrangements for cloud computing.

- Any amortization expenses for the period

- Major classes of implementation costs that have been capitalized

- Accumulated amortization of the implementation costs

Conclusion

With the release of ASU 2018-15, the way to manage cloud computing contracts has clarity. It is now a three-step process that consists of determining whether an arrangement has a software license included. Manage the implementation project and capitalize the correct costs. Lastly present the costs correctly based on the new ASU.