Accounts receivable (AR) is money owed to a company by customers who have been invoiced for a product or service they've received but haven't yet paid for. The AR process comprises all of the steps involved in collecting the funds due in a timely manner, starting with sending an invoice to the customer. Whether that task falls to a few people or a large team, an effective and efficient AR function is essential for all businesses to maintain healthy cash flow, customer relationships and business operations. Automation is key to speeding the AR process, alleviating staff from many of the monotonous, time-consuming tasks that can drag down a company's ability to collect what's due. The first step to a more automated AR future is to map out the current process using an AR automation flowchart.

What Is an Accounts Receivable Automation Flowchart?

An AR automation flowchart is a visualization of a business's AR process, created with the goal of automating as many manual tasks as possible. It begins by documenting and examining the way AR is handled, laying out every step from when a sale is made to when payment is processed. The flowchart helps the company better understand the resources required to complete each step and where automation can be applied to optimize the process. It also highlights where improvements can be made in the AR process of invoicing, collecting, depositing and reconciling funds from customers.

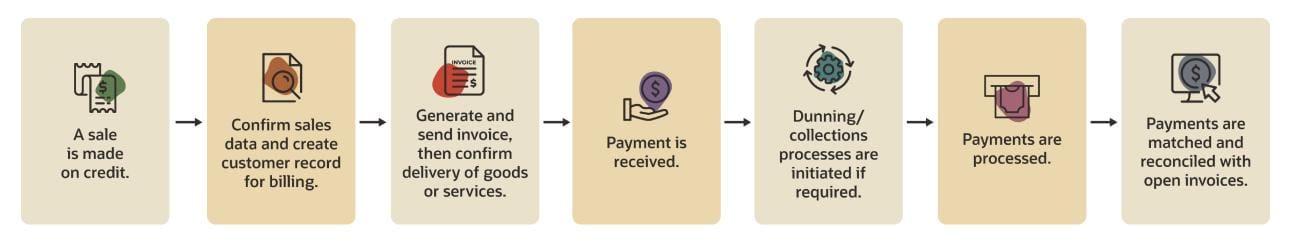

While it can vary from one company to another, a common AR automation flowchart looks like this:

Key Takeaways

- The traditional AR life cycle includes many manual touch points and inefficiencies.

- Creating an AR automation flowchart is one of the most important steps toward identifying which parts of the process can be automated.

- Automating AR can transform a fundamental bookkeeping task into a strategic business function.

- It can also improve cash flow — one of the key indicators of a business's financial health.

Accounts Receivable Automation Flowchart Explained

Buy now, pay later: Businesses and consumers have been using credit cards to purchase goods and services ever since the Diners Club Card was introduced in 1950. Money owed by a buyer to a seller after the purchase and delivery of a good or service is called accounts receivable, and it's due within a specified time frame. The selling company, such as an equipment vendor, issues an invoice and works to collect funds before they become past due. This not only helps to ensure steady cash flow and sufficient working capital, but it can also strengthen customer and investor relations.

From a bird's eye view, the AR process seems relatively straightforward. However, in the accounting trenches, particularly for a rapidly growing organizations with hundreds or thousands of customers, the task can quickly become overwhelming, especially when handled manually, leading to higher costs and increasing the risk of errors.

By creating an AR automation flowchart, an organization lays out all of the steps of the AR process — from the initial sale to payment reconciliation. This exercise enables the company to identify time-consuming, labor-intensive and potentially error-prone steps in the workflow, and it uncovers where automation can be implemented to increase productivity and decrease costs.

Steps in an Accounts Receivable Automation Flowchart

The key responsibility of the AR function is to issue invoices to customers in a timely fashion and then follow up on collections. While there may be some variation, the AR process follows a similar workflow in most organizations. By laying out the steps of the process in the form of a flowchart, a company can visualize where automation can take the place of repetitive manual tasks.

Here are the typical steps included in an accounts receivable automation flowchart, including how automation can help expedite the process.

-

A sale is made.

The AR process begins with the sale of a product or service on credit. If a customer has agreed to buy a product or service on a recurring basis, the AR department can set up a billing schedule to ensure invoices are generated and sent on a regular basis.

-

New customer data is added to the platform.

When a company makes a sale to a new customer, it collects certain data from the customer, such as its billing address and payment information. Once the data is captured, it can automatically be pulled into subsequent invoices.

-

An invoice is generated and sent electronically.

After confirming that goods or services were delivered, invoicing is the first step toward collecting payment for the sale. The invoice describes what the customer has purchased, the amount owed and the payment due date. Automating the creation and distribution of electronic invoices will speed this important step of the AR process.

-

Multiple invoices are consolidated automatically.

When a customer purchases multiple products and/or services, they may find it more convenient and organized to receive one itemized, consolidated invoice. Handled manually, this step is ripe for error, especially when sales occur in different parts of the organization. Automating the task, however, eliminates the heavy lifting.

-

Payment is collected electronically.

The AR end goal is to collect outstanding balances on or even before the date they are due. Making it easy for customers to pay their bills by offering electronic payment options, such as ACH and wire transfers, or accepting credit cards increases the likelihood of on-time payments and speeds the transaction process.

-

Dunning and collection is performed.

Customers with past-due invoices may require prodding to pay their bill. So-called dunning letters and late-payment notices can be automatically issued to remind customers what they owe. Other escalation efforts, such as phone calls, third-party collections or, worst case, litigation may also be employed to secure payments due to the company. Eventually, if collections efforts aren't successful, the invoice will be deemed uncollectible and written off as bad debt.

-

Payments are automatically debited.

Most companies accept payment in multiple ways, including printed checks. However, a direct debit automatically pulls funds from the customer's bank account when payment is due. This accelerates cash inflows by ensuring bills are paid on time and is both more efficient and more secure handling paper checks.

-

Payments are reconciled.

The last step in the AR workflow is processing the customer's payment. Here, automation can help streamline the process and eliminate errors stemming from manual input.

Dashboards Help With Data Analysis and Forecasting

Just as a car dashboard provides all of the relevant information a driver needs to operate effectively behind the wheel, an AR dashboard displays key insights in the form of metrics and key performance indicators (KPIs) about a company's state of receivables and cash flow. This performance data, most useful when it's in real time, also demonstrates how well the business is moving toward its objectives.

One KPI to include in a dashboard is “days sales outstanding (DSO).” This accounting ratio measures the average number of days it takes for a company to collect a credit sale. The lower the DSO, the quicker it is paid. Tracking and analyzing this data as part of an AR dashboard can enable key business stakeholders to visualize the state of their company's finances and inform decision-making.

AR aging is another important metric to track. Aging reports categorize open receivables based on the length of time an invoice has been outstanding — typically 30, 60 and 90 days, with a separate column showing invoices that are over 90 days past due. Monitoring AR aging helps accounting and finance teams manage AR risk: The longer an invoice is outstanding, the less likely it is to be collected, which could lead to write offs that affect cash flow and earnings.

Other KPIs include AR turnover, an accounting ratio that quantifies the effectiveness of AR collections; productivity statistics, such as invoices per AR clerk; and the percentage of AR that winds up as bad debt.

Put AR/AP on autopilot.

Automate Your AR Workflows With NetSuite

Companies that go through the process of mapping out their AR workflows will likely identify several steps that can be automated with modern accounting software, such as NetSuite Accounts Receivable. The cloud-based solution handles many time-consuming manual AR tasks, like generating invoicing, processing payments and account reconciliation, so that accounting teams have more time to focus on higher-value efforts. NetSuite Accounts Receivable also simplifies the payment process for customers, increasing the likelihood that they will pay their invoices on time or even early and making for a better customer experience. In addition, NetSuite Accounts Receivable can help reduce a company's DSO by automatically issuing dunning and collections notices, as well as empower more informed decision-making through advanced analytics tools and AR reporting.

An effective and efficient AR function is essential for a business to maintain healthy cash flow. The traditional AR process includes many manual touch points that slow the process and lead to errors. Creating an AR automation flowchart enables a business to identify areas of inefficiency that can be improved with automation. Automating the AR workflow can empower the accounting team to transform a basic and sometimes burdensome bookkeeping task into a strategic business function.

#1 Cloud

Accounting Software

Accounts Receivable Automation Flowchart FAQs

What are the steps in the collection process?

Collection refers to the efforts made by a company to obtain money owed by customers. In many companies, there is an accounts receivable department that is responsible for collections. The AR collection process is composed of multiple steps, including invoicing, dunning, payment collection and payment reconciliation.

What is the difference between invoicing and billing?

The terms “invoicing” and “billing” are often used interchangeably to describe the documents and processes for requesting payments due to a company for the sale of goods or services. However, billing is the broader term, whereas invoicing specifically refers to the delivery of an invoice or bill.

What is the difference between billing and accounts receivable?

Billing (or invoicing) is a task in the accounts receivable workflow that includes generating invoices for goods and services purchased on credit, collecting payment from customers and reconciling accounts receivable in the company's ledger. The accounts receivable function may be responsible for other tasks as well, such as producing monthly financial and management reports or assisting in financial analysis. In organizations with a more limited AR function, the accounts receivable department may be referred to as the billing department.

What is account receivable automation?

Many of the tasks involved in AR involve lower-level, repetitive work. Historically, accounting teams have performed this work manually, spending the majority of their work days collecting customer data, generating invoices and reactively managing late payments and unresponsive customers. However, this approach leaves the accounting team little time to proactively improve collections and increase cash flow. AR automation takes this kind of tedious work off the AR team's plate through the use of modern accounting software that automates common AR tasks. AR automation increases the efficiency and efficacy of AR workflows, reduces the rate of human error and frees the accounting team to focus on higher-level tasks.

What is a workflow in accounts receivable?

An AR workflow refers to the step-by-step process a company takes to invoice and collect payments due for products or services sold on credit to its customers. Issues related to late payments or nonpayment by customers can negatively impact a company's ability to grow or even run, so creating an efficient AR workflow is crucial. Companies that want to streamline and optimize their AR function can begin by creating an AR automation flowchart to visualize, refine and — ultimately — automate this workflow.

What are the steps in managing accounts receivable?

Steps may vary somewhat from one company to the next, but generally speaking the AR process begins after a credit sale is made. The steps that typically follow are collection of master customer data, generation and delivery of an invoice, consolidation of multiple invoices, payment collection, dunning and collections, payment deposits and payment reconciliation.

What is the AR collection process?

This step of the AR process focuses on collecting payment for sales made on credit. It includes sending periodic payment reminders, late payment notices and, when all else fails, escalation to collections.